IAS 37 Provisions, Contingent Liabilities and Contingent Assets

Last update: March 2025

Free video lecture with the rules of IAS 37:

Have you ever heard a joke about two accountants applying for a job?

During their interview, they were given a task to calculate a net profit figure based on available data.

After some while, interviewer asked them a question: “What result did you get? What is the net profit of this company?”

The first accountant replied: the net profit is 150 mil. USD.

And the second one asked: “What would you like it to be?”

Now guess which one got the job! 🙂

In fact, manipulation of profit figure by making and releasing various provisions back and forth was very popular “creative accounting practice” in the past.

No wonder, as there were no rules for making provisions. Therefore, many companies utilized so-called “big bath provisioning” in order to smooth profits.

This situation was addressed in 1998 when the standard IAS 37 Provisions, Contingent Liabilities and Contingent Assets was issued with its effective date from 1 July 1999.

What is the objective of IAS 37?

The Standard IAS 37 Provisions, Contingent Liabilities and Contingent assets sets the criteria for recognition and measurement of

- Provisions;

- Contingent liabilities;

- Contingent assets; and

requires a number of disclosures about these items in order to understand them better.

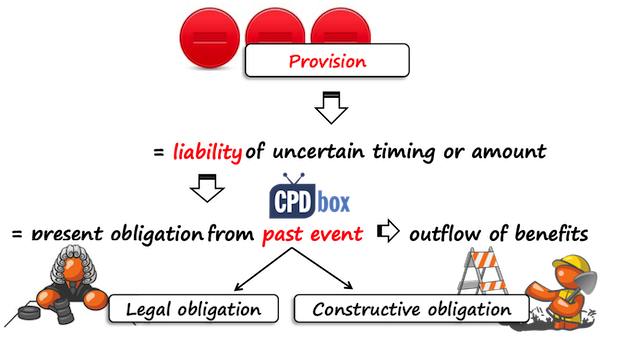

What is a provision?

Provision is a liability of uncertain timing or amount.

The word “uncertain” is very important here, because if timing and amount are certain or almost certain, then you don’t deal with the provision but with a payable or an accrual.

To understand provisions better, let’s break down the definition of a liability in IAS 37:

A liability is a present obligation arising from past event that is expected to be settled by an outflow of economic benefits from an entity.

In other words, if there is no past event, then there is no liability and no provision should be recognized.

Past event can create 2 types of obligation:

- Legal obligation that arises from legislation, a contract or other legal act; or

- Constructive obligation that arises from some business practice or customs and created an expectation in other parties to fulfill the obligation (in other words, people simply expect some company to fulfill the obligation even if it’s not in the law or any contract).

It does not really matter what type of obligation you deal with – whichever it is, it leads to a provision. However, if you identify the obligation, it can help you to decide whether recognize a provision or not.

When to recognize a provision?

The standard IAS sets 3 criteria for recognizing a provision:

- There must be a present obligation as a result of a past event;

- The outflow of economic benefits to satisfy the obligation must be probable (i.e. more than 50% probable)

- The amount of economic benefits required to satisfy the obligation must be reliably estimated.

If all 3 criteria are met, then you should recognize a provision.

If just one of them is not met, then you should either:

- Disclose a contingent liability (read more about it below), or

- Do nothing if the outflow of economic benefits is remote.

To get better understanding and guidance on provisions and contingencies, IAS 37 presents a decision tree, too.

