Monetary or Non-Monetary?

Updated: 2023 – please scroll below to download the infographics for your future reference, it is free.

When you need to translate your items denominated in foreign currency to your own functional currency, then there’s one little problem:

Is that item monetary or non-monetary?

If you determine the nature of your item incorrectly, it can lead to totally wrong presentation in the financial statements.

It’s not so important when you consolidate and you need to translate some foreign subsidiary to your own presentation currency, right?

Why?

Because, the rules in IAS 21 The Effects of Changes in Foreign Exchange Rates say that in such a case, you translate all your assets and liabilities by the closing rate. That’s clear.

But when it comes to translating individual items and transactions in your own financial statements to the functional currency, then the rules are more complex.

Let’s take a look.

What do the rules say?

For translation of the amounts in foreign currency to your functional currency, the standard IAS 21 states that you should re-calculate all items after initial recognition using exchange rate based on characteristics of the specific item.

More specifically:

- For all monetary items in foreign currency – use closing exchange rate at the reporting date;

- For all non-monetary items in foreign currency carried at historical cost – use the historical exchange rate (at the date of transaction – thus, you keep non-monetary asset at historical rate with no recalculation);

- For all non-monetary items in foreign currency carried at fair value – use the exchange rate at the date when fair value was determined.

The principal question here is:

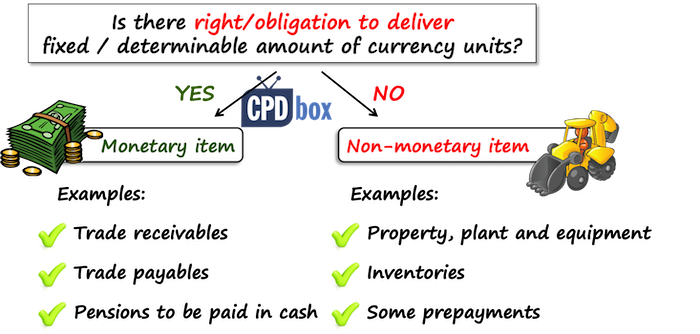

What is monetary and what is non-monetary?

There’s one essential characteristic that makes a difference:

A right to receive or obligation to deliver a fixed or determinable number of units of currency.

All monetary items DO have this feature. All non-monetary items DO NOT have this feature.

Once you apply this rule of thumb, it should be easy to determine what’s monetary and what’s not.

In the following table, I have summarized various kinds of items with their characteristics for you:

| Item | Monetary/Non-monetary |

| Assets | |

| Property, plant and equipment | Non-monetary |

| Intangible assets (including goodwill) | Non-monetary |

| Investments in associates | Non-monetary |

| Equity investments (e.g. shares) | Non-monetary – see below |

| Investments in debt securities | Monetary |

| Net investment in the lease | Monetary |

| Biological assets | Non-monetary |

| Deferred tax asset | Monetary – see below |

| Inventories (including allowances) | Non-monetary |

| Contract assets (IFRS 15) | Monetary – see below |

| Trade receivables (including allowances) | Monetary |

| Other receivables to be settled in cash | Monetary |

| Advances and prepayments | It depends – see below |

| Deposits and bank accounts | Monetary |

| Cash | Monetary |

| Equity and liabilities | |

| Share capital | Non-monetary – see below |

| Other components of equity | Non-monetary |

| Provisions for employee benefits | Monetary |

| Lease liability | Monetary |

| Deferred tax liability | Monetary – see below |

| Bank and other loans | Monetary |

| Accruals | Monetary |

| Contract liabilities (IFRS 15) | Non-monetary – see below |

| Deferred income | Non-monetary |

| Trade payables | Monetary |

| Advances received | It depends – see below |

| Current tax liability | Monetary |

As you can see from this table, some items are crystal clear, but some of them are not and further questions arise.

Advances paid or received

You need to assess the character and substance of every advance paid or received carefully, because some advances can be monetary and some of them can be non-monetary.

