IFRS 3 Business Combinations

When should you apply IFRS 3 and when IFRS 10?

What is the difference between IFRS 3 Business Combinations and IFRS 10 Consolidated Financial Statements?

Today, I’d like to continue our “consolidation” series and after the introductory lesson and the summary of IFRS 10, let’s dive in the IFRS 3 Business Combinations.

What is the objective of IFRS 3?

The objective of IFRS 3 Business Combinations is to improve the relevance, reliability and comparability of the information that a reporting entity provides in its financial statements about a business combination and its effects.

More specifically, IFRS 3 establishes principles and requirements for how the acquirer:

- Recognizes and measures the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree;

- Recognizes and measures the goodwill acquired in the business combination, or a gain from a bargain purchase;

- Determines what information to disclose about the business combination.

What is the difference between IFRS 3 and IFRS 10?

Although it may seem that the IFRS 10 Consolidated Financial Statements and IFRS 3 Business Combinations deal with the same thing, that’s not the whole truth.

Both standards deal with business combinations and their financial statements.

But while IFRS 10 defines a control and prescribes specific consolidation procedures, IFRS 3 is more about the measurement of the items in the consolidated financial statements, such as goodwill, non-controlling interest, etc.

If you need to deal with the consolidation, then you need to apply both standards, not just one or the other.

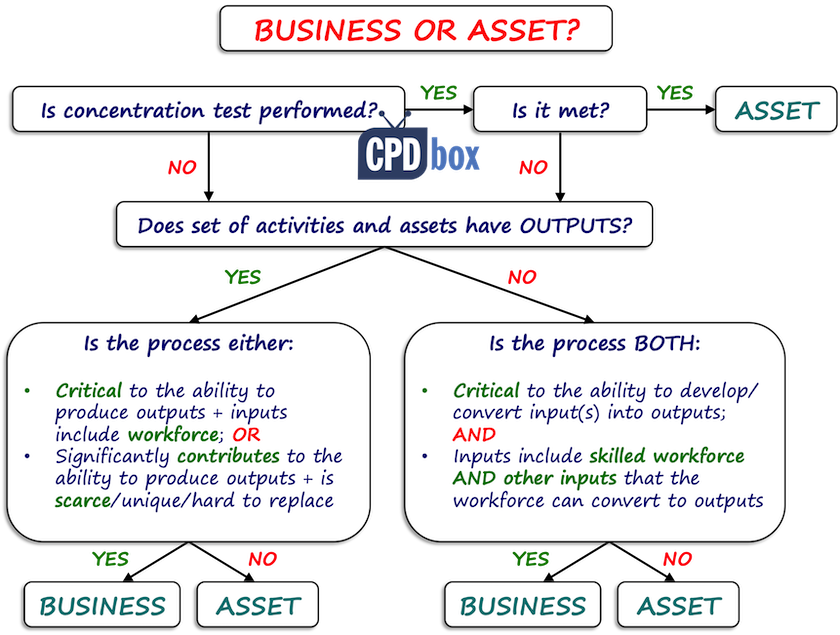

Is it a business combination or not?

Any investor who acquires some investment needs to determine whether this transaction or event is a business combination or not.

IFRS 3 requires that assets and liabilities acquired need to constitute a business, otherwise it’s not a business combination and an investor needs to account for the transaction in line with other IFRS.

A business consists of 3 elements:

- Input = any economic resource that creates or can create outputs when one or more processes are applied to it, e.g. non-current assets, etc.;

- Process = any system, standard, protocol, convention or rule that when applied to an input(s), creates outputs, e.g. management processes, workforce, etc.

- Output = the result of inputs and processes applied to those inputs that provide or can provide a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners.

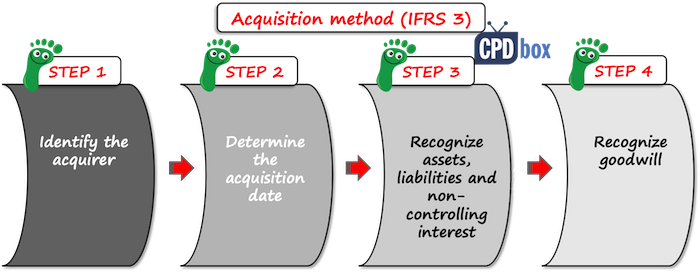

Apply the acquisition method

Once the investor acquires a subsidiary, it has to account for each business combination by applying the acquisition method.

