IAS 16 PPE Explained (2025): Full PPE Guide + Free Compliance Checklist

Updated: April 2025

IAS 16 sets the rules for accounting for Property, Plant and Equipment (PPE). This guide breaks it down clearly, plus it includes 2 free video lectures and downloadable IAS 16 compliance checklist.

Jump to section:

1. Free VIDEO lecture: Overview of IAS 16 in 10 minutes

2. Recognition of Property, Plant and Equipment

3. Initial & subsequent costs of PPE

4. Initial measurement of PPE

5. Subsequent measurement of PPE: cost model and revaluation model

6. Free VIDEO lecture: Revaluation model explained with example

7. Depreciation

8. Note to impairment under IAS 36

9. Derecognition of PPE

10. DOWNLOAD IAS 16 Compliance Checklist (including disclosures)

11. Further reading&learning

1. Overview of IAS 16 in 10 minutes (free VIDEO lecture)

2. Recognition of Property, Plant and Equipment

Property, plant and equipment are tangible items that are held:

- for use in the production or supply of goods or services,

- for rental to others, or

- for administrative purposes;

and are expected to be used during more than one period (IAS 16.6).

IAS 16.7 states that the cost of an item of property, plant and equipment shall be recognized as an asset if, and only if:

- it is probable that future economic benefits associated with the item will flow to the entity; and

- the cost of the item can be measured reliably.

This recognition principle shall be applied to all costs at the time they are incurred, both incurred initially to acquire or construct an item of property, plant and equipment and incurred subsequently after recognition to add to, replace part of or service it.

Return to top

3. Initial and subsequent costs of PPE

2.1 Initial costs

Some items of property, plant and equipment might be necessary to acquire for safety or environmental reasons. (IAS 16.11)

Although they do not directly increase the future economic benefits, they might be inevitable to obtain future economic benefits from other assets and therefore, should be recognized as an asset.

For example, water cleaning station might be necessary in order to proceed with some chemical processes within chemical manufacturer.

2.2 Subsequent costs

Day-to-day servicing of the item shall be recognized in profit or loss as incurred, because they just maintain (not enhance) item’s capacity to bring future economic benefits. (IAS 16.12,13)

However, some parts of the item of property, plant and equipment may require replacement at regular intervals, for example, aircraft interiors.

In such a case, an entity derecognizes carrying amount of older part and recognizes the cost of new part into the carrying amount of the item. The same applies to major inspections for faults, overhauling and similar items.

4. Initial measurement of PPE

An item of property, plant and equipment that qualifies for recognition as an asset shall be measured at its cost (IAS 16.15)

The cost of an item of property, plant and equipment comprises (IAS 16.16):

- its purchase price including import duties, non-refundable purchase taxes, after deducting trade discounts and rebates

- any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. Examples of these costs are: costs of site preparation, professional fees, initial delivery and handling, installation and assembly, etc.,

- the initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located.

The cost of an item of property, plant and equipment is the cash price equivalent at the recognition date.

If payment is deferred beyond normal credit terms, the difference between the cash price equivalent and the total payment is recognized as interest over the period of credit (unless such interest is capitalized in accordance with IAS 23).

If an asset is acquired in exchange for another non-monetary asset, the cost will be measured at the fair value unless:

- the exchange transaction lacks commercial substance or

- the fair value of neither the asset received nor the asset given up is reliably measurable.

If the acquired item is not measured at fair value, its cost is measured at the carrying amount of the asset given up.

5. Subsequent Measurement of PPE

An entity may choose 2 accounting models for its property plant and equipment:

- Cost model: An entity shall carry an asset at its cost less any accumulated depreciation and any accumulated impairment losses.

- Revaluation model:An entity shall carry an asset at a revalued amount. Revalued amount is its fair value at the date of the revaluation less any subsequent accumulated depreciation and subsequent accumulated impairment losses.

An entity shall revalue its assets with sufficient regularity so that the carrying amount does not differ materially from its fair value at the end of the reporting period. If an item of property, plant and equipment is revalued, the entire class of property, plant and equipment to which that asset belongs shall be revalued.

