IAS 21 The Effects of Changes in Foreign Exchange Rates

These days people use about 180 currencies world wide!

The truth is that we, people, don’t want to stay isolated. We love to sell, buy, import, export, trade together and do many other things, all in foreign currencies!

When you look at the business world, you’ll see that business go global in two ways: they either have individual transactions in foreign currencies, or when they grow bigger, they often set up foreign operations (separate business abroad).

Moreover, the exchange rates change every minute. So how to bring a bit of organization into this currency mix-up? That’s why there is the standard IAS 21 The Effects of Changes in Foreign Exchange Rates.

What is the objective of IAS 21?

The objective of IAS 21 The Effects of Changes in Foreign Exchange Rates is to prescribe:

- How to include foreign currency transactions and foreign operations in the financial statements of an entity; and

- How to translate financial statements into a presentation currency.

In other words, IAS 21 answers 2 basic questions:

- What exchange rates shall we use?

- How to report gains or losses from foreign exchange rates in the financial statements?

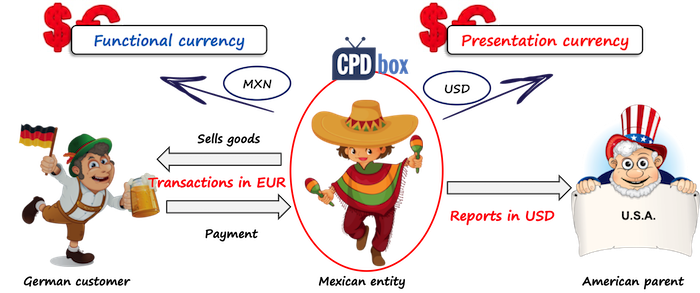

Functional vs. Presentation Currency

IAS 21 defines both functional and presentation currency and it’s crucial to understand the difference:

Functional currency is the currency of the primary economic environment in which the entity operates. It is the own entity’s currency and all other currencies are “foreign currencies”.

Presentation currency is the currency in which the financial statements are presented.

In most cases, functional and presentation currencies are the same.

Also, while an entity has only 1 functional currency, it can have 1 or more presentation currencies, if an entity decides to present its financial statements in more currencies.

You also need to realize that an entity can actually choose its presentation currency, but it CANNOT choose its functional currency. The functional currency needs to be determined by assessing several factors.

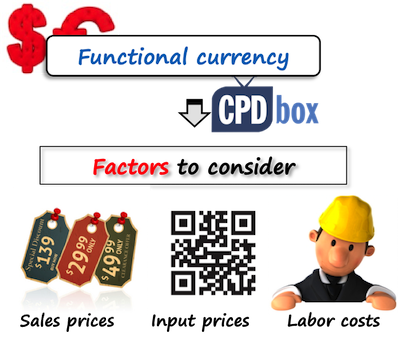

How to determine functional currency

The most important factor in determining the functional currency is the entity’s primary economic environment in which it operates. In most cases, it will be the country where an entity operates, but this is not necessarily true.

The primary economic environment is normally the one in which the entity primarily generates and expends the cash. The following factors can be considered:

- What currency does mainly influence sales prices for goods and services?

- In what currency are the labor, material and other costs denominated and settled?

- In what currency are funds from financing activities generated (loans, issued equity instruments)?

- And other factors, too.

Sometimes, sales prices, labor and material costs and other items might be denominated in various currencies and therefore, the functional currency is not obvious.

In this case, management must use its judgment to determine the functional currency that most faithfully represents the economic effects of the underlying transactions, events and conditions.

How to report transactions in Functional Currency

Initial recognition

Initially, all foreign currency transactions shall be translated to functional currency by applying the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

The date of transaction is the date when the conditions for the initial recognition of an asset or liability are met in line with IFRS.

Subsequent reporting

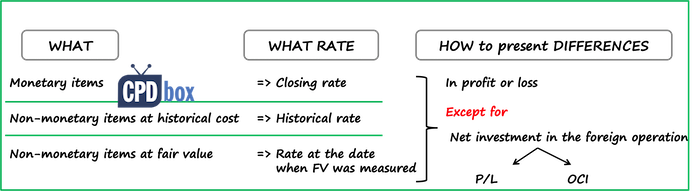

Subsequently, at the end of each reporting period, you should translate:

- All monetary items in foreign currency using the closing rate;

- All non-monetary items measured in terms of historical cost using the exchange rate at the date of transaction (historical rate);

- All non-monetary items measured at fair value using the exchange rate at the date when the fair value was measured.

How to report foreign exchange differences

All exchange rate differences shall be recognized in profit or loss, with the following exceptions:

- Exchange rate gains or losses on non-monetary items are recognized consistently with the recognition of gains or losses on an item itself.For example, when an item is revalued with the changes recognized in other comprehensive income, then also exchange rate component of that gain or loss is recognized in OCI, too.

- Exchange rate gain or loss on a monetary item that forms a part of a reporting entity’s net investment in a foreign operation shall be recognized:

- In the separate entity’s or foreign operation’s financial statements: in profit or loss;

- In the consolidated financial statements: initially in other comprehensive income and subsequently, on disposal of net investment in the foreign operation, they shall be reclassified to profit or loss.

Change in functional currency

When there is a change in a functional currency, then the entity applies the translation procedures related to the new functional currency prospectively from the date of the change.

How to translate financial statements into a Presentation Currency

When an entity presents its financial in the presentation currency different from its functional currency, then the rules depend on whether the entity operates in a non-hyperinflationary economy or not.

Non-hyperinflationary economy

When an entity’s functional currency is NOT the currency of a hyperinflationary economy, then an entity should translate:

- All assets and liabilities for each statement of financial position presented (including comparatives) using the closing rate at the date of that statement of financial position.

Here, this rule applies for goodwill and fair value adjustments, too. - All income and expenses and other comprehensive income items (including comparatives) using the exchange rates at the date of transactions.

Standard IAS 21 permits using some period average rates for the practical reasons, but if the exchange rates fluctuate a lot during the reporting period, then the use of averages is not appropriate.

All resulting exchange differences shall be recognized in other comprehensive income as a separate component of equity.

However, when an entity disposes the foreign operation, then the cumulative amount of exchange differences relating to that foreign operation shall be reclassified from equity to profit or loss when the gain or loss on disposal is recognized.

Hyperinflationary economy

When an entity’s functional currency IS the currency of a hyperinflationary economy, then the approach slightly changes:

- The entity’s current year’s financial statements are restated first, as required by IAS 29 Financial Reporting in Hyperinflationary Economies. Comparative figures are used the same as current year’s figures in the financial statements from previous reporting period.