Now you may ask: what is the difference between the acquisition method and consolidation procedures?

I would say that the acquisition method is simply a part of all consolidation procedures you need to perform.

So when you prepare your consolidated financial statements, you must start with the correct application of the acquisition method, and then continue with the eliminating the mutual intra-group transactions, etc.

The acquisition method involves 4 steps:

- Identifying the acquirer,

- Determining the acquisition date,

- Recognizing and measuring the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree;

- Recognizing and measuring goodwill or a gain from a bargain purchase.

Let’s break it down.

Step 1: Identify the acquirer

Most of the time, it’s straightforward – the acquirer is usually the investor who acquires an investment or a subsidiary.

Sometimes, it is not so clear. The most common example is a merger. When two companies merge together and create just 1 company, the acquirer is usually the bigger one – with larger fair value.

However, IFRS 3 provides the application guidance in its appendix, so you might need to check out.

Step 2: Determine the acquisition date

The acquisition date is the date on which the acquirer obtains control of the acquiree.

It is generally the date on which the acquirer legally transfers the consideration (=the payment for the investment), acquires the assets and assumes the liabilities of the acquiree – the closing date.

However, it can be earlier or later than the closing date, too. It depends on the contractual arrangements in the written agreement, if something like that exists.

Step 3: Recognize and measure the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree

3.1 Acquired assets and liabilities

An acquirer or investor shall recognize all identifiable assets acquired, liabilities assumed and non-controlling interests in the acquiree separately from goodwill.

So please be careful, because sometimes, there’s some unrecognized asset in an acquiree, and an investor needs to recognize this asset if it meets the criteria for the recognition.

For example, a subsidiary can have some unrecognized internally generated intangible assets meeting separability criterion. In such a case, an acquirer needs to recognize these assets, too.

All assets and liabilities are measured at acquisition-date fair value.

Often, investors need to perform “fair value adjustments” at acquisition date, because assets and liabilities are often valued in a different way – either at cost less accumulated depreciation, at amortized cost, etc.

However, there are some exceptions from fair value measurement rule:

- Contingent liabilities (IAS 37);

- Income taxes (IAS 12);

- Employee benefits (IAS 19);

- Indemnification assets;

- Reacquired rights;

- Share-based payment transactions (IFRS 2);

- Assets held for sale (IFRS 5).

3.2 Non-controlling interest

Non-controlling interest is the equity in a subsidiary not attributable, directly or indirectly, to a parent.

For example, when an investor acquires 100% share in a company, then there’s no non-controlling interest, because the investor owns subsidiary’s equity in full.

However, when an investor acquires less than 100%, let’s say 80%, then there’s non-controlling interest of 20%, as the 20% of subsidiary’s net assets belong to someone else.

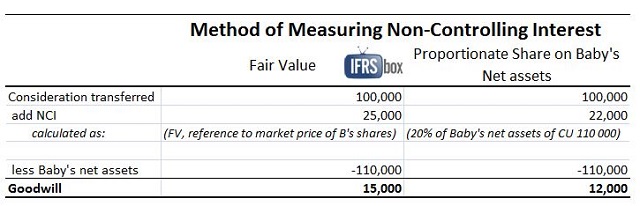

IFRS 3 permits 2 methods of measuring non-controlling interest:

- Fair value, or

- The proportionate share in the recognized acquiree’s net assets.

Selection of method for measuring non-controlling interest directly impacts the amount of goodwill recognized, as you can see in the illustrative example below Step 4.

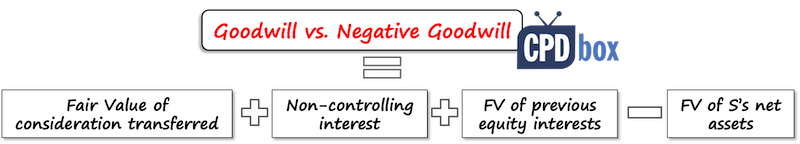

Step 4: Recognize and measure goodwill or a gain from a bargain purchase.

Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized.

It is calculated as a difference between:

- The aggregate of:

- The fair value of the consideration transferred;

- The amount of any non-controlling interest;

- In a business combination achieved in stages: the acquisition-date fair value of the acquirer’s previously-held equity interest in the acquiree;

and

- The acquisition-date amounts of net assets in an acquiree.

The goodwill can be both positive and negative:

- If the goodwill is positive, then you shall recognize it as an intangible asset and perform annual impairment test;

- If the goodwill is negative, then it is a gain on a bargain purchase. You should:

- Review the procedures for recognizing assets and liabilities, non-controlling interest, previously held interest and consideration transferred (i.e. check whether they are error-free);

- Recognize a gain on bargain purchase in profit or loss.

Consideration transferred is measured at fair value, including any contingent consideration. Subsequent change in a consideration transferred is accounted for depending on the initial recognition of the contingent consideration.

Example: Goodwill and non-controlling interest under IFRS 3

Mommy Corp. acquires 80% share in Baby Ltd. for the cash payment of CU 100 000.

On the acquisition date, the aggregate value of Baby’s identifiable assets and liabilities in line with IFRS 3 is CU 110 000.

The fair value of non-controlling interest (the remaining 20% share) is CU 25 000. This amount was determined with the reference of market price of Baby’s ordinary shares before the acquisition date.

I have calculated goodwill and non-controlling interest using both methods mentioned in Step 3 and the results are in the following table. Please note the differences:

Additional guidance to specific transactions

Besides the above rules on application of the acquisition method, IFRS 3 provides guidance about the following transactions:

- A business combination achieved in stages:

The acquirer shall re-measure its previously held equity interest in the acquiree at its acquisition-date fair value and recognize the resulting gain or loss, if any, in profit or loss or other comprehensive income, as appropriate. - Acquisition costs:

Costs of issuing debt or equity instruments are accounted for under IAS 32 Financial Instruments: Presentation and IAS 39 Financial Instruments: Recognition and Measurement/IFRS 9 Financial Instruments. All other costs associated with an acquisition must be expensed. - Pre-existing relationships

If the acquirer and acquiree were parties to a pre-existing relationship, this must must be accounted for separately from the business combination. - Reacquired rights

A reacquired right recognized as an intangible asset shall be amortized over the remaining contractual period of the contract in which the right was granted. An acquirer that subsequently sells a reacquired right to a third party shall include the carrying amount of the intangible asset in determining the gain or loss on the sale. - Contingent liabilities:

Yes, acquirer recognizes a contingent liability in a business combination, contrary to IAS 37, even when the outflow of economic benefits to settle it is remote.After initial recognition and until the liability is settled, cancelled or expires, the acquirer shall measure a contingent liability recognized in a business combination at the higher of the amount determined in accordance with IAS 37, and the amount initially recognized less cumulative amortization in line with IAS 18 Revenue. - Indemnification assets

Indemnification assets recognized at the acquisition are subsequently measured on the same basis of the indemnified liability or asset, subject to contractual impacts and collectibility. Indemnification assets are only derecognized when collected, sold or when rights to it are lost.

Standard IFRS 3 prescribes a number of disclosures, too.

Here’s the list of articles published on IFRSbox related to the consolidation and group accounts:

- Intro to consolidation and group accounts – which method for your investment?

- Example: How to consolidate

- Example: Consolidation with foreign currencies

- How to make consolidated statement of cash flows with foreign currencies

- How to test goodwill for impairment

- How the groups change

- Accounting for deemed disposal of an associate

- Podcast 002: How to treat different useful lives of PPE used by the parent and subsidiary?

Please watch the video with IFRS 3 summary here:

If you like this summary, please let me know by leaving a comment right below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

I’m your fan Silvia.

I would like to clarify some points.