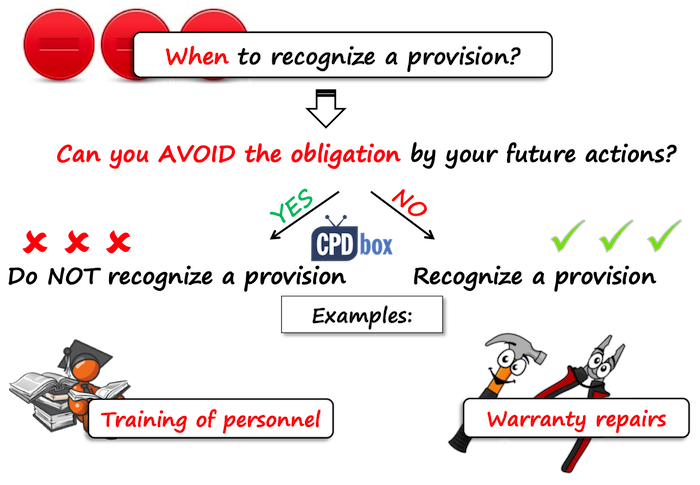

If you are unsure whether to recognize a provision in a particular situation or not, just ask yourself a simple question:

Can the obligation be avoided by some future actions?

If yes, then you should NOT book a provision. For example, if a government introduced new tax legislation, does the tax consulting company need to spend a cash for training of its employees and thus recognize a provision for that training?

No, it does not have to. Tax consulting company can avoid the training and decide to stop its activities (OK, that’s a bit far-fetched and unlikely, but you get the point).

If you cannot avoid the obligation by some future action, then you have to recognize a provision.

For example, when you promised a free warranty service for defective products at the point of sale, then you have a present obligation. If your past statistics show that you needed to spend some cash for warranty repairs, then you need to make a provision.

How to measure a provision?

The amount of the provision should be measured at the best estimate of the expenditures required to satisfy the obligation at the end of the reporting period.

As you can see, here’s some judgement and estimates involved. Management should really incorporate all available information in their estimates and they must not forget about:

- Risks and uncertainties (like inflation),

- Time value of money (discounting when the settlement is expected in the long-term future)

- Some probable future events, etc.

There are 2 basic methods of measuring a provision:

- Expected value method: You would use this method when you have a range of possible outcomes or you measure the provision for large amount of items. In this case, you need to weight each outcome by its probability (for example, warranty repair costs for 10 000 products).

- The most likely outcome: This method is suitable in the case of a single obligation or just 1 item (for example, provision for loss in the court case).

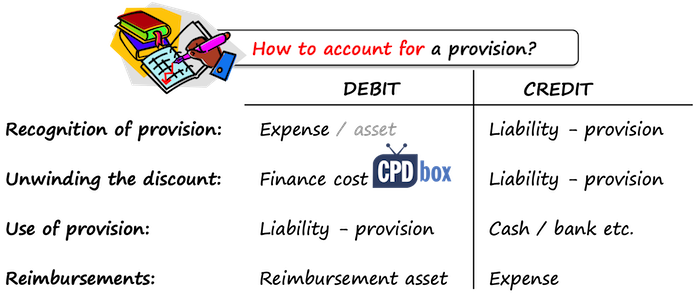

How to account for a provision?

There are several events associated with the accounting for provisions:

-

- Recognition of a provision: In most cases, you should recognize a provision in profit or loss. Sometimes, a provision is recognized in the cost of another asset, for example, provision for removing the asset and restoring the site after its use.Don’t forget to split the provision in the current and non-current part for the presentation purposes in your statement of financial position.

- Unwinding the discount: When a provision has a long-term nature (beyond 12 months), then there’s some discounting involved as you need to present it in its present value.In each reporting period, you account for an interest on the opening balance of the provision and this is called „unwinding the discount“.Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!You should recognize the interest in profit or loss and it also increases the amount of a provision.

- Utilization of a provision: When you incur expenditures associated with the settlement of your obligation, you should „utilize a provision“.In most cases, you simply recognize this utilization directly with incurring the invoices from suppliers or any related payments (e.g. Debit Provision / Credit Cash).

- Reimbursement: Sometimes, entities have right to reimbursement of related expenditures by the third party (e.g. from an insurance company).In this case, a right to reimbursement is recognized as a separate asset (no netting off with the provision itself), but you can net off the expenses for provision with the income from reimbursement in the profit or loss.

