How to Account for Subsequent Expenditures in Agriculture?

The standard IAS 41 Agriculture prescribes measuring all biological assets at fair value less costs to sell (with exceptions), while all the changes in fair value are recognized in profit or loss.

Here, one significant question arises: How should you account for expenditures that you incur during the year in relation to these biological assets?

Food, vaccinations, veterinary expenses, fertilizers, pesticides…?

In this article with video, I tried to answer the question from Wai from Australia who struggled with exactly the same thing:

“I work for a company that owns a few sheep farms. We are breeding sheep for sale and for the purpose of the production of sheep products like milk, cheese and other.

I know that we must apply IAS 41 for accounting of sheep and remeasure them at fair value less costs to sell at the end of the reporting period.

But, how shall we account for expenses like food for animals and veterinary costs?”

Answer: IAS 41 does not tell you, so make your own policy

I am sure that many accountants working in agricultural activities will appreciate the answer to this question and not only if you work in the animal production, but the similar questions pop out in the companies working with plants, like palm trees, wheat, vineyards and other.

In fact, my answer will not only relate to the animal food and veterinary expenses, but also to fertilizers, pesticides, removing the weed and other related expenses.

So how shall we account for these costs?

Well, the trouble is that the standard IAS 41 Agriculture is silent on this topic.

There are no exact rules on how to present these costs.

Why?

I read the basis for conclusion related to IAS 41 – that’s a document explaining why the standard creators created the rules as they are.

It says that it is not necessary to make the rules about the subsequent expenditures in agricultural activities, because biological assets need to be remeasured to their fair value less cost to sell with all changes in profit or loss and thus it does not matter how you treat the subsequent expenditure.

I do not fully agree with this approach, for a very simple reason:

It is true that the effect on profit or loss will always be the same – I will show you in the short illustration later.

But, the presentation of the individual expenses in your profit or loss is totally affected by the way of how you treat the subsequent expenditure.

Also, your cash flow statement will look differently.

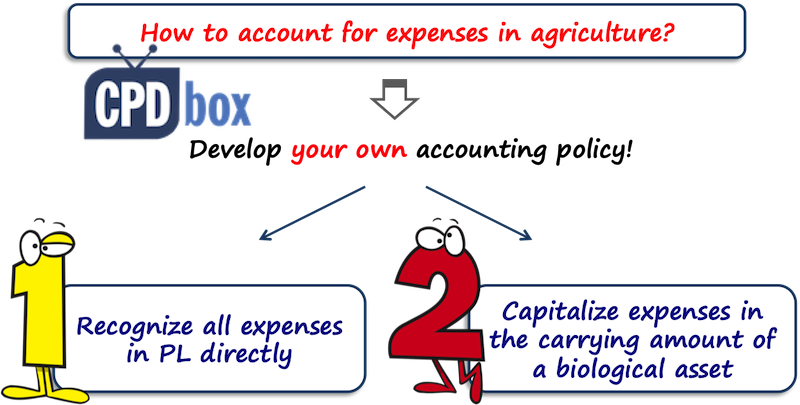

Select the accounting policy

In any case, it is YOU who need to set the accounting policy of treating the subsequent expenditure.

Basically, you have 2 options:

- Put all subsequent expenditure in profit or loss directly, or

- Capitalize the subsequent expenditure in the carrying amount of your biological assets.

Let’s explain.

Option #1: All expenses in profit or loss

This is very simple and very easy way of doing the things.

In my opinion, it is not ideal, because in this case, you would show big expenses in your profit or loss statement and on the other hand, you would show big increase in fair value of your biological assets.

What’s wrong with that?

Well, the fair value of your biological assets increases not only due to external market changes, but also due to your activities like feeding the animals, taking care of them etc.

If you present all expenses in profit or loss, you are effectively presenting the increase in fair value in one bunch regardless its source or reason.

Sure, fo some assets, you need to add additional disclosures about the fair value change due to price change and physical change – but this disclosure is just encouraged, not obligatory.

