Difference Between Fair Value Hedge and Cash Flow Hedge

The first thing you need to do before you even start to play with hedge accounting is to determine the TYPE of hedge relationship that you’re dealing with.

Why?

Because: the type of hedge determines your accounting entries. Make no mistake here. If you incorrectly identify the type of the hedge, then your hedge accounting will go totally wrong.

But here’s the thing:

Although all types of hedges are neatly defined in IFRS 9, we all struggle with understanding the differences and distinguishing one type from the other one.

A few weeks ago I was giving a lecture about hedge accounting to the group of auditors. Most of them were audit managers and seniors – so not really freshmen, but experienced and highly qualified people.

Yet after about 5 or 10 minutes of speaking about different types of hedges, one audit manager interrupted me with the question:

“Silvia, I get the definitions. I just don’t get the difference. I mean the real substance of a difference between fair value hedge and cash flow hedge. It looks the same in many cases. Can you shed some light there?”

Of course.

What types of hedges do we have?

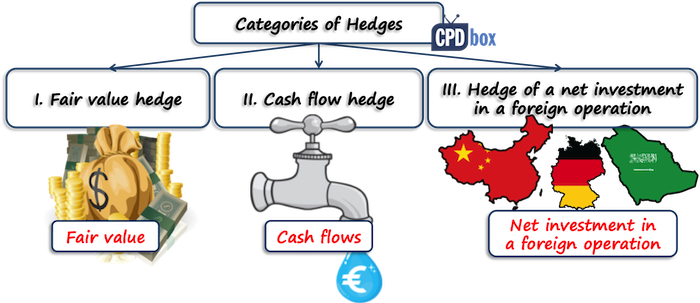

Although I clearly explain a hedge accounting in details in my IFRS Kit, let me shortly explain what type of hedges we have:

- Fair Value Hedge;

- Cash Flow Hedge, and

- Hedge of a Net Investment in a Foreign Operation – but we will not deal with this one here, as it’s almost the same mechanics as a cash flow hedge.

First, let’s explain the basics.

What is a Fair Value Hedge?

Fair value hedge is a hedge of the exposure to changes in fair value of a recognized asset or liability or unrecognized firm commitment, or a component of any such item, that is attributable to a particular risk and could affect profit or loss.

That’s the definition in IFRS 9 and IAS 39.

So here, you have some “fixed item” and you’re worried that its value will fluctuate with the market. I’ll come back to this later.

How to Account for a Fair Value Hedge?

OK, let’s not go into details and let’s just assume that your fair value hedge meets all criteria for hedge accounting.

In such a case, you need to make the following steps:

- Step 1:

Determine the fair value of both your hedged item and hedging instrument at the reporting date; - Step 2:

Recognize any change in fair value (gain or loss) on the hedging instrument in profit or loss (in most cases).

You need to do the same in most cases even if you don’t apply the hedge accounting, because you need to measure all derivatives (your hedging instruments) at fair value anyway. - Step 3:

Recognize the hedging gain or loss on the hedged item in its carrying amount.

To sum up the accounting entries for a fair value hedge:

| Description | Debit | Credit |

| Hedging instrument: | ||

| Loss on the hedging instrument | P/L – FV loss on hedging instrument | FP – Financial liabilities from hedging instruments |

| OR | ||

| Gain on the hedging instrument | FP – Financial assets from hedging instruments | P/L – FV gain on hedging instrument |

| Hedged item: | ||

| Gain on the hedged item | FP – Hedged item (e.g. inventories) | P/L – Gain on the hedged item |

| OR | ||

| Loss on the hedged item | P/L – Loss on the hedged item | FP – Hedged item (e.g. inventories) |

Note: P/L = profit or loss, FP = statement of financial position.

What is a Cash Flow Hedge?

Cash flow hedge is a hedge of the exposure to variability in cash flows that is attributable to a particular risk associated with all or a component of a recognized asset or liability or a highly probable forecast transaction, and could affect profit or loss.

Again, that’s the definition in IAS 39 and IFRS 9.

Here, you have some ”variable item” and you’re worried that you might get less money or have to pay more money in the future than now.

Equally, you can have a highly probable forecast transaction that hasn’t been recognized in your accounts yet.

How to Account for a Cash Flow Hedge?

Assuming your cash flow hedge meets all hedge accounting criteria, you’ll need to make the following steps:

- Step 1:

Determine the gain or loss on your hedging instrument and hedge item at the reporting date; - Step 2:

Calculate the effective and ineffective portions of the gain or loss on the hedging instrument; - Step 3:

Recognize the effective portion of the gain or loss on the hedging instrument in other comprehensive income (OCI). This item in OCI will be called “Cash flow hedge reserve” in OCI. - Step 4:

Recognize the ineffective portion of the gain or loss on the hedging instrument in profit or loss. - Step 5:

Deal with a cash flow hedge reserve when necessary. You would do this step basically when the hedged expected future cash flows affect profit or loss, or when a hedged forecast transaction occurs – but let’s not go in details here, as it’s all covered in the IFRS Kit.

