How to Account for Government Grants (IAS 20)

Almost every government supports certain companies or business by providing grants or other kind of assistance.

As this is clear benefit and advantage comparing with other companies without such an assistance, it should be properly reported in the financial statements.

How?

Let’s explain the rules and then solve a simple example.

What do the rules say?

The most important standard dealing with government grants is IAS 20 Accounting for government grants and disclosure of government assistance.

It’s quite an old standard – it was issued in 1983 with the effective date from 1 January 1984 and there were no significant changes from that day.

The main objective of IAS 20 is to prescribe the accounting for and the disclosure of

- The government grants – simply speaking, these are the actual resources, whether monetary or non-monetary, transferred to an entity by a government, in most cases upon completion of some conditions;

- The government assistance – these are other actions of the government designed to provide some economic benefit to an entity, for example free marketing or business advices.

IAS 20 deals with almost all types of government grants, with the following exclusions:

- Government assistance in the form of tax reliefs (tax breaks, tax holidays, etc.),

- Grants related to agriculture under IAS 41;

- Grants in the financial statements that reflect the effect of changing prices and

- Government acting as a part-owner of the entity.

How to Account for Government Grants

Before we dig a bit more in details, let me stress that you should never ever credit the receipt of any grant directly in equity.

This capital approach is not permitted in IFRS.

Instead, IFRS prescribe so-called “income approach” – to recognize grants as income over the relevant periods to match them with the related expenditures or costs they should compensate.