However, I have explained particularly this issue in my article on Accounting for prepayments in foreign currency under IFRS together with the numerical example, so please read there if interested.

Deferred taxation

Currently, this is a little bit unclear in the standards.

The standard IAS 12 Income Taxes indirectly indicates that the deferred tax assets and liabilities are monetary items, because it notes that the exchange rate differences on deferred foreign tax liabilities or assets are recognized in the statement of comprehensive income (par. 78).

Investments in preference shares

Investments in preference shares are another item that requires our careful judgment.

More specifically, you should assess the rights attaching to the shares.

In fact, both IAS 39 and IFRS 9 say that investments in equity instruments are non-monetary items.

It means that if terms of the preference shares lead to the shares classified as equity instrument, then they are non-monetary.

For example, the share that does NOT specify any mandatory redemption by the issuer at some future date would represent an equity instrument (or at least an equity component of a compound financial instrument).

On the other hand, if terms of the preference shares lead to the shares being classified as a financial liability, then it should be treated as a monetary item.

For example, the share that DOES specify mandatory redemption by the issuer at some future date would represent a liability.

Share capital in a foreign currency

Some companies issue their share capital in a foreign currency.

However, neither IAS 21, nor IFRS 9/IAS 39 specify whether the share capital in a foreign currency is monetary or non-monetary item and how to treat the difference.

In practice, the ordinary share capital is viewed as non-monetary item and maintained at the historical rates. The reason is that its retranslation to closing rate does not affect the cash flows of the company.

However, I have experienced the opposite in the past. A few companies treated their foreign currency share capital as a monetary item, but they took foreign exchange differences directly to equity, and not to profit or loss. In this case, total equity is the same as the share capital would have been kept at the historical cost.

Contract assets and contract liabilities

In short, contract assets are monetary and contract liabilities are non-monetary, however exceptions may exist. Please read this article for full explanation with examples.

Download the infographics here

Please click here and download the infographics that you can save and use for the future reference when in doubt. It is free.

Is there any item you would like me to explain further? Please leave me comment right below article. Do not forget to share this article with your friends. Thank you!

Please, let me know in a comment below the article and if you know someone who can use this information, please share – thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello,

Please I am an auditor and I realised that my client always revalue its investment in shares (equity investment) using the exchange rate because the shares were issued in a foreign currency.

Please the gain is added to other income and treated in the profit or loss.

Please is it right

Примите сердечные приветствия от нас с Удачей в Лото! Офоpмить вывод ваших cpедств: http://tinyurl.com/hevahaig NFDAW4601832JUYEGRT

Hi!!, when translating the Balance sheet item, is it reasonable to translate Liabilities using Closing Selling Rate, Assets using Closing Buying Rates? please help me with this

Hi Liz,

We live in a country with hyperinflation rates about 200% a year. So Our Functional currency is very weak.

We are four partners with 25% each in the company. Since 2016 there has been numerous partner withdrawals. At the end of the year to zero it out we face the challenge with devaluation of the currency. Any way to translate these partner withdrawals. As it has no value to Partner B compared to Partner A at time of withdrawal.

Can this be translated to be fair to all partners. This is a huge issue we are facing at the moment and finding it not fair for some partners to receive the same amount at a time with much less value.

Your advice please

Makki, n. 1 point – I am Silvia, not Liz. N. 2 point – no, it cannot be translated fair to all the partners if withdrawals happen at the different time points, sorry. If you live in hyperinflationary economy, then you are taking that risk. The only way is to agree compensations on a private basis.

Dear Silvia,

Good Day!

My company did accrual revenue in functional currency and billed customer in foreign currency at later date. As such, there would be differences at exchange rate. To offset the accrual revenue caused by the exchange rate, should it be debit revenue (P/L) or debit unrealized loss?

Thank you so much for your kind advice in advance.

Should unrealized gain or loss reserve account revalued?

In some cases if we not revalued the account, there remains a differenc.

