How to Account for Employee Loans (interest-free or below-market interest)

After I wrote an article about capitalizing borrowing cost, I got a lot of e-mails asking me actually HOW to account for loans that do not bear the interest rate reflecting market conditions.

In other words, how to account for loans at below-market interest rate, or even interest-free loans.

Such advantageous loans are seen in many circumstances:

- They are provided by a government to support some activities, such as construction of some assets, creation of employment, reimbursement of operating expenses;

- They can be provided by an employer to its employees as one form of employee benefits;

- They can be as well provided by a parent to its subsidiary (or vice versa) in order to support global business, etc.

In today’s article we will focus on the loans provided to the employees, but you can apply measurement criteria to other types of “advantageous” loans, too.

What rules do apply here?

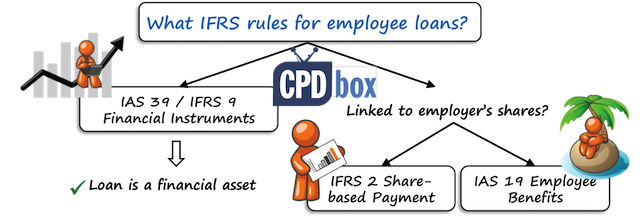

Any loan provided to anybody meets the definition of a financial instrument under IFRS 9 Financial Instruments (and IAS 39, too). Therefore, we will be looking at the rules for initial and subsequent measurement of financial instruments.

However, here’s the other side of the transaction:

Employee loans are provided to a company’s employees and therefore, there is some employee benefit involved, whether falling under the scope of IAS 19 Employee Benefits or IFRS 2 Share-based Payments at some circumstances.

We will assume here that the loans are not connected to some share purchases or anything like that and therefore we will focus on IAS 19 Employee Benefits.

To break the transaction into small easy pieces, let’s come up with a simple example:

Practical example – question

On 1 January 20X1, Goodie Ltd. provided a loan to its employee Mr. Jones amounting to CU 20 000 at interest rate of 1% p.a., repayable in 3 installments of CU 6 800 on 31 December 20X1, 31 December 20X2 and 31 December 20X3. (Note: if you discount 3 payments of 6 800 at 1 %, you should arrive to CU 20 000).

The market interest rate on similar loans is 5%.

How should Goodie Ltd. recognize and measure this loan initially and subsequently?

Initial recognition and measurement of an employee loan

As I wrote above, any loan meets the definition of a financial instrument under IAS 39 or IFRS 9. Both standards require measuring the financial assets initially at their fair value (plus the transaction cost in some cases).

Let’s say that Goodie Ltd. classifies the loan at amortized cost under IFRS 9 (or into “loans and receivables” category under IAS 39).

If the loan would have been made on market terms, then clearly, its fair value at inception would have equaled the loan amount of CU 20 000.

But this is NOT the case.

So what is the fair value of the employee loan?

In order to determine the fair value of the loan, Goodie Ltd. needs to take the following steps:

- Determine the market interest rate for similar instruments (here: 5% p.a.)

- Discount all cash flows from the loan with the market interest rate to arrive at their present value.

The present value of all cash flows is the fair value of the loan.

There are few methods of discounting. Here, let’s apply simple Excel formula “PV” or “present value”, as the cash flows or installments are the same each period. Simply type =PV in the excel file and insert the following parameters:

- Rate = 0.05 (that’s for 5% being the market interest rate)

- Nper = 3 (for 3 regular installments)

- Pmt = – 6 800 (that’s how much employee will repay in each installment)

- Fv = 0 (the future value after repayments, in this case 0)

- Type = 0 (payments are made at the end of period)

Your formula should look something like =PV(0.05;3;-6800;0;0) and if you did it right, the fair value of the employee loan is CU 18 518.

You can do this calculation also in the table format, using the discount factors for the individual year – up to you. I elaborate more on this in my premium training package The IFRS Kit, so if interested, please check it out.

How to treat the difference between loan’s fair value and nominal amount?

