Summary of IAS 40 Investment Property

Last update: July 2023

Many accountants falsely believe that there’s only one standard that deals with long-term tangible assets: IAS 16 Property, Plant and Equipment.

While it’s true that you need to apply IAS 16 for most of your long-term tangible assets, it’s not the one ruling all. I tried to falsify this myth some time ago here.

Except for IAS 16, we have a few other standards arranging the long term assets. IAS 40 Investment Property is one of them.

In today’s article, you’ll learn:

- What the investment property is,

- How you should account for it initially and subsequently,

- You’ll also learn that the fair value model is NOT the same as the revaluation model, and

- The video is waiting for you in the end.

Here’s a little bonus for you:

Before we dive in IAS 40, my good friend Professor Robin Joyce wrote a wonderful piece that teaches you accounting for IAS 40 in 40 seconds. Hope you’ll enjoy!

Accounting for IAS 40 in 40 seconds

The accounting for IAS 40 Investment Property is identical to that of IAS 16 (Property, Plant and Equipment),

EXCEPT

that IAS 40 revaluations (both positive and negative) go to the income statement (not revaluation reserve)

AND

there is no depreciation if revaluations are carried out every year.

DONE!

Any remaining seconds should be spent on learning the classifications and rules of IAS 40 Investment Property.

Now, let’s take Robin’s advice and spend the remaining seconds for learning the rest.

Objective of IAS 40

IAS 40 Investment Property prescribes the accounting treatment and disclosure with respect to investment property.

But, what is investment property?

The investment property is a land, a building (or a part of it), or both, held for the following specific purposes:

- To earn rentals;

- For capital appreciation; or

- Both. (IAS 40.5)

Here, the strong impact in on purpose. If you hold a building or a land for any of the following purposes, then it cannot be classified as investment property:

- For production or supply of goods or services,

- For administrative purposes, or

- For sale in ordinary course of business.

If you’re using your building or land for the first 2 purposes, then you should apply IAS 16; and the standard IAS 2 Inventories fits when you use them for the sale in ordinary course of business.

Examples of investment property

What specifically can be classified as investment property?

Here is a couple of examples (refer to IAS 40.8):

- Land held as an investment for long-term capital appreciation, or for future undetermined use (i.e. you don’t know yet what you’ll use it for).

However, if you buy a land and you intend to build some production hall for your own purposes sometime in the future, then this land is NOT an investment property. - A building owned by the entity and leased out under one or more operating leases. This includes a building that is still vacant, but you plan to lease it out.

- Any property that you actually construct or develop for future use as investment property.

Be careful here again, because when you construct a building for some third party, this is NOT an investment property, but you should apply IFRS 15 Revenue from Contracts with Customers.

When to Recognize investment property

The rules for recognition of investment property are essentially the same as stated in IAS 16 for property, plant and equipment, i.e. you recognize an investment property as an asset only if 2 conditions are met:

- It is probable that future economic benefits associated with the item will flow to the entity; and

- The cost of the item can be measured reliably.

How to measure investment property initially

Investment property shall be initially measured at cost, including the transaction cost.

The cost of investment property includes:

- Its purchase price and

- Any directly attributable expenditure, such as legal fees or professional fees, property taxes, etc.

You should NOT include:

- Start-up expenses whatsoever.

However, if these start-up expenses are directly attributable to the item of investment property, then you can include them. But do NOT include any general start-up expenses. - Operating losses that you incur before planned occupancy level is achieved, and

- Abnormal waste of material, labor or other resources incurred at construction.

When payment for investment property is deferred, then you need to discount it to its present value in order to set the cash price equivalent.

Let me just mention that actually, you can classify assets held under the lease as investment property and in this case, it’s initial cost is calculated in line with IFRS 16 Leases.

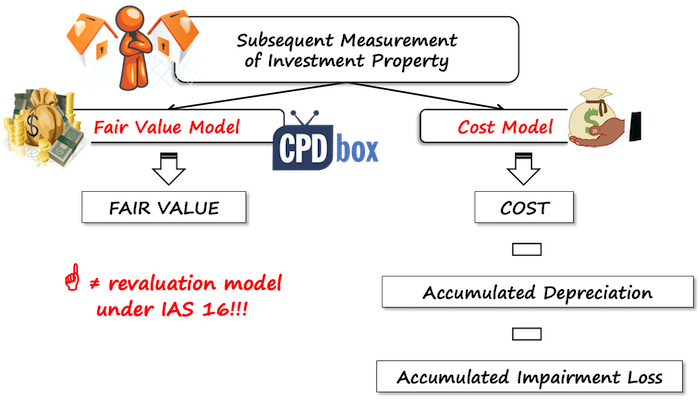

Subsequent measurement of investment property

After initial recognition, you have 2 choices for measuring your investment property (IAS 40.30 and following).

