How to Implement IFRS 9

The new IFRS 9 Financial Instruments will replace the older standard IAS 39 in January 2018 and it practically means that if you are affected, you need to start getting ready NOW.

Why?

Because your comparative period starts in January 2017 and you will need to restate the numbers for 2017 in line with the new standard.

New IFRS 9 will be effective in many jurisdictions, including the European Union and UK, Australia, Canada, Singapore and Hong Kong, etc. China also launched a working draft in August 2016 that is consistent with the IFRS 9. Even the US capital market also accepts the IFRS reporting of those foreign companies.

The IFRS 9 will enormously affect the financial institutions, but not only them. And, it takes a LOT of hard work!

According to the Deloitte’s survey, the implementation project will probably take 3 years in some institutions. That’s a LOT!

In this article, you will learn about:

- The biggest weaknesses in the older standard IAS 39 Financial Instruments: Recognition and Measurement,

- The main changes introduced by IFRS 9 Financial Instruments,

- Key points for the successful implementation of IFRS 9 into your business.

This article was written by Mr. Wang Jun Spark and I just need to add that even if you don’t work in the financial institution (like a bank), you should still keep your eyes open.

The reason is that many IFRS 9 rules affect also trading companies, leasing companies and many other businesses.

Weaknesses of the IAS 39

During and after the 2008 global financial crisis, IAS 39 was fiercely criticised for its drawbacks in its inherent logic. The main critical arguments are:

- Inconsistent classification

It seems the classification logic of the IAS 39 is less consistent, which is difficult to understand and implement.For instance, the Loans & Receivables’ category is defined by the legal form, while available for sale (AFS) is classified by the holder’s intention and ability, and finally the held to maturity (HTM) is defined by all above factors.

Furthermore, there are two subtypes of the AFS: debt instruments and equity instruments.

- Insufficient and delayed provision

Under the incurred loss model as prescribed by IAS 39, the accrual of the credit losses was “too little and too late”.

It means that insufficient provisions cannot timely reflect the accelerated deterioration during the 2008 global financial crisis.

In addition, there are different credit loss benchmarks for AFS and Loans & Receivables, where the fair value is for the former and the expected future cash recovery for the latter.

- Hedge accounting

Sometimes, it is difficult to comply with current hedge accounting principles (under IAS 39) due to their rigid requirements.For example, the hedge effectiveness ratio must be within the range 80%-125% that is very hard to control and verify.

In addition, if the reporting entity cannot meet those restrictions, they shall prepare another set of disclosures to reflect the hedging results, rather than incorporating the risk management activities in the financial statements.

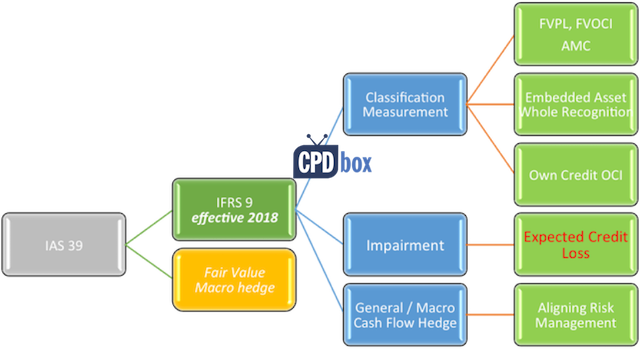

- Classification and measurement

As the first part of the three phases of the IFRS 9, Classification and Measurement is designed with more consistent logic.

The financial assets will be categorized into three groups, namely the FVPL (Fair Value through Profit and Loss), FVOCI (Fair Value through Other Comprehensive Income) and AMC (Amortized Cost), which are determined by the types of the contractual cash flow, business model, and the status of the fair value designation.

In most cases, the embedded financial asset will be recognized together with the host contract without separation under the IFRS 9.

Thirdly, the fair value fluctuations of the financial liabilities under the FVPL caused by the changes in the issuer’s own credit risk will be booked against the OCI (Other Comprehensive Income), instead of profits of the beginning period.

- Expected credit loss model

Though the classification and measurement is the very important foundation, the most significant change is in the second part, impairment, where the ECL (Expected Credit Loss) model with a forward looking approach to replace the incurred loss approach that heavily rely on historical information.

The ECL model is more consistent with the economic value of a financial asset and more proactive in the economic downturn.

However, the three-stage credit loss recognition that requires advanced modelling skills and high data quality poses a new big challenge to most banks in accrual and disclosure.

Subsequently, the expected loss will probably cause significant reductions and fluctuations in the profits afterwards.

- Hedge Accounting

As the third part, hedge accounting is more closely linked to the risk management activities in more flexible ways.

