Difference Between Fair Value Hedge and Cash Flow Hedge

The first thing you need to do before you even start to play with hedge accounting is to determine the TYPE of hedge relationship that you’re dealing with.

Why?

Because: the type of hedge determines your accounting entries. Make no mistake here. If you incorrectly identify the type of the hedge, then your hedge accounting will go totally wrong.

But here’s the thing:

Although all types of hedges are neatly defined in IFRS 9, we all struggle with understanding the differences and distinguishing one type from the other one.

A few weeks ago I was giving a lecture about hedge accounting to the group of auditors. Most of them were audit managers and seniors – so not really freshmen, but experienced and highly qualified people.

Yet after about 5 or 10 minutes of speaking about different types of hedges, one audit manager interrupted me with the question:

“Silvia, I get the definitions. I just don’t get the difference. I mean the real substance of a difference between fair value hedge and cash flow hedge. It looks the same in many cases. Can you shed some light there?”

Of course.

What types of hedges do we have?

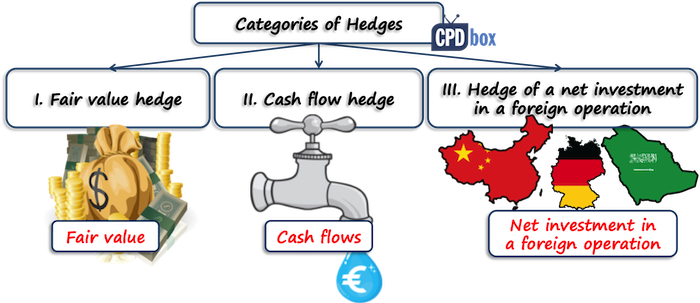

Although I clearly explain a hedge accounting in details in my IFRS Kit, let me shortly explain what type of hedges we have:

- Fair Value Hedge;

- Cash Flow Hedge, and

- Hedge of a Net Investment in a Foreign Operation – but we will not deal with this one here, as it’s almost the same mechanics as a cash flow hedge.

First, let’s explain the basics.

What is a Fair Value Hedge?

Fair value hedge is a hedge of the exposure to changes in fair value of a recognized asset or liability or unrecognized firm commitment, or a component of any such item, that is attributable to a particular risk and could affect profit or loss.

That’s the definition in IFRS 9 and IAS 39.

So here, you have some “fixed item” and you’re worried that its value will fluctuate with the market. I’ll come back to this later.

How to Account for a Fair Value Hedge?

OK, let’s not go into details and let’s just assume that your fair value hedge meets all criteria for hedge accounting.

In such a case, you need to make the following steps:

- Step 1:

Determine the fair value of both your hedged item and hedging instrument at the reporting date; - Step 2:

Recognize any change in fair value (gain or loss) on the hedging instrument in profit or loss (in most cases).

You need to do the same in most cases even if you don’t apply the hedge accounting, because you need to measure all derivatives (your hedging instruments) at fair value anyway. - Step 3:

Recognize the hedging gain or loss on the hedged item in its carrying amount.

To sum up the accounting entries for a fair value hedge:

| Description | Debit | Credit |

| Hedging instrument: | ||

| Loss on the hedging instrument | P/L – FV loss on hedging instrument | FP – Financial liabilities from hedging instruments |

| OR | ||

| Gain on the hedging instrument | FP – Financial assets from hedging instruments | P/L – FV gain on hedging instrument |

| Hedged item: | ||

| Gain on the hedged item | FP – Hedged item (e.g. inventories) | P/L – Gain on the hedged item |

| OR | ||

| Loss on the hedged item | P/L – Loss on the hedged item | FP – Hedged item (e.g. inventories) |

Note: P/L = profit or loss, FP = statement of financial position.

What is a Cash Flow Hedge?

Cash flow hedge is a hedge of the exposure to variability in cash flows that is attributable to a particular risk associated with all or a component of a recognized asset or liability or a highly probable forecast transaction, and could affect profit or loss.

Again, that’s the definition in IAS 39 and IFRS 9.

Here, you have some ”variable item” and you’re worried that you might get less money or have to pay more money in the future than now.

Equally, you can have a highly probable forecast transaction that hasn’t been recognized in your accounts yet.

How to Account for a Cash Flow Hedge?

Assuming your cash flow hedge meets all hedge accounting criteria, you’ll need to make the following steps:

- Step 1:

Determine the gain or loss on your hedging instrument and hedge item at the reporting date; - Step 2:

Calculate the effective and ineffective portions of the gain or loss on the hedging instrument; - Step 3:

Recognize the effective portion of the gain or loss on the hedging instrument in other comprehensive income (OCI). This item in OCI will be called “Cash flow hedge reserve” in OCI. - Step 4:

Recognize the ineffective portion of the gain or loss on the hedging instrument in profit or loss. - Step 5:

Deal with a cash flow hedge reserve when necessary. You would do this step basically when the hedged expected future cash flows affect profit or loss, or when a hedged forecast transaction occurs – but let’s not go in details here, as it’s all covered in the IFRS Kit.

To sum up the accounting entries for a cash flow hedge:

| Description | Debit | Credit |

| Loss on the hedging instrument – effective portion | OCI – Cash flow hedge reserve | FP – Financial liabilities from hedging instruments |

| Loss on the hedging instrument – ineffective portion | P/L – Ineffective portion of loss on hedging instrument | FP – Financial liabilities from hedging instruments |

| OR | ||

| Gain on the hedging instrument – effective portion | FP – Financial assets from hedging instruments | OCI – Cash flow hedge reserve |

| Gain on the hedging instrument – ineffective portion | FP – Financial assets from hedging instruments | P/L – Ineffective portion of gain on hedging instrument |

Note: P/L = profit or loss, FP = statement of financial position, OCI = other comprehensive income.

As you can see, you don’t even touch the hedged item here and you only deal with the hedging instrument. So that’s completely different from fair value hedge accounting.

How to Distinguish Fair Value Hedge and Cash Flow Hedge?

What I’m going to explain right now is my own logic of looking at this issue. It’s not covered in any book.

It’s how I look at most hedging transactions and this is a very simplified view. But maybe it opens up your mind to logical thinking about hedges.

Please, ask first:

What kind of item are we hedging?

Basically, you can hedge a fixed item or a variable item.

