IAS 7 Statement of Cash Flows

Ignoring an accrual principle??? What?! No way! That’s the basic accounting rule we should all follow!

Yes, of course, you’re right. BUT: There IS an exception.

The statement of cash flows.

Preparing the statement of cash flows might become the biggest accountant’s nightmare. Why is that?

Because the statement of cash flows is THE ONLY statement ignoring an accrual basis and based on a CASH basis.

All other financial statements follow an accrual principle and it means that we have lots of non-cash transactions in our financial statements that we need to eliminate for cash flows.

Exactly the process of eliminating non-cash transactions and showing pure cash movements may give you headaches because the numbers sometimes do not balance.

But before I’ll show you perfectly clean starting point for your cash flow preparations, let’s dive a bit deeper into the standard IAS 7 Statement of cash flows and see how IFRS want us to present cash.

Why IAS 7?

The statement of cash flows shows the ability of any company to generate cash. It is really simple as that.

Some accountants look to the statement of cash flows as to some unnecessary and annoying issue and they prepare it because they MUST.

But in reality, many investors explore the statement of cash flows right after looking to profit figure, because they sometimes feel that the profit could be manipulated by some non-cash transactions, such as various provisions, fair value adjustments, etc.

However, cash is cash and the statement of cash flows not only shows you HOW MUCH CASH the company generated over the year, but also WHERE the cash was generated:

- Did the company increase their sales and generated cash by operating activities?

- Did the company sell some of its property and generated cash by investing activities?

- Or did the company take new loans and generated cash by financing activities?

So, looking to where the cash was generated and spent is as important as assessing the liquidity ratio, profitability ratio, and other financial indicators.

What is the objective of IAS 7?

The objective of IAS 7 Statement of cash flows is to require the information about the historical changes in cash and cash equivalents of an entity.

This information shall be provided in the statement of cash flows which classifies cash flows during the period from operating, investing and financing activities.

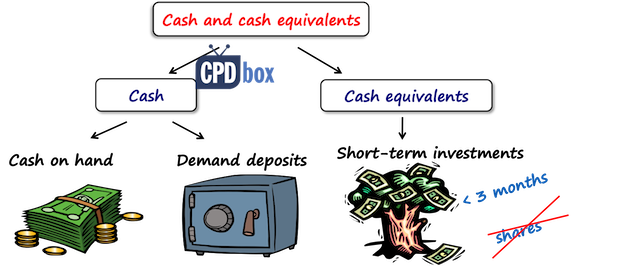

What comprises cash and cash equivalents?

The statement of cash flows shows you the movements in cash and cash equivalents.

Cash comprises cash on hand (e.g. petty cash) and demand deposits (e.g. bank accounts).

Cash equivalents are short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

Here, the investment with short maturity (up to 3 months) would qualify for cash equivalent – for example, state treasury note. However, most shares and other equity instruments are excluded from cash equivalents.

Please note that the movements between cash and cash equivalents is a part of cash management and are not shown in the operating, financing or investing part of the statement of cash flows. So if your company buys the state treasury bill with short maturity date, then this movement is not shown (it appears as the cash and cash equivalents have not moved at all).

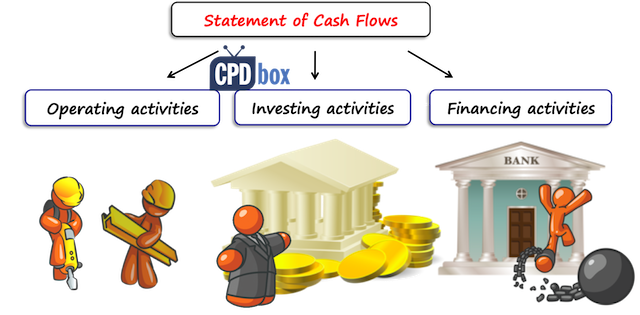

How the statement of cash flows shall be presented?

IAS 7 says that the statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities.

