How to Account for Debt Factoring or Selling of Receivables

When I was auditing the financial statements of one of our clients, I spotted a few strange things:

- There was a huge balance of cash on client’s bank account at the year-end.

And I mean HUGE.To illustrate: normally, the client had about CU 100 000 on the bank account with some variations, but at the year-end, the balance was ten times greater, about CU 1 mil. (CU means currency unit).

- Client’s receivables showed an extremely low balance. In comparison with the previous year, the balance dropped by 90%.

I was a freshman in that audit year and the first thing I did before I started to bother our senior auditor was to look at the client’s bank statements from January next year – that is AFTER the reporting date.

Guess what I discovered!

I was staring at that January bank statement with shock.

The balance of cash was back to about CU 100 000.

WOW!

Where did this CU 900 000 go?

Just to be on the safe side, I checked also the subledger of receivables.

Not such a big surprise there – the receivables were also back to their normal levels.

Hmmm, something smells here…

Instead of bothering the senior auditor, I went to bother client’s CFO.

The nice talkative lady explained that just before the year-end, they sold a significant amount of receivables… (a Hollywood smile).

My question: Did you buy them back in January?

The smile faded slightly: “Oooh, yes….”

Me, still puzzled: “Why did you do it?”

The remaining smile is replaced with an annoyed look: “Well, there’s nothing wrong with that… we needed to meet the bank’s covenants for our loan and show enough cash on our bank account…”

OK, I understood.

However in this particular case, the client did it wrong.

In other words, it did not help at all.

Why?

You’re just about to find out!

Why sell receivables?

Many companies regularly sell their receivables to someone else.

There are few reasons for that:

- They need cash and don’t want to (or cannot) wait until their own clients pay invoices.

- They don’t want to deal with the credit risk of their clients.

- They don’t want to employ people who try to call clients, remind them about due dates and missing payments – in other words, they don’t want to bother with collecting of receivables.

- They are trying to “window-dress” their financial statements, just as my client did – but in reality, it does not happen very often.

What is a debt factoring?

In a modern business world, factoring of receivables, or selling receivables with discount is a normal practice of cash management.

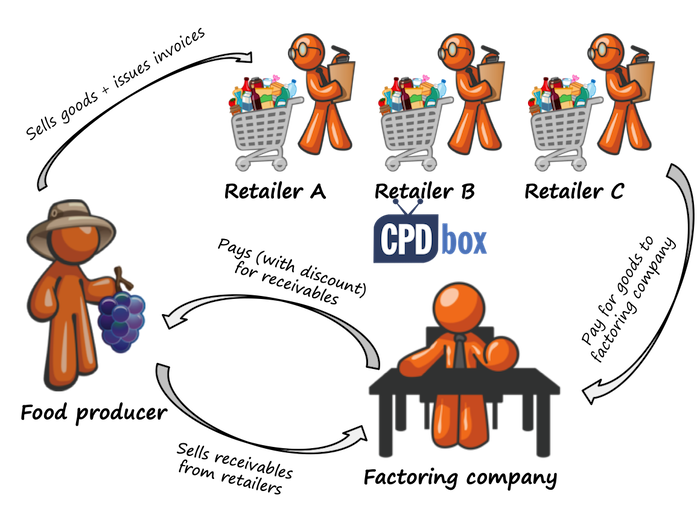

Here’s how it works:

- You (food producer in the scheme) sell your products to the customers and issue invoices.

- As the invoices are due in 90 days (if you deal with big retail chains, then the credit terms are even longer), you cannot afford to wait for the cash and sell the receivables to a factor (factoring company).

The receivables are sold with discount that represents both:

- Your fee for having cash immediately (interest on the loan provided by the factor),

- The revenue of the factoring company.

- Your customers (retailers in the scheme) pay the invoices when they are due directly to the factoring company.

Now, the principal question is:

Should you remove the receivables from the financial statements?

Well, it depends.

In fact, you need to decide whether the conditions for derecognition of financial asset were met or not.

If you remember, IFRS 9 Financial Instruments is very sticky in derecognition and it’s much easier to recognize an asset than to derecognize it.

For this reason, IFRS 9 contains a big decision tree helping you to determine whether you should derecognize your asset or not.

When you sell receivables, you need to assess whether you transfer significant risks and rewards of ownership or not in the first instance.

Then, if you don’t, you need to assess whether you retain some control or you have some continuing involvement in the receivables.

There are many types of factoring arrangements with various conditions. The three main types are:

- Factoring without recourse – in this case, the factor buys all the receivables from you with no right of return to you (if your customers do not pay, then it’s factor’s care).

- Factoring with recourse – in this case, the factor has the right to return uncollectible receivables to you.

- Factoring with limited recourse (guarantee) – in this case, you guarantee the losses up to certain amount and the factor can return the receivables only up to the guarantee.

Let me show you how to account for the first two types.

Example: Factoring without recourse

Question:

Tradex is a trading company. Due to urgent cash shortage, it decides to transfer trade receivables to the factoring company for 90% of their nominal amount. Total transferred receivables amount to CU 300 000. The factor has no right of returning the receivables back to Tradex.

Solution

Tradex transfers all the risks and rewards resulting from the receivables to the factoring company.

