IFRS 15 vs. IAS 18: Huge Change Is Here!

When to recognize revenue? This simple question is one of the most controversial issues in today’s accounting.

Why?

Well, it’s simple and easy when you sell goods, but how about long-term contracts or some sort of services?

You need to have some rules on WHEN to recognize the revenue from all these things, because all your profits and losses, your reputation in front of the outside world and your taxes depend on this.

Revenue recognition rules have just changed and later in this article, you’ll find an example showing you the impact of this change.

Revenue Recognition: IFRS vs. US GAAP

Until now, revenue recognition was exactly one of the biggest gaps between IFRS and US GAAP.

As you know, IAS 18 Revenue contains principles for revenue recognition, but they are quite broad and as a result, many companies use their judgment to apply them in their specific situation. Some companies even developed their own IFRS policies based on the US GAAP rules.

Opposed to IFRS, US GAAP guidance about revenues is very detailed – US GAAP contains about 100 separate documents and protocols about revenue recognition in specific areas (often conflicting, by the way).

Finally, these 2 standards came closer and tried to solve all these differences on 28 May 2014.

IFRS 15 Revenue from Contracts with Customers

New revenue recognition standard was issued: IFRS 15 Revenue from Contracts with Customers and it should fill the gap between IFRS and US GAAP.

FASB (the US GAAP standard setting body) issued the new revenue recognition standard, too: Topic 606, which is almost a mirror of IFRS 15 (full text of Topic 606 is here).

Although I’ll cover this standard in one of my videos in the following months, here are the basic points for your information:

-

- You’ll need to apply IFRS 15 for reporting periods beginning on or after 1 January 2018 (early application permitted);

- IFRS 15 will replace the following standards and interpretations:

- IAS 18 Revenue,

- IAS 11 Construction Contracts

- SIC 31 Revenue – Barter Transaction Involving Advertising Services

- IFRIC 13 Customer Loyalty Programs

- IFRIC 15 Agreements for the Construction of Real Estate and

- IFRIC 18 Transfer of Assets from Customers

- The core principle of IFRS 15 is that an entity will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration (payment) to which the entity expects to be entitled in exchange for those goods or services.

To apply this principle, you need to follow a five-step model framework described below.

- IFRS 15 contains guidance for transactions not previously addressed (service revenue, contract modifications);

- IFRS 15 improves guidance for multiple-element arrangements;

- IFRS 15 requires enhanced disclosures about revenue.

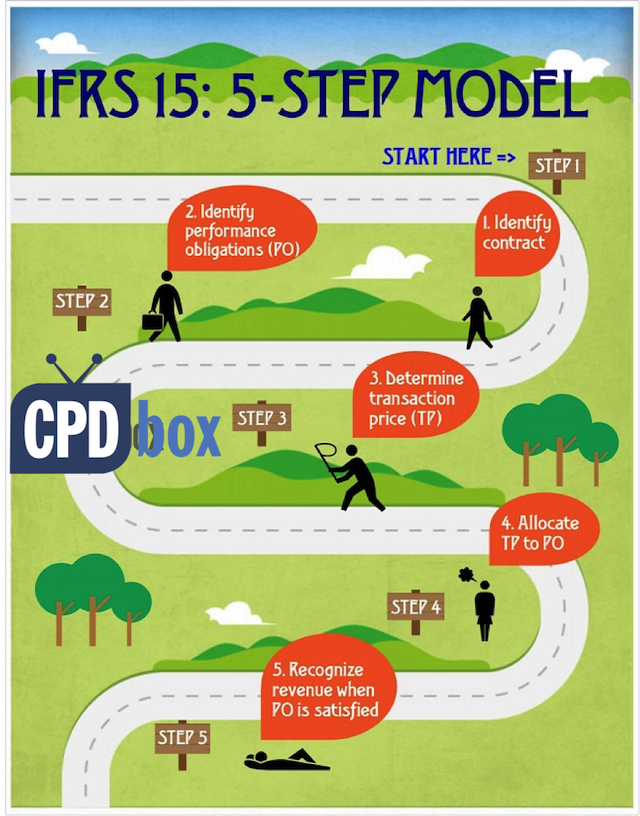

Five-Step Model Framework

Every company must follow the five-step model in order to comply with IFRS 15. We’ll not go into details, just let me brief you a bit:

- Step 1: Identify the contract(s) with a customer.

