What Is a Financial Instrument?

A few weeks ago, we published the article about How to Implement IFRS 9 to assist you with the adoption of the major forthcoming IFRS update.

Many accountants and CFOs are worried about IFRS 9, there are numerous discussions going on about it, but not everybody has the clear vision about WHAT is a financial instrument.

Indeed, some items are crystal clear to identify – yes or no.

But, some other transactions require careful assessment of the terms in the contract to conclude whether we deal with the financial instruments and IFRS 9 rules apply.

In today’s article, Mr. Spark Wang and Silvia explain:

- What the financial instruments are (with a few illustrative examples);

- The main features of the financial instruments;

- Where IFRS 9 applies and where it does NOT apply.

What is a financial instrument?

Before we explain what the financial instrument is, we would like to point out that the definitions of financial instruments are prescribed in IAS 32 Financial Instruments: Presentation.

Despite clear definitions in IAS 32 Financial Instruments: Presentation, it’s still quite difficult to apply IFRS 9, because of the complexity in different scenarios.

For example, it is very tricky to differentiate the perpetual bonds from the preferred stock, which triggers completely different accounting treatments subsequently.

So, what is it?

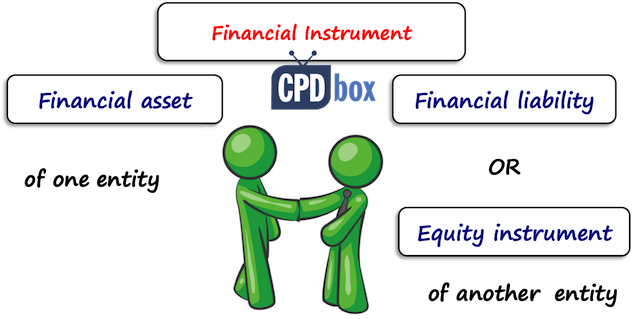

A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity. (IAS 32 par.11)

Please note that unlike other assets or liabilities, financial instruments arise from the CONTRACT.

Here, the equity instrument is the investment in another entity, so entity’s own shares are excluded, as well as the interests in the reporting entity’s joint venture or subsidiary.

Therefore, the financial instrument is a bridging tool between the assets or rights on one side, and liabilities or equity instruments of another entity on the other side.

What is a financial asset?

Financial assets are:

- Cash,

- Equity instruments of another entity (e.g. shares),

- Contractual right

- To receive cash or another financial asset of another entity (e.g. trade receivable);

- To exchange financial assets or financial liabilities with another entities under potentially favorable conditions (e.g. foreign currency forward contract with positive outcome – derivative asset)

- Contract settled with variable amount of own equity instruments (very simplified). If this would be settled with fixed amount of own equity instruments, then it would have been an equity instrument, not a financial asset.

Please note that the contractual rights to receive an asset other than cash or a financial asset of another entity is NOT a financial instrument.

Example – financial instrument or not?

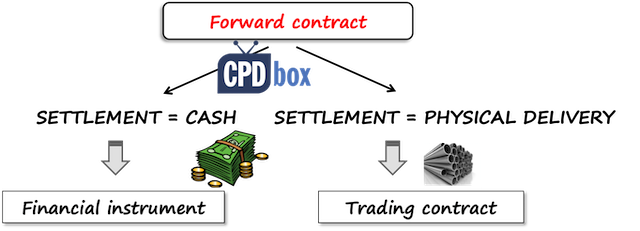

Imagine you ordered XY barrels of petrol with delivery in 3 months at market price valid at the time of delivery. You have 2 options:

- You can take physical delivery (=petrol)

- Instead of physical delivery, you settle in cash (pay or receive the difference in market prices between the date of the contract and the time of delivery).

If you intend to take physical delivery, then it’s NOT a financial instrument (if you have no history of similar contracts settling in cash). It’s a regular trading contract, because you will NOT receive a cash or a financial asset of another entity.

But, if you intend to settle in cash, then here we go, it’s a financial instrument and you need to recognize a derivative from the day 1.

What is a financial liability?

Financial liability is:

- A contractual obligation

- To deliver cash or another financial asset to another entity (e.g. loan taken, ,trade payable), or

- To exchange financial assets or financial liabilities other than the entity’s own equity under potentially unfavorable conditions.