Dear Silvia,

In reference to the IFRS, you have mentioned that the Monetary Items should be translated at the year-end rate of the presentation currency. For example, I have Bank Accounts in functional currency i.e USD and the presentation currency is Tanzanian Shillings. At the year-end, I noticed that the Cash at Bank (USD) into Tanzanian Shillings less to the Actual Balance in USD hence I need to record gain and increase the bank balance after translation to year-end rate. Where is this gain recorded in the Profit or Loss account as other income or in Other Comprehensive Income (SFP)?

Dear Silvia,

My company has an investment of 12% in a foreign based entity. Will this investment needs to be revalued at closing rate? Or leave as is at historical rate?

Hello Silvia.

Kindly advise on how to deal with depreciation on revalued fixed assets

Hi Silvia, can I check with you how can I translate the depreciation of fixed asset and right of use assets? Is it using the average exchange rate?

In general, use historical rate as for any other items of expenses and revenues. If you are translating to presentation currency, you can use average rate as an approximation. S.

Is a financial guarantee a monetary item?

Yes 🙂

Hi Silvia,

Many thnaks for your amazing website. It`s really useful,

Would you be so nice to explain how to treat for month-end valuation purposes` accrued income and accrued expenses? Are they non-monetary or monetary items?

Your swift reply will be much appreciated. Thank for help.

Hello Floydka, as I wrote above – some of them are monetary, some of them are non-monetary. But, if they relate to items that will materialize in cash later on, then they are monetary.

Thank you Silvia for your kind assistance. My understanding now is that it depends mainly on a probability of bearing these costs by a company ( whether accrued costs are calculated based on a contract or whether it is a kind of estimation) Best regards.

Hey Silvia – Excellent article, though I am willing to understand more on why Investment in associates is a non-monetary item when the amount is carried at NAV which indicates determinable amount receivable upon disinvestment/disposal.

Dear Sivia,

thanks for your information. could you please provide me details regarding below two questions.

1) all loans are monetary items, what about loans that are classified as doubtful and loss. can we consider them as monetary, although they are uncertainty and will be not back.

2) you mentioned in one of the above questions that loan loss reserves are monetary items. can we consider these loan loss reserve as monetary liability??

Hi Silvia

I have a current situation ,,,during the year 2017 the company has prepaid shareholder 1.000.000 E (pre-payment of Divident ) and in March 2018 for 500.000 Euro (prepayment of divident).In 30 june 2018 the Shareholder settled to recognise the Profit of the Year 2017 as divident distribution in Local currency 2.000.000 USD .This “‘prepayments “‘ are monetary -or non monetary items…should I revaluated them in local currency 2019.I would be very grateful If you can clarify this situation for me , Thank you in advance

Thanks for the detail. it is very clear.

Hi Silvia, thank you for the article.

I have current situation where a branch receives cash in FX from the head office to fund its operations. The head office is insisting the amount sent to the branch even the branch has no means of paying back. Using the substance over form principle I see the amount transferred from head office as a form equity hence do not agree with revaluation proposed by the head office accounts team. can you help clarify this for me, thank you.

Hi Sylvia, thank you for this article.

Could you please clarify, are contract assets under IFRS 15 classified as monetary items, and if so, why and also, what becomes the reason for distinguishing between “conditional” – contract asset and unconditional” – trade receivables if both are monetary

Trade receivables are contract assets that became unconditional. Contract asset is normally expected to be received in fixed or determinable units of currency.

Hi Silvia, could you clarify if there was a typo in his statement: t”A few companies treated their foreign currency share capital as a monetary item, but they took foreign exchange differences to the statement of other comprehensive income, …”

Should the foreign currency differences be taken to equity directly instead of through OCI?

Thank you.

Yes, sure, thank you!

hi,i have two questions

1. what if a company issued new share and agreed to receive the payment in a currency different from the functional currency but the payment has been made subsequently on different times. how to treat the exchange difference.