IFRS 15 defines a contract as an agreement between two or more parties that creates enforceable rights and obligations and sets out the criteria for every contract that must be met.

- Step 2: Identify the performance obligations in the contract.

A performance obligation is a promise in a contract with a customer to transfer a good or service to the customer.

- Step 3: Determine the transaction price.

The transaction price is the amount of consideration (for example, payment) to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties.

- Step 4: Allocate the transaction price to the performance obligations in the contract. For a contract that has more than one performance obligation, an entity should allocate the transaction price to each performance obligation in an amount that depicts the amount of consideration to which the entity expects to be entitled in exchange for satisfying each performance obligation.

- Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation.

Who Will Feel the Biggest Impact of IFRS 15?

The experts say that the most impacted industries are telecom, software development, real estate and other industries with long-term contracts.

If you work in an industry where bundled contracts of “product + service” are quite common, then you should pay attention.

I’m referring mainly to software development or telecommunications, where customers usually buy a prepayment plans with a handset or software development comes with implementation and post-delivery service in 1 package, or any similar arrangements.

Under the new model, companies in telecom and software will probably recognize revenue earlier than under older rules.

Why is that?

Well, because under new IFRS 15, the transaction price must be allocated to the individual performance obligations in the contract and recognized when these obligations are delivered or fulfilled.

It means that under new IFRS 15, telecom operator must allocate a part of the revenue from prepayment plan with free handset to the sale of handset, too.

Under IAS 18, the revenue is defined as a gross inflow of economic benefits arising from ordinary operating activities of an entity.

It means that if the operator gives a handset for free with the prepayment plan, then the revenue from handset is 0.

OK, if that sounds a bit confusing, we’ll better look at numbers.

Example: IAS 18 vs. IFRS 15

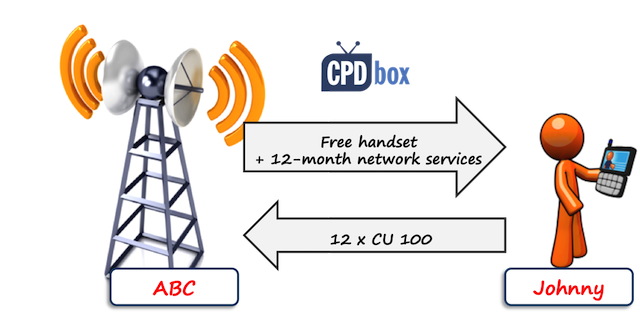

Johnny enters into a 12-month telecom plan with the local mobile operator ABC. The terms of plan are as follows:

- Johnny’s monthly fixed fee is CU 100.

- Johnny receives a free handset at the inception of the plan.

ABC sells the same handsets for CU 300 and the same monthly prepayment plans without handset for CU 80/month.

How should ABC recognize the revenues from this plan in line with IAS 18 and IFRS 15?

OK, let’s ignore a couple of things here, like a price of a SIM kit, or the situations when Johnny hangs on the phone for hours and spends some minutes in excess of his plan. Let’s focus just on these 2 things.

Revenue under IAS 18

Current rules of IAS 18 say that ABC should apply the recognition criteria to the separately identifiable components of a single transaction (here: handset + monthly plan).

However, IAS 18 does not give any guidance on how to identify these components and how to allocate selling price and as a result, there were different practices applied.

For example, telecom companies recognized revenue from the sale of monthly plans in full as the service was provided, and no revenue for handset – they treated the cost of handset as the cost of acquiring the customer.

Some companies identified these components, but then limited the revenue allocated to the sale of handset to the amount received from customer (zero in this case). This is a certain form of a residual method (based on US GAAP’s cash cap method).

For the simplicity, let’s assume that ABC recognizes no revenue from the sale of handset, because ABC gives it away for free. The cost of handset is recognized to profit or loss and effectively, ABC treats that as a cost of acquiring new customer.

Revenue from monthly plan is recognized on a monthly basis. The journal entry is to debit receivables or cash and credit revenues with CU 100.

Revenue under IFRS 15

Under new rules in IFRS 15, ABC needs to identify the contract first (step 1), which is obvious here as there’s a clear 12-month plan with Johnny.

Then, ABC needs to identify all performance obligations from the contract with Johnny (step 2 in a 5-step model):

-

-

- Obligation to deliver a handset

- Obligation to deliver network services over 1 year

-

The transaction price (step 3) is CU 1 200, calculated as monthly fee of CU 100 times 12 months.