There’s a difference between:

- The nominal amount of the loan (or the cash paid to an employee): CU 20 000, and

- The loan’s fair value of CU 18 518

- Difference = CU 1 482

Normally, this would be recognized directly in profit or loss, but here’s the trick:

This difference is an employee benefit and Goodie Ltd. must recognize it in line with IAS 19 rules.

The problem is that IAS 19 does NOT provide any direct guidance on accounting for this form of benefits, and therefore we need to apply general principles of IAS 19.

Determine the type of the employee benefit

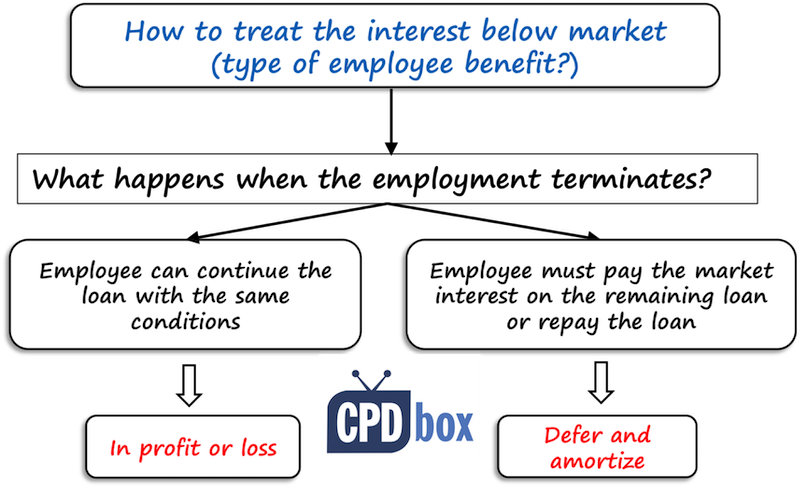

First of all, we need to determine the type of the employee benefit under IAS 19 and it depends on the specific terms of the loan agreement.

You should seek answers to the following questions:

What happens when the employee leaves the company? Can he still keep the loan at favorable conditions and continue paying beneficial interest? Or will he need to start paying the market interest rate? Or will the loan become repayable?

If the employee can continue with the loan under the same favorable conditions even after he terminates the employment, it means that the employee benefit has already been earned.

In practical terms – it is recognized straight in profit or loss and the journal entry is:

- Debit Profit or loss – Employee benefits: CU 1 482

- Debit Financial assets – Loans: CU 18 518

- Credit Cash: CU 20 000

If the loan will revert to a market interest rate after the employee leaves, then the benefit has not been fully earned and is available only while the employee provides services to the entity.

In line with IAS 19, an expense should be recognized when the employee provides its services, therefore in this case, we cannot recognize the full amount of CU 1 482 in profit or loss at the time of making the loan.

Instead, we need to defer the expense and allocate it to the periods when the employee provides services.

The journal entry is:

- Debit Prepaid (deferred) expenses for employee benefits: CU 1 482

- Debit Financial assets – Loans: CU 18 518

- Credit Cash: CU 20 000

Amortize the benefit in profit or loss

Then you need to determine HOW you will amortize these prepaid expenses in profit or loss.

Here, several methods are acceptable, but let me show you the method I have seen very frequently. This method looks at the employee benefit as short-term benefit, i.e. settled within 12 months after the employee renders the service.

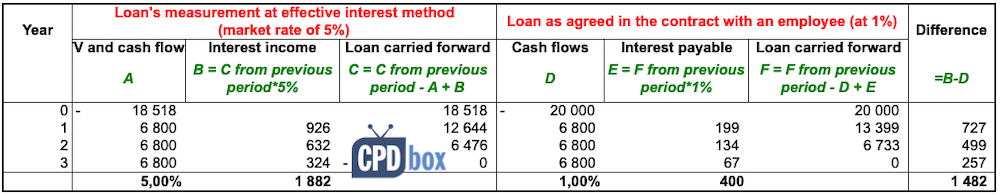

You can estimate the cost of such an employee benefit in each period as the difference between:

- The interest income for the period based on the fair value of the loan asset (using effective interest method at the market rate of 5%); and

- The interest payable by the employee (at 1%).