Provisions in specific circumstances

Standard IAS 37 specifies the treatment of provisions in a few specific situations:

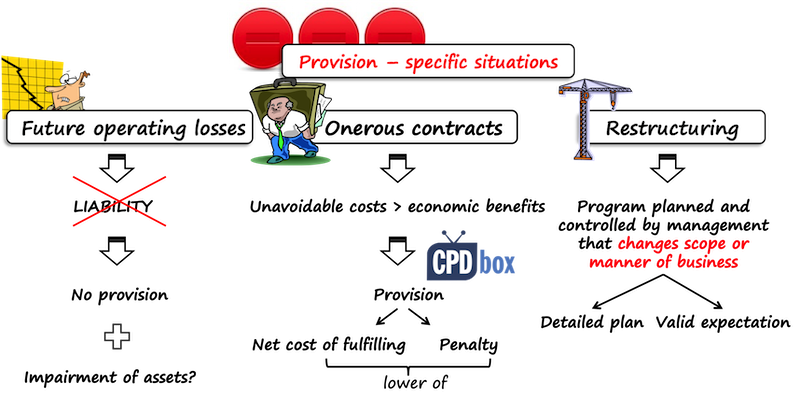

Future operating losses

You should not make a provision for future operating loss.

Why?

Because there is no past event. The future operating losses can be avoided by some future actions, for example – by selling a business.

However, you should test your assets for impairment under IAS 36 Impairment of Assets.

Onerous contracts

Onerous contract is a contract in which unavoidable costs of fulfilling exceed the benefits from the contract.

In other words, it is a loss contract that cannot be avoided.

You should make a provision in the amount lower of:

- Unavoidable costs of fulfilling the contract and

- Penalty for not meeting your obligations from the contract

Restructuring

Restructuring is a plan of management to change the scope of business or a manner of conducting a business.

You should recognize a provision for restructuring only when the general criteria for recognizing provisions are met.

In the case of restructuring, an obligation to restructure arises only if:

- There is a detailed formal plan for restructuring with relevant information in it (about business, location, employees, time schedule and expenditures)

- A valid expectation related to restructuring has been raised in the affected parties.

IAS 37 also clarifies which type of expenses can / cannot be included in the provision.

What are contingencies?

Except for provisions, we can deal both with contingent liabilities and contingent assets.

Contingent liabilities

A contingent liability is either:

- A possible obligation (not present) from past event that will be confirmed by some future event; or

- A present obligation from past event, but either:

- The ouflow of economic benefits to satisfy this obligation is not probable (less than 50%), or

- The amount of obligation cannot be reliably measured (this is very rare, in fact).

For example, you might face a lawsuit, but your lawyers estimate the probability of losing the case at 30% – in this case, it’s not probable that you will have to incur any expenditures to settle the claim and you should not book a provision. It’s typical contingent liability.

If you identify you have a contingent liability, you do NOT recognize it – no journal entry. You should only make appropriate disclosures in the notes to the financial statements.

Contingent assets

A contingent asset is a possible asset arising from past events that will be confirmed by some future events not fully under the entity’s control.

Similarly as with contingent liabilities, you should not book anything in relation to contingent assets, but you make appropriate disclosures.

Provisions and further specific guidance

Standard IAS 37 gives further guidance for certain situations in its appendix and also, several interpretations clarify the accounting for provisions in some specific cases:

- IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities deals with the provision for removing the asset and restoring the site after the end of its useful life;

- IFRIC 5 Rights to Interests Arising from Decommissioning, Restoration and Environmental Rehabilitation Funds is related to IFRIC 1 and it applies when a company contributes to a fund for reimbursement of these expenses.

