IFRS 15: Practical Revenue Recognition + Free Video & Checklist

Updated: May 2025

IFRS 15 Revenue from Contracts with Customers brought the most significant change in revenue recognition under IFRS. It affects almost every company with customer contracts — and applying it correctly takes more than just knowing the 5 steps.

In this quick summary, you’ll learn the core rules and practical insights to apply IFRS 15 effectively — including contract costs, presentation, disclosures, and adoption options. Also, you can download free practical IFRS 15 compliance checklist below.

Jump to section:

1. Free VIDEO lecture: Overview of IFRS 15 Revenue from Contracts with Customers

2. Objective and scope of IFRS 15

3. The 5-step revenue recognition model

- 3.1 Step 1: Identify the contract with the customer

- 3.2 Step 2: Identify the performance obligations in the contract

- 3.3 Step 3: Determine the transaction price

- 3.4 Step 4: Allocate the transaction price to the performance obligations

- 3.5 Step 5 Recognize revenue when (or as) the entity satisfies a performance obligation

4. Contract costs

5. Presentation and disclosures

6. Note to adoption

7. DOWNLOAD IFRS 15 Practical Checklist

8. Further reading&learning

1. Overview of IFRS 15 Revenue from Contracts with Customers (free VIDEO lecture)

2. Objective and scope of IFRS 15

IFRS 15 sets the principles to apply when reporting about:

- the nature;

- the amount;

- the timing; and

- the uncertainty

of revenue and cash flows from a contract with a customer.

Let me stress “a customer” here. If you have a contract with party other than a customer, then IFRS 15 does not apply.

Sometimes, it’s quite difficult to determine whether you deal with a customer or simply with a collaborating party (e.g. some mutual development projects with other entities), therefore take care!

Also, be aware that there are some scope exclusions from IFRS 15, namely:

- Leases (IAS 17 or IFRS 16)

- Financial instruments and other rights and obligations within the scope of IFRS 9 (IAS 39), IFRS 10, IFRS 11, IAS 27, IAS 28;

- Insurance contracts (IFRS 4) and

- Non-monetary exchanges between entities within the same business to facilitate sales.

We need to apply IFRS 15 for periods starting from 1 January 2018 or later.

3. The 5-step revenue recognition model

The main aim of IFRS 15 is to recognize revenue in a way that shows the transfer of goods/services promised to customers in an amount reflecting the expected consideration in return for those goods or services.

It seems understandable and very easy at first sight, and it truly is in many cases. So why is IFRS 15 so extensive?

Well, because many situations are not straightforward and entities recognize revenues differently in these cases, for example:

- Buy 1+get 1 free;

- Buy monthly prepaid plan + get handset for free;

- Earn loyalty points and cash them out/receive free goods later on;

- Get bonuses for delivery on time; etc.

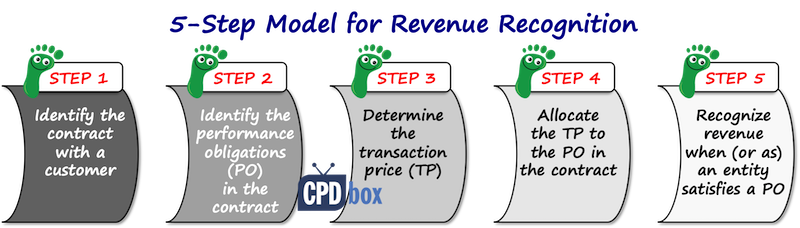

To make it systematic, IFRS 15 requires application of 5 step model for revenue recognition (go to this link to see full guide of IFRS 15 5-step model with videos, examples and journal entries template).

The 5 steps are shown in the following picture:

3.1 Step 1: Identify the contract with the customer

A contract is an agreement between 2 parties that creates enforceable rights and obligations (IFRS 15, Appendix A).

You need to apply IFRS 15 to all contracts that have the following 5 attributes (IFRS 15.9):

- Parties to the contract has approved it and are committed to perform;

- Each party’s rights to the goods/services transferred are identified;

- The payment terms are identified;

- The contract has a commercial substance; and

- It is probable that an entity will collect the consideration – here, you need to evaluate the customer’s ability and intention to pay.

So, if the contract does not meet all 5 criteria, then you don’t apply IFRS 15, but some other standard.