Some people say “acquisition of an associate is a business combination under IFRS3”. I’m not sure we can say that. “If we can prove that the entity has only significant influence over another entity (e.g. 25%), the acquisition’s transaction is a business combination”. This makes me confused. I understand that this is not business combination when we use the defination of “control” in respect of IFRS10. But the initial measurement of investment in associate is initially recognized at cost, goodwill may be arised using acquisition method as described in IFRS3 but included in cost of investment.

Could you please advise.

Dear Silvia, thanks for good article. Kindly advise how to reflect business combination when parent connects with subsidiary (100%) and subsidiary has inventory bought from parent? Thanks

Dear Silvia

Could you plase advise if consideration was paid in foreign currency before the closing date how should we calculate goodwill?

Thank you

How do i record transaction where I have acquired a partially owned sub. For example we had 51% control of a sub and now we have 100% control. Do i need to record the goodwill again in the financials? and do i have to do the PPA again? I am confused because i thought PPA only has to be done when you have control which was when we acquired 51% of the sub?

Hi A,

what is PPA, please?

Maybe this article would help a bit more. S.

Hi Silvia,

Could youn please elibrate further on the following standards, IFRS 3,9,10 on their recognition,measurement,classification and derecognition cafeterias?

Thanks

Hi Sent, I think I have elaborated on these topics, either here within my articles (please browse them) or within my IFRS Kit. All the best, S.

Hello Silvia, Just to clarify the following statement “If the acquirer and acquiree were parties to a pre-existing relationship, this must must be accounted for separately from the business combination”. Are you suggesting that any related AP/AR balances between acquirer and acquiree prior to acquistion is not part of the FV of assets and liabilties acquired?? Hence the consideration if in cash is adjusted for this?? Thanks

Hi Silvia,

The acquirer entered into an option agreement with the owner of a company and paid a refundable option fee in exchange for the exclusive option to acquire the company for a price during an option period subject to certain conditions and agreements and approval of regulatory bodies. If the acquisition does not push through, the seller shall return the option fee.

How do the acquirer record the refundable option fee? Can the acquirer treat the fee as a receivable?

Thanks much,

Claire

What happens if it is an asset acquisition, but the acquirer only purchase 75% of the assets & liabilities? Do you recognise NCI and why/why not? Or how would you account for the other 25%?

Hi Frank,

in this case, if an acquirer does NOT acquire business, just assets – IFRS 3 does not apply and you should be looking at IFRS 11 Joint Arrangements. S.

I have two entities with a common controlling shareholder (an individual) that merged. The surviving company did not pay anything to the non-surviving entity, but took control of the assets and assumed responsibility for the liabilities of the non-surviving entity. My reading I dictated that this does not fall under the scope of IFRS 3. I was tempted to account for the net assets as a gain in the surviving entities income statement, but it seems more appropriate to reflect the amount in equity as a contributed surplus. Is this the correct approach.

Well done Silivia,

Can you please help me with this:

‘A’ (a listed co.)with 100 million shares of $10 par value,and sells at $50, owns 80% of ‘B’ a consolidated subsidiary (unlisted)with 100 million shares of $10 par value. ‘A’ decided to acquire the remaining 20% NCI thru share offering at 1:2 (one share in ‘A’ for every two shares owned by NCI in ‘B’ – ‘B’ is FV’d at $25 a share).

What would be the journal entries in ‘A’ at acquisition date? and what would be the effect of the transaction in the consolidated Financials.

Thank you very much.

Hi AbuSarrah, this would require longer response than I can do in the comment, so maybe I’ll do some example later, but you can read this article for the changes in the group composition. S.

Hi Silvia,

Great Article. I need to know few clarification regarding business merger.

1. What would be the accounting treatment?

2. Whether we need to reverse the AFS Fair value and impairment gains and losses?

Thanks

Great article to have a grip over IFRS 3. Please tell how to account for bargain purchase, and tell condition which result in bargain purchase in business combinations?

Hi Silvia

Great article. A query on acquisition costs – is stamp duty still an allowable expense to be capitalized so long as it is not included in the Goodwill calculation?

Thank you

Kind regards

Davey

Hi Silvia,

What would be the acquisition date if acquisition is made in tranches?