- IFRIC 6 Liabilities Arising from Participating in a Specific Market – Waste Electrical and Electronic Equipment: this IFRIC specifies when the producers of electrical and similar appliances sold to household are liable for decommissioning of electrical waste

- IFRIC 17 Distributions of Non-cash Assets to Owners

- IFRIC 21 Levies

Here’s the list of articles published on CPDbox related to the standard IAS 37:

- How to account for decommissioning provision under IFRS

- Practical questions about accounting for provisions

If you liked this article or you have anything to say, please leave a comment below this video and share, thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi,

I am a CPA Student and in the exam, there was a question regarding the onerous contract and asked us to analyze it from the chart whether the contract should be classified as onerous or not.

Unfortunately, I don’t know how we can recognize this matter from the chart or graph.it is appreciated to help me.

Thank you for the clarification. If the provision forms part of the cost of a PPE for instance plant and equipment, does that mean the cost of the plant and equipment will be changing every year as we incorporate the best estimate into our provision?

Hi Silvia, thank you for this wonderful write-up. Please I have a question. This standard requires that if the obligation is to be settled after 12 months, then we should discount it, considering inflation too. Also, it stated that provision is the best estimate of the amount required to settle the obligation at the end of every reporting period. My questions are:

1. By discounting an amount payable in 10 years, the PV will definitely be smaller after year 1(interest inclusive), this will always fall below the best estimate as the PV is expected to be increased by10 yrs interest to achieve the desired amount. So of what importance is the PV when the best estimate will always exceed the carrying amount of the provision provided is not yet the planned years?.

2. The best estimate is an annual routine. What is the essence of considering inflation in estimating it?

Hi Joshua,

I got a bit lost in your question, but I will try.

1. If your obligation should happen in 10 years and you estimate the amount to pay after 10 years, then yes, you need to discount it to the present value by using the appropriate discount rate. Then each year, you need to increase the amount of that present value by unwinding the discount in profit or loss, so after 10 years, the amount of your provision equals to its estimate.

2. You are estimating the amount that you will be liable to pay in the future. That future amount might be affected by the inflation. So, the future amount needs to include the inflation estimate, too. When you update it annually, you will of course update the estimate of the inflation in it and your estimate will be more precise, year by year.

Suppose, ALtd has entered into contract with 3rd party contractor for tetra pack production. A Ltd. will purchase them on yearly basis and M committed to purchase a minimum number of tetra packs each financial year. If not purchased M Ltd will pay shortfall penalty.

Whether this will be covered under IAS 37 or not. Please guide

I would say that the penalty makes it connected to IAS 37. If that contract becomes onerous, then the provision would beed to be recognized.

good job thank you selvia for adding to my information thank you

Thank you Silvia

Hi Silvia, we have mark up for goods we sale to customer, so should provision incurred Standard price or standard price + mark up ?

Hi Silvia, thank you for the article and ongoing responses to the publics queries!! I had a quick question so hoping you could advise. We currently holding a provision for an expected pay-out to some suppliers who assisted in the financing of our companies infrastructure build. The provision has historically been discounted using a pre tax WACC rate, as some cashflow are uncertain as it depends on the performance of the infrastructure. Is it appropriate to use the company internal WACC rate to discount this provision? Thank you

Hi Silvia,

I have a doubt about the unwinding provision. We have discounted long service leave liability of 1.183mn at the end of the year and 1.317mn at the beginning of the year. The interest rate was 1.28% and I have calculated the PV by multiplying the opening liability with the interest rate and debitted that amount to the unwinding expense account and credited to the lsl provision account. Is the treatment right or wrong?

Yes, it seems correct – but I have not checked the numbers.

Hi Alison, this one is for you. S.

Dear Silvia,

Company had an open case in court as at reporting date. It thought that loss would be improbable. After 2 months the case was lost and caused losses. Company is preparing FS and know about the outcome of the case. Should it create provisions for the losses as at reporting date?

Hi Yeldar,

it depends on the exact dates. Please check the standard IAS 10 Events after the reporting period and if the date of the court decision falls before the authorization of financial statements for previous year, then you need to adjust. S.