Now, ABC needs to allocate that transaction price of CU 1 200 to individual performance obligations under the contract based on their relative stand-alone selling prices (or their estimates) – this is step 4.

I made it really simple for you here, so let’s do it in the following table:

| Performance obligation | Stand-alone selling price |

% on total | Revenue (=relative selling price = 1 200*%) |

| Handset | 300.00 | 23.8% | 285.60 |

| Network services | 960.00 (=80*12) | 76.2% | 914.40 |

| Total | 1 260.00 | 100.0% | 1 200.00 |

The step 5 is to recognize the revenue when ABC satisfies the performance obligations. Therefore:

-

-

- When ABC gives a handset to Johnny, it needs to recognize the revenue of CU 285.60;

- When ABC provides network services to Johnny, it needs to recognize the total revenue of CU 914.40. It’s practical to do it once per month as the billing happens.

-

The journal entries are summarized in the following table:

| Description | Amount | Debit | Credit | When |

| 285.60 | FP – Unbilled revenue | P/L – Revenue from sale of goods | When handset is given to Johnny | |

| Network services | 100.00 (= monthly billing to Johnny) | FP – Receivable to Johnny | When network services are provided; on a monthly basis according to contract with Johnny | |

| 76.20 (=914.40/12) | P/L – Revenue from network services | |||

| 23.80 (=285.60/12) | FP – Unbilled revenue | |||

So as you can see, Johnny effectively pays not only for network services, but also for his handset.

What’s the Impact of the IFRS 15?

The biggest impact of the new standard is that the companies will report profits in a different way and profit reporting patterns will change.

In our telecom example, ABC reported loss in the beginning of the contract and then steady profits under IAS 18, because they recognized the revenue in line with the invoicing to customers.

Under IFRS 15, ABC’s reported profits are the same in total, but their pattern over time is different.

Why does it matter?

Well, because some contracts surpass one accounting period. They are long-term and reporting revenues in incorrect accounting periods might cause wrong taxation, different reporting to stock exchange and other things, too.

Don’t believe me?

Just look at ABC. Let’s say that contract started on 1 July 20X1 and ABC’s financial year-end is 31 December 20X1. Just look how much profits ABC reports from the same contract with Johnny under IAS 18 and IFRS 15 in the year 20X1:

| Performance obligation | Under IAS 18 | Under IFRS 15 |

| Handset | 0.00 | 285.60 |

| Network services | 600.00 (=100*6) | 457.20 (=76.2*6) |

| Total | 600.00 | 742.80 |

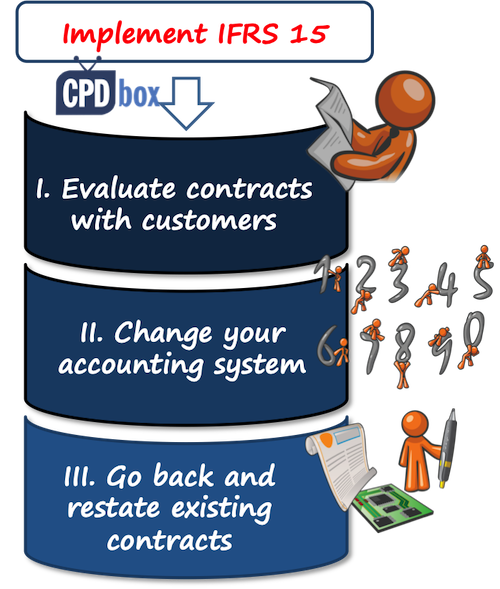

How to Prepare for IFRS 15

I really do think that IFRS 15 is a huge change and it requires a massive amount of work not only from accountants, but also from IT departments, tax people and maybe other departments in your company, too.

A few ideas for your future steps:

- Go through your contracts and evaluate

Your profit reporting will depend on the specific contract terms. If your company has a number of different types of contracts, you need to assess each type separately and decide how to deal with that type in line with IFRS 15.

- Change your accounting system

OK, how many customers does the “average” telecom company have?How many contracts are there?

Thousands. Millions. Tens of millions.

And once you decide how to recognize revenue for each type of contract that you have, then you need to implement this accounting process into your accounting software or system.

Whether you realize it or not, the implementation of IFRS 15 will cost affected companies significant amount of money for system upgrades, consultants, training the employees and other related activities.

