IAS 36 Explained (2025): Full Impairment Guide + Free Practical Checklist

Updated: April 2025

IAS 36 prescribes the procedures to make sure that an asset is carried at no more than its recoverable amount. This guide breaks it down clearly, plus it includes a free video lecture and downloadable IAS 36 practical checklist.

Jump to section:

1. Free VIDEO lecture: Overview of IAS 36 in 12 minutes

2. Objective and scope of IAS 36

3. When is an asset impaired?

4. Identify the impairment indicators: external and internal

5. How to measure recoverable amount

6. How to measure and recognize impairment loss?

7. Cash-generating units, goodwill, corporate assets

8. Reversal of impairment loss

9. FREE DOWNLOAD: IAS 36 Practical Checklist (with disclosures)

10. Further reading and learning

1. Free VIDEO lecture: Overview of IAS 36 in 12 minutes

Return to top

2. What is the objective and scope of IAS 36?

The objective of IAS 36 Impairment of assets is to make sure that entity’s assets are carried at no more than their recoverable amount.

The Standard also defines when an asset is impaired, how to recognize an impairment loss, when an entity should reverse this loss and what information related to impairment should be disclosed in the financial statements.

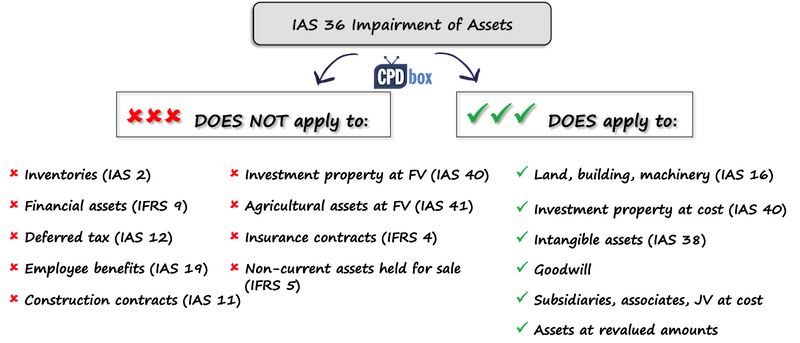

The following scheme shows to what assets IAS 36 does and does not apply:

Basically, when you’re dealing with property, plant and equipment in line with IAS 16 or intangible assets in line with IAS 38, then you need to look to IAS 36, too.

Return to top

3. When is an asset impaired?

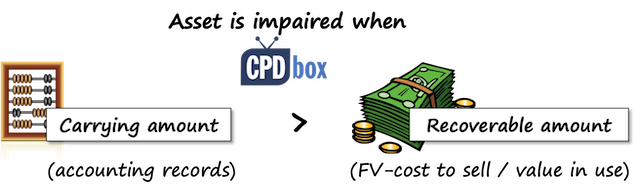

An asset is impaired when its carrying amount exceeds its recoverable amount.

4. Identify an asset that might be impaired

If you want to be compliant with IAS 36, you have to perform the following procedures:

- You need to assess whether there is any indication that an asset might be impaired at the end of each reporting period.

You don’t need to perform impairment testing if there’s no indication. However, you need to assess the existence of such an indication. - If you hold some intangible asset with an indefinite useful life (such as trademarks) or intangible asset not yet available for use, then you need to test these assets for impairment annually.

- If your accounting records show some goodwill acquired in a business combination, you also need to test this goodwill for impairment annually.

What are the indications of impairment?

4.1 External sources of information

- Observable indications that the asset’s value has declined during the period significantly more than would be expected as a result of the passage of time or normal use.

- Significant changes with an adverse effect on the entity in the technological, market, economic or legal environment in which the entity operates or in the market to which an asset is dedicated.

- Market interest rates or other market rates of return on investments have increased during the period, and those increases are likely to affect the discount rate used in calculating an asset’s value in use and decrease the asset’s recoverable amount materially.

- The carrying amount of the net assets of the entity is higher than its market capitalization.

4.2 Internal sources of information

- Obsolescence or physical damage of an asset.

- Significant changes with an adverse effect on the entity related to the use of an asset, for example: an asset becoming idle, plans to discontinue or restructure the operation to which an asset belongs, plans to dispose of an asset before the previously expected date, and reassessing the useful life of an asset as finite rather than indefinite.