Once you make your choice, you should stick to it and measure all of your investment property using the same model (there are actually exceptions from that rule).

Option 1: Fair value model

Under fair value model, an investment property is carried at fair value at the reporting date. (IAS 40.33)

The fair value is determined in line with the standard IFRS 13 Fair Value Measurement.

A gain or loss from re-measurement to fair value shall be recognized in profit or loss.

Sometimes, the fair value cannot be reliably measurable after initial recognition. This can happen in absolutely rare circumstances (e.g. active marked ceased existing) and in this case, IAS 40 prescribes (IAS 40.53):

- To measure your investment property at cost, if it’s not yet completed and is under construction; or

- To measure your investment property using cost model, if it’s completed.

Option 2: Cost model

The second choice for subsequent measurement of investment property is a cost model.

Here, IAS 40 does not describe it in details, but refers to the standard IAS 16 Property, Plant and Equipment. It means you need to take the same methodology as in IAS 16.

Switching the models

Can you actually switch from cost model to fair value model or vice versa from fair value model to cost model?

The answer is YES, but only if the change results in the financial statements providing better, more reliable information about company’s financial position, results and other events.

What does it mean in practice?

Switching from cost model to fair value model would probably meet the condition and therefore, you can do it whenever you’re sure that you’ll be able to determine the fair value regularly and the fair value model fits better.

However, the opposite change – switch from fair value model to cost model – is highly unlikely to result in more reliable presentation. Therefore, you should not really do it, and if – rarely and for good reasons.

Transfers from and to investment property

When we speak about transfers related to investment property, we mean the change of classification, for example, you classify a building previously held as property, plant and equipment under IAS 16 to investment property under IAS 40.

The transfers are possible, but only when there’s a change in use or asset’s purpose, for example (refer to IAS 40.57):

- You start renting out the property that you previously used as your headquarters (transfer to investment property from owner-occupied property under IAS 16)

- You stop renting out the building and start using it for yourself

- You held a land for undefined purpose and recently, you decided to construct an apartment house to sell apartments when they are built (transfer from investment property to inventories).

What’s the accounting treatment in this case?

It depends on the type of a transfer and the accounting choice for your investment property.

If you opted to account for your investment property at cost model, then there’s no problem with the transfers, you simply continue with what you did.

However, if you picked up a fair value model, then it’s a bit more complicated:

- When you transfer to investment property, then the deemed cost is a fair value at the date of transfer. Difference between asset’s carrying amount and its fair value is treated in the same way as revaluations under IAS 16.

- When you transfer from investment property, then the deemed cost is also fair value at the date of transfer.

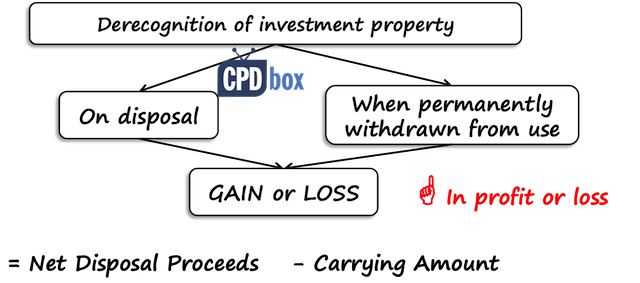

Derecognition of investment property

The derecognition rules (=when you can remove your investment property from your books) in IAS 40 are similar to the rules in IAS 16.

You can derecognize your investment property in two circumstances (IAS 40.66):

- On disposal, or

- When the investment property is permanently withdrawn from use and no future economic benefits are expected.

You need to calculate gain or loss on disposal (IAS 40.69) as a difference between:

- Net disposal proceeds, and

- Asset’s carrying amount.

Gain or loss on disposal is recognized in profit or loss.

Disclosures

IAS 40 Investment property prescribes a lot of disclosures to be presented in the financial statements, including the description of selected model, how the fair value was derived, what the classification criteria for investment property are, movements in investment property during the reporting period (please refer to IAS 40.74 and following for more information).

Please watch the following video with a summary of IAS 40 Investment property:

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

- Yamkela on How to Account for Decommissioning Provision under IFRS

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

Hope you are doing good.