That’s why IFRS 15 must be implemented starting 1 January 2018 – some time is left for making these changes.

- Go back and restate existing contracts

I did not want to scare you in my previous point, but this is going to be a bit scary:All companies need to look back and recalculate profits and revenue reporting from all contracts.

When you apply IFRS 15, you need to apply it as the new rules have always been in place, that is retrospectively.

Let’s say that Johnny and ABC enter into 2-year plan on 1 July 2015 and IFRS 15 has not applied yet; thus ABC recognized zero revenue for handset and monthly revenues from network services in line with the billing.

On 1 January 2017, ABC will apply IFRS 15 and contract with Johnny is still open (it expires on 30 June 2017). ABC needs to perform all the calculations as shown above and adjust opening balances related to the contract.

What does it mean?

Companies will need to gather lots of numbers, fair values, estimates, stand-alone selling prices and other things and then perform lots of recalculations and adjustments.

Just imagine you work in a construction of real estate and you’re affected by IFRS 15. Some contracts run for 10 or 15 years … OK, I finish here and leave it to your imagination.

UPDATE 2018: I have written few articles about IFRS 15 and you can check them out here:

- IFRS 15 Examples: How IFRS 15 affects your company

- Accounting for discounts under IFRS

- How to account for customer incentives under IFRS

- Principal or agent – revenue or liability?

- Short summary of IFRS 15 Revenue from Contracts with Customers (with video)

Now, I’d really love to hear your view. Do you think IFRS 15 will hit you hard? Are you making your plans to adopt or implement it? Please leave a comment below and if you liked reading this article, share it with your friends here.

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Sylvia,

Great read and I echo the sentiments above. As an accounting student, my knowledge is somewhat limited at the moment so I apologise if this sounds naive.

But when you state that the standard will have to be introduced retrospectively, how will this impact the statements of previous periods?

Thanks,

Jack

Thanks Silvia for making IFRS 15 easy to understand. I have been reading publications on this topic from professional accounting websites, but could not make meaning of what they are saying; but just reading your article solved my problem. Thanks again.

Hi Silvia,

First of all thank you for your article. I am student and i have a project how the IFRS15 impact to the KPN. I found that KPN mainly expects an impact on the timing of revenue recognition

due to the removal of the cash restriction rule currently applied in revenue arrangements with multiple deliverables and on the accounting treatment of dealer commissions. I would like if is possible to explain me a shortly this proposal and how impact to the KPN. Thank you in advance

Dear Jessy, sorry for my ignorance, but what is KPN?

KPN is a Dutch ladline and mobile telecommunications company

In this case, Jessy, I’m afraid I’m not the right person to explain this. I don’t know how KPN recognizes revenues currently – I would need to know the details and then assess the impact. I am sorry but I don’t have any capacity to study it. Please turn to someone from that company – hope they will be able and willing to help. S.

Hey Silvia!Very interesting and helpful explanation about the IFRS 15.I would like you to inform me, if is possible how the financial statement of the telecommunication company will be affected from the IFRS 15 which recognize revenue under the IAS 18.

Hey Anthi,

there are many ways in which mostly telecom companies are affected and for me, it’s not possible to list them in the comment. However, I gave you example above in this article – it’s exactly about the telecom. S.

Hi Silvia,

First of all thanks for giving us an easier explanation of what this standard entails. I am still a student and we are currently undergoing a research on the impacts of the recent amendments on the software industry.

What do you think are the main impacts, and how will companies cope with this?

Also, if I am not mistaken it has been told that the effective date has been moved by one year, 2018, is this true?

Thanks

Hi Jenise,

hm, your question is very broad and it’s not really possible to reply in a comment. Maybe I will come back to this topic and write an article about it.

As with the effective date – I don’t think it has been moved, it’s still 1 January 2017 (although there are some discussions about it). S.

Hi

How does IFRS 15 change the way we will account for revenue under IFRIC 18?

Silvia, compliments for making complex subject look simple and range of questions is testimony to the fact people really understood the concept.

In the context of your example don’t you think Handset transaction is more in the nature of Loan or Financing transaction and not Sales.

Similarly remaining with your example, what happens if user stops making payment, may be bacause that person lost the instrument or just vanished with Handsset. What is IFRS 15 interpretaion of such events.

Hi Silvia,

Thank you for your efforts.

Could you comment on the treatment of sales discounts using IFRS15 and how it differs from previous IAS18.