Hedging a Fixed Item

A fixed item means that the item has a fixed value in your accounts and it may provide or require fixed amount of cash in the future.

The same applies for unrecognized firm commitments that have not been sitting in your accounts yet, but they will be in the future.

And when it comes to hedging fixed items, then you’re practically dealing with the fair value hedge.

Why is that?

Well, here, you are worried, that in the future, you would be paying or receiving a different amount than the market or fair value will be. So you don’t want to FIX the amount, you want to GET or PAY exactly in line with the market.

I’m referring to “GET” or “PAY” only for the sake of simplicity. In fact, you don’t even need to get or pay anything in the future – you’re just worried that the item will have a different carrying amount in your books that its’ fair value.

Fair Value Hedge Example

You issued some bonds with coupon 2% p.a.

It’s nice that you always know how much you’ll pay in the future.

BUT you are worried that in the future, market interest rate will be much lower than 2% and you will be overpaying (in other words, you could get the loan at much lower interest in the future than you will be paying at the fixed rate of 2%).

Therefore, you enter into interest rate swap to receive 2% fixed / pay LIBOR12M + 0.5%. This is a fair value hedge – you tied the fair value of your interest payments to market rates.

Hedging a Variable Item

A variable item means that the expected future cash flows from this item change as a result of certain risk exposure, for example, variable interest rates or foreign currencies.

When it comes to hedging variable items, you’re practically speaking of a cash flow hedge.

Why is that?

Here, you are worried that you will get or pay a different amount of moneyin certain currency in the future that you would get now.

In fact, in a cash flow hedge, you want to FIX the amount of money you’ll get or pay – so that this amount would be the same NOW and IN THE FUTURE.

Cash Flow Hedge Example

You issued some bonds with coupon LIBOR 12M+0.5%.

It means that in the future, you will pay interest in line with the market, because LIBOR reflects the market conditions.

BUT – you don’t want to pay in line with market. You want to know how much you will pay in the future, as you need to make some budget, etc.

Therefore you enter into interest rate swap to receive LIBOR 12 M + 0.5% / pay 2% fixed. This is cash flow hedge – you fixed your cash flows and you will always pay 2%.

To Sum This All Up

Now you can see that the same derivative – interest rate swap – can be a hedging instrument in a cash flow hedge as well as in a fair value hedge.

The key to differentiate is WHAT RISK you hedge. Always ask yourself, why you undertake the hedging instrument.

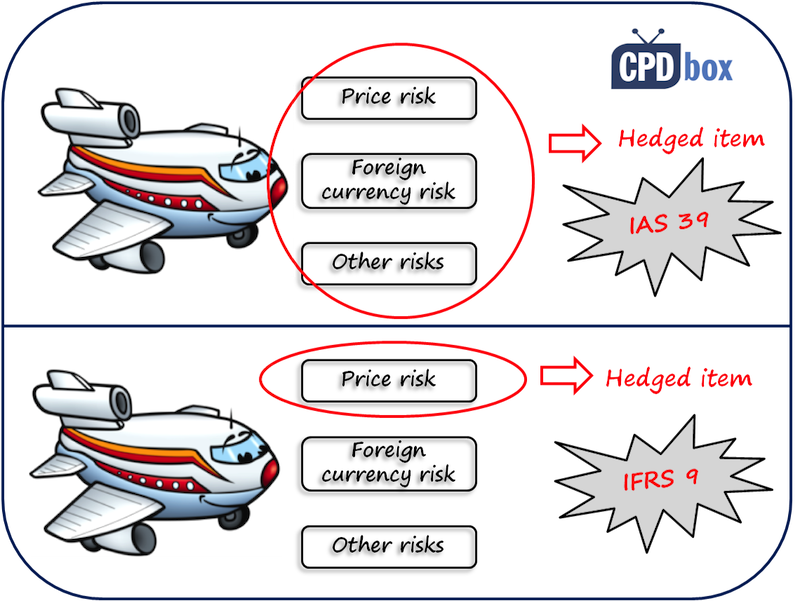

But it’s not that simple as it seems because there are some exceptions in IAS 39 and IFRS 9.

For example, even when you have a fixed item, you can still hedge it under cash flow hedge and protect it against foreign currency risk.

Equally, you can hedge a variable rate debt against fair value changes – and that’s the fair value hedge.

Therefore, please refer to the following table summarizing the types of hedges according to risks and items hedged:

| Item hedged | Risk hedged | Type of hedge |

| Fixed-rate assets and liabilities | Interest rates, Fair value, Termination Options | Fair value hedge |

| Fixed-rate assets and liabilities | Foreign currency, credit risk | Fair value hedge or cash flow hedge |

| Unrecognized firm commitments | Interest rates, Fair value, Credit risk | Fair value hedge |

| Unrecognized firm commitments | Foreign currency | Fair value hedge or cash flow hedge |

| Variable-rate assets and liabilities | Fair value, termination options | Fair value hedge |

| Variable-rate assets and liabilities | Interest rates, foreign currencies, credit risk | Cash flow hedge (most cases) |

| Highly probable forecast transactions | Fair value, interest rates, credit risk, foreign currency | Cash flow hedge |

Now, I’d like to hear from you. Please leave me a comment and let me know whether you have dealt with some hedge accounting in practice, what issues you faced and how you solved them. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

In banking, we offer fixed rate loans to borrowers and offset the interest rate risk by entering into an interest rate swap or fair value hedge. With the hedge, we pay a fixed rate payment and get a variable rate payment in return. With regards to reporting the change in fair value of the hedging instrument (the loan in this case), does this amount get added to the book balance of the loan or is it reported separately on the Balance Sheet as part of Other Assets. I understand the change in fair value of the hedge is reported as its own item on the Balance Sheet, just not sure if the fair value of the hedging instrument receives the same treatment.

Hi Silvia,

“irrespective of the hedge type, hedge accounting essentially involves measurement of the hedging instrument at fair value, regardless of the accounting method used on the underlying hedged item.”

Is this statement correct?

thanks

Ahamed

Can we get cash flow hedge for an interest rate swap agreement to manage 75% the risk of a variable debt. Meaning the notional amount on interest rate agreement is 75% of the value of the debt outstanding at the date interest rate swap agreement. Also can we get cash flow hedge for interest rate swap if the debt agreement was entered into on July 29, 2014 where as the interest date swap agreement was entered into on November 20, 2014. Does few months variance in the commencement matters?