I have prepared the simple calculation in the following table:

The specific numbers depend on the year. Let’s draft the journal entries at the end of the year 1:

#1 Interest income on the loan using the effective interest method (at 5%):

- Debit Financial Assets – Loans: CU 926

- Credit P/L – Interest income: CU 926

#2 The 1st installment paid by the employee:

- Debit Cash: CU 6 800

- Credit Financial Assets – Loans: CU 6 800

#3 The employee benefit resulting from the employee loan:

- Debit P/L – Employee benefits: CU 727

- Credit Prepaid (deferred) expenses for employee benefits: CU 727

Any questions or notes? Please leave me a comment right below this article and don’t forget to share it with your friends – thank you! 🙂

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hey really liked the explanation

But i have a question

What is the concessional rate facility is stopped midway

like loan from 2014-2018

rate in 2014-6% but in 2017 the company changed the policy and decided to not provide concessional rate and just provide market rate after 2017.

(we’re in 2018 trying to do first time implementation from 2014.)

Thank you.

Hi Silvia it is very interesting since IFRS is based on substance rather than rule basis like GAAP do so , while i am a little bit confused about the calculation of for fair value of the Loan, that is CU 18518 could you give me some elaboration about it?

Thank you for this

Thank you very much Silvia, I always learn from you.

I have a situation and I will be very gleeful if you help me. In my company we give our employees a free interest loan to build or buy houses for them (Home Ownership Program. then they repay it through about 20 years and if they resigned the loan will be payable immediately. In addition they have an advantage if they continue working in the company till the loan is completed, they will get 16% discount. how can I recognize they loan and the discount?

Kudos Silvia

Should it need to change the fair value adjustment for current year market lending rate for the loans which were granted in previous years ?or the company should consider the market lending rate at the date of granting the loan in order to calculate the PV

Very well explained can you send excel sheet prepared by you .

Thank you very much

Indika

An interest free loan facility given for one of supplier and loan will be settled by the goods borrower supplied to the entity in future.agreed price range for the goods always below the market price. How should we account for the loan and purchases specially below market price.(IFRS9)

what should I refer to get more understanding

please is it prudent to calculate the interest for the entire period and add it to the loan principal and credit the employee account with the full principal plus interest. And afterwards debit the interest portion from the employee account and credit P&L with it? In this case, the employer will treat the interest upfront, other than to wait and be taking the interest on monthly or yearly bases. the company will realize its full interest even before the loan repayment actually starts.

Hi Silvia,

Thank you so much. It was a wonderful article on IFRS 9.

I have a question related to amortization of prepaid staff welfare expense [ FV – loan ]

In few ACCA questions, Instead of accounting it in a ratio of difference in interest [ as per Market rate and concessional rate ] , they have just amortized it on SLM basis.

Is it still acceptable ?

If yes then what is the view behind applying such treatment.

Thank you so much

Hi Silvia,

How if the Company never measured the initial recognition using the amortized cost, they just recorded the financial asset amounting to CU20,000 at initial date? Let’s say the Company has just realized it on the Year 2. What should the Company do on this? Should they remeasure the PV by the end of balance sheet date in Year 2 using the market rate at Year 2?

hi Silvia ,

Thanks so much .

please clarify if Penalties imposed by central banks on banks are treated in the same way or not = free deposits for 1 year =

A company provide vehicle of $ 1 Million to employee. An employee has option to buy the vehicle after seven years at price arrived after deducting depreciation of 10% on SLM. What is the treatment of such under IFRS???

Hi Silvia,

Thanks again for spelling out the standard into an understandable way, and your examples are really useful.

I have a question on Seasonal rail tickets that a lot of companies provide to employees, it’s effectively an interest free loan to buy a season ticket to get to work, should this be treated under IFRS 9 as it’s a loan and under IAS 19 employee benefits or just under IAS 19?

