How to Present Earnings per Share (IAS 33)

If you invest your savings to the purchase of some shares on the stock exchange, then you probably perform some analysis in order to select the right stock.

Well, this is at least what you should do. Still, your own hard-earned money needs to work efficiently to make you enough profits for your retirement (or for whatever you want).

In most cases, the investors, whether institutional or individual like you, look to a few measures.

One of them is PE ratio (or P/E ratio).

What is it?

The price-earnings ratio tells you how many years of the same earnings you need to wait until you get the price you paid for the shares back.

When PE is 10, then your investment into certain share will theoretically return back to you in 10 years (if all company’s earnings are paid out as dividends – that’s why it is purely theoretic).

In PE ratio, you have 2 important items:

- Market value per share – it’s the numerator, and

- Earnings per share – it’s the denominator.

The formula looks like:

P/E Ratio = Market value per share / Earnings per Share (EPS)

Actually, you can get the numerator, or the market value per share, from the data on the stock exchange – not a problem.

But what about the denominator – earnings per share?

The earnings per share usually come from the company’s financial statements.

And, in order to make this amount reliable and comparable, we have the standard IAS 33 Earnings per Share giving the guidance about how to present EPS.

In this article, I want to outline the basic rules for EPS calculation and show a few examples.

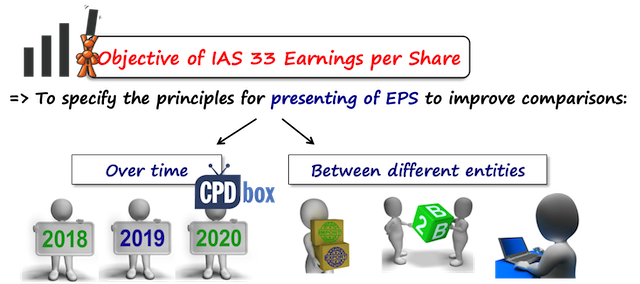

Why IAS 33 Earnings per Share?

The aim of IAS 33 is to give the rules of calculating the earnings per share, in order to improve the comparability of financial performance

- Over time of the same entity, and

- Of different entities.

Who needs to present EPS?

Maybe you tell yourself:

“OK, that’s fine, but EPS is needed only for stock exchange. Our shares are not publicly traded, so should we really bother?”

No.

That’s the valid point.

Only the following companies must present EPS:

- Whose ordinary shares (or potential ordinary shares) are traded in a public market (stock exchange), or

- Whose financial statements are filed or in the process of filing with a securities commission or similar regulatory body for the purpose of issuing the shares in a public market.

If you present both consolidated and separate financial statements, then you should present EPS based on the consolidated information.

However, if you also disclose EPS on your separate financial statements, then you present “separate” EPS only there, not in your consolidated financial statements.

If you have to present earnings per share, then you need to present both:

- Basic EPS

- Diluted EPS

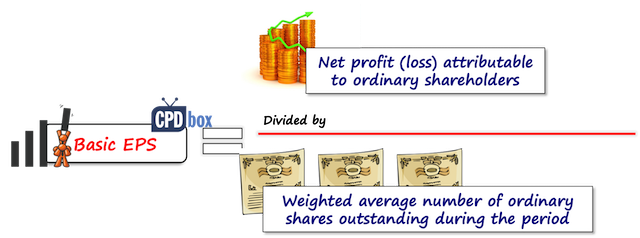

Basic Earnings per Share

Basic earnings per share is calculated simply as the

- Net profit or loss for the period attributable to ordinary shareholders, divided by

- Weighted average number of ordinary shares outstanding during the period.

Here, it’s quite easy, because you consider only what has already happened, not what can happen in the future.

In other words, you do not count with any potential ordinary shares and their effects (more about it a bit later).

Let’s break this formula down.

Earnings

Earnings basically include all items of income and expense including tax and non-controlling interests LESS the net profit attributable to preference shareholders, including preference dividends.

Shares

The weighted average number of ordinary shares during the period is used, but this number must be adjusted for all events that changed the number of shares during the period.

So, you would be looking at issuance of the new shares for cash, buying back some shares, etc.

Some complications might also arise with the bonus issues or rights issues – here, you don’t adjust the number of shares in the same way as with issuance for cash or buy back for cash.

Instead, you need to adjust the number of ordinary shares before the event, as if the event occurred at the beginning of the period.

Let’s illustrate the basic EPS on some examples.

Example 1 – Basic EPS with share issue for cash

Question:

ABC company had a share capital of 10 000 ordinary shares of CU 1 each and 1 000 redeemable preference shares of CU 1 each as of 1 January 20X1.

