How to Test Goodwill for Impairment

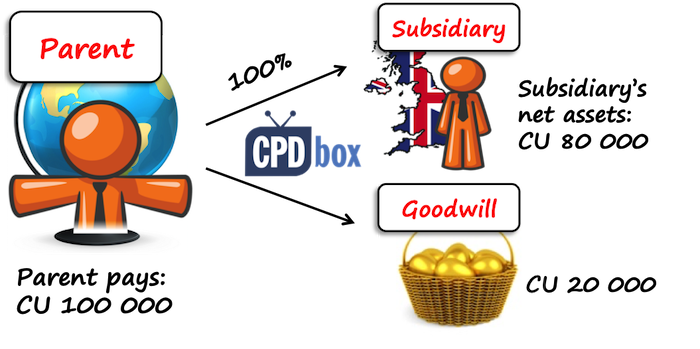

When a company acquires control over another company, then often a goodwill arises, too.

You should present it as an intangible asset, but when you think about it carefully, a goodwill is not a typical asset, because unlike other assets, you cannot sell it to somebody, you cannot use it in your production process or to provide your services.

Therefore, IFRS standards are quite strict about goodwill – for example, you need to test goodwill for impairment every single year (you do not need to test other assets, only when there are some indicators).

Well, OK, but how to test goodwill for impairment every year?

I respond to that question quite frequently, because although IAS 36 prescribes the extensive rules about goodwill impairment, it’s not so easy to understand the logic behind.

What is goodwill?

Before we explain how to test goodwill for impairment, you need to understand what a goodwill is all about.

The definition of goodwill from the standard IFRS 3 Business Combinations tells us that a goodwill is “an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized” (IFRS 3, Appendix A).

Imagine an investor buying 100% shares in some company for CU 120 000. At the date of acquisition, the net assets of this company (or its fair value) amount to CU 100 000.

As you can see, the investor “overpaid” – he paid CU 20 000 more than the fair value of a company is.

Why would he do that?

Maybe the investor believes that there must be some “hidden” value, something extra that he pays willingly for.

Maybe he believes that this “overpayment” for the investment will bring more returns or profits in the future.

Therefore, the investor does not account for the “overpayment” as for the “loss” or some expense in profit or loss.

Instead, the investor accounts for it as for a goodwill – a separate intangible asset.

What to do with goodwill after acquisition?

Some years ago, IFRS asked you to amortize goodwill, but no longer!

You do NOT amortize goodwill.

Instead, you need to test it for impairment annually, as the standard IAS 36 Impairment of Assets requires.

Why is it so?

Well, if an investor is willing to pay more than he gets, then he probably believes that the new business will generate enough profits to provide satisfactory returns even after the investor paid the premium (or goodwill).

But, is this really the case?

Is your new investment really generating sufficient returns? Is it worth it? Isn’t it overstated in your accounts?

Your annual impairment test of goodwill will give you the answers.

A little recap – basic principles of impairment testing

I don’t want to describe what’s the impairment testing about in a detail here – you can read the whole article about it here (with video).

Just to refresh the basics:

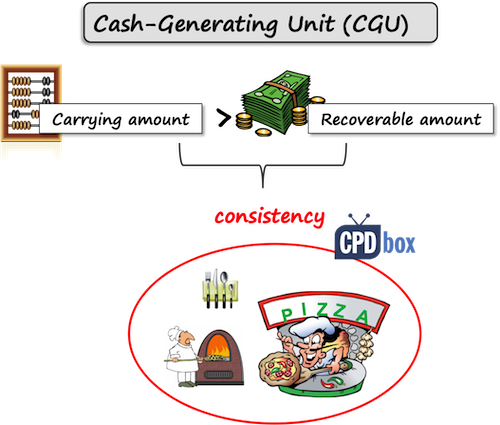

You need to compare an asset’s carrying amount with its recoverable amount (higher of fair value less costs of disposal and value in use).

When the carrying amount is greater that the recoverable amount, then you need to recognize the impairment loss.

Often, it is not possible to test an individual asset for the impairment, e.g. when it does not generate any cash flows on its own and you cannot determine its fair value.

In this case, you need to test cash generating unit (CGU) – the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets (IAS 36.6).