Option #2: Capitalize expenses in the carrying amount of an asset.

Under the first option, you would add the expenses to the carrying amount of the biological asset.

This way, you do not show big expenses for agricultural activity in your profit or loss, and also you show smaller increase in fair value of your biological assets.

In my opinion, this method reflects the fair value changes better than the first method, but it is more demanding and challenging.

Example: expense vs. capitalize

Let’s say the fair value of your herd of sheep was CU 1 000 at the end of year 1.

In the year 2, you spent CU 200 for the sheep food supplements, vet and other living and breeding expenses.

The fair value of your herd is CU 1 500 at the end of the year 2.

Accounting #1 – all expenses in profit or loss:

The journal entry for the subsequent expenses is:

- Debit Profit or loss – operating expenses: CU 200

- Credit Suppliers / Bank account: CU 200

The journal entry to remeasure the carrying amount of sheep herd to fair value less cost to sell at the end of year 2:

- Debit Biological assets: CU 500 (CU 1 500 – CU 1 000)

- Credit Fair value change in profit or loss: CU 500

Here, the net effect in profit or loss is CU 300 which a gain from remeasurement of 500 less the expenses of 200.

Accounting #2 – expenses are capitalized:

The journal entry for the subsequent expenses is:

- Debit Biological assets – sheep herd: CU 200

- Credit Suppliers / Bank account: CU 200

The journal entry to remeasure the carrying amount of sheep herd to fair value less cost to sell at the end of year 2:

- Debit Biological assets: CU 300 (CU 1 500 – CU 1 200)

- Credit Fair value change in profit or loss: CU 300

The net effect in profit or loss is CU 300 which is just gain from remeasurement.

So it’s the same, but the presentation is different.

This table summarizes the impact on profit or loss:

| Expense | Capitalize | |

|---|---|---|

| FV change | 500 | 300 |

| Operating expenses | -200 | 0 |

| Net effect on P/L | 300 | 300 |

How to set your accounting policy?

Finally let me just outline the optimal process of setting the accounting policy for the subsequent expenditures.

If you want to take it easy regardless the presentation in profit or loss, then go for option 1 and put all the expenses in profit or loss as they arise.

If you care more about the presentation of your profit or loss and cash flows, then you can try looking at IAS 2 and IAS 16 for some guidance.

These standards do not apply to biological assets, but you can use them as help in developing your own policy.

You can just decide that all the expenses that maintain the assets, are expensed – for example, routine vaccinations of animals, pesticides with plants, etc.

And, all the expenses that help increase the yield or outcome of the biological assets would be capitalized – for example, food supplements or fertilizers.

This is quite challenging, because here you need to apply your judgement to determined which costs to capitalize and which to expense.

Here’s the video summing up the issue:

Any questions or comments?

Please add them below this article. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

23 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Dear Silvia …. some Accounting standards teacher stated that when agriculture produce has been detached from biological asset , it would be treated under IAS 2 . where as table given by ifrs.org shows wool, milk and picked fruit as agriculture produce . now my question is whether wool detached from lamb , milk out of udder and fruit picked from tree would be dealt according to IAS 2 or IAS 41 ?

https://www.ifrs.org/content/dam/ifrs/publications/pdf-standards/english/2021/issued/part-a/ias-41-agriculture.pdf

Hi Malik, both are correct. So, when the wool is detached from the lamb, it is an agricultural produce and you should measure it at fair value less costs to sell initially – which is essentially NRV. This is also in line with IAS 2, where you measure inventories at lower of cost and NRV – in the case of wool, you can’t measure cost reliably, so you use NRV. Simply speaking – you harvest the agricultural produce, measure it at NRV and then continue in line with IAS 2.

Hi Silvia, kindly clarify if you need to apply IAS 41 to the “apple still on the tree” before harvested. Or do you not account for the produce at all while growing.

“Apple still on the tree” is not detached from the bearer plant, thus it does not meet the definition of a harvest.

