Can We Interrupt Depreciation due to Covid-19 Pandemics? 3 Tips & Tricks

Lockdowns stripped many businesses of their revenues due to temporary closures and ban on activities.

However, businesses still have assets and related expenses. For example depreciation.

Many businesses still need to charge the depreciation despite having zero revenues, and as a result they end up in a huge loss.

Can you do something about it?

I received an interesting question from one of my readers and here I am sharing my views, tips and tricks to solve this situation.

Question: Can you stop depreciation when the asset it idle due to Covid-19?

We run a bus transportation business and most of our clients are travel agencies. Due to lockdowns and restrictions our revenues dropped down significantly, almost to zero in some periods.

However, we have been depreciating our buses on a straight-line basis over 6 years and as a result, depreciation charges exceed revenues generated by buses during lockdown periods.

Can we interrupt depreciation charge due to Covid-19 pandemics and lockdowns?

Answer: No, but maybe there are some solutions

Strictly speaking no, you cannot stop the depreciation, but there are some ways around it.

The standard IAS 16 prohibits interrupting depreciation when an asset is idle (see paragraph 55). Therefore you cannot interrupt it even when you do not operate your buses during some periods.

Now, let me give you a few ways of thinking about this situation and what the possible solution is.

This is by no means creative accounting. It is rather applying other IFRS paragraphs based on your specific situation.

Warning: Examine these three tips and tricks in the context of the type of the asset, way of operating it, etc. It is not possible to apply all these ideas to all assets in general.

Tip & trick #1: Apply number of units method

Depreciation should reflect the pattern of consumption of your asset and sometimes, it is appropriate to use number of units method.

Thus, you do not depreciate your asset over time.

Instead, you depreciate it based on number of units produced by that asset.

For example, stamping machine can produce 10 000 units in total and afterwards it needs to be replaced.

In this case it is more appropriate to depreciate the cost of stamping machine over 10 000 units and not over time. Let me give you the numbers here:

- So, let’s say that in the year 1, you plan to produce 5 000 units on that machine, thus you depreciate 50% of its cost (5 000/10 000).

- And then, in the year 2, there are lockdowns and you are forced to close your factory temporarily. You produce 0 units, so the depreciation is 0% of its cost in that year.

See? Your depreciation charge is 0 at the time of Covid-19. That’s what you wanted.

Can you apply this method to all assets?

Of course not, because most assets are consumed over some time (like furniture), not over number of units produced.

However, with the example of buses, I can imagine that the company may set the policy to depreciate buses over number of kilometers or miles travelled.

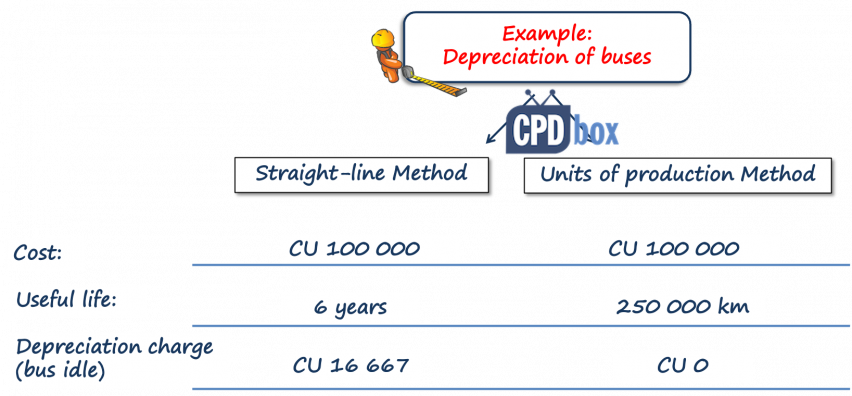

For example, let’s say the cost of your bus is CU 100 000 and you would set the useful life of a bus at 250 000 km. If you travelled 0 km due to pandemic lockdowns, then you would depreciate 0% of its cost during that particular period.

Just see the contrast yourself in the following scheme:

What if you currently do not apply units of production method? Please see tip&trick #3 below.

Tip & trick #2: Revise the useful life of your assets

IAS 16.51 requires revising the useful life and its change at least at the end of each financial year-end.

Note the words “at least”. It means you can revise more often if it changes.

Now let me ask you a question:

When government announces lockdowns and all your offices need to be closed, isn’t it true that during the lockdown, there is no wear and tear of your office equipment, like furniture?

So, isn’t it true that the useful life of these assets may become longer than you originally assumed?

Let’s assume the extreme case of a lockdown taking place for one full year. No office assets have been used. No chairs, no tables, no hand driers on toilets, etc. Can we say that their useful life is extended by 1 year?

Of course, in this case, there will not be zero depreciation, but your depreciation charge would certainly decrease due to spreading of remaining carrying amount over longer useful life.

You do NOT have to account for this change retrospectively (that is no correction of previous periods), but prospectively in the future periods after the change in this accounting estimate. Please see IAS 8 for more information.

So, if you change the accounting estimate immediately after the government claims a lockdown, you can start charging decreased depreciation charge immediately (no need to wait until the next year).

I know, it is not ideal, but better than nothing.

Also, you cannot apply this approach to all assets. For example, some assets become obsolete despite lockdowns, like computers.

Tip & trick #3: Change the depreciation method to number of units method

If you are depreciating your buses by the straight-line method and wish to take the advice in the point 1, you can change the depreciation method to the straight-line when the lockdowns strike.

The reason is that yes, under normal operating conditions, straight-line method appropriately reflected the consumption of the assets like buses, because management could reasonably assume that buses will travel the same number of kilometers/miles per year.

However, lockdowns change the situation dramatically and the management assumption does not apply anymore.