Therefore, be careful about intragroup transactions, as they often lack a commercial substance (as these companies often transfer inventories and other items at prices different than the market).

IFRS 15 provides a guidance about contract combinations and contract modifications, too.

Contract combination happens when you need to account for two or more contract as for 1 contract and not separately. IFRS 15 sets the criteria for combined accounting.

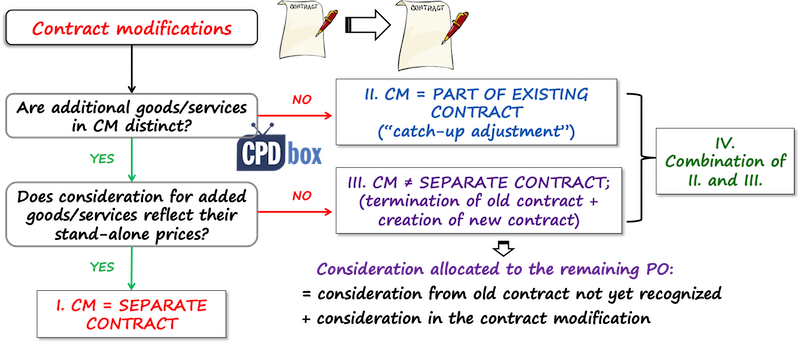

Contract modification is the change in the contract’s scope, price or both. In other words, when you add certain goods or services, or you provide some additional discount, you are effectively dealing with the contract modification.

IFRS 15 sets different accounting methods for individual contract modification, depending on certain conditions.

3.2 Step 2: Identify the performance obligations in the contract

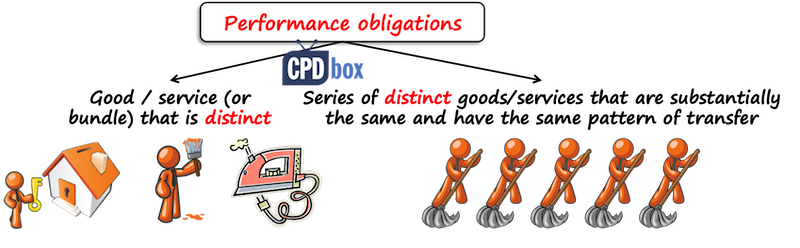

Performance obligation is any good or service that contract promises to transfer to the customer.

It can be either (IFRS 15 App. A)

- A single good or service, or their bundle that is distinct; or

- A series of distinct goods or services that are substantially the same and have the same pattern of transfer.

An essential characteristic of a performance obligation is the word “distinct”. Simply said, distinct means separable, or separately identifiable, and IFRS 15 sets criteria that you must assess in order to determine whether the performance obligation is distinct or not.

Let me say that this is extremely important and you must do it right.

The reason is that in further steps, you will account for distinct performance obligations and their revenues separately, in line with their allocated transaction price, and if you fail in the correct identification of distinct performance obligations, then the whole contract accounting will be wrong.

I say more about that in my IFRS Kit, so check it out if you need.

Let me also add that the performance obligations can be both explicit (e.g. written in the contract) and implicit (e.g. implied by some customary practices).

Also, if there’s no transfer to customer, then there’s no performance obligation. For example, imagine you construct a building for your client. Before you actually start, you build a small mobile toilet for your workers. As this will not be delivered to your customer, it is not a separate performance obligation.

3.3 Step 3: Determine the transaction price

The transaction price is the amount of consideration than an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties (IFRS 15 Appendix A).

That’t the definition from the standard and in other words, it’s what you expect to receive from your customer in return for your supplies.

Attention – it’s NOT always the price set in the contract. It is you expectation of what your receive.

It means that you need to estimate the transaction price.

How?

First, you need to take the price stated in the contract as some basis (if applicable).

- Variable consideration – are there some bonuses or discounts, for example, performance bonus?

- Constraining estimates in variable consideration – you should include variable consideration (e.g. bonus) in the transaction price only when it’s highly probable that you can keep it (this is a big simplification);

- Significant financing component – if your clients will pay you with delay, do the payments reflect the time value of money?

- Non-cash consideration – do you receive some non-cash items from your customer in return for your goods or services?

- Consideration payable to a customer – do you provide some vouchers or coupons to your customers?