Thanks in advance

Kind Regards

Valerie

Hi Valerie,

the question is – why are seasonal ticket an interest free loan? Do these employees need to pay for these tickets, or do they get them completely freely? I assume that the companies prepay those rail tickets with railway company and then give them to the employees at no cost, isn’t it? If this is the case, then it is not a financial instrument, but yes, it is an employee benefit, and if provided to the current employees in return for their current service, it is classified as short-term benefit.

can we do the calculation individually ?

Hi! Siva

I appreciate the commendable support that you provide from time to time. I have read your previous videos but I have a question to be cleared.

1. An organization had an outstanding free loan offered to its employees of birr 1,340,140.-as of june 30, 2017 which is expected to be paid with in two years. the intent is to prepare an opening balance for adopting IFRS. How could I treat this balance till it is fully paid.

2. The organization has also started to offer medium term loans for a period of 5 years @8% interest rate and long term loans for a period of 15 years at @11% interest rate while the market interest rate is 17%.

The loan is to be reversed if employees terminate.

How could I handle these issues.

Hi Assefa, well, I cannot answer this specific question in the comment, this would be too elaborate, but you have a method in this article. All the best, S.

If classification and measurement of employee loans receivables has not been done in line with your above proposed solution, i.e., the “employee benefit” component has not been carved out of the financial instrument to take it to the P&L or as a prepayment and this has continued for a period of time, how should one revert back to the correct treatment of loans in line with the above discussion. Can we cover it as a change in accounting policy under IAS 8 and fix the books prospectively

Hi Jim, it depends – is the error material or not? If yes, then do it retrospectively; if not, then prospectively in the current reporting period.

Hi Silvia,

First of all I want to say thank you for simplifying IFRS9. Then I want to ask that if the loan arrangement is that the benefit is acquired at the inception of the loan, and the present value of the loan is less than the cash payment since the loan is interest free (or 0% interest). Then upon collection how can we treat the Journal entry.

The difference is recognized in profit or loss upon initial recognition.

Thank you Silvia for the quick response. The problem in the above case is that if upon initial recognition Debit P/L-employee benefit by 10 and financial asset 90 and credit cash 100. when the loan is collected the financial asset/receivable becomes debit cash 100 and credit receivable 100, which leaves the net receivable 10 credit. so how can I treat the excess of 10 in the receivable?

Please, read the above article carefully. You are increasing the nominal value of the loan receivable by the interest revenue charged by the market rate. Thus you should arrive at value of 100 at the repayment date.

Hi Silvia,

First of all I want to say thank you for simplifying the application of IFRS 9. Secondly, I wanted to ask, is the market interest rate the same thing as the effective interest rate, is this rate also gotten by computing an effective interest rate formula or is it a rate set by the financial institution of the country we are working with, to be honest I am finding it difficult understanding how the rate is set and what the purpose of the rate is.

Hi Silvia,

That’s an interesting piece. Thank you.

I wish to know which IFRS standard covers the treatment of loans given at lower than market rates. Is it the same IFRS 9?

Hi Dieter, thank you. Yes, in general it is IFRS 9.

I really appreciate you SILVIA, and wish a continuous support for People in accounting

field and wish you to go back for that session of Cash flow statement ( I need a deep skills

& experience ) in its preparation.

Best regards

Thank you 🙂

what will be the impact if the market interest is changed in subsequent years?

can i have a copy of the excel calculation?

hi silvia , thank you for the great job you doing in explaining debatable areas , i have a question lets consider banks make loans lower than market rate (because of governmental limitations) like a forced rate and the funds are not provided by government but own bank funds , So is this to be treated like employee loans or loans to subsidiaries?

and if it does , consider the loan is being held to maturity, you should only do the initial recognition in fair value and then continue with amortized cost method or use fair value for the life time of the loan(because the rate is not reflecting the credit risk) ?

would really appreciate an answer

Hi Silvia, a company bought a vehicle for R50′ then sold it to one of the employees for the same amount (interest free). How should this transaction be captured? When will the ownership transfer to the employee? Will it only be a loan without and fringe benefit tax as it is a purchase?