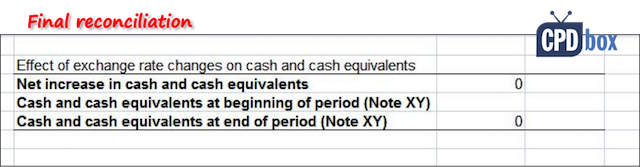

Before we’ll take a look at each part, let me also add that the statement of cash flows should also contain the final reconciliation in which you summarize the overall movement in cash and cash equivalents (corresponding with your balance sheet) as shown in this picture:

In the notes to the financial statements, an entity shall disclose the components of cash and cash equivalents.

Operating activities

Operating activities are the principal revenue-producing activities of the entity and other activities that are not investing or financing activities.

This part is probably the most important, because it shows the ability of the company to generate cash by its own activities, rather than by external financing or making investments.

Cash flows from operating activities result from the primary revenue-generating activities of each company and therefore, there might be differences between different entities.

For example, manufacturing company would report advance given for the acquisition of PPE as investing activity, but the bank would report similar advance as an operating activity based on its specific purpose.

However, operating activities generally result from profit making activities and the examples are:

- Cash receipts from the sale of goods and the rendering of services;

- Cash receipts from royalties, fees, commissions and other revenue;

- Cash payments to suppliers for goods and services;

- Cash payments to and on behalf of employees;

- Cash receipts and cash payments of an insurance entity for premiums and claims, annuities and other policy benefits;

- Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities; and

- cash receipts and payments from contracts held for dealing or trading purposes.

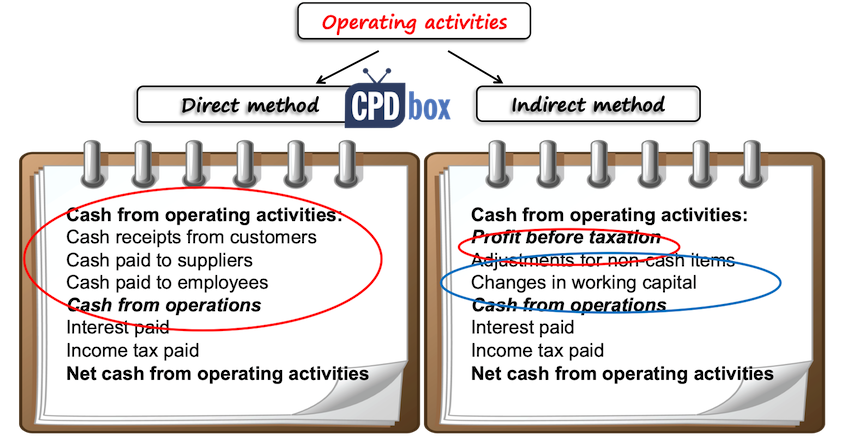

Direct and indirect method

A company may select from 2 methods of reporting cash flows from operating activities:

- Direct method: here, you need to disclose major classes of gross cash receipts and gross cash payments; or

- Indirect method: here, you start with the profit or loss before tax and then you adjust it for the effect of:

- Working capital changes over the period (inventories, operating receivables, payables);

- Non-cash items (depreciation, unrealized foreign exchange gains or losses, etc.);

- Items associated with investing or financing activities.

Direct method provides more understandable information not disclosed under indirect method. However, in reality, indirect method is far more preferred because it’s easier to get the information based on your accounting records. (in most cases).

You can read the article about preparation of the statement of cash flows here.

Investing activities

Investing activities are the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

Examples of cash flows classified in investing activities are:

- Cash payments to acquire property, plant and equipment, intangibles and other long-term assets (including capitalized development costs and self-constructed PPE);

- Cash receipts from sales of PPE, intangibles and other long-term assets;

- Cash payments to acquire and cash receipts from sales of equity or debt instruments of other entities and interests in joint ventures (but not for trading or dealing purposes);

- Cash advances and loans made to other parties, and cash receipts from their repayment (other than advances and loans made by a financial institution – these would go to operating part);

- Cash payments for and cash receipts from various derivative contracts except when the contracts are held for dealing or trading purposes, or the payments are classified as financing activities.

