IFRS 16 Leases vs. IAS 17 Leases: How the lease accounting changed

In January 2016, IASB issued another important and long-discussed standard: IFRS 16 Leases that will replace IAS 17.

Ever since then I receive lots of e-mails asking me to sum up what’s new.

OK, so here you go.

In this article, you’ll learn about the main changes that IFRS 16 introduces to the accounting for leases, illustrated on a very simple example.

Warning: this is NOT exhaustive description of the standard, and I simplify the things a lot for illustration purposes.

I will come back to it at the later stage, because I truly think that there will be lots of questions, discussions and additional guidance on how to tackle several areas of the lease accounting.

The effective date of the new IFRS 16 is 1 January 2019.

Why the new lease standard?

Short answer: To eliminate off-balance sheet financing.

Under IAS 17, lessees needed to classify the lease as either finance or operating.

If the lease was classified as operating, then the lessees did not show neither asset nor liability in their balance sheets – just the lease payments as an expense in profit or loss.

But, some operating leases were non-cancellable, and therefore, they represented a liability (and an asset) for the lessees.

This liability was hidden from the readers of the financial statements, as it was not presented anywhere.

Oh yes, some disclosures in the notes to the financial statements were mandatory, but frankly – who, except for auditors, ever reads the notes to the financial statements?

New IFRS 16 removes this discrepancy and puts most leases on balance sheet.

I’ll show you how in the next paragraphs.

Let’s see what has changed

Is it a lease?

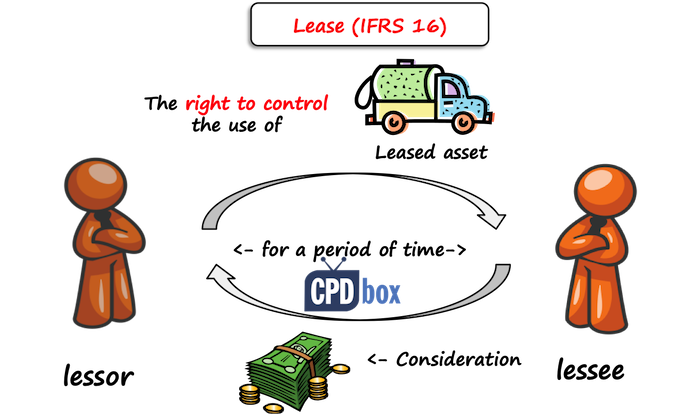

The new IFRS 16 introduces a new definition of a lease. However, it is very similar to the old definition in older IAS 17 (differences do exist).

It means that when you actually accounted for some contracts as for lease contracts under IAS 17 Leases, you will continue to do so also under the new standard (careful, methodology may change).

BUT!!!

You have to be extremely careful when it comes to some service contracts.

Why?

Because, the new standard IFRS 16 provides a detailed guidance to determine whether your contract is a lease contract or a service contract (non-lease contract).

Under old IAS 17, it did not matter so much whether you have an operating lease contract or a service contract, for a very simple reason: you probably accounted for both types of contracts in the same way (that is, as a simple expense in profit or loss).

However, as the accounting for some types of previously-called operating lease contracts dramatically changes, we need to distinguish whether we have a lease under IFRS 16 or some other service contract under different standard.

As a simple illustration, let me come up with a small example:

- You will occupy a certain area of XY cubic meters, but the specific place will be determined by the owner of the warehouse, based on actual usage of the warehouse and free storage.

- You will occupy the unit n. 13 of XY cubic meters in the sector A of that warehouse. This place is assigned to you and no one can change it during the duration of the contract.

Both contracts look like lease contracts, and indeed, in both cases, you would book the rental payments an expense in profit or loss under older IAS 17.

Under new IFRS 16, you need to assess whether these contracts contain lease as defined in IFRS 16.

The first thing you would look at is whether an underlying asset can be identified.

Long story short:

- The first contract does not contain any lease, because no asset can be identified.

The reason is that the supplier (warehouse owner) can exchange one place for another and you lease only certain capacity. Therefore, you would account for rental payments as for expenses in profit or loss. - The second contract does contain a lease, because an underlying asset can be identified– you are leasing the unit n. 13 of XY cubic meters in the sector A.

Therefore, you need to account for this contract as for the lease and it means recognizing some asset and a liability in your balance sheet.

This was a very simplified illustration to make you aware of this and it’s by no means exhaustive – but you get a point.