The change of asset’s carrying amount as a result of revaluation shall be treated in the following way:

| Change in Carying Amount | Where | |

|---|---|---|

| Increase | Other comprehensive income (heading “Revaluation surplus”) | Profit or loss if reverses previous revaluation decrease of the same value |

| Decrease | Profit or loss | Other comprehensive income if reduces previously recognized revaluation surplus (heading “Revaluation surplus”) |

6. Revaluation model explained with example (free video lecture)

You can learn more about the revaluation model in this video:

7. Depreciation (both models)

Depreciation is defined as the systematic allocation of the depreciable amount of an asset over its useful life.

The items of property, plant and equipment are usually depreciated in order to maintain matching principle – as they are in operation for more than 1 year, they assist in producing the revenues in more than 1 year and therefore, their cost shall be spread among those years in order to match the revenue they help to produce.

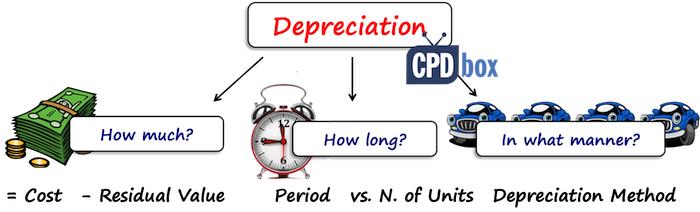

When dealing with the depreciation please do have 3 basic things in mind:

- Depreciable amount: Depreciable amount is simply HOW MUCH you are going to depreciate. It is the cost of an asset, or other amount substituted for cost, less its residual value.

- Depreciation period: Depreciation period is simply HOW LONG you are going to depreciate and it is basically asset’s useful life.

Useful life is the period over which an asset is expected to be available for use by an entity; or the number of production or similar units expected to be obtained from the asset by an entity.

IFRS16 lists several factors that shall be considered when establishing item’s useful life:

- expected usage of the item,

- expected physical wear and tear,

- technical or commercial obsolescence of the item, and

- legal or other limits on the use of the asset.

Useful life and asset’s residual value (input to depreciable amount) shall be reviewed at least at the end of each financial year.

If there is a change in the expectations comparing to previous estimates, then change shall be accounted for as a change in an accounting estimate in line with IAS 8 (no restatement of previous periods).

- Depreciation method: Depreciation method is simply HOW, IN WHAT MANNER you are going to depreciate.

The depreciation method used shall reflect the pattern in which the asset’s future economic benefits are expected to be consumed by the entity.

An entity may select from variety of depreciation methods, such as straight-line method, diminishing balance method and the units of production methods.

Selected method shall be reviewed at least at the end of each financial year. If there is a change in the expected pattern of asset’s usage, then the depreciation method shall be changed and be accounted for as a change in an accounting estimate in line with IAS8 (no restatement of previous periods).

Depreciation shall be recognized in profit or loss unless it is capitalized into the carrying amount of another asset (for example, inventories, or another item of property, plant and equipment).

Each part of an item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately. For example, aircraft interior cost might be depreciated separately from the remaining airplane cost.

8. Note to Impairment (IAS 36)

Here, IAS 16 refers to another standard, IAS 36 Impairment of Assets, that prescribes rules for reviewing the carrying amount of assets, determining their recoverable amount and impairment loss, recognizing and reversing impairment loss and more.

IAS 16 states that compensation from third parties for items of property, plant and equipment that were impaired, lost or given up shall be included in profit or loss when the compensation becomes receivable.

For example, claim for compensation of damage on insured property from insurance company is recognized to profit or loss when insurance company accepts claim, closes the case and agrees to compensate (or after whatever procedure is agreed in the insurance contract).