Financing activities

Financing activities are activities that result in changes in the size and composition of the contributed equity and borrowings of the entity.

Examples of cash flows arising from financing activities are:

- Cash proceeds from issuing shares or other equity instruments;

- Cash payments to owners to acquire or redeem the entity’s shares;

- Cash proceeds from issuing debentures, loans, notes, bonds, mortgages and other short-term or long-term borrowings;

- Cash repayments of amounts borrowed; and

- Cash payments by a lessee for the reduction of the outstanding liability relating to a finance lease.

Reporting cash flows from investing and financing activities

Cash flows from investing and financing activities shall always be reported GROSS, so no netting off.

It means that you cannot present the cash paid to acquire some vehicle and cash received from sale of some other vehicle in 1 line – instead, you must present these cash flows separately in 2 lines.

However, IAS 7 gives you 2 exceptions where you actually can present net:

- Cash receipts and payments on behalf of customers when the cash flows reflect the activities of the customer rather than those of the entity.For example, some real estate company can collect rents from tenants and pay them over to the property owners.

- Cash receipts and payments for items in which the turnover is quick, the amounts are large, and the maturities are short.For example, changes in principal amounts relating to credit card customers.

Also, financial institutions can report certain transactions on the net basis.

Other issues

Foreign currency

When there are foreign currency cash flows, then you need to translate them to your functional currency by applying the exchange rate at the date of the cash flow.

However, be careful at the closing, because unrealized year-end foreign exchange gains or losses are NOT cash flows. If they relate to your cash or cash equivalents, then you should present these amounts in the separate line in the final reconciliation.

Interest and dividends

Cash flows from interest and dividends received and paid shall be presented separately and consistently from period to period.

In fact, you have a choice here for each of these items:

- Interest and dividends paid can be classified either as operating cash flow, or financing cash flow.

- Interest and dividends received can be classified either as operating cash flow, or investing cash flow.

Either way you choose, it’s OK, but do it consistently in each reporting period.

Taxes on income

Basically, cash flows arising from income taxes are classified as cash flows from operating activities.

But if you can specifically identify these taxes with financing or investing activities, then you should report your cash flows from taxes in these parts.

Investments

When you hold some investments in subsidiaries, associates and joint venture, then reporting cash flows to and from these investments really depends on the accounting method you use.

When you apply equity or cost method, then you should include only the cash flows between yourself and the investee into the cash flow statement (dividends or advances).

Please watch the following video with the summary of IAS 7 here:

Have you ever had any issues or troubles when preparing the statement of cash flows? Please comment below this video and don’t forget to share it with your friends by clicking HERE. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

83 Comments

Leave a Reply Cancel reply

Recent Comments

- Jesslin on How to calculate deferred tax with step-by-step example (IAS 12)

- philip on How to present restricted cash under IFRS?

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

- Yamkela on How to Account for Decommissioning Provision under IFRS

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

do we show the movement in deferred income related to non-monetary government grants anywhere in the cash flow statement? Thanks

Is any movement in Deferred tax asset or liability reflected in the Statement of Cash Flows under IFRS? I saw an example somewhere under US GAAP which showed the movements under the Cash flows from Operations Section

Hi Val, not sure what your example was about, but usually no, the movement in deferred tax is a non-cash item. It is an accounting measure of a long-term character. S.

Dear Silvia, how to state late payment interest received from our customer in the cash flow statement?

Regards!

Dear Jenny,

You mentioned that the late payment interest received from your customer, It is related to sales revenue by transferring goods or rendering services to the customers. It refers to cash flows to operating activities due to the normal course of business. Thanks

ma,am why we include interest paid in operation activites

Hello Silvia,

As above comment to youngtrainee you said first presentation was correct, but when i add effect of receivable in cash flow, its was overstated with same amount as bad debt was add back will calculating working capital.

