How to Account for Debt Factoring or Selling of Receivables

When I was auditing the financial statements of one of our clients, I spotted a few strange things:

- There was a huge balance of cash on client’s bank account at the year-end.

And I mean HUGE.To illustrate: normally, the client had about CU 100 000 on the bank account with some variations, but at the year-end, the balance was ten times greater, about CU 1 mil. (CU means currency unit).

- Client’s receivables showed an extremely low balance. In comparison with the previous year, the balance dropped by 90%.

I was a freshman in that audit year and the first thing I did before I started to bother our senior auditor was to look at the client’s bank statements from January next year – that is AFTER the reporting date.

Guess what I discovered!

I was staring at that January bank statement with shock.

The balance of cash was back to about CU 100 000.

WOW!

Where did this CU 900 000 go?

Just to be on the safe side, I checked also the subledger of receivables.

Not such a big surprise there – the receivables were also back to their normal levels.

Hmmm, something smells here…

Instead of bothering the senior auditor, I went to bother client’s CFO.

The nice talkative lady explained that just before the year-end, they sold a significant amount of receivables… (a Hollywood smile).

My question: Did you buy them back in January?

The smile faded slightly: “Oooh, yes….”

Me, still puzzled: “Why did you do it?”

The remaining smile is replaced with an annoyed look: “Well, there’s nothing wrong with that… we needed to meet the bank’s covenants for our loan and show enough cash on our bank account…”

OK, I understood.

However in this particular case, the client did it wrong.

In other words, it did not help at all.

Why?

You’re just about to find out!

Why sell receivables?

Many companies regularly sell their receivables to someone else.

There are few reasons for that:

- They need cash and don’t want to (or cannot) wait until their own clients pay invoices.

- They don’t want to deal with the credit risk of their clients.

- They don’t want to employ people who try to call clients, remind them about due dates and missing payments – in other words, they don’t want to bother with collecting of receivables.

- They are trying to “window-dress” their financial statements, just as my client did – but in reality, it does not happen very often.

What is a debt factoring?

In a modern business world, factoring of receivables, or selling receivables with discount is a normal practice of cash management.

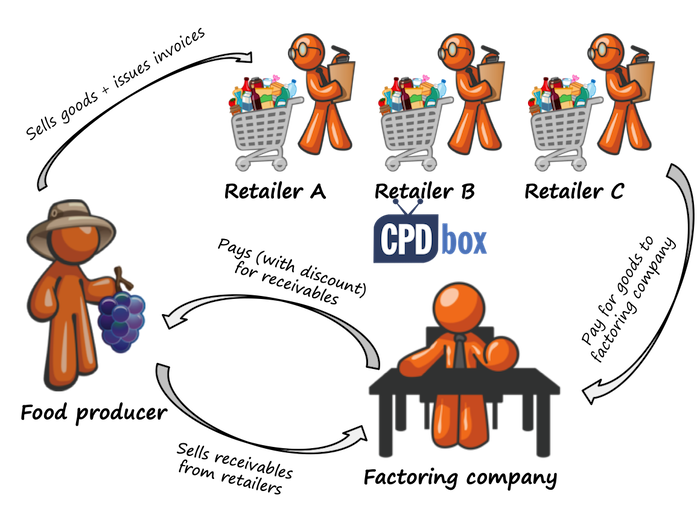

Here’s how it works:

- You (food producer in the scheme) sell your products to the customers and issue invoices.

- As the invoices are due in 90 days (if you deal with big retail chains, then the credit terms are even longer), you cannot afford to wait for the cash and sell the receivables to a factor (factoring company).

The receivables are sold with discount that represents both:

- Your fee for having cash immediately (interest on the loan provided by the factor),

- The revenue of the factoring company.

- Your customers (retailers in the scheme) pay the invoices when they are due directly to the factoring company.

Now, the principal question is:

Should you remove the receivables from the financial statements?

Well, it depends.

In fact, you need to decide whether the conditions for derecognition of financial asset were met or not.

If you remember, IFRS 9 Financial Instruments is very sticky in derecognition and it’s much easier to recognize an asset than to derecognize it.

For this reason, IFRS 9 contains a big decision tree helping you to determine whether you should derecognize your asset or not.

When you sell receivables, you need to assess whether you transfer significant risks and rewards of ownership or not in the first instance.

Then, if you don’t, you need to assess whether you retain some control or you have some continuing involvement in the receivables.

There are many types of factoring arrangements with various conditions. The three main types are:

- Factoring without recourse – in this case, the factor buys all the receivables from you with no right of return to you (if your customers do not pay, then it’s factor’s care).