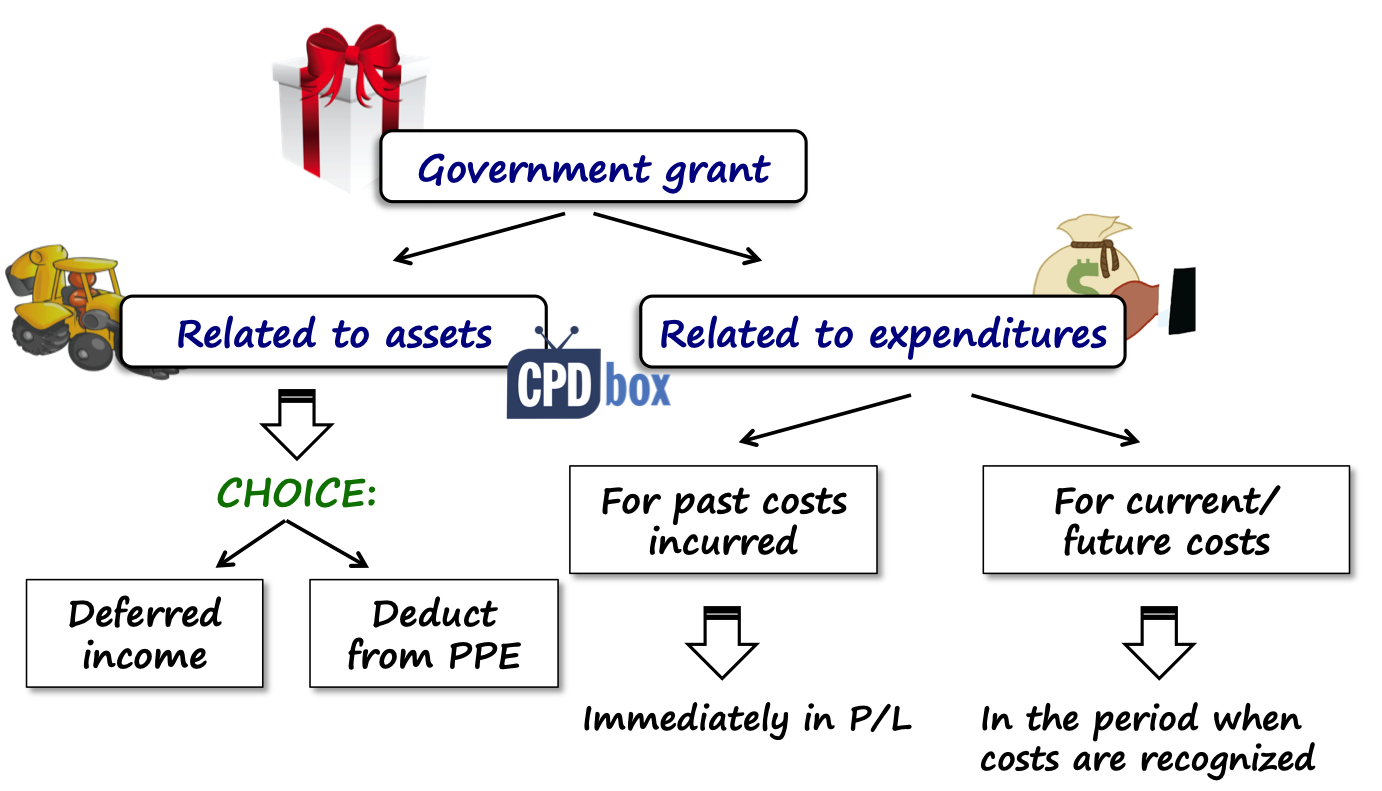

Specific accounting treatment depends on the purpose of the grant received. An entity can receive a grant either for:

- Acquisition of an asset, or

- Reimbursement of costs.

Grant related to assets

If an entity receives the grant for acquisition of some assets, there are 2 options to present such grant in the financial statements:

- To present it as deferred income; or

- To deduct the grant from the carrying amount of an asset acquired.

In the example below, I show you both options.

Grant related to income (reimbursement of expenditures)

Here, you need to differentiate between the grants for past costs (already incurred) or the grants for current or future costs.

If the grant is provided to reimburse costs incurred in the past, then it is recognized immediately in profit or loss.

If the grant is provided to reimburse costs incurred or to be incurred at the present time or in the future, then the grant is recognized in profit or loss in the periods when the costs are incurred.

From the presentation point of view, there are 2 options:

- To present the grant income as a separate line item as “other income”, or

- To deduct the grant income from the related expense.

Let me illustrate it on a short example:

Government grants – question:

ABC receives the following government grants in 20X2:

- Grant of CU 40 000 to acquire a water cleaning station. The cost of the station was CU 100 000 and its useful life is 8 years. ABC acquired the station on 1 July 20X2 and recognized depreciation on a straight-line monthly basis.

- Grant of CU 10 000 to cover the expenses for ecological measures during 20X2 – 20X5. ABC assumes to spend CU 3 000 in 20X2-20X5 and CU 2 000 in 20X6 (CU 14 000 in total).

- Grant of CU 3 000 to cover the expenses for ecological measures made by ABC in 20X0-20X1.

Prepare the journal entries in the year ended 31 December 20X2.

Government grants – solution:

As there are 3 different grants, let’s solve them one by one.

Grant for a water cleaning station

This grant is a typical grant to acquire property, plant and equipment. As written above, we have 2 choices to present it:

Option #1: Deferred income

ABC can credit the grant to deferred income and amortize it over the useful life of a water cleaning station in order to match the grant income with the relevant costs (in this case depreciation charges).

In 20X2, ABC recognizes CU 2 500 in profit or loss (calculated as the grant of CU 40 000 divided by 8 years times 6 monhts in 20X2 divided by 12 months in a year).

Our journal entries are:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 40 000 | SoFP – Cash/Bank account | SoFP – Deferred income |

| Recognition in P/L in 20X2 | 2 500 (40 000/8*6/12) | SoFP – Deferred income | P/L – Income from government grant |

Option #2: Deduction from an asset

ABC can deduct the grant amount to arrive at carrying amount of a water cleaning station. Then its recognition in profit or loss is automatically reflected in depreciation charges.

As a result, the new carrying amount of a water cleaning station upon initial recognition is CU 60 000 (cost of CU 100 000 less grant of CU 40 000) and the annual depreciation charge is CU 7 500 (CU 60 000 divided by 8) instead of CU 12 500 (CU 100 000 divided by 8). In the first year, it’s CU 3 750 (6 months only).

Our journal entries are:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 40 000 | SoFP – Cash/Bank account | SoFP – PPE (Water cleaning station) |

| Recognition in P/L in 20X2 (within depreciation charge) | 3 750 (60 000/8*6/12) | P/L – Depreciation of water cleaning station | SoFP – PPE (water cleaning station) |

Note: SoFP = statement of financial position.