Hi Sylvia,

Thanks so much for your article. Please, if I have restated my opening retaining earnings and this as a result of the implementation of IFRS 9, how does this affect the statement of cash flows? I am not balancing without inputting this change to the retained earnings. Where does it go? The entry was Dr Acc Losses and Cr Loan Loss Provisioning.

Hi there,

Firstly thanks for great explanation. I would like kindly to get your opinion regarding the Cash Flow Indirect, from below:

1. I start cash flow from Profit Before Interest and Tax, then adding D&A, Interest Expense/Revenue and Gain or loss on Provision and getting “Operational Cash Flow before working capital adjustments”. Could you please tell me if this is correct way or I miss some point here? Especially regards with Provisions.

2. I represent all financial statements in currencies other than functional one. When I make translation, Statement of Financial Position, has been translated with the currency rate from closing day, but considering the “periodic nature” of Cash Flow, is taken average exchange rate for the period. And differences which appears at the end, I include it to the cash flow result. Could you tell me please, if this is ok or not?

Thanks in advance!

Shukran

My Dear,

I need your help. I have a case that i have settle a receivable with 1.000.000 CU and interest for non paying 300.00 CU by pieces of lands. Then distribut some of them to my shareholders. So what will be the effect on Cash flow statement. I do recommend to follow if up with a disclosure statement by those transactions

HI silvia

I am subsribed to your kit but would like some tips on ias 7 cashflow presentation on defined benefit pension schemes and how best to calculate the cashflow effect where there are balance sheet balances and gain loss goes through oci.

and how to deal with derivatives in the cashflow.

Dear Sylvia,

When ever i have doubts I read your articles. Thank you for posting articles regularly and appreciate your efforts.

I work in a FMCG company and we manufacture household cleaners and detergents. Have a question on “advance payments” to suppliers meant for Raw materials. Some suppliers demand advance money to secure future supplies at an agreed rate. This frankly helps us to secure supplies and also avoid price fluctuations. This is a recent trend and we end up in paying big amount in “cash” as advance payments or we provide the suppliers with “post dated cheques”. My company is considering these advance money and post dated cheques as part of “Inventory” in NWC calculations ? a) Is this right or b) if it should not be part of inventory, where should it be considered in NWC calculations and c) what is IFRS guidelines.

Thank you

Marc

NOW I GOT THE GIST AND ROOT OF THE CASHFLOW STATEMENT, CANT EVEN HOW TO THANK SUCH A GREAT PERSON LIKE YOU DR. SILVIA FOR THE KNOWLEDGEBLE INFORMATION YOU ON THIS SITE

Hi Mr. Manager, thank you! 🙂

Dear Sylvia, how to account for reclassification from PPE to held for sale in cash flow statement (indirect method)? Thanks!

Hi Jane,

it’s non-cash reclassification and if you use the method shown in this article, then you would offset the change in PPE held for sale with change in PPE in the amount of reclassification.

Dear Syliva,

if a customer, for which impaired of trade receivables was recognized, initially pays, should this be accounted as a change in working capital?

Thanks!

Yes.

Thanks Silvia,

and how to account for default interest?

Kind regards,

Dear Silvia,

First i’d like to thank u 4 the effort u r putting into this but I believe it’s very impotent to add solved examples for each topic to help as fully understand the material

Many thanks, keep up the good work

Thanks, Samer 🙂

you are the best, thank you

Hello Dear Silvia,

My question is about the presentation of “allowance for receivable” in the cashflow.

Just for simplicity, suppose we have an entity that has make an allowance for receivable = 100 and it there is no other changes in the receivable.

Method 1 :

Profit before tax : XXX

Addback :

Allowance for receivable = 100

Changes in the working capital:

Changes in the receivable = 0

Method 2 :

Profit before tax : XXX

Addback :

Allowance for receivable = 0

Changes in the working capital:

Changes in the receivable = 100

I know both method will create the same balance for “cash generation from operations” in the cashflow, but I am getting confused about the correct presentation ?