- And other factors.

3.4 Step 4: Allocate the transaction price to the performance obligations

Once you have identified the contract‘s performace obligations and determined the transaction price, you need to split the transaction price and allocate it to the individual performance obligations.

The general rule is to do it based on their relative stand-alone selling prices, but there are 2 exceptions when you allocate in a different way:

- When allocating discounts, and

- When allocating considerations with variable amounts.

A stand-alone selling price is a price at which an entity would sell a promised good or a service separately to the customer (not in the bundle).

The best way to determine a stand-alone selling price is simply to take observable selling prices and if these are not available, then you need to estimate them. IFRS 15 suggest a few methods for estimating stand-alone selling prices, such as adjusted market assessment approach, etc.

If this seems to theoretical, let me point you to this article. It illustrates all steps on a very simple telecom example.

3.5 Step 5 Recognize revenue when (or as) the entity satisfies a performance obligation

A performance obligation is satisfied (and revenue is recognized) when a promised good or service is transferred to a customer. This happens when control is passed.

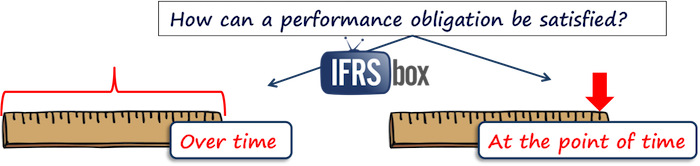

A performance obligation can be satisfied either:

- Over time – in this case, control is passed to the customer over some period of time (e.g. contract term); or

- At the point of time – in this case, control is retained by the supplier until it is transferred at some moment.

IFRS 15 sets a few criteria when you should recognize revenue over time. In all other cases, revenue is recognized at the point of time.

You can read more about it in this article, or learn it in details in my IFRS Kit.

Except for these 5 steps, IFRS 15 arranges a few other areas, such as…

Return to top

4. Contract costs

IFRS 15 provides a guidance about two types of costs related to the contract:

- Costs to obtain a contract

Those are the incremental costs to obtain a contract. In other words, these costs would not have been incurred without an effort to obtain a contract – for example, legal fees, sales commissions and similar.These costs are not expensed in profit or loss, but instead, they are recognized as an asset if they are expected to be recovered (the exception is the contract costs related to the contracts for less then 12 months). - Costs to fulfill a contractIf these costs are within the scope of IAS 2, IAS 16, IAS 38, then you should treat them in line with the appropriate standard.If not, then you should capitalize them only if certain criteria are met.

5. Presentation and Disclosure

IFRS 15 requires entities to present and disclose revenue in a way that provides users of financial statements with clear, relevant information about the nature, amount, timing, and uncertainty of revenue and related cash flows.

Here are the main requirements:

5.1 Presentation

- Revenue must be presented separately in the statement of profit or loss (IFRS 15.113).

- Contract assets and contract liabilities must be disclosed on the face of the financial position or in the notes (IFRS 15.105):

- Contract asset arises when an entity has transferred goods/services but not yet billed the customer.

- Contract liability arises when a customer pays in advance for goods or services not yet delivered.

5.2 Disclosures

The disclosures aim to explain the revenue recognition in more detail and typically include:

- Disaggregation of Revenue (IFRS 15.114–115):

Revenue must be disaggregated into meaningful categories (e.g., by geography, product line, type of customer, or contract duration) to help users understand revenue drivers. - Contract Balances (IFRS 15.116–118):

Disclose opening and closing balances of contract assets, liabilities, and receivables, and explain significant changes during the period. - Performance Obligations (IFRS 15.119–122):

- Describe when performance obligations are typically satisfied.

- Outline payment terms and whether there are significant financing components.

- Explain the nature of variable consideration and how it is estimated.

- Transaction Price Allocation (IFRS 15.123–124):

Disclose the amount of transaction price allocated to remaining performance obligations and explain when this revenue is expected to be recognized. - Contract Costs (IFRS 15.127–128):

If contract costs are capitalized (e.g. sales commissions), disclose the balances and amortization policies. - Significant Judgments (IFRS 15.123, 129–133):

Disclose judgments made in applying IFRS 15, such as:- Whether performance obligations are satisfied over time or at a point in time;

- Methods used to recognize revenue (e.g. input vs output methods);

- Estimates made when measuring progress or transaction prices.