On 1 June 20X1 ABC issued new share capital of 2 000 ordinary shares (CU 1 each) for cash.

In 20X1 ABC’s profit after tax was CU 20 000. ABC paid the preference dividend of CU 0.20 per share during 20X2 and it was included as a finance charge within the net profit.

Calculate the basic EPS.

Solution:

With EPS, always calculate “earnings” and “shares” separately, then connect the dots and come up with EPS:

- Earnings = CU 20 000Here, you don’t adjust earnings, because the question says that the net profit has already been adjusted for the preference dividend.

- Number of shares:This is a little more complicated here, because ABC issued some new capital for cash during the year.

Let’s set up a table:

| Dates | N. of days | N. of ordinary shares | Weighted average n. of ord.shares |

|---|---|---|---|

| 1 January – 31 May | 151 | 10 000 | 4 137 |

| 1 June – 31 December | 214 | 12 000 | 7 036 |

| Total | 365 | n/a | 11 173 |

*Note 1: Weighted average n. of shares is calculated with the n. of days as weighting factor, e.g. 151/365*10 000 = 4 137

*Note 2: During the exam, you can use months instead of days.

Basic EPS = CU 20 000 / 11 173 = CU 1.79 per share

Example 2 – Basic EPS with bonus issue

Question:

DEF had a share capital of 200 000 shares (CU 1.00 each) at 1 January 20X3. On 31 August 20X3, DEF made a bonus issue of 40 000 shares.

Earnings in 20X3 were CU 30 000 and in 20X2 CU 25 000.

Calculate basic EPS.

Solution:

The bonus issue simply means the issue of new shares to the existing shareholders without the corresponding increase in cash.

Therefore, we need to adjust the number of ordinary shares before the event and also, restate the EPS for previous year:

- EPS in 20X3 = CU 30 000/240 000 = CU 0.125/share

- Restated EPS in 20X2 = CU 25 000/240 000 = CU 0.104/share

What about the rights issue?

The rights issue is different from bonus issue, because here, the existing shareholders get the new shares at the price below the current market value (not completely free as with bonus issue).

Calculating EPS is more demanding here, because you need to come up with theoretical ex-rights price first and then you need to restate the EPS for the previous period and adjust both earnings and number of shares in the current EPS.

Here’s the article with the example related to rights issue.

Diluted Earnings per Share

Except for basic EPS, you must disclose also diluted EPS.

Why diluted EPS?

The reason is that the company might have issued some contracts or securities that are NOT the ordinary shares right now, but CAN convert to them in the future, for example:

- Loans convertible to ordinary shares

- Convertible preference shares

- Share warrants and options

- Employee plans that grant them some ordinary shares as their remuneration

These instruments are called “potential ordinary shares” and they can have two-fold impact on your EPS:

- Earnings: they could be affected by saving some expenses on potential ordinary shares, for example, when some loan converts to the shares, you stop paying the interest on that loan.

- Shares: naturally, when the potential ordinary shares convert to ordinary shares, the number of shares goes up and it dilutes the EPS.

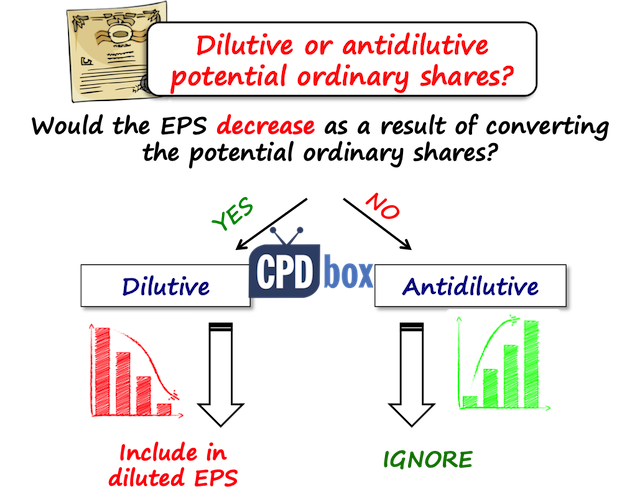

Before you start calculating the diluted EPS, you need to determine whether the potential ordinary share is dilutive or not:

Some potential ordinary shares can have dilutive effect (your EPS would go down) and some can have antidilutive impact (your EPS would go up).

IAS 33 requires ignoring antidilutive shares – you just present the effect of dilutive shares.

How to measure diluted EPS?

The formula for measuring diluted EPS is exactly the same as for basic EPS, but both earnings and number of shares must be adjusted for the effect of dilutive potential ordinary shares.

I repeat: ignore antidilutive potential ordinary shares.