My question” If a property transferred from IAS 16 to IAS40, and you picked up a fair value model then as per the standard firstly, we need to revalue the assets under IAS16, so what would be the treatment of that revaluation reserve and when this revaluation reserve move into retained earnings?As per IAS 16 we can transfer the revaluation reserve into retained earning at the time of disposal of asset.But here we are not disposing the assets and we only reclassifying the asset.Could you please suggest?

Thanks in advance!

Regards,

Deepak

Hi Deepak,you leave the revaluation reserve as it is and you would reclassify it to retained earnings upon subsequent disposal of investment property (not through profit or loss). Please see par. 62 b (ii) of IAS 40.

If a property has been recognized as an Investment property mistakenly & this should have been a PPE. A revaluation was also recognized.

Could you please help me rectify this !!!!!

I have to get this sorted at the earliest.

Dear Shameela,

if this was a mistake or an error, just correct it as an error in line with IAS 8. If it is material, then correct the previous periods, too. If it’s not material, just correct the error in the current period. You can read more here. S.

Could you kindly give me the details of bibliography for this page?

Dear Syliva

please help to solve this dilemma

a company bought a land and measure it at fair value as investment property,after years, the company decided to erect a building on the land to be used also as investment property.

Now the fair value of the new investment property( both land and building) is not reliably measurable and the company will apply IAS 40, para 53 to record building under construction at cost until construction complete.

The Dilemma is how to account for land element, which will cease to be separate element anymore.

should we record it at its initial cost? continue recording at fv separately from the building, use current fv as cost basis during construction? or other treatment?

the company policy is to consider each investment building and its land as one asset

Dear Sylvia,

a company owns a land held for rental to sellers on open city market (fruits, vegetables, fish). No contract is signed, the sellers pay a certain amount to the company for the “place” they can put their stand. How to account for this land? It is not covered. IAS 40?

Thanks

Dear Silvia,

In case we chose to keep the investment property at fair value, how often should we revalue them? Do we have to do it yearly? If not, how do we prove that the value of the investment property did not change from one year to another?

Thank you,

Adriana

Dear Adriana,

for investment property under IAS 40 – yes, you do need to account for the change in fair value on a yearly basis. S.

Dear Silvia,

Thank you for your answer.

Adriana

Hi Silvia – can capital raising fees and loan structuring fees be capitalised to the cost of the investment property (i.e cost of incurring the loan)? the loan was incurred to finance

the develolment/building costs -interest has also been capitalised to the cost of the property.

dear Silvia,

i dont know what is the difference between transfer TO and transfer FROM investment property… should we record the depreciation in the year of transfer from investment property to fixed asset ?

Hi Sylvia

I am a bit confuse. The company owns a office park with 3 stand-alone buildings. One building is use by them as there head office and the other 2 are rented out under a operating lease. Can this whole land be classified as joint use property or can I say the head office is ppe-owner occupied and the other 2 are Investment property…please help

Just a clarification on Owner Occupied, what if a residential property owned by the a business is used to house the business management personnel. Should it be classified as Investment property (IAS40) or PPE (IAS16)

Madam,

till last year the Investment property and the financial instruments are reported at cost model. Now the company has decided to use fair value model. The company has engaged consultant to value the investment property and the financial instrument such as Bond and Equity at fair value. The difference between carrying value and the fair value is so huge.

also, the company is yet to adopt full IAS and IFRS, and intends to adopt full IAS and IFRS by June 2017.

Under such case, how should I treat the fair value gains for Investment property and Financial instruments. Can I consider this initial fair value gains (Fair value-carrying amount) as revaluation reserve. the subsequent gains/loss will be routed through P/L.

Madam Silvia

I have following practical question. Can you please look into and respond?

A company changes from cost to fair value mode. On 1 Jan 2016 the carrying amount of the property is CUR 750 and the fair value of the property is CUR 1000. During the year end 31 Dec 2016 company capitalizes further additions of CUR 400 and borrowing costs CUR 100. Now the carrying cost as on 31 Dec 2016 is CUR 1250. The fair value of the property at 31 Dec 2016 is CUR 1400. What will be gain to be recognized in income statement CUR 650 (1400 – 750) or CUR 150 [1400 – 1250 (750 + 400 + 100)]? If answer is CUR 650 then whether additions during the year (400 + 100) will be capitalized or will there be a different treatment? Further, has fair value as on 01 Jan 2016 (CUR 1000) any relevance?

Thank you.