- Only then, the same procedures as described above are applied.

IAS 21 prescribes the number of disclosures, too. Please watch the following video with the summary of IAS 21 here:

Have you ever been unsure what foreign exchange rate to use? Please comment below this video and don’t forget to share it with your friends by clicking HERE. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Sylvia,

I work for an NPO and would like to know the treatment of exchange rate differences of funds received from donors. At the budgeting stage we use the spot rate and these budgets can be for a period of 3years and the funds received in tranches. Please advise, thank you.

Regards,

Farisai

Please consider below situation –

X Ltd is registered in Georgia (Europe) and is engaged in power business. Power is sold 20% in local georgian market and 80% in Turkey. All sales proceeds are converted in USD on receipt of revenue. The providers of capital i.e. Term loans and equity provides funds in USD.

The functional currency decided by management is Lari (Georgian Currency). Now at every end of period, outstanding loan is being revalued and the exchange difference (USD-lari) is charged to Profit & Loss Account. This exchange loss is a non-cash item because this notional loss will never impact the profitability of the company, as the loans are denominated in USD and loan liability will remain in USD.

In this situation, can Company route such exchange loss on revaluation of loans through other comprehensive income instead of hitting P&L statement.

Hi Mohit, no, I’m sorry. I understand your concerns, but if your functional currency is Lari, then you need to re-calculate and recognize the difference via P/L. S.

Thanks Silvia.

Dear Silvia

I am a bit confused about journalizing foreign currency transactions,let say a sale of goods in foreign currency on account.

The standard says that you translate it to functional currency by applying the spot exchange rate. The receivable is denominated in foreign currency while it is journalized in the functional currency. If it is not flagged as a receivable in foreign currency then you cannot keep keep track of the change in value do to the change of the foreign currency exchange rate. How do you specify that in the general journal? Thanks a lot in advance

Dear gen,

usually, as far as I know, these foreign currency items are recognized in 2 currencies in the accounting system – both functional and foreign. Of course, you see only the balance in the functional currency when looking to the general ledger, but the information should be somewhere in the system. S.

Dear Silvia,

Kindly help me in regard to below query:

Treatment of FX rate variation on imported material: Kindly note that we import material e.g. from US and have SAP system in our company.

At the time of Goods Receipt system (i.e. SAP) Debit the inventory with exchange rate at the time of receipt of material and pass the entry

Matetrial Account ——Debit (With FX rate at the time of Goods Receipt)

To GR/IR Clearing Account.

On receipt of Invoice from Vendor system pass the entry

GR/IR Account———–Debit (With FX rate at the time of GR)

Price Rate Difference—Debit (With FX rate variation between GR and Date of Invoice Receipt)

To Vendor Account (FX Rate at the time of Invice Receipt)

My query is whether the price rate difference mentioned above should charge on the Material or directly charged in Profit & Loss Account?

Please advise……….

Rgds

Rajesh

Dear Rajesh,

the question is what the transaction date is. In my opinion it is the date when you accepted inventories, not the invoice. Therefore, the price difference should be recognized in profit or loss. You can read more about it here. The article is about the prepayments in foreign currency, but it explain quite clearly what the transaction date is and it helps you understand the issue. S.

Hi Silvia, in the above example if it is not a prepayment and as you mentioned it should flow to Profit & Loss. So whether difference between GRN and Invoice booking to be recorded as unrealized gain/loss or realised.

Hi Sylvia, Revenue was recognised in year 2014 in VEF which has steeply declined up till 2016, subsequently invoice was also cancelled and reissued with revised rates in 2016. Should revenue be also reversed in 2016 and re-recognised at a revised rate or it should be adjusted through retained earnings? Could you please quote relevant para of IFRS addressing the issue? Thanks a lot in advance.

Dear Allan,

the good question here is why the invoice was cancelled and reissued – was is just due to the change in the VEF?

If it relates to the correction of the revenue itself, then yes, it would be appropriate to correct the retained earnings (it’s a correction of error in the past, please see IAS 8).

If it relates only to the change in VEF and adjusting the receivable in VEF to reflect the change, but it has nothing to do with the past revenue, then I would simply recognized changes in P/L. The reason is that it’s a current-year transaction, something like “revising a receivable and passing the loss to a client”. S.

Dear Silvia, Thanks a lot for your reply to Allan. Really appreciated. What I would like to ask further is that I have seen a lot of leading companies declaring revenue results post and pre Foreign Exchange Gain/Loss. If I go by your approach then why do they absorb the foreign exchange impact in the revenue line. To be more specifc US Dollar appreciated in Q1 2015 and leading companies such as Genral Motors, Coca Cola etc. put out their result showing a pre & post Fx impact. We thank you once again for a continuous support you provide to readers all across the world. Kindly keep up the good work.

Dear Ketan,

In Allan’s case, it was one specific case and from the question it was implied that the revenue was adjusted by the difference in foreign exchange – maybe this was the agreement with the client. In some other agreements, it’s the supplier who bears the currency risk. As you see, it all depends.

However, you need to understand how these leading companies sell. Do they sell in USD? Or do they sell in foreign currency – other than their presentation currency?

Also, may I kindly point you to their notes to the financial statements? I am pretty sure that there’s an explanation for that. S.

Hello I’m in Lebanon and I’m not able to purchase the IFRS kit why? Why my country not on the list

Dear Moustafa,

I think PayPal does not work in Lebanon, that’s why your country is not on the list. For this reason, you can make a payment with the alternative payment gate, directly with the credit card here: http://sites.fastspring.com/ifrsbox/product/ifrs-kit-offer

If you need my further help, just let me know. Kind regards, S.

Dear Silvia, one question regarding PPE traslation.

Example:

(I am in Argentina, our funcional currency is PESOS, but the presentation currency (in order to send montly package to Vienna) is USD.

1) In 2006 we bought a warehouse. The cost was 1.055.00 USD. The fx rate at that moment was 3,07. Therefore It equeals to 3.238.850 PESOS.

2)Then, at the end of each month, I have to do the “periodic valuation”. Considerig it is a non monetary item and we measure according historical cost, I have to transalte those 1.055.000 usd to the “historic rate” (3,07). Therefore, by the end of the month the amount in PEOS is the same.

3) Transaltion into presentation currency:

IAS 21 says that all assets have to be translate using the closing rate, BUT in this case this asset is nominate in USD (it was a result of a foreing transaction). So in this case I do not have to transalte from PESOS to USD right? The amount in USD to report in package will allwasy be 1.055.00 USD?

