Different profit or loss for specified main business activity (IFRS 18)

Question:

We are operating a chain of luxury hotels and our auditors pointed out that maybe we have a specified main business activity under IFRS 18.

However, our main business activity is to provide short-term stays with breakfast, which does not qualify neither as investing in assets, nor as providing finance to customers.

We do offer some of the hotel capacity for rentals on a long-term basis, but it is definitely a minor part of our business.

Should we be concerned, when it comes to IFRS 18?

Answer

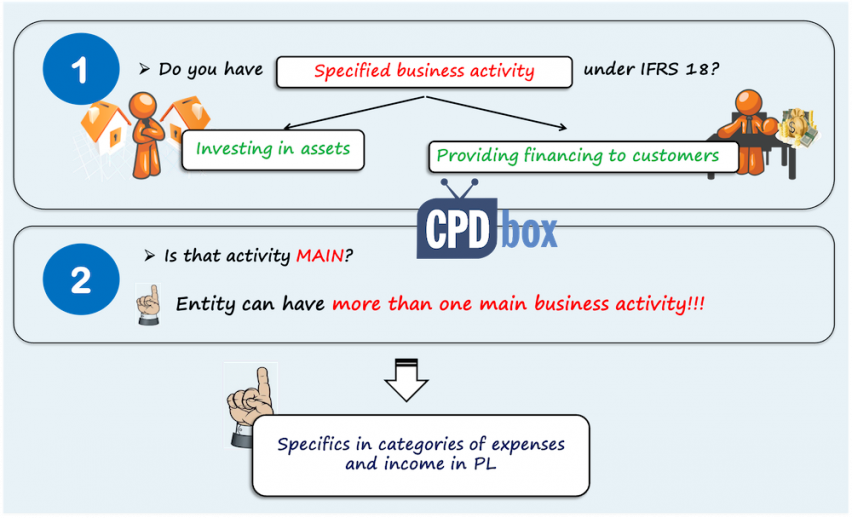

Specified main business activity under IFRS 18 may sound innocent, but watch out—it can be a trap!

It’s a new concept in IFRS 18 that states that if your company performs certain business activities as its main activity, then its profit or loss statement might look different from other types of businesses.

My initial impression was that this only applied to banks, leasing companies, investment funds, insurance companies, real estate developers, and other similar SPECIFIC businesses.

Well, that was the wrong impression.

The truth is that any type of business can engage in a specified business activity—that is, either investing in assets or providing funds to customers.

For example:

- A car manufacturer who offers sales on credit;

- A hotel that leases out some of its capacity on a long-term basis;

- A retail network that invests some of its free cash in the stock market.

You get the point.

So in the case of the luxury hotel chain in question – if that chain offers some portion of its room capacity for long-term rentals, then that part meets the definition of the investment property under IAS 40.

As a result, there is a specified business activity of investing in assets (in this case, into rental property under IAS 40).

Once you identify an activity of your business as specified under IFRS 18, then try to determine if it is main or not.

And “main” can be, for example, anything that meets the definition of a reportable operating segment under IFRS 8. This is just an indicator—of course, IFRS 18 contains the full guidance on this topic.

If your business happens to have a specified business activity as its main activity, you need to be careful when drafting your statement of profit or loss under the new IFRS 18, because some items are reported very differently compared to other businesses.

So – if the luxury hotel chain identifies, that the revenues from long-term stays exceed 10% of total revenues (as an example of indicators), then the investing in assets is specified main business activity for that company.

Then, the structure of profit or loss under IFRS 18 looks a bit differently, for example – rental income must be reported in operating category (while normally it is reported in the investing category under the new rules).

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)