- Contract settled with variable amount of own equity instruments (very simplified). If this would be settled with fixed amount of own equity instruments, then it would have been an equity instrument, not a financial liability.

Why variable amount, not fixed?

Why is the fixed amount of own equity instruments excluded when defining the financial assets and liabilities?

It is probably because the nature of such transactions is very close to equity issuance or repurchase.

Example – liability or equity?

Your company writes 2 options to deliver your own shares:

- The first option is to deliver your own shares for total value of CU 1 000;

- The second option is to deliver 100 pieces of your own shares.

Which one is an equity?

Well, clearly option n. 2, because you will deliver fixed amount of your own shares.

Under option n.1, you deliver variable amount, because precise amount will depend on the market price of your shares at the time of delivery (CU 1 000 divided by the unit price). Therefore, it’s a financial liability.

What are the main Features of Financial Instruments

According to the characteristics of risks and rewards associated with the financial instruments, there are three types:

- Derivatives,

- Equities (e.g. shares) and

- Debt instruments (including receivables).

In addition to the three basic instruments, there are hybrid or compound financial instruments with more complicated features.

The following matrix depicts the main features of the financial instruments in three dimensions:

- How to define the Rights and Obligations,

- Who recognizes Assets or Liabilities for each category of the financial instruments, and

- Various subtypes available for the category.

Derivatives

Derivatives are the contracts with negligible or zero initial net value and subsequent fair value changes depending on the mark to market value of the underlying assets.

Derivatives can be either asset or liability depending on whether there is a mark to market gain or loss from the contract.

In addition, the future settlement of derivatives is normally in cash or other types of financial assets, instead of physical delivery.

Forward, futures, swaps and options are four basic types of the derivatives. Moreover, there are advanced or exotic derivatives.

Equity instruments

Equity represents both the residual rights of the holders and the issuers’ limited obligation to stakeholders after total assets deducting total liabilities during solvency.

However, the residual rights and limited obligations are applicable only during the issuers’ solvency, which means the issuer of ordinary shares has no obligation to pay the holder in daily operations.

As per previous discussion, only the equity holder needs to book it under the IFRS 9 as the financial assets, while the equity on the issuer’s side is out of scope of IFRS 9.

Debt instruments

Debt instruments are the contractual rights and obligations with defined terms for amount and timing to pay.

It must be reminded that the receiver of the debt contract, or the rights owner should book the debt as assets; while the payer of debt contract should book the debt as liabilities.

Unlike the equity where the payment by the issuer is only be expected during the solvency, the debt must be paid when due as prescribed by the debt contracts. Normally the debts are in the form of deposits, loan, bonds, payables and receivables.

According to IFRS 9, the debts should be further split into SPPI (Solely Payments of Principal & Interest) and Non-SPPI, where the interest of the former is mainly based on time value, credit risk and liquidity risk.

Scope of the IFRS 9 Assets and Liabilities

Until now, we discussed and explain which items ARE within the scope of IFRS 9.

Now, let’s try to list a few items what are NOT within the scope of IFRS 9 and you should apply some other standard to these items:

- Contract to deliver physical goods or services that is not settled by cash, cash equivalent, and financial instruments (see the example above).

- Constructive obligations such as deferred income, warranty, or impairment provision; and statutory obligations such as tax payables; which are all not contractual.

- Special items with its own standards, such as insurance contracts under IFRS 4, finance lease under IAS 17 , share-based payment under IFRS 2, contract assets under IFRS 15, and contingent events and provisions under IAS 37.

- Certain loan commitments and finance guarantees that is not booked at the FVPL. However, potential credit losses are subject to the ECL model like the finance lease.

Finally, we would like to stress that even if the above items are NOT within the scope of IFRS 9, this standard can still have some impact on their accounting.

For example, you should account for leases under IAS 17 / IFRS 16, but any potential impairment of the net investment in the lease in the lessor’s accounts is still subject to the IFRS 9 expected credit loss model.

About the author

His expertise also includes Basel III reporting, Capital Adequacy Ratio, Liquidity and Funding Risk.

Spark is a CICPA (China Institute of Certified Public Accountants), FCCA (fellow of the Chartered Association of Certified Accountants), CMA (Certified Management Accountant), and a panel of the Expert committee of ESNAI (Electronic Shanghai National Accounting Institute).