Thanks in advance!!

Dear Fernando,

unfortunately not. PPE is a non-monetary asset and once it sits in your account, you stop thinking of it as about “USD” asset. So no, the amount on your fixed assets will not be 1055 USD, but 3 238 850 pesos translated with the closing rate. S.

Dear Silvia,

If it is true that non-monetary items such as PPE cannot be thought of as an asset in foreign currency, then how would you interpret IAS 21.23:

“Non-monetary items that are measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value was measured.”

If you measure non-monetary asset using cost model, then it is no more foreign currency asset. However if you determine its fair value regularly due to using revaluation model, then of course fair value is determined in FCY. But be careful here- you don’t have to revalue PPE each year and when you do NOT revalue it and use FV from previous years, then you do NOT recalculate its amount with the closing rate.

Dear Silvia,

My company is located in Nigeria and functional currency is Naira. our transaction included foreign currency as well as we are involved in Port Logistic services under Oil and gas sector. Every month we run exchange routing to align our current assets and Liability with closing rate.

Now my boss has ask me Balance sheet in USD currency as of end 31st Oct. if I convert all the assets and Liability with closing rate of Oct, then my assets will drastically reduced in term of USD currency compare to last year. the last year rate was 197.5/USD where as of Oct closing rate is Naira 315/USD.

My question

Should I convert with closing rate assets or I should use historical rate.

or

I should use closing rate only for Current assets and current liability. For assets I should use historical rate?

if I use historical rate only for assets then I am generating difference around 153Mil USD which I have to show under share capital to make the tally Asses-Liability=share capital.

Kindly advice.

Hi Sarvesh,

it depends on whether you want to follow IFRS or not. If yes, then technically speaking, you will be translating your financial statements to another presentation currency and in such a case, you need to use the closing rate (in this case, you don’t care about monetary/non-monetary items and historical rates).

Unfortunately, Naira weakened a lot and you could show very high “CTD” or currency translation difference in your equity to balance assets with liabilities.

S.

Dear Silvia,

In consolidate foreign operation to presentation currency, IAS 21 states that the results and financial position of foreign operation shall be translated using:

– Assets, liability: closing rate

– PL: average rate

However, I don’t know the mentioned fx rate at closing date is the Fx rate used to FX revaluation of foreign operation or parent company at reporting date?

Due to parent company has cash in foreign operation’s currency, it will revaluation foreign cash at reporting date using closing rate. I wonder if using the closing rate of foreign operation to translate to presentation country leads to different applied closing rate in consolidation FS.

And the average rate will get from foreign operation or parent’s transaction?

Hope to see your answer, thanks!

Hi there Silvia, I would like to obtain a clarification with regards to the term “Settlement” as used in IAS 21.

In paragraph 15 of IAS 21, it is stated as follows :

“An entity may have a monetary item that is receivable from or payable to a foreign operation. An item for which settlement is neither planned nor likely to occur in the foreseeable future is, in substance, a part of the entity’s net investment in that foreign operation, and is accounted for in accordance with paragraphs 32 and 33.”

Does SETTLEMENT of the intercompany balance refer only to payment, as in, cash payments ? Or let’s say, to settle a loan payable to its parent, a subsidiary issues shares to the parent. In substance, would the issue of shares be considered as a form of settlement ?

My interpretation of this is : since the liability of the subsidiary towards the parent no longer exists because of the issue of shares, this is in substance, a settlement of the loan.

Please tell me if I’m right here.

Thanks in advance 🙂

Yes, Rishi, I agree. Settlement is a broader term, not limited only to a payment or cash (that would be “cash settlement”).

Thanks for the reply Silvia 🙂

Dear Silva ,

would you please clarify the deference between the translation in subsequent report in How to report transactions in Functional Currency paragraph and How to translate financial statements into a Presentation Currency paragraph as the non monetary items well translated at historical cost initially then we well translated them at closing rate when we translate financial statements?

Also Silva need advice regards the risks that may arise if we replaced volatile functional currency with one of major currency like $( specially in

Hyperinflationary economy environment )

Hi Hisham, if you don’ translate all your financial statements into some other (presentation) currency, then you do nothing with your non-monetary asset. If you do translate your financial statements to the other currency, then you use closing rate for all assets including non-monetary. I think I explained it in the paragraph Functional vs. Presentation currency.

Hi Silvia,

I have one question as follow.

Our subsidiary is based in Mozambique where the exchange rate was about 30 at 31/12/2014 and 44.49 at 31/12/2015 and around 78 at this moment. However, the official inflation rate of this country is relative low (about 15% in 2016) and will not be over 100% for the last 3 years.

Can we consider Mozambique a hyperinflationary economy? If not, what can we do to ensure the comparability of prior period information.

Thank you in advance for your help,

Andy N.

Sorry, I would like to add further information.

This question is for the consolidation purpose. The parent company is reporting in USD while the subsidiary is reporting in MZN (Mozambique local currency).

Thank you,

Andy N.

Hi Andy,

well, the criterion about the official rate being over or coming close to 100% for 3 years is not decisive. There are more factors to consider whether the economy is or is not hyperinflationary – e.g. how do people keep their wealth – in foreign currency? In local currency? Or, are interest rates, salaries and prices anyhow linked to a price index? etc. For more guidance, please look to IAS 29.3.

Then, if there are no such indicators, and you conclude that an economy is not hyperinflationary, you just don’t apply IAS 29. S.

Dear Silvia , In case the company decides to change the prtesenatation currency during the year, then how to translate comparative figures.Also wrt current year figures-is the procedure same as for change in functional currency.

Dear Lalitha,

IAS 21 does not say anything about the change of presentation currency, but it is appropriate to follow the rules for change in accounting policy under IAS 8 (unless it is not practical), i.e. retrospective application.

Also Silvia,

I am not yet due to pay back the loan , is the exchange rate realized or unrealized . Also is there any situation I can treat the exchange loss through OCI

Hi Silvia,

Thanks for IFRS Box , has always been helpful, please if I have taken a loan denominated in foreign currency and at each reporting date , I convert to my functional currency at the closing rate at that period , will the exchange loss or gain go to OCI or P&L

Thanks

P/L, because it’s a monetary item. S.

hi silvia,

i have a issue regarding loan revaluation. can you tell me which rate is use for revaluation of loan?? i.e. buying rate or selling rate. this revaluation is not for a bank or any financial institution

HI Sylvia

I really like your explanations on IFRS but i also need clarifications IAS 21 (Foreign currency translation) on tax administration that collects in different currencies and now during reporting what would be the treatment of the opening balances, period collections, treatment of the loss/gain on translation and closing balances presentation.

