IFRS 2 Share-Based Payment

Does your company remunerate its top management by granting them own shares? Or, do employees receive bonuses based on the increase of the company’s share price?

Transactions whereby companies pay for the goods or services received by issuing shares or similar instruments are very common in these days.

In fact, their volume is rapidly increasing, because many people (including top management members) regard having shares of the company as very exclusive and rewarding.

To address the issue of share-based payment reporting, the standard IFRS 2 Share-based Payment was issued. Every other benefit paid to employees is reported in line with the standard IAS 19 Employee Benefits.

Why IFRS 2?

In the past, companies often did not reflect granting share options in their financial statements. Why?

For very simple reason: the options had no intrinsic value, so there was nothing to record in the financial statements.

And what happens in such a case?

If company paid its management by cash, the transaction was recorded as an expense. But if company paid its management by share options, nothing was recorded.

Therefore, standard IFRS 2 Share-based Payment is here to remove this inconsistency.

What is the objective of IFRS 2?

The objective of IFRS 2 Share-based payment is to specify the financial reporting by an entity when it undertakes a share-based payment transaction.

IFRS 2 requires an entity to reflect the effect of share-based payment transactions (including share options to employees) in its profit or loss and statement of financial position.

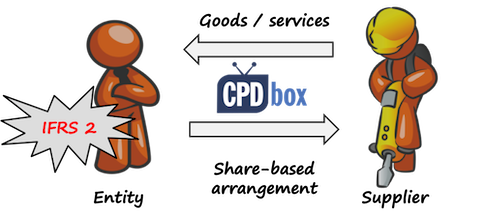

What is a share-based payment transaction?

Share-based payment transaction is a transaction in which the entity:

- receives goods or services from the supplier (including employee) in a share-based payment arrangement; or

- incurs an obligation to settle the transaction with the supplier in a share-based payment arrangement when another group entity receives those goods or services.

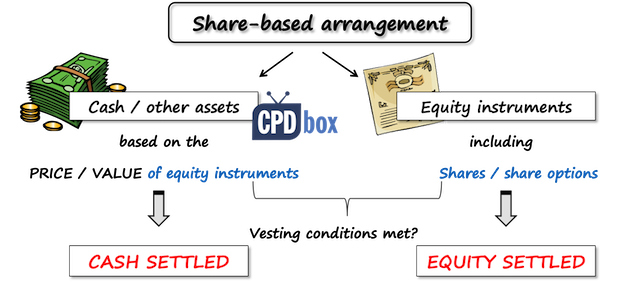

Share-based payment arrangement is an agreement between the entity and another party (including an employee) whereby the other party receives:

- cash or other assets of the entity for amounts that are based on the price (or value) of equity instruments (including shares or share options) of the entity or another group entity.

This type of arrangement is cash-settled share-based payment transaction.

Alternatively, the other party can receive - equity instruments (including shares or share options) of the entity or another group entity.

This type is called equity-settled share-based payment.

If there are some specified vesting conditions, these must be met before receiving any share-based payment.

There’s also the third type of share-based payment arrangements: transactions in which either the entity or the supplier has a choice of settlement (to receive equity instruments or cash / other assets).

Vesting condition

Some share-based payment transactions include vesting conditions that must be met before any payment is made.

IFRS 2 recognizes 2 types of vesting conditions:

- Service conditions:they require the counterparty to complete a specified period or service;

- Performance conditions: they require the counterparty to complete a specified period of services AND specified performance targets to be met.

A performance condition might include a market condition that is linked to the market price of shares in some way, for example, vesting might depend on achieving a minimum increase in the share price of the entity.

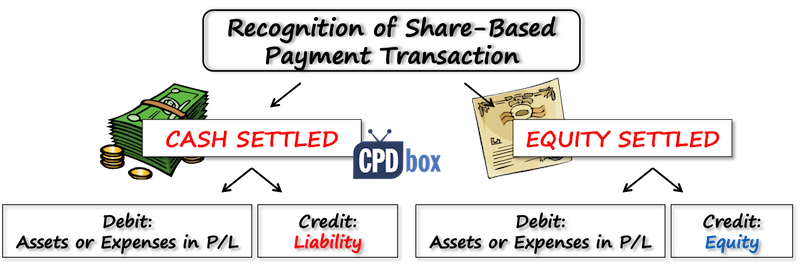

How to recognize share-based payments

The basic recognition principle is to recognize goods or services received in a share-based payment transaction when the goods are obtained or as the services are received.

Goods or services acquired should be recognized as expenses in profit or loss unless they qualify for recognition as assets. That’s the debit side of an accounting entry.

The credit side depends on the type of share-based payment arrangement:

- If the goods or services were acquired in an equity-settled share-based payment transaction, then the corresponding increase is recognized in equity.

- If the goods or services were acquired in a cash-settled share-based payment transaction, then the corresponding increase is recognized as a liability.

Recognition of equity-settled share-based payment transactions

How to measure equity-settled share-based payment?

The key principle in IFRS 2 is to measure the amount of transaction at fair value of the goods or services received. This is relatively easy when the transaction is with parties other than employees.

However, sometimes (for example, when transaction is with employees), the fair value of goods or services received cannot be measured reliably. In such a case, the entity should measure their value by reference to fair value of the equity instruments granted.

And specifically for employees, the entity should measure the services received from employees at the grant date (not at the date of their receipt).

How to determine the fair value of equity instruments granted?

There’s a whole guidance on how to determine the fair value of equity instruments granted in IFRS 2 and IFRS 13 Fair Value Measurement, too.

Basically, when possible, the fair value should be based on the market prices if available. If not, then it is acceptable to use some valuation technique (for example, share option pricing model).

How to deal with vesting conditions?

