IAS 8 Accounting Policies, Changes in Accounting Estimates, Errors

Updated in March 2023

I bet every single company needed to change something in its accounting records and financial statements.

Often, the change is very small, so you just don’t worry about it and make correction on the go.

But sometimes, the change can impact companies quite hard. For example:

- You are adopting new IFRS.

- You forgot to revalue your assets last year.

- You made some capital investments and as a result, useful lives of your assets are longer than you currently use for depreciation purposes.

- You booked an impairment loss of your building, but the year later, you found a buyer for much higher price than you anticipated.

- You lost that damn court case, but the settlement you need to pay is a bit lower than your provisions for it.

And I could continue like that.

Now the question is:

How to account for the change? Should we restate previous year’s financial statements? Or can we just make a change or correction in the current year?

To approach this issue systematically, you need to decide whether you deal with the change in accounting policy, change in accounting estimate or correction of error.

Let’s take a look to IAS 8 Accounting policies, changes in accounting estimates and errors.

What is the objective of IAS 8?

The Standard IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors tells us:

- How to select and apply our accounting policies;

- How to account for the changes in accounting policies;

- How to account for changes in accounting estimates; and

- How to correct errors made in the previous reporting periods.

First, we’ll explain all three terms and basic rules, and then, we will focus on clarifying the main differences between the accounting policy and the accounting estimate.

#1 Accounting Policies

Accounting policies are anything from rules, guidelines, conventions, principles and similar norms used by entities for the preparation of the financial statements.

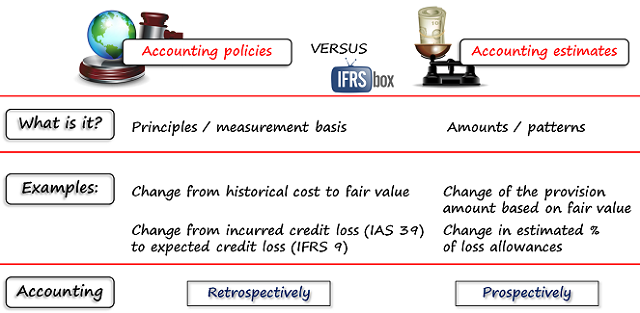

Here, I’d like to stress that IAS 8 specifically points out that the basis, especially measurement basis is an accounting policy rather than accounting estimate.

So careful, if you are deciding whether to use historical cost or fair value measurement, you are basically selecting your accounting policy and not assessing the accounting estimate.

How to select accounting policy?

The question here is whether there IS some IFRS or interpretation IFRIC/SIC dealing with your specific transaction or situation, or NOT.

If there is some standard or interpretation, then you simply apply it. For example, when you account for your new machines, then you obviously need to apply IAS 16 Property, plant and equipment.

When there is NO specific standard or interpretation dealing with your transaction or item, then management needs to use judgement and develop its own policy, but careful, the policy needs to provide as reliable and relevant information as possible.

Example: I wrote an article about accounting for artwork under IFRS, because it is not specifically addressed by the standards and in many cases you need to develop your own accounting policy.

How should you develop your accounting policy?

First, you need to look at IFRS and IFRIC/SIC dealing with the similar or related issues. For example, if you are selecting your accounting policy for artwork, maybe IAS 16 Property, Plant and Equipment or IAS 40 Investment Property are standards dealing with similar issues.

Second, you need to apply concepts from the Conceptual Framework for Financial Reporting.

Also, in order to help, you can look to other standard setting bodies and their own rules or standards for guidance. Many companies do it regularly.

For example, IFRS do not contain any guidance related to accounting for gold as a storage of value, so they need to develop their own accounting policy.

Let me also add that you must apply every accounting policy consistently, to all transactions within the same category or of the same type. In some cases, IFRS permit to categorize your transactions – in this case, you can apply different accounting policies to different categories.

When and how to change your accounting policy?

Life brings many twists and tweaks and sometimes, you need to change your accounting policy.

When can you change the accounting policy?

Only at 2 circumstances:

- When it is required by another IFRS. This will be the case when new IFRS is issued and you HAVE TO apply it mandatorily.

- When new accounting policy provides better, more reliable and relevant information. In this case, you apply new accounting policy voluntarily.

How can you change the accounting policy?

If you apply new IFRS and this IFRS contains some transitional guidance, then you simply follow the rules in that transition provisions. New IFRS will tell you exactly how.

However, if there’s no transitional guidance, or you change your accounting policy voluntarily, then you should apply it retrospectively (there are some exceptions).

“Retrospectively” means going back to the previous reporting periods and restating every single component of equity as if the new policy had always been in place. Be careful here because you need to restate comparatives, too!