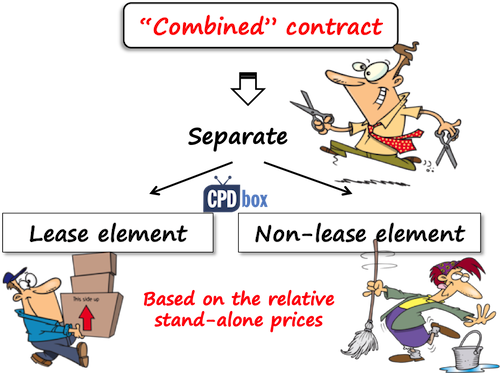

Do we pay only for a lease, or also for some services?

This is another change we need to watch out under IFRS 16.

When you lease some assets under operating lease (as called by older IAS 17), in most cases, a lessor provides certain services to you, such as maintenance, repairs, cleaning, etc.

Under older IAS 17, you did not need to think about it too much, because you put all lease payments as some rental expense to your profit or loss.

BUT!!!

Under new IFRS 16, you need to split the rental or lease payments into lease element and non-lease element, because you need to:

- Account for a lease element as for a lease under IFRS 16 (if it meets the criteria in IFRS 16); and

- Account for a service element as before, in most cases as an expense in profit or loss.

From our example above: let’s say you took the option 2 and you pay CU 10 000 per year. This payment includes the payment for rental of the unit n. 13 and its cleaning once per week.

Therefore, you need to split the payment of CU 10 000 into lease element and cleaning element based on their relative stand-alone selling prices (i.e. for similar contracts when got separately).

You find out that you would be able to rent out similar unit in the warehouse next door for CU 9 000 per year without cleaning service, and you would need to pay CU 1 500 per year for its cleaning.

Based on this, you need to:

- Allocate CU 8 571 (CU 9 000/(CU 9 000+CU 1 500)) to the lease element and account for that as for the lease; and

- Allocate CU 1 429 (CU 1 500/(CU 9 000+CU 1 500)) to the service element and in this case, probably recognize it in profit or loss as an expense for cleaning.

Not an easy thing, especially when the stand-alone selling prices are not readily available.

The biggest change: lessee’s accounting for leases

Here’s the biggest change: lessees (those who take an asset under lease) do not need to classify the lease at its inception and determine whether it’s finance or operating.

You might say: OH YES!!!

But not so fast.

The reason is that IFRS 16 prescribes a single model of accounting for every lease for the lessees. Very shortly:

- Lessee needs to recognize a right-of-use asset and corresponding liability in its statement of financial position.

- An asset shall be depreciated and a liability amortized over the lease term.

This model is very similar to the accounting for finance leases under IAS 17.

And yes, you need to account for operating leases in the same way.

There are 2 exceptions from this rule:

- Lease of assets for less than 12 months (short-term leases), and

- Lease of assets of a low value (such as computers, furniture etc.).

Example IAS 17 vs. IFRS 16

Let me illustrate the new accounting model and put it in the contract with the treatment under IAS 17.

I will continue in the above example of a warehouse. To make it quick, I will just make up some data:

- Annual rental payments are CU 10 000, including the cleaning services, all payable in arrears (at the end of year)

- Appropriate discount rate is 5%

- The lease term is 3 years.

How would you account for this contract under IAS 17 and IFRS 16?

Accounting under IAS 17 Leases

Under IAS 17, you need to classify the lease first.

Let’s say that based on warehouse’s economic life, lease payments, etc. you assess that this lease is operating.

Therefore, accounting is very simple:

- At the commencement, you do nothing;

- At the end of each year, you simply book the rental expense of CU 10 000 in profit or loss.

Accounting under IFRS 16

Here, no classification is necessary as one accounting model applies to all leases.

You need to follow 3 steps:

- Is it a lease under IFRS 16?

Yes, here it probably is. Please see the explanation above.

- Is there some element other than lease element? Do we need to separate?

Yes, we need to separate the cleaning element from the lease element. We did it above:

- CU 8 571 relates to the lease element;

- CU 1 429 relates to the cleaning element.

- How to we recognize these elements?

- At the commencement:

- You need to recognize right to use a warehouse in the amount equal to the lease liability plus some other items like initial direct costs.

- The lease liability is calculated at present value of lease payments over the lease term. In this case you need to calculate the present value of 3 payments of CU 8 571 (only lease element) at 5%, which is CU 23 341.

- Accounting entry is then

-

Debit Right-of-use asset: EUR 23 341

-

Credit Lease Liability: EUR 23 341

-

- Subsequently, when you make a payment and/or at the end of reporting period, you need to:

- Recognize depreciation of the right-of-use asset over the lease term, in this case CU 7 780 (CU 23 341/3) per year (I took straight-line depreciation);

- Recognize remeasurement of the lease liability to include interest, exclude amounts paid and take any lease modifications into account.