Hey Silvia,

Under IFRS 3, Can preference shares be issued to the shareholders of the company (which is acquired) in case of common control transaction, when pooling of interest method is applied instead of purchase method of accounting?

Thank you!!

Thanks Silva,

I am on an engagement now and I have this issue. I don’t know if it comes under the purview of business Combination IFRS 3 or IFRS 10. Here it is- The parent company set up a one or two subsidiaries and it has not been consolidating up until now. Does IFRS apply here because the parent isn’t taken over an existing business or asset.Secondly, would there be a need for calculation of Goodwill and how?

Hi Sylvia,

Can you shed some light on the mechanics of Merger accounting( merger relief etc).

Holding company: Net Assets $1,000 and Investment in T $500 backed by a share capital of $900 and reserves of $600.

Target Company: NA $800 backed by Share capital of %500 and reserves of $300

Notes

• The balance sheets are at Merger date

• Holding Ltd fully owns Target ltd both shares are at $1 nominal values.

• Target will not exist after the merger.

• Target Ltd net assets are acquired at costs, except land to be revalued at $280 (costs $100).

• Holding Ltd is quoted with share market value of $2.

To prepare the Merged Balance sheet under following scenario:

1) Holding company will issue shares to T Ltd shareholders in the B/S FV parity ratio.

2) Holding company agreed to issue shares 600 shares

to T Ltd shareholders. (Is there a goodwill?)

Thank you

Rama

Thank you

Notes

• The balance sheets are at Merger date

• Holding Ltd fully owns Target ltd both shares are at $1 nominal values.

• Target will not exist after the merger.

• Target Ltd net assets are acquired at costs, except land to be revalued at $280 (costs $100).

• Holding Ltd is quoted with share market value of $2.

To prepare the Merged Balance sheet under following scenario:

1) Holding company will issue shares to T Ltd shareholders in the B/S FV parity ratio.

2) Holding company agreed to issue shares 600 shares to T Ltd shareholders. (Is there a goodwill?)

Thank you

Rama, this is for the separate article. I’ll try to put something up. S.

Hi Silvia

That would be great. Thank you

Regards

Rama

Hi Silvia M

Very good explanation of the difference IFRS 3 and IFRS 10, keep it up. Thanks

Hi Sylvia,

Thank you so much.

Can I get a pdf file of this summary ?

Thank you again.

Hi Silvia,

Thanks for nice article on IFRS 3. I need your help to understand whether IFRS 3 is applicable for Investment in Associate transaction.

Please also confirm whether PPA mythology/IFRS 3 will be applicable if there is a increase of holding percentage from 25% to 35% means the holding percentage increase and control also changed but nature of accounting remain same as equity method.

Dear Singh,

it all depends on whether by increasing the percentage from 25% to 35% meant the acquisition of control or not.

So, did the parent acquired control (and lost significant influence)? It’s possible even when the ownership is less than 50%. If yes, then you discontinue the equity method and start the full consolidation under IFRS 3/IFRS 10. In this case, you will have high non-controlling interest.

Or, did the parent keep significant influence, but is not able to exercise control? In this case, you continue with equity method. S.

Hi Silvia,

Thank you for the great effort, you are absolutely amazing.The video was very helpful.

I have 2 questions in regards to good will and business combination, I have gone through them many times with my friends, and sadly our answers were not the same. We would appreciate if you can help us answering them.

– The first question is, On May 2010, C Ltd paid $430,000 to acquire the entire share capital of $200,000 and retained earnings of $90,000. All of it is assets and liabilities were carried at fair value. On 30 April 2014, the retained earnings of C Ltd are $970,000 and $115,000 respectively. Good will arising on consolidation has suffered an impairment loss of 25% since 1 May 2012. Group retained earnings at 30 April 2014 are?

– The second question, on 1 July 2014, A ltd pays $870,000 to acquire the entire share capital of B ltd. The equity of B ltd on that date consists of ordinary shares capital $400,000 and retained earnings of $210,000. The fair value of the non-current assets of B Ltd on 1 July 2014 exceeds their carrying amount by $35,000. The amount paid for good will by A ltd is?