Chantal, if the vehicle was sold to employee – does it mean that the control of vehicle passed to employee? Also, did the employee pay or was it on credit? not clear from your scenario. However, the vehicle is derecognized when the control passes to the employee.

Silva, you are doing just fine with your explanations.

My question is a director gave an interest-free loan to the business to support the operations until the future years when the company shall be able to repay.

Shall we fair value the initial loan given in the similar manner as the example above just that this is just on the liability side?

Also, help clarify the place of ‘Day One Loss’ under the above example given by you?

Dele,Lagos-Nigeria

Hi Olapoju, yes, you should. I think that would be day one gain in this case. S.

Hi Silva,

I appreciate your support and notes on IFRS and IAS… Simple and self explanatory… In my country jurisdiction, we are applying defined contribution plan for retires and any entity is not accountable for any shortages or benefits after retirement… Pension is managed by government agency… and any contributions are made to this agency….

But,

1. we don have some employee benefits which will be payable upon employee resignation (employee’s request) and the liability is increased and vested as employment service year increases …

i.e (last date’s salary rate*Service year)/3

2. Medical services and refunds (even after retirement)

How can i accrue and treat these benefits’ accounting annually? Shall I undertake actuarial valuation?

Thanks

Thanks Silva for enlightening us with the IFRS and IAS with its trearments.

Hi Silvia,

How do you determine market interest rate for similar loans? Is there a kind of calculation to be done?

Hi Sunday, please check out the IFRS Q&A episode 32, it will be issued this week and will speak about this topic in relation to leases, but you can apply it to employee loans, too.

Thank you

If a Bank offers a facility where a short term loan is offered to it’s employee under interest free arrangement. I agree that every loan is an example of financial instrument therefore the loan shall be recognized at fair value at inception plus transaction cost. While, the mark up charge for similar loan is 7.5% on the outstanding principal. The problem is how can it be accounted for under IFRS 9 Ammortized cost classification as it does not fulfill the SPPI criteria.

Dear Slivia

At every year end how can we knock off all the entries, as the loan at year end will be stelled down. And prepaid expenses how we amortized it in accounts.

I am from Ethiopia. I have taken IFRS Training of Trainers (TOT) your effort gives me relief how to delivery the standards.

I really appreciate your effort.

Thank U.

hello Silvia ,

please mention the journals for receiving installments from employment for the first year in case we have recognized the difference in profit or loss .

do we will reverse the amount charged before in P/L =CU 1 482 with every installment.

Thank you

Hi Silvia,

Really appreciative explanation. I would like to know the treatment in the following situation:

when the loan is insured and annual insurance premium is deducted from employees’ salary and at the time of maturity, the amount received from insurance company is shared between employees and employees at certain proportion. The premium deducted is not the income of employer but only amount received at the time of maturity is income. The loan in interest free to employees but premium should be paid as deduction from salary.

Does it similar to loan with no interest rate and one time repayment (equal to employer’s share) at the time of maturity? Thank you.

A subsidiary has taken a loan from parent company without any interest and so far there are no repayments also. How to treat the same under financial instruments

I think this article will help. S.

Hi Silvia

what happens on settlement date of the below market interest loan offered to the employee. i.e if the loan is settled at an earlier date than agreed upon or when there are changes in the market rate during the period of the loan, because in this case the employee benefit will not equal the fair value adjustment at initial recognition.

Hello Silvia,

Thank you for the example. Before looking at your solution, I had tried on my side. The result is the same except for the allocation of the 1,481 over the 3 years. I had taken the fact that employee received 20K in cash but did not pay enough interest. Thus, taking the discounted difference in the installment he actually paid with the beneficial 1% interest rate (6,800) versus what he should have paid with a 5% market interest rate (7,344). Resulting in Employee benefits of 518, 493 and 470. I know you mentioned that there are several possibilities. But do you see anything wrong with that ?