#2 Accounting Estimates

Accounting estimate are defined as “monetary amounts in the financial statements that are subject to measurement uncertainty”.

This is a new definition that came into effect on 1 January 2023.

When you change the accounting estimate, you change either some amount of an asset or a liability, or pattern of its consumption in both current and future reporting periods.

Again a little warning:

- If these changes result from some new information or new trend, or development, then they are changes in accounting estimates.

- If these changes result from some error, such as incorrect calculation or wrong application of accounting policies – then they are NOT changes in accounting estimates, but errors and they must be accounted for as for errors.

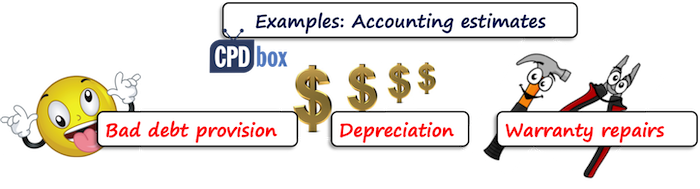

Typical examples of changes in accounting estimates are:

- Bad debt provisions,

- Depreciation rates and useful lives of your assets,

- Provisions for warranty repairs, etc.

How can you account for change in accounting estimate?

Unlike accounting for change in accounting policy, we need to change our accounting estimates prospectively, either:

- In the current reporting period, in form of so-called „catch-up adjustment“;

- In both the current and future reporting periods, if the change affects both (for example, change in useful lives affects depreciation charges in both the current and the future reporting periods).

“Prospectively” means that you do NOT restate comparatives and equity. You do NOT touch financial statements in the previous reporting periods; you simply adjust calculations in the current and future reporting periods.

Difference between accounting policy and accounting estimate

Sometimes, it’s very difficult to assess whether we deal with an accounting policy or an accounting estimate.

What are the main differences?

- While accounting policy is a principle or rule, or a measurement basis, accounting estimate is the amount determined based on selected basis or some pattern of future consumption of the asset.For example: choice fair value vs. historical cost is a choice in accounting policy (remember, measurement basis), but updating some provision based on fair value change is a change in accounting estimate.

- While change accounting policy is accounted for retrospectively , you need to account for change in accounting estimate prospectively.

Just be very careful and realize whether it’s about principle or about calculation. If you do it wrong, well, your accounts can go wrong, too!

The standard IAS 8 says that if you cannot distinguish if your change is a change in accounting policy or a change in accounting estimate, then treat it as a change in accounting estimate.

Errors

Prior-period errors are some omissions from (that’s when you forget something) or misstatements in the financial statements as a result of ignoring or misusing the information that was available or could be reasonably obtained when preparing these financial statements.

It does not really matter why the error happened – whether it was intentional (fraud) or unintentional, you still need to correct it if it is material.

The question is:

Is the error material?

The concept of materiality is explained in IAS 1 Presentation of Financial Statements, but to simplify: anything that can affect the decisions of users of financial statements is material. In other words – anything significant.

Do not forget that something can be material not only because of its size, but also due to its nature: for example, bonuses paid to your management are always significant, whether they amounted to a few dollars or to millions.

Back to our errors:

- If the error is NOT material, then you can correct it in the current reporting period. Remember, if the error is NOT material, then your financial statements still might be reliable and relevant.

- If the error IS MATERIAL, then you always correct it retrospectively, by going back and restating your figures in the previous periods.

For the specific example with correction of error, please read here about correcting wrongly estimated useful lives of your assets.

You can watch a video with IAS 8 here:

If you liked this article or you have anything to say, please leave a comment below this video and share, thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia

A great article. One technical question to better understand the standard.

If a company has been capitalizing ~40% of its IT development cost (based on actual time sheets) and for sick and vacation days all amounts were expenses; and in case of is a decision to apply the same allocation of 40%60% to sick & vacation days shall it be treated as a change in policy (with retrospective application) or change in estimate (prospective application) or an error?

Hi Silvia,

Thanks for the wonderful explanation. Your really made IFRS easy to understand. I have a doubt, where excess remuneration received by the director in previous year was refunded to the company in current reporting period, whether this transaction will be treated as prior period items and do we need to restate the comparatives of last year leading to the nature of transaction.

this is important topics

It was really helpful. Thank you Silvia!

Hi, is there any chance you’d be able to show how each section( errors estimates and accounting policies ) affect the financial statements.

A very simple and concise way of presenting a standard for easy assimilation.