Dear Silvia,

Thanks for the write up, its informative.

i have a question on transfer from owner occupied property to investment property. If i am currently following revaluation model under IAS 16 for the owner occupied property whereas for investment property I am following cost model, on the date of transfer at what value should i recognize the property under IAS 40?

Hi Sandeep,

this is a very odd – measuring PPE using revaluation model (i.e. fair values) and investment property using cost model. It’s not against the standards, however, I’m not sure if it really ensures the true and fair view. Just my opinion.

Nevertheless, this situation is not solved in IAS 40, however, I would apply the analogical method as the one when you transfer the asset from investment property at fair value to PPE. You should simply take the fair value at the date of change as the cost of an asset. S.

HI. Siva .It was excellant

A hotel which only provides rooms to stay, rooms will be treated as inventory or PPE or Investment property?

Hi Silvia,

Really insightfull vedio.

In Property, plant and equipment,, defines as tangible items that:

are held for use in the production or supply of goods or services, for rental to others, or for administrative

purposes;

the purpose also covers Rental and In Investment property also covering rentals..

Could you Please tell us how to differentiate.

What if our main business is to earn rentals is the building should be classified as fix asset or IP. ?

Hello Silvia,

if there is a transfer from IAS2 to IAS40 will this be made at cost provided that i elect the cost model under IAS40?

Also, if i have a property under IAS2 and then i use it for own purposes IAS16, the transfer from IAS2 to IAS16 will be made again at cost?

HI Silvia,

Thank you for this great article.

I have a query: If a bank held a prperty from defaulted customer with intention to sell it in order to collect the amount of defaulted debt, what is the applicable IFRS for accounting for this property? Is it IAS 16, IAS 40 or IFRS 5?

Thank you

Omar

Normally, if all conditions are met (and it’s probable they would be met), the bank can classify the property as non-current asset held for sale, otherwise under IAS 40 (as the property would not be owner-occupied). Please read more about the classification as held for sale here. S.

Good time of the day!

I have a very specific question.I would apprceiate a lot if you could answer.

According to IAS 40, paragraph 61, during transfer from PPE to investment property that will be carried at fair value, we treated any difference between CV and Fv of property in accordance with IAS 16.

So,for example, at the transfer, we had CV 10 and FV 12. The difference 2 was recognised as revaluation reserve.

But how should we treat it in subsequent years?

Say, we now have CV 12 and FV 9. Can that negative revaluation of 3 be split into: 2 – decrease of revaluation reserve, recognised in previous period and 1 directly recognised as a loss from revaluation in Income statement, i.e. consistent with IAS 16?

Because, otherwise, if we recognise all revaluation loss of 3 in IS in accordance with IAS 40 fair value model, we leave revaluation reserves of 2 untouched, while significantly lowering our net result in IS.

Thanks in advance

Dear Maule,

great question.

I think you are right in your last paragraph. IAS 40 in par. 62 mentions that in this case, the revaluation surplus is transferred to retained earnings on subsequent disposal only. It implies that until you dispose the asset, you normally follow fair value model and book all fair value changes in profit or loss.

In my opinion, this is fair, because if you would have purchased the same asset for its fair value of 12 (no revaluation surplus), under fair value model, you would have to do the same thing. S.

Dear Silvia,

Thank you very much for your reply.

Greetings from Kazakhstan & Merry Christamas!

Thanks for the efforts

Again I have concern as our company is in the process of converging from Local GAAP to IFRS.

our company activities includes constructing of Villas, Apartments on owned or leased lands, then rent them for periods ranging from 1-3 years contracts.

Do I need to classify those villas & apartments as PPE ( as my business to rent them) or investment properties as per IAS 40

Your usually response is needed.

Dear Ahmed,

that would be a typical IAS 40 Investment property. S.

Thanks

I have one question where I did not find an answer neither in the standard nor in interpretation.

What is if a property (vacant) has been acquired with the intention to let it after a re-development phase of approx. 2.5 years.

At inception the property has to be classified under IAS 40 as IP (held at cost as FV was not reliably measurable). However, in year two an offer to sell the property is accepted and a pre-sale contract is signed.

Would this trigger a reclassification from IP to inventories (IFRS 5 is not relevant as the property is not available for immediate sale in its current condition)?

Many thanks in advance for your assessment.

Dear Michael,

yes, I think you get it right. The original purpose of holding your property was to let it after development phase, but now your intention is to sell it after some development is completed – it’s in inventories then. S.