Thank you!

Dear Frank,

please, you need to describe the transaction more precisely. When tax is paid in your local currency on foreign currency items, then the translation depends also on the tax rules, not only on IFRS. But in general – all these payments are translated either via real rate recalculated by your bank, or by the spot rate, as they represent the translation from foreign currency to your functional currency. Opening tax liabilities in foreign currency are translated by the closing rate (of previous rep. period). Gains/losses are reported in profit or loss. S.

Hi Silvia,

I am from the Philippines. My client has a foreign currency bank account. At year end, I translated the balance using the closing rate for Financial reporting purposes. How do I account for the foreign currency gain/loss? Is it “unrelealized” or “realized”? Thank you very much.

Dear Claire,

it’s realized, i.e. you recognize the gain or loss via profit or loss account. S.

Is there any possibility of an unrealized gain portion for cash?

Dear Silvia,

Could you pls explain why you state that gain/loss on balance valuation of bank accounts should be presented as realized one? My understanding was that we recognize realized FX only when cash flow occurs. Your explanation will be very helpful. Thank you in advance.

Hi Floydka, OK, so now the question is – what do you think is “realized” and “unrealized”? Because, there are no such terms in IAS 21 related to FX differences and I am only referring to them based on older accounting practice. So, to explain – unrealized FX difference was a difference calculated on open balances (receivables/payables) at the reporting date and in some previous accounting principles, it was held in the balance sheet as “unrealized FX differences” and kept there. Under IAS 21, this is not so – instead, even this difference is seen as “realized” an is recognized in profit or loss, REGARDLESS of cash flow occurring. I hope this helps. S.

Hi Silvia. Thank you for making me aware of existing distinction between the old accounting approach and IFRS one:-) Is that for IFRS purposes we are not obliged to present FX differences split into realized and unrealized ones?I do understand that both hit profit and loss. However, I am not sure in which category ( realized or unrealized) I should present these coming from valuation of bank accounts at month end ( in case this distinction is still valid for P&L purposes). I was convinced that as unrealized ones but your answer from above made me confused. Your help is invaluable thus. Thank you for your time.Kind regards

There is no distinction in IFRS. That says is all.

Dear Silvia,

I have seen one IFRS interoperatation Committe for Revenue Recognition when the Sales Contact is in Foreign Currency (Foreign currency translation of Revenue)

Foreign currency translation of revenue: views 5

Revenue is recognised using the spot rate at the date:

• an enforceable contract is entered into (T0): View A

– rights and obligations of transaction established at this date

• advance payment is received (ie on recognition of deferred

revenue) (T1): View B

– first recognition of transaction is when either of parties to contract first

performs

• the revenue is recognised (T2): View C

– if payment is in advance, the difference between the deferred revenue

balance and amount of revenue due to fx movements is recognised

as an exchange gain/loss as revenue is recognised

– delivering services/goods is viewed as a transaction in its own right

http://www.ifrs.org/Meetings/MeetingDocs/Other%20Meeting/2014/November/AP2%20IC%20Update%20-%20GPF%20Nov%202014.pdf

You have any idea about finalisation of above issue .

Contract signed

Advance Payment Received

Goods Supplied.

Which Exchnage rate we should use for entering Sales & Purchases ?

your clarification is highly useful.

Hi,

More on this topic

http://www.ifrs.org/Meetings/MeetingDocs/Interpretations%20Committee/2015/January/AP05%20-%20IAS%2021%20Revenue%20transaction%20denominated%20in%20foreign%20currency.pdf

Honestly speaking it is difficult to understand the topic.suppose the following is the case

Contract signed Jnaury

Advance Payment Received (30%) February

Goods Supplied. May

Remaining amount Received (70%) July

Hi Albi, no, this issue has not been completed yet. And, it’s so complex, that it’s difficult to respond within 1 comment, but I can write an article with a case study in the future. S.

Dear Silvia,

thank you in advance for that Article.That would be a great research 🙂

If feasible, please consider Payments to Supplier also

Contract in Foreign Currency (Sales& Purchase)

Contract signed with Client Janaury

Contract signed with Suppplier Janaury

Advance Payment Received from Client (30%) February

Advance Payment to Supplier (70%)-March

Goods Purchased-May

Goods Supplied- May

Remaining amount to Supplier (30%)-May

Remaining amount Received from Client (70%) July

Many accountants & Auditors are confused about the proper treatment.If we use spot rate for recording all the transactions,There would be misleading result.If exchanges rate goes up during the period, better to delay the receipt from Clients 🙂 🙂 if rates decreases then huge loss.

Hi, Silvia. I`m wondering is there any situations when IAS 21 may not be applied. Particularly I`m interested in the preparation of statements in the reporting currency other than functional. I`m working in the company that prepares statements for its Holding, using the closing rate for all items, including retained earnings, so there is no need of including differences in OCI. But Holding is the European company and works according to the IFRS requirement. My colleagues don`t know. You are my only hope

Dear Katrina,

well, as soon as a company or a holding applies IFRS, then it must apply ALL IFRS standards, including IAS 21. There is no exception. So, if your financial statements will be a part of holding’s consolidated financial statements under IFRS, then yes, you need to apply IAS 21. S.

Hi, Silvia. I have a question about translating statements from functional currency to presentation. Is the resulting difference in OCI is just an item (line) which balances other items of statement of financial position with each other? Or there should be some postings in the accounting books? It`s a little bit confusing, because if we have operations in different currencies other than functional and we report in the functional currency, the exchange difference goes to P/L.

But I think the first variant is right.

Yes, Katrine, the first variant is right. Translating FS to presentation currency is NOT a bookkeeping operation – it’s just a presentation. S.

Thanks! It helped a lot)

Hi

I have a question. If my entity has a functional currency of EUR and it has foreign currency transactions in GBP, when I go and prepare the accounts in a GBP presentation currency, do I apply a period end rate to my original GBP transactions or just use the original GBP amounts?

Dear Richard, please apologize for the later response. Let me split it:

– Monetary assets/liabilities: At the year-end, you translate it from GBP to EUR, you use closing rate, isn’t it? Then when you translate it back to GBP (as to presentation currency), you use the same rate and you should be fine.