Would you like to ask something or add your own remarks to this article? Please leave a comment right below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

37 Comments

Leave a Reply Cancel reply

Recent Comments

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

An entity purchased inventory in a currency other than its functional currency on say 14th August 2022. However, on 30th of October, the supplier wanting to grant discount on inventory purchased on 14th August generated and sent in a new invoice to the entity. How are they to account for it. Should they use the new invoice date to recognize the transaction or the old invoice.

amount due from customers for contract work in progress as stated in balance sheet is financial assets??

Hi! Are accrued expenses and employee-related short term liabilities financial liabilities within the scope of IAS 32, IFRS 7 and IFRS 9? It seems that they don’t meet the definition of a financial instrument and therefore that of a financial liability. However, I do review Big-4 audited financial statements these two are frequently listed as financial liabilities under the note disclosures on financial instruments and risk management.

Dear Silvia,

I have a question on valuing put and call option, would be grateful if you could assist in solving the problem.

My client company own a subsidiary. During the financial year beginning 1 March 2018, the subsidiary issued 1000 unit of convertible debentures and raised INR 10million through the issuance. The debentures have a ten-year term, the holders may chose to convert the debentures into ordinary shares in the subsidiary/parent company any time during the ten-year term. At the end of the term, all outstanding debentures will automatically be converted into ordinary shares in the subsidiary.

The conversion ratio is such that each debenture can be converted into 1% shares in the subsidiary/parent company (ie. not fixed number of shares).

The contract provides a put option, where upon conversion into ordinary shares, the holder has the right to require the parent company to purchase all or part of the shares; as well as a call option, where the parent company has the right to buy back the shares from the holder. There is no repayment obligation mentioned in the contract.

My questions are:-

1. Should this instrument be presented as equity or a liability?

2. If this instrument is to be presented as equity, how should the put and call options be measured?

3. If this instrument is to be presented as liability, how should the put and call options be measured?

Thanks in advance!

Dear Silvia,

Thanks for you and your guest for this great post.

Yet, I am a bit confused with Receivables. Let me explain by an w=example: Co “A” sold to Co “B” its equity shares in Co. “C” for less than its book value. selling price is CU 25 million payable in equal quarterly installment over 5 year period. Is this a financial instrument? if yes, how to account for it, at amortized cost using effective interest rate or some other method and rate?

hello silvia,

Can u please provide me example of financial asset fulfilling condition on Contract settled with variable amount of own equity instruments (very simplified).

I sell you goods and you pay me in one year with your own shares for total market value of 10 000 USD. Today, you don’t know how many shares you will have to give me because you don’t know the market value per share in 1 year, hence the amount is variable.

I became curious on IFRS9 because our external auditor was directed to prepare our funds statement (Pension Funds)using Expected Credit Loss .I don’t have any option than to refer to your lectures on this. I read your general and simplified approach to see the one used for implementation. I am still reading to grasp the knowledge. Sylva could you please expatiates using dummy on the application as regards to pension funds.

Thank you Brown, good suggestion, I will try to come up with something.

Hope all is well Silvia. What do you think are the major accounting implications on the shift from IAS 39 to IFRS 9 for Business grants and concessions given by Government bodies to its local business?

You have been doing a really fantastic job and please keep doing those great videos..

Hi Silvia, Want to understand stage 3 Loans. I work in a bank and I came across Stage 3 customers with days past due as Not yet due. So even if the customers has not defaulted, yet they are classified as Stage 3 customers. Just want to understand what could be the reasons for the same.?

Hi IFRS Queen,

I buy foreign currency and then I will sell them later if their value increases

Does it meet the definition of financial asset? should I recognise it as financial asset or not?

That’s cash – which is a financial asset by definition.

Hi Sylvia

Thanks for your articles. I have a capped insurance contract to cover our fixed and movable assets. An initial deposit was paid in 2003 and since then annual premium of R20 million. It earns 7% p.a. insurance claims for damages or loss of assets paid by insurance from this amount.

The principal plus interest increased to about R400 million to date.

Is this a financial instrument?

If it is, is this at amortised cost i.t.o IFRS 9?

Regards

Dear Fortunate, yes, it seems so – normally, IFRS 17 Insurance contracts does not apply to insurance contracts held by policy holders and in this case it seems you are a policyholder. For further advice, I recommend our online advisory service. S.