- At the commencement:

This simple table illustrates our example:

| Year | Lease liability b/f | Add interest at 5% | Less amounts paid | Lease liability c/f |

| 1 | 23 341 | 1 167 | – 8 571 | 15 937 |

| 2 | 15 937 | 797 | – 8 571 | 8 163 |

| 3 | 8 163 | 408 | – 8 571 | 0 |

| Total | n/a | 2 372 | – 25 713 | n/a |

Note: “b/f” means “brought forward (at the beginning of the year)”, “c/f” means “carried forward (at the end of the year)”.

Summary of accounting entries under IFRS 16:

| When | What | How much | Debit | Credit |

| At the commencement | Right-of-use asset + lease liability | 23 341 | Right-of-use asset | Lease liability |

| At the end of the year 1 | Interest | 1 167 | P/L: Interest expense | Lease liability |

| Rental payment | 10 000 | Cash (bank account) | ||

| 8 571 | Lease liability | |||

| 1 429 | P/L: Expenses for cleaning services | |||

| Depreciation | 7 780 | P/L: Depreciation | Right-of-use asset | |

Now, let’s compare.

Under IAS 17, the impact on profit or loss in the year 1 was CU 10 000, as we recognized the full rental payment in profit or loss.

Under IFRS 16, the impact on profit or loss in the year 1 was:

- Interest of CU 1 167, plus

- Depreciation of CU 7 780, plus

- Expense for cleaning services of CU 1 429.

- TOTAL of CU 10 376.

Hmmm, that’s actually more expenses in the first year under IFRS 16 than under IAS 17, isn’t it?

The reason is that thanks to the new model, the pattern of expenses has changed: we have loads of interest in the beginning of the lease, but smaller expenses at the end of the lease when the lease liability is amortized.

In total, both models have the same profit or loss impact over total lease term:

| Type of expense | IAS 17 | IFRS 16 | Note |

| Rental expense | 30 000 | – | 3*10 000 |

| Interest expense | – | 2 372 | Table above |

| Depreciation | – | 23 341 | 3*7 780 |

| Cleaning expenses | – | 4 287 | 3*1 429 |

| Total | 30 000 | 30 000 | |

Note: I am showing the cleaning expenses, too in order to show total impact of the whole contract, although technically they are not part of the lease accounting.

Also, under IFRS 16, we show more assets on the balance sheet, but also more debt or liabilities.

Please note that the cash flow does not change. You pay still the same amounts whether you apply IAS 17 or IFRS 16.

What about Lessors and accounting for leases under IFRS 16?

Good news, folks!

Accounting for leases by lessors almost does not change, so they can continue in the same way.

That’s all I need to say about it.

Final warning

The new lease standard will have significant impact on the companies heavily working with operating leases, no questions about it.

The financial indicators of these companies can substantially change, because new assets and liabilities are coming to the balance sheet.

Also, many lessees will have a hard time to set up a system of gathering and analyzing enough information to satisfy new requirements.

I will stop here, as this post is longer than I expected, but if you have some ideas or remarks on whether and how the new standard can affect your company, please let us know below in the comments. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Sylvia,

Thank you for your immense contributions. When in doubt, i read your posts for guidance.

Per your post above, i have some questions which I have been trying to rationalize. Perhaps your input would help demystify them.

First, IAS 17 prescribes assets acquired under finance lease to be depreciated at the shorter of the lease term and its economic useful life. what then happens to the carrying amount of the leased asset at the end of its lease period if the lease period is shorter than its economic useful life because at this point, the asset would have been fully depreciated but then it continues to generate economic benefits for the company.

Secondly, why is IASB compounding issues for Accountants? As you have rightly noted, too much estimates and judgments in accounting for these transactions might in fact defeat the objective of fair reporting. Arriving at a suitable discount rate, determining the cost of the non lease element to be separated from the lease payment would all contribute to creating headache for accountants. Why creating a fuss over nothing?? The new standard would even help bloat total assets and total liabilities if the lessee defaults in annual lease payments. Although no impact on net asset.

Thank you.

Dear Christian,

1. If the lessee intends to use the option to purchase the asset at the end of the lease term, then you need to depreciate over its economic life.

2. I’m not the right person to respond to this question, sorry 🙂 I just take the rules as they are and try to play with the cards I have. S.

Hi Silvia,

Thank you for this wonderful article. Just a quick question regarding the example calculation. why did you include the interest and add it to the carried forward liability? In your other example of finance lease, the interest portion is always just in the p/l and never part of the liability. Can you please explain why this is?

Thank you.

Hi James,

the interest portion IS recognized in P/L – please note the debit side of the entry. The credit side is a liability and when it’s paid, then it’s a cash. S.