Hi Silvia,

Hope you are safe and well. Thanks a lot for your articles. Extremely helpful,

The company is very likely to receive 5 m compensation so it is more than a contingency Asset. What is the correct way to account for the compensation. As provision is a liability can we still have a Provision ‘Asset’ account? Please advise Thank you

Dear Silvia

I have a Landrover Spare company that is one of our clients.

Can you maybe mail me the PDF of that article you wrote on PPE and Spare Parts.

Also can you perhaps explain in more detail Warranty Provisions?

Hi Silvia,

Is it acceptable to split the provision over a few months provided that it it within the financial year ?

E.g:

Financial Year is Jan 2019 to Dec 2019. In Feb 2019, a provision for a customer claim is identified for $200 000, the accountant decides to split the provision over 4 month (Feb 2019 to May 2019) at $50 000 per month. Is this acceptable practice?

Hello, Silvia. Can you comment on whether the provision is needed when the warranty sum (say, 5% of a contract sum) is withheld from a builder by a customer until the end of warranty period? Builder doesn’t create a provision because he already accounts for a money withheld as an asset which would cover all possible warranty costs. I don’t believe it’s right because, whether the money is withheld or not, the provision exists nevertheless.

Hi Yeldar, there is a misconception in what you write here. The amount withheld as a warranty is not treated as an asset itself – it is accounted for under IFRS 15 as a deferred consideration (that may fall under receivables or contract asset/liability depending on the contract). The provision itself is a completely different story and yes, I am with you here – if the rules of IAS 37 are met, the provision exists regardless warranty amount withheld. S.

Thanks, Silvia!

Hello Silvia, I read and watch your article and video regularly IAS & IFRS. I am a fan of you. I love your analysis. If you give me updated information regarding IAS & IFRS, I will be grateful to you. Email: (anamul_05@yahoo.com)

Hi Silvia,

I’m trying to find out if the restructuring costs e.g. dismantling costs which are included in the cost of the asset and also provided for in IAS 37, are they included in Goodwill calculation in the form of ‘net identifiable assets’ in IFRS 3? Another one, What is the subsequent measurement of Goodwill in IFRS 3? Or is it just initial recognition, Positive Goodwill- Asset and Negative Goodwill- bargain purchase?

Dear Silva,

Trust my email find you well!

I have one disturbing issue regarding provision for project future losses .The issue is provision was made and charged to P & L account, now i want to close the provision because the project is finished at loss which account to use to close the provision

Very helpful stuff. Find useful for my studies and work related.

Dear Silvia

please has the standard solve the problem of ”Big Bath”? if Yes, How?

Yes, to some extent. By giving you at least some rules, while previously they were non-existent.

Dear Silvia,

This is wonderful!

However, I will appreciate if your examples and elaborations are based on financial institutions mainly banks as they deal with provisions frequently. Central banks sett rates on provision to the banks. Loss, doubtful, sub-standards, watch and normal.

Thanks,,,

Dear Ms. Silvia,

Are the provisions monetary or not monetary?

Hi Silvia,

Happy New Year and Thanks a lot for your articles. Extremely helpful, great job!

I am throwing a sample question here. Assume that during 2017 year end there was a fire accident and we were expecting insurance claim in 2018 around USD 11 Million. But it is getting delayed and we are now expecting to receive in year 2019. Now I would like to understand the accounting treatment. do we need book provision for receivables? Thanks in advance.

Hi Sathya, Happy New Year to you, too!

No, you do not book anything.

Thanks a lot Silvia for your response… But, can you please explain in detail why I shouldn’t book anything (explain the concept and IFRS accounting rules).

Regards,

Sathya

Hi Silvia,

Can you please help me understand what does “remote” mean?

Thanks,

Annie

Very low probability. IAS 37 does not give you definition of remote, so it’s a bit matter of judgment. S.

Thanks Silvia for your support. Please how do we account for spare part stock used for warranties repairs and are refundable by insurance companies.