– Non-monetary assets/liabilities: At the year-end, you do not translate them, but you keep them in a historical rate. However, after you recognized the asset initially, it stopped being GBP asset and became EUR asset (it’s non-monetary). So yes, apply closing rate.

– Transactions in P/L: you should apply the transaction date rates, so you should be OK.

Hope this helps! S.

Hi Silvia, I have a peculiar situation which is similar to this. Assuming an entity with a functional currency of EUR (and presentation currency of GBP) accepting additional finance from shareholders in GBP. The additional share capital is translated to EUR at the date of transaction and will be kept at a fixed EUR amount in the future. However, the additional GBP funds received would need to be translated to EUR in every reporting period using the closing rate. An unrealised forex gain/loss would arise. However, to fulfill the presentation currency requirement, the EUR financial statements need to be translated to GBP at the end of reporting period, which includes the previously recognised unrealised forex gain/loss.

My question is, isn’t it weird to recognise an unrealised forex gain/loss from a GBP transaction that is ultimately presented in a GBP financial statements? The unrealised forex gain/loss seems unnecessary and doesn’t really make sense if we look at the big picture. An additional entry to the reserve is needed then to balance out the unrealised forex gain/loss impact.

Really appreciate your advice on this. Thanks in advance!

Hey Silvia,

Suppose I have an external commercial borrowing(India) of 100M USD for 10 years, with conversion rate of 1USD= 50INR.

Now I hedge this and I have a 10M debtor every year.

If in future the exchange rate becomes 1USD=60INR, how would my liability be impacted and what would be the balancing accounting

On my books in INR, I will have a 6000INR loan, but how would I balance this?

Dear Chirag Jain,

if you do it right, then you would have a corresponding derivative asset amounting to approximately 1000INR in your accounts. S.

I have following queries:

1. Exchange Gain or Loss – Realized and Unrealized: How to present it in financials

• As Raw material Cost i.e before gross margin

• As finance cost i.e after gross margin

• Realized and unrealized Both as finance cost

• Realized and unrealized Both as raw material cost

2. Finance Cost: Inclusion and exclusion Trade Finance and Bank Charges, Overdraft interest shall form part of finance cost or bank interest, LC Commission shall form part of Raw Material cost or shall be treated as bank charges (may not be relevant to IFRS) just the accounting treatment

3. Revaluation of Forex assets and liability at period closing, eg cash backed LC, how to treat this…

Dear Silvia.

Thank you for this.I appreciate your explanation.

Please kindly shed some light on the following.

Please for a financial statement,when you translate the bank Balances in foreign curency using the closing rate the gain or loss as a result of the translation-is it realized or unrealized?

If realized or unrealized what are the tax effect.

Hi Duke,

it’s realized (as any other foreign currency difference). The tax effect depends on the tax legislation of your country. E.g. in our country, these realized differences are optionally taxable (you can opt to tax them when they arise, or not to tax them at all). S.

Hi Silvia, could you please inform the gains/losses raised from the revaluation of bank balances in foreign currencies should be classified as realized or unrealized according to IFRS?

Hi Mohamed,

I assume you are translating into the functional currency. In this case, it’s realized in profit or loss (anyway, IFRS do not know the term “unrealized”). S.

Hi Silvia,

Thanks for quick answer, my local Financial statement currency is EGP and my question is regarding reevaluating the bank balances in foreign currencies (the equivalent of these currencies in EGP in my books) the FX gains or losses appears is realized? I need your reply for my local reporting and for the consolidated report for my group (more than 1 company report)

Many thanks

Yes, these gains and losses are realized, that is in profit or loss. S.

Hello,

Thanks for your support but i have question, what’s the reference in IFRS that bank balance reevaluation should booked as realized gain or loss

Standard IAS 21 paragraph 28.

I am doing year end account for one of my client, they have an account in Euro and ending balance showing in GBB in my bookkeeping system is different if I use the actual exchange rate on the date. My understanding was the difference on exchange should reported in equity as Unrealised gain or loss the P&L. Please correct me if I am wrong.

Dear Jibran,

that depends on what you’re trying to do. Are you translating foreign currency amounts to your functional currency? Then translation differences are reported in profit or loss, not equity. S.

Hi Silvia, referring to this, if I were to report in profit or loss, is it considered realised or unrealised?

Thanks.

Hi Sylvia,

Me and my colleagues always have this arguement on whether to translate monetary items at the reporting date using “Buying” rate or “SElling” rate. I am of the argument that the rate at which i can buy the foreign currency should be used meaning the selling rate set by the bank. For example if my functional currency is USD and i need to translate EURO in to USD i should take the rate at which i can exchange USD to Euro right?

Dear Hassaan,

good question. Well, it depends on what’s available. In the EU, European Central Bank sets the rates for the other currencies and many companies simply use these rates, regardless the commercial rates of the bank.

However, IAS 21 in paragraph 26 states that when you have several rates available, then you should take the rate at which you would settle the liability or recover the asset at the measurement date. Practically it means – if you have USD receivable, then you use buying rate (you will receive USD and bank buys them to convert to EUR), and if you have USD liability, then you use sell rate.

Anyway – you absolutely need to be consistent and use the same principles every time. Hope this helps! S.

Hi Silvia,

Regarding the example that you gave with USD receivable, should we not use the buying rate for such an item ? Let me explain :

We have 1000 USD receivable from Debtor X. The presentation currency of our company is EUR.

Rates prevailing :

USD to EUR – Buying rate : 0.75 (the bank is buying 1 USD for 0.75 EUR)

USD to EUR – Selling rate : 0.80 (the bank is selling 1 USD for 0.80 EUR)

Debtor X pays us the 1000 USD.

In the current context, I have obtained USD from Debtor X and to know the value of the USD in terms of EUR, i need to Sell this USD to the bank. This means that the bank would be Buying my USD and for each 1 USD, I would receive 0.75 EUR.

Based on that, should we not be using the bank buying rate for such a type of receivable ?

Of course, you are right! 🙂 Corrected!

Thanks for your prompt reply Silvia 🙂

I also have another question relating to the year end retranslation of balances. I’ve been browsing IAS 21 to obtain an answer to these but without success :

Upon retranslating all foreign currency monetary amounts to the presentation currency, there are gains and losses which arise.

Are all foreign exchange gains/losses accounted for as realised or unrealised ?

Could you also explain the logic behind classifiying the gains/losses as either realised or unrealised ?

Rishi,

when you translate to presentation currency, don’t calculate any gains or losses, simply translate. There will be difference between total assets and liabilities – this is currency translation difference presented in equity. S.