The changes are in the definition and requirement to establish the hedging relationship, scope of the hedging instruments and the hedged exposures.

The hedge accounting cannot create any real economic value by itself, so its purpose is to offset the fluctuations in the net profits or other comprehensive income by booking the opposite changes in the hedging instrument and the hedged exposures to the same period.

The new hedge accounting has a closer relationship with the economic hedging activities by setting a wider scope for the applicable tool and exposure, and removing the 80%-125% requirement in the hedge effectiveness ratio.

Under the IFRS 9, the economic relationship between the tool (hedging instrument) and the exposure (hedged item) becomes the most significant criteria to apply the hedge accounting.

In addition, some costs of the hedging instrument directly related to the hedging periods can be amortized evenly, instead of charging the net profit at the very beginning.

Hedge accounting of IFRS 9 is applicable in many cases except for the macro hedge regarding the net interest rate exposures, which is now under IAS 39 and would be another separate standard under IASB discussion.

- IAS 32 Financial Instruments: Presentation for definitions of the financial assets and liabilities,

- IFRS 13 Fair Value Measurement about the fair value, and

- IFRS 7 Financial Instruments: Disclosures governing the disclosures.

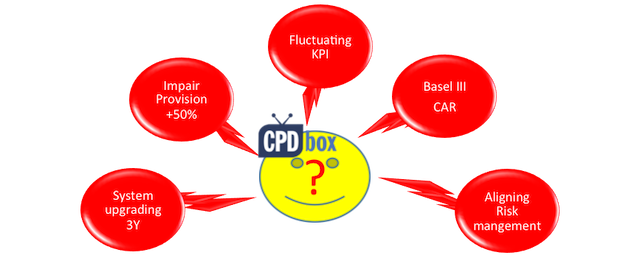

- Upgrading the business and accounting system,

- Establishing the expected credit loss model,

- Managing the fluctuations of the profits and KPIs (key performance indicators),

- Reconciling the financial reporting and the Basel III regime, and

- Aligning hedge accounting with risk management activities.

Main changes introduced by IFRS 9 Financial Instruments

The main changes introduced by IFRS 9 Financial Instruments are illustrated in the following chart:

As shown in the above picture, starting from the leftmost IAS 39, the upper box of second column is for IFRS 9 (2014) and the lower one for macro hedge that is currently still in discussion. The third column and the forth columns are more detailed layers of the changes.

The summary of the changes is as follows:

Related standards and applicable scope

Besides the IFRS 9, there are also some other IAS or IFRS arranging the definition, measurement and reporting of the financial instruments and the hedge accounting, such as:

Surprisingly, the above-mentioned fair value macro hedge of the IAS 39 is still effective until a new release of this topic finalized by the IASB.

It would be more accurate to speak about the applicable scope of the IFRS 9 part by part.

For example, the classification and measurement of the finance lease is out of the IFRS 9 because it is governed by IAS 17 Leases (IFRS 16 Leases).

However, the impairment of the finance lease receivables falls under the IFRS 9 expected credit loss model.

In addition, the hedge accounting is probably with the widest scope because it is applicable to non-financial assets or liabilities as a hedged exposure.

Overall, most significant changes in the accounting of the financial instrument are in the asset measurement and credit assets impairment.

How to implement IFRS 9 – key points

IFRS 9 is about the financial accounting, risk control, regulatory reporting and capital management, which means further impact on the corporate governance and management of credit and market risks.

Therefore, a flexible combination of the accounting scheme and risk management system must be the solid foundation of implementation.

According to Deloitte survey, the IFRS 9 takes about three years to implement and more than 50% additional loss provision.

Furthermore, the ECL model will probably lead to big fluctuations in the net profits and KPI between each period. The British Bankers Association also said that the IFRS 9 implementation is a difficult process comparable to the first time adoption of the IFRS and only second to the Basel II.

The following picture indicates that the main implementation challenges are:

To get through these challenges successfully, the correct understanding in the new standard is a MUST.

The starting point of the successful implementation is to clarify relationships between the conceptual framework and quantify requirements by figuring out the logical or timing sequences, cause and effect for the three phases.

It would be much better if there were a parallel run period for both IAS 39 and IFRS 9 to find out and investigate the variances caused by the new rule. Meanwhile, preparing for the impact on the KPI and regulatory ratios also needs some time.

Reorganizing the accounting workflow

Certain new professional judgements required by the IFRS 9, such as the contractual cash flow, business model, and significant increase in the credit risk, are beyond the traditional accountants’ scope and capability. Thus, existing system and work flow needs modification with the help from other departments.

A concise approach with elaborated parameters and precise control points to determine the classification of financial instruments is the most important foundation of the first part.