Thank you,

Hi silivia ,,

Does Unbilled revenue is the same as Un earned revenues ?

Hi Dalia,

well, not exactly.

Unbilled revenues = revenues of the current year that will be invoiced in the future periods.

Unearned revenues = revenues of the future reporting periods that have been invoiced in the current reporting period (or in the past).

However, everybody is using different terminology! S.

It’s really a very simple direct short and fruitful explanation for a big and major issue in the ifrs 15

I appreciate your way in delivering the information smoothly and effectively

Thx

keep going ….

Hi Sylvia

Will there be any changes in the banking industry, regarding how they account for revenue? Upfront charges, etc

Hi Sylvia

I would appreciate it if you can explain the likely impact of IFRS 15 in revenue recognition of banks

Hi Nathan,

I will write an article about the impact of IFRS 15 on various types of businesses, but in short for banks here:

You should probably watch out for the contracts or types of services where variable pricing incurs, for example, when your banks provides “performance bonuses” to clients (e.g. rewards them for maintaining certain balance on their account or making certain amount or volume of transactions), or some structuring fees, etc. Here, the rules are more rigid than before and you should examine whether IFRS 15 impacts you or not (it does not need to).

Then also, you should examine whether to capitalize certain costs related to obtaining the contract, for example success fees (currently, everybody treats that differently).

And there are couple of other things to watch out, like up-front fees, loyalty programs (e.g. for paying frequently with the debit/credit card), etc. I’m not necessarily saying that everything will change under IFRS 15 – it depends on your own practices, but you should definitely go through it and make appropriate conclusions.

Look, I don’t know where you’re from, but in March 2015, I’m leading live 2-day seminar “IFRS for banks” in Bratislava and be sure I’ll cover that too. If you’d like to come to discuss, you’re welcome 🙂

You do really understand the IAS 18 preactice in telecom industry previously, don’t you?

Hi again Silvia

Please ignore my question. I see the build up in the FP of the £23.80 each month then offsets the £285.60 already in the FP from the “sale” of the phone which is recognised immediately on sale of the handset.

Great article, thank you again.

Paul

Exactly! And thank you 🙂 S.

Hi Sylvia.

Great article, thank you.

One question I have is around the accounting treatment at the end of contract life. Regarding your journal entries during the life of hhe contract:

Dr FP Receivable £100

Cr P/L Revenue £76.20

Cr FP £23.80

Presumably then after fulfillment of the 12 month contract, the balance built up in the FP of £23.80 * 12 = £285.60 would be recognised immediately in p/l in month 12?

Kind regards

Hi Sylvia, one quick question? If an OEM sells a car and an extended warranty service(‘EWS’) along with the car, is the EWS should be treated as a separate performance obligation or bundled along with the sale of car. When shall we recognize the sale of EWS. is that point of sale of car or is that the EWS which starts after 2 years from sale of car.

How probable is extending the warranty service after 2 years? Also, do you charge extra fee for EWS? In other words – is a car with EWS more expensive than a car without it? There are more questions to answer before you can assess the situation and decide. For me, it’s difficult to say without seeing the contract – revenue recognition strongly depends on what’s written there.

Hi 🙂

1- IFRS 15 said that contract must be enforceable and enforceability is a matter of law >>

how come oral contracts are enforceable?

2- why u didnt write Contact asset in entry 1 instead of unbilled revenue ?

Hi Sara 🙂

1) I can’t find where I wrote that oral contracts were enforceable 🙂

2) That’s the matter of naming the things. For me, unbilled revenue fits quite well. 😉

it has been written in IFRS 15 , the standard said that contract is enforcabble and ( the parties to the contract have approved the contract (in writing, ORALLY or in accordance with other customary business practices)

🙂

thnx

Sure, I know it’s in IFRS 15, just did not understand your first comment. Aaaa, now I see, do you ask why is it there in IFRS 15 as it’s hardly enforceable due to oral character? Well, in some countries, oral word has a strong power and often replaces written form (I think for example in Islamic countries). S.

Hi Silvia,

Your article is brilliant. I am now so much addicted and looking forwards for updates from you. This IFRS is mind blowing and scary too, lots to learn and there are million possibilities of going wrong. You are guiding us really well. Thankyou

Hi Lakshmi, thank you 🙂 That’s a BIG responsibility to guide people, but believe, sometimes I can be wrong, too 🙂 S.