Dear Silvia

Wonder how you explain such complicated topics at ease. really appreciate

Thanks 🙂 I just don’t like to be “lost in translation” 🙂

Hi Silvia, my client currently enter into future commodities contract to ‘short’ (sell) it purchases of commodities on the purchase date of the commodities and at the same time ‘Long’ (buy) the commodities when a sales contract is sign between the seller on the sales contract date. Then follow by the prompt date as dated by the future contract. The client will either settle earlier or at the prompt and make a gain / loss .

For example, purchase 100mts @ $1/mt of zinc on 1/1/2015 , buyer not finalised yet hence short(sell) it by entering into future contract at $1.10/mt and at a later date when a sales contract with customer A to sell zinc at $1.30/mts is signed with a customer on 3/1/2015, the client entered into a long (buy) future contract 100mts of zinc @ $1.20 with the future broker.

Hence the company made a future contract loss of ($1.20 x 100 – $1.10 x 100 = $10).

while in actual purchases and sales, the company made a profit of ($1.30 x 100 – $1 x 100 = $30).

The company will recognised the $10/- as hedging loss and this amount will be recognised directly into PL. The amount due to or due from the future brokers should be recognised into the FP as derivative financial assets / derivative financial liabilties. Is this the right way to account for hedging??

The future contract could also work in the opposite way such as entering in ‘Long’ (buy) future contract in regards to the sales contract signed and subsequently enter into ‘Short’ purchase contract.

The sales and purchases is only recognised when the goods is delivered and onto the FP and PL.

This should be designated as fair value hedge?

Hi Silvia, thanks for replying to questions like this. I wanted to know if the following is correct. A company has FX denominated loans and entered into forward contracts to cover the interest and principal payments. The accounting treatment: book and carry the loan in functional currency translated at the hedge contract rate/forward rate. The mark-to-market on the hedge contract sits on the balance sheet. When loan and hedge contract matures, the gain/loss on the hedge contract goes to update the Loan Payable account on the balance sheet. Not hitting P&L at all.. rationale is that once forward contract was entered into, this effectively turned the loan into functional currency….does this make sense? I’m used to traditional fair value hedge where remeasurement gain/loss is offset by hedge gain/loss on the P&L.

Hi Silvia,

Wondering if you could clarify something…

My company have taken out CCIRS in GBP/USD and GBP/JPY.

We revalue these items (at fair value) every period in the STRGL (performing retrospective testing each period) and posting the changes accordingly in STGL. I presume this is correct methodology using IAS39?

How will the accounting change following IFR9 implementation? I presume no retrospective testing will be required and the change in fair value will need to be recognised in OCI?

Many thanks for clarifying

Hi Bob,

you haven’t written whether your CCIRS is a designated hedging instrument or it’s just a derivative without any hedging relationship. You mentioned some retrospective testing, however, it’s not clear what you hedge, what the type of the hedge is etc.

If it’s not a part of some hedge, then of course, you’re right and IFRS 9 implementation won’t change it’s treatment.

If it’s a hedging instrument, then there are some differences in relation to testing the effectiveness, but the mechanics of accounting for a hedge itself does not change.

Hello Silvia,

I wanted to inquire whether I can hedge my Loan payable in USD with my Revenue which I will receive in USD?

Is that possible under IAS 39 and IFRS 9?

What difference does it make whether you designate a fair value hedge or not, as far as I can see the movements in the values of the hedging instrument and the underlying item both go through the P&L irrespective of whether you designate or not.

Dear Doug,

that’s not true, please refer to my above comment. Some “hedged items” are not revalued through P/L without FV hedge (e.g. inventories). S.

Dear Silvia,

Thank you for a very very useful web site. I would like to kindly ask a question.

What if the hedged item is already recognised receivable which is denominated in Dollar, where functional currency is Euro (FX forward is enterred). The movement in receivables due to FX rate change is already booked on P&L at reporting date. If FV hedge is applied, hedged item (in this case $ denominated receivables) fair value change will be booked twice in P%L (one for usual accounting entry, two for FV hedge accounting)?

Dear Dora,

if you designate your receivable for FV hedge (but I guess that it’s not what you want to do, because most of the time, you designate it for cash flow hedge really), then you do not book the change twice. As soon as you revalue receivable to the current year-end FX rate, it’s in its fair value, so there’s nothing to be booked within FV hedge. S.

Thank you so much Silvia for your very helpful and quick response.

Then, if you designate FX forward as CFH (assume 100% efficiency), net income will fluctuate until settlement of FX forward as change in fair value of FX forward will be booked to OCI under CFH accounting. And the revaluation of receivable/payable will be booked in P&L (they will not offset each other in the P&L until settlement).

After settlement of FX forward, amount in OCI will be reclassified to P&L and offset with the revaluation gain/loss from receivable/payable. Am I right thinking like that?

If this is the case, why would we want to apply Cash Flow Hedge for recorded assets/liabilities denominated in FX (receivables, payables, etc) which are revalued at period-ends? We can simply apply Economic Hedge (as change in fair value goes to P&L, it will offset with revaluation of hedged item) instead of Hedge Accounting, given that hedge accounting requires upfront documentation and testing?

Best regards

Hi Sylvia

I also came across this ifrs box nd wow! You’re good at what you do.

Just a quick 1 though, hedge accounting for a basic FV hedge is exactly the same as normal accounting treatment of the hedging instrument and item. Cos I really don’t c the difference between when we apply hedge accounting and when we don’t?

Only difference comes with CF hedges.

Am I right in this!

Hi Glen,

thank you!

Well, not really. FV hedge is a bit different from “normal” accounting treatment. Yes, it’s true, that for hedging instrument, you use some derivative in most cases and its fair value change is recognised in P/L anyway. But for the hedged item no. For example, if you hedge your inventories at FV, then you also recognise a change in FV of your hedge item (inventories), while normally, you keep your inventories at lower of cost or NRV (IAS 2).

Have a nice day!

Silvia

Crystal clear – thanks!

Iam still very confused when you still talk of IAS 39 yet my tutor told me that it was replaced long time ago by IFRS 9

Hi Julius,

it’s just a partial truth. Today, there are 2 valid standards: IAS 39 and IFRS 9 and the companies can make a choice which one to apply. IAS 39 stops being valid after 1 January 2018 only, so from 2018, there will be only IFRS 9.