Therefore, it is quite reasonable to change the depreciation method from straight-line to number of units, because number of units method would better reflect the new pattern of consumption.

BUT!!!

Once you do it, then after lockdowns it is hardly possible to go back to straight-line, because you would hardly give a good reasoning why suddenly less precise straight-line method reflects the consumption of buses better than more precise number of units method.

So think.

Summary: What is more beneficial for YOU?

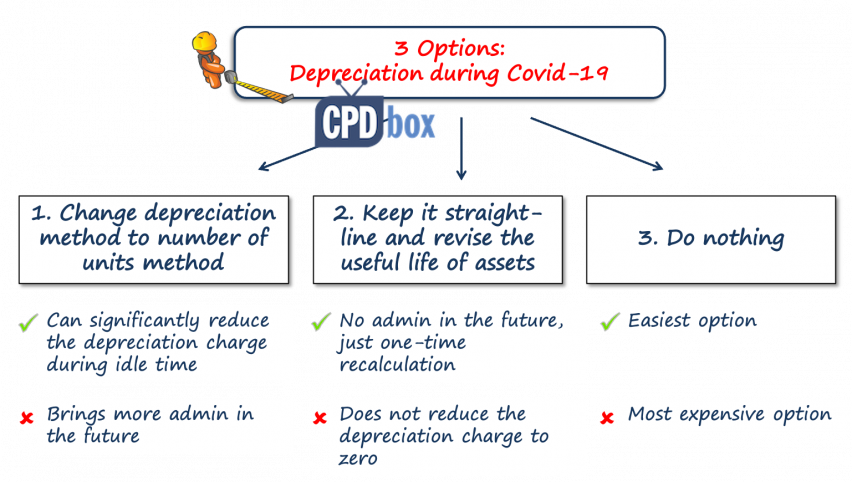

Let me sum up three basic options that you have when thinking of depreciation charges during lockdown periods:

- Change the depreciation method to number of units.

In this case, you would record zero depreciation when buses are idle, but in the next years of operating your business, you would need to monitor number of kilometers traveled by each bus in a particular year to charge the correct depreciation.

And no, you cannot apply it to the old buses only; you will have to apply it to all buses including the new ones you will acquire in the future.

So, this option reduces your depreciation charge to zero, but brings more admin in the future.

- Keep it straight line and revise the useful life.

You can prolong the useful life of buses by the time of the lockdown as I described in the point 1, because you can argue that there was no wear and tear of buses during idle time. Fair enough.

But, this option does not reduce your depreciation charge to zero.

On the other hand, no additional admin in the future, you continue with straight-line method and you are making the adjustment prospectively with just one recalculation.

- Do nothing and keep it as it is.

That’s the easiest option, because doing nothing is always the easiest way.

But, in most cases, the easiest option is the most expensive one. In this case, it means the greatest depreciation charges of all three options during lockdowns.

Any comments?

Please let me know below. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

23 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

We regularly loan our exhibition assets to other cultural organisations. In theory we would lose control over those assets loaned out and we would also lose benefits that come from them as we cannot exhibit and earn from them.

If the loan was for longer than a year, should we interrupt depreciation on those assets?

Thank you

Davide, I would need to know more about the transaction since it looks like a typical lease under IFRS 16 where you are the lessor. Lessors classify leases into finance and operating, so furthermore I would need to assess which type it is. To me, it seems it is operating as you will always receive the assets back. In this case no, you should not interrupt depreciation.

thank you, really appreciated

This is superbly written and just what I need the impact of COVID and currency devaluation on a trucking business is such a case study for this.

Thank you Silvia

It’s midnight here 🇧🇩 but I still can’t sleep before reading the entire article (including the comments section). Really enjoyed the read! Thank you so much Silvia!

Great 🙂 Make sure you get enough sleep though 🙂

I love this writeup, Milla. Keep it up. You are always inspiring with your writeups. Thanks for this. It is an eye opener

We must use these options as per company’s objectives because they are permissible by IFRS. Excellent work!

The most practicable is changing the useful life but these other are hard to explain

Does change of the depreciation method from straight line to number of units method amount to change in accounting policy? If yes, do we apply the change retrospectively?

No, it is the change in accounting estimate to be applied prospectively.

Hi Silvia, Thanks a lot for this very informative, useful and wonderful article. I study and found superb. Really appreciated. Keep us updated always.

Wonderful stuff Sylvia. I love this. Keep teaching us!

Madam, as you said rightly, for selective assets only we can apply the solutions you have given.

Great stuff! There could be possibility of exploring IAS 20 – Government Grants if Covid 19 Relief Funds would be available and would be offset against depreciation charge.

Yes, sure, thank you for the comment!

Even though you change your depreciation method, what happens wnen you submit your income tax returns, do you change the Capital Cost Allowance or do you still have to use the guidelines as recommended by the IRS?

Hi Leiland,

thank you for this question. IFRS does not solve tax returns at all, so I was speaking just in terms of IFRS. You need to check your own tax legislation that depends country by country. In some countries, tax law simply says that tax depreciation is whatever you book under IFRS. In different countries, it is set as a fixed percentage. So please check your tax laws.

Dear Silvia,

Thank you very much for the lecture.

If the organization applied a revaluation method, can we apply the same principle, or is there another option? The other thing, if the organization closed one of its branch due to external factor how do we recognize PPE.

Thank you

Hi Yerom,

yes, you can, but in the case of revaluation model, you have one more option (which is perhaps more relevant). You would simply revalue your assets at fair value at the reporting date and it can happen that it will go significantly down due to lower expected value in use. S.

Very interesting article, thanks Silvia

This Article was superb. We must really appreciate efforts of silvia

Thank you, glad to help, much appreciated 🙂