To sum up the accounting entries for a cash flow hedge:

| Description | Debit | Credit |

| Loss on the hedging instrument – effective portion | OCI – Cash flow hedge reserve | FP – Financial liabilities from hedging instruments |

| Loss on the hedging instrument – ineffective portion | P/L – Ineffective portion of loss on hedging instrument | FP – Financial liabilities from hedging instruments |

| OR | ||

| Gain on the hedging instrument – effective portion | FP – Financial assets from hedging instruments | OCI – Cash flow hedge reserve |

| Gain on the hedging instrument – ineffective portion | FP – Financial assets from hedging instruments | P/L – Ineffective portion of gain on hedging instrument |

Note: P/L = profit or loss, FP = statement of financial position, OCI = other comprehensive income.

As you can see, you don’t even touch the hedged item here and you only deal with the hedging instrument. So that’s completely different from fair value hedge accounting.

How to Distinguish Fair Value Hedge and Cash Flow Hedge?

What I’m going to explain right now is my own logic of looking at this issue. It’s not covered in any book.

It’s how I look at most hedging transactions and this is a very simplified view. But maybe it opens up your mind to logical thinking about hedges.

Please, ask first:

What kind of item are we hedging?

Basically, you can hedge a fixed item or a variable item.

Hedging a Fixed Item

A fixed item means that the item has a fixed value in your accounts and it may provide or require fixed amount of cash in the future.

The same applies for unrecognized firm commitments that have not been sitting in your accounts yet, but they will be in the future.

And when it comes to hedging fixed items, then you’re practically dealing with the fair value hedge.

Why is that?

Well, here, you are worried, that in the future, you would be paying or receiving a different amount than the market or fair value will be. So you don’t want to FIX the amount, you want to GET or PAY exactly in line with the market.

I’m referring to “GET” or “PAY” only for the sake of simplicity. In fact, you don’t even need to get or pay anything in the future – you’re just worried that the item will have a different carrying amount in your books that its’ fair value.

Fair Value Hedge Example

You issued some bonds with coupon 2% p.a.

It’s nice that you always know how much you’ll pay in the future.

BUT you are worried that in the future, market interest rate will be much lower than 2% and you will be overpaying (in other words, you could get the loan at much lower interest in the future than you will be paying at the fixed rate of 2%).

Therefore, you enter into interest rate swap to receive 2% fixed / pay LIBOR12M + 0.5%. This is a fair value hedge – you tied the fair value of your interest payments to market rates.

Hedging a Variable Item

A variable item means that the expected future cash flows from this item change as a result of certain risk exposure, for example, variable interest rates or foreign currencies.

When it comes to hedging variable items, you’re practically speaking of a cash flow hedge.

Why is that?

Here, you are worried that you will get or pay a different amount of moneyin certain currency in the future that you would get now.

In fact, in a cash flow hedge, you want to FIX the amount of money you’ll get or pay – so that this amount would be the same NOW and IN THE FUTURE.

Cash Flow Hedge Example

You issued some bonds with coupon LIBOR 12M+0.5%.

It means that in the future, you will pay interest in line with the market, because LIBOR reflects the market conditions.

BUT – you don’t want to pay in line with market. You want to know how much you will pay in the future, as you need to make some budget, etc.

Therefore you enter into interest rate swap to receive LIBOR 12 M + 0.5% / pay 2% fixed. This is cash flow hedge – you fixed your cash flows and you will always pay 2%.

To Sum This All Up

Now you can see that the same derivative – interest rate swap – can be a hedging instrument in a cash flow hedge as well as in a fair value hedge.

The key to differentiate is WHAT RISK you hedge. Always ask yourself, why you undertake the hedging instrument.