Hi Silvia,

I would like to know what accounting entries would be made upon the year end translation of financial statements to the reporting currency.

Let’s take the below example :

Reporting currency of the business is USD. It has foreign debtors and creditors in EUR. Let’s assume only these 2 items to calculate the CTD at year end (31 Dec 2016).

Rate EUR to USD at 1 Jan 2016 : 1.5

Rate EUR to USD at 31 Dec 2016 : 1.3

Foreign debtors (EUR) at 1 Jan 2016 and 31 Dec 2016 : EUR 1000

Foreign debtors (USD) at 1 Jan 2016 : USD 1500 (1000 x 1.5)

Foreign debtors (USD) at 31 Dec 2016 : USD 1300 (1000 x 1.3)

Foreign creditors (EUR) at 1 Jan 2016 and 31 Dec 2016 : EUR 2000

Foreign creditors (USD) at 1 Jan 2016 : USD 3000 (2000 x 1.5)

Foreign creditors (USD) at 31 Dec 2016 : USD 2600 (2000 x 1.3)

From here on, how do we calculate the difference between assets and liabilities and how do we record the CTD as a separate component of equity at 31 Dec 2016 ?

Thanks in advance 🙂

At year-end we had revalued goodwill that arised on consolidation at closing exchange rate and resulted in write-down which we have taken it to CTA in equity. Does changes in CTA balance will impact consolidated cash flow statement?

Hi Silvia

Now its clear. Thank you for your great advice.

Hi , Silvia

My parent company has given a USD loan us (subsidiary ) 3 years ago and at that time they did not ask us to repay. therefore, we did not revalue the currency . But now we have to pay it.my questions are

1. Do we need to revalue USD loan

2. what possible way to reduce our big loss on this USD revaluation.

Dear Bandara,

yes, you should have revalued this loan also in the previous periods under IAS 21. Now, clearly, you made an error as you have not applied IAS 21 properly. Therefore, I would calculate the profit or loss impact of revaluation in the previous periods and if it is significant or material, then I would make a correction in line with IAS 8.

This way, “big loss” on USD revaluation would be spread over 3 periods and a part of it would be recognized in equity as a correction of error.

S.

Hi silvia,

i have almost same issue on Loan.

We have USD4mio Loan in 2017 (our book is in Local Currency)

at the end of the loan period we receive Parents Loan to pay portion of above loan, let say $2mio.

my question is, should i book $4mio fx loss/gain based on 2015 rate or could i just book fx impact of $2mio.

of course i will make revaluation of parents loan as well.

Hi Sylvia,

Kindly help with the treatment of exchange gains or losses in a forward contract arrangement (forward contract here is for construction of non current assets

Seun,

without knowing what the forward contract is about I can’t help really – not enough information.S.

Dear Silvia,

I have a question on how to determine functional currency for cost plus entity (IFRS) for entity A.

The fact pattern:

Entity A (MY)- principally involved in assembling and testing products for its immediate parent entity which is Entity B (US).

Entity A generate revenue under cost plus arrangement to Entity B under TP agreement.

For entity A:

Revenue is generated in USD (under cost plus model)

Direct costs is MYR (labor charges/direct materials).

based on this fact pattern, what will be the appropriate functional currency for Entity A and how to justify on the its?

Regards and thank you.

If the Functional Currency of the Parent Company is USD and the Subsidiary is in SGD. Will a Capital injection from Parent Company in USD to the Subsidiary result in any exchange differences

Hi Silvia,

I am practicing in Nepal. Regarding the translation of Financial Statements into Reporting Currencies of parent Company the assets and liabilities were translated into reporting date exchange rate of Central bank and for translating the income statement yearly average rate has been considered. The Difference was presented in OCI. Please let me know whether this is correct? Thanks

Yes, that’s how you should translate the financial statements into the presentation currency. S.

Hi Silvia,

A question on FX unrealized gains and losses for interco loans: we remeasure all outstanding IC BS positions using Group determined FX rates as of year end. And if we have long term loans is it possible to show these unrealized gains and losses from remeasurement in OCI as part of equity and exclude them from PNL? Under US GAAP it is allowed. But I did my research on IFRS and I can not fild an answer. As usually please help 🙂

Hi Vadims,

if you classify your loans as debt securities measured at fair value through OCI, then the foreign exchange gain/loss would be a part of fair value remeasurement and posted in OCI. This is the new category introduced by IFRS 9 and it is also covered in the IFRS Kit with example. S.

My South Africa branch purchases goods in USD from Japan/India.

Once supplier ship out the goods, my SA branch records liability in the books. (during this time the exchange rate ZAR to USD is say 11)

So system records liability in ZAR based on exchange rate of 11.

When the goods are actually received by SA branch, the exchange rate is 12. So while posting Goods Receipt, system identifies this difference of 1 (exchange diff) and Debit Merchandise a/c in BS and credits exchange gain account in PL. Is it correct?

Is it right to increase/decrease the inventory for exchange rate fluctuation? Please advice.

Thanks Vishi

Hi Viswanathan,

it depends on the terms of delivery – when the risks and rewards of ownerhip pass to your branch? And how is the initial transaction (when the supplier ships the goods) recorded? Inventories are non-monetary item and therefore, you should keep them at historical rate. The question is when the ownership passes to you – if it’s at the moment of shipping the goods, you should keep them at 11. S.

Hi Silvia,

Thank you so much for your quick reply.

In this case the delivery term is FOB. So once the BL is issued, we need to recognize the liability. However goods may arrive after 1 month by which time, the exchange rate is changed. In this scenario, to which account we can charge this cost (if not merchandise). One side of the entry is clear i.e. is exchange gain/LOss to the PL. Pl advise.

Thanks

Viswanathan

In this case, the date of ownership transfer (and recognition of goods) is when the goods are loaded for transport. Since that point, it’s you who controls the goods. Therefore, you should use the historical rate of 11, also for posting the goods from goods in transit to goods in the warehouse. S.

Hi silvia

If the fx change.is any effect on parant and subsidiary firm net profit

Hi, Silvia

It is me again with tricking question… looking for a fresh view.

The Company has a contract with a constructor fixed at the local currency. At the same time the contract has a clause saying that in case the local currency depreciate against USD more than 3 points, the payment is to be increased by the difference in exchange rates. For example, total trade payable is 500 local currency (or 100 USD) at recognition and at the payment date the local currency depreciate to 60 per USD, therefore the final payment is to be made is 600 local currency.