Grant for ecological measures in 20X2-20X5

Apparently, the second grant is provided to reimburse the expenses for ecological measures in 20X2 to 20X5. In other words, it is a grant for current and future expenses.

ABC needs to recognize the income from grant in the periods when relevant expenses are incurred.

In this example, we can calculate the portion recognized in P/L in 20X2 on a proportionate basis, i.e. assumed CU 3 000 in 20X2 divided by total assumed expenses of CU 14 000 times the grant of CU 10 000.

The credit entry goes in profit or loss, but here, ABC has a choice to present the grant income as a separate line item (that’s easier) or to deduct it from the expenses.

The journal entries are:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 10 000 | SoFP – Cash/Bank account | SoFP – Deferred income |

| Recognition in P/L in 20X2 | 2 143 (3 000/14 000*10 000) | SoFP – Deferred income | P/L – Income from grants (or relevant expense) |

Grant for ecological measures in 20X0-20X1

The third grand relates to the expenses that had already been incurred in the previous years 20X0 and 20X1.

As a result, the grant is recognized immediately in profit or loss.

The journal entry is:

| Description | Amount | Debit | Credit |

| Receipt of the grant | 3 000 | SoFP – Cash/Bank account | P/L – Income from government grant |

You can watch a video about accounting for government grants here:

In my next article, I will try to clarify the biggest issues arising around government grants, so if you have any specific question, just leave me a comment and stay tuned! I’ll be happy if you share this article with your friends, thanks a lot!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Nayert on Example: How to Adopt IFRS 16 Leases

- Jesslin on How to calculate deferred tax with step-by-step example (IAS 12)

- philip on How to present restricted cash under IFRS?

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

How do you account for a reimbursement grant that is based on previous years expenses? Let’s say your total expenses for 2022 were $500,000 and you received a grant in the amount of $100,000 in 2023 based on the 2022 expense. When the revenue comes in 2023 how should that revenue be recognized? Does it get put in the current year 2023 or should it be recorded in the previous year 2022 for the expenses it is reimbursing?

Dear Syliva,

how to account for a government grant which we received with no exact indication of expenses this is about to compensate? The Company decided to cover salaries and related expenditures. However, our grant is much higher than the actual expenses we had. Can we defer the recognition of income; and recognize only the income as actual expenditure? And in the future, compensate future expenses? There are no provisions in the contract that will indicate we need to repay the grant if we have no expenses. Thanks

Hi Silvia, how do you determine whether a contract or agreement with a government is IAS 20 or IFRS 15?

Well, you need to see in what position the government acts. Is it paying for some services or goods? Or is it providing certain grant and gets nothing or lower value in return? Difficult to say if I don’t see it 🙂

Hi Ms Syliva,

Just wondering if you opt for the choice of reducing PPE in a grant for an assets. Do you deduct the cost account or the depreciation account in the disclosure?

Thanks,

Ann

Hi Ann,

since this is deduction from cost, you deduct the cost account. Then your depreciation charges would reflect the lower cost.

Hello Ms Silvia

Sorry, since I couldn’t understand , the Deduct Asset method , can you give me some more example or explanation ? b/c i’m unable to get or understand the accounting effect of the government grant.

Thanks

I have a question regarding a government grant we received. We received a grant for some software valued at say $1,000 USD. The Grant direct pays the vendor 85% and we match the remaining 15%. How would you account for the 85%?

Hi K.,

if there are no further strings attached, there are two options:

1) Debit Intangible assets – Software 1 000 / Credit Trade payables – 1 000; and then when grant becomes receivable Debit Trade payables 850 / Credit Deferred income Grant received 850

or

2) Debit Intangible assets – Software 1 000 / Credit Trade payables – 1 000; and then when grant becomes receivable Debit Trade payables 850 / Credit Intangible assets – software 850

The precise entries depend on the contract with vendor, invoicing, etc.

Hi Silvia,

I have a few questions as follows:

1. How do we treat govt grants in preparing cash flows for capital budgeting? The grant, in addition to other source of financing, will be used to finance the capex and/or other initial outlay for the project.