- Factoring with recourse – in this case, the factor has the right to return uncollectible receivables to you.

- Factoring with limited recourse (guarantee) – in this case, you guarantee the losses up to certain amount and the factor can return the receivables only up to the guarantee.

Let me show you how to account for the first two types.

Example: Factoring without recourse

Question:

Tradex is a trading company. Due to urgent cash shortage, it decides to transfer trade receivables to the factoring company for 90% of their nominal amount. Total transferred receivables amount to CU 300 000. The factor has no right of returning the receivables back to Tradex.

Solution

Tradex transfers all the risks and rewards resulting from the receivables to the factoring company.

As a result, Tradex derecognizes the receivables fully, because the derecognition criteria in IFRS 9 are met.

Journal entries are:

-

Debit Bank account (CU 300 000*90%): CU 270 000

-

Profit or loss – finance expenses (see note below): CU 30 000

-

Credit Receivables: CU 300 000

Note: Most of these finance expenses represent the interest, because factoring is a form of a loan from the factor. Therefore, if material, you should accrue the interest expenses and recognize them over the period of financing (not one-time as shown here).

In this case, when the clients do not pay to the factor and go bankrupt, it’s the factor’s care and not Tradex’s care. That’s the biggest advantage of non-recourse factoring.

On the other hand, the discount (the fees) are higher than when factoring is with recourse.

Example: factoring with recourse

Question:

The same situation as above. This time, Tadex transfers the receivables for 96% of their nominal amount. Total transferred receivables amount to CU 300 000. The factor has the full right of returning the receivables back to Tradex if they become uncollectible.

Solution

Tradex retains some risks resulting from the receivables to the factoring company. The clients’ credit risk was not transferred because the factor has the right of return.

As a result, Tradex keeps the receivables in the balance sheet, because the derecognition criteria in IFRS 9 are not met.

The amount received from factoring company is recognized as a liability.

Journal entries are:

-

Debit Bank account (CU 300 000*96%): CU 288 000

-

Debit Profit or loss – finance expenses (see note below): CU 12 000

-

Credit Refund liability: CU 300 000

Note: Most of these finance expenses represent the interest, because factoring is a form of a loan from the factor. Therefore, if material, you should accrue the interest expenses and recognize them over the period of financing (not one-time as shown here).

The subsequent journal entries are:

- When the customer goes bankrupt and the factor applies the recourse right:

-

Debit Refund liability: CU 10 000 (the amount of uncollectible receivable)

-

Credit Bank account: CU 10 000

-

- When the customers pay to the factor (based on some payment report from factor):

-

Debit Refund liability: CU 50 000 (the amount actually collected by the factor)

-

Credit Receivables: CU 50 000

-

Factoring with guarantee

The most common type of factoring transaction is something in between these two “black or white” cases described above.

Factors often require a guarantee up to certain amount.

As a result, the factor does not have the right to the full return up to nominal amount of receivables, but only up to a guarantee.

Here, there is a continuing involvement in the receivables, so you cannot derecognize them fully.

In the IFRS Kit, there’s an example of this type of factoring solved in Excel file and clearly explained in the video, so please, check it out if interested!

Finally…

Let’s come back to my client from the beginning of this article.

I handed the case to our senior auditor (so finally yes, I bothered him), but this appeared to be the major audit finding.

The senior auditor revised the contract for sale of receivables and it clearly stated that our client has an obligation to buy these receivables back in January next year.

As a result, not all the risks and rewards were transferred and the client needed to put the receivables back to its balance sheet and recognize a refund liability.

Of course, the client did not agree and we issued an audit report with qualification. But that’s another story.

Did this article help?

Do you have come comments or questions?

Please, leave a comment below! Thanks!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia, great work !

But I have a little doubt with regards to the non recourse factoring. You made mention that the refund liability should be the amount the factoring company will pay. With this example they paid cu288000 but u recorded cu300000

Hey Slavia,

This article helped me a lot. Keep on the good job.,

Hi Silvia

I came across an interesting example of this process today at work that I am interested to get to the bottom of. My example differs slightly as to avoid extra work for the customer, in setting up a new payee, they will pay the debt at maturity to the original issuer of the debt. (ie, not the factor)

Then once this is received, as the company has already sold the debt (At a discount) to the factor, and received the cash, they are mandated to just act as a pass through with the cash, and give it to the factor.

The various debits and credits to recognise the receivable, and then write this off, putting the balancing figure to the income statement under finance costs I am comfortable with.

What I hesitate with, is do I need to disclose anything at that time showing that I am still to receive cash in X months time, but I have no right to that cash and it will just be passed on when received?