Thank you for you help,

Regards

Hi YoungTrainee,

the first presentation is correct, because the allowance for receivable is a non-cash adjustment that has nothing to do with the change in the working capital. In fact, your working capital did not move at all in this particular example. S.

Hi Silvia,

If we have gains or losses from foreign exchange rates in statement of income and we cannot determine the effect of exchange rates on accounts, is there any way to approximate the effect of exchange rates on statement of cash flow and what exchange rate should we use for beginning balances?

Thanks in advance

Omar

Hi Omar,

I think that you are always able to apply the rates at the beginning of the year to the opening balances – it relates to assets and liabilities only. S.

Dear Sylvia, a company is producing apartments, and the land it was owned before is reclassified from property, plant and equipment to inventories.

How to treat this in the cash flow statement?

Thank you!

thank you for these explanation. it really help. can we have prepared cash flows both questions and answers for more studies?

Hi Abodeke, sure, more of that is in the IFRS Kit here. S.

I am so grateful I visited this site. Your articles are so helpful and it will definitely assist in my forth coming presentation. All thanks to you,Silvia.. I bless God for your knowledge

Thank you, glad to help! 🙂

thank for everything

Silvis many thanks for this valuable, clear and practical information. Really good videos and documents!!! ITs the first time I really understand cash flow contents

Great, glad to help 🙂

Dear Sylvia, if a Company received promissory note from the buyer that bears interest rate of three month EURIBOR + 150 bps, should this note be considered as operating activity or financing activity? Thank you for your help and explanations!

Jenny, did the client pay with the promissory note for the goods? In this case, the cash received from payment of principal is operating activity. With regard to interest – you can classify it either as operating or investing activity (not financing – this would be the case when you actually pay interest on the loans received), but you need to be consistent. S.

Dear Sylvia, thank you. It was not used from the client to pay for the goods we delivered. We repaid the amount in total plus interest during this year.

Kind regards

Ah, I see, I understood it other way round. In this case, it’s either operating or financing (be consistent). S.

Hi Silvia,

Thanks for your prompt reply.

The deferred income is a prepaid income for the next 10 years.

It is then accurate to disclose as a non cash item within Operating activities?

Best regards

Adil

Yes – if it relates to your principal revenue-generating activities. S.

Hi Silvia,

First thanks for the great input of your website 🙂

My question:

I am not sure how to disclose the a “long term” deferred income in my Cash flow statement.

I have a deferred income that relates to 10 years.

I disclosed the total amount of the “Deferred income” within Operating activities.

Can you confirm it is the accurate disclosure?

Best regards

Adil

Hi Adil,

it depends on what your deferred income relates to. If yes, then it’s a non-cash adjustment in operating activities (change in deferred income).

S.

Hi Silvia, This your write up is exactly 2 years now yet it remain relevant. Thanks so much for the information shared. You’ve really been a blessing to me.

Thank you

Thank you! 🙂

Dear Sylvia,

should I split the change in accounts payable for property plant and equipment (one car was purchased (price 2.000 USD), and it was paid in an amount of 1.000 USD; i.e. show the payment only in the investing activities in an amount of 1.000 USD), from the change of accounts payable for inventories (-10.000 USD), which is show in operating activities? I.e. a change of 1.000 USD i accounts payable for PPE is now shows as a decrease/ increase in cash flow from operating activities?

Thanks!

**I.e. a change of 1.000 USD is accounts payable for PPE is not shown as a decrease/ increase in cash flow from operating activities?

Thanks!

Yes, exactly. S.

Dear Silvia, its really great lecture.

This is great. Silvia please keep on the good work. You are making my dream of becoming a seasoned professional accountant a reality. Thank you so much.

This post really helped me to understand cash-flow statement, Thanks for sharing valuable information.

Dear Silvia

“you really opened my eyes on IFRS. before know about IFRSBOX, i was Thinking IFRS is difficult to understand. but now….. thanks a lot”

Silvia

Thank you so much indeed! All your material is amazingly good, thank you for making IFRS simple for all of us.