The effects of dilutive potential ordinary shares on earnings could be:

- Dividends on dilutive potential ordinary shares that were deducted to arrive at earnings for basic EPS;

- Interest on dilutive potential ordinary shares (e.g. convertible loan);

- Any other changes in income on expenses resulting from the conversion of the dilutive potential ordinary shares

You need to adjust these items post-tax.

Please don’t forget that because this is a very common mistake either during the exams or even in the real-life financial statements.

When it comes to adjusted number of shares, you always need to assume that all dilutive potential ordinary shares will convert at the beginning of the period.

Let’s see some example.

Example 3 – Diluted EPS

Question:

In 20X1, KLM had earnings of CU 8 000 and 25 000 ordinary CU 1.00 shares.

On top of that, KLM had issued convertible loan stock of CU 10 000 with interest rate of 8%. The loan is convertible in 2 years at the rate of 1 ordinary share for every CU 4.00 of a loan stock.

The tax rate is 20%. Calculate both basic and diluted EPS.

Solution:

The basic EPS is easy: CU 8 000/25 000 shares = CU 0.32 per share.

For the diluted EPS, let’s proceed one by one:

- Earnings:

KLM will save 8% interest on convertible loan if the loan is fully converted to ordinary shares.Pre-tax adjustment is: CU 10 000*8% = 800Deduct the tax effect: 800*(1-20%) = 640

Adjusted earnings = Earnings of CU 8 000+adjustment of CU 640 = CU 8 640

- N. of shares:

KLM would issue 1 share per CU 4.00 of a loan stock; that is CU 10 000/4 = 2 500 the new sharesAdjusted n. of shares = N. of shares of 25 000+ adjustment of 2 500 = 27 500 - Diluted EPS = Adjusted earnings/Adjusted n. of shares = 8 640/27 500 = CU 0,314 per share.Thus the dilution is earnings is CU 0,32 – CU 0,314 = CU 0,006 per share.

Here, never forget to determine whether the potential ordinary shares (in this case, convertible loan) or dilutive or antidilutive.

In this example, we could have done that very easily – just calculate the incremental EPS and compare with basic EPS.

Incremental EPS of convertible loan stock is adjustment of earnings divided by adjustment in number of shares; or CU 640 / 2 500 = 0,256

The basic EPS was CU 0,32 per share and the incremental EPS is 0,256 which is LOWER than the basic EPS.

Therefore, the loan stock is dilutive (if it would have been higher, then the loan stock would have been antidilutive and you would IGNORE it).

It is very easy to do it when you have just one type of potential ordinary shares, but if you have more than one, you should first determine whether it is dilutive or antidilutive.

Here’s the video with the short summary of IAS 33 Earnings per share:

Any questions?

If you have any issues or questions related to earnings per share, well – comment, please!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

48 Comments

Leave a Reply Cancel reply

Recent Comments

- Anguyo Sam on Can you capitalize it as PPE or not?

- Saide Ali on IFRS Sustainability Reporting Just Behind Your Door

- Agustus Arel Gon on IAS 8 Accounting Policies, Changes in Accounting Estimates, Errors

- Silvia on IAS 36 Explained (2025): Full Impairment Guide + Free Practical Checklist

- Junaid Alam Khan on IAS 36 Explained (2025): Full Impairment Guide + Free Practical Checklist

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (73) 73

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (55) 55

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (26) 26

- Uncategorized (1) 1

Thank you Silvia, very interesting and comprehensive introduction to the subject of IFRS 33 – Earnings per Share. Your continuous updates through emails are also very much appreciated. I have in the past taken full advantage of your IFRS KIT and the articles which you frequently contribute make my readings and understanding of IFRS principles more useful.

Thank you, Dilip, much appreciated!

Thanks a lot ,Mam. I like your way of presentation in language and giving examples to clear it which make me much more easy to understand.

Hi silvia, I have one question about bonus issue. I am not quite clear about bonus issue that is made during the year after other events such as further issue of shares. I would be grateful if you could give me an idea on following:

For financial period ending 30 June 2019

Opening no. of shares (1 July 2018)- 900,000

1 December 2018- issue of new shares- 300,000

1 March 2019- one for six bonus issue

What will be the weighted average no. of shares for EPS calculation?

Hi Shiva, here’s the article about it where you have the full step-by-step method.

Hi Silvia, I am sorry but the article only gives an example of bonus shares in isolation. I am specially confused with the bonus shares that is issued after further share issue during the year. Because I have found in some materials adding flat amount of bonus shares (i.e 200,000( 1/6*1,200,000) ) with time proportion of 900,000 and 1,200,000 for deriving weighted average no. of shares while in some, bonus fraction (7/6) has been taken for both opening balance (900,000) as well as balance after new share issue (1,200,000 ) and no fraction for (1,400,000) for 3 months ending 30 June 2019 and time factor is multiplied into these three balances.