Furthermore, the second part has much more significant impact on the net profit and KPI because of the ECL model that is based on future events for the loan, debt securities, and interbank lending.

The possible huge fluctuations in the net profits, KPI and stock prices of the reporting entity will lead to subsequent negative comments and enormous pressures on the management team.

Therefore, the establishment of the ECL model with tuning parameters to achieve widely acceptable and well-managed impairment provision results is the key of the second phase.

In addition, the unexpected variances caused by the new standard should be investigated to find out better explanations to the key stakeholders and get prepared for the future.

Since the third part of IFRS 9, hedge accounting is not compulsory and the fair value macro hedge is still under discussion, postponing this part is not a bad option.

Aligning with Basel III and risk management

Despite of the continuous communications between the IASB and the BCBS (Basel Committee on Banking Supervision), there are still gaps between these two systems, especially in the impairment loss.

Therefore, there would probably be differences between the accounting and capital management needs reconciliation.

Reporting entity also needs enhance the procedures to track, identify, and measure the credit risk and market risk as a sound foundation of the ECL and hedge accounting.

About the author

His expertise also includes Basel III reporting, Capital Adequacy Ratio, Liquidity and Funding Risk.

Spark is a CICPA (China Institute of Certified Public Accountants), FCCA (fellow of the Chartered Association of Certified Accountants), CMA (Certified Management Accountant), and a panel of the Expert committee of ESNAI (Electronic Shanghai National Accounting Institute).

Now, if you feel this article could help your colleague or friend, please share it.

And, we would love to read about your own IFRS 9 implementation challenges, whether you work in a bank, some other financial institution or in the non-financial institution with IFRS 9 impact. Please leave us a comment below this article. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

28 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thank you Silvia for the detailed article on the topic.

May i request you to please respond on this query.

Whether subsequent reclassification of financial asset – investment in equity is allowed from FVPL model to FVOCI model?

As per para 4.1.4 of IFRS 9, an entity may make an irrevocable election at initial recognition for particular investments in equity instruments that would otherwise be measured at fair value through profit or loss to present subsequent changes in fair value in other comprehensive income.

The term irrevocable election is used with equity investment at FVOCI category and not with FVPL category, therefore one can interpret that once financial asset – equity investment in classified at FVOCI model, it can not be reclassified subsequently. But if financial asset – equity investment is initially classified at FVPL model, it can be reclassified subsequently to FVOCI model.

However, from 4.1.4 of IFRS 9, it also seems that option to designate equity investment to FVOCI model is available on initial recognition, and not subsequently. Therefore, once equity investment is initially classified at FVPL model, it will also be not reclassified to FVOCI model subsequently.

I would be extremely thankful for your kind response. Thank you.

Hi Murtaza, in line with IFRS 9.4.1.5 – once you designate your financial asset at FVTPL, this is an irrevocable choice. Please note that the word “irrevocable” is included within both paragraphs 4.1.4 and 4.1.5.

Hi Silvia and Spark,

What are the accounting implications from the change of IAS 39 to IFRS 9 for concessionary loans and grants provided by Government bodies to its businesses?

Kind Regards

jeff

Kindly guide me what if company has given loan to another group company at market interest rate but period of repayment of loan and interest amount is not defined. Since its fails SPPI test, should be taken at FVTPL and if so how to calculate its Fair Value.

Regards

Hi Silvia and Spark. Thank you for the explanations. I am still of the opinion that the IFRS authority that brings out these standards should endeavour to adopt day to day languages and illustration that greatly simplified understanding and adoption. I am still trying to understand your article on IFRS 9!

Keep up the good work.

Poju, Lagos Nigeria

Hello Spark, Well written article

Please could you provide an excel based IFRS 9 that can be used in the implementation of IFRS 9 for a bank?

Hi, I want to understand to logic behind the following:

The fair value fluctuations of the financial liabilities under the FVPL caused by the changes in the issuer’s own credit risk will be booked against the OCI (Other Comprehensive Income), instead of profits of the beginning period.

Why we are required to take change to OCI rather than PL.

Looking forward for your reply.

Thanks.

Dear Mr. Spark Wang,I would like to know the accounting entries after implementation of IFRS 9 following changes in the 3 categories: Amortized cost,FVTPL & FVTOCI

1 From Amortized cost to FVTOCI

2 From FVTOCI to Amortized cost

3 From Amortized cost to FVTPL

4 From FVTPL to Amortized cost

5 From FVTPL to FVTOCI

6 From FVTOCI to FVTPL

I am confused as to the transition entries. Does it mean the transition entries are the same as those under reclassification under IFRS 9 post implementation

Thanks for kind consideration Mr. S Wang

hi, Wee,

I think the costs of higher provision and the implementation will be a higher burden of the traiditonal loan market. there will maybe some innovation to reduce the costs and client relationship

Hi Spark and Silvia.