Hi Silvia,

Thankyou so much for the wonderful article:)

I believe that there is a serious difference in sale and lease back transactions as well. I appreciate the effort you have made and for clarifying a lot of misconceptions of mine. And now I need to know about how IFRS 16 deals with the sale and lease back sceneries. Can you help here as well?

Hi SK,

this article was written to give a word of warning in order to prepare – it’s by no means exhaustive. And yes, I will write some other articles about IFRS 16 later on. S.

What are changes in Finance lease of Lessor.

Is there any change regarding journal entries.

as previously we record as

Dr. Gross investment in Lease

Cr. Asset (net investment in lease)

Cr. unearned Finance Income

Subsequently

Dr. Bank

Cr. Gross Investment in Lease

&

Dr. UEFI

Cr. Finance income

i am confused as i have seen different entries now.

Your article is really so helpful.

Especially with example it is like a cakewalk

Thanks for such an elaborate explanation of each and every detail

What do I do with the balance of my deferred liability for previously expensed straight-line rent for leases formerly classified as operating leases?

Todd,

We have the same question with respect to IFRS 16. I have not been able to find an answer as of yet.

I have the same question as well. Our auditor currently also raise this issue but haven’t been able to arrive an conclusion yet.

OK OK guys, sorry for not responding! If you are adopting IFRS 16 from IAS 17, you have to state the balances as if IFRS 16 has always been adopted. It means that you need to reverse all entries under IAS 17 and book entries under IFRS 16. It relates to previous periods, too. And, when doing this, you will book the cummulative adjustment in opening retained earnings (depending on which approach you take, whether modified or full). If you can tell me how you accounted for operating leases previously and how the deferred liability arose, I will show you the entries. Meanwhile, here’s the article about transition to IFRS 16. – you will see how I did the adjustments (reversal of “old” numbers and booking of “new” numbers). S.

Hi Silvia,

How do you account for it if the modified retrospective approach, ROU=LL is adopted?

IFRS 16 C8(b)(ii)

Hi Martin, I described various options here. S.

Hello,

Considering that the lessor accounting remains unchanged, it will result in a single asset recorded by two separate entities in its books, which seems bizarre. Could you please confirm?

Suppose an entity owning and operating a power plant where all the electric output is sold to the Government off taker (customer) via a power purchase agreement for 20 years. The lessor recognizes the asset in its balance sheet, which is depreciated over its useful life. The lessee records the expense of monthly payments, however with the implementation of IFRS 16, the lessee will also recognize the asset and liability in its books. As the lessor will continue to account for the asset in its books under IFRS 16, this results in the same asset being recorded by two separate entities. Your thoughts?

DEAR SALVIA

I request you to please upload a video solving a comprehensive worked example.that will surely help us to get benefit from your supreme perfection on IFRS.

Best Regards.

Dear Silvia, here the questions. How can I solve this case?

You discovered that a company, Axia Automobile is not listed in the subsidiary ledger. You

have asked your account assistant, who is controlling the transaction of vehicle from Axia

Automobile. The account assistant told that she did not record the automobile because the

company was only leasing it. The lease agreement was created on 1 January 2016. You

decided to review the lease agreement to ensure that the lease should be afforded operating

lease treatment, and you discovered the following lease terms:

1. Non-cancellable term of 4 years.

2. Rental of RM38,000 per year at the end of each year. (The fair value of the automobile is

RM135,000).

3. The estimated economic life of the automobile is 5 years.

4. The implicit rate and Honey’s incremental borrowing rate is 8% per year.

thank you.

Dear Kakciksmine,

this looks like your homework and if you know me, I try to give you a hint, but you should solve it yourself. Therefore, assuming that you apply older IAS 17:

– you need to classify the lease first (it says that it’s operating, but looking to the conditions- is it really?)

– then you need to learn how to account for finance and operating leases by the lessee, and then

– draft the journal entries. S.

Hi Silva,

Your posts are very informative and easy to understand. IFRS box always proved the best platform to provide quick, accurate and best explanation of IFRS standards whether its new standard or existing standards. Your illustrations are very simple and thorough.

I have a question related to IFRS 16

How do IFRS-16 apply to sale and leaseback transaction specially for lessee?

Dear Muhammad,

thank you for your kind words 🙂 In relation to your question – I will send out the newest article the next week, it’s going to be about leases in IFRS 16 and the sale and leaseback is covered there, so please wait a bit 🙂 S.

Hi Silvia,

Thank you very much for your very informative post, especially that you made it very simple to understand.