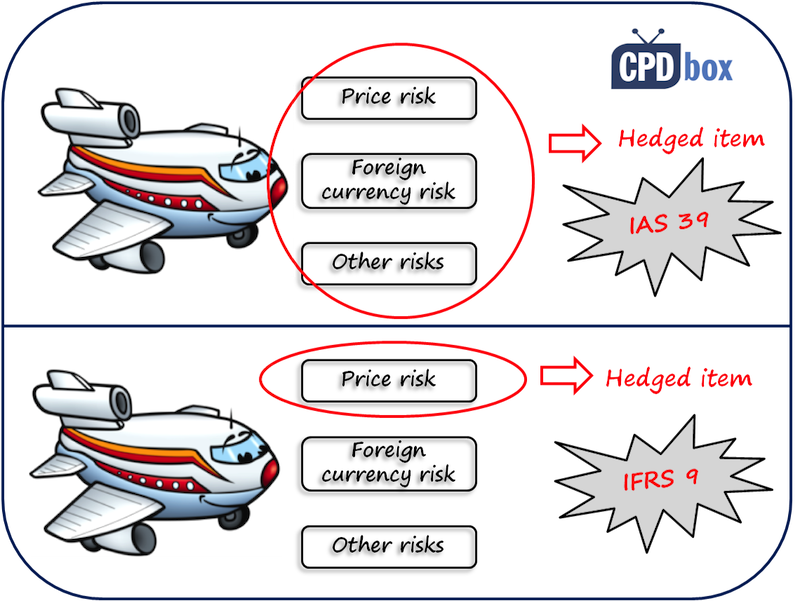

But it’s not that simple as it seems because there are some exceptions in IAS 39 and IFRS 9.

For example, even when you have a fixed item, you can still hedge it under cash flow hedge and protect it against foreign currency risk.

Equally, you can hedge a variable rate debt against fair value changes – and that’s the fair value hedge.

Therefore, please refer to the following table summarizing the types of hedges according to risks and items hedged:

| Item hedged | Risk hedged | Type of hedge |

| Fixed-rate assets and liabilities | Interest rates, Fair value, Termination Options | Fair value hedge |

| Fixed-rate assets and liabilities | Foreign currency, credit risk | Fair value hedge or cash flow hedge |

| Unrecognized firm commitments | Interest rates, Fair value, Credit risk | Fair value hedge |

| Unrecognized firm commitments | Foreign currency | Fair value hedge or cash flow hedge |

| Variable-rate assets and liabilities | Fair value, termination options | Fair value hedge |

| Variable-rate assets and liabilities | Interest rates, foreign currencies, credit risk | Cash flow hedge (most cases) |

| Highly probable forecast transactions | Fair value, interest rates, credit risk, foreign currency | Cash flow hedge |

Now, I’d like to hear from you. Please leave me a comment and let me know whether you have dealt with some hedge accounting in practice, what issues you faced and how you solved them. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

good afternoon, I’m working for an oil and service company and I have the following example:

we got an advance from a client(contract in dollar) in NAIRA equivalent at fix exchange rate. During 2016 NAIRA has been drastically devaluated and the equivalent amount of naira that we are getting from client against the advance is giving us a huge loss on the current year.

is it a sample where a cash flow edge have suppose to be applicable in order to minimize the impact on P&L?

regards

Sabino

Thanks for the great article. If a hypothetical derivative is used to check effectiveness, should the hedged item still be used to calculate to ineffective portion that goes to P&L?

If it’s a cash flow hedge, yes. The hedge can be effective, but not 100% effective and it means that it will have some ineffective portion.

Great, thanks Silvia. Yes, it is a cashflow hedge. So I’ll check effectiveness using a hypothetical derivative and the hedging instrument. Then I’ll calculate the cumulative change of the hedging instrument and if it is more than the cumulative change of the hedging item, that excess portion is the ineffective portion that will go to P&L. Does this sound correct?

Hi silvia, so my question is :-

what would be the financial impact (if u had to sum it up) if the other comprehensive income/loss arising from cash flow hedges is to be reclassified to profit or loss account in the subsequent period. Hope to hear back soon as its very urgent! Thank you 🙂

If fair value hedge accounting requires adjustment of hedge item , particularly when fair value of hedge item increases , does this mean IAS 2 has no application when company uses fair value hedge accounting?

Hi Silvia

Thanks for your time and effort in all this.

I feel this ‘fixed’ and ‘variable’ rule does not always work. Like if an entity X has 100 Tons of cotton in its inventory and its enters into futures contract to sell this cotton in 3 months time @ 50$ per Ton. The way I see it that company has converted something variable into fixed, so it is cash flow hedge. Am I right? And if it is fair value hedge, what am I doing wrong? Thanks

Pardon me, Tahir, but what’s the hedging here? I see only 1 contract – that is to sell the inventory in 3 months at fixed price. What’s the hedged item? And also, there’s also the question whether the delivery is physical, because if yes, then you don’t even have a derivative here, but the regular trading contract. S.

Hi Silvia, Entity entered into the contract to guard against the future fluctuations in the price of cotton (so that the value of its inventory does not fall), so inventory is hedged item. And lets assume contract can be net-settled. And thanks a lot

Hi Silvia, waiting for your guidance.

Hedge of inventory in hand through a forward contract is accounted for as cash flow hedge of fair value hedge? Thanks for your time.

Fair value. In your books, it’s a fixed item.