Many thanks

Matt

Thanks Silva for great clarifications, keep on, it was helpful

Hi Amr I have a doubt in IFRS -9 , if we make any advance payment to supplier -for the year -do that advance -constitute financial asset as per definition of financial instrument ?

Hi Silva

This is an absolutely wonderful article – cant thank you enough for this invaluable piece of work

I had a little query, can you please advise where in the PnL would the Factoring/discounting cost be classified? The discounting cost is Time value of Money in principal. So, in case of Non recourse Factoring of receivables would the underlying discounting cost/ interest be recorded as Finance Cost after administrative expense or otherwise as an Overhead in administrative expenses?

Hi Sylvia,

Are you sure the accounting treatment for non-recourse is correct:

Debit Bank account (CU 300 000*90%): CU 270 000

Profit or loss – finance expenses (see note below): CU 30 000

Credit Receivables: CU 300 000

Note: Most of these finance expenses represent the interest, because factoring is a form of a loan from the factor. Therefore, if material, you should accrue the interest expenses and recognize them over the period of financing (not one-time as shown here).

IFRS 9

3.2.13 If the transferred asset is part of a larger financial asset (eg when an entity transfers interest cash flows that are part of a debt instrument, see paragraph 3.2.2(a)) and the part transferred qualifies for derecognition in its entirety, the previous carrying amount of the larger financial asset shall be allocated between the part that continues to be recognised and the part that is derecognised, on the basis of the relative fair values of those parts on the date of the transfer. For this purpose, a retained servicing asset shall be treated as a part that continues to be recognised. The difference between:

(a) the carrying amount (measured at the date of derecognition) allocated to the part derecognised and

(b) the consideration received for the part derecognised (including any new asset obtained less any new liability assumed)

shall be recognised in profit or loss.

Which doesn’t give you the option to recognise the expense over the period financing.

But I would not say that this paragraph applies here… you are not transferring an asset that is a part of larger asset. S.

Hi Silvia,

Nice and helpful article, I have a query on the revenue side of this issue which was not discussed.

For e.g. If a leasing company decides to sell its receivables without recourse:

1. Sell receivables amounting to 1 million within which 0.2 million of unearned revenue is also included.

2. Upon selling these receivables to a bank for 90% of their value or 0.9 million, I assume we are left with only 0.1 million in terms of the unearned revenue as the rest was taken by the bank to cover their credit risk and interest revenue.

3. How will this remainder of the unearned revenue be accounted for as the receivable is recognized, should it be recognized immediately or amortized like the interest expense?

Appreciate your input/help on this matter.

I would like to reply on this part.

1) unearned revenue is not included in receivables. it is deferred revenue and classified as liability. you should separate it from receivables and should have separate treatment

2) 10% of value accounted for fees against credit risk- conversion from receivables to cash. unearned revenue has different concept.

2)

Hi Silvia

Can you please let us know the presentation of refund liability in the balance sheet. Will this be treated as a short term loan or under other financial liability

Thanks

Saurabh

Not a short-term loan. It’s other financial liability and can be grouped with other items if not material.

Hi Silvia,

Please confirm the accounting treatment in below case

Our payment terms with a customer are for 60 days from the invoice date. However the customer wants extended term till 120 days. We have entered into an arrangement with a Bank for factoring, wherein bank pays us the money on 60th Day and collects the same from the customer on 120th day.

Financing cost is borne by the customer for the extended term of 60 days.

In this case if some part of the factoring cost is to be borne by us then then how the same should be treated.

Dear Sylvia,

how should we classify the factoring agreement with recourse in the cash flow statement? Operating or financing activity?

Hi Jane, in fact I’ve seen both. However in my opinion, despite the fact it is financing, majority of it relates to the collection of receivables and hence I’m more for classifying as operating activity. S.

Hi Silvia, I am agree with your opinion where the factoring with recourse from its substance consider as credit department working on behalf the company to collect the indebtedness, therefore it is not financing elements and so that it should classified under the operating activities in statement of cash flows.

Thanks. My question is;

What happens if the factoring is non recourse but there is a guarantee that the entity will pay the factor some cash if part of the receivables default. Buh now the entity now believes that it’s customers represent a low credit risk and the probability of default is low.

Do you derecognise the receivables in full since the probability of default is low? More clarity. Thanks madam

Thanks for this madam.

Some thing puzzling now about the non recourse with a guarantee. What happens if the entity believes that it’s customers represent a low credit risk and the probability of default is low? Thanks

Well, sometimes they just enter into factoring with recourse (the entity keeps the full credit risk). The treatment is shown in the above article. Or, I did not get your question fully.