What is effective and ineffective portion, Please give a suitable example. |?

Dear Raj,

please revise the above comments, there’s a mention above. Also, I talk about these issues fully in my IFRS Kit. However, maybe in 1 of my future articles, I’ll bring simple illustration,too. Have a nice day! S.

Hello Silvia. I have one question. Is effectiveness or ineffectiveness only calculated in relation to cash flow hedging relationships or is it also applicable to fair value hedging relationship? Thank you for your time.

Every hedge must meet hedge effectiveness criteria in IFRS 9 in order to apply hedge accounting. If these are met, then you can apply hedge accounting, if not – then no hedge accounting.

However, hedge can me effective, but not perfectly effective.

Measuring “how much ineffectiveness” is applicable for cash flow hedge as you recognize ineffective portion in P/L and effective portion in OCI. For fair value hedges, you only need to determine whether your hedge is effective or not, but once your hedge meets effectiveness criteria, you do not measure effective and ineffective portion separately.

Hi Silvia, with regards to your answer to Xavier’s question, is it correct that for Fair Value hedges we only record the effective portion of the hedging instrument to P/L and no journal entry for the ineffective portion?

No, not this way. Once your hedge is effective, then you record the full change in fair value (hence both parts) in profit or loss, on both hedged item and hedging instrument (at cash flow hedges, you are recording only the changes in fair value of hedging instrument split to effective and ineffective part).

By the way, here’s the article with podcast on measuring the hedge effectiveness, it will shed some light on the topic. S.

Hi Silvia, also as you mentioned “For example, even when you have a fixed item, you can still hedge it under cash flow hedge and protect it against foreign currency risk.

Equally, you can hedge a variable rate debt against fair value changes – and that’s the fair value hedge.”

In this example you said, we can hedge a variable debt against fair value changes and thats fair value hedge. This is exceptional, right. Can you please explain how are we hedging this?

Hi Silvia, thanks for you explanation, very useful. Assuming a perfect hedge lets say either in the form of a cash flow hedge or fair value hedge. A fair value hedge will have zero FX impact because underlying is at same spot rate as hedge and they both mature at same rate. For cash flow hedges the spot will be taken in advance of the underlying being on your balance sheet so although they mature on the same date the initial value will be different and so FX gain/loss will be recognised. Is that a fair synopsis?

Hi Silvia, thanks for such great explanation. I have been reading IAS 39, IFRS 7 and 9 and I still did not had an clear understanding between Fair Value and Cash Flow Hedge. I knew that I have to identify the risk, the hedge item, hedge instrument, strategy, economic relationship, effective and inefective portion and many other issues.

I work in treasury and am responsible for the follow up of financial instruments and their accounting/financial treatment. My industry is Coffee, a well known Commodity. So I will make up the context to you.

Hedge item: Arabica Coffee inventory bought at a fixed price.

Hedge instrument: Arabica Coffee Futures Contracts traded in Intercontinental Exchange (ICE, NY).

Economic relationship: the item is arabica coffee and the instrument is Arabica coffee futures. So the economic principle is very clear for me.

Strategy: Short Hedging for selling commodities.

Risk: possible decline price

Action: when we buy the coffee in the cash market, we hedge the inventory doing the oposite in the futures market (Sell) and buying futures later (buy) when is time to sell.

We do not have risk on the buying side of coffee in cash market since, we buy on spot price always. We never buy on a forward or time in advance later. In the same day we make a purchase contract of coffee(1 lot 375 bags of 46 kg), we fix a buying price, and that is the entry price for us to enter the futures market and start the Short hedge by selling (1 lot 375 bags of 46kg) futures Arabica coffee contracts in the futures market. Giving us a short position on the futures market, and long position on the cash market.

Now, on the sell side, we do make forward contracts to deliver an exact amount of coffee (e.g. 5 lots) at an exact quality(High Grown European Preparation HG EP), exact time (shipment on May N15 July expiration month), and exact place (Port FOB). But we do not fix a price, so we call these forward contracts Price to be fix (PTBF).

Now, that I have explain you the context, I will get you to the big deal I have.

Our company is implementing IFRS Full for the first time on FY14. Our Auditors are Deloitte. On the previous year we have been using Local GAAP. (Which does not even know or recognize financial instruments accounting treatment other than ordinary Assets and Liabilities.

We have these Derivaties (Financial Instruments) and we use them as hedging instruments, both item and instrument are well defined as I have mentioned before. Now let´s try to find out if the hedge item is a Fix or Variable item.

You mentioned that inventories are Fix item. That is ok for inventories of items that are not listed on Exchanges. For example, cars, iPads, beds, shoes, etc. But for coffee, we have an active market (Level 1). The information of these prices are available for everyone and they are a common ordinary item. Nonetheless, commodity prices are very volatile, and prices can vary more than 100% in less than one year.

We can say we have a fix item on the buy side, but as I mentioned before we do not make commitments to buy on forward prices just spot prices. And we sell on PTBF that means our value of our sales are unknown, and so are the cash flows related to the income of our physical inventory of coffee.

My boss financial controller says that the inventories are an asset an therefore should be treated as a fair value hedge. The auditos initially wanted to treat the inventory with IAS 2, and Net realizable Value NRV. I do not agree. I have change auditors mind that commodity inventories should not be treated as NRV since the IAS 2 clear states it should be treated as Fair Value. That is ok if the inventories were not hedge. And since we do not like risk, and we want to offset market price risk, we use coffee futures to mitigate that risk.

If we had firm commitments or contracts that represent the sale of our inventory we could treat them as Fair value less cost to sell. But since we do not have a fix price, and we are hedging them, I think, understand and belief they should be treated as a Cash Flow Hedge.

To add more context, we do have the practice of making the mark-to-market valuation approach, which in other words represent fair value of inventories.

As we are hedging the inventory that Is ready for sale but with a PTBF contract, there should be an account that records the variation on fair value of the hedge item (lets call PNL of the inventorie) and should be recorded against a reserve of equity, called (Reserve of PNL of coffee inventory) although they are called PNL that does not mean I am saying the effects should be taken to P/L statement.

