Adopting IFRS 16 – What Is The Best Option For You?

The standard IFRS 16 Leases has been issued for a while with the mandatory effective date of 1 January 2019.

It means that you should have done some work and have it in function by this time.

Yet, I still keep receiving questions related to different transition approaches, something like:

“Is it possible that the transition to IFRS 16 has no impact on our equity?”

“Does the lease liability need to be different from right-of-use asset and why?”

I have published a few articles dedicated to implementation of IFRS 16 in the real practice, for example this one (theoretical) and this one (with illustrative example).

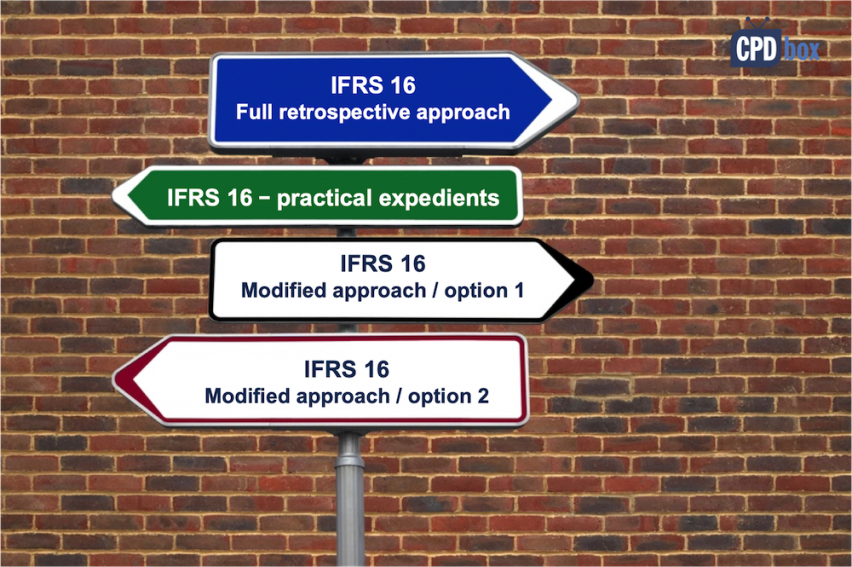

However, it is true that the new IFRS 16 permits more than one method of implementing IFRS 16 and it is up to you to choose the one and follow it.

It is also true that your results, including the impact on equity, directly depend on the method that you choose.

How many options are there?

Well, actually it is hard to say.

The reason is that IFRS 16 contains TWO basic transition approaches and A FEW practical expedients (certain exceptions) that you can apply optionally on top of your selected transition approach.

So, if you combine application of individual transition approaches with practical expedients, there are indeed many options.

Here I would like to outline a few decisions that you may need to make in order to select the best option for you.

Decision #1: Should we reassess all the lease contracts existing prior adoption of IFRS 16?

Here, you have the first choice.

You can choose either:

- To reassess all your previous contracts and examine whether they contain the lease according to new definition in IFRS 16 or not; or

- To apply practical expedient and not to reassess, but accept the assessment under previous standards.

It can really happen that some contracts that did not contain the lease under older rules will contain the lease under newer rules and vice versa.

For example, imagine that in the past you entered into a long-term contract for the supply of energy and for that purpose, the supplier dedicated some equipment in order to fulfil the contract.

Under IFRIC 4 you might have identified that there was a lease, but under IFRS 16 you concluded that there is no lease because you as a customer could not decide about the use of the equipment (supplier can).

Therefore, if you apply option 1 and reassess, you need to make an adjustment at transition date to stop accounting for that contract as for a lease and start accounting for it as for a service contract.

Or, you can apply option 2, no reassessment and you continue accounting for that contract as for the lease.

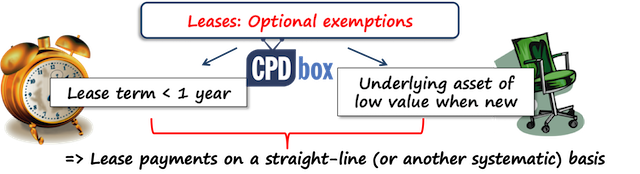

Decision #2: Exemption for short-term leases and low value leases?

If you are a lessee, you can apply 2 exemptions related to accounting for leases:

- Leases with the lease term of 12 months or less with no purchase option (applied to the whole class of assets)

- Leases where underlying asset has a low value when new (applied on one-by-one basis)

If you apply this exemption, you don’t have to calculate the lease liability and right-of-use asset.

Instead, you can recognize the lease payments straight in profit or loss.