2 what if a company issued new shares at a premium higher than the par value how do we treat the gains thank u

Hi,

In the case of share capital, where the balance is still receivable from a related party at the time issue of shares. The shares issued were in a different currency.

So the balance of receivable from the related party would be translated at the SOFP date since there is a right to receive a fixed or determinable number of currency units. RIght?

Yes, right.

Hi Silvia, i am really appreciate to reply to each and every query!!, really great job you are doing.

I have an some query which i need to understand, if you could please helping out that would be really appreciated.

Query : 1

My Query is, we have an foreign vendor against which we are receiving the material in foreign currency (USD) and contract specified the rate of payment 1 USD = 70 INR, in that case at the of book closure if the USD liability exists in our books and the closing rate of month end is 1 USD = 72 INR OR 1 USD = 69 INR in that case, whether we re-instate the liability by considering the month end closing rate if reporting currency (INR) or not to re-instate.

Query: 2

We have an contract where mentioned USD liability suppose $1 Mn for whole year and the PO would be released for services by converting the rate 1 USD = 70 INR and one condition mentioned if the rate of for complete F.Y, is fluctuating +2% upward then more than +2% whatever then amount to be pay to vendor, in that case the nature of this upward would be treated a foreign exchange gain / loss or consider into the nature for which PO have released.

e.g. of Query : 2

Contractual liability for Managed Services = $1,000,000.00

FX Rate at the time of issuing of PO 1 USD = INR 70.00

PO issued in INR – 1st Apr’18 = INR 70,000,000.00

Condition mentioned if the rate going upward by 2% in complete F.Y. then in excess of 2% amount would be pay to vendor.

Closing Rate at the end of F.Y. (31st Mar’19) 1 USD = 73

Rate change is 104%

in Excess of 2% -2%

Rate Fluctuation =INR 1.60

Fresh PO to be issued of INR 1.60 INR 1,600,000.00

– What treatment would be done for extra PO issued in books either Management Services or Forex gain / loss.

– Whether we required to re-instate the value till the end of F.Y.

Regards,

Rohit Singh

Dear Rohit,

I am sorry, but these comments serve as a quick help in case of doubt, but not as a solution to similar more complex scenarios. We will be very happy to serve you within our online advisory service here.

Hi Silvia

It’s great that you are of so much help to so many,

I had some questions relating to “the acquisitive “case study on the Ifrs website. Im not sure what to do about issue 3 and was wondering if you’ve posted anything relating to these case studies or if you could assist me.

This would be truly appreciated.

Hi zaa,

thanks! Well, please specify what you are talking about since I have no idea what is “the issue 3 in the acquisitive case study”. Thank you!

Hi Silvia,

Firstly thanks for a helpful website, it is amazing.

My question is about accruals. As you mentioned above “Accruals” are monetory. In my company sometimes we are posting some accruals due to the not received or not billed invoices. Example the lawyer is in a trip and forgot to bill the current months’ invoice. We are posting the monthly contract lawyer fee to accrual account and expense account. Then after the month-end closing we are getting an invoice sometimes more than sometimes less than the accrual. I think that expense was happened when the service was taken and I did my best estimate for the expense. So I believe that this accrual must be non-monetary. What do you think about this subject?

Dear Silvia,

thanks a lot for the response and reply, the article talked about foreign entity revaluation, could you please clarify where we have specific foreign vendors in the parent books( functional currency) should it be valued using closing

Dear Silvia, got a question, in the article the monetary/non-monetary has been emphasized only on the balance sheet, does it mean that all items in the Profit and loss is considered as monetary hence translated at closing.

sabhan

Dear Sabhan,

for the purposes of translating transactions into your functional currency it makes no sense to distinguish monetary/non-monetary for expenses and revenue, since you never translate them at closing (the different thing is translation to presentation currency, but here, no monetary/non-monetary distinction is necessary). S.