Hi Tahir,

I also think the fixed and variable method can’t be used to explain every case of fair value hedge and cash flow hedge. For the inventory example, I think can go back to the basics of the definition of fair value hedge and cash flow hedge. For example, Company A obtained a short term borrowing with a bank secured by Company A’s inventory of 1,000 tons of copper which it bought at $5 million. According to this borrowing contract, Company A has to provide additional collateral if the copper value falls below $4.8 million in future. So company A worries about the change in fair value of the copper and hedges it by a copper forward contract at price of $5,200 per ton. This is a fair value hedge. On the other hand, if company A worries about the change in cash flow from the copper in future then it can create a cash flow hedge. I think there are many ways to interpret a classification of fair value hedge or cash flow hedge. And the fixed and variable method is one of them and no one method can explain every classification. So sometimes we can apply the traditional method and sometimes we can apply this method.

He Madam,

I have been studying theory but still I am not clear with the distinction of the two hedges. I got lost on the cash Flow hedge. What do you mean by effective portion and ineffective portion, Please help

Hi Madam,

Thanks for explaining such a difficult topic so clearly.

But what happens if the swap is based on two floating interest,

for example: A bank pays 3M LIBOR and receives 1M LIBOR, which type of hedge it will be?

Currency swaps can be both cash flow hedge and fair value hedge

Hi,

I am not asking for a currency swap.

It is a basis swap, in which we swap the base on which the floating rates depends.

Hi Silvia,

I have the same query as Neal.

Kindly answer this. TIA 🙂

It depends on what the hedged item is – for me, it’s very unclear from what Neal wrote. S.

Hi Silvia,

Suppose X borrows @3M LIBOR and hedges it by an interest rate swap in which it receives 3M LIBOR and pays 1M LIBOR. So hedged item here is the 3M LIBOR. Is it the cash flow hegde or fair value hedge?

Cheers 🙂 !!

OK, nice but I understood that 🙂 Fine, let me tell you that this basis swap that exchanges one variability for another type of variability does not qualify for neither type of the hedge. So I’m afraid you could not account for a hedge accounting if you just took this type of a derivative. But, if you combine this swap with another derivative, well then, it could be possible to designate this combined item in either fair value hedge or cash flow hedge, depending on the specific circumstances. Cheers!! 🙂

Madam

In case of fair value hedge, why there is no requirement for a reserve like that in cash flow hedge? Also, Why there is no distinction between effective / in-effective portion of hedge and separate accounting treatment in fair value hedge like that in cash-flow hedge? Request to clarify the logic.

Thank you.

Juhi,

it’s because in FV hedge, you revalue not only hedging instrument, but also a hedged item (this is not the case at CF hedge). Both items are revalued to their fair value, hence there’s no sense to apportion effective/ineffective part. S.

What are the hedges we can use on securities (equities)FVH OR CFH OR BOTH…AND what should be our hedging instruments for this.

hello Md. Silvia I watch your video a lot and you are very helpful.

please how come was the Variable-rate assets and liabilities classified under fair value in your text above.

Madam Silvia

In the example of accounting for fair value hedge given above, no hedge effectiveness testing has been included. Is it not compulsory to test hedge effectiveness for fair value hedges? If so, what could be the logic of keeping it mandatory for only cash flow hedges and not for fair value hedges? As far as I know, under US GAAP, hedge effectiveness testing is done for both fair value and cash flow hedges.

Thank you in advance for the clarification.

Hi Juhi,

you should test the fair value hedge for the effectiveness. If it’s not effective, then under IAS 39 you need to discontinue the hedge accounting and under IFRS 9, you need to rebalance the hedge ration. If it’s effective, you account for it as written in the article – you don’t split the effective and ineffective part though. S.

Hi Silvia,

I have a question. If an entity is applying hedge accounting on a cash flow hedge and has hedged for sales of say 100,000 units of x commodity and then has forecasted sales of 90,000, are they required to recognised the g/l on the additional 10,000 units (over hedged?) in the P&L as opposed to the OCI?

Thanks and regards,

Daniel

Daniel,

you should hedge only 90 000 of sales, not 100 000 units. The hedging instrument to hedge additional 10 000 units (that do not exist) should not be accounted for as a hedge accounting, but as a regular derivative. S.

Hi Silvia,

I have a question.

Why the Gain/Loss on Fair value hedges booked in P&L, however in case of Cash flow hedges effective goes to OCI and ineffective goes to P&L.

Why this is happening if purpose of both is hedging ?

Regards,

Safiq

Safiq,

you forgot to add that at fair value hedge, also the gain/loss on the hedged item is booked (not in cash flow hedge). And it answers your question. It is happening to offset the fluctuations in fair value of the hedged item that are also recognized in P/L. S.

Hi Silvia,

Appreciated for this great article which helps me a lot to understand for about the topic. As I am a bit confused with the concept of hedge as I think to qualify as hedge the gain/loss on hedging instruments and on hedged items must be opposite (i.e. gain on hedging instrument vs loss on hedged item). Just wondering for a cash flow hedge, whether it is correct to deem the hedge as effective when there are gains on both hedging instrument and hedged items and the effectiveness is within the range of 80-125%, because for cash flow hedge we are just looking to hedge the variability of the cash flows. Many thanks Silvia.