- Evidence is available from internal reporting that indicates that the economic performance of an asset is, or will be, worse than expected.

Standard also outlines the indications related to subsidiaries, associates and joint ventures.

Return to top

5. Measure recoverable amount

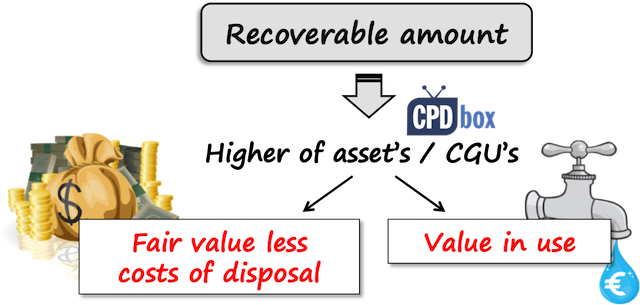

Recoverable amount is the higher of an asset’s (or cash-generating unit’s) fair value less costs of disposal and its value in use.

You don’t necessarily need to determine both of these amounts, because if just one of them is higher than asset’s carrying amount, then there’s no impairment.

When an individual asset does not generate cash inflows that are largely independent of those from other assets (or groups of assets), then you need to determine recoverable amount for the cash-generating unit (CGU) to which this asset belongs.

5.1 Fair value less costs of disposal

Rules and guidelines for measuring the fair value of any assets are set by the standard IFRS 13 Fair Value Measurement. This standard applies for all periods beginning on 1 January 2013 or later, so you need to make sure to take it into account.

Costs of disposal are for example legal costs, stamp duties and similar transaction taxes, costs of removing the asset and direct incremental costs to bring an asset into condition for its sale.

5.2 Value in use

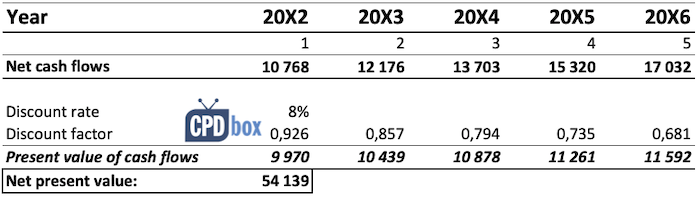

Value in use is the present value of the future cash flows expected to be derived from an asset or cash-generating unit.

In order to determine value in use, you need take the following elements into account:

- An estimate of the future cash flows the entity expects to derive from the asset.

- Expectations about possible variations in the amount or timing of those future cash flows.

- The time value of money, represented by the current market risk-free rate of interest.

- The price for bearing the uncertainty inherent in the asset.

- Other factors, such as illiquidity, that market participants would reflect in pricing the future cash flows the entity expects to derive from the asset.

Estimating the value in use can usually be performed in 2 following steps:

Step 1: Estimate your future cash flows

When you measure value in use, you shall always base your cash flow projections on:

- Reasonable and supportable assumptions that represent management’s best estimate of the economic conditions that will exist over the remaining useful life of the asset.

- The most recent financial budgets/forecasts but for a maximum period of 5 years.

- Extrapolation of cash flow projections for the periods beyond 5 years using a steady or declining growth rate for subsequent years.

In your cash flow estimations, you shall include:

- Projections of cash inflows from the continuing use of the asset.

- Projections of cash outflows to generate the cash inflows from continuing use of the asset and can be directly attributed, or allocated on a reasonable and consistent basis, to the asset.

- Net cash flows to be received (or paid) for the disposal of the asset at the end of its useful life.

In your cash flow estimations, you shall NOT include:

- Cash inflows from receivables.

- Cash outflows from payables.

- Cash outflows expected to arise from future restructurings to which an entity is not yet committed.

- Cash outflows expected to arise from improving or enhancing the asset’s performance.

- Cash inflows and cash outflows from financing activities.

- Income tax receipts and payments.

Let me also warn you about the inflation. You need to be consistent in projecting your cash flows and selecting your discount rate. You can either adjust your future cash flows by the inflation and use the nominal discount rate or alternatively you can project your future cash flows in the real terms and use the real discount rate.

Step 2: Determine discount rate

After projecting your cash flows you need to determine a discount rate used to calculate the present value.