If your CGU is impaired, then you allocate the impairment loss to the individual assets.

That’s the impairment of assets from the airplane.

Now let’s take a closer look to goodwill impairment.

How to test goodwill for impairment

Please, remember this:

You CANNOT test goodwill for impairment as an individual asset, standing on its own, because it is NOT possible.

The reason is that you just cannot calculate the recoverable amount of goodwill.

Why?

Because, goodwill is not an asset that you can sell to someone else separately –there’s no fair value.

Also, you cannot really estimate goodwill’s value in use, because goodwill does not bring anything to the company, it has just been sitting there since acquisition.

In other words, a goodwill is a specific asset that does not generate any cash flows on its own, independently of other assets. Your business would probably generate the same revenues/expenses whether with or without a goodwill, isn’t it?

Instead, you need to look at its impairment testing as at some business valuation test, not as at goodwill impairment test.

Simply said, you are required to compare the book value of your company or division with its revenue-generating ability (whether it is market value or projection of profits).

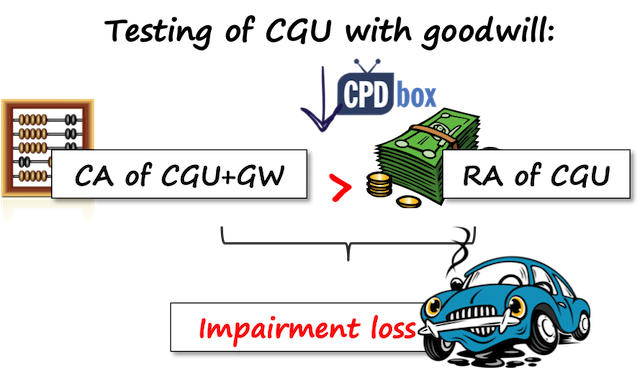

Translating this to IFRS language: you need to compare the carrying amount of your cash-generating unit including goodwill with its recoverable amount (higher of its fair value less cost of disposal and value in use).

What is a CGU including goodwill?

Typically, a cash-generating unit would be a company as a whole, but if there are some separate divisions generating independent cash flows, then your CGU would be a division.

So if you buy a company with a few divisions and a goodwill arose, then you need to allocate that goodwill to each of the cash-generating units that are expected to benefit from the synergies of the business combination.

However, each CGU to which goodwill is allocated should represent the lowest level at which the goodwill is monitored and it cannot be larger than an operating segment as defined by IFRS 8.

Unfortunately, IAS 36 does not say anything about the allocation method, or how you should allocate the goodwill.

In practice, there are more methods used, for example, you can allocate goodwill based on the fair value of CGU before and after acquisition and the difference represents the allocated goodwill.

Alternatively, you can make a simple difference between the fair value of net assets acquired and the fair value of acquired business (or division).

It’s quite demanding to allocate goodwill, so IAS 36 gives you one year to do so.

Impairment loss of CGU with goodwill

After you identified you CGUs and allocated goodwill to them, then you can perform the impairment test.

You should compare:

- The carrying amount of your CGU + allocated goodwill, with

- The recoverable amount of your CGU

If the carrying amount is greater than the recoverable amount, then you need to recognize the impairment loss.

However, as the impairment loss relates to many assets within your CGU, you need to allocate it as follows:

- First, you reduce any goodwill to zero;

- If there’s some impairment loss left, you allocate it to the individual assets within CGU on pro-rata basis.

Just be careful not to reduce the carrying amount of any asset below its recoverable amount or zero.

Please remember that you should NEVER reverse any impairment loss related to goodwill.

Example – a company with 3 divisions

Mommy Corp. purchased 100% shares in Baby Ltd. for CU 200 000 when Baby’s net assets were CU 185 000. Baby operates in 3 geographical areas:

- Division Aland; net assets of CU 70 000;

- Division Bland; net assets of CU 50 000;

- Division Cland; net assets of CU 80 000.

Based on synergies expected from the business combination, Mommy allocated the goodwill of CU 15 000 (CU 200 000-CU 185 000) as follows:

- Aland: CU 6 000

- Bland: CU 4 000

- Cland: CU 5 000

At the end of 20X1, an independent valuator estimated Cland’s market value to CU 67 000 and management projected Cland’s value in use to CU 65 000. Cost of disposal related to Cland would be negligible.