I just have a question, How will we classify the “right-of-use asset” in the balance sheet? Will it be part of property plant and equipment, or intangible assets? Thanks

Hi Jay,

you can either present it separately from other assets in the statement of financial position, or you can include it within the same line as within you would include the underlying asset and disclose it in the notes to the financial statements only. S.

Thank God I found ifrsbox,I’m gaining momentum for my P2 exam. Your articles are blessing me.

Thanks, Bob and all the best!!! Remember – keep it simple, revise a lot and re-do past ACCA’s exam questions as much as you can. During the exam, read the question and underline major information while reading. STATE THE OBVIOUS – you can earn easy marks. All the best! S.

How do IFRS-16 apply to sale and leaseback transaction. Is gain still required to be accounted for in the same way like in IAS-17?

Hi

Sincere apologies for the inconvenience.

Please could you upload an illustration of an example of an IFRS 16 note in the annual financial statements.

I am curious to know how it would be presented and disclosed in a set of annual financial statements.

The standard is vague with regards to this.

How should the note look like?

(for lessees as well as for lessors)

Hi Silvia,

How do I calculate retroactively? We have Bldg rental payments since 2012 on our (Lessee)books? Can you explain with example?

Thanks

For an operating lease under IFRS16, does the lessor record the lesaed asset as an Asset and depreciate it?

Irshad, the lessor’s accounting has not changed. It means that under IFRS 16, lessor keeps an asset it its financial statements when it comes to an operating lease. S.

Thanks for the clarification, Silvia.

Thank you for the clarification, Sylvia. Does that mean the asset will appear in both balance sheets: the lessor’s and the lessee’s?

Dear Irshad,

yes, but it’s not the same asset. A lessor will show a PPE and a lessee will show a right to use a PPE. Also, the amounts will be different. S.

Thanks for the added clarification, Silvia. This is very useful. If I understand correctly, the asset will be under PPE in the Lessor’s books and will be depreciated. Will it also be included under PPE in the Lessee’s books? at what value? does the Lessee depreciate it? at what rate?

What explains / makes up the difference between the Lessor’s and the Lessee’s valuation of the asset?

Dear Silvia,

I end up @ IFRSbox whenever in doubt and have to say, no one else does a better job than you in clearing out the hazy parts in the IFRS.

So simple once read through!

Quick question though, If i made all my operating lease contracts to be under one year, I wouldn’t have to bother much about IFRS 16 right?!

And a very big congrats on your bundle of joy..God bless!

Thanks Ashvin 🙂

And yes, you are right. Leases below 1 year are the exception. S.

Hi Sylvia

I am doing a presentation on ifrs 16 and i have been asked to address the provisions of ifrs 16, what exactly are these provisions?

Thank you

Hi1 Sylvia,

The effective date is 1 January 2019, so company at present moment can choose to apply between the old IAS 17 is IFRS 16

is it?

Yes 🙂

Hi silvia,

Thanks for your simple yet informative post.

But would like to ask, in practice/real life, where do we get the discount rate to calculate the lease?

Do different type of lease uses different discount rates? (office lease, equipment lease, vehicle lease, etc)

Thanks.

Dear Petter, in practice, you would calculate the discount rate as the rate implicit in the lease. Yes, it works in most cases. If not, then you should look to incremental borrowing rates (e.g. rates for similar loans at the market). To your last question – yes, there can be different discount rates for leases, but it’s not a leased asset that makes a difference. It’s rather term of lease, credibility of lessee (its credit rating), etc. S.

I have an ACCA P2 exam and after some weeks reading and trying to compare, your examples have broke it down and made it easy to understand. Here is hoping it comes up in the exam!

Thank you 🙂

All the best, good luck! You’ll kill it! 🙂

Hi Silvia,

I have a question on sale and leaseback-Transition part.

Para C18 of the IFRS 16 states:

If a sale and leaseback transaction was accounted for as a sale and operating lease applying MFRS 117, the seller-lessee shall:

(a) account for the leaseback in the same way as it accounts for

any other operating lease that exists at the date of initial

application; and

(b) adjust the leaseback right-of-use asset for any deferred gains or losses that relate to off-market terms recognised in the

statement of financial position immediately before the date of

initial application

I do not understand what does b) means. I mean, I tried to find examples but failed to find a simple explanation.

Thank you in advance Silvia!=)

Hi Silvia

I came cross that one of my friend’s company leased a land from government for 99 years lease term, but they not recognized it to balance sheet (Right to use land and lease obligation under liabilities)instead charging lease payment to profit or loss. I want to know is this treatment is right?

Thank you

Dear Nimasha,

IAS 17 states that the lease of land is almost always operating, because the land has indefinite useful life. So yes, I guess it’s the right treatment to recognize lease expenses in profit or loss. S.