Therefore, using one method, we get weignted average of 1,275,000 shares whereas using fraction method, we get 1,254,166.67. It seems to me that one method only assumes total no. of bonus shares to be existing from beginning of the year whereas another method assumes that bonus fraction of (one for six) is both applied in opening balance as well as balance after further issue of shares. I want to know which is the correct answer and I need your help on this.

Thanks

Shiva

If an entity has a Class A, nonvoting share, which is entitled to a fixed dividend of say , 6%? will this be included in the determination of EPS?

That seems like a preference share – in this case it is excluded from EPS calculation.

Hi Silvia,

I do have a question.

If an entity has written put option on its own shares, it is obliged to purchase the shares above market price (at Excercise Price) if the contract is in the money in settlement date. As the purchase will be accounted for directly in equity, Is the excess price paid above market price on exercise of such a contract is deducted from computing Earning Attributable to Ordinary Shareholders for computing EPS ?

Very nicely explained and illustrated Sylvie!

Thank you.

i would really want this “Maybe I’ll solve one complex example for you in one of my next articles”

Hi Fazeel, thanks! Actually, I have done that already – click here. S.

You are a gem!

Apologies for misspelling your name Siilvia.

please i really need an example for right issues with numbers because i did’t understand it.

OK, I will do that – thank you for the idea!

Hi there Sylvie.

If there is potential ordinary shares (employee options in particular)

If a company expects to incur future expenses that will be

recognised in regard to these options up to the date of vesting.

How do you incorporate that when computing diluted earnings per share. I already know that such share options have no effect on retained earnings. Some guidance on this

Hi Silvia, silly question what does CU stand for?

CU = currency unit (I mean – any currency, it is a general abbreviation)

(I mean – any currency, it is a general abbreviation)

What happen if l have loss, the did I have to calculate the diluation eps?

Dear Silva,

You are doing a great job. Keep it up. God bless you with more wisdom

Hi Silvia,

Wonderful narration and the way you present is damn pretty, Love to read IFRS because of your videos. Pictorial representation is nice’

Great thanks.

Thank you!

Can proof of concept payment be treated as research and expense out as per IAS 38

Hi Silvia,

I just read it and feel like that it is going to remain in my mind forever. It is so well explained. I am really thankful to you for this genuine effort you are making in regard of IFRS teaching.

Regards,

Thank you, glad to help!

Thank you for making IFRS simple for our understanding.

hi Silvia

asking my self a question why knowing this IFRS box only this year after failed 3 times IFrs , i would surely have passed with your teachings at first time attempt and saved time and dollars. tnx for your great teachings

Oh, thank you, Tinashe, I really wish you pass the next time! S.

Hi Silvia, under Basic EPS above, you mentioned that “Earnings basically include all items of income and expense including tax and non-controlling interests LESS the net profit attributable to preference shareholders, including preference dividends.”

Did you mean that we should be excluding non-controlling interests instead of including when it comes to consolidated statements? I think IAS 33:A1 mentions that we should be adjusting for NCI since we are only considering earnings attributable to the parent. Thanks.

Hi Silvia..Can u please tell me what would be the treatment of partly paid shares in case of Basic and diluted EPS?Kindly explain it through any example.

The company has YE of 28 February 2017. Incorporated on 17 February 2017 and shares issue listed on 9 May 2017, no other activity. No. Shares at YE is 1,000,000. What would be the weighted average of shares?

YE 28 February 2018*

4 ways on how to improve Basic earning per share!?

Dear Silvia, you did a great job, you save my time.

Wishing you all the best.

Good one there, thanks

thanku so much mam for giving clear cut concept

AWESOME MAM

Dear Silvia,

I love your IFRS videos! They are so great! Thanks a lot for doing this.

I was wondering which software you used to draw the paintings? I love the figures and I thought maybe I could use them in my presentations to my students and of course refer to your site. I teach in IFRS

Dear Ms Silvia,

Good morning. Hope you are fine with good health.

Thanks for your valuable topics as sent by you.

Dear Mohammad, thanks a lot for your appreciation! Yes, I’m fine with great health – hope the same for you S.

S.

I really found easy to comprehend. Thank you.

Thanks

Excellent

Silvia, that’s great, i will refer my students, very good examples!

Thanks, Eve, feel free to send anyone here

thanks m’am, I just needed it to pass my exam, perfect timing!

Great Hope it helped

Hope it helped

Hi mam, It’s been a long time. How are u? I’m Harish from Nepal. I great thank to you. I fully understand this standard through your note. I share it to my friends.