We would appreciate it very much if you can help us?

Thank you,

Tamer

Hi Tamer,

it really looks like the homework questions. OK, let me try:

1) Goodwill on acquisition = 430 000 – 200 000 – 90 000 = 140 000

Group retained earnings in 2014 = 970 000 + (115 000 – 90 000)*100% – 25%*140 000 = 960 000.

2) Goodwill on acquisition = 870 000 – 400 000 – 210 000 – 35 000 = 225 000.

And the next time, please do your homework yourself 🙂 S.

Hi Silvia,

Thank you very much for the answers. I promise you they are not the homework questions. In fact the story behind these 2 questions that,I was preparing for the Certifrs and was collecting questions from every where. These 2 questions were among many questions but I got stuck only with these 2 questions. Luckily the second question I answered my self and it was the same result. However the first one I got it wrong. You’re material were very helpful in simplifying the IFRSs and in fact helped me to get through the exam. Thank you Silvia, You are My role model when it comes to IFRSs.

Warm regards,

Tamer

Thank you, Tamer, for your kind words. It’s an honor for me to be the role model 🙂

Hi Silvia,

thank you for the article.

Company S is 100% subsidiary of Company M (share capital 1mil). Company M increases the share capital by capital contribution of non-cash assets worth 5mil in M books. Assets are valued by expert`s valuation at 6mil.

I assume that this is not IFRS 3, because it is between entities under common control and not even business combination, but capital contribution.

The bookings at contribution:

In Co S:

Debit – Assets 6mil

Credit – Share Capital 6mil

In Co M

Credit – Assets 5mil

Debit – Investment in S 5mil

>> then what happens in consolidation with 1mil diff. when eliminating investment against equity?

>> or should be the investment valued at 6mil, then how the remaining 1mil is booked?

thank you

Jan

Dear Jan,

in this situation, company M is effectively selling its non-cash assets at profit of 1 mil (refer to IAS 16 – exchanges of assets, for example). Also, as cost of investment is not precisely defined, we should refer to other standards for a guidance and in my opinion, that’s the fair value of consideration transferred (i.e. 6 mil.).Therefore the entry would be Debit Investment in S – 6 mil., Credit Assets – 5 mil., Credit P/L – 1 mil.

And then it’s IFRS 3. I don’t see why these 2 companies would be under common control, because S is clearly 100% subsidiary of M. S.

Dear Silvia,

thank you for your answer.

Your answer makes great sense.

Just 2 more clarifications:

1. in standalone statements of M, it is correct to present profit of 1mil from transfer (sale) of the assets to 100% owned subsidiary?

Basically what this would mean that for PPE assets valued at historical costs, I can create a 100% subsidiary, sell assets (based on valuation) and realize profit on this

Because M still owns the same assets (just through the subsidiary), however M realized profit just by revaluating them by experts valuation (but the assets are valued at historical cost model).

2. if both M and S are ultimately owned by the same shareholder (owner of M) this is not considered as common control?

Thank you very much for clarification

Jan

Hi Silvia

Thanks For the article.

Now I got to understand presentation you made in the excel.

I was confused before why the goodwill portion of the NON controlling interest recognised in the Consolidated balance sheet.

Goodwill can be recognised in full even where control is less than 100%. Before the revisions to IFRS 3, the IFRS stated that on acquisition, goodwill should only be recognised with respect to the part of the subsidiary undertaking that is attributable to the interest held by the parent. This is still an option in IFRS 3 but now goodwill can be recognised in full which now means that the non-controlling interest (previously known as ‘minority interest’) will be measured at fair value and be included within goodwill.

good summary !

Dear Silvia,

Could you please provide your advice on the following matter:

Following a merger, company A will absorb company B and company B will cease to exist. Reporting currency at both companies is EUR. There is one intra-group loan between A and B, which functional currency is GBP.

Prior the merger, A had loan receivables to B in GBP 150 shown as EUR 200 and vice versa B had loan payables to A in GBP 150 show as EUR 300 in accounting records.