My question is on the day of translation. What are you calling historical exchange rate which should be used for non monetary assets? For instance, i have

day1: pruchase of PPE at USD100 when exchange rate is $1: 12ZAR.

day 2: Functional currency change to ZAR – exchange rate $1: 9ZAR

day 3: Year end : exchange rate $1: 11 ZAR

Am i going to translate PPE at $1:9 which is the rate at functional currency change or i stick to day 1 rate?

I understand at year end (day 3) i wont translate again, but the question is i should maintain the non monetary assets at which rate?

Hi Wisodm, if you change your functional currency, the rate at the date of change becomes the new “historical” rate – that would be 9 ZAR/1 USD. Please read this article to learn more about it.

Thanks Silvia for clarification

Dear Silvia,

I have the same though as: In individual, investment in subsidiary is an equity investment and thus it is non-monetary. In consolidated, it is different – we need to translate the financial statements of subsidiary by the closing rates.

However, the Partner from our audit firm, he disagreed. He said that the “loan” is considered as equity and it should be translated as “historical rate”.

Do you have any accounting guidance that I can show to him?

Many thanks!

Elly

That’s an interesting question. However, I don’t think that the full loan can be considered as a capital contribution – please see this article. Intragroup loans must be carefully assessed upon initial recognition, then you should decide on what it is and then decide on the accounting treatment.

Hello Silvia,

If the parent company funding the subs, the functional currency is USD, is the Intercompany AP/AR will be translated at month end rate instead of historical rate?

Will this funding to the subs considered as “loans” and treated as “equity” instead of monetary items?

Thanks,

Elly

Please see my response to your second comment.

Hello Silvia,

Non govermental organization has Grant from donor $1.000.000. Functional currency is Gel. At the end of period it has receivables $800.000, cash $200.000 and Restricted funds $1.000.000. Exchange rate changed. I have obligation to Donor to spend all amount if not I should pay back unspent amount.

Is Restricted funds monetary or non-monetary item?

Hi Silvia, On the issue of foreign currency revaluation, is it advisable for a company to account for exchange gain/loss monthly.

Hi Silvia,

Thank you for such a wonderful post. I have a clarification, I am analyzing a Singapore listed company and it occurred to me that if foreign currency non-monetary items like PPE is carried at historical cost, then there should be no foreign currency translation adjustment. But their notes to accounts says, “For consolidation purpose, the assets and liabilities of foreign operations are translated into SGD at

the rate of exchange ruling at the end of the reporting period and their profit or loss are translated at

the exchange rates prevailing at the date of the transactions. ” Does this mean that they keep translating the historical cost of a foreign currency asset in a subsidiary, and when it is consolidated these assets recorded at historical cost in the foreign currency is translated at year end rate?

Thank you

Dear Krishnaraj,

I think there is a bit of confusion. First, you have to think of WHAT YOU DO. So:

– if you prepare individual, your own financial statements in your functional currency (let’s say USD), then you do NOT revalue non-monetary items.

– if you have a parent in Singapore and you need to translate your all financial statements to presentation currency (SGD), then you revalue ALL assets with the closing rate.

You can read more about it here and here. I hope it helps. S.

It does! Thank you very much!

Dear Silvia, if i have prepayment for translation service is this monetary or non-monetary?

Dear Silvia,

If i havs prepayment for translation service (translation of document from one lenguage into other) is this monetary or non-monetary?

Oh yes Sylvia. Perfectly clear.

Thank you very much.

Hi Sylvia,

I’m a bit confused about the following part:

For translation of the amounts in foreign currency to your functional currency, the standard IAS 21 states that you should re-calculate all items after initial recognition using exchange rate based on characteristics of the specific item.

More specifically:

[…]

For all non-monetary items in foreign currency carried at historical cost – the historical exchange rate (at the date of transaction);

For all non-monetary items in foreign currency carried at fair value – use the exchange rate at the date when fair value was determined.

According to my understanding, when we first acquire a non-monetary item incurred in a foreign currency (say $) such as PPE, in order to record the transaction in the books (kept in € functional currency) the cost of the PPE would instinctively be translated at the rate ruling at the acquisition date.