At the end of 20X1, Cland’s assets included (in their carrying amounts):

- Buildings: CU 50 000

- Equipment: CU 15 000

- Other assets: CU 6 000

Calculate the impairment loss of Cland and show how to recognize it in the financial statements of Mommy Group.

Solution

Aland, Bland and Cland are all cash generating units to which goodwill was allocated.

Here, we will focus on Cland only, but Mommy needs to test also goodwill allocated to Aland and Bland annually – just not to forget that.

We need to compare:

- Cland’s carrying amount including allocated goodwill at the end of 20X1: CU 50 000 (buildings)+CU 15 000 (equipment)+CU 6 000 (other assets)+CU 5 000 (allocated goodwill) = CU 76 000

- Cland’s recoverable amount at the end of 20X1, that is higher of:

- Cland’s market value (fair value less cost of disposal) of CU 67 000 and

- Cland’s value in use of CU 65 000

WITH

There is an impairment loss of CU 9 000 (CU 67 000 – CU 76 000).

Mommy allocates CU 5 000 to goodwill and thus, the goodwill is reduced to zero. The remaining loss of CU 4 000 is allocated on a pro-rata basis:

| Assets | Carrying amount | Allocated impairment loss |

| Buildings | 50 000 | 2 817 |

| Equipment | 15 000 | 845 |

| Other assets | 6 000 | 338 |

| Total | 71 000 | 4 000 |

Note: Mommy allocated 50 000/71 000*4 000 = 2 817 of impairment loss to buildings. Similar calculation appies to equipment and other assets, too.

The journal entry is:

-

Debit Profit or loss – Impairment of assets: CU 9 000

-

Credit Goodwill: CU 5 000

-

Credit Buildings: CU 2 817

-

Credit Equipment: CU 845

-

Credit Other assets: CU 338

Note – you need to allocate the impairment loss to the individual assets, so in fact, you are crediting some specific building or a piece of machinery.

What if there’s a non-controlling interest?

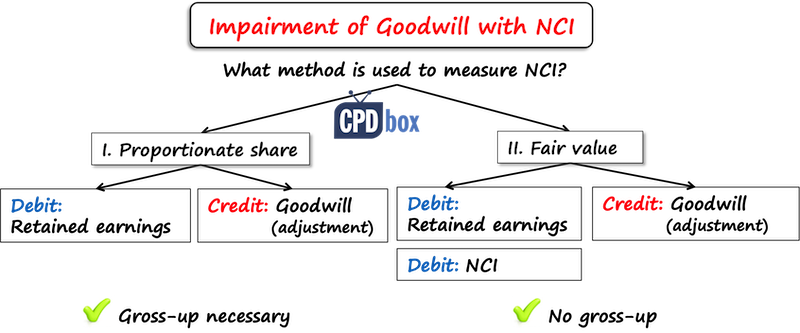

A complication arises when a parent acquired less than 100% shares in a subsidiary and there is some non-controlling interest.

As you might know, you have two options to measure the non-controlling interest:

- Partial method, or at the proportionate share of NCI on subsidiary’s assets, or

- Full method, or at fair value.

Your calculation of goodwill impairment depends on the method you selected for measuring the non-controlling interest.

Goodwill impairment with the partial method for NCI

When you measure your NCI using the partial method, then the goodwill represents only a parent’s share of it.

Therefore, in fact, you need to gross-up the goodwill to 100% before you start testing it for impairment.

Why?

Because you need to compare 100% of CGU’s carrying amount with goodwill with 100% of CGU’s recoverable amount.

If there’s an impairment loss of goodwill, then you need to reduce it to a parent’s share only.

For example, let’s say that a parent has 80% in a subsidiary and you measure NCI by the partial method.

The carrying amount of goodwill is CU 100 and the carrying amount of other CGU’s assets is CU 1 300. The recoverable amount is CU 1 400.

It might seem that there’s no impairment loss, but not so fast – you haven’t grossed up the goodwill yet!

The impairment loss calculation is:

- Carrying amount of goodwill grossed-up to 100%: CU 100/80%*100% = CU 125

- Add carrying amount of other assets: CU 1 300 (no need to gross-up as they are stated at 100%),

- Less recoverable amount of CGU: – 1 400

- Impairment loss: CU 25

As it’s 100% and it fully relates to the goodwill, you need to recognize only 80% of it, that is CU 20.