Hi Silvia,

Would it be possible to designate a USD denominated loan as the “hedging instrument” to hedge highly probable forecast sales also denominated in USD. As far as I know, the answer is yes, as I am trying to hedge the FX exposure.

Trick here is, this loan has already been designated as the “hedged item” to be able to hedge the interest rate risk with an IRS earlier & the relationship is still ongoing.

Therefore, technically, I am trying to use the same loan as the “hedged item” in my first designation & “hedging instrument” in my second designation. I was wondering if this is a possible scenario.

Many thanks!

Hi Sylvia,

Great article, thanks very much! I think I now am clear about fair value vs cash flow hedges. But now I see people speaking about balance sheet hedging vs cash flow hedging, and then things get muddled again. Is “balance sheet hedging” simply another way of referring to fair value hedging? Thanks very much!

Hi Dan,

IFRS do not define the term “balance sheet hedging”, but in most cases it refers to protecting against the risk associated with foreign currency movements, related to your assets or liabilities denominated in foreign currency. In most cases, it’s a cash flow hedge. S.

Thank you for the explanation, Sylvia!

Hello Sylvia,

Can you tell me how to account for hedging for a portion of assets classified at Amortised cost.

The hedging insturment is as usual but noit sure how MTM is treated on the balance sheet and the P&L.(IFRS 9)

Sorry, what is MTM?

MTM is Mark to market

It depends on what you are hedging. Is it the fair value hedge or a cash flow hedge?

Fair value hedge for Securities at Amortised cost(IFRS 9)

Hi silvia

The article is very helpful.Thanks for explaining complex topic in a simple way.

I have a doubt ;if I have two types of fixed debt instruments one I have amortised using EIR & the other I havenot amortised. Now I have entered in to fixed rate prinicipal & interest swap in foreign currency, whether the same will be cash flow hedge or fair value hedge ?

Regards

Dear Priya,

it depends on what risk you hedge. You need to specify that precisely. Are you protecting against foreign currency movements? Then it’s a cash flow hedge. Are you protecting against fair value movement (i.e. are you swapping fixed rate to get floating market rate)? Then it’s a fair value hedge.S.

Hi,

Can you please also explain how to account for cross currency interest rate swaps (CCRIS).

I understand that fixed to fixed CCRIS are fixed interest payments in future and can be treated similar to forward contracts.

But how to account for floating to fixed CCIRS and vice versa and floating to floating CCRIS.

DO we apply hedge accounting these ?

Dear Mirza,

that’s the topic for a separate article itself. Let me just mention that yes, it’s possible to apply hedge accounting to CCIRS, based on what the hedge relationship is. What is your hedged item? What precisely is your hedging instrument – is it the full CCIRS? Or a part of it? Also, can you measure hedge effectiveness somehow?

If you hold your CCIRS outside any hedging relationship, then no, you do not apply hedge accounting, but you should account for all fair value changes of that derivative in profit or loss. S.

Dear Silva!

Thanks a million for sharing such a fantastic explanation about the differentiation both of these hedge’s type. Please define & explain the followings:

1. Define Effective & Ineffective portion of Gain or Loss on Derivatives;

2. What is the basis, criteria or parameters for splitting of Gain or Loss into Effective & Ineffective portions of Hedging Instruments?

Profound regards

Atif

Dear Muhammad,

hmmm, this is really a complex question and I think I need to write some article about it. In short: when the change in fair value (FV) of hedging instrument is greater than the change in FV of hedged item, you have an “overhedge”. If it falls within the range of 80-125%, then the effective part is the FV change equals to FV change on hedged item, and ineffective part is the difference between FV change of hedging instrument and FV change on hedged item. It looks very complicated, but it’s not really possible to explain it easily in the comment. And also, it’s only the example of dollar-offset method, applied under IAS 39. S.

Dear Silvia,

Firstly I thank you for replying my question. I made a flow chart presentation according to your comment still found very complicated. I would really appreciate if you write an article on this complex matter with numerical example for better understanding.

Profound regards

Muhammad,

may your wish come true. I’lll write something up within 1-2 months. S.

Hi Silvia,

If I take out a forward exchange contract to secure my exchange rate on a forecast transaction (for the purchase of inventory), I can obviously apply cash flow hedging.

However, once I receipt this inventory, I stop applying cash flow hedging. Does the hedge then become a fair value hedge or do I simply now account for this as a derivative instrument. I know the accounting treatment of a derivative and fair value hedge is the same, but want to understand the principle).

Thank you

Dear Jonathan,

I think that by the forward contract, you are hedging the planned cash flows and the receipt of inventories is not an event that would force you to discontinue the hedge accounting. Instead, you keep your hedge accounting until you pay for the inventories and exercise the forward contract. In fact, you are not hedging the inventories themselves, but the payment for these inventories.