9. Derecognition of PPE

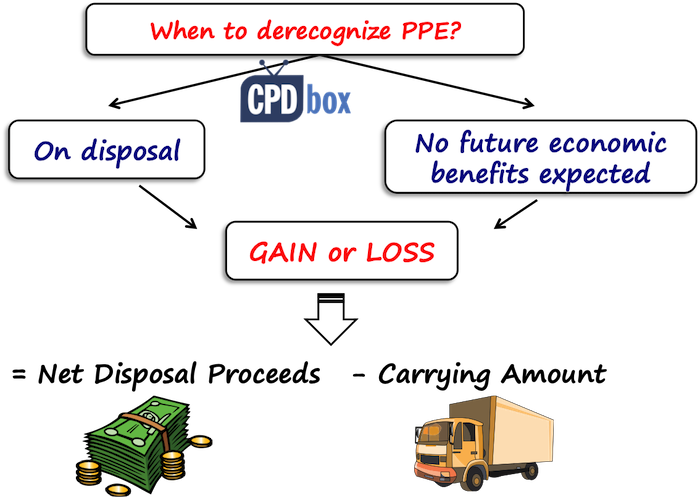

IAS 16 prescribes that the carrying amount of an item of property, plant and equipment shall be derecognized on disposal; or when no future economic benefits are expected from its use or disposal.

The gain (not classified as revenue!) or loss arising from the derecognition of an item of property, plant and equipment shall be included in profit or loss when the item is derecognized. The gain or loss from the derecognition is calculated as the net disposal proceeds (usually income from sale of item) less the carrying amount of the item.

10. IAS 16 Compliance Checklist – free DOWNLOAD

- Recognition Criteria

- Will the asset provide future economic benefits?

- Can the cost be measured reliably?

- Initial Measurement

- Purchase price includes import duties and non-refundable taxes

- Directly attributable costs included (e.g., site preparation, installation)

- Dismantling/restoration obligations estimated and added

- For exchanges: fair value used unless not measurable or lacks commercial substance

- Subsequent Expenditures

- Routine maintenance expensed

- Replacement of significant parts: old part derecognized, new capitalized

- Major inspections capitalized and depreciated separately

- Measurement After Recognition

- Cost model OR revaluation model selected and applied consistently

- Revaluations done regularly (if applicable)

- Entire class of assets revalued (not just selected items)

- Depreciation

- Method reflects usage pattern (straight-line, diminishing balance, units of production)

- Useful life and residual value reviewed at least annually

- Significant components depreciated separately

- Changes treated as accounting estimates (IAS 8)

- Impairment

- Reviewed for impairment under IAS 36 when indicators exist

- Compensation for damage/loss recognized when receivable

- Derecognition

- Derecognize on disposal or when no future benefits expected

- Gain/loss = Proceeds minus Carrying Amount (reported in P/L)

- Disclosure Requirements (Summary)

- Measurement basis (cost or revaluation)

- Depreciation methods and useful lives or rates

- Gross carrying amount and accumulated depreciation (beginning and end)

- Reconciliation of carrying amount (additions, disposals, revaluations, depreciation, impairment, etc.)

- Restrictions on title and PPE pledged as security

- Expenditures recognized in the carrying amount of PPE in the course of its construction

- Contractual commitments for acquisition of PPE

- Compensation received from third parties (e.g., for loss or damage)

- For revalued assets:

- Date of revaluation and use of independent valuer

- Carrying amount under cost model

- Revaluation surplus movement (OCI and equity)

Further reading

Explore more on IAS 16: Visit this page to access the full library of all IAS 16-related articles, videos, and examples published by CPDbox.

Learn IFRS with real examples – not just theory.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Silvia on Accounting for gain or loss on sale of shares classified at FVOCI

- Silvia on Lease term when contract is for indefinite period

- H on Accounting for gain or loss on sale of shares classified at FVOCI

- jibril Tegenu on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Alexei Estrella on Lease term when contract is for indefinite period

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (73) 73

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (55) 55

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (26) 26

- Uncategorized (1) 1

Hi silvia, greate article. Could you help me with a question i am struggling with.

Suppose we have an asset A that is valued at revalvuation model, on which accounts do we book depreciation?

Hello

I have a question too.

Are drilling water wells depreciated or not. What is the prectice. do they have a definite or indefinite life.

Thanks

Usually they are, because usually they do not have an indefinite useful life. Commercial or agricultural water wells have useful life of 20-50 years (depending on many factors), smaller residential wells have usually shorter, but if you are able to justify indefinite life, then you know the answer.