The journal entry:

-

Debit Profit or loss – Impairment of assets: CU 20

-

Credit Goodwill: CU 20

Goodwill impairment with the full method for NCI

When you measure the NCI using the full method, then the goodwill is stated in full amount as it represents both parent’s and NCI’s share on it.

Therefore, no adjustment of goodwill is needed for the purpose of the impairment testing and the impairment loss is recognized in full.

However, you need to be careful how you recognize the impairment loss. As a part of it is attributable to non-controlling interest, you need to split the entry in your consolidated statement of financial position between the retained earnings and NCI.

In the profit or loss statement, it would be recognized fully as an expense.

Let’s take a look to the same example as above, but this time, goodwill is stated in full, i.e. it is CU 125.

Then the impairment loss calculation is exactly the same as above (without grossing up).

The impairment loss of CU 25 is fully recognized in profit or loss.

In the consolidated statement of financial position, the journal entry is:

-

Debit Retained earnings: CU 20 (80%*CU 25)

-

Debit Non-controlling interest: CU 5 (20%*CU 25)

-

Credit Goodwill: CU 25

Do you have any questions or concerns? Please leave a comment right below this article. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

how are deffered taxes considered in carrying value, where there is DTL on the PPE and intangibles for different in book and tax depreciation. (Carrying value = Equity + Debt, should it include

why do we need to gross up the goodwill under the partial method of recognising NCI?

Excellent explanation. Thanks a lot.

hi selvia

nice from you to talk about goodwill with details but I have Question

what if the goodwill greater that Impairment Loses

Hi Mostafa, that’s easy. You would recognize the full impairment loss against goodwill and no need to do pro-rata calculations.

Nice written article with a lot of examples. Well done!

Hi, your explanations are brilliant – thank you! I am in the process of writing a dissertation on IAS 36 looking specifically at goodwill and this is extremely helpful.

Question: In calculating goodwill, what if the company being acquired is in a net deficit position (rather than net asset position), implying the equity is a debit balance hence accumulated deficit, would we go ahead and compute the goodwill and impair it immediately, or should we indicate that since the net assets are below zero (hence net liabilities), the value acquired is nil?

Hello Silvia,

I have one doubt regarding Goodwill impairment with the full method for NCI

In the profit or loss statement, it would be recognized fully as an expense.

As per the journal entry posted by you in that Assets and liability is equally effected and then you mentioned PL will be fully expenses how can that be possible any one account in balance sheet should be effected right and the other one will be in P&L

Hey nice, explanation, thank you very much, but one thing that intrigues me in first example (of CLAND ) is that

why would you add up the allocated goodwill of 5000 to CU of cland if it is to deducted or absorbed later.

the impairment loss allocated to CLAND of 4000 {(76000-67000)-5000} would have been there even when no goodwill of 5000 was added to it i.e. (71000-67000) =4000)

there is no impact of adding up goodwill on CLAND then why would we do it..

please help me by answering this question..

and sorry if I am not able to make you understand my question, just ping me on my email and i would try to clear my question.

thanking you in anticipation..

Hi Silvia ,

I hope you are doing good, please help me with the following question

Goodwill Impairment testing being conducted at 31st December 2019 Following are the data

Net assets of subsidiary at testing date 50 million

Goodwill 20 million

Recoverable amount (value in use) 40 million

Impairment loss 30 million

My question is, how this impairment loss will be recorded in standalone of parent, consolidation and stand alone of subsidiary

Only in consolidation – you reduce goodwill first to zero and the remaining 10 million is pro-rata allocated to all other assets in CGU. In standalone FS, there is no goodwill.

Thank You!!

Hi Silvia,

According to IAS36.81 sometimes goodwill cannot be allocated to individual CGUs but only to group of CGUs. For the purpose of impairment testing of this case according to IAS36.88 the carrying amount of the CGU (to which the goodwill is not allocated) excluding goodwill should be compared to its recoverable amount,

The question is:

In case of impairment loss how to reduce goodwill? as it has been allocated to the group of CGUs not to the CGU?

Thanks a lot.