How to determine the discount rate for lessees under IFRS 16?

Can you use the same incremental borrowing rate for all your leases under IFRS 16? Why can’t you use your own implicit rate in the lease if you are a lessee? Learn here!

What is the lease term of cancellable property rental contracts under IFRS 16?

What is the lease term under IFRS 16? How to account for definite or indefinite lease term with 2-months notice period? Learn here.

How to account for rentals depending on inflation and future sales?

What if your lease payments depend on future sales, inflation, use of the asset, interest rate or other things – what should you do? How should you account for them under IFRS 16? Find out here!

Example: Leases under IFRS 16 during COVID-19

The pandemics of coronavirus, or COVID-19 has been here for a while and after the first shock of its quick spread and effect on people’s health, we are all seeing its economic consequences. In order to stop the spread, governments in many countries ordered complete…

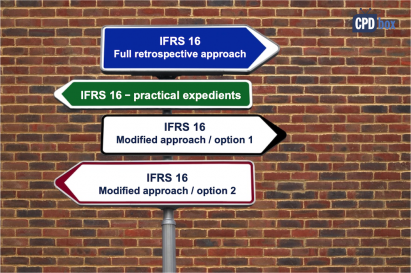

Adopting IFRS 16 – What Is The Best Option For You?

Let’s compare different transition options that you have when adopting IFRS 16 in your company. Let’s see what they are, which one is easier and which one has the smallest impact on your equity.

Example: How to Adopt IFRS 16 Leases

In my last article I tried to outline the strategy and your choices when implementing the new lease standard IFRS 16 Leases. I am grateful for many responses and comments I got from you. Almost all e-mails I received from you asked me to publish…

How to Implement IFRS 16 Leases

The new lease standard IFRS 16 is exactly one of these earthshaking things that can make your head spin around. Well, especially if your company uses the operating lease as an effective tool of getting your assets quickly with relatively low risk. I wrote a…

Troubles with IFRS 16 Leases

The new lease standard IFRS 16 can initially cause some troubles to the affected companies, because it introduces huge changes in the lessee’s accounting for leases. It was issued in January 2016 and we have to apply it for the periods starting 1 January 2019…

IFRS 16 Leases Explained: Full Guide + Free Video & Checklist

Updated: May 2025 IFRS 16 changed lease accounting forever. Lessees now bring almost all leases onto the balance sheet — no more hiding operating lease liabilities in the footnotes. In this guide, you’ll learn how IFRS 16 works in practice, including main rules, two free…

IFRS 16 Leases vs. IAS 17 Leases: How the lease accounting changed

In January 2016, IASB issued another important and long-discussed standard: IFRS 16 Leases that will replace IAS 17. Ever since then I receive lots of e-mails asking me to sum up what’s new. OK, so here you go. In this article, you’ll learn about the…

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)