Hi Silvia,

I have doubts about what is meant by “subsequent expenditures”. Is purchased fodder considered a “subsequent expenditures” on the date of purchase or when it is used? If it is the first case, what happens with the unused fodder on the date of the financial statements? is it inventory? Could it be considered materials and supplies consumed in the production process or provision of services? please.

Thanks.

Only what has been consumed.

Hello Sylvia, thanks for the good work. I have an issue here. Let me explain to you. I am currently working for PriceWaterhouseCoopers, and now I am assisting in Implementation of Accrual Accounting Standard for my local government system. At the moment, the local government policy do not capitalize the cost to acquire animals and plant but instead they expensed them off to the P/L Statements. This is because those costs are deemed to be immaterial to their financial statements. So my question here, what if in the future the costs suddenly become material, and they capitalize the costs, how should the transition be done? Is there any explanation in the standard for such case?

Hi Peter,

here we are in fact talking about the threshold for capitalizing the costs. I answered analogical question related to PPE here: https://www.cpdbox.com/030-capex-threshold-ppe-ifrs/

Please read it, I think it answers your question, too.

Honey bees considered biological assets?

Yes, if they are held to produce honey and you control them.

I work with a plantain farm which over 5000 plantain studs, however fire gut about 2550 of the plantain studs the following year. please how do we account for the fire incident in line with IAs 41?

Yes, it does, to the point of harvesting the wood.

Dear Siliva,

A Co (plywood industry) having a land and done forestry on it . co have done all relevant expenses on it for 2 years (life).After 2 year they cut plant and use their wood as a raw material.

please guide either IAs 41 apply on above activity on it or not.

Can you please tell me how we treat the expenses or cost we incur initially.

How do we treat them

Thank you soo much. And for the quick response too

Hello Sylivie. Thanks for the good work. My question is:

If a company ventures in agriculture with objective of breeding and maturing cattle for future sales, do we record any purchase of calves and mature cows as biological assets or inventories?

What journal entries do we pass if some of the cows are sold? Do we credit sales and credit inventories / biological assets? Thanks

Hi Kapala, yes, they are biological assets, because they are involved in agricultural activities (breeding/maturing). If you sell them, then you account for Debit Receivables (or cash received for sale)/Credit Revenues from sales; and Debit Cost of sales / Credit Biological assets. S.

Thank you so over much for the mail.God bless you and wish you LONG LIVE!

Dear, How can i recognize the accumulated cost of Young coffee if young coffee died before bearing first fruit?? Example, Suppose,Total accumulated cost of young coffee incurred for 5000USD three years. If three years of half of young Coffee died,how could i recognize the cost of death coffee??

Hi Deme,

I think you should take the value of the threes and add to the depreciation of the biological asset, vrs the expense as impairment of losses. NIIF SMEs 34.10

Dear,Silvia, How are you doing today?? Hopping things are goes with you awesomely. I would kindly like to thank you so over much for sheer humble description on subsequent expenditure in agriculture.

My name is Deme Gebreyesus. i am 29. i live Jimma, Ethiopia,East Africa. I am accountant at Horizon Plantation PLC unde MIDROC company. My company will have colse its accotnts as per IFRS starting from July7/2018 (Ethiopian Fiscal year starting July8 through July7),

Best regards with warm greetings!!

Deme

Hi Deme, you are very welcome, I’m glad it helped!

I think that this article can also help if you are dealing with agriculture: Top 3 Questions about IAS 41 Agriculture.

All the best

S.

dear, Silvia, for i am working as accountant at Horizon Plantation PLC, i am really facing some accounting challenges for sure.Please, Should I capitalize up-rooting cost of coffee tree and infilling or re-planting cost of coffee too. Impairment is too new for company.

Hi Silvia.

Thanks for the well detailed information. Just for emphasis, can the cost of planting seedlings be capitalized?

Awaiting ur prompt revert. Thanks