These disclosures are not optional and should be tailored to the specific facts and circumstances of your business. Generic or overly brief (i.e. “boilerplate”) disclosures are discouraged by regulators.

Return to top

6. Note to adoption of IFRS 15

IFRS 15 became mandatory for reporting periods beginning on or after 1 January 2018. Most companies have already adopted it, but if you’re reviewing past transitions or joining a new reporting regime, you may still need to apply the transition rules, so let me just quickly sum them up:

As the requirements of IFRS 15 are very extensive and demanding, IFRS 15 permits 2 methods of adoption:

- Full retrospective adoption

Under this approach, you need to apply IFRS 15 fully to all prior reporting periods, with some exceptions. - Modified retrospective adoption

Under this approach, comparative figures remain as they were reported under the previous standards and you recognize the cumulative effect of IFRS 15 adoption as a one-off adjustment to the opening equity at the initial application date.

7. DOWNLOAD IFRS 15 Practical Checklist

8. Further reading and learning

Explore more on IFRS 15: Visit this page to access the full library of all IFRS 15-related articles, videos, and examples published by CPDbox.

Learn IFRS with real examples – not just theory.

Any questions? Please let me know below, thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello silvia

I have a doubt. When we issue tax invoice as per ifrs 15, we Debit customer account and credit billing on contract or contract liability and when we record revenue we debit contract asset and credit revenue .there is a mismatch in revenue as per invoice issued and revenue recognized in P &L .How tax department treat this difference? will they accept paying corporate tax as per the income recognized?

Dear Suresh,

there should not be a mismatch, because the specific entries depend on the sequence of the transactions. For example, you provide service to the customer, but cannot bill yet – the entry is Debit Contract Asset/Credit Revenue. Then you can bill, so the entry is Debit Receivable to the customer/Credit Contract Asset (not contract liability, since you recognized the asset first).

As for tax department – that is totally different issue and depends on the tax legislation.

Hi Silvia, Company A has a project. they invoice 45% at the beginning and the 55% upon completion. Customer requested 55% to be paid over 11 months. should the 55% be recognised in month of completion by way of Debiting Accrued Income and Crediting Sales? Then as the monthly invoices are raised for payment we cancel the amount against Accrued Income? Is this the correct way? Do we need to consider gross margin at all?

Not much info here. OK, let’s assume that the revenue is satisfied over time (not at the point of time), so you need to measure the progress towards completion. My advice is to see payments separately from recognizing revenue. So, the journal entry when you recognize revenue based on progress towards completion: Dr. Contract Asset (or Contract Liability if Co. A got some cash from the customer earlier) / Cr. Revenue. When you have a right to payment, then Dr. Trade Receivable / Cr. Contract Asset. And yes, if you are recognizing revenues this way, you of course consider gross margin.

You wrote “Costs to fulfill a contract – If these costs are within the scope of IAS 2, IAS 16, IAS 38, then you should treat them in line with the appropriate standard. If not, then you should capitalize them only if certain criteria are met.”

Two questions

1. Does it mean if I bundle a product with an installation, they are one performance obligation, that revenue recognition should happen when the installation is finished? The installation takes 3 months for example.

2. The revenue will not be matching cost as the product was delivered much earlier?

Hi Fred,

I think you are combining two different items. If you actually charge for the installation, then it is a performance obligation (you need to assess if it is distinct). On the other hand, costs to fulfil a contract are your own supplier’s costs, so how much will providing that installation cost YOU (not your client).

Hi Silvia,

What should we do if we recognize the revenue without doing collectability assessment.

And later on we realized that collection is not possible.

Can we reverse the revenue is this case, considering it was never supposed to reported because contract didn’t exist as per IFRS 15 criteria.

Hi Taher, instead of reversing revenue, you should be looking at IAS 8, more specifically – correction of errors. From what you wrote I can conclude that if the contract did not exist at all, you made an error in accounting for the revenue, thus you should correct it in line with IAS 8.

Hi Siliva,

Thanks for you prompt response.