Hello Madam. Thanks for you comprehensive article. Whenever I got doubt, I refer ifrsbox. One small doubt. Can you give examples for the following statement

1. Application of accounting policy for transactions, events, conditions that differ in substance from those previously occurring

2. Application of new accounting policy for transactions, events, conditions that did not occur previously or were immaterial.

Thank you Silvia, You turns accounting & IFRS from routine daily work to art.

I like your way of summarizing and explain the IFRS, Your work is very appreciated.

Thank you.

Thank you very much for your invaluable support for the learners. I am very pleased.

Hi Silvia I really appreciate this bec. it is short yet so precise and direct to the point.

I would like to inquire for your decision with this situation:

100,ooo worth of depreciation was unintentionally reversed due to the sale of the asset, however, it should still be included in the expense. The total amount of Depn for that year amounted to 84 million but to that specific group of assets it amounted only to 1.3 million. Should i reinstate or just adjust this year’s depn?

Would really appreciate your reply 🙂

Thank you.

A short question please: My company was presenting its Investment Property under cost model because they were not able to measure fair value (FV) of the property in the past upto FY 2017. Now from FY 2018, they are able to measure the FV of the property. Hence, they decided to change the accounting policy voluntarily from cost model to FV model for relevant and faithful presentation of the financials. However, they are unable to re-state comparatives FY 2017 because they were not able to measure FV of the property in previous years e.g. 2017 and earlier.

Is this allowed or they have must re-state comparatives?

Good day

If I revalue assets at the end of the financial year (period 12) do I need to adjust prior period in the financial year this is period 1 to period 11

As per Power Purchase Agreement terms after every four years tariff revision happen and previous tariff revision was happened in 2013 and which was due for next revision in 31st Dec 2017. Two government took yearlong to negotiate to increase the export tariff. However it was approved in March 2018 for export tariff increase by 0.20 cent w.e.f 1 Jan 2017.

Do we have to restate the financial for the revised tariff from 1 Jan 2017 to 31st Dec 2017, Since Financial statement for the year end 31st Dec 2017 was complete or can we recognize the revenue in the current period

Hi Silvia!

IAS 8 deals with changes from cost to revaluation model as a prospective change.

is this in line with the conceptual framework and how?

i understand that by applying the rules of IAS16 over IAS8 in this particular case would prove to have more relevant and reliable information. would this argument be correct?

can you also give me additional information that i could include in my discussion

thank you very much!

Hi,

Can I reverse the previous year Bonus/IT expenses as other income ? Or the same needs to be reversed in the respective GL ? What is the guideline, if after the reversal into the same account, the expenses in respective GL goes -ve ?

Thanks in advance

Hi Ajit,

there is no guidance specifically tackling this question, but IAS 1 asks to categorize expenses either by nature or by function and logically, reversal of some previously recognized expense should be done under the same caption (also for comparability purposes).

Hello Silvia, great article, We are going to use it to assess our situation.

Recently, the supreme court equivalent here in Brazil judged a change in the VAT calculation method over selling gross price. This method generated additional VAT that was deducted from gross sales, resulting in less net sales. That difference can now be compensated (it will become an income/revenue/ VAT reversion). Furthermore, the government will not (so far) change the law, thus all companies that want to use that difference will have to undergo administrative/legal procedures, even for the current/coming years. So, based on this evidence, I understand that this should be classified as a change in accounting estimates (meaning we will recognize it in the current P&L and in the future P&Ls) and not as an error, since we never recognized that as a possible gain (due to the impossibility of estimating how long the court would judge that question). Can you give us a comment?

Thanks in advance!

Rafael

Hi Silvia,

Thanks for explaining the IAS 8.

In case of a PPE, initially we were using the cost model and now we have changed it to revaluation model,whether it is a change in policy or estimation? If it is a change in policy(as measurement changes) then treatment should be retrospective but I have seen in some texts treatment for such cases is prospective.. Could you please suggest the correct treatment for such cases?

Thanks in advance!

Regards,

Deepak

Deepak,

IAS 8 specifically says that this type of change is treated prospectively. S.

Ok, Thanks Silvia!

Hi Silvia

Hope you’re well. IFRS for SME’s does state this in s10.10A.

But I cannot find the reference in IFRS. Please may you assist me

I think I may have found it – IAS8.17

Thank You Silivia this is great Opportunity for us

Thanku Silvia , this is very helpful!!!

Dear Silvia,

We currently depreciate our PPE over 10yrs using straight line method. however, we now wish to change this to 15% using the reducing balance method. Will this represent a change in a/c policy or estimate or both. Do we need to disclose this in the notes?

Thanks

Hello, AKM, this is the change in accounting estimate. Yes, you need to disclose it in the notes and account for the change prospectively (do not restate anything). S.