Hey Sylvia thanks for simplifying the new standard. I wish to know how would this affect the food industry

Thank you for a great website. I would like to see practical ways in obtaining the required information from a group to assess impact in the retail and wholesale industry.

Hi IFRS Kid, yes, impact on retail and wholesale industry will be quite significant, as there are some discounts, gift cards, “3 for 2”, and other transactions involved. I’ll cover that in the future 🙂 S.

Silvia,

As per IAS 18 also Revenue for handset would be recognised.

😉

Hi Silvia,

Thanks for the Article. But I ma one of them who requires illustrative example of construction or contracting company. Waiting !!!!

Hi Ibrahim, I’m sorry, I have some editorial plan of these free articles and believe, I work to give as much as I can! S.

Hi, thanks for your article. I would like to ask regarding the IFRS 15, what do you think the future global development expected to be??

Thanks Sivia. Your article is Great.

Many Thanks Sivia , please i need another example for the cnstruction industry when adopt IFRS 15

Dear Ehab, please be patient, I will cover it in the future for sure! S.

Hi silivia , please I didn’t understand why u write in the first entry Unbilled revenues why we didn’t write it as account receivable /or cash in debit ,,, also in the second entry why u didn’t make the entry as cash or accounts receivable by 76.20 in debit and revenue by 76.2 revenue ,, thanks in advance

Hi Dalia,

1) Unbilled revenues in the first entry: well, you can’t really book neither cash (as no cash has been received yet) nor receivables (these are reserved for invoices and no invoice has been issued for that amount). “Unbilled revenues” is a kind of deferral account.

2) In fact, I made that entry you mentioned. When you look at it you’ll see that there’s 100 in debit – which is aggregated amount of 76.20 and 23.80. The first part of the credit is exactly 76.20 to P/L. The second part of credit entry 23.80 is monthly portion transferred from unbilled revenues (what you booked in the first entry) to P/L. Hope it helps! S.

i have a disagreement with the author. on telecom case Johnny. Reference to IAS 18 para 9 “”Revenue is measured at the fair value of the consideration received or receivable””. May be i;m wrong but i seek your guidance on this matter. the revenue should be recognized at 1,260 amount instead 1200. but i don’t know what IFRS 15 say about fair value as compared to Para 9 of IAS 18 because it is a pretty new standard couple of months ago

Hi Zunair,

thank you for your comment. The thing with Johnny’s example is that the revenue cannot really be measured at 1260, because all what ABC gets is 1200 in cash, isn’t it? FV of cash is still cash value, if received within 12 months.

In fact, the difference of 60 (1260-1200) is a kind of some discount that Johnny gets in return for subscribing for the whole year. This discount can be allocated to just 1 performance obligation, or allocated just as I did – by relative stand-alone selling prices.

Please note that this was the very simple example to illustrate the impact of IFRS 15. The reality can be much more complex. Have a nice day!

S.

Thanks Sivia. Great article. I liked your Telecom example.

Hi Silvia – great website!

The resource is quite informative.

I am unclear on how to recognize revenue relating to the provision of hardware (lets say handsets) and variable billing

– How would we recognize revenue on a) sale of handsets, if sales of handsets are included in the contract, but no price is set. Would it be the same as in the previous IAS? i.e revenue recognized based on invoice price.

– Would the revenue recognition of variable billing for capacity change? I would assume not.

Thanks

Hi Muhammad,

I promise I’ll write something more detailed about the standard IFRS 15 – this was really just an intro to make people aware. But shortly to your questions: 1) you need to apportion the revenue to handsets based on relative stand-alone prices. If there is no stand-alone price, then go for fair values and IFRS 15 gives a guidance on that. But you cannot bill the revenue based on invoice (as sale of handsets would be 0).

2) it depends on how specifically the contract is set. Kind regards, S.

Hi:

I am in a game developer company, and how can I put the value added tax to the revenue according to the gross method like USGAAP?

Hi, this is a very nice example. But i think there is a mistake. In your second table you show that the sum of the stand alone values is higher than the total price of the contract. IFRS 15.81 says that this would lead to a discount.

Or am i wrong ?

Hi Lukas, it’s OK. IFRS 15.81 says that

“Any overall discount compared to the aggregate of standalone selling prices is allocated between performance obligations on a relative standalone selling price basis.” – this is what I did in the short example.