Do you think that IFRS 9 may make loans more expensive for borrowers? Non financial companies might subject to IFRS 9? Implementation of IFRS9 will influence borrower make less loan? Is there any needs of improvement with the relationship between borrowers and financial companies?

It would very much appreciate your view.

Wee Lie

Hi Spark and Silvia, I have a question on classification and measurement under IFRS 9 and would very much appreciate your view.

A company decides to elect the fair value option for its investment portfolio as it is trying to align and match the financial assets to its financial liabilities and thereby reduce P&L volatility. (For simplicity, the company has fixed income securities in its portfolio and manages on hold to collect and sale business model.) So on election of FVO, its the changes in FV will go through Profit or Loss. My question is, would the company still need to perform the SPPI test and business model assessment given the fact it knows that it will elect the FVO and the end result is it will be measured at FVTPL (so doing the SPPI test will be a futile exercise).

Do you have any thoughts on this?

Thank you in anticipation

Alex

Dear Alex,

no, if you opt for FVTPL, then you don’t need to perform any test. It’s a voluntary choice available for any financial asset. S.

Using IFRS 9, can a company elect to use both classifications and measurements? Or have a dual business model if it intends to hold to maturity and sell its financial assets? Also, If it chooses one business model, does the whole financial asset portfolio need to be adjusted?

Richmond, my pleasure to provide something useful . Many thanks to Silvia to establish this platform and opportunity.

I thank you, Spark, for your well-written article and for all your responses to our readers. Thumbs up!

Thanks for sharing this article Sylvia and thanks to you too Mr. Spark. It is insightful!

hi Idris,

This article is about the IFRS 9. There are two possbile scenarios to revalue the financial instruments in a currecny other than the reporting currency. One is normally the month end to convert the original currency into the reporting currency. The other scenario is related to the impairment provision. there are three sub-scenarios, the first is the initial recognition; the second is to recognize when there is “significant increase in credit risk”; and the third is identified when there is impairment evidence.

Hope this clarifies.

Spark

Thank you, Spark.

For the month end conversion, system automatically converts but it will be at the value initially recognized. It is only at the time of matching payment against the bills that one sees the revalued amount.

The second scenario, it is the three sub-scenarios that will be considered together or either of them?

Please clarify.

Idris, I guess your current question is about the impairment provision of the financial assets. For certain financial assets subject to the impairment accouting, it should be within only one category at any time. You can refer to my following articles for this topic.

Regards

How often do I revalue my trade receivables and payables denominated in currency other than reporting currency? The transactions are translated in reporting currency using the ruling exchange rate at the time of updating the records.

Kindly expatiate further on this.

Thank you

Hi tony, this is spark. The IAS 37 has different scope, excluding the financial assets. Additionally, the IAS 37 provision is about future expenditures to settle a possible unfavorable event, which is quite different from the objective of the IFRS 9

Silvia, further to my question/comment above i will opine that the ECL model will be very scientific and futuristic expectation of financial assets performance. given this the results of the ECL will simply be provisioning which i will imagine should come under IAS 37. while an impairment approach is specific in time and adjusted on the asset directly a provision is not. why are these two concepts coming together in IFRS 9?

IFRS 9 – are you inferring that the version of this standard contained in the Red Book 2016 has been replaced or will be replaced?

IAS 39 – This is still in the 2016 Red Book. At what point will it become obsolete?

Financial assets classification – the write up has identified three classes, FVTPOL; FVTOCI and AMC. What are the criteria for the classification into each of these. Also what conditions must be satisfied before reclassification from OCI to POL?

The most part of the IAS 39 will be replaced by the IFRS 9 since 2018 Jan, except for the macro hedge part that will be efffective until the dynamic hedge IFRS is officially released.

Classification is up to the contractual cash flow, and the business model. You can find a straightforward way in subsequent articles later, together with the OCI to PL

For the effetive date and obsolete date, you can refer to the introduction at the beginning and 7.1 effective date of Ifrs 9

Very useful, thank you. We are trading company, so how we can find out how much provision to receivables we can book?

In principle, the provision should be based on the historical and available expected information. There is no specific method specified by the ifrs 9. You can choose the best approach based on above guidelines. One method for you is the aging matrix or historical losss ratio method. There will be further articles about the ECL model. Please wait

Hi

Very useful but I am looking for information on FTA impact of Ifrs 9

For example if an AFS under ias 39 is acccounted for at AMC under IFRS9 what is my AMC as an opening , the one it would have been if it has always been at AMC or or the FV under ias 39 become my opening AMC

Thanks in advance