My policy was lifo at 2001.now at 2006 I want to change in FIFO. Only restate 2006 & 2005 amount? Or start from 2001?

What is the meaning of earliest date?

Hmhm, are we really talking about 12 years ago? S.

Dear Silvia,

I have this client that do not record/accrue for bonus of employees due to insufficient profit. However, come 2017 they decided to record bonus expense based on 2016 performance. So come the end of 2017, they accrue bonus for 2017. In their GL, there will be two bonus one based on 2016 and other for 2017. Does the change in bonus policy resulted to change in accounting policy? Or this is an prior year error on the part of the company?

Thank you

Hi Cyrisse, the question is when the bonus was granted to employees and whether there was some obligation (legal or constructive) to provide the bonus. Anyway, this is NOT the change in the accounting policy; if there was a constructive obligation to provide bonus for 2016, then I would really adjust prior year. S.

Hai Silvia, for error, you mentioned that “If the error is NOT material, then you can correct it in the current reporting period. Remember, if the error is NOT material, then your financial statements still might be reliable and relevant.”

My question is how we correct it, by:

a. Recognizing profit/loss in income statement?; OR

b. Restating the opening balance of asset, liability, and equity in the current period?

Thanks..

Hi Yulias,

that would be a) option. S.

In regards to changes in estimate and retrospective adjustment. What does current period really mean?

So, if a company changes an accounting estimate at month 7 of a financial year, should the effect of this change in estimate be made from Month 7 (is this retrospective?) or will the company be allowed to pass a journal to correct the figures from Month 1 to Month 6 of that particular financial year?

Hi Silvia

Where a company wants to change the depreciation method of its assets from diminishing value to straight line (i.e. a change in estimate) does AASB 108 (IAS 8) para 37 apply in that the carrying values of the asset must be adjusted?

If this is the case a significant reversal of depreciation would need to occur. Which to me does not seem correct. I am having trouble finding examples in this regard.

Could you provide some guidance an example calculation/ journal or direct me to the an appropriate resource.

Thanks in advance

Hi Silvia,

On analyzing the Fixed Assets classification we realized, some of the assets were wrongly classified under inappropriate heads. However, the depreciation impact is not material. Would like to know, in current reporting period which of the following treatment would be appropriate for correcting this:

1. Depreciating the current carrying value over remaining revised useful life or,

2. Taking a one time impact for Depreciation wrongly charged till Date minus Revised Depreciation calculated till date using correct useful life in P&L

Dear Mansi,

it depends on whether the error is material or not. You write that it’s not material and therefore, you can simply correct it by recognizing total impact in profit or loss and making the appropriate disclosure in the notes. S.

Hi silvia,

Following is my question. Can you please help me with this one:

A company changed its accounting policy for land and building from fair value to historical cost. The change in accounting policy resulted in reduction of carrying value of land and building of $29.229M although the net reducion in assets was $20.460M owing to the reversal of related deferred tax liability of $8.769M.

Critique the change in accounting policy ?

Dear Pranjal,

this seems like a homework question and I’ve said it a few times on this website – it’s YOU who should do it. Thanks for your understanding. S.

Hi Sylvia..

In year end 2015, based on estimation, my company accrued a fee expense, say CU 1,500. Then in March 2016 (2015 book is closed and audited), the agreed fee is CU 1,350. How should we account the difference CU 150? Should we correct the 2015 accrued expense and correct beginning R/E, and treated as error?

Thanks

Dear Yulias,

no, you should not correct the books in 2015 – after all, CU 1500 was your best estimate of the expense that you made in 2015 in line with IAS 37. The difference is recognized in profit or loss of 2016. S.

Hi Sylvia

Is reclassifying investment in associate to AFS a change in accounting policy in consolidated financials? Assuming that no circumstances were changed from the date of initial investment.

Hi Sylvia,

What about special industry like insurance, whereby the company would like to re-class its other operating income to operating income as they realized the nature of the other operating income is actually income from operating activity.

Does this need to be stated in the notes to the financial statements and to be adjusted the previous year as well?

Please advice

Tq

Dear Azlin,

in fact yes – you would need to present restated comparative figures in your statement of financial position, because IAS 1 asks for consistency of the reporting. So you can’t really present this income as operating income 1 year and other operating income for comparatives. But this is more question of IAS 1 rather than IAS 8, because here, it’s a matter of presentation and not really some recognition error or change in accounting policy. S.

Hi Sylvia. Thank you very much. However, I have a question which is off this topic.

The question is on IAS 2.

My company used a method of valuing inventory where the selling price is adjusted using a cost factor to arrive at estimated cost. Is this acceptable under IFRS?