IFRS 15.81 continues: “In certain circumstances, it may be appropriate to allocate such a discount to some but not all of the performance obligations.” – so yes, it might be OK to allocate this discount just to 1 obligation, for example to mobile phone sale. It all depends on the contract terms.

All the best! S.

Came across your website when looking for new IFRS and was pleasantly surprised to find very simple and easy to understand xplanations of complex standards including IFRS 15 and IAS 39! Keep it up Sylvie!

A very simple and easy to grasp case study of IFRS 15 application for student. Thank you Silvia! 🙂

Hi silvia :

its very useful

waiting your interesting video ….

In the case of addition is an example of calculating the revenue for construction contracts will answer additional questions .

Best Regards

Hi Osama,

thank you for your comment.

The point with construction contracts is far more complicated. It ALL depends on WHAT specifically is written in the contract. So in fact, there could be a situation that you build 2 same assets for 2 customers, just the contract terms are a bit different – and the accounting treatment for these same assets can be totally different.

But I’ll work on it in the future 🙂

S.

I work for a company doing Hire Purchase and Leasing . In what way will the new IFRS 15 affect revenue reporting ?

hi Sylvia.

your examples tend to be around contracts how would IFRS15 be treated for say a managed savings accounts MSA?

thanks

Hi Emmanuella, of course, this was just 1 example of the impact of IFRS 15. This standard will affect many entities in many different ways and it’s necessary to study it carefully. But as I see, lots of people are interested in practical examples and therefore, I’ll issue some short guide to IFRS 15 a bit later. S.

Hello Sylvia,

Thank you so much for putting IFRS 15 in a simple to understand format. I really like the way the diagrams illustrated the 5 steps. (One doesn’t forget pictorials easily) God bless you & cheers

Dear Silvia,

Currently I’m working on real estate company. However, Kindly explain with an example how it will affect my revenue since we do not provide any free services?

Hi Rosham, well, IFRS 15 impacts real estate companies in a different way. It depends on what your company specifically does. Do you develop real estate? Are you a construction company? Then IFRS 15 defines when the revenue shall be recognized “over time” or “at the point of time”. And only a small change in contractual terms decides whether to apply 1 or another approach. And what’s the difference? Well if you recognize revenue “over time”, then you can apply some percentage of completion method. When you recognize revenue “at the point of time”, then percentage of completion does not apply; you rather recognize revenue at the certain dates in line with the contract.

It’s not really possible to illustrate all this in 1 single article. I just wanted to say: Stay awake and carefully examine, because you might be affected. S.

Hi Silvia,

Your presentation is superb and simple. Keep going. Thanks for all of it.

Great Article 🙂

Thanks Silvia,

Outstanding and easy to understand. Keep going.

Al-Amin (Shanto)

Hi Sylvia,

How would you recognise revenue if a firm deals in writing policy papers about investment strategy in overseas market. These kind of assignments may straddle over a number of months.

Mike

Hi Mike, again, it depends on the terms stated in the contract. As I have written in some previous comment, you need to examine whether the revenue can be recognized “over time” or “at the point of time”. For example, are these papers delivered at 1 point of time and a client takes a control over them at the delivery date? Then the revenue should be recognized accordingly. S.

Hi Silvia,

Your doing a great job !!!

Hi Silvia!

Great article

Hi Sylvia,

I’ve managed to pass the ACCA, IFRS certification And your articles have helped me so much in this.

Thank you very much

GREEEAAAAAT!!!!

Big congratulation!!!!

Thank you for letting me know and CELEBRATE IT – you deserve it! 🙂 S.

Congrajulations for what you have achieved It would really a favour if you tell me the benefit to get this IFRS Certificate I am ACCA also.

Hi Sylvia,

Thank you for making IFRS a pleasure to read.

Pls keep up the good work!

Mike

Hi Silvia,

Thank you for this interesting introduction to the new IFRS.

But my confusion is that application of the new IFRS will be retrospective as you mentioned. I think I need more clarifications

OK, when you apply new accounting policy, you need to apply it retrospectively – that is as the new policy had always been in place, also for the existing items. That’s the requirement of IAS 8. New IFRS 15 is definitely a change in accounting policy. Therefore, when you find out that some of your contracts would be presented differently under IFRS 15 than under IAS 18, you need to re-calculate the revenues from these contracts from their beginning and make adjustment as of 1 January 2017 (or whatever is your application date).

Also, you need to be careful about comparative figures, too (year 2016).