Also, let me stress that fair value hedge accounting and the accounting treatment of a derivative are NOT the same. Yes, in both cases, you recognize the fair value change of a derivative in profit or loss, but in the case of fair value hedge, you also recognize the fair value change of the hedged item in profit or loss. S.

Hi Silvia,

Excellent Post! Thank you for making it so simple.

I have two questions:

1. We do cash flow forecast of our foreign currency purchases. Example: we forecast purchase of 10 million EUR of raw material in May. 2017. Functional currency is USD.

If I want to hedge the future purchase with a FX forward contract in order to fix my margins (P/L), is this Cash Flow Hedge?

2. In May 2017 when I purchase this raw material, this 10 million EUR is A/P on my Balance Sheet with 45 days payment term.

I want to fix my A/P in USD so I hedge it with FX forward contract – Is this FV hedge?

Is there a major difference between GAAP and IFRS on hedge accounting?

Hi KHF,

thank you!

1) Yes

2) No, it’s a cash flow hedge.

There are some differences, but probably not major. S.

Hi Silvia, how does one think about hedging inventory that comprises gold jewellery, for example. Would this be a fixed hedge…and consequently, one has to adopt the Fair Value method?

Hi Silvia,

thanks for all the detailed explanations!

I had a question which is more specific to commodity hedges – is the accounting at all affected if there is an asset lien? I am looking at a gas hedge for a power plant.

Also, does the US GAAP differ on this topic?

Many thanks!

Visan

Dear Silvia,

Would like to check with you. If the Company is entered into Cross Currency Swap (applying hedge accounting, cash flow hedge and the hedge is effective). The loan which entered into the swap is different from the functional currency. Understand that the Fair Value of the derivative is taken up in Other Comprehensive Income, how about the spot rate translation of the loan itself? Should recognised in P&L or OCI?

Thanks.

Hi Sylvia,

Should we classify a foreign currency denominated fixed rate bond as a fair value hedge or cash flow hedge?

S

Ah got it both!

But if I expect it to be effective, I’d rather choose to do fair value?

It would go straight to benefit P&L.

Hi Please I need clarification. I am having difficult establishing if a transaction I am working on is an hedging relationship.

My case,

I am currently reviewing the financials of a company which has an account designated as cashflow hedge reserve.

Now the entity buys raw material from foreign supplier and agrees times of payment which could be in 3 months. So my client sets aside some foreign currency amount in the bank( Eg EURO 15Million for the payment which will be due in say 3 months at an exchange rate of for example NGN250 per Euro on that day. So on the payment date the Euro I5 million is translated at the exchange rate of say NGN 300 per Euro and the exchange difference will now be recognized as cashflow hedge reserve.

My concern is that I am unable to identify a third party in this transaction. No one really bears the loss or reward of the transactions. Seems to me like is mere translation of foreign denominated monetary assets using the spot rate on the balance sheet date as required by IFRS.

Please assist to provide me with guidance on this as I am so confused

We hedge our foreign currency receivable on forecasted sales/future sales against the creditors, here hedged item is forecasted sales and hedged instrument is creditor. Please note we dont enter into an any forward contract or future contract.

i.e. any foreign currency receivables in future is hedged against the amount payable to creditors in foreign currency.

We treat this as Cash Flow hedge. This example (we are actually doing this) not covered in any book. Is this correct?

Hi Sylvia

I have some questions regarding the designation and treatment of cash flow hedge for FX swap (funding swap) under IAS 39.

My Case:

FX swap is a swap transaction exchange of principals of different currencies at the beginning and at maturity (i.e. convert USD to AUD at the beginning (near leg) and convert AUD to USD at the maturity (far leg)).

Initially, I would raise USD by issuing discounted bill and the USD received would be swapped to AUD to fund an asset. At the maturity, the AUD asset would be converted back to USD by swap for repayment of liabilities.

Between the value date of near leg and maturity date, I would have a USD Liability and a AUD asset in my balance sheet while the far leg of swap would be a derivative asset or liabilities like a forward fx contract.

Because the Asset and Liabilities would be revalued using spot FX rate and the far leg of FX swap would be remeasured based on forward FX rate, the non-parallel shifts of spot rate and swap rate would cause fluctuation of FX Profit. Therefore, I would like to use cash flow hedging to offset such fluctuation. (Namely, designate the discounted bill in USD as hedged item and the far leg of swap as hedging instrument and hedge on forward rate method)

My Questions

For cash flow designation:

1. Should be hedged item be defined as a “Forecast” transaction or recognised liabilities?

2. Given the liability is a discounted bill, should the value of hedged item equal to the notional value to be paid at the end or the discounted value I received at beginning?