Will your answer be different if I say at the timing of signing the contract customer ability and intention to pay was okay, but there was a notification from government in the country where customer is operating restricting transfer money to country in which company operates. Obviously company would not be aware of the all notification published in the different countries where its customer are operating. After signing the contract and satisfying the performance obligation company came to know about this fact, which already existed at the time of signing the contract. Please let me know what does the the IFRS or IASB says on this.

Hi Silvia

thank you for keeping and sharing a lot of resources for all of us.

I would like to seek your opinion on some matter that i have encountered.

Here is the fact, my Company functional currency is in US$. We have entered long term contract for shipbuild for our customer (of course will meet revenue recognition overtime). The matter is our contract here is under foreign currencies, let say it is CNYRMB.

Of course all our cost will incurred majority in US$ when fulfilling our contract performance obligation. What we would like to seek your opinion is, when we do monthly or annual assessment for the revenues recognized, :

1. shall assess it under CNYRMB on then translated it into US$ for our accounting and reporting purposes?

or

2. shall we assess it at the beginning of the contract which CNYRMB times US$ rate (as initial contract price) at the contract date, then record the contract assets at each period based on the initial contract price which has predetermined. Any movement on foreign currency shall resolved when do the billing to our customers?

please share your opinion on this,

Thanks alot

Hi silvia, i also have the same question to ask.

Hi Budi and Chacko,

a few points:

1) If a contract is in CNY, then the revenue (and all related items such as contract assets, contract liabilities, etc.) shall be assessed in CNY.

2) Contract assets is monetary and contract liabilities under IFRS 15 are non-monetary. Contract liabilities are not subsequently revalued to the functional currency (USD in this case). Initially they are recognized at the transaction-date spot rate (and not revalued subsequently). Contract asset is subsequently revalued to the closing rate.

I recommend skimming through the illustrative examples of IFRIC 22 – there are similar cases.

Hi Silvia

Your response is very much appreciated.

Thank you and have a nice day

Hi Silvia,

Need clarification on this particular issue. I’d really appreciate if you could clarify.

We are into district cooling and our contract with customers have two revenue streams one is consumption fee and the other one is annual capacity fee.

Revenue is recognized at the service commencement date. However due to financial difficulties customer could not complete the construction of his tower on due date.

But the contract states that irrespective of the amount of cooling service consumed annual capacity shall be paid.

So can we recognize the annual capacity fees though the tower is not connected for cooling service? Please note that the cooling capacity is already reserved for him and cannot be sold to another customers.

Thanks

Hi Sylvia,

Previously, I would like to thank you since all your article about IFRS is helping me to get understand more. I have a question related to the revenue recognition under IFRS 15 for manufacturing services. For example, Company A is manufacturing and sells the product. Company A also provides manufacturing services, i.e., converting customers’ raw materials to finished goods and transporting the finished goods to the customer’s warehouse.

My question is: whether the manufacturing services meet the IFRS 15 Paragraph 35.b that the entity’s (in this case Company A) performance creates or enhances an asset (in this case convert the customer’s raw materials to be finished goods) that the customer controls as the asset (in this case: the raw material belongs to the customer). ?Should the revenue be recognized over time?

Many Thanks

We have incurred expenses in relation to claim by the customer – such as quantity claim, price flunctuations claim. How can we present it in P/L? Is it be netted against revenue?

We have collaboration with other company to fund for an upcoming project, how this is accounted as per the IFRS 15

Hello Sylvie. Thanks for this article.

Our company enters into a contract to offer consultancy services at a fee €50,000. Our company was to be paid on submission of an acceptable consultancy report. The company is paid a commitment fee of €10,000 by the customer which amount would be offset from the contract price on submission of the report. At the year end our we have not submitted the report since the client had not yet cleared the draft report. We apply IFRS 15 when recognising revenue.

Should revenue be recognized and of how much? Thanks

Is it right to say that no revenue should be recognized. The €10,000 is treated as deferred income (liability). Thanks

Hi Kapala, well, submission of a report can be seen as a milestone – however, you should really assess whether the performance obligation (consultancy services) are provided at the point of time or over time. From what you wrote – I cannot really assess. You should be looking at three conditions or indicators of providing services over time, i.e. customer simultaneously consumes as you perform, etc. So, if your performance obligation is satisfied at the point of time, then you are right, but if it is over time, then you should really recognize revenue by reference to progress towards completion. When it comes to specific consulting services with no alternative use, then “over time” recognition is appropriate in most cases, but again, I cannot say for sure in your case. S.