Upon merger, how you would account for the difference of EUR 100 between the intra-group loans of A and B as the intra-group balances need to be eliminated in the merged accounts of company A.

Thank you.

Dear Vladimir,

this situation should not happen before you start consolidating. The reason is that both parent and subsidiary should apply the same or uniform accounting policies. Both receivables is parent’s statements and loan in subsidiary’s statements are monetary items and therefore, they both should have been translated using the same rates.

If that’s not the case and a subsidiary applied different accounting policies, then you should make adjustment in subsidiary’s accounts first and then consolidate. The same applies for mergers. Hope this helps. S.

Dear Silvia,

Many thanks for your prompt answer, I really appreciate it. I guess even if we assume that Co A and Co B are not Parent/Subsidiary but sister companies within same group, then still we would apply the rationale that one of the companies should correct its error before doing the merger.

Thank you again. Your materials are really great and very helpful.

Regards,

Vladimir

Yes, sure, the methodology is the same. You’re welcome 🙂 S.

Hi Mam Slyvia. I have a question for clarification regarding the accounting treatment of share issuance cost in business combination.

What if the share issuance cost cannot be fully absorbed by the share premium arising from additional issuance of share during acquisition date? can the excess be absorbed by the share premium identified to acquirer prior to combination (which is not related to the issuance of share on the date of acquisition) or should it be directly charged to retained earning? I believe this will impact the computation purposes of consolidated share premium and consolidated retained earnings. Thanks.

Dear Silivia M.

May you please guide on how accounting of merger of two entities under common Control is done ? Entity A had 50% shares in entity B before merger . They had a common parent Entity C. Now entity A has merged with entity B and Entity A has issued remaining shares to entity C? What would be the correct accounting treatment in books of Entity A?

Thank you

Dasrat

Thank You for explanation.

I have a question, what is the principle if there is a mother company, baby a where there is a goodwill and baby b where is a gain from a bargain purchase? How to present it in Consolidated financial statement? Is it both presented goodwill and a gain from a bargain purchase in the Consolidated financial statement, or net effect between goodwill and a gain from a bargain purchase?

Thank You.

Srđan Milanović

Dear Srdan,

in fact, when there’s a gain on a bargain purchase, it is not recognized in the balance sheet, but as a gain in profit or loss. So, you would present just goodwill from 1 subsidiary acquisition and gain (negative goodwill) on the other subsidiary in profit or loss. S.

Excellent Summary. Please keep it up

Hi Silvia,

What about subsidiary that is set-up by the holding company from beginning? Holding company was paying all the preliminary expenses for the subsidiary and transfer a start up capital as well.

Am I right in saying that the Financial Assets subsidiary is the start up capital transfer and the preliminary expenses just go straight to the income and expenditure?

Thanks a mil in advance.

Hi Aizah, yes, I can agree with that. S.

Thanks Silvia. In the subsidiary company separate financial can we capitalise the preliminary expenses?

Very good explanation of IFRS 3 and IFRS 10. Complex topics made easy

Hi Silvia;

My question is if I am acquiring only 100 % shares in a company and information given is only the shares, general reserve, asset revaluation surplus & retained earnings; how to account for the journal entries of the acquirer?

I have question under business combination under common control (BCUCC) I am the acquirer. I am aware BCUCC is out of scope of IFRS 3. The method of acquisition is 100% share purchase and subsequently transfer assets/ liabilities to acquirer book based on book value.The date of share transfer and book transfer is different (around 3months). On the consolidation standpoint, assume control exist on the date of share transfer by acquirer, does the consolidation need to be done at 2 different stage? ie. from the date control exist to the date book transfer?

Hi Silvia, Thanks for the above, I have one question:

Say if there is a negative goodwill for instance, 75K purchase consideration as per your example and if the carrying value of corresponding assets decreases later after acquisition , are we suppoused to bring the negative goodwill down?

Ravi,

you do NOT recognize negative goodwill. You put it straight to P/L (retained earnings) on acquisition. S.

Does incorporation of a company come under the purview of Business Combination under common control

Very nice summary of IFRS 3 and IFRS 10. It is easy to understand and remember.