The discount rate shall be a pre-tax rate that reflects current market assessment of both the time value of money and the risks specific to the asset for which the future cash flow estimates have not been adjusted.

The best way to select your discount rate is to look on the market and pick a market rate of return. Here, please be careful! Market rates of return are usually quoted as POST-tax rate and you need PRE-tax rate, so you need to determine pre-tax rate from post-tax rate yourself.

Return to top

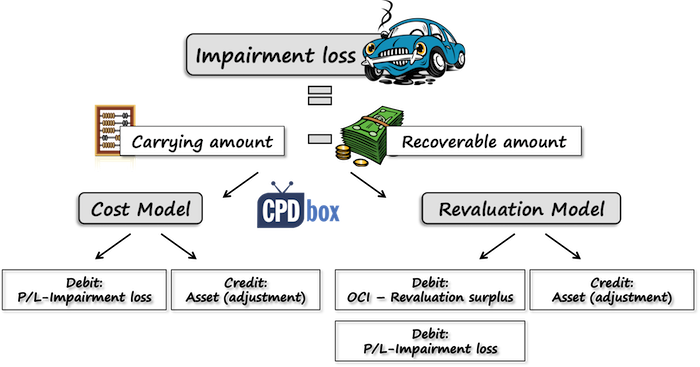

6. Recognize and measure an impairment loss

If the asset’s recoverable amount is lower than its carrying amount, then an entity must recognize an impairment loss as a difference between these 2 amounts.

An impairment loss shall be recognized to profit or loss or as a revaluation decrease if the asset is carried at revalued amount in line with other IFRS.

Don’t forget to adjust the depreciation in the future periods in order to reflect the asset’s new carrying amount.

Return to top

7. Cash-generating units

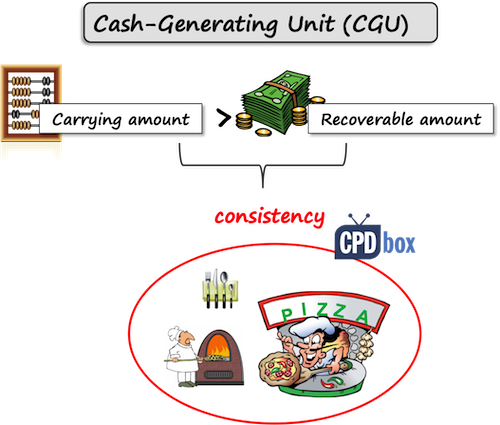

A cash-generating unit is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets.

If you are not able to determine recoverable amount for an individual asset, then you might need to establish cash-generating unit to which this asset belongs.

For example, you might not be able to set the fair value less costs to sell for used 5 years-old pizza oven as the quotes might not be available. At the same time, you might not be able to calculate pizza oven’s value in use because you really cannot estimate future cash inflows from pizza oven – this pizza oven does not generate any cash inflows itself.

Therefore your need to establish cash-generating unit for this pizza oven – it would probably be the whole pizzeria.

In determining your cash-generating unit you need to be consistent from period to period to include the same asset or type of assets.

You need to be consistent in determining the carrying amount of cash-generating unit with determining recoverable amount of that unit. It means that you need to include the same assets in calculation of carrying amount and recoverable amount, too.

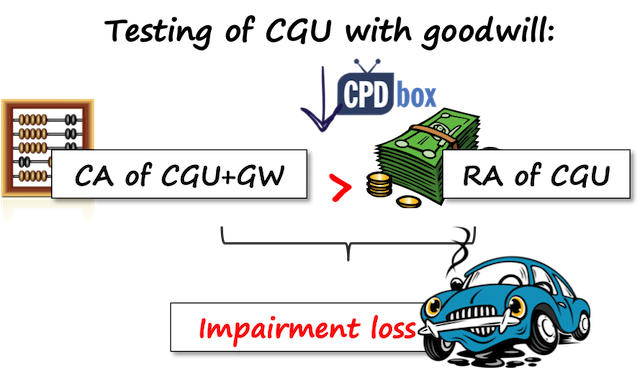

7.1 Goodwill

If there is a goodwill acquired in a business combination, then it must be allocated to each of the acquirer’s cash-generating units (or group of them) that are expected to benefit from the synergies of the combination.