Hi Silvia,

Please could you advise what are the accounting entries for the following transactions on Factoring of Receivables without recourse.

1) Assume there are sales discounts of CU10,000 and bad debts of CU30,000. The debts are collected by the bank. Do I need to record any entries for the seller or the company? Are the above transactions only affected the factor/bankers?

Thanks

Hi Sue,

non-recourse factoring means that the bank (buyer of your receivables) has no right to return bad debts to you, but the credit risk passes to the bank. Hence the seller of the receivables can fully derecognize them as risks and rewards are passed (not retained). So as a seller, you just record the sale and derecognition of receivables. I assume there’s no guarantee and no other strings attached. S.

Thanks Silvia for the reply. I am trying to explain this to my students.

I presume that in the banker’s book I have to treat the sales returns and bad debt as normal receivables transactions? In other words, the entries in the bankers’ book should be as follow?

Dr Sales Returns

Dr Bad Debts Expense

Cr Account Receivables

Thanks again!

Did this issue differs between US GASP and IFRS in Accounting for factored A/R

Dear Silvia,

how to reflect in balance sheet receivables from factoring company if for example: according deal’s conditions factoring company pays 90% amount at once and 10% amount later (after 3 month) if client will pay 100 % his debt to factoring company. Where must be this this 10% amount until we will collect it from factoring? in trade receivables? or in other place? For example: we sell 1200 Eur trade receivable amount for 1000 , factoring company pays 90% at once -900 Eur and 100 Eur- later after 2 month. Where this 100 Eur amount must be counted ? As trade receivables? After 2 month we receive this amount because of our debtor pays to factoring in time.

Thanks

Dear Silvia, what journal entries will be for factor?

Silvia thank you for this wonderful article

I love reading your writing

so interesting and so benefit

Thanks for the excelent explanation. I have one quesiton: Should the expences regarding factoring always be disclosed as an financial expense or could they also be shown as an operating expense? As they are linked to operating receivebles. I have factoring with recourse and in the BS it is ok-shown gross ammount. Acc. Receivable and Financial liabilities. The P&L on the other side is a question… could you guide me perhaps to an IFRS that deals with this?

Thank u Very much! Simple & understandable.

thanks good job

Thanks so much! Very helpful 🙂

Thanks Silvia for sharing your practical experience with us. It’s well appreciated.

Hi Silvia. A wonderful job you have done there. Thumps up.

Please, I would like a clarification on the factoring with recourse. In the illustration above, you Debited the refund liability and credited the bank with CU10,000, where the debt goes bad, and the factor recourses to the company.

Should it not be a full repayment of the CU288,000 initially obtained from the factor as follows:

Debit Refund Liability – CU288,000 and

Credit Bank – CU288,000. Then the difference being part of the full bad debt to be written off. My thought. Please clear me. Thanks

Thanks Silvia

Dear Silvia,

Thanks for the great article. I’m Preparing for my CA exams and this topic was not cleared to me. After I read ur article step by step I got clear understanding about factoring and how to account those.

Once again thanks for the help.

nice article, it was a question on acca p2 June 2017. glad to have your articles

Thanks for the interesting article.

There are not so many details about the contract for sale of receivables, but I think the principle “substance over form” may be applied to the described situation. The client just got a short-term loan and receivables were as a kind of collateral.

Thanks Silvia

Great Job, Easy and stick to the point

I think there is no deferent between GAAP and IFRS In this particular matter! Is it right?

Dear Silvia,

Thank you so much for the illustration.

But could you please tell us the difference between the secured borrowing and the factoring of receivables with recourse or with guarantee??

And when we will have an off-balance sheet items in factoring?

Thank you so much

Hi Hashem,

if you have a borrowing secured with receivables, then you eventually need to return the amount borrowed to the lender when you collect the receivables. However with factoring, it’s a lender – factor – who collects the receivables. That’s one of the main features of factoring – you as a client stop collecting receivables and instead of paying to the lender back, your customers pay him by paying their invoices. S.

Thank you so much, and we consider the secured borrowing as an off-balance sheet item or what?

Hi Silvia,

you make it look very easy, i am impressed !before i read this article,i had failed to understand how factoring works in practice.

God bless you

Hi Silvia

Thanks very much for your help your really playing your part in helping others especially in accounting matters. I love that big up for that

Thank you silva for sharing your experience.Your write ups are captivating and enlightening.

Thanks Silvia, nice auditing there

Many thanks, very clear!