Hey Sylvia

I have a question about paragraph 43 of standard 16

According to this paragraph:

“Each part of an item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately.”

The paragraph does not specify what objects it concerns.

It follows that this applies to all fixed assets that have such components.

But, then, in almost every basic tool you can find such a component. For example, a car engine has a significant cost in relation to a car.

Does this mean that everyone should keep records of fixed assets by components and separate cars, computers, calculators, etc.? This means that we must produce an innumerable number of fixed assets.

It’s like a nightmare.

Thank you for your attention

I just don’t know where to raise such questions.

If the spare part is critical part of the asset, then you will need to recognize it as unit of account.

Hi Silvia,

If an item of PPE has been constructed to be used in operations which, due to government pushback, cannot yet commence (Target Operating Model pushed back to Jan 2024). Would this external factor mean that the PPE is not yet “available for use” and therefore not yet depreciated – as the conditions for the use of asset as intended by management do not (until Jan 2024) exist?

Thanks!

hello hope this would be helpful!

yes, you are right there is no need for depreciation when the non-current asset has not yet started to generate income, but once it starts to generate income, we’ll have to provide deprecation along its useful life years which is called the matching concept, as for every income there is a corresponding expense.

Hi Silvia,

Thank you for your great articles, I have a question:

We purchased a Building for a total cost of CU100,000 however IAS 16.58 requires that we split the Land from the Building. Practically how can the cost be split between Land and Building.

Hi Silvia,

I have 2 questions related to Borrowing costs which can be capitalized and Income received from Investing the surplus.

1. What is the trigger of capitalisation for a machine which requires further developments. If I buy a machine in October but I start to develop it only in December, capitalisation starts from October?

2. Investment income (which offset the borrowing costs) should be for the same period as for which capitalisation cost occurs? If the loan is for 1 year, eligible capitalisation costs are 6 months, then the Investment income eligible should be only for those 6 months?

1. Depreciation starting when it is based on available to use concept

2. Investment income should not be taken in consideration for this.

Is it mandatory to revalue assets in every 3 to 5 years? Reference Pls.

No, it is not. The standard says “with sufficient regularity”, so that the carrying amount does not significantly differ from the fair value (IAS 16.31). The paragraph IAS 16.34 describes the frequency of revaluations, and refers to every 3-5 years, but it implies that it should not be done less frequently.

Hi Silvia,

Please I have a few questions.

Can the cost of purchasing flower pots and landscapes and also rugs for office decorative purposes be recognised as assets?

Hi there,

that all comes down to materiality. Flower pots, landscapes and rugs can meet the definition of PPE, however, the question is if you should bother due to the amount of the cost. You can read more about it here: Accounting for CAPEX threshold and its change under IFRS

An asset is purchased for $3,000.The estimated residual value at purchase was $300 and it has a useful life of nine years. The entity uses the straight-line method of depreciation. The estimate of useful life does not change until the beginning of year four, when the residual value is expected to be $600. The depreciation charge in year four will be:

A) $250

B) $300

C) $333

D) $214

Oh, I think you should solve your own accounting test

Hi Sylvia,

Thank you so much for the detailed explanations. Could you please assist with the below scenario:

I have a property which is being measured using the revaluation model and the FV is determined using the income approach method. I then performed some renovations on the property and replaced a number of items in that property which I would like to capitalise to the property. How do I treat those costs considering the initial costs of items that were replaced were not previously depreciated for me to derecognise the carying amount? At what amount do I get to derecognise those items replaced?

Hi Silvia!

Thank you for a clear guide on PPE. I was wondering – what is the difference between subsequent accumulated depreciation and accumulated depreciation (cost vs revaluation models)?

Hi Kristina,

subsequent accumulated depreciation means the sum of depreciation charges AFTER revaluation of your asset. E.g. you revalue assets every 5 years. You acquire asset in year 1, charge depreciation for 2 years (1 and 2), then revalue it at the end of year 2, then charge depreciation in the years 3, 4, 5 – hence at the end of year 5, subsequent accumulated depreciation refers to charges made in years 3,4,5. You do not include charges in years 1 and 2, because they happened before revaluation and they were cleared with revaluation.