On the financial instrument (derivative)[by the way I read commodity contracts are not financial instruments how is that possible or when is it????] And this should have an impact on its fair value depending on the market price. If prices goes down I will have an unrealized gain, and if prices go higher I will have an unrealized loss, ok? Because the futures market position is Short Hedge.

MY approach is the following.

Any variation of the hedge item and hedge instrument should be taken to :

Price Hedge item Dr. Cr.

Higher Gain Asset (Gain inventorie) Cash flow Reserve (Gain)

Lower Loss Cash Flow Reserve (Loss) Liabilitie (Loss)

Hedge instrument

Higher Loss OCI (Loss) Liabilitie (Loss)

Lower Gain Asset (Derivatie gain) OCI (Gain)

If the hedge is 100% effective, any ineffectiveness should be taken to Income statement for the FY of the change in price as the date of the FP.

We then arrive to the time to make the sell, and we have a known sell price.

Cash market (offset gain or loss on Cash Flow reserve Equity)

Future market (reclassify gain or loss to income statement when the price is know, and we buy the futures contract we had initially sold. That exit price will be my new fix price for the sale and the PTBF expires so I do not need any hedge since the market price risk have disappeared.

The main reason for these treatment I recall again, is the condition that I have a variable item hedge and not a fix variable hedge (coffee inventory).

Who makes more sense, me or my boss? Or the auditors?

Dear Jacinto,

thank you for your comment, and really let me thank you for your trust you placed in me and for posting me this question. However, to answer this question properly, I would need to dedicate more time than I currently can afford. I believe quick response would not give you the quality and diligence that everybody (also you) expect from my work.

Hence I leave it to other readers to go through your questions and tell you their opinion. When I have more time, I may eventually come back to it.

Hope you understand. S.

i want to know about use of cash flow at risk in intelligence hedging decision?can u help me plz

Thanks So Much Silvia. This Is “Hedge Accounting Made Easy”.

Please i really néed to get your IFRS KITS, but i need You to confirm to me the pricé and the last edition

Specifically, does the newest édition of the IFRS KIT covers the completed version of IFRS 9- Financial Instruments.(i.e Released July 2014).

Please i need a response as urgent as possible.

thanks.

Hi Oluwaseun, I’ve just responded by e-mail, but to answer: YES, the IFRS Kit does include the newest version of IFRS 9. S.

Hi Silvia,

Needed a clarification:-

In case a Co whose reporting currency is INR & has fx risk on account of export receivables in USD, has a fixed rate debt issued in INR in its books.

The Co intends to swap this INR debt with a CCIRS where it receives fixed rate INR Interest & pays floating libor USD. On the final prinicipal exchange it receives INR & pays USD.

Through this the Co intends to naturally offset USD payment against its forecast receivables in USD.

Can this CCIRS be put into a cash flow hedge against highly probable forecast exports? The following issues may arise:-

1)Through the swap I am converting a fixed liability into floating which will require fair value hedge accounting.

2) The risk being hedged is fx risk for forecast trnsaction which will require cash flow hedge accounting.

3) At the time of taking the swap, the INR debt in the books has no risk involved.

Your guidance on the same would be appreciated.

Hi Silva,

Nice reading about Hedge Accounting, please help me to have better understanding, i want to ask you that:

1.how to calculate hedge effectiveness at the first cut off reporting period, because we just start to calculate the fair value and there is no changes in fair value movement?

2.how to calculate the ineffective portion? For example when the calculation set at 130%,is it only the portion amount of 130%-120% will be charge at Profit and Loss?

3.for fair value hedge at the perfectly match of Hedge Items versus Hedge Instruments, is it always perfectly offsetting in Profit and Loss between changes in Fair value of Hedge Instruments and Hedge Items?

4.in a very fluctuative exchange rate conditions, our company set several CCIRS transactions where our Hedge items is bank loan, the main problem is that our on balance sheet hedge items revaluated at each reporting period and then the net settlement from CCIRS also resulting a foreign exchange exposure due to different between book rate compare to spot rate when we receive or pay the CCIRS, is it my accounting treatment is not proper?

5. For a perfectly match condition of Hedge Items versus Hedge Instruments, can we only applied for critical match method for hedge accounting?

I would like to thanks in advance for your favourable reply.

Rgrds,

Ferry

Hi Silvia. In relation to an investment in a foreign currency, does the hedge term have to meet the expected life of the investment. If so, what would occur if you cannot get a hedge to match the expected life of the asset, or if there was no defined term for the life of the asset, eg if you were buying property.

Hi Tony, not necessarily. If you can demonstrate that the hedge will still be effective and meets its objective, then OK. But in this case, it is very probable that there will be some ineffectiveness in the hedge, caused by different “maturity periods” of hedging instrument and hedged item. S.

Awesome explanation – thanks so much. Wonder if the predictability of the expected future cash flow is a required for the hedge accounting at inception. Say I am buying Foreign inventory payable in their currency and then If I as a practice keep taking different maturities of hedges to settle that due. My question is only after i purchase that inventory should I take that hedge can I use the hedge accounting or is it just the predictability of the forecasted purchase to offset my currency exposure (variable here). I am assuming that this is cash flow hedge

Thank you – I stumbled upon your resource – its brilliant

Hi Aparna,

thank you!

You can hedge highly probable forecast transactions – this would be your case. You don’t have to purchase the inventory in order to hedge, but the transaction must be highly probable. And yes, that would be a cash flow hedge.

S.

hi Silvia,

i found some materials that the change in fair value of hedge instrument was discounted. i.e. discount period from closing date till settlement date.

my question is: when and/or what type of hedge do we use discounting the changes of FV?

thanks. would be very helpful.

hi Silvi,

What about commodity price hedge this i suppose also can be either cash flow or fair value hedge. In this case the FV of the hedged instrument will be the unrealised gain or loss as per the broker statement but what about the gain or loss of the hedged item? Will this be the same?

Eg customer wants to buy aluminium for USD 2K on 7th Jan and so supplier hedged the same quantity of aluminium at USD 2K on same date on 7th Jan. Broker statement will be USD 10 loss, so will this also represent the gain or loss on the hedged item and hence no entry will be passed? Thanx in advance

Dear Rima,

it really depends on the type of the hedge.

If you have a fair value hedge, then you book both FV gain/loss on hedging instrument and FV loss/gain on hedged item.