As a result, Tradex derecognizes the receivables fully, because the derecognition criteria in IFRS 9 are met.

Journal entries are:

-

Debit Bank account (CU 300 000*90%): CU 270 000

-

Profit or loss – finance expenses (see note below): CU 30 000

-

Credit Receivables: CU 300 000

Note: Most of these finance expenses represent the interest, because factoring is a form of a loan from the factor. Therefore, if material, you should accrue the interest expenses and recognize them over the period of financing (not one-time as shown here).

In this case, when the clients do not pay to the factor and go bankrupt, it’s the factor’s care and not Tradex’s care. That’s the biggest advantage of non-recourse factoring.

On the other hand, the discount (the fees) are higher than when factoring is with recourse.

Example: factoring with recourse

Question:

The same situation as above. This time, Tadex transfers the receivables for 96% of their nominal amount. Total transferred receivables amount to CU 300 000. The factor has the full right of returning the receivables back to Tradex if they become uncollectible.

Solution

Tradex retains some risks resulting from the receivables to the factoring company. The clients’ credit risk was not transferred because the factor has the right of return.

As a result, Tradex keeps the receivables in the balance sheet, because the derecognition criteria in IFRS 9 are not met.

The amount received from factoring company is recognized as a liability.

Journal entries are:

-

Debit Bank account (CU 300 000*96%): CU 288 000

-

Debit Profit or loss – finance expenses (see note below): CU 12 000

-

Credit Refund liability: CU 300 000

Note: Most of these finance expenses represent the interest, because factoring is a form of a loan from the factor. Therefore, if material, you should accrue the interest expenses and recognize them over the period of financing (not one-time as shown here).

The subsequent journal entries are:

- When the customer goes bankrupt and the factor applies the recourse right:

-

Debit Refund liability: CU 10 000 (the amount of uncollectible receivable)

-

Credit Bank account: CU 10 000

-

- When the customers pay to the factor (based on some payment report from factor):

-

Debit Refund liability: CU 50 000 (the amount actually collected by the factor)

-

Credit Receivables: CU 50 000

-

Factoring with guarantee

The most common type of factoring transaction is something in between these two “black or white” cases described above.

Factors often require a guarantee up to certain amount.

As a result, the factor does not have the right to the full return up to nominal amount of receivables, but only up to a guarantee.

Here, there is a continuing involvement in the receivables, so you cannot derecognize them fully.

In the IFRS Kit, there’s an example of this type of factoring solved in Excel file and clearly explained in the video, so please, check it out if interested!

Finally…

Let’s come back to my client from the beginning of this article.

I handed the case to our senior auditor (so finally yes, I bothered him), but this appeared to be the major audit finding.

The senior auditor revised the contract for sale of receivables and it clearly stated that our client has an obligation to buy these receivables back in January next year.

As a result, not all the risks and rewards were transferred and the client needed to put the receivables back to its balance sheet and recognize a refund liability.

Of course, the client did not agree and we issued an audit report with qualification. But that’s another story.

Did this article help?

Do you have come comments or questions?

Please, leave a comment below! Thanks!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thanks for sharing this nice article to understand debt factoring in details.

Hi Sylvia,

Please when the factor release the money to the factoring company,

I guess the factor will DR loans receivable, CR Cash/bank right?

Does it present it the commissions and fees as finance income in its books

Excellent Article with new findings, which is the overall objective of Audit in today’s complicated business environment, thanks for sharing the deep-down knowledge,

I found the article very informative and helpful.. Thank you.

nice article

Excellent and easily understandable….Keep up the good work…… Thank you.

Hi Silvia,

Using above example can you explain what accounting from factors side would look like ?

Hi Silvia,

I just wanted to find out whether IFRS 9 would require the disclosure of debt factoring?

Thanks!

Hi Sylvia,

I have a question regarding the transactions from opposite sides. I am currently looking at a debt factoring company, and I was wondering whether you have any detail or material on how to perform ECL on this debt, considering it’s purchased based on debtors who have already defaulted.

Thanks

Very intersting Silvia…..even if i have not dealt with this practically, the information has really put me on a higher notch…….Thanks!

Thank you Silvia for wonderful Article. Appreciate your demonstration with examples.

Thanks for your sharing knowledge.

It’s excellent and useful for everyone.

Under Example: factoring with recourse, you are mentioning

“Tradex retains some risks resulting from the receivables to the factoring company.”

I think Tradex retains the FULL risks

Hi Silvia, nice article. It would be helpful if you could address 1 small query regarding the discount fees. You mentioned in your article above the following: “Note: Most of these finance expenses represent the interest, because factoring is a form of a loan from the factor. Therefore, if material, you should accrue the interest expenses and recognize them over the period of financing (not one-time as shown here).” My query is – if the same of receivables are without any recourse to the Company – this means that it is akin to a sale of any other assets – like fixed assets – and therefore, the fees that the Company pays to the Discounters should be recognised immediately on the sale – and not over the period of time. The risks and rewards have already passed to the Discounter on sale and you have received 90% of the money. The fees should be recognised at this point. What is your opinion on this matter?

Great Article. Thanks for the refresher.