In the cost model, you do not revalue, so accumulated depreciation is usually the sum of all charges you made.

Hi,

We are creating a plant for production of electricity. As per the terms of contract if the construction of plant gets delayed beyond for e.g 30 June 2021. The purchaser of electricity will charge liquidated damages to us. As currently, we have exceeded the time limit for construction of plant and the purchaser is charging us liquidated damages to us.

My question is that can we capitalise the liquidated damage in the cost of the plant or charge the same to revenue in P/L.

Hello Silvia,

Thanks for your web and work. Could you indicate me if road tax es (traffic taxes) payables year to year are component of cost of a car classified as PPE please. I think that the answer is a NOT… now, in my country also tax about initial registration and a green tax on the acquisition of car is payable, I think for analogy to IAS 40 that the first is a component of cost of cars as PPE, the second also in accordance with Paragraph 16(a) of IAS 16 to be a indirect tax, correct?

I agree. Road tax relates to the certain year, it is annual tax and cannot be capitalized as such. Initial taxes related to registration are different story and yes, you can capitalize them.

Thanks again for everything.

Hello, Silvia

could you please explain the following sentence, thanks in advance

When we have depreciable assets and then have a revaluation gain following a previous loss, that was included in profit or loss, the amount of the gain that can then be credited to profit or loss is the amount of the original loss less any depreciation saving.

I hope that I did not write that sentence…

Year 0: impairment loss included in P/L = 200

Year 1: revaluation gain = 300, you book it as Debit PPE 300, Credit P/L 200, Credit Revaluation surplus 100; not complicating this with depreciation. Simply said.

Hi Silvia, I have quite a simple question regarding CWIP.

We have paid deposits on three vehicles just before the end of our financial year, 10% of the total price. We did this to book a better rate and delivery date. No delivery has taken place and is only scheduled for the following financial year. We are now closing off our financials and no delivery has taken place (scheduled for three weeks’ time). In our AFS do we disclose this deposit as advanced payments/deposits paid or do we take the amounts to CWIP?

Hello, i have a question.

I have a Foundation, and has donated around USD 1.3 million to a School for renovation, and at year end only 80% of the renovation was completed. Should i recognise the USD1.3 million as a PPE and start amortising the renovation cost once the school is ready for use?

Well, I don’t get the situation fully. So your entity is a foundation who received a grant to build the school and did not spend it fully? Or? If that’s the case, you should recognize only the actual cost into the cost of PPE, not the grant amount. If the school is available for use, you should start depreciating it.

The Foundation has a school that is renovated, and the foundation gave the school a sum for the renovation. As of year-end, 80% of the renovation was completed. In the books of the foundation, should it capitalize the whole amount it gave to the school irrespective of whether the renovation is completed?

The building should be capitalized in the books of the entity that has control of it – I guess that’s the school, not the foundation. As far as I understand it, there is nothing to capitalize in the books of Foundation with respect to the building of which it has no control of. However I am only guessing here because I have no idea about relationships between the school vs foundation etc.

Hello, thank you for the topic.

I have question about determining ppe cost if it is acquired with future payments. I guess, that cost should be the discounted value of future payments, but could not find reference in standards. Could you please help me to find sufficient chapter? Or interpretation about issue?

Hi Sandro, I recommend looking at IAS 16 paragraph 23, the second sentence in it.

Hi, I was wondering if I receive a grant today for a construction project over multiple years, would I pick Option #2: deduction from asset, would the journal entries be as follows?

DR Bank/ CR WIP (for initial recognition)

DR WIP/ CR PPE (to transfer asset out of WIP to PPE)

DR Depreciation expense/ CR Accumulated depreciation

Would this be the corrected treatment in accordance with AASB 116 and AASB 120?

Many thanks in advance for your answer!

Hi Tania, this seems OK to me in line with IAS 20, but be careful with your timing. E.g. if you receive grant first and after that you spend it on WIP, then you should not deduct it straight from WIP upon receipt.