Treatment Afterward:

3. By using forward method Cash Flow Hedge, the value of far leg would be all transferred into OCI. Should I recycle the amount of realised FX Profit and Loss of hedged item (asset and liability) out of OCI and return back to P&L during the life of swap? If the answer is yes, which section in IAS 39 would require/allow me to do so?

Many Thanks

Thanks for the explanation. If we purchase your material will it have examples on effectiveness testing on cash flow hedges as per AASB139.

Regards

Roland

Hi Sylvia

I have an interest in the impact of FX movement for reporting purposes.

In most (if not all) of the examples you gave above, they would be deemed to be monetary items. A company that held such items in a foreign subsidiary may consider cashflow or fair value hedges depending on the item.

Would it be fair to say that a company wouldn’t need to worry about FX movements for non-monetary items such as plant and equipment in a foreign subsidiary, as they would be converted to reporting currency at an historic rate?

Many thanks

Dear Steve,

in fact, when you translate foreign subsidiary’s accounts to a presentation currency for the reporting purposes, then you do NOT use historical rate, but the closing rate. You use historical rate for non-monetary assets only when you translate individual transactions to your functional currency (careful about what you translate: to a presentation currency? to a functional currency?). Of course, when you translate subsidiary’s functional currency accounts to parent’s functional currency (i.e. to a presentation currency), there are many exchange differences and their cumulative effect is recognized in other comprehensive income.

And then, about hedging of non-monetary items – maybe it would be great if you specify further what you have in mind. Do you own some fixed asset and you’d like to hedge its value? Or would you like to hedge investor’s interest in net assets of foreign subsidiary?

If the last is the case, then you can hedge the net assets and apply a cash flow hedge, but only to the foreign exchange differences arising between parent’s functional currency and subsidiary’s functional currency. You can apply cash flow hedge accounting, but only in the consolidated financial statements.

It’s quite a difficult topic and I plan to write some article about it. S.

hi Silvia,

i want to know ,in case we have hedged most of the payments which we have to pay to supplier with bank .further to explain ,bank first pay to supplier & then we pay to bank after 3 to 6 month of on forward contract rate ,so is it necessary to calculate the unrealise gain/loss for loan from bank in foreign currency

Shipra, I am a little lost in your question. You should calculate any unrealized gain/loss on any loan in foreign currencies stated in your financial statements. On top of that, if you enterred into a derivative (whether for hedge or not), then you should determine its fair value at the end of reporting period and recognize it. S.

Hi Silvia, thanks for the explanations. I just get confused on how to account for interest rate swaps with regards to hedging. Bank A is exposed to variable rate payments on their loan liabilities. They enter into a IRS with Bank B to pay fixed and receive variable.

1) This would be a CF hedge right?

2) What would be the difference if we apply hedge accounting and if we do not apply hedge accounting because I can’t see a difference – i.e under hedge accounting, the net amount between what we pay and what we receive will go to P+L (basically the non-effective portion). under normal accounting, we would still affect P+L with the net amount. So how does hedge accounting change this?

Thank you!

Dear Kalpesh,

1) Yes

2) There are 2 things to take care about:

– The interest paid: Sure, what you pay, is a part of the effective interest method and goes in profit or loss. I would say this is what happened in the past.

– Interest rate swap itself: You shall recognize the derivative too. This is what will happen in the future (its fair value is calculated as present value of future cash flows). Initially, its fair value is close to zero, but in the subsequent reporting periods, it will have some fair value and you need to account also for fair value change. Here the hedge accounting comes.

If you do not apply a hedge accounting, then the full change in derivative’s fair value goes to profit or loss.

If you do apply a hedge accounting, then only ineffective portion of change in FV goes to profit or loss and the effective portion is recognized in OCI.

Hope this helps. S.

Hi. Sivia

I want to ask from you about Cash Flow Hedge reclassification to earnings.

we are in Travel industry and we sell out tour package to our subsidiary companies in other countries..we have forward contract with bank..

Initially, we recognize gain from hedging in other comprehensive income..

my question is,

1. can we reclassify the gain from Hedging into earnings again ?

2.When we can make the reclassification.

Hi silvia

Say I’m going to receive $10million GBP as royalty payment from my subsidiary. However, as i’m a US company i would want to hedge this against a variable foreign exchange currency. Does this justifies to be a Cash flow hedge ?

I would say a cash flow hedge. S.

Hi Silvia

Another question is that, since i have entered into a forward contract (signed and sealed). Do I have to record it down as a transaction (E.g a Receivable) or should it be included in the notes of the financial statements?

Thanks

Dear Philip, since this is a derivative, it should be recognized in the financial statements at fair value (although initially, the fair value usually comes close to zero). S.