Hi there, I have two acquisitions coming up in my group at the moment (1) acquisition of shares in a company and (2) acquisition of a portion of a trade and certain assets/liabilities. Is it correct that with the share purchase (100%) we take on the full balance sheet and all RE (but do consol adjustment to take out the pre-acq RE), but with the asset and related liability acquisition it is more straightforward as we just assume the FV into our own balance sheet? If you have any article links I can look at, please let me know. Thanks

Yes, Michelle, basically you’re right. Just don’t forget that when you make a share purchase, you take 100% of the full balance sheet (as you named it) only in the consolidated financial statements. In the parent’s individual financial statements, the share purchase will be shown in 1 line as some financial investment. S.

Thanks Silvia, very helpful. One more question (may be very basic but need to make sure!); if I am Co. A and purchasing Co. B in period 11 of financial year, which itself is a parent of Co’s C,D and E; on a standalone basis I know it A will account for B at cost, but for consolidation purposes do I need to set out each company as its own “column” in excel and sum across with individual consol adjustment for each , or else is should I take “Consol Co. B” accounts and do FV adjustments to this sub-consol total?

A well summariesed pleasing summary and comparison of IFRS3 and IFRS10/ THANK YOU SILVIA with your dedicated efforts.

Amazing, thank you!

Hi. Can you please guide, whether this standard would apply in following situation? if not, what would be the accounting treatment?:

Company A is having investment in two companies; Company B and Company C. If company C Transfers all assets and liabilities to company B, and Company B have not paid any amount, it has just adjusted to the account of Company A. Please advise.

It is a case of common control transactions. It has to be dealt in a manner similar to pooling of interest method. Please refer Ind AS 103

Dear Silvia,

Can you please tell which standard deals with common control acquisitions and what are the rules for that?

Well, no standard deals with it currently and IASB is in the process of developing the new standard. Currently, you need to develop your accounting policy in line with IAS 8. So, you can apply acquisition accounting as under IFRS 3, or other suitable accounting method (for example pooling of interest).

hi selivia please can you tell me the impact of ifrs 3 and 15 in quality of financial statement please

Dear Hafidha,

this is very broad question and I write about the impact of the individual standards all the time in my articles. So please, go through them and if you have any specific question, maybe I’ll be able to help 😉 S.

Hi Silvia,

Just wondering, is there any circumstance where a liability item such as regulatory capital instrument issued by a banking institution not being consolidated by the shareholder (100% own and exercise control)?

Hi Fizi

I’m a bit confused what you’re asking. Can you please break it down? Thank you, S.

Tough and complicated concepts explained in lucid manner

Silvia,

You are really great!!!

Very nice, well structured, series of Applause.

Thank you! 🙂

What is meant by FV of previous equity interests?

Fair value of previous equity interests.

Imagine co. A bought 20% of co. B and 1 year later, A bought further 35% – thus its ownership in B is 55% and presumably, A acquired control and needs to consolidate. In this case, FV of previous equity interest = fair value of 20% holding in B that was owned before the acquisition of further 35%. This is called “acquisition in stages”. Hope it helps! S.

Great explanation. One small question please. If A’s existing interest in 90% (with control) and it acquires NCI of 10% at a huge price just to make it 100% holding, Will FV of previously held interest of 90% still be re-measured?? Please note it may be very high value given that price paid for 10% might be proportionately higher than for existing interest. Will the re-measurement impact be recognized as Goodwill in BS? Many thanks.

Yes, but please bear in mind that 90% share can be fair-valued differently than 10% share exactly due to different considerations of gaining control. Thus you should not fair value 90% share with the reference of 10% share – overall, you might not be able to sell the entire investment for the price based on price paid for 10% share.

Many thanks Sylvia! You should provide IFRS Desk Services to global corporates on a monthly retainer 🙂

Great idea, thank you! 🙂

Really a nice explanation. Thank you.

Thank you for your efforts (Very good summary of IFRS 3 and IFRS 10)

Well explained in a simple language. Thanks.

Well outlined IFRS 3 summery

Very good summary of IFRS 3 and IFRS 10