I am mentioning it here because you have the option to apply these exemptions on transition to IFRS 16.

However, if you apply this exemption on transition, you need to be consistent and apply it also for all new similar leases – especially the short-term lease exemption, because it has to apply for the whole class of assets.

When it comes to exemption related to low value assets, you can apply it lease by lease, but you still need to define in your policies how you assess the low value assets.

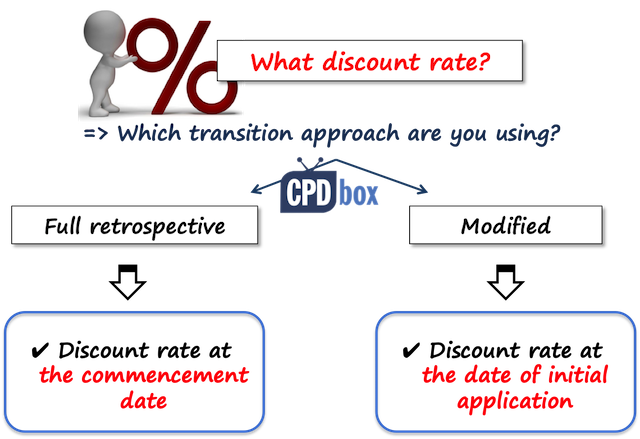

Decision #3: Full or modified retrospective approach?

I have dedicated the full article with illustrative examples to explanation of these 2 different approaches, so check it out here.

Let me just add one quite significant point when it comes to measuring lease liability under full retrospective approach vs. modified retrospective approach.

What discount rates shall you use for measuring your lease liability?

- If you apply full retrospective approach, you need to use the discount rate applicable at the lease commencement date.

- If you apply modified retrospective approach, you need to use the discount rate applicable at the date of initial application, not at the commencement date.

If these two rates are different, it could also have the strong impact on your equity.

Let’s make some comparison.

Let’s take the same example as solved here and use different discount rates when using full and modified approaches.

Just to refresh your memory, here are the basic facts of the example:

- ABC needs to make adjustment related to operating lease contract

- Inception date: 1 January 2017

- Lease term: 5 years

- Annual rental payments: CU 100 000 on 31 December each year

- Machine’s economic life: 10 years

- Machine will be returned back to the lessor after the lease term.

- Mandatory effective date: 1 January 2019

Let’s say that the discount rates are as follows:

- At the commencement date (1 January 2017): 3%

- At the date of initial application of IFRS 16 when using modified approach (1 January 2019): 2.5%

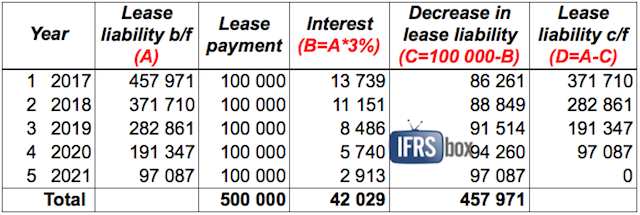

Lease liability under the full retrospective approach

Under full retrospective approach, the lease liability at 1 January 2019 is measured as if IFRS 16 has always been in place; using the discount rate of 3%.

Let me remind you the calculation we made:

As you can see, the lease liability at 1 January 2019 (or at the end of 2018) under full retrospective approach is CU 282 861.

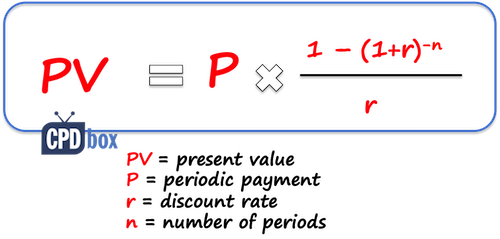

Lease liability under the modified retrospective approach

Upon transition to IFRS 16 and using modified retrospective approach, ABC will measure the lease liability as the present value of the lease payments not paid at the date of adjustment, discounted using the discount rate applicable at the date of initial application (here 2.5%).

Thus, at 1 January 2019, three payments are not paid and their total present value is calculated using the following formula:

In this case, it is CU 100 000 x ((1-(1,025^-3))/0.025) = CU 285 602.

As you can see, due to decline in a discount rate, the lease liability at 1 January 2019 is greater under modified approach than under full approach.

That’s the price of making things easier and applying modified approach.

However, if the interest rates increase over time, then modified approach would trigger the opposite effect.

But, that’s your job to analyze.

Decision #4: How to apply modified retrospective approach?

It seems that the modified retrospective approach to IFRS 16 transition is more popular than the full approach.