Thanks much

Hi Thomas, there’s a trouble only with the fact that there’s no theoretical cash flow of “what he would have paid”. But yes, if it adds up, then you would be able to justify it. S.

Hi Silva,

since the fair value of loan is less than the actual loan given in initial phase, is it right for me to understand that as loan is being issued at concessional rate, so the fair value is less than actual loan given,there fore its a part of expense, please correct me silva

If a Parent company gives Interest free loan to Subsidiary and there is no period defined till when the loan will be repaid. In an agreement its mention payable on demand.

Kindly advise whether we need to recognise the loan at fair value.

As per IFRS there is no specific guidance.As per IFRS/Indian Accounting Standards (Ind AS) “The fair value of a financial liability with a demand feature is not less than the amount payable on demand, discounted from the first date that the amount could be required to be paid. Since it is repayable on demand at any time, no discounting would be required on initial recognition.”

Can you let us know if any guidance there in US GAAP.

Hi,Silva

What is the accounting implication or treatment when employees salaries are being paid before month end. Does IAS 19 or any other standard address this situation? Your prompt response will be highly appreciated

Your article is really helpful. I sincerely admire the way you explain each and every point. I just have a simple query that whether deferred tax to be created on the entries of deferred employee cost amortised and notional interest income booked .

Manoj, as soon as these accounting entries are different from your tax rules, then of course, the deferred tax should be booked. S.

Hi Silvia,

thank you very much for this topic. I have one question regarding the last table: could you please tell me what formulas did you use for the columns of B and E? Interest income and interest payable?

Thank you$regards

Dear Salome, if you look to that table, please note that in the header there are formulas stated in green color. S.

It was very helpful. and further let me know, If an employee make the balance capital payment to settle the balance & mgt is ok to proceed with it. how do we recognized the interest income which should have been received under normal conditions but not received due to above reason.

1. Cash dr (capital balance)

Loan receivable Cr

2. Staff loan expense Dr

Deferred int. Cr (balance remaining)

? where to credit Cr (difference)

Sylvie, I have purchased your IFRS kit package, but did not find the table above for this example in any of the excel spreadsheets. Can you let me know which excel spreadsheet is the above example and the table illustrated in?

Thanks –

Oh, I think it’s not there, but I can send it to your e-mail address – just please, write me an e-mail. Thank you 🙂 S.

Thanks for this insight. Great article

Whether it is appropriate to expense out to P/L Account the difference between FV and loan amount CU. 1,482 directly whether it is in compliance with IAS -39/IFRS-9. Please explain and provide me any reference of this in IAS -39/IFRS-9. Thanks.

Hi Silvia,

I have one query in your example. Expenses for Employee Benefits which is 1482 at the beginning. Can we debit the Employee Benefit expenses at the year end 1,2 & 3 CU 494 each year on straight line basis ?

No, because that’s not the application of the effective interest method. Please look in the last table above – the last column shows you the schedule of amortizing these expenses. S.

Hi

Please help me with the following:

While lending a employee loan let say i am lending at a concessional rate of 6% p.a. fixed rate for 5 years where els the same nature of loan with same credit rating is provided in market @ 10% p.a. variable rate (which will reset every year). In such a case while initial recognition, can i consider the same 10% rate for arriving at fair value? will 6% fixed rate be comparable to 10% variable rate??

In arriving the fair value, you should really apply the market rate of 10% and any difference goes in profit or loss.

Do I treat loans made to employees to buy company shares as an employee benefit if the interest rate charged to is below market rate. So conditions are (a) employee can make a loan to buy company shares and pay 1.5% interest (b) loan is repayable at any point but must be repaid on the earlier of leaving the company, selling matched shares or at end of loan period. At each accounting period after initial recognition should these loans be measured at FV (IAS39). What about discounting? Bit confused here because there is both an employee benefit and SBP involved.