Therefore it won’t be necessary to re-measure the non-monetary items at each reporting date since they are already carried at cost less accumulated depreciation.

Thus, the part of the standard that says: “For all non-monetary items in foreign currency carried at historical cost – use the historical exchange rate (at the date of transaction);” looks irrelevant to me.

Hopefully, I made my point clear.

Please advise.

Thank you in advance.

No, it is not irrelevant. I simply restates the rules of IAS 21 that you should keep non-monetary assets at historical cost. But I added a note that you should not recalculate – I hope it makes things clearer.

Hi, should we do revaluation for the provision for unutilised leave?

Hi Sylvia,

Thank you for your information. I would like to ask:

There is a investment in subsidiary. Investment cost keeps as historical cost in a foreign currency at the date of the transaction.

At the year ended, because of decreasing vale of foreign currency (around 10%). 1) Should I make impairment of the investment using the closing rate? However, the subsidiary’s retained earning is positive in foreign currency .

2) or the test of impairment of the subsidiary should use the exchange rate at the date of the transaction ?

Thank you !

Nick

Hi Sylvia,

Many thanks for the explanation. I have the following questions:

– For consolidation purposes, as investments in subsidiaries will be eliminated. Is it necessary to make the conversion?

-If we consider the standalone level, for a conversion from a framework to IFRS, investments in subsidiaries are non-monetary items? Then, do we need to convert to the closing rate or keep it to the historical cost?

I am a little bit confused with the following ;

t’s not so important when you consolidate and you need to translate some foreign subsidiary to your own presentation currency, right?

Why?

Because, the rules in IAS 21 The Effects of Changes in Foreign Exchange Rates say that in such a case, you translate all your assets and liabilities by the closing rate. That’s clear.

Francine,

1) Yes, you do need to make conversion for the individual financial statements if they are published. I think you are still confusing these two items (consolidated vs. individual).

2) Historical.

S.

Hi Sylvia,

Thank you for your explanation. I have 2 questions

– Are investments in subsidiairies non-monetary items ?

-For consoldiation purposes, should them be converted at the closing rate or keep at the historical cost

-If I am converted the standalone accounts to IFRS, should I use the closing rate or the historical cost

I am a little bit confused with thes sentences:

” ‘It’s not so important when you consolidate and you need to translate some foreign subsidiary to your own presentation currency, right?

Why?

Because, the rules in IAS 21 The Effects of Changes in Foreign Exchange Rates say that in such a case, you translate all your assets and liabilities by the closing rate. That’s clear.”

Thank you for your feedback

Hi Francine,

please do not be confused with individual separate financial statements and consolidated financial statements. In individual, investment in subsidiary is an equity investment and thus it is non-monetary. In consolidated, it is different – you need to translate the financial statements of subsidiary by the closing rates as shown in this example. S.

What a quick and clear answer!Thank you so much. you are amazing!

is investment in a mutual fund a monetary or non monetary item

Hi Ozar, it is similar as shares (equity investments) – please look to the above table 🙂

Hi Slivia

I have some unquoted non current investment in Prefernce share and mutual fund , how can i present in financial statement as per IFRS finanical instrument .

Hi Silvia, I was wondering if there is any provision that allows non-monetary items to be converted at a rate other than historical rate (assuming that the company might not know what was the historical rate used in the beginning). I was not able to identify any such provisions in FRS 21. Hoping you could help! Thank you.

G8 explanation, loving it.

Hi Silvia! Thanks for all the information that you share with us.

Hi Silvia

When one is not able to find a solution on peculiar accounting issues, they have only one way to run- towards you- to have a simplified understanding.

My query is as follows- Company maintains accounts in USD. Share capital is in EUR. On the day of share capital infusion, the share capital is shown in the balance sheet in USD (because accounts must be maintained in USD) on the forex rate (EUR:USD) as applicable on the day when share capital is actually transferred to the company’s bank account. At the end of each financial year, the share capital is valued and the forex is shown in the reserve so that the net equity (shown in EUR) remains same as was infused. (QUESTION 1- is this the correct way of accounting? If not, what is the correct manner).