Hello,

We recently finished constructing an airport. The airport is located in a remote location, to promote the facility special lowe rates were advertised to airlines from the

Launch date for 1 year.

My question is, is there any special accounting required

Thanks

Revenue rec explained really well

Hi Silvia!

Thanks for the detailed clear explanation.

I just wanted to ask, can we recognise revenue on completion of a part of a performance objective?

E.g. If the objective is to dig a 20 meter hole and as at year end a 10 meter hold is dug.

Can the company recognise half of the revenue allocated to that performance objective as a work in progress?

Or would the company have to transfer their expenses incurred as advanced expenses?

Dear Silvia

my Company recognizes revenue in accordance with IFRS 15. For some of our customers, we have arranged subsequently new payment terms in arrears (up to two years), because they could not pay when the invoiced amounts were due.

Should we continue to recognize trade receivables (current); or reclassify the amounts due over 12 months to non-current items? Is this an adjustment of significant financing component (after contract inception there is a change in the expected period between customer payment and the transfer of goods or services)?

Thank you!

Hi Jane,

if you have right to bill the full amount, just the payment was deferred, then yes, significant financing component arose and you need to adjust. And of course, some of your current receivables became non-current. S.

Hi, may i know how to recognize the revenue of a business which is renting vehicles for 1-7 days to customers. whether it’s coming under IFRS 15 or IFRS 16.

Hi Silvia,

How this IFRS 15 improve operating revenues?

Hi Silvia,

When can we consider that a Sale and leaseback transaction is NOT a sale under IFRS 15?

Dear Silvia

Can we recognize the scrip dividend/stock divided as an income ?

Kosala

Hi Silvia,

Can you explain more on the significant financing component and the determination of a discount rate to use? If I have a license contract with a customer for 4 yrs, whereby the revenue is recognised point in time at the inception of the contract (i.e. grant of the license), but the billings are made monthly for the next 4 yrs. There seem to be a significant financing component, whereby I would recognise interest income from the monthly billing. However, I am unsure of how to determine a discount rate to use. Does it have to reflect the credit risk of my customer?

Hi Tam, are you sure you need to recognize revenue at the point of time in this case? There are 2 types of licenses and when you have “right-to-access”, you actually need to recognize revenue OVER time. From what you wrote here, it seems this is this type of a license (as the right to access terminates after 4 years). Please check this Q&A, I described it there. In this case there would not be any significant financing component.

Hi Silvia,

Thanks for the great explanation in that Q&A regarding software license! We have actually determined that our license is right to use and hence point in time. The main concern now is that the billing are made monthly for the next 4 years (like an zero-interest installment). In this case, we would need to account for significant financing component. But how should we determine the discount rate?

I want to implement IFRs 15 and my question is do I need to recompute the revenue from the contract date, say 2003 and adjust for all modifications or I need to start at a convenient date e.g. from the time of takeover of the books of the company.

Under IFRS 15, can we recognise the full selling price of the service as revenue if it is offered for free e.g. Cr Revenue – $150 and Dr discount/cost of Service – $150 or should no revenue be recognised as it nets off to 0. Appreciate your assistance.

Many Thanks

Yes, but in this case we have increased the sales of previous year and decreased the sales of this year, we have made the worng allocation of revenues without correcting it.

We have debited a revenue account which hasn’t been credited while the revenues are now included in the retained earnings. I think it wouldn’t be a fair presentation.

Thank you so much!

I know what you mean – and this is why I added a note “However, I need to ….”. Also from this scarce information I really cannot give reliable advice.

Thank you for your answer…. I appreciate it….

Hi Silvia,

I have a small question, if we have issued an invoice in 2018, and we want to make sales return in 2019. The Financial Statement are already issued and the revenues account has been closed in the retained earnings. What is the accounting treatment in this case?

Well, the return is an event of the current reporting period – isn’t it? Thus make an adjustment in the current reporting period. However, I need to warn you – if there are possibilities of sales returns and you have some statistics, you should bear that in mind when recognizing the revenue in the first instance.

Hi Silvia

I really like your videos and how you explain the standards.