In a cash flow hedge, you need to measure effective/ineffective portion of the loss/gain on hedging instrument and if the hedge is still effective, you book ineffective part in P/L and effective part in OCI.

If I understand it correctly, the supplier holds aluminium for its client and contract’s price is fixed, so is supplier hedging the fair value of its inventories of aluminium? If yes, then it’s FV hedge.

I have a question regarding the hedge relationships, from a banks perspective,

lets say a bank provides a interest rate gurantee on a mortgage for a period of 6 months. To reduce the risk that the bank is exposed to, the bank begins to economically hedge the risk via derivatives.

Based on this information – would this be a fair value hedge relationship? the hedge item is the fixed interest rate? or would the hedge item be the potential variable interest rate to be received when the customer funds their mortgage?

thanks

For me it seems like it is a fair value hedge, meaning that the hedged item is a “fixed-rate” interest rate.

Hi Silvia. Your explanation is great. However, there’s one thing I’d like to ask. If the an entity’s commitment fixed only the quantity and date of the purchase while the price is fixed on a certain benchmark, is it still considered as firm commitment and should apply fair value hedge?

Hi Silvia,

Good day!

Would appreciate your insights on this…

We’re an importer of raw materials and pay the same in USD. We use FOB Shipping point terms. To hedge against the volatility of Forex we entered into a Forward contract to ensure that we already have a fixed amount of local currency equivalent to pay for the obligation. How should be clasifty this transaction? What are our proposed entries to record this transaction? Should we recognize the RM at the forward rate amount or the FOB date forex.

Thanks in advance and hope you can help us.

Hi Silvia, thanks for being helpful and so clear! In the case of a variable rate bond, why would a fair value hedge be needed? Since by its very nature, a variable rate bond would be at fair value.

Hi Silvia,

Very helpful article and thanks for explaining such a complex area in a very simple manner. It would be great if you can clear my dobut. I had asked this before and guess it was missed.

I understand that when a company goes for fair value hedge accounting, they take the accounting priviledge on the hedged item unlike a cash flow hedge where the same is taken on the hedging instrument.

I have couple of questions;

1. Can a fair value hedge be applied to Available for Sale securities? If yes then do we take the FV changes to P/L instead of OCI?

2. When I am entering into a FV hedge for a fixed rate debt (as mentioned in your example), I understand we do a fair valuation of the interest component for the debt (since FV of debt might also include other variable factors like credit risk, liquidity risk etc). In such case do I split the FV component and show them separately from the host debt contract?

Many thanks in advance

Regards,

Manish

How to determine the effective and ineffective portion of cash flow hedge.

Thanks

I have same question

OK, let me reply, although it’s not really a topic to cover in 1 comment:

You simply need to compare the change in FV of your hedged item and the change in FV of your hedging instrument (in CF hedges).

Let’s say change in FV of hedging instrument is +100, and change in FV of hedged item is -90. It means that this hedge is not perfectly effective (in such a case, change in FV of hedging instrument would be 90 and there would be 100% offset). However, percentage of offsetting is 111% (100/90) which is very effective.

Now, the effective part of change in FV of hedging instrument is then 90, and ineffective part is 10 (100-90).

Is it clear, guys? 😉

Thanks a lot Silvia, really appreciate it. I guess its more clear now. But what if it was the other way round? Change in FV of Hedging instrument was +90, and change in FV of Hedge item was -100.. Then what will we do?

Thanks again for your help 🙂

Hi Anas,

above, I described “over-hedge”. Here, you described “under-hedge”.

In CF hedges, if there’s under-hedge, then there’s no ineffective portion and you should take all the change in FV of hedging instrument to OCI.

If there’s over-hedge in CF hedge, then you split change in FV of hedging instrument to effective and ineffective portion just as I described above.

Hope it’s clearer now. S.

We are an European country (EUR) and we have a contract in Middle East (AED) for the next 5 years (long term), so our risk is a foreign currency risk, thus, Should we do a cash flow hedge better than fair valur hedge?

Are there some “clues” to identify the choice (FV hedge or CF hedge) in this kind of situations? For example:

-> Contracts > 1 year or

-> Hedges > EUR 500k

etc.

You recommend to work with CF hedge btter than FV hedge…

Thank you.

Dear Silvia

Thanks for the clarifications. I understand this much better now. I assume in such cases that there are no advantages in using a particular type of hedge accounting. If you think there is there an advantage in using a particular type of hedge accounting, can you explain with the reasons.

Regards

Harry

Silvia,

With reasons can you explain whether hedging reserve is a distributable reserve or non distributable reserve?

it would be highly appreciated if you could give me an answer today

Thank you in advance

Non-distributable. At some point in the future, it will reverse in P/L. S.

Hi Silvia

Lucid explanations to explain the hedge treatment. Thank you.

However am not sure what type of hedge would i classify a currency forward to hedge a payment for acquiring a fixed asset in future (the currency in which the payment is made is different from the functional currency). The purchase of fixed asset is committed hence I could call this unrecognized firm committment (hedged item) and the risk hedged is the foreign currency. Looking at your table where you have summarized the types of hedges it looks like we could use both Cashflow hedges or Fair value hedges which seems to be a bit confusing. Can you please clarify this.

Thank you

Harry

Hi Harry,

it depends on what you hedge. For example:

1) If you know your machine will cost the exact amount in the foreign currency in the future, and you want to protect just against foreign currency rate movements, then you can treat as a cash flow hedge.

2) If you’re not sure about the future price of your machine and you’re afraid of the price increase in the foreign currency, then it’s basically fair value hedge.

And there are lots of combinations, too. Hope it’s clearer! S.

Hi Silvia

Thanks for the clarifications. Yes the purchase price payable is fixed in foreign currency. Since the amount payable is fixed in foreign currency, since we are dealing with fixed item i pretty much concluded that we are dealing with the fair value hedge. Shouldnt this be the case? Are we talking about exceptions here? Please let me know

Thank you

Warm Regards

Harry

Dear Harry,

the thing with unrecognized firm commitments is that IAS 39 permits to hedge foreign currency risk under both fair value and cash flow hedge.

Above, I suggested to treat it as a cash flow hedge, because in your case, the amount to pay in the foreign currency is fixed – that’s true, but in fact, the amount to pay in your own currency is variable as it fluctuates with the changes in the foreign exchange rates. It’s very similar to typical receivable or payable.