After few years, shareholders decided to reduce the par value from 100 to 96. So 4% share capital needs to be returned back to shareholders. As the original infusion was in EUR so the shareholder needs 4% reduction and refund in EUR only. Considering that accounts are maintained in USD so there will be a forex impact due to EUR share capital reduction. I believe this results in forex realization on the date when the share capital reduction actually took place and on the forex rate applicable on the date of reduction. If the share capital is reduced, reserves should also be reduced. (QUESTION 2- where and how this forex realization should be shown? Should it be part of Other Comprehensive Income or should it be part of Other Reserves? Can you please provide the recording entries? I believe 2 accounts which will be affected by the forex are: Forex Resevers maintained in the balance sheet showing the forex valuation of foreign currency capital and the second account will be forex realization account in Other Comprehensive Income showing the affect of realized forex on capital reduction)

Please advise.

Hi Victor,

thank you for this question. It is quite long to cover in one comment, but I’ll try to cover it in one of my podcast articles within the near future – check out here. S.

Thanks a ton Silvia

Hi Silvia,

Please clarify on the following;

A local company in Malawi receives a loan from a foreign company in USD for the purchase of goods and services from suppliers, contractors of consultants to facilitate the construction of an asset.

The loan of say $1 million is being disbursed in installments of varying amounts over a period of 5 years. After 5 years the loan will be fully disbursed and asset will be capitalized once its complete and in operation. The loan will then be repayable in the next 20 years with 2 payment per year on fixed dates and amount.

Please clarify on the following;

– Is this monetary or non-Monetary item?

-How should the loan and forex be treated during the 1st 5 years when disbursements are being received?Assuming valuation is done every reporting period should the revaluation go to revaluation loan/curreny reserve in equity or unrealised forex

-once payments commence the loan/borrowing will be split between non-current and current portion; how should the non-current portion be valued (through revaluation loan/curreny reserve in equity or unrealised forex) as for the current portion i think forex will be realized on the date of payment

Please guide

Hi Said,

very shortly – the loan is monetary, but the asset is non-monetary. Once you recognize them in your financial statements, they live their own life. So, you will retranslate the loan with the closing rate at each reporting date (forex gain/loss mostly to profit or loss, but you capitalize a part of it as borrowing cost to the cost of asset under construction – please see below) and you will keep the asset at the historical price.

Now, I can’t give you detailed answer in the comment (it would give a whole article), but for the guidance:

– Here, you can read how to capitalize the asset when the foreign currencies are involved. It is asset acquired on prepayments, but the principles are the same for the loan, too.

– Here, you can find a little piece on how to capitalize the foreign exchange differences on loan as borrowing cost to the cost of an asset.

Hi Silvia. could you please advise on following question: For the fixed assets purchased in foreign currency which exchange rate I should use? Usually I capitalize asset in USD when it was delivered to warehouse (Goods receipt (GR) is created in the system) using exchange rate for the date of GR. After several month when I receive final invoice should I recalculate the value of asset according to exchange rate of posted invoice and updated the value of assets for difference?

Hi Mira, thanks for writing me! I think that this article exactly answers your question. S.

Hello Silvia,

Hope you are doing well.

My question pertains to application of conversion rate on Share Capital and other parts of equity.

Can you please specify what rate shall be used to convert the Share Capital as of Balance Sheet date. Also, can you please refer the relevant section of IFRSs to evaluate the basis.

Further, what are the basis to classify Share Capital as non-monetary item.

Regards,

Hi Kashif, I think I answered your question in the last paragraph of this article. Also, you can find some insights and thoughts here. S.

Hi Silvia. Great article. D

1. Do all monetary assets qualify as financial assets and vice versa?

Interesting question and my answer is no. Just as an example – deferred tax asset is monetary and it is NOT a financial asset.