No wonder.

Although the full approach provides more comparable information, it is a way cheaper and easier to apply IFRS 16 using modified approach, despite the fact that it can produce different impact on equity.

In my illustrative example solved here I selected one way of applying modified approach just to show the difference between the full and modified version.

However, a few practical expedients are available when you use modified approach and thus it is possible that two companies with the same leases will get different results under modified approach based on their choices.

One of the most significant choices is selecting HOW you will measure the right-of-use asset.

Under full approach it is clear and the only choice is as IFRS 16 has always been in place.

How about modified approach?

Measurement of right-of-use asset at the transition date (modified approach)

You has 2 options here:

- Option 1: As IFRS 16 has always been applied (using discount rate at the date of adjustment) – for our example, see calculation below.

- Option 2: In the amount of a lease liability: CU 285 602 – see calculation above (Decision #3)

Let me measure ROU asset as if IFRS 16 has always been applied, just using discount rate at the date of initial application.

In this simple example, there were no initial direct costs related to the lease or other items, so ROU asset at the commencement date would be equal to the lease liability at the commencement date.

Therefore we need to discount all lease payments with the discount rate of 2.5% (applicable at the date of initial application of IFRS 16).

The formula is similar as above, we just need to use the full lease term of 5 years:

CU 100 000 x ((1-(1,025^-5))/0.025) = CU 464 583.

This is the ROU asset at the commencement date of 1 January 2017 and we still need to deduct the depreciation charge for 2 years to bring it to 1 January 2019.

Let’s charge the straight-line depreciation over 5 years, thus the carrying amount of ROU asset at 1 January 2019 is: CU 464 583 – 464 583/5*2 = CU 278 750.

And, that is a difference of CU 6 852 when compared to using option 1.

Comparing three methods of transition to IFRS 16

To show you the journal entry and impact on equity of this exercise under different methods, I summed it up in the following table:

| Journal entry at 1 Jan 2019 | Full retrospective | Modified – Option 1 | Modified – Option 2 |

| Debit ROU asset | 274 783 | 278 750 | 285 602 |

| Credit Lease Liability | -282 861 | -285 602 | -285 602 |

| Debit Equity | 8 078 | 6 852 | 0 |

| Total | 0 | 0 | 0 |

Note – amounts for full retrospective come from the example solved here.

Now you see the difference.

If you implement IFRS 16 using modified approach and you opt for practical expedient related to measuring your ROU asset, you will have probably the smallest impact on equity (in this example none).

Just a small note: you can opt this practical expedient on lease-by-lease basis, thus you can apply it selectively for some leases (no necessity to apply for all of them).

Decision #5 for modified approach: other practical expedients

To ease your life, IFRS 16 gives you the option to go for another practical expedients that can potential make the transition less challenging.

Let me name a few of them:

- Discount rates

You may apply a single discount rate to a whole portfolio of leases with reasonably similar characteristics. - Onerous contracts

If you assessed the lease as onerous contract under IAS 37 immediately before the date of initial application, you do NOT have to perform the impairment test on right-of-use asset, but you can adjust its carrying amount by the amount of provision for onerous contract instead. - Leases with remaining term of less than 12 months

If the lease term of some lease contract ends within 12 months after the date of initial application, you can account for it as for short-term lease (i.e. all lease payments in profit or loss). - Initial direct costs

You can exclude initial direct costs from the measurement of right-of-use asset at the date of initial application. - Hindsight

You can use hindsight in determining the lease term if the contract contains option to extend or to terminate the lease.

In other words – you can assess this option based on the previous experience.

Oh, I almost forgot – the mysterious shortcut “CU” means “currency unit” – it replaces any currency for the purpose of examples. Just because many of you are asking me this.

Please, have you already adopted IFRS 16? Or are you just in the process?

Let me know in the comments how it went and what challenges you faced. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

44 Comments

Leave a Reply Cancel reply

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

HI

I need to ask about the “Residual value guarantee” and “Unguaranteed residual value “

Hi Silvia, I hope everything is going well

I have one question concerning retrospective application of a ROU asset under a 10 years lease contract, start from 2012 to 2022.

The contract installments paid in USD and our company reports in EGP ”Egyptian pound” so the ROU asset and the lease liability will be reported in an amount equal to the paid USD in Egyptian pound

– My question about whether to report the retrospective application amount by the exchange rate that had been paid in the previous periods or by the exchange rate of the first installment in 2012.