But as I wrote, IAS 39 allows you to account for hedge of unrecognized firm commitment under both types of hedges.

Silvia, thank you for the excellent write up and question responses. However I am confused by your answer to Harry’s question. In the detailed article at the top of the page you explained that a fixed value item will be hedged using a fair value hedge. As the price of that item fluctuates in your local currency, your hedge PnL will offset the item’s PnL (in local currency). However, in your response to Harry’s question you’re saying that a cash flow hedge should be used. What am I missing?

Thank you.

Hi George, if I read my answer correctly. I suggested both hedges in this case, based on what risk Harry is hedging.

Silvia,

For a fair value hedge using an interest rate swap to hedge corporate bonds, do the notional values of the swap and the bond(s) have to be the same? Do the terms of the swap and the corporate bonds have to be the same?

Thank you!

Gail

Hi Gail,

IAS 39/IFRS 9 do not state this requirement. Notional values can be different, but in such a case, you’ll have a harder time to prove that your hedge is effective and qualifies for hedge accounting (as the terms in your hedged item and hedging instruments do not match). But I don’t say it’s impossible. S.

Silvia. I am doing a college assignment. in notes of a financial statement by a company i saw this statement

“Hedging reserve we have relates to the effective portion of the cumulative net change in the fair value of cash flow hedges related to hedged transactions that have not yet occurred”.

Can you please tell me what type of hedging reserve this is? i find it a bit confusing. it would be highly appreciated if you could give me an answer today or tomorrow as my assignment is due tomorrow

Thank you in advance

Well, when you account for cash flow hedges, then you calculate effective and ineffective portion of FV change in your hedging instrument. The ineffective portion is recognized in P/L and the effective portion in OCI. This effective portion in OCI is then called “hedging reserve” – hope that’s clearer. S.

Thanks a lot Silvia

it really helped. can you tell me the difference between hedging reserve and share premium… i know its different but still need some point

Thanks Again

Thanks silvia, the topic is explained in a perfect manner. Was very helpful and interesting.

Dear Silvia,

I have an ACCA P2 exam in December 2014 and I’m a bit confused with all these changes lately, so my q is: which standard we should refer to when dealing with financial instruments in our exams, IFRS 9 or IAS 39?

Thank you in advance

Hi Nena, don’t worry about this, you will be told in the question what to use. If not, and the accounting treatment in IAS 39 is different from IFRS 9, then simply make your choice and don’t forget to write it clearly in your answer. Remember that ACCA examiners give marks for stating the obvious, so do it 🙂 S.

Hi Silvia,

Very helpful article and thanks for explaining such a complex area in a very simple manner.

I understand that when a company goes for fair value hedge accounting, they take the accounting priviledge on the hedged item unlike a cash flow hedge where the same is taken on the hedging instrument.

I have couple of questions;

1. Can a fair value hedge be applied to Available for Sale securities? If yes then do we take the FV changes to P/L instead of OCI?

2. When I am entering into a FV hedge for a fixed rate debt (as mentioned in your example), I understand we do a fair valuation of the interest component for the debt (since FV of debt might also include other variable factors like credit risk, liquidity risk etc). In such case do I split the FV component and show them separately from the host debt contract?

Many thanks in advance

Regards,

Manish

Can you tell me how many types of risks are there for which hedging can be done. As per me there are four risks– market price risk, interest rate risk, credit risk and foreign currency risk.

Regds

Sambhav

Hi Sambhav

In my view hedging for FX Risk, Interest Rate Risk and Credit Risk (limited) can be done by hedging. Other components of Market Risk due to macroeconomic scenarios can be managed by diversification.

Regards

Amit

Thank you very much Silvia,

Kind regards

Visar

Thank you very much Silvia,

Just to clarify,

How should Bank A classify type of hedge in this scenario?

(Bank A (Subsidiary) use Interest Rate Swaps- The Bank A pays fix and

receives variable interest rates from Bank B (Parent).)

Cash flow hedge or

Fair value hedge

I sincerely appreciate the time you spent in my issue

Best regards,

Visar

That would be a cash flow hedge for the bank A. If the swap is opposite (A pays floating, receives fixed), then it’s a fair value hedge. S.

Hi Silvia

Wrt your reply to Visar, wont it be a FV hedge if Bank A is paying fixed as per your initial examples as the Swap is the hedging instrument in this case.

Regards

Amit

Yes, Amit, that’s what I wrote above.

Hi Silvia

Sorry, but I think I didn’t frame my question correctly earlier. If bank A is paying fixed that means it has a variable rate liability which it is hedging. So as per the example given under CF hedge above this should qualify under CF hedge for Bank A.

Regards

Amit

Hi Amit, my head turns around now 😀

You see, it’s usually not that easy to realize what risk we’re hedging.

So once again:

Hedged item = variable-rate loan

Hedging instrument = IRS with pay fixed, receive variable => then pay variable receive variable cancel out, so we’re left with pay fixed. Which is CF hedge as we’re fixing the amount of cash to pay. Hope it’s clear now 🙂

Thank you very much Silvia,

Bank A (Subsidiary) in 2006 started to use Interest Rate Swaps- The Bank A pays fix and

receives variable interest rates from Bank B (Parent). The main purpose of these instruments is to mitigate the interest rate risk associated to the fixed rate lending (difference between loans –deposits)

For two years (2006&2007) Bank A recognized in Income Statement: Expenses in IRS SWAP and Income from SWAP

In 2008 Bank A recognized Negative fair value financial derivative instruments through profit or loss.

Please can you help in question below:

• According IFRS is allowed Subsidiary to use Interest Rate Swaps with Parent (Related Party)

• Is correct to recognized Negative fair value financial derivative instruments through profit or loss

• Can you help how to calculate fair value for Interest Rate Swaps

Thank you very much,

Hi Visar,

OK, let me go straight to your questions:

1) Yes, IRS can be arranged between 2 related parties. But in this case you need to make appropriate disclosures and also, you need to be careful because IRS between related parties are not necessarily arranged at market conditions (=fair values) and as a result, you would need to make appropriate adjustment to bring it to the fair value. Maybe it’s not your case though.

2) Of course. Is it officially designated and treated as a cash flow hedge? Because if not, then you don’t have any other choice but to recognize all gains or losses from derivative in profit or loss.