Would your answer change now? after IAS 16 was implemented?

Well, the question was asked in 2016 when IAS 17 has been in place and I assumed no one had implemented IFRS 16 yet. Sure, if you follow IFRS 16, then of course you need to recognize right-of-use asset and lease liability for any lease (except for short-term and low-value), so yes, the company with 99-year land lease needed to make an adjustment during transition to IFRS 16.

Hi Silvia,

I want to apply IFRS 16 on real financial statement and income statement of company which already have applied IFRS 17 just to know the effect of this change in the represent the financial statement, so can you tell me how can I start

Hi slay,

you need to look at your current transactions to which you apply IAS 17, and compare whether IFRS 16 rules change with respect to these specific transactions. Look after operating leases especially as the rules changed there. Then you need to:

– determine how these transactions are presented according to the current rules (IAS 17)

– how they would have been presented under IFRS 16,

– calculate differences and recognize them as at the beginning of the reporting period to equity. You also need to adjust comparatives. S.

Hi silvia, thakks for your helped

I have one question, hehehe.

In IFRS 16 stated, if the company adopt IFRS 16, they also need to adopt IFRS 15 earlier or at the same time.

Based on that statement above, My question is:

What is relationship between IFRS 15 adn IFRS 16?

Dear Deaa,

it is because IFRS 16 often refers to IFRS 15 provisions – for example, in sales and leaseback transactions. It would be non-sense to apply IFRS 16 earlier than IFRS 15. S.

Thanks for your explanation, really appreciate it

Hi silvia,

Thank you so much, you have made this article. It’s very very very easy to understand.

Keep writing silvia.

Oh ya, I have invite your linkedin account. i wish you can accept it. hehehhe thanks

hello

does this changes will affect the accounting treatment of the lease?

Dear Silvia

As the purpose of IFRS 16 is to elimanate the use of “off balance sheet leases”, if a company traet an asset which is leases for every year as “one year contract”, it is recorded as operating laese because it is a contract foa 12 months (excption 1). As an auditor , how should we treat with this situation?

Thanks

Congratulations, God bless you both

It’s worth adding it. I would like to thank you for the Kit, I gain a lot of knowledge and experience from the Kit. Great and wonderful efforts.

Thank you, Mahmoud!

You’re right, it’s absolutely worth adding it. I’ll be working on that later this year, as I’m still a full-time mom of a little baby.

S.

Don’t know yet.

How would we link this new standard to the conceptual framework principles

Would it be a fair presentation of operating leases to the users of statements

Hi Silvia

The purpose of the new standard is to eliminate off balance sheet financing but it seems that in the case of operating lease we will record the assets twice. Once on the lessor book and then on the lessee book as right of use asset.

My point is that if you add the value of asset recorded on the lessor balance sheet + the right of use asset on the lessee book , it is not equal to the actual value of the asset.

Seems that this is in contradiction to the fair value accounting principle.

🙂 Yes, agreed, it sounds strange when the same asset is shown in 2 balance sheets. However, the right-to-use asset is not exactly the same as an underlying asset. S.

Dear Silvia

Thank you for you graet explanation. Under IFRS 16 , this is a problem that an asset reported in two balance sheet. Is there any reason for it?

THanks

Unmatched analytical skills

Is there any requirement that we only record asset in operating lease when contract is for fixed time? Or we record right of use of asset irrespective of time

Under IFRS 16 yes, if you meet the definition of lease, you need to record some asset (right-to-use). There are just 2 exceptions when you don’t record asset – please look above to the article. S.

Hi Silvia,

This is the first time I heard about IFRS 16 leases, thank you very much for your presentation.

I’m have a dough, In one place you mentioned “But, some operating leases were non-cancellable, and therefore, they represented a liability (and an asset) for the lessees” and in the example 2 “You will occupy the unit n. 13 of XY cubic meters in the sector A of that warehouse”

In above two places I hope you mentioned about “Honorius Contract”. Where we need to book liability (IAS 37). So what is the difference between IAS 37 and ITFS 16 in above senario??

Thanks and regards.

Dear Silvia,

Does the IAS 17 have any limitation, so we need to change to IFRS16?

Does the conceptual or theoretical factors for these

changes proposed in the new standard?

Hello,

hmm, not quite sure I understand the questions. IAS 17 does not have any limitation (except for almost the same scope limitations as in IFRS 16) apart from the fact that it will be superseded in 2019, so you will have to apply IFRS 16. S.

Hello,

Sorry that my question may be quite confusing. Anyway thank you very much! The “limitation” that I mentioned is actually the reason why there needs a change from IAS 17 to IFRS16. Apart from disclosing more assets and liabilities could help investors know more information about the company, I would like to know whether there is other reasons for the change.