The question is whether there is exchange loss and should it be capitalized to the constructed facility or recognized in PL.

It looks like that initially it is USD contract and no forex loss/gain is to be recognized (functional currency of the Company is USD). However if the difference is less than 3 points than no compensation is made and the forex gain is recognized on trade payable up to 3 points. Moreover, there is no mention if the local currency appreciates against USD (which did not happen in the past).

For me there is embedded derivative instrument, rather than USD Trade Payable and therefore IAS 39 applied. I am wondering whether you have different view? And how would you account for this transaction?

Sylvia,

this is very informative. I cannot seem to find the answer here, (or anywhere), however, to an issue with our German subsidiary (parent is US based). Each month’s valuations for exchange rate are posted to the P&L, but we use an unrealized gain/loss account to do so. Our German subsidiary, though, posts all of its changes in the value of its cash bank accounts to Realized gain/loss, not unrealized. Both are hittin gthe P&L properly, so that is not a major issue. I am just trying to get an understanding whether theis is required by IFRS vs GAAP in the US which would just use unrealized gain/loss.

Thank you Silvia…

Hii Silvia,

Thank you for these wonderful articles,

I would appreciate if you could help me in the following issue :

We have recorded one transaction in the month of Jan’15 by using the exchange rate prevailing on that date. Now we are required to reverse the transaction because it was posted inadvertently. The reversal entry should be passed in the month of March’15. Can we use the exchange rate we used while passing the original entry? Or should we use the exchange rate of March’15.

Thank you

Hi Vinod,

if that’s just annulation (as the transaction would have never happened), then do it with the original FX rate.

S.

Dear Silvia, Thanks for creating and sharing these very good articles and videos. I watched the video and read the article on IAS 21 and have some query. I need to prepare individual subsidiary balance sheet and income statement on parent’s currency.

1. Do I retranslate forex gain/loss recognised in I/S in functional currency by using average rate in I/S of parent’s currency? Note, forex gain/loss include loan received from parent in parent’s currency.

2.Is it alright to recognise the gain/loss from exchange difference in retranslating net profit in closing rate in B/S and average rate in I/S as Other comprehensive income in I/S in presentation currency?

I would be really grateful if you kindly help me out on this two issues. Thanks.

Thanks Silvia

But i still have that small doubt with regards to the translate the foreign currency transaction with the rate AT THE DATE of transaction.I am interpreting AT THE DATE of transaction as the date i recognize asset which i would do that when asset is actually received and not the date the advance is released , at the time of release of advance , asset is yet to be formed a such is not recognized in the books. For eg. if we had not released advance then asset would have been recognized on the rate the asset is received , so if i am to assume asset value would be recognized at the time of payment if no advance has been released.

I hope i am making sense.

Yes, it makes sense and I understand your doubts. Believe me, everybody is treating that differently as there’s no specific guidance in the standards for that.

Try to look at it in a different view: what is your real cost of acquiring the asset? Your real cash out? Part of it was done when you paid the advance payment. If you translate the advance payment with the rate of invoice, then you are effectively capitalizing foreign exchange rate differences (and you should not do it).

At the date of transaction = the first time when the transaction appears in your financial statements. Sure, if you don’t pay any advance, then it is the delivery date. But if you incurred real cost (payment) before that day…

There’s a lot of discussion going on about it. My opinion is that you should take your real cost.

Dear Silvia,

Here also I have One Doubt

At the date of transaction = the first time when the transaction appears in your financial statements. Sure, if you don’t pay any advance, then it is the delivery date. But if you incurred real cost (payment) before that day…

What will be the treatment if 50% advance is Paid and 50% paid one month after delivery .Which exchange rate should be applied for recording the purchases. Here date of Transaction is 50% advance payment date

Really confused Forex Accounting !!!!

Hi Silvia

Then what will happen if the asset is received ahead and payment is made few months later. So here also do we recognize asset two months later.

Please advise.

Sonam Choeden

Central Accounts

DGPC

Sonam, since this discussion, I wrote an article about prepayments specifically, please refer here.

Interestingly, and the analogue is?

Hello Silvia,

Yours is the only resource that that i have found on-line that explains properly what IAS 21 is all about – thank you. but i am still having a problem understanding it 100%. I am invested in a company on the UK stock market. they are a gold mining company based in South Africa. their functional currency is ZAR and their presentation currency (for the purpose of releasing annual reports to UK shareholders) is in Sterling. their most recent P&L account states that profit-after-tax was £26m…but then then in comprehensive income it states that Foreign currency translation differences amount to £25m ! therefore almost completely wiping out reported profit.

I cannot work out what could cause foreign currency translation differences to amount to £25m and there are no notes in the annual report to explain (probably they are hoping no one will notice !) would you be kind enough to give an example or two ?

Many thanks,

Paul

Hi Paul,

foreign currency translation difference in OCI is exactly what I refer to as “CTD” or “currency translation difference”. It is because when your company is translating its financial statements from ZAR (functional currency) to GBP (presentation currency), it uses different exchange rates for translating assets and liabilities (closing rates) and for translating income and expenses (average year rates).

You also need to realize that CTD in OCI is CUMULATIVE – it does not arise only in the current reporting year, but it is accumulating from the initial date of translating financial statements in the presentation currency.

CTD of GBP 25m is probably cumulative figure. Please try to look at previous year’s numbers and the balance of CTD. Newly arisen CTD is a difference. Or you can look to the statement of profit or loss and other comprehensive income – you’ll see exactly how much CTD grew in the current reporting year.

Hope it helps! S.

Thank you Silvia yes you are correct of course, the OCI for this year is £25m and the previous year was £20m so £5m difference. Thanks a lot for your help.

Hi there

I would appreciate if you could help me with following issues:

Issue for foreign currency transaction

1. Initial Recognition

Scenario 1

100% advance has been released at certain rate and final invoice with material is received after for eg. two months during which different exchange rate exists. So which rate to be used, the rate at which the advance has been released or the rate existing on the date of actual receipt of goods.

2. For 100 % advance which has remained unadjusted on the date of closing, do we have to translate at the closing rate.

3. Subsequent Recognition of Liability

Procurement of assets in foreign currency- on settlement of liability, the difference is charged to asset (if the asset is in Work in progress stage) or to gain or loss.

Hi Sonam,

aaaaaa, advance payments – everybody treats that differently!