2. Does govt grants have a corporate tax implication in the cash flow as per question 1.

3. Will it be considered as a financing item in the cash flows or a revenue item under cash from operation?

Thanks in advance. 🙂

Hi Mahima,

the answer to all of these questions lies in precise classification of that grant. So in fact, you answered it yourself. If the grant is for investing activities (CAPEX), then treat the cash from it as such. If the grant is used for both purposes, then split it. As for taxes, normally income taxes are reported in the same caption to which they relate, so as soon as your grant is taxable, then yes, report in in the appropriate part. Many grants are not taxable at all though, so in this case there is no tax implication.

Hi Silvia

You refer to not recognising the grant directly as part of equity (i.e. reserve), could you please branch out about this more and where I can find the related IFRS text regarding this?

That would be IAS 20, since it clearly permits 2 options and none of them is in equity.

Ok perfect. I thought maybe it was stated elsewhere as well that I missed and which I can use as a reference.

Thank you!!

Can you explain the definition of “government”? Can a grant from Unicef or an NGO or a similar body be treated as a government grant?

Yes, it can.

Hi Sylvia,

How would you treat expenses incurred to meet the requirements or conditions of a grant to be used towards an item of PPE?

Anyone can briefly explain how to account for the Government grant related to assets. To me, I think that these are journal entries should be look like:

Dr Asset grant (specific name of Asset)

Cr Deferred Income (Liability)

Cr Amortized Deferred Income (Income)

Please confirm if this is correct.

Thank you for article

I just have one question regarding the exemption of government acting as a part-owner of the entity.

A parent company is entity owned by the government; one of its subsidiaries received an asset from the government. In this case, is the exemption applicable for the subsidiary since it’s parent is owned by the government?

Yes, we follow IFRS. So you mean even though it is The Government that establishes and is funding the operations of the institution (which means they own the institution), we can still treat it as Grant.

Well, the question is the documentation and assessment if that money was received from the government in its capacity of shareholders (no contract, just transfers, no strings attached) or in its capacity as government.

The institution is an agency of the Government and was established by an act of parliament (it has no shareholders as such). The Government is responsible for its funding, and it does so by providing monthly subvention. However, periodically (usually every four years), the Government provides funds specifically for the purchase of vehicles, and these funds are received with no contracts, just transfers, and no strings attached. The only condition could be that the vehicles purchased are seen as part of The Government’s fleets, and whenever they need the vehicles for national function, we are obliged to release the vehicles to them..

Dear Sylvia,

My institution is a subvented Government department under the Ministry of Trade and receives a monthly subvention from the Finance Ministry. Periodically, they will give us money to buy vehicles. I now want to know how we should treat the funds received for the purchase of this specific asset.

Hi Yaya, as soon as you follow IFRS, then it is a grant for acquisition of PPE, thus please see above in the article “Grant related to assets”. However, if you are some governmental institution, please check which standards you follow.

Hi Silvia,

What are the pros and cons of using the gross model using deferred income and net approach?

Thanks

Nice question, seems like homework type 🙂

Gross model: Pros = reflects the fact that the asset was acquired with grant; Cons = More challenging for admin

Net model: Pros = easier to monitor; Cons: Sometimes the asset is carried at zero value since fully acquired with grant; does not reflect the acquisition cost of an asset (but does reflect the cost for that entity)

Dear Sylvia,

my company is a company from the public sector. We received from the government, our only shareholder, an amount to build an access road. This road is used for access to the amenities in the National Nature Park, however, it is also used by the people who have houses in the National Park. I am not sure how to treat the capital expenditure and the cash received. Do you have any idea or solution? Thanks for the help.

Hi Comfy,

it depends on the contract between you and government in relation to control of that road, so I’m not really able to make a full conclusion from this scarce info. Are you going to be responsible for that road, its maintenance and are you going to get some compensation from the government for it? Is there some document about it? You should be answering these questions first.

Hi Silvia

We are following the deferred income approach.

1. What do we do to the deferred grant income when there is a disposal of an asset which still had a carrying amount (not fully depreciated)?

2. for multi year construction projects – does the WIP/ AUC affects the deferred income (before depreciation kicks in)?