Hi Silvia,

There’s something that is not very clear for me. The monthly rent paid for an office (for a company that doesn’t use ifrs 16 because it’s not mandatory in the country) should be decreased from depreciation of RoU? I have to report according to IFRS for a company from a non EU country….:(

Thank you.

Christine

Hi Christine, rent paid should be based on the contract and not depreciation of ROU – please where did you get that from?

Hello Silvia

I hope you are doing well?

I am uncertain about determining the figures for the following disclosure that is required:

* Explanation of the difference between the operating lease commitments disclosed under IAS 17 at the end of the prior year, discounted using the incremental rate at the initial application date.

Do you perhaps have a simple calculation that will assist me?

Thank you for your reply. Have a nice weekend and stay safe!

Hi Silvia. I have one question. My company was incorporated in October 2018 and the first financial year is December 2019. Does IFRS 16 apply? because I read that it effective on Jan 1, 2019.

Yes, it was mandatorily effective from 1 January 2019, but it would be wise for you to apply it voluntarily even for the period prior that date (as you won’t have to make unnecessary changes afterwards).

Hi Silvia, for Decision 1, I have 1 question here. Let’s said if a company has been entering into a 5 years lease contract since 1 January 2017 (2 years prior to the adoption of IFRS 16), means for the Year 2019, the company can actually choose to apply the practical expedient option 2 (mentioned above) and not to reassess, but accept the assessment under previous standards and continue to account it for an operating lease expense under IAS 17?

You are the best teacher of my Life. Thanks alot.

Dear Madam

I have one leasehold property for our warehouse. Which is basically having a lease contract for one year. We are planning to continue the same same for another two year as well (But still contract is one year, which need to renewed every year). do we need to adopt IFRS 16 for the warehouse rental ?.

Dear Sylvia, i have an urgent case for the year end 2019, my question is: is it a must to affect the numbers of the new IFRS 16 before 01/01/219? i mean i have a contract rent started from 01/01/2016, is it a must to affect the beginning numbers of 2019 with the number of 2016, 2017 and 2018?

Hi Hussam, yes, you need to recalculate this contract under IFRS 16 – this is just the general answer and there are some exceptions as well.

correction to line 4, “when it will not be zero”

Thanks Sylvia for the excel table example.Really helps

Hi Silvia, nice work and very happy again with the ifrs box purchase.

We have already applied IFRS 16 on office lease and your excel helped but

I have a question. How should I decide if I have to apply IFRS 16 on Car leases and on IT software license.?

based on materiality but how do you believe so that auditors can be ok?

thanks

Hi Vasilis,

great, thank you for your feedback!

Well, yes – based on materiality and significance level for IT software license if it has “low value when new”. As for a car lease – here it is not probable that low value exception applies since cars generally don’t have such a low value. But, you can apply the short-term lease exception if applicable – and there is no materiality concept to apply; you simply need to assess the lease term. S.

Hi Silva,

Thanks for your guidance articles! It always helps.

A question on Deferred tax relating to the modified retro approach- Will any deferred tax implications arise? I came across the following article which states that there is no implications at initial recognition (IAS 12 states that an entity does not recognise a deferred tax asset or a deferred tax liability to the extent that it arises from the initial recognition of an asset or liability in a transaction that is not a business combination and at the time of the transaction, affects neither accounting profit nor taxable profit.) https://www.iasplus.com/en/meeting-notes/ifrs-ic/2018/march/ias-12-deferred-tax-tax-base.

Just to confirm we are on the right track here.

Hi Silva, please how should we treat the balance in prepayment under the modified option 2?

Hi Silvia, how should we treat the future payments, if that is different from the initial measurement. For example, for next 5 year, we are expecting to pay 100,000. But, actually, we have to pay 120,000. So,

In this case, can we charge the difference 20000 to P&L directly as we don’t need to change the original calculation, provided that there is no change in identified asset?

Dear Silvia,

How is your example above will change in the case where the shareholder fully paid the ROU for identified assets and on the liability site you owe the amount to the shareholder of the company rather than the lease payments with the interest factor to influence your calculation. Do you still need to discount the liability to take into consideration the time value of money?

For many lease contracts under IFRS 16, My company request our IT programmers to write code (using their familiar coding language), do you have any suggestion for our accountant to check whether programmers run a code completely and correctly? (I suppose my company accountants have to use vba code in excel, but no one can write vba code.)

In the Statement of Financial Position, is Lease liabilities treated as a part of Interest-Bearing Debt or IBD or just a liability like other liabilities?

What is the international treatment for Good Portfolio to IBD ratio of a Micro-finance company with loans from financial institutions? Do they treat a lease liability as part of IBD or excluding it?