Each unit to which the goodwill is allocated shall:

- Represent the lowest level within the entity at which the goodwill is monitored for internal management purposes; and

- Not be larger than an operating segment determined in accordance with IFRS 8 Operating Segments.

Goodwill should be tested for impairment on an annual basis.

A cash-generating unit (CGU) with allocated goodwill shall be tested for impairment at least annually. In this case testing means to compare:

- The carrying amount of CGU including the goodwill, and

- The recoverable amount of that CGU.

7.2 Corporate assets

Corporate assets are assets (other than goodwill) that contribute to the future cash flows of both the CGU under review and other CGUs.

The examples of corporate assets are a headquarters’ building, EDP equipment or a research center.

When you are testing a CGU, then you should first identify all the corporate assets that relate to the CGU under review.

Then, if a portion of the carrying amount of a corporate asset can be allocated to that unit on some reasonable and consistent basis, then you shall compare the carrying amount of that unit plus allocated portion of a corporate asset with its recoverable amount.

If such an allocation is not possible, then you go so-called bottom-up direction:

- You shall test the CGU without corporate asset for impairment first and recognize any impairment loss.

- Identify the smallest group of CGUs that includes the CGU under review and to which a portion of the carrying amount of the corporate asset can be allocated on a reasonable and consistent basis.

- Compare the carrying amount of that group of CGUs including the allocated portion of a corporate asset with the recoverable amount of the group of CGUs.

- Recognize impairment loss in line with the next paragraph.

7.3 Impairment loss of cash-generating unit

If the recoverable amount of CGU is lower than its carrying amount, then an entity shall recognize the impairment loss.

The impairment loss shall be allocated to reduce the carrying amount of the assets of the unit in the following order:

- Reduce the carrying amount of any goodwill allocated to the CGU.

- Allocate remaining impairment loss to the other assets of the unit pro rata on the basis of the carrying amount of each asset in the unit. These reductions are recognized as impairment losses on individual assets.

In allocating an impairment loss you must make sure that you don’t reduce the carrying amount of an asset below the highest of:

- Its fair value less cost of disposal;

- Its value in use;

- Zero.

Return to top

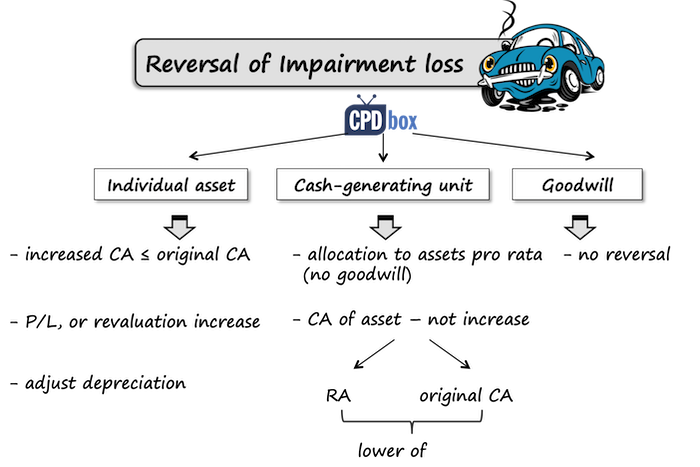

8. Reversal of impairment loss

Here, you need to take the same approach as in identifying the impairment loss. You need to assess at the end of each reporting period whether there is any indication that an impairment loss recognized in prior periods for an asset (other than goodwill) may no longer exist or may have decreased.

You need to assess the same set of indications from external and internal sources than when assessing the existence of impairment, just from the other side.

You can reverse an impairment loss only when there is a change in the estimates used to determine the asset’s recoverable amount. It means that you cannot reverse an impairment loss due to passage of time or unwinding the discount.

8.1 Reversal of an impairment loss for an individual asset

You can reverse an impairment loss only when there is a change in the estimates used to determine the asset’s recoverable amount. It means that you cannot reverse an impairment loss due to passage of time or unwinding the discount.

Reversal of an impairment loss is recognized in the profit or loss unless it relates to a revalued asset. The increased carrying amount due to reversal should not be more than what the depreciated historical cost would have been if the impairment had not been recognized.

Also, you must not forget to adjust the depreciation for future periods to reflect revised carrying amount.