Hi Fortunate, 1) It depends on the terms in the contract related to the grant; if that’s not repayable back to government then you should simply recognize the remaining balance of deferred income in profit or loss. 2) I don’t think so since no P/L is affected.

Would we show this remaining balance of deferred income under ‘other income’ or under ‘grant income’?

Hi Silvia,

My apologies if this question pops up a second time. I am not sure if the first one was posted as I cannot find it anywhere.

My question is in relation to the accounting treatment of WIP and grant received.

If I receive a grant today to finance a construction project over the next 3 years, would my initial journal entry be DR Bank/CR WIP?

And subsequently, DR WIP/ CR PPE.

After the project is finished and the asset is available for use, I would start depreciation.

Would this be the correct treatment? I am a bit confused, as crediting WIP would mean that I have a negative WIP balance.

Could you please help to bring some light into the dark :)?

Many thanks in advance!

Tania

Hi Tania,

I personally prefer the fist method of accounting for grants – treating as a deferred income, because the grant is shown clearly. However, I do understand why the second method is used – it brings CAPEX down, and EBIDTA looks better, too.

OK, but as you selected the second choice, here’s my view on your issue: Clearly, you have not spent the cash on your WIP and you received more money from the government than you spent at that moment. I assume that the grant was only for the acquisition of that PPE, and not for anything else. Hence, at that moment of the grant receipt, you did not meet the full conditions of the grant (ie spending that fully on PPE) and thus you should not deduct it from WIP, but recognize it as some liability Dr Cash/Cr Liabilities from grant.

And only when you actually spend that cash for WIP, you pass the entry Dr Liabilities from grant / Cr WIP. And, if it happens that you spend less than you received in a form of a grant and government is happy with that and does not ask for repayment (have a paper on that!!!), then you would recognize the remaining grant liability straight in profit or loss.

Hi Silvia, I have a related situation in my company. We received government grant of lets say 50 million to develop a software. Initially we recgonize it as

Dr. Cash

Cr. Deferred liability

Company incurred 10 million at the end of first year and has made following entries.

Dr. WIP 10 million

Cr. Accounts Payable

and

Dr. Accounts payable

Cr. Cash.

we will continue to pass these entries till the software is fully developed and available for use.

Then we will start amortizing the intangible asset over its useful life and transferring amounts from Deferred liability to P/L in same pattern. Is our proposed treatment fine. Please advise.

Hi Silvia,

How to account for land received from government as a Non-monetary grant?

I think this question is quite well answered by this article.

Hi Silvia,

Thanks for your comprehensive video. However i have some confused .

For Example I received a grant $1mil today (which consist of a) salary incurred for the past year before 2021 $500K, b) professional fee incurred this year 2021 April $100K and c) equipment $400K which total equipment cost $1.5mil acquired on in year 2017 and capitalized in assets over 5years) but government only subsidy $400K),

so my accounting entities will be:

DR cash $1mil

CR P/L $500K matched with salary expense or P/L-other income-Grant ?

CR P/L $100K match with professional fee expense or P/L -other income-Grant?

CR Deferred Income $400K and amortized it over the PPE useful life , JV entry will be DR Deferred Income DR P/L depreciation expense or Other Income -grant?

I will really appreciate it if you can advise me ( PS: we have fullfiled the grant condition )

Thanks

Agnis

Hi Silvia

I want to ask about the accounting treatment of furlough where the employees are on temporary leave due to covid , as such the employers can claim under certain conditions certain amount from the government . My question is whether the accounting treatment then would be similar to grants related to future or present expenditure in this case .

thank you

Hi Silvia,

Recently my employer received a government grant amounting $200,000 to finance a certain project with a clause “grant of option” to grant the government body to subscribe 10% pf the shares (the “option shares”) and this option may be exercised any time within a-5-year-period.

Should i still account for S$200,000 as government grant income? and how to treat this 10% as per IFRS?

Thanks Silvia 🙂

Hi Silvia,

We received a monetary grant from one of our shareholders, and as per the shareholder’s agreement, we must utilize this monetary grant to procure certain capital assets. In this case, can we record this monetary grant as differed income and amortize it over the useful lifetimes of the capital assets?