Jessica

Hello Silvia,

What do you think about the influence of the IFRS16

to the users and financial statements compare with the IAS17?

Hi Michael,

the main impact will relate to the leases previously classified as operating. There will be much more assets and liabilities in the balance sheets as before, and as a result, financial rations can change. S.

Helllo Silvia,

In case of a business combination done in earlier years we have created certain intangible assets (which represents right to use certain property rights for generating revenue for our business). Beside this, we were showing operating lease commitments for these property rights in our financial statements.

Now with the IFRS 16, do we need to capitalise these operating lease commitments irrespective of the fact that we have already accounted them as intangible assets at the time of business combination or is there any relief available in IFRS 16.

Thanks

Sachin,

I’m afraid you need to apply IFRS 16 retrospectively, also to existing operating leases. S.

Hello silvia,thx for ur vivid explanation.i want to know if right to use asset is a tangible or an intangible asset as compared with other rights that generates cashinflows

Obi,

it’s not really a tangible or intangible asset as such. It should be presented separately from other assets and if not, then it is included in the line where the corresponding asset would go; e.g. if you lease a car under “operating” lease, then the right-to-use asset is presented within PPE. S.

Dear Silvia M.,

The rental expense of $30,000 would be deductible for income tax purpose if it is accounted for as operating leases under previous accounting standard on leases, IAS 17. Would the both depreciation of $23,341 and interest of $2,372 (which are part of $30,000) deductible for tax as well under UK tax jurisdictions?

Would the present value calculated by discounting future lease payments (i.e.the highly certain cash outflows) at appropriate market interest/ discount rate more superior valuation method than the one under fair value model? If there exist a fair value for a leases accounted for as a finance lease, then what if the Present Value calculated result in difference much more than the fair value?

Thanks.

Yen Khang

Hi Yen,

1) Tax deductibility depends on the tax rules in the particular country and unfortunately, I don’t know how it would be in UK. Anyway, if there’s a difference between tax rules and accounting rules, you should recognize a deferred tax.

2) IFRS 16 explicitely says that you shoud measure right-to-use asset at cost – and that includes the initial measurement of a liability. So you are really using discounting technique here and not the fair value.

S.

As usual, you make a complicated topic very simple. Thank you for an extremely lucid explanation on the new standard.

“…but frankly – who, except for auditors, ever reads the notes to the financial statements?”

I hope analysts do

Thumbs up! 🙂

Silvia, first of all, I highly appreciate your efforts. And I am 100% with you, as analysts seldom have enough time to read the notes in depth, as you might expect them to do.

I also have to contribute to the policital discussion here and I have to agree with John 100%. It is a game, played by politicians, state regulators and the accounting boards, with the aim to prevent catastrophes such as 1. the great depression 2. Dot-com 3. Enron 4. Housing bubble etc. No doubt, most of the players have the “right intentions” but guess what, although regulation grew exponantially since the 30’s, the “scandals” got more severe and greater in numbers.

There is a reason why Swiss Bluechip companies increasingly refrain from reporting under IFRS and switch to a Swiss true and fair view standard (Swiss GAAP FER, approximately 200 pages Din A5, Arial 10) the biggest one being Swatch group.

Long story short, I believe the only regulation which effectively eliminates bad players is the market, not government or any accounting standard.

Dear Bernhard,

thank you, this is a very interesting comment. I also believe in market, but frankly speaking, it’s more difficult to rely on the market these days than ever before. The reason is that “market” or business become concentrated into the hands of few multinational groups who play under their own rules. Therefore, market becomes less and less efficient. On the other hand I agree that this type of regulations will hardly help – at least, these groups will have to report everything and maybe also the things they would prefer to hide.

S.

I do!

Apart from being an accountant I like investing in my spare time and I definitely read notes to financial statements of a company I do a research on..

sometimes you can understand so much of the background of many financial decisions recorded in FS.

As you have mentioned that there are two exceptions, in the second exception how can we decide whether the asset has a low value since it is based on judgement..

Hi Lakshitha,

yes, you do need to apply some judgement here, but the guidance says that the examples of items with low value are computers or items of furniture – so you get the point. S.

IASB seems to define ‘low-value’ lease as those have a value of 5000 dollars or less, saw it on IFRS 16, I am not sure about this.

Thank you dear Salivia M.

I am here again to thank you for your well simplified explanations. However, I have only one question, as i am finance office at Premier Bank Somalia, if we already recorded the lease as an expense; is IFRS allowed to change our records?

Regards

If IFRS are mandated by the governing laws of your bank for general purpose financial statements, then you’ll have to change your policy.