8.2 Reversal of an impairment loss for a cash-generating unit

When you reverse an impairment loss for a cash-generating unit, you need to allocate reversal to the assets of the unit (except for goodwill) pro rata with the carrying amounts of these assets.

The carrying amount of an assets shall not be increased above the lower of:

- Its recoverable amount and

- The carrying amount that would have been determined (net of amortization or depreciation) without any prior impairment loss.

8.3 Reversal of an impairment loss for goodwill

Reversal of an impairment loss for goodwill is prohibited.

Return to top

9. IAS 36 Practical Checklist – FREE DOWNLOAD

- Scope: Does IAS 36 apply?

- YES: PPE (IAS 16), intangible assets (IAS 38), investment property under cost model (IAS 40), right-of use assets (IFRS 16), goodwill (IFRS 3), subsidiaries (IFRS 10), associates (IAS 28), joint ventures (IFRS 11 )

- NO: Exclude: inventories, deferred tax assets, contract assets (IFRS 15), employee benefits (IAS 19), financial assets, investment property at fair value, biological assets, insurance contract assets, non-current assets held for sale (IFRS 5)

- Are there impairment indicators?

- External:

- Market value of assets declined significantly

- Market interest rates increased → higher discount rate

- Adverse economic, legal, regulatory, or technological changes

- Market cap < net asset value of entity

- Internal:

- Asset is obsolete or physically damaged

- Plans to discontinue, dispose of or restructure an asset/business

- Poor economic performance vs forecasts

- If YES → Go to impairment test

- If NO → No further action (except for mandatory testing assets below)

- External:

- Annual Mandatory Impairment test: Is the asset one of these?

- Goodwill

- Intangible assets with indefinite useful life

- Intangible assets not yet available for use

- If YES → Go perform annual impairment test regardless of indicators/triggers

- If NO → Test only if indicators exist

- Estimate Recoverable Amount – Higher of:

- Fair value less Costs of Disposal:

- Use IFRS 13 Fair Value Measurement for guidance

- Deduct direct disposal costs (legal fees, taxes, removal, etc.)

- Value in Use

- Estimate future cash flows (max 5 years forecast + extrapolation

- Use reasonable, supportable assumptions

- Apply pre-tax discount rate reflecting market risks

- TIP: Be consistent → discount inflation-adjusted cash flows with nominal rate / real cash flows with real rate

- Fair value less Costs of Disposal:

- Determine Impairment Loss

- Is recoverable amount < impairment loss?

- If NO → No impairment loss

- If YES → The difference = impairment loss; recognize in profit or loss, or OCI if asset is revalued in line with IAS 16/IAS 38

- Is the asset a part of CGU (Cash-Generating Unit)?

- Use CGU when asset does not generate independent cash inflows

- Allocate corporate assets & goodwill appropriately

- Maintain consistency across periods

- Document CGU assumptions and allocations

- Allocate Impairment Loss

- First reduce goodwill

- Then reduce other CGU assets pro rata

- Do not reduce any asset below:

- FV less costs of disposal

- Value in use

- Zero

- Reversal of Impairment Loss – reassess at each reporting date:

- Have the impairment indicators reversed?

- Re-estimate recoverable amount

- Cannot reverse impairment of goodwill

- Reverse only to the extent the asset’s carrying amount would not exceed depreciated historical cost

- Disclosure Requirements (Summary of selected disclosures)

- For each class of assets:

- Amount of impairment losses & reversals in P/L

- Line item in P/L where recognized

- Impairment losses on revalued assets in OCI

- Events leading to recognition/reversal

- Expenditures recognized in the carrying amount of PPE in the course of its construction

- Recoverable amount basis: FV less costs or value in use

- Discount rates used (if value in use calculated)

- For CGUs:

- Amount of impairment losses & reversals in P&L

- Basis for determining recoverable amount

- Key assumptions used in cash flow projections

- Growth rate used and justification

- Discount rate used

- For each class of assets:

10. Further reading

Explore more on IAS 36: Visit this page to access the full library of all IAS 36-related articles, videos, and examples published by CPDbox.

Learn IFRS with real examples – not just theory.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mohamed on How to Account for Spare Parts under IFRS

- KAREEM IBRAHEEM on Lease term when contract is for indefinite period

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hello, is there a rule that specifies on what happens when the reversal of impairment loss is higher than the impairment loss?