Thanks In advance- Ranawaka

Hi Ranawaka,

in general no, because the shareholders are neither government nor similar body and thus IAS 20 does not apply (or are they?) Please take a look here, maybe you will find a different way.S.

Hi Silvia,

First of all great post! I’m just a little confused regarding the application of a grant for an asset. For example, if the asset was already purchased and paid for before the government grant is received, would we still be able to apply both the options mentioned above for the method regarding assets?

How to account for a grant of land in the Financial statements???

This is exactly what I’m trying to figure out as the land is non depreciable.

All right guys. So, take a look at paragraph IAS 20.18. It says that if the grant is provided to acquire non-depreciable assets, then it may require fulfilment of certain obligations and in this case, it needs to be recognized in profit or loss over the periods bearing the cost of meeting these obligations. Let’s say you get a grant to acquire the land, but you have to make certain improvements on that land within 3 years, so in this case you need to recognize the grant in profit or loss over that period. You get the point. It is very rare that you get the grant to acquire land with no further conditions or obligations – if this is still the case, then well, maybe it would be appropriate to account the grant’s income in profit or loss when you acquire that land.

Thank you for the clarification, I think the response you have provided relates to getting the grant to acquire non-depreciable asset. What happens when the Govt provides the non-depreciable asset? How is it initially recognized? Do we have to assess the fair value of the non-monetary asset and to account for both grant and asset at that fair value? Or is it ok to record both asset and grant at a nominal amount?

I still couldn’t figure out what journal entries would be for receipt of Revenue grant. If you know please reply I would appreciate it. Thanks.

Hi,

Thats a great explanation. but i have still some doubt onHow to treat grant for non depreciable asset.. weather monetary or non monetary grant.

Thanks and regards

Rushang soni

Dear Silvia,

I have a question. One of Government Agencies transferred the raw material with no charged to another government agency and that agency used the raw material in the production process. I would like to know whether that raw material should be recognized as grant related assets or grant related income. I’m waiting for your kind response.

Thanks in advance.

It depends on the inventory’s production cycle. See, you should match the grant income with the related expenses – that’s the main point. So, if inventory was consumed right away, then recognize the grant as income immediately.

Thank you so much, dear Silvia. It is very helpful to me.

Hi, How are we going to account a grant received from the government which will be used to repay a company’s liabilities

Thanks

Hi Silvia, I have a question om government grant funding and grant funding in general.

For government grant funding I’d government gives you funding to construct an asset and as you incur costs they approve the costs of the assets can you say that the method of income approach is more applicable as once you perform their work totheir satisfaction they approve these past project costs. As apposed to the asset based approach.

2.what happens if you receive a grant that is a mix of funding, some for assets and some for expense which you are not completely aware at the start or thr audit can you apply a hybrid deferred income release until thr conditions of thr grants are met.. Eg based on a proxy of thr assert depreciation and release to the income statement.. This is a very grey area in thr standard. This is really vexing and I would sincerely appreciate your input

Good day! My question is that in Pakistan we have financing facility for exporters at concessional rate of interest (Export Refinance). IFRS is applicable in Pakistan, but exporting entity availing such finance treat this as normal financing arrangement. Shouldn’t they have applied IAS 20?.

Hi Silva

on Question 2

The grant of CU 10,000 is for cost on ecological measures incurred from 2000 to 2005 and in that period the company incurred only CU 12,000. Do we have to extend the grant to cover for costs incurred in 2006 year as you have done by your calculation?

Awaiting your response

Hello,

In the current pandemic situation, most of the government has provided the relief in the time frame for depositing VAT and other tax liability. Can we address this as “Government assistance” under IAS 20 and required to disclose the same in FS. Please help with the treatment.

Hi Mayank, sometimes you need to apply IAS 12 for income tax, sometimes IAS 20. However, I don’t see the direct accounting implications other than disclosure in the notes.

Dear Ms. Silvia

I hope my e-mail finds you fine. I am trying to write a paper about ISA 20. You mentioned that ISA 20 was issued in 1983 and became an effective 1984. It is highly appreciated if you could send me the document for this information

Best wishes

Mohammed

Hello,

We have such case : Company received government grant in the form of cash, for continuing operation as normal course of business, without conditions attached to it. For accounting purpose ,what conditions have to be met in order to account grant in operational activities in the statement of cash flow ?