Regards

Thanks a lot for the info. Way easier to grasp than the original IFRS script. By the way, does this mean that ALL advances made by, say, a manufacturing company are investing activities? Even if they involve inventory items?

Thanks again 🙂

Dear Sam, I would rather look to the purpose of the advances, not by who makes them. So if advances relate to the property, then they are investing cash flows. But if they relate to inventories, it is an operating cash flow (you put the change in inventories to operating part).

S.

please how do get to download the videos(animations)to explanation of the ifrs

Dear Silvia M

I would like to know that operating activities should start from profit before tax or profit before interest and tax according to the updated IAS 7.Please give me your advice.

full moon

Dear full moon, it starts with profit before tax. You would adjust the interest in the statement itself. Kind regards, Silvia

Hi silvia,

The truth must be said, the materials from your site has been of great help to me in the study of IFRS. I really admire the simplicity in presentation and excellent knowledge you are pouring out here. Will Love to do same some day. Keep up the good work and stay Blessed.

Thank you Amaka, I really appreciate! All the best 🙂 S.

it is really cool websites , not only helpful for my coming exams but benefits me more in accounting principle, so lovely

Hii Silvia =) I must say.. This is Really really Good.!!! I’m from Venezuela, but English is my second maternal language 😀 and I had to study the IAS 7 (in Spanish NIC 7) for a test.. And it might look unbelivable but I understood this content much better than the one in my own Language.. Weird right.? Hahahahaha..

Thank you very very much..

It really helped..

God bless You 😉

That’s awesome! But I think people understand me exactly because English is NOT my native language, so as a result, it’s very simple 🙂

Take care!

Silvia

hi i just need a help. i am student of ACCA on this june iam preparing for my p2 exam. i got accident on march but now i am fine and back to my home after two months. my problem is that i paid my fees for p2 and now i have just 20 days left i did nothing but i want to do something to atleast go for this exam please guide me what should i do now for 20 days? do i learned ifrs and ias pls reply Silvia ..

Hi Arsalan, just don’t give up and go hard in your studies. Show up on your exam. If you don’t then you will not pass.

Then – what study materials do you have? Go through them and revise. Go through this website. P2 is a difficult paper, but you have plenty of time – 20 days, that’s a lot. Good luck!

thank you so much.I am anxiously waiting for your next topic.What is it and when is it coming?

Hi Usman, just wait until the next week – I’ve got a surprise for you 🙂

Silvia, this is really helpful.Great stuff!

Paul

Silvia, you are just the BEST!. Thanks so much

Hi Silvia M.

thank you for all Tips . could you Please attache the transcripts of this video . that will be like a academic lecture and we can read it any time we want

Hmmmmm… that’s actually a great idea, but the problem is that I simply have no time to do this 🙁 Would anyone help me with this? S.

Hello, Silvia M.

I can voluntarily help you in any kind of your work.

You can just write to me via mentioned e-mail (mushviq.ahad@gmail.com)

Regards,

Appreciated 🙂

Thank you for this write up. Accounting made easy in clear and simple english. Regards

Silvia, honestly I must confess, your IFRS material is very compressed, explicit and educating.

I really thank you for the knowledge you are impacting on “us”.

Thank you! I’m really glad to help! S.

Thanks alot. Very educative

I have to say, I stumbled accross this site accidentally and have been amazed ever since. Thank you for all of this, I hope one day to do the same… Knowledge for all… Respect 🙂

When this “one day” comes, let me know – I’ll help! 🙂 Thanks! S.

Thanks for sharing a nice learning to us….

This article is really helpful and easy to understand. By the way i am getting lot of assistance from Silvia through this site 🙂

Thanks Silvia

Thank you – that’s exactly what I want: to HELP and to GIVE 🙂 All the best! S.

The notes prepared by Silvia are great. Simple english and comprehensible.

Thank you 🙂