Hi Sylvia,

If a company applies in 2019 the IFRS 16 Leases and we capitalize borrowing costs for qualifying asses during construction period, what happens if we would like to make a switch after construction to IFRS SME? Do you have to retroactively correct the capitalized interest and reverse IFRS 16?

Hi Silvia,

can you please provide assistance regarding the below

Company A to finance and build an asset

Company B to operate and maintain the asset

Company B to consume 50% of the output of the asset

Company A to offer the other 50% to the wider market

Company B has option to purchase the asset after 5 years.

is it accurate that company B can account for the transaction as a service contract and consequently no balance sheet implication or recognition

Many thanks

Thank you Silvia. It is lovely to be part of this study. This is educative and informative. You are doing great. Please keep up with the good work.

Dear Silvia

how are you doing? hope you are doing great.

thank you for the lesson that you given us.

Please Silvia would you send me the draft financial statement which was prepared by the IFRS standard for the service company and merchandising and manufacturing companies

thank you.

sent by an email thank you asmaraakalu@gmail.com

Hi Silvia, thank you for an informative article as always.

I have a question pertaining to lease accrual (straight lining adjustment)

My company has adopted IFRS 16 using the modified retrospective approach 1, but we are unclear on what to do with the accrual in the SOFP, is it right to adjust the ROU asset with it?

Sorry option 2 rather

Hi Felicity, is this accrual coming from the application of IAS 17, am I right? So, you need to reverse it, that’s all – via equity, I would say. But it’s hard to give advice without actually seeing your numbers and situation.

Hi Silvia and Felicity

The way I understand the accrual is that if you follow the modified retrospective approach option 1 where you measure the right of use asset by setting it equal to the lease liability, then the lease accrual is set off against the right of use asset, whereas if you follow option 2 and measure the right of use asset as if IFRS 16 has been applied always, then the lease accrual is set off against retained earning. Is that right?

I cannot agree with this fully – in fact, you would always set off accrual against retained earnings, because that’s how it was created in the first instance and you need to reverse it.

Dear Silvia

Thank you for your response. It does make sense that the accrual would always go against the retained earnings.

If the accrual is set off against the right of use asset, the difference would be recycled to retained earnings at the end of the day through the depreciation that is less and would increase the profit or loss in the current year instead of the retained earnings at the start of the year. In other words, in both cases the accrual is recycled to retained earnings being either at the start of the year or throughout the year via the decreased depreciation due to the decrease in the value of the right of use asset. Would the above not be the same mechanism?

Thank you

Hi Silvia,

We have implemented the IFRS 16 using modified approach – option 2. The process went smoothly. We‘re currently coping with modifications, effects from derecognition of ROU assets due to unexpected cancellation of contracts. As well we’re working on first time disclosures for year end. If you have some tips on these points please share.

BR, M.

Hi Miba,

great, thank you for your comment! Yes, my view is that the option 2 is the easiest one to adopt. Well, disclosure requirements are something that needs to be covered separately 🙂 All the best and good luck!

Use the working schedules for IAS17 at transition to ensure that all leases are included within the ROU / finance liability calculation.

Modified option 1 and 2 allow management to manage profit. for a example, if we select Modified option 1, then, future depreciation lower (due to RE adjustment) compared to Modified option 2. In option 2 we need to book higher amount of depreciation.

This helps greatly Silvia! Thank you so much. I needed to refresh my mind abit as the company I work with has not effected it yet.

Hi Ms. Silvia I am working in a Retail sector and we have a lot of long term lease contracts with Malls in UAE. I would like to know does IFRS 16 also apply on rent lease contracts. Like we have a shop in Dubai Mall on 5 years lease

Ofcourse it applies to rent contracts.

Yes, it does. in as much as you are able to assess that the contract contain a lease ( contains an identifiable asset and you can control the use)

However, you may choose the practical expedient of not reassessing all the EXISTING contracts to determine whether they contain a lease and continue to account for them as always.. but note that this option not applicable for new contract after I January 2019.

Thanks for the example, really simplifies the implementation approaches. We are at the stage of choosing the implementation approach and i have to say its not easy. From your experience what are approach are the majority of companies choosing?

Hi Will,

well, it really depends, but I would say from what I consulted, companies slightly prefer modified approach with option 2 with zero or low impact on equity. However, it is not clear preference – some companies went for full approach because they clearly wanted to show comparative information under the same rules as current information – it is easy to present to shareholders and explain that this big impact on equity is caused by the change in the accounting rules and not something else.

Great work as always Silvia!