My thoughts are that the cost is estimated cost and may not represented the truest or fairest value of the inventory.

Please what do you advise?

Thank you.

My company is into lake transportation. We estimated 25years for our vessels and we use straightline method of depreciation.this method leads to huge depreciation charge in our fin statements. What is the best international practice for estimating fresh water vessels and thedepreciation method.should it on reducing balance or on nautical miles?

I really need your help

Dear Moses,

I have read your question (also in my e-mails 😉 ). This is very specific and frankly speaking, I haven’t came across this type of industry.

But, logically thinking about your situation, it would be really appropriate to use “units of production” method for the depreciation, as these vessels are used specifically for transporting water and they wear and tear based on their usage.

So, if you can estimate total amount of nautical miles (I’m not sure whether only miles; whether it would be appropriate to include some weight of the cargo transported – as carrying 200 kg probably uses your vessels less than carrying 1000 kg – I hope you get my point) over the life of the vessels and then trace the amount of miles transported each year, that would be fully acceptable in my opinion.

S.

Silvia, am really enjoying your lessons. I want the best international practice for estimating the useful life of fresh water vessels and the depreciation method that is appropriate

Dear Silvia,

In 2014, my company bought an equipment, estimated useful life 10 year. During 2015, change of useful life and residual value due to technology reason. So, do I have to restate the depreciation of 2014?.

Great thanks

Dear Hang,

no, this is a typical change in accounting estimate and you need to adjust it prospectively (=in the current and future periods if applicable, no restatement of past). S.

Dear Silvia,

Recently i came across a fuzzy question from one of my clients. A company 3 years ago bought the 100% of share capital of another company but they booked this acquisition as an asset acquisition and not a business combination.

Today they want to change this choice because they want to recognize the initial deffered tax from which an exception was in place at the first day. is this a change in accounting policy ,estimation , or error ?.

b) Suppose that the company i mentioned above change its operations and today is a real business and not just an asset , should they treat that change as a change in estimates,error or policy?

thanks in advance

Hi Bill,

well, suppose the buyer gained a control – then yes, they should have accounted for this acquisition as for the business combination. But here be careful – it means, that in the separate (buyer’s) financial statements, they can still book the asset only as per IAS 27, you can keep investments in subsidiaries at cost, too (besides other methods).

However, they did not prepare the consolidated financial statements in line with IFRS 10 – which really is a kind of error, as they ignored IFRS 10/IFRS 3 completely. What I would do, is to present consolidated financial statements as at the current reporting period, with comparatives and stating about this omission.

I don’t understand your second question. Sorry for that. Maybe you should explain what you mean, as I don’t get the point.

S.

I like your instant answers

Hi Silvia thanx alot too easy and too simple.by the way what do you mean by restating comparatives?

It means that you present the comparative figures in line with new policy, not the same numbers as in the previous reporting period.

where is my question which i sent today

An asset value of 500,000 received as Government grant received last year have been omitted from last year accounts and also amortization of government grant for last year amounting to 200,000 have not been charged to P&L.

So what we did this year we debit 500,000 assets account and credit 500,000 government grant account this year. Is this ok or should we restate last year figures that mean opening balance of last year grant a/C and asset a/c.

Then we credit retained earnings 200,000 and debit that amount to grant account as prior year adjustment is this ok or should we restate opening balance of retained earrings and grant account.

any one can please help

Nayani, it all depends on whether this is material for your own company or not. I would say that this omission is material due to its sensitivity if not size, because it’s government grant – but it’s up to you to assess.

In that case, you need to go back and restate previous year’s amounts. S.

Thanks so much. we appreciate what you are doing. God bless u.

Hi Silvia,

Thank you. This summary is very helpful. I really appreciate your help.

thanks a lot very useful lesson for us we are waiting for more from you ,pleas we asked for the consolidation standards.

Hi Azakaria,

thank you! In relation to consolidation standards: there’s lot of articles and videos about them on this website, just take a look. Silvia

This is insightful Silvia. What about disclosures?

wow! so valuable and resourceful. I appreciate your effort

I am very excited to have this article as I am preparing to set for my f7 ACCA subject, well done Silvia, and Thank you.

Very useful and well done.Thank you Silvia for this excellent update.

valuable information, thanks a lot.

excellent wow very valuable thank you very much

Hi, this is a very good note. Really appreciate your help every time.

Regards.

very simple ways of explaining

very good

Your presentation of IAS 8 is concise, clear and good graphics help accelerate understanding of the fine points as illustrated by you. A Big Thank You.

really important and thanks sivia..