I wonder i well i would have understood that area of Financial Instruments without your presentation Silvia. Guess what ? It was succinct and simply simplified.Under how to account for a cash flow hedge you clearly stated “As you can see,you don’t even touch the hedged iten hear” Hahahahh…….That was pam. Thanks and keep it up.

🙂 I wish everyone would read my stuff so carefully 🙂 S.

Hi Silvia,

I enter into a forward to hedge an expenses in future in one year and the invoices will be come in at that point of time.

I recorded it as cash flow hedge. Just when the forward contract is expire but the invoices haven’t come in and it sit under my accrual, is this call ineffective potion? need to charge out to PL?

Hi Silvia,

The difference between Fair value & cash Flow Hedge is explained beautifully. I have one doubt in case of Cash Flow Hedge what will happen to Mark to Market(MTM) gain/Loss of an Investment (Hedged Item). Because as explained earlier, in cash flow hedge we do not touch Hedged Item in accounting??

Regards,

Vikash

Hi Silvia,

Assume a scenario where I agree a fixed price for a defined quantity of crude oil, say USD90 for 10,000bbl of crude. The price of crude in the market is USD30 and I agreed to pay the Buyer USD3.50 for each barrel of crude lifted so as to guarantee the price. How do I treat this type of hedge? In my view this is as good as a cash and carry transaction. Do I need to recognize any gain from this type of forward contract since I have basically agreed to sell the crude at a fixed price?

Hi selvia

I am looking for material /subscription covering the Hengyang accounting with Examples especially for

1)the treatment for hedging a bond that is classified under amortized cost (IFRS 9) or held to maturity (IAS 39)

2) examples for IAS 39

Method of hedge effectiveness calculating

1)dollar offset method

2)volatility reduction method

3)regression analysis

4)hypothetical derivatives method(for only cash flow)

Or rebalancing under IFRS 9

Hi Silivia,

I am looking for material/subscription covering the following topics/Questions

1)If I have a bond that is classified under Amortized cost, could I do hedging accounting i.e the bond to be hedged item (with examples)

2)examples for Method of hedge effectiveness calculating

3)examples for hedging accounting under IFRS 9

Thanks

Sami

In the search of how to write up a significant matter for my client’s new fair value hedge and came to this website.

Have to say, very helpful! Thanks a lot!

And, I have a laugh when reading your “Top 3 Biggest Dilemma with your auditors”

I experienced all of what you mentioned there before. Lol!

am also interested in knowing how to Calculate the effective and ineffective portions of the gain or loss on the hedging instrument?

Hi Naomi,

I replied somewhere above in the comment. Plus, I noted you subscribed to the IFRS Kit – so you’ll find a clear explanation there. S.

How do you present cash hedging in the cash flow statements (investment or financing)? Is there a specific lingo I should use to add a line in the cash flow?

I think the difference is the certainty of cash flows. In cash flow hedge u r certain to receive or pay and u just protect from variation in that receipt or payment. In fair value hedge, there is no certainty in cash flow yet as the decision to hold or to sell and when to sell are still undecided. Is my logic right?…:)

Hi Silvia, Need a clarification.

We have a long term loan in USD and intend to re pay with the foreign exchange earning in the future. Could please let me know, which one is the hedge item, hedge instrument and the impact on the OCI when the settlement is made. Thanking you

Hi Silvia, Thanks a lot for the explanation. In our company we have hedged the foreign currency risk with forward contracts. Is this falling under fair value hedge? Can u please explain on this?

Hi Shafras,

in most cases, it’s a cash flow risk when it comes to foreign currencies (e.g. you protect your receivables/payables in foreign currencies). But sometimes, it can be a fair value hedge, too. S.

Good afternoon Silvia!

I have been searching internet for 2 months in a row and still didnt find answer for this:

What lines in P/L statement are affected by the change of the value of hedge item/instrument? Up till now, I have found 3 different ways in different books: to Financial income, operating income and to revenues.

Is it different for each hedging relationship? Or e.g. hedge of fair value of commodity inventory is always affects operating income.

Please help me! <3 My head is going to blow up soon.

Hi Wen,

it strongly depends on what your hedged item is 🙂 Then the change of fair value goes to the same line as the main expenses related to the hedged item. S.

Hi Silvia,

How to identify the ineffective portion of a hedging instrument practically. Can you give a short example to clarify the same under IFRS 9.

Hello Silvia!

I would like to humbly ask you for your kind help since I have read most of articles here and didnt find the answer. 🙂

If inventory is hedged through FV hedge and the FV increases during the perioid till reporting date, is the value of inventory changed (increased) accordingly? Im just confused by IAS 2 and its “lower of cost or NRV” rule. Does it not apply here?

I will be forever grateful for your reply, this question is kind of preventing me from further understanding of whole hedge accounting.

Thank you1 Have a great day!

Hi Silvia

how to Calculate the effective and ineffective portions of the gain or loss on the hedging instrument?

regards,

Tom