Hello Silvia,

what about hire purchase? is it out or in the scope of IFRS 16?

Hi Nadiah,

well, hire purchase is very similar to the finance lease, isn’t it? It basically depends on the conditions of the contract, but sometimes, hire purchase qualifies for lease accounting. S.

Hi Silvia

How does one deal with existing operating leases in place when one adopts IAS 16?

Further when first time adoption of the standard occurs is there an adjustment required for to the comparatives of the prior financial year?

Is there any guidance regarding discount rates for operating leases under IAS16?

Hi Riaan,

at the date of initial application of IFRS 16, you need to restate your operating leases under the new rules and IFRS 16 permits 2 options:

– either you do full retrospective approach (with comparatives)

– or you do one-off adjustment.

In relation to discount rates- it should be the interest rate implicit in the lease, and if this is impractical to determine, then it should be incremental borrowing rate. S.

Dear Riaan/Silvia,

I have really been so enlightened reading you interpretations to IFRS. Thank you so much for all the efforts.

Please I am very interested in the response to Riaan’s question.

The IASB along with all the other accounting boards are a bunch of morons. They need to justify the money they get paid by changing the accounting standards frequently. It is a joke, a game, and is very sad the accounting standard boards continue to do this. In the future the new standards will be changed back to the old standards. Accounting is very simple until the morons step in and screw things up b/c they want to justify their existence. A lot of these standard changes started in the late 60’s and 70’s. Thank you Silvia for your good examples and illustrations.

🙂 Thank you, John 🙂

See, I also think that they make some things complicated sometimes and I’m guessing whether lots of estimates and judgements in the accounting is actually good for the clarity of the reporting. For me, that’s the main problem. S.

mate, calm down, you need to ease up on the IASB and all the Governing bodies; AICPA and CPA Australia, ACCA and ICAANZ.

We need them more than they need us, we want them to show the society (social contract) that they can (should) trust us and our numbers. We try to ensure credibility.

These regulatory bodies are just helping you and me to restore the credibility that we have lost.

Look at Creative accounting, not illegal but misleading!

Look at the scandals, such as Enron and Worldcom (they failed even the going-concern test for God’s sake), HH Insurance and Global Financial Crises.

Look at the lack of independence due to the auditor consulting businesses to their clients.

It used to be called regulatory bodies, now it is co-regulatory bodies because the government stepped in because they don’t trust the accounting profession.

This is my view

Dear Arie,

thank you for your view, it’s very valuable and I appreciate you posted it here.

Well, in my humble opinion, all what you wrote is very true and fine. But, remember, road to hell is paved with good intentions and the question is whether too many estimates and judgements won’t exactly lead to creative accounting that we want to prevent.

Take care!

S.

Dear Silvia

I have come with a situation whereby the company hired five cars for an agreement of five years. Insurance and maintenance is the responsibility of lessor. Lessee is responsible for providing driver and fuel only.

The client insist this is an operating lease due to maintenance service element.

Please advice

Dear Vincent,

I guess your clients follows IAS 17 rather than IFRS 16 as it’s completely new. So in this case, you need to assess 5 criteria to classify the lease properly. Let me mention that if just one of them is met, then the lease is finance in most cases.

In your situation, you need to compare the useful life of cars with their economic life (it seems your client rents these cars for most of their useful lives as it’s 5 years), you also need to compare present value of the minimum lease payments with the fair value of the cars, etc.

Let me stress that the mere fact that the lessor is responsible for maintenance DOES NOT automatically classifies the lease as operating.

Please read more here: IAS 17 Leases.

S.

Hi Silvia ,is mantainance non-leaese elemslentI?,I suppose insurance is not since it the lossor who benefits.

Dear Silvia

Your explanation with example is really easy to understand.

“Property Lease” seems meet the definition under IFRS16, if so, after the lease commencement, should we measure the right-of-use asset by using the cost model or revaluation model?

Dear AC,

IFRS 16 says that you should measure right-of-use asset under cost model, but the fair value model as well as revaluation model are acceptable if they fit more to the specific conditions. For the simplicity, I illustrated it on the cost model. S.

Am I missing something why is the Right of assets minus depreciation not equal to the lease liability balance of 15,937 at the end of the first year. The 376 difference, where does that go in the Balance sheet?

paid amount less depreciation less interest expense. (it is kept within the lease liability).

Because in liability you reduce principal value of 7,404 (Rent 8,571 – Interest 1,167). However in assets, you reduce only depreciation, which is 7,780. So this difference between principal amount and depreciation creates difference, which will be there. No worries.

where does that amount go in the Balance sheet?