Hi Silvia,

I find your website is very useful. Are there any examples of accounting for investments in future equity? would greatly appreciate.

Hi Louisa, thank you for your suggestion, I will try to cover it.

Silvia,

Despite my initial comment, i must clear that the article is STILL very helpful, even for us who are not native english.Helpful tips

Many thanks

i am sorry but still i am having difficulties understanding what these mean. someone to make it more simplified? come on Silvia we are bored with these standarised definitions. even the standard setters dont know what they are writing about.

🙂 Marios, this article was a guest post – not written by me 🙂 But, the good news is that in 2 or 3 weeks I will publish an article about IAS 32 with the video and I really hope to put it easier 🙂

Hi Silvia. How we recognized the Fair value of unquoted equity share. Can we booked on cost price or shall we formulate specific policy for recognition such unquoted share?

Hi Silvia, could you explain why cash is a financial instrument? I can imagine when I have cash on a bank account, this is a ‘contract’ with the bank which is a financial asset to me and a financial liability to the bank. However, how about petty cash?

Nice question. However, petty cash is issued by some official authority, too, isn’t it? It is a sort of a contract with your government that you can exchange petty cash for other items. Yes, I know, sounds weird 🙂

Hi Silvia,

one Q – how would you treat investment in gold (investment physical gold). Could that be financial instrument or should it be inventory under broker exemption (fair value through P&L)?

Hi Tiles,

nice question. Gold bullion is NOT a financial instrument, because there’s no contractual right to receive cash or another financial instrument. Now, what is gold bullion? It depends on how it is used and for what purpose it was acquired:

– if it is not traded frequently, but will sit there for more than 1 period and is there in order to protect against movements on the market (including currencies), then it’s PPE under IAS 16. This is more the case of central banks.

– if it is traded, then it’s inventory and yes, under “broker exemption”. S.

Hi Silvia,

Can you please give an example of debt instrument that is classified as FVTPL.

Regards

Perfect accounting notes ever, please advise some auditing stuff for clear guidance

Hello Silvia,

Please tell me the Accounting treatment of off balance sheet for derivative contract in IFRS specifically incase of option..

Thank you in advance for your quick response…

Regards,

Himanshu

Himanshu,

IFRS do not prescribe how to account “off-balance” sheet – these are simply the items that are not appearing in the financial statements despite their existence. However, IFRS 9 prescribes to measure all derivatives at fair value through profit or loss. So, after initial recognition, you need to determine the fair value of your option at the reporting date, and any difference from its actual carrying amount (what’s in your books) is recognized in profit or loss. The entry is, for example, Debit P/L-Loss from FV remearurement/Credit Liabilities from derivatives (or whatever applies). S.

Thank you Silvia for your quick response… But IN IFRS also do we need show off balance sheet in notes to accounts??

Do you trhink stock rights or Rights issues to be considered under IAS 32 ?

what is the cost basis of selling these rights to another investor ?

thank you

Dear Sylvia and team

Thank you for your informative articles.

We are preparing our client’s accounts and we came across the following situation:

The company is trading in financial assets (shares, bonds etc.). During the financial year 2016, the company has opened a Precious Metal account and it has purchased XAU(Gold ounces) units. The purpose of the acquisition of these units is twofold:

· The company has used these units to buy structured products with a one month redemption and in return receive an interest at a predetermined percentage i.e. 4%

· For investment purposes, hold the units and sell them at a higher price with a view of a profit.

Kindly note, the broker has classified these units as currency.

I would appreciate if you could clarify to me how the company should classify these units under IFRS and how it should be measured in such case.

If there are more than one methods of measurement we would appreciate to receive your feedback accordingly.

I need to know whether this is an institution that offers certificate at the end.am in Kenya currently doing CPA meanwhile how should I acces the private videos.thank you

Hi Aidarus,

yes, there’s a few of institutions offering certificate, for example, DipIFR by ACCA. The information about accessing the private videos is here. Kind regards, S.

Humble comments:

1) Under “Example – financial instrument or not?”, should be “derivative” instead of “derivate”.

2) Over your “Example – liability or equity?”, more explanations should be given on the answer (i.e. the second option). Or the answer should be option n.1?

Humble thanks for edits!