Hello

If a property was used by the entity it would be classed under IAS 16. Lets say this value was 1000 less dep of 400 giving a NBV of 600. The entity now decides that it should be investment property and so its valued at fair value of $1,100. The difference of $500 should be recorded in the OCI-revaluation reserve?

Dear Nari,

yes, ecactly as you wrote. S.

Hi, Silvia. Thank you for your insights. But I have a query. The standard says that if the the property is partly Investment Property and PPE and it cannot be sold or leased (finance) out separately, it would be classified as Investment Property only if the PPE portion is insignificant. What if both portions are significant but cannot be sold or leased out separately, how should it be accounted? Thanks, Silvia.

In this case, that would be accounted for under IAS 16, i.e. as PPE.

Hi, Silvia. May I know why? Thank you

hi, the answer is in your question. “…it would be classified as Investment Property only if the PPE portion is insignificant.” so if both portions are significant you cannot classify the asset as Investment Property therefore it is PPE.

Dear Silvia

What is the definition of building? is quayside of port or parking lot (rented to third party) can be clasified as building?

thanks

Hi Yulias,

IFRS do not define “building”. This is more an issue for tax rules. But definitely, parking lots meet the definition of PPE under IAS 16 🙂 S.

Hi,

As part of our property financing arrangements, we are required to register a bond over the property, which serves as security for the financier. The registration of such a bond is performed by an attorney and significant fees are charged to do so.

How would you treat these costs? Would they be considered as other transaction costs at initial recognition and form part of the cost of the property? Or are these regarded as a cost of financing, which should be expenses in profit or loss?

Regards

Riaan

Riaan, these are the financing costs. And, I don’t know the details of the arrangement, but if you keep your bond at amortized cost, then these transaction costs are not expensed in P/L immediately, but they are treated as a part of amortized cost/effective interest method. S.

Hello Silvia,why these costs are treated as finance costs,is that they are legal coasts therefore should be included in the purchase price?

Hi Njabulo, I understood that these costs were incurred to gain some cash to finance acquisition of an asset, not to bring the asset to the planned location and condition. S.

Hello Silvia,

Could I treat these costs as the borrowing costs under IAS 23 and capitalized to the cost of property>

Thank you very much.

Hi,

Please how do you treat and disclose selling costs of an investment property on the financial statement.

Best regards

In profit or loss.

Very useful resource material. Easy to apply. Thank you

Thanks Silvia for the insight.

Hi Silvia,

Its really Understandable the way you approach to the topic,

i have question regarding the Insured Damaged assets,correct

accounting treatment,

1: firstly, Booking the Insurance co. receivable & Accumulated

Depreciation and credit the Book value of assets any gain or loss

charged to the

2: subsequently, when the cash received than credited the insurance co.

What about Prepaid Insurance Expenses???? and above covered the whole accounting for Insured Assets???

thanks,

If there is a switch from cost model to fair value model, could you please advise how to deal with the fair value gain or loss?

All to profit or loss in the current year?

Or this is a change in accounting policies and retrospective adjustment needs to be made? And investment property and retained earnings have to be restated?

Many thanks!

Excellent presentation. Thank you for your efforts.

Silvia, It will be really great if you also mention the exact reference in the SLFRS. Many people fail to go through the standards, they just rely on what others say. If you state the reference along with your explanation, it will be great for us to refer in case if we require more detail explanation.

True, Mohamed, but please realize that here, I’m trying to give quick answers here 🙂

Hi,

If cost model is applied, there is a requirement to disclose its fair value. Should this fair value be the fair value as at reporting date? Or can I disclose it using last year fair value?

At the reporting date.

Hi Silvia

Are you saying that under cost model for investment property, that the fair value should be disclosed at each reporting date? If yes, then what is the benefit of applying cost model when fair value will still be determined on annual basis?

Regards

That’s optional which model you would apply. Under cost model, you are charging depreciation and maybe for some reason it would be beneficial to show asset’s wear and tear by this. In my opinion, fair value model is more suitable for investment property.

Really an amazing job, and than you for what you are doing!!

Such a great explanation Silvia!! you are awesome!

Thanks for making time to explain IFRS in its simplest way and treatment. You are doing a good job.

Patrick

Hi Silvia,

Can a hotel which is owned by the company be classified as an investment property ? And if yes according to what basis?

Dear Maan,

it depends on what services hotel provides to its occupants. Normally, these “ancillary” services are quite significant, and therefore, a hotel should be classified as owner-occupied property (IAS 16), not investment property (IAS 40). S.

you are doing an amazing job Silvia…it’s truly a great service..thanks a lot…

Really helpful thanks.