Hello,

We have such case : Company received government grant in the form of cash, for continuing operation as normal course of business, without conditions attached to it. For accounting purpose ,what conditions have to be met in order to account grant in operational activities in the statement of cash flow ?

Regar

Hello Silvia,

What is the treatment when government granted land with no condition?

Regards,

Dear Silvia,

My church was donated with land and building without any condition, What the church did was as follows:

1. Dr Land and Building

Cr Capital grant

2. Dr Depreciation of building to pl

Cr accumulated depreciation

3. Dr Pl

Cr Capital grant

– with the annual depreciation charged on building

What happens at the end of it, the capital grant of the building element became zero and only remains amount for the land in the capital grant. Also, a result of this entry the depreciation charged for the year is cancelled and there is no effect in the pl. May i know whether such treatment is correct. If no, what is the correct treatment?

Government has announced to pay less social security than the normal scenario due to this covid-19. example: usually the company accounts 100 as expense and remit it to government in normal scenario. but due to this pandemic, government announced to pay only 60. whether as per ias20, 100 to be accounted as expense and take 40 as income (or) account only 60 as expense..?

Hello silvia , How to account for percentage of employees salaries that government will pay monthly because of covid 19 ?

In my opinion that is the grant to cover operating expenses in that year, so recognize in profit or loss as a revenue.

Thank you so much. Your lectures are very educative

Hi Silvia, i have a question, as you probably aware due to pandemic Govt’s are issuing interest free loan partly or fully to companies to pay employee payroll for next 2 to 3 months. So should this be considered as Govt grant and would this grant go under other income (after operating income) or reduce payroll exp under salaries expense account. Thanks

Hi Silvia

How to account for below market rentals charged by government entities? How to account for fair value and the actual rental paid?

Thank you. ?

Sylvia,

The Government is providing a grant to a fund a partial credit guarantee scheme, should i capitalise this grant and amortise it to meet the operations cost when these cost are incurred?

Hello Silvia

Explain the treatment to be given when an entity after enjoying government grants can not pay the capital and interest

Thanks.

That depends on the grant terms/contract/official document related to the grant. You should look what happens and then decide on the accounting. IFRS do not solve the general issue related to this.

If a public sector company gets interest free loan from Govt and it is sure that company will not be able to pay repay the loan. Since the loan is payable but the timing of the loan repayment is uncertain. Under this situation, should this loan be amortized or not?

Hi Silvia,

What would be the appropriate way to present a shareholder capital grant? I believe it shall not be presented under NCL and amortized but to be presented as an Investment subsidy under equity. These capital grants are provided by the shareholder to acquire initial capital assets ( shareholder is not a government entity or related ). Appreciate if you could confirm. Thanks in advance.

Hi TR, I think this article can give some hints. S.

Thanks for your article on treatment of government grants, my area of interest is on grants for assets and the issues with the treatments; deferred income approach means the organisation will be recognizing income in the future even if it does not carry out any activity. There will be an income tax implication. If one adopts deduction from PPE, means company assets will be understated, especially if these assets form a substantial part of the total assets. I have a similar situation in my books and I’m trying to see which option is better

Hello MS Silvia, i am from Ethiopia and its my pleasure to read and listen your articles. it is helpful and very interesting. i would like to Thank you.

Thanks, Sylvia.

You are a valuable expert!

Dear Ms. Silvia,

Hope you are fine and doing well,

I highly appreciate if you answer the below question of mine:

Assume World Bank has given 3 vehicle valued 100,000 USD, and a an intangible asset valued 50,000t USD to an entity as a grant. there is not cash/bank transaction. how should treat it under IAS 20.

I look forward for your kind response!

thanks

I think the following entries should be made:

1. PPE 100,000

Intangible 50,000

Deferred Income 150,000

2. Dep. Exp (over its useful ife) Dr.

Amortization Exp Dr.

PPE Cr.

Intangible Cr.

3. Deferred Income (over its useful life) Dr.

Govt. Grant Income (P/L) Cr.