Thanks for such a good lesson related to Factoring.

I am looking forward to see an article related to acretion of transaction cost at the borrower company.

Thanks again.

Hi Alonzo, thanks a lot. I see that there are more questions on this topic, so yes, maybe I’ll write some “sequel”. All the best 🙂

Hi sylvia

Thanks for the good job.

You are a great teacher.

Regards

Ike

Thanks Sylvia…that was really insightful.

Hi Silvia,

Great article on factoring – this helps much! We were purchased recently by a Spanish parent and they want us to utilize factoring and we currently do none here in the US as is very uncommon and US banks tend to frown on the practice. Why is it so popular in Europe vs. US? Do you know?

Thanks,

John

John, I don’t know why it’s not so popular in US (or as popular as in Europe), but the main reason why factoring is so popular is that on top of having cash quickly, factor usually collects the receivables, too (not you). That’s the great service. S.

Hi Silvia,

Thank you very much for the job well done on debt factoring.

What can you say about invoice discounting?

Regards,

Segun.

Hi Segun, the invoice discounting is very similar to the debt factoring… what specifically would you like to know?

Thanks for the swift response.

How finance cost can be accounted for under invoice discounting.

Thanks a lot!

Hi Silvia

Thank you very much, I had some challenges with receivable factoring but now I have a great understanding.

Hi Silvia,

Great job!

Thanks a lot for your insightful illustrations on this.

However, i don’t know and would love to know if your IFRS packages could be subscribed to and make payment in installment??

Dear Silvia,

For accrual of finance expense , using your example, shall I record as follows:

1) Debit Bank account ( CU 300,000 x 96%) : CU 288000; Credit Refund liability :CU 288,000

2) Assuming the interest cost is calculated on a monthly basis, with monthly cost of CU 100 charged to P&L, would the entries be:

Debit the finance cost : CU 100; and Credit the Refund liability : CU 100

Would you kindly give me some help in this?

Hello Edmund,

initial entry

————

Debit Bank account (CU 300 000*96%): CU 288 000

Debit Profit or loss – finance expenses CU 12 000(ie interest cost is recorded annually)

Credit Refund liability: CU 300 000

—————————————————————–

If interest cost is calculated monthly then the following entries

Debit Interest Accrued==CU 12 000 Instead of expense

subsequently

Debit interest expense CU 500 ( say over 24mths)

Credit Interest Accrued CU 500

MY humble opinion

This article is of great value to me. I didn’t the accounting treatment for factoring of receivables until now. I am definitely going to forward this mail to my colleague.

Thanks Silvia!

Nice Job silvia. Concept explained with easy method. I grasp it very well.

Dear Silvia,

I also have the same question as with Mamuka. I understand that the IFRS may not permit accouting for the interest expenses on a time proprotion basis. If so, would you mind telling us how to accrue for the interest expenses over the credit term (say 2 years) properly ? Thanks

Hi Wilson,

the effective interest method is the answer. Just careful, because if you have the credit terms 2 years and you factor at let’s say 4% discount (that is, you receive 96% of nominal), then 4% is the interest rate for 2 years. You need to calculate how much it is monthly/annually, depending on the frequency of interest booking (some do it monthly, some annually – depends on the frequency of your reporting).

Hi Silvia

Thanks for the usual excellent coverage, and for sharing about your practical work case history illustration, which was very interesting. Your work in ‘IFRS Box’ is such a great help to so many – awesome !

Thank you, I’m glad to help 😉

Dear Silvia,

Good job as always.

In case company decides to spread an interest expenses over some years should interest expenses be discounted to the present value?

Regards

Dear Mamuka,

thank you! No, you do not discount expenses to the present value. Instead, you book them in accruals (instead of directly in profit or loss) and then, over time, you recognize them as expenses using the effective interest method.

Dear Silvia, just reading your article and must admit it’s really great. Just one doubt: shall that indeed go over time? If the factoring is with recourse and the debt is recognized- it’s pretty clear it shall go over the loan term. however, when the receivables are derecognized, I’m not so sure. IFRS9 Appx says about “computing gain or loss on the sale of the cash flows”, B3.2.17. What would be your view on that?

Great illustrations.

Hi Silvia,

Thanks for the great job.

In the illustration above, why was 96% used for the factoring with recourse when 90% when mentioned in the question?

Please shed more light on this. Thanks

Hi Kazeem, thanks!

As I mentioned in the article, the fees for factoring company are greater when there’s higher risk – that’s why I made difference in the percentages (90% without recourse = 10% fee, 96% with recourse = 4% fee). S.

Great effort Silvia. Highly informative.