3) This is much more complex topic. I have covered it in my IFRS Kit where I show how to calculate the fair value of plain vanilla interest rate swap (same currency, fixed for floating). However, the calculation of IRS’s fair value depends on HOW exactly it is constructed and may require complex modelling.

Have a nice day!

Silvia

Thank you Silvia for the explanations above , i have one question , can we have a fair value hedge against a Fixed rate bond classified At Amortized cost” to hedge the interest rate risk ?

Yes, you can. In that case, any hedge adjustment is amortised to profit or loss based on a recalculated effective interest rate – so not right away to P/L. S.

Hi Silvia,

when fair value adjustments are amortized to p/l, isn’t there still the problem that financial statements do not represent the effect of an entity’s risk management? (when only the amortized volume is recognized in p/l for a period?)

Thanks in advance and kind regards, Janni

Hi Janni,

I don’t think so. When you keep an asset at FVTPL, then you put all the difference from revaluation in P/L at once, you do NOT “amortize it” over time. S.

Hello Madam,

Have a following doubt.

If company has issued foreign currency fixed interest rate bond than and to hedge currency risk and interest rate risk it has undertaken cross currency interest rate swap than can this hedge be qualified for both fair value hedge (for interest rate movements) and cash flow hedge (for cross currency movements).

If yes than this hedge will be subject to cashflow hedge accounting treatment for currency movements and fair value hedge accounting treatment for interest rate movements.

Hello, Mayur, this is a great and interesting question.

The answer depends on the construction of the hedging relationship, but to make it short: what you described is totally doable. If your CCIRS (cross-currency interest rate swap) is constructed in a way that currency risk element is separable from interest rate risk element, and if these two elements can be separated and measured separately also for your fixed interest rate bond, then you can do it. You just need to designate it in your hedging strategy that way.

I have seen that CCIRS can be used in various types of hedges, for example, pure cash flow hedge (if swap is fixed for fixed, just in a different currency), also pure FV hedge (fixed for floating). By the way, if you want to keep your life easier, you can designate your hedge as CF or FV only, depending on the type and conditions of CCIRS. Have a nice day! S.

Hi Silvia,

Kindly explain the meaning of effective and ineffective portion as I m unable to understand it.

Rajesh,

Effectiveness is the measure that how successfully hedging instrument has covered the fluctuation in hedged item.

OK! how we determine that it effective or not

Thank you very much Silvia. When are you going to take us through Hedge of net investment in a foreign operation in this manner?

Hi James, well, I did not want to cover it here, because once you see this type of a hedge, you can clearly identify it – there’s no doubt about the type of the hedge 🙂 But I’ll do it. The thing is that not many people are interested in this topic, because that type of hedge is taken mostly by bigger companies or corporations and some IFRS expert solves it for them 🙂 S.

Thanks Sylvia. . Difficult subject matter well explained.

Kind regards

Raj..

hi Silvia, thnks , I did P2 in 2012 in quite forgotten some bits , thanks once again . this is a very challenging IFRS ! BEST REGARDS . OOMESH .

thank you for this. we do foreign currency forwards at the year-end, cause we buy in usd. but they are short-term and we don’t book them as hedges. is it wrong?

Hi Anilla, no, it’s OK. Hedge accounting is OPTIONAL, not obligatory. So if you prefer to keep it simple, it’s OK to revalue your forwards to fair value and that’s it. Mainly when the forwards expire within some short term. S.

hi silvia, is the posting of the ineffective portion a balancing figure ? oomesh from mauritius

Hi, Oomesh, yes, basically it is. The gain or loss from change in FV of hedging instrument = effective portion (to OCI) + ineffective portion (to P/L). Take care! S.

Hi Madam,

Just wanted to ask what is the specific difference in hedge accounting between Cash flow hedge and Fair value Hedge.

Mayur, please revise the 2 tables above where you can see the tables with journal entries for both hedges. But the main difference is, that at CF hedge you don’t touch the hedged item and you revalue only hedging instrument + you need to split the gain/loss to effective and ineffective portion+effective goes to OCI and ineffective to P/L.

At FV hedge, you revalue both hedging instrument and hedged item and if the hedge is effective, you put gain/loss from both elements to P/L.

S.

Hi silvia

m c.a finalist n m finding it quite difficult to learn about how derivatives and hedging work and about their definition and accounting treatments in the light of ifrs. please help me out if u have easy to understand easy material on mentioned topics.

Hi Anjum,

yes, I have an easy-to-understand material about hedging, however, it is included in the IFRS Kit http://www.cpdbox.com/ifrs-kit.

Kind regards, S.

Hi silvia,

Hope you are doing well.

I have quesgion regarding IAS 20 with IFRS 9.

If an entity receives loan from Government @ LIBOR -1% and entity is not subject to IFRS 9 application Would it still account for it as Government grant?

Reference; kindly you may refer to Para 10A of IAS 20.

Thank you.

Hi Silvia,

in this case with short term forward agreements classified as CF hedge what will be the accounting entries? I will go for a forward agreement for 21 days to buy a fixed amount of USD (functional currency is RSD) in order to pay for the acquisition of a PPE (I know the exact amount of this order). How can I record the loss calculated for this agreement as being the difference between spot rate and the actual exchange rate at the settlement date? Many thanks

Hi Silvia,

I am doing an audit for an oil refinery, where they purchase crude and process it and sell the final product.

Please tell me that hedging performed for purchase of crude in order to tackle the risk of price movement of crude, will it be classified under cash flow or fair value hedge??

Thanks Silvia for the clear explanation. Just want to know, in terms of the “Hedge accounting is OPTIONAL”, in which IFRS could we find this assertion? Thanks a lot in advance.

Hi Oliver, it is implied throughout the section 6 of IFRS 9, just as an example take a look to 6.5.1 – “An entity applies hedge accounting to hedging relationships that meet the qualifying criteria in paragraph 6.4.1 (which include the entity’s decision to designate the hedging relationship).” – the brackets say “entity’s decision”, thus if there is no entity’s decision to designate the hedging relationship, then this condition is not met and hedge accounting is not applied. Entity’s decision makes it voluntary, right? (as it depends on the entity’s will).

Thank a lot for the kind reply and clear clarification! It is so much appreciated!!