Here, the principal question is whether vesting condition exists or not.

- NO: If the share-based payment IS vested immediately, or there are no vesting conditions, then IFRS 2 regards this transaction as granted in return for the supplier’s (employee’s) service in the past.

Therefore, an entity needs to recognize the services received immediately in full at the grant date, with the corresponding increase in equity. - YES: If the share-based payment DOES NOT vest until the counterparty meets some vesting conditions, then IFRS 2 regards this transaction as granted in return for the supplier’s (employee’s) service rendered during the vesting period.

In this case, an entity should recognize an amount for the goods or services received during the vesting period based on the best available estimate of the number of equity instruments expected to vest.

How to deal with changes?

Sometimes, an entity might change the terms of the share-based payment transaction.

Modification of the terms on which equity instruments were granted depends on the fair value of the new equity instruments:

- If the fair value of the new instruments is greater than the fair value of the old instruments, then the incremental amount is recognized over the remaining vesting period (or immediately if modification happens after the vesting period).

- If the fair value of the new instruments is lower than the fair value of the old instruments, the original fair value of the equity instruments granted should be expensed as if the modification never occurred.

If an entity cancels or settles the equity instruments, then it is recognized as an acceleration of the vesting period and any remaining unrecognized amount is recognized immediately.

Recognition of cash-settled share-based payment transactions

Typical examples of cash-settled share-based payment transactions are:

- Share appreciation rights: employee is entitled to the cash payment in the future based on the increase of entity’s share price over specified period of time from a specified level;

- Rights to redeemable shares: employee will receive the shares in the future that are redeemable in cash.

Similarly as in the equity-settled share-based payment transaction, the goods or services received are measured at the fair value of the liability.

The fair value of the liability has to be remeasured at each reporting date until this liability is settled and any changes of fair value are recognized in profit or loss.

Vesting conditions are treated in the similar manner as in the equity-settled share-based payment transactions.

Please watch the following video with the summary of IFRS 2 here:

Want to dive deeper into IFRS? I’ve created the free report “Top 7 IFRS mistakes that you should avoid”. Sign up for email updates, right here, and you’ll get this report as well as free IFRS mini-course.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia, thanks for this wonderful article. I have subscribed the IFRSKit courses, but seems IFRS 2 is not included in the lectures, may I know why? Is it possible to have the lectures for IFRS 2 in IFRSKit?

Many thanks

Hongyun Xiao

In some circumstances, employees might provide services in advance of the grant date. Can a company use the grant date fair value estimate for the purposes of recognising the expense during the period between service commencement and grant date.

Hello,

I was wondering what the treatment should be for when you are expecting to grant share awards as a bonus. If it is the year-end and you plan to grant bonus share awards in the following financial year, should you record a bonus provision in the same way that you would for a cash bonus? And if the awards would vest over a 5 year period, would this make a difference? Or do you only record anything to do with share awards once they are granted?

Hello Melissa,

Could treat the scenario by applying both IAS37 & IFRS2.

IAS37: Record prov. for the year end based on the total value of the bonus payable (based on FV of the shares as at end of year) = present obligation from past event + other 2 conditions satisfied.

IFRS2: Reclass from prov. to equity = once share awards are granted in next year.

@Silvia, pl. let me know if I’m mistaken.

Silvia, first of all thanks a lot for doing this – your articles are very useful and on several occasions I found these more understandable than guidance provided by big4 companies.

IFRS2 says that equity-settled share-based payments should go to expense and increase in equity, but it is not really specified where exactly in equity is should be.

Usually, it is going to separate reserve within equity – called Share-based-payment reserve or similar, which seems to be the best practice.

But have you ever seen companies presenting equity-settled share-based payments in other section of equity – e.g. directly to Retained earnings?

Dear Silvia, Thanks a lot for this very useful and informative article. This great, thanks and keep helping us understand the IFRS and become experts like yourself

Hi Silvia,

Thank you so much for this explicit yet simple to understand article.

I would like to have your input in a scenario where the company has granted share option to the employee with only one market condition that is the increase in share price with indefinite period. Whenever the condition is met the options will be vested.

How are we going to treat this when there is no service period tied with this condition?

Regards,

Ali

Hi Silvia

Thanks for the useful article. I have a question

If employees of subsidiary company through monthly payroll deductions purchase the shares of parent company. The subsidiary books only a payable to parent company. Is this treatment correct? Or does IFRS 2 applied to the subsidiary company?

If the Company has a mandatory convertible loan with fix interest rate per annum, and the principal and interest at the maturity date, will be converted in shares with fix to fix term. For the above arrangement ,is it fully in scope in IFRS 9 or IFRS 2? is the interest portion recognised as equity component or profit or loss?

Hi Silvia,

Given that (a)100 5-year-life options were granted, (b) these 100 options would become totally vested at 4th anniversary, (c) there is accelerated vesting clause which requires for more than 15 trading days within any consecutive 30 trading days in the Measurement Period (e.g. from 1st anniversary to 2nd anniversary), (i) closing share price exceeding $10, AND, (ii) average daily trading volume for the 30 days, by value, exceeding $5 million, then 50 options (50% of total options would become vested at once) and remaining 50 options would become vested at 4th anniversary); Then is Target (ii) on trading volume a market condition? Or non-market vesting condition? Is the aggregative Target (i AND ii) a market condition? Or non-market vesting condition? Under IFRS 2, should any market condition be considered in estimating share option expense? If IFRS 2 requires considering accelerating vesting clause, what is the period for amortization of option expense? Is it from grant date to the start of Measurement Period?

Hi Silvia. In a situation where market value of share is $100 and employees paid $70 for new issues in the first year and these shares would not vest until the expiration of 3 years from the point of issue, can it be said that this is a share based payment transaction?