Good presentation. keep it up

Hi Silvia,

Excellent piece as usual please keep it up.

Chuka.

Dear Silvia

I really admire your way of teaching and presentation.

Regards

Khalid

Nafees

Hi Silvia, Congrats!

However, i have a problem with the computations of deferred tax assets. pls help

hak you.

Thank you very much.

Thanks for nice explanations

Hi Silvia,

I have 2 scenarios to understand

1. A Vehicle rental company : How will it recognize its motor vehicles?? will it still apply IAS 16??

2. An equipment trading Co. : Which has some motor vehicles used for its own administration purposes, while a couple of vehicles it rents out to some external customers to earn some extra income.

Could you please assist me in understanding as to how this companies recognize the Motor vehicles in line with IFRS???

Option 2 is the cost model which is the same as IAS16 PPE

Hi Mohammed, both vehicles need to be recognized under IAS 16. Please remember that IAS 40 applies only to lands or buildings. S.

Hi Silvia,

Many thanks. I have a small query

Under both standards, IAS 40 and IAS 16 can include properties that are rented out right.

So how will we distinguish .

I guess,

If the rental property form part of the primary operation of the business ( say car rental co) then it will accounted under IAS16.

If the rental property is ( land or building) held to earn rental but does not form part of primary operation , we can account under IAS 40.

Kindly let me know whether my understanding is right.

Hi Priya,

I would not say so. As soon as you earn rentals from the buildings/lands, then it’s automatically classified as investment property, no matter your principal activities. S.

Thank you Silvia,

so under what circumstances;

– ‘for rental to others’ mentioned in IAS 16 definition of PPE will become applicable? can you give an example.?

Is the renal part mentioning in IAS16 only for properties other than land and building?

Thanks

Practically it is any PPE, except for land and buildings, because they are specifically listed in IAS 40. Examples: vehicles, machines, furniture… S.

Dear Silvia,

could you, please, provide your thoughts regarding situation below:

We have building, which is rented, but last month it was decided to sell it during upcoming 12 months. How I should treat it in my FS? As asset held for sale or as Investment property? We are still renting it 🙂

many thanks in advance!

If it meets the definition of held for sale, then IFRS 5 – please revise the conditions in IFRS 5.

Excellent and easy to follow. Thanks!

Hi Silvia,

Really helpful article. I have a practical issue with my Company.

The parent company has rented one of the building to its subsidiary ever since constructed and is likely to continue it forever. Both parent and subsidiary are in same line of the business.

So, will in the separate financial statement, parent will classify that building as “Investment Property” and “Property Plant and Equipment” in consolidated financial statement.

Looks odd at first instance but logical at same time.

Hi Ankit,

thank you for the comment. Yes, it might look odd – but, it’s not unusual 🙂 S.

Hi Silvia

Please further explain what would be the treatment of rent expense for subsidiary and rent income for parents

Hi Ankit Bindal,

If an entity owns a property that is leased to and occupied by another group member being parent or subsidiary the property is not recognized as investment property in the consolidated financial statements because it will be treated as owner -occupied from the perspective of the group. However from and individual entity perspective the property is treated as an investment property if its the definition in IAS 40.

Dear Silvia,

We hava a building where we occupy part and also rent part. How do we account for the building?

Thanks

Dear Kwasi,

in this case, a part of a building that is owner-occupied is treated under IAS 16, and a part that is rented is treated under IAS 40. S.

makes perfect sense

but how can we distinguish each parts value. how much of the portion is related to IAS 16 OR IAS 40. Please explain

thanks

Dear Sohail,

it requires your judgment and some calculation. Let’s say you have a building with 40 offices. You use 10 offices for your own admin purposes and you rent out 30 offices. You bought the building at its fair value for CU 100. In this case, 10/40, or 1/4 will be treated as owner-occupied property under IAS 16 (i.e. 100/4 = 25, you will depreciate it or apply revaluation model). The remaining 30/40 or 3/4 will be treated as investment property (75 – revalue to fair value each year, or cost model). S.

Silvia,

This is an excellent summary of the standard. Much appreciated.

Thank you, Lawrence! 🙂

Thank you. Siliva M. This is an excellent Summary of Standard. Keep it up.

This is really great and you did well for all

Thank you dear Silvia for your efforts 🙂

Please can other non current asset like motor vehicles, plant and machinery that are put for rent be classified as investment property

No. Only land and buildings.

How to account revaluation surplus and revaluation deficit when there is a change in use of an asset from IAS-40 to IAS-16?