Hi Silvia, In the above case of retrospective application of the revenue standard, what is the treatment to be followed if the contracts have already been closed/completed?

Do we need recognize the impact for the closed contracts also?

Hi DJ,

for closed contracts, there is no adjustment, right? But it depends on when the contracts were closed – if before the transition date, then there shouldn’t be any adjustment. However, you should check out the transitional provisions in IFRS 15, as they precisely specify the exceptions from making the transition (closed contracts are one of them). S.

Hi

Thanks for the explanation provided.

However I still do not think or see where the difference is between IAS 18 and IFRS 15 in terms of the recognition of revenue due to the following:

IAS 18 states that revenue should be recognised when there is a transfer of risks and rewards which I feel is essentially the same as the IFRS 15 requirements with the criteria that needs to be met. Thus the two standards are the same regarding the TIMING of the revenue recognition.

I think that the only difference comes into play regarding the allocation of the transaction price of the components of a transaction.

Can you please help me on this:-)

Thanks in advance.

Could I just clarify application date, you refer to as 2017. Should this read 2018?

Hi Silvia, Osama

From the above, if all existing contracts would time out by December 2016, I gather it would be best to adopt the new standard immediately.

Don’t forget that you need to re-calculate all contracts open before 2016 too, because you need comparative figures 🙂

And yes, adopting the new standard immediately is a nice idea, but it’s very difficult to implement it, because it requires a change in the accounting software or system, too (mainly in the companies with lots of contracts).

S.

Hi Sylvia

thanks for the explanations with illustrated example.

Really made it easy

Kind regards

Raj

Glad to help 🙂 Thank you! S.

Good day Silvia, thank you for always making IFRS interesting. Your write up about IFRS 15 above drives it home. It is an eye opener to the standard. Thank you.

Hi, Ayodeji, thank you! That’s exactly what I wanted to achieve 🙂

Hi Silva, Thank you so much for sharing a great amount of knowledge. I would like to know how IFRS15 is applicable on Shipping and freight revenues. Any idea?

This is very useful and easy to be understood. Thank you and wish you the best, Silvia ^^

Thank you! 🙂

Hi Silvia

What is the impact for Construction Contracts, the percentage of completiom remain aplicable?

Well, it depends on WHAT your construction contract says. IFRS 15 defines when the revenue should be recognized “at the point of time” and when “over time”.

So when your construction contract meets one of 3 criteria for recognizing revenue “over time”, then yes, you may apply percentage of completion method (=”method of measuring progress toward complete satisfaction of performance obligation”).

But you need to make sure that contract meets ONE of those 3 criteria.

Hi silvia ,

how did u arrived at the 300 for handset and 960 (80 X 12) in the 1st numerical eg . ?

Hi Oomesh, the question is example said that ABC sells handsets normally for CU 300 and monthly plans without free handsets for CU 80 / month. That’s how you need to allocate revenues to individual items in a bundle offer: try to find their stand-alone selling prices if available, so how how much you would charge for these items individually and then allocate the transaction price based on relative stand-alone selling prices.

S.

Sylvia,

If the contract was longer than a year, could the difference (R60) not have been treated as finance income and recognised over the period of the contract using the effective interest rate?

Hi Ronell, the thing is that the full amount is not received in 1 amount – it’s just an aggregate of monthly billings. Also, the service is not provided in 1 moment of time. It is the continual service provided over 1 year. So I would say in this case, you would not discount anything. S.

Hi Silvia,

In above illustration you have mentioned that the ABC can sell the handset separately as well, what if they don’t sell the handset separately? Business nature is such that they provide only together (handset+ network services) Then there should be single performance obligation right? We do not have to find the standalone price for handset? will there still be allocation of transaction price?

Hi Silvia,

Thanks so much for that elaborate and simple example, But my question is how are the limitations of IAS 11 been solved or addressed by the new standard IFRS 15

Thank you

Thank you madam. For that example/illustration

Hi Silvia,

What are the Balace sheet implications will we have a Contract Asset/Liability as a result of the subsidy given on the device. Also will there be continuities required for disclosure purposes.

Hi Khan, your questions would require detailed answer, not very suitable in the comments, but in short – yes of course it has an impact on a balance sheet, since before you recognized zero revenue for the device and thus zero contract asset; now you have some asset that needs to be tested for impairment under IFRS 9.

hi silvia , sorry , yeah i got it its in the scenario . i saw it . thanks .