Could you please help me with the question below:

If a company is reimbursed for overtime which is not part of original contract, do we treat this cost reimbursement as revenue, other income or we net it with expenses?

Looking forward to your reply.

Hi Sebastian, thank you! I would say this is a part of revenue and is recognized in revenues immediately as the service is provided.

Hi Silvia.

Thanks for the good work.

I would be glad to have clarifications on how revenue is recognized in a Logistics company that serves as intermediary between two parties.

(a) Company A has a platform that serves as intermediary between truck owners and cargo owners.

(b) It charges cargo owners the sum of $500 and pays truck drivers $400 to move goods to the cargo owners.

(c) For business purpose, the spread of $100 is not disclosed so when invoices are issued to cargo owners, $500 is always stated together with the applicable Sales Tax and Withholding tax is deducted by Cargo owners on the $500 quoted.

(d) Truck drivers charge appropriate sales tax on the invoice of $400 issued to company A and company A deducts Withholding tax on the invoice as required by law.

(e) Company A in most cases make advance payment to truck drivers to mobilize them to quickly deliver, however, it doesn’t get paid by cargo drivers until waybill is stamped showing actual delivery of items by cargo drivers.

Questions:

1. Is $500 the right amount of Revenue or the spread of $100

2. What will be the cost of sales.

3. What is the appropriate amount of Sales tax that should be charged.

4. How should the advance payment to truck owners be treated

Thank you.

Hi Silvia – Thanks for illustrating IFRS 15, excellently.

In my current company, we’re sometime swapping commodities (feed stock or semi finished goods or finished products) with other local companies with non-monetary values. I am struggle to find out a way how would I record these transactions with out impacting my Days sales outstanding? Does IFRS defines the Commodities Swaps (non-monetary) with outside entities that not come under same business.

Looking for your kind advise.

Regards,

Hi Muhammad, thank you! I think this Q&A episode will give you some answer to that.

Thanks Silvia for referring the article. I was fortune enough to read the article “account for barter transaction” before-hand while I posted my above comment. In my scenario, we’re swapping commodities (feed stock) of same nature at same price but in different time period. My local tax regulations enforces me to treat this event like sale but in actual this is not a sale. This is just a swapping to fulfill the needs of each other and save the time of shipping. But on the other hand it is badly effected my company’s DSO due to this artificial sale entry.

I am looking for way around to avoid this non necessary sales entry under IFRS guidelines. Please advise.

Regards,

Hi Muhammad, I pointed you to this article because I have the same position to your case as I took in the article. Please bear in mind that tax rules can differ from the IFRS rules and yes, although it is not a sale (just swap under IFRS 15), you might need to pay income taxes in line with your tax legislation. Thus I believe you should negotiate this with your tax authorities.

Thanks Silvia – I wish if I could discover some other way rather than convincing tax authorities 🙂

Regards,

Spanish version is larger than this English version

Dear Silvia,

How is ifrs 15 applicable to work in progress in construction company?

Yes, if the construction company has WIP as a result of some contract with customer.

Hi Sylvia

wander if you can help me clarify principles of reporting on a Principle Agency transactiom To exemplify my issue :

1. Company A ( principle) provides services to Company B ( Agent) who sells Company A products to Customers thru their website . A has given two type of rates .

a) Gross retail rates – B sells at specified prices by A and receives a commission of say 20%

b) Net rates – B sells to customer with a mark up can be anything upward to A’s retail price and collect margin ( difference between price sold to customer and net rate as commission directly from customer. A invoices the agreed net rate to B and collects cash .

c) In both cases A deliver the product to customer booked by B

So principle

what would the accounting be for Company A as a principle. Assume the following:

Gross Transaction : – Sold at 123 including VAT of say 23% . A collects 123 from customer. A Accounts for VAT 23 . retains Net 100 . A pays be 20% of 100 to B as commission and reclaims VAT on commission.

Net transaction: A has agreed a net rate of say 70 incl VAT 23%. B sells it at 95 and keeps 25 as commission. A receives 70 and accounts for VAT 23% and recognises revenues at 57 accounts for VAT 17.. so

Q1 – is A liable to pay VAT as principle on the 25 margin B makes ?

Q2 . Should A report 25 as revenue ?

what should be correct accounting disclosures for principle ?