Thanks.

Hi Paul, I think this will help! S.

Dear Sylvia,

my company had a litigation pending, with an uncertain outcome until April 2018. In April, the management agreed outside the court to pay the principle, and penalty interest. My financial adviser believes, that the penalty interest should be treated as an error in accordance with IAS 8. However, the outcome of the litigation could not be reliably estimated earlier, and if we have pay the principle earlier we would still pay the penalty interest, but in a lesser amount. Do you have any advice how to treat the penalty interest related to the court judgment? Thanks

Well, I would say that you should have taken the interest into account when measuring your provision at the end of 2017 – as soon as you believed that time that you will be liable to pay also the interest. If that’s not the case and you measured the provision as the best estimate with the belief that you would pay just the amount due, then that’s not error. In most cases, the interest should be included in the amount of provision, though.

Hello Silvia,

Let me first take the opportunity to thank you for your wonderful effort. I have an issue to share with you;

I want to establish an incentive plan i.e. gratuity fund for my employees this year. In my region, keeping an incentive plan is mandatory but it should be gratuity fund is not. Currently, I have one incentive plan rather than gratuity fund. Regarding this;

Query-I: Currently, my Company is loss-making. I don’t want to give the impact in Profit and loss statement fully this year as this will run my profit falling drastically. In this situation, how could I do this?

Query-II: In this situation, is there any implication of IAS-8; changes in accounting estimate, error or policy? If so how should I deal with this?

I would very lucky to have your assistance in this regards.

Thanks.

Hi Robiul,

as far as employee benefits are concerned, you should be looking at IAS 19, not IAS 37. And then, you should determine what kind of benefit you are promising and based on the type, you should determine the accounting treatment.

Hello Silvia,

Thanks for your write-ups. Please, Should a provision for Audit Fees and Expenses be made on the accounts at the year end, say Dec 31 2017 where the external auditors have not done anything relating to 2017 audit. Can we establish a present obligation here? And if yes, what would be the past event? Thank you

Dear Joe, normally not, because indeed, there’s no past event, so it’s not a typical provision under IAS 37. However, according to best practices, you should take consistent approach to expenses for audit. In some countries and companies, they book the expense to 2017 as the audit relates to the year 2017. In other countries, they book the expense to 2018, as the service itself is provided in 2018 and you consume the benefit of this service only in 2018. But, you need to be consistent and take the same practice every year. Best, S.

Government has provided a company right to extract oil from and offshore oil well for 25yrs from 2022. Government has legally mentioned the company to be owner of oil well till 2047. Company has to give a bonus in return starting from 2022 till 2029. Company in its books has increased the life of its oil extracting asset. Should the company provide for the liability in it’s books of Accounts? It has no way out.

Hi Aditi,

what if the company decides to go out of business in 2020? Will it still have to provide the bonus? I know this is purely hypothetical, but it will help you decide whether the bonus relates to the past event or not. S.

But it has increased life of it’s off-shore assets, assets extracting oil from the well. That means It will continue it.

Let’s consider it a Refinery. A land agreement has been entered with Government for 30years. From 01.05.2018

Now if we enter the agreement 01.05.2018 then should we provide the liability? It is apparent that we can not vacate the land as Refinery has been constructed over it. We can’t exit it inbetween

@ Silvia. Thank you very much for this kind of an article.

I have referred so many books to know the difference between possible obligation and present obligation for a contingent liability, but could find anywhere so far. IFRS 3 says only contingent liabilities relating to present obligation arising from past events regardless of outflow of economic benefits can be recognized at fair value at the acquisition date. It means contingent liability relating to possible obligation need not to be measured and considered on acquisition of business ? If so, how to distinguish possible obligation and present obligation? Is it determined with reference to percentage .i.e if more than 50%, present obligation and 50% or less is possible obligation?

thank you very much in advance in anticipation of quick expert response.

please read ‘could not’ instead of ‘could’ in third line.