OK, but here’s my opinion:

1) If the advance payment was made for the specific asset (inventories or PPE), then do not revalue it, but simply treat a part of acquisition cost in the original FX rate of payment. The reason is that IAS 21 requires you to translate the foreign currency transaction with the rate AT THE DATE of transaction.

Now, what is the date of transaction? IFRS say that it is the day when the transaction appears for the first time in your financial statements. In this case, you start acquiring asset at the date of making prepayment.

2) Again, when it is an advance payment for the specific asset, it is non-monetary asset (as you have no right to receive cash… you are just expecting the non-monetary asset to be acquired). No revaluation 🙂

3) IAS 16 does not permit capitalizing FX differences 😉 so to P/L 🙂

Hi silva. Appreciate your effort.

Here’s what I need to know, when translating individual financial statements of a foreign subsidiary into presentation currency of the parent, will the resulting differences ( that are recognised in the separate component of equity in the individual FS ) be charged to CRE and NCI of the consolidated accounts in their respective % ?

Also, where will the exchange difference of goodwill arising on acquisition be charged?

Have an exam in 3 days!

Hi Fatima,

hope it’s not too late for your exam! To reply your questions:

1) No, all the differences are presented in 1 line: CTD (currency translation difference). They are not split.

2) Hmhm, I think goodwill arising on acquisition is a historical item appearing only in the consolidated financial statements, not in the separate FS of a foreign subsidiary.

On acquisition, you calculate goodwill using the actual translation rates at the date of acquisition. I just don’t like the idea of translating it by the current rate – as it’s a historical asset, but the exchange rate is grouped with all other exchange differences.

Hope it helps and good luck to your exam!

S.

Thanks a lot Silvia.

And yes, we do translate goodwill on acquisition date and at year end closing rate (just like the rest of the assets). I think this is because if the translation is taking place for consolidation purposes only, all the elements of the financial position will be covered.

Correct, that’s what IAS 21 requires. I just don’t like it – my personal opinion. Anyway, exchange difference arising on translation of GW is a part of that OCI component “CTD”. Good luck!

Thank you so much for this explanation, it help me a lot,

i have small Q, how to account for transfers between our bank accounts that one is in our functional currency and the other account is in foreign currency ,

the case i had that we earn divided and it’s deposited in the foreign currency bank account, then after sometime we transfer the monies to the our functional currency bank account?

Hi Fatma,

this is more question of practicalities than the question of what’s written in IAS 21. It strongly depends on how currency issues are covered in your country. Let me give you my own situation as an example:

I am from EU and our functional currency is EUR. When some payment arrives to USD account in USD, it appears in USD on the account, but for accounting records, we need to translate this amount to EUR. In line with IAS 21, we need to use the translation rate at the date of transaction (when money arrived). In line with our legislation, that would be the rate set by the European Central Bank (ECB) at the date preceding the transaction – which is perfectly acceptable for IAS 21. In your own country, that might be different, but you should be looking at central bank rates, not commercial banks for this particular case.

S.

I would like to the diff between Non-hyperinflationary economy and hyper inflationary economy. Thanks

Dinesh, hyperinflationary economy is discussed in the standard IAS 29 Financial reporting in hyperinflationary economies and this standard provides guidance, too. However, the standard does not establish the absolute rate of inflation for a country to be deemed “hyperinflationary”, it’s a matter of judgement, but as a guidance: for example, if a cumulative inflation rate over 3 years is exceeding or approaching to 100%.

Hyperinflation -Your reply to Dinesh october 12,2014

Restatements are made by applying a general price index. Items such as monetary items that are already stated at the measuring unit at the balance sheet date are not restated. Other items are restated based on the change in the general price index between the date those items were acquired or incurred and the balance sheet date.

This statement not clear .Could you please help me understanding it more clearly.Which exchange rate should be applied for translating the foreign currency monetary items.

i like your explain this ias really and i hope to get full tutorial but how i life in egypt ? can tell me the way to get all tutorial for all ifrs

The following two statements always make me confused

All resulting exchange differences shall be recognized in other comprehensive income as a separate component of equity.

All exchange rate differences shall be recognized in profit or loss,

Would you please shed light on it.

Regards,

Ezat

Hi Ezat, I can understand your confusion, it’s not so easy. Please, as the first thing, realize what you’re translating:

– are you translating some individual transactions, like sale in foreign currency, or purchase or anything else? Are you translating these transactions to your own (functional) currency? Then any foreign currency differences go to P/L.

– are you translating the whole balance sheet and income statement to foreign currency (for the purpose of consolidation or any other purpose)? Then you’re probably translating the whole statements to presentation currency and resulting exchange difference goes to OCI.

Hope it helps

S.

I’ve been looking for a site that answers some queries on accounting standards explicitly! This one is excellent! I just wouldn’t post my Qs because it’s already being answered. I keep your posts for future reference.

I just wondering how your mind and temper keep managing these Qs.

Hoping you will not get exhausted!

May God bless what you do!

Interesting question 🙂 I tell you the secret – when I have enough of these queries, I try to keep my hands and mind busy in another way. I do some needlework 🙂 Embroidery 🙂 All the best! S.

Hello. If I am translating the whole if financial statements from functional to presentation currency I have two questions:

1) Assets and liabilities are translated using closing rates. Should we distinguish between monetary and non or in all cases we use closing rates?

2) what about equity? Share capital, share premium, retained earnings? Which rate is to be used?

First,it’s not necessary to distinguish.

second, the share capital, share premium use the rate of transaction occured. the retained earning use the last year closed rate and the spot rate.

Exchange difference arises on import of machinery for a project and project under a WIP on account of Pre-operative expenses the exchange Dif. coud be capitalized. this asset expenses directly related to PPE whether as per PPE IndAS 16 it could be capitalized.

Hi Silvia. Thanks for the explanation. Can you please elaborate on your 1st point:

– are you translating some individual transactions, like sale in foreign currency, or purchase or anything else? Are you translating these transactions to your own (functional) currency? Then any foreign currency differences go to P/L.

If you have recognized this FX on the P/L of the individual company which has a functional currency which differs to the consolidation presentation currency, what happens to that FX balance when you subsequently consolidate the entity? Would this appear in the consolidated P/L or rather the FCTR in OCI?

Thanks

Katherine

Hi Silvia, thank your nice work on this article and video. Those really helpful to understand in determing the currencies used under different circumstances. Keep up your nice work. Thanks a lot.

hi silvia, thank you so much for this explanation. i could not understand the difference between functional and presentation currency… now it’s clear, thanks a lot

Hello

My name is Joe,

My question goes this way, the two main method of translation are what