Hi Silvia,

Accounting policy

When it comes to PPE accounting policy, the Group and the Company elected to revaluation model as a subsequent measurement. It’s Clearly said in the accounting policy, Land and building are revalued at at least once in every 3 years or when the asset fair value is substantially increases it carrying value.

Background

Group has revalued their entire class of land and building last year, however, this year one of the group’s component hold Investment property which rented out to one of a another component of the group. due to the fact as owner occupied, Group recognized the respective property as PPE in the consolidated financial statement.

Respective component measure IP as fair value where they recognized gain on changes in fair value in the components account which is significant changes to the respective property.

Contradiction.

As per the accounting policy, when there is a substantial increase, Group must recognise revaluation. however, As per IAS 16 revaluation should be carried out for entire class of asset.

Question

when it comes to consolidation, can the Group recognise revaluation gain for only one property or should only eliminate fair value gain on IP with the deferred tax impact?

Hi Asjad,

it is possible that the same item is a PPE in the group’s financial statements, but IP in individual subsidiary’s financial statements (or other group company). So yes, if individual company revalued building classified as IP, but it is still PPE within the group, then you should indeed reverse that revaluation in consolidated FS and treat the same building as PPE.

S.

Dear Sylvia,

a subsidiary company is in the process of building a site and acquisition and installing new equipment. Since the production was delayed and no revenues from sales were recognized, the subsidiary company wants to make an invoice for these costs which were not capitalized (mostly employees who had nothing to do because of the production was delayed), and to send this invoice to the parent company which agreed to pay for them. Is this something usual and how to record these transactions? Thank you and kind regards,

Hi Comfy, it is not unusual, this is normally done – no problem with that, but there could be tax implications.

dear silvia

one question in regards to ias 16 what are the three practical challenges in complying with the ias 16

Hi Madam

My Questions

1. Discuss the impacts of the accounting standards on fundamental qualitative characteristic

(relevance and faithful representation) of information reporting.

2.Identify and critically discuss any three practical challenges in complying with the selected

accounting standards.

Thank you Silvia for the immersive effort explaining IAS 16.

I kindly request your insight, I work in oil industry where we have drilling and workover costs. my question, do I capitalize workover cost which are considered Production costs (maintenance cost) in recovery to capex?

Hello Silvia,

If I have PP&E (Hotels, Lands, Production lines, .. etc.), the company use the valuation model in recognizing all assets, but they use different FV methods in each category (e.g. one of the hotels they use the Value in use, but for the rest, they use Selling price – cost to sell), is that allowed to use a different method for the same category, and if they consider each Hotel as a CGU and the same for each production line, can they use selling price – costs to sell method for valuing the CGU or they must use the Vlue in use and prepare a discounted cash flow.

Dear Youssef,

thanks for this question, but it is not exactly the point. As for the impairment, you should determine recoverable amount as higher of fair value less costs to sell and value in use. If one of these is greater than the carrying amount, then you have no impairment and you don’t have to determine the second one. The best method is to determine both and compare. But, if for example, you determine the FV less cost to sell and it is lower than the asset’s carrying amount, then there is impairment and you SHOULD determine also value in use to see if it is greater than FV less cost to sell. I hope it clarifies a bit.

Hi Silvia,

In the long discussion in the comments, I haven’t seen the topic what level of threshold to apply.

Many electronic devices which in the past might be perceived as fixed asset, now got cheaper so often time it might be below the company threshold while if you sum up the value of all such electronics it might be significant in the balance sheet, especially for consulting companies.

In case the company sets the threshold let’s say to 1k EUR and buys laptops and expenses that immediately for 0.9k EUR each, can be that objected by an auditor? Are there any guidelines to the thresholds? Does a single threshold need to be applied to all types of the fixed assets or maybe it can vary depending on whether it is electronics, furniture, other fixed assets?

Hi Mariusz, thank you for your question and that’s the topic for the discussion – so I covered it here. I hope it helps! S.

Hi Silvia, I have a question on revaluation of asset. Say, the company has a machine work-in-progress, currently recorded based on the total costs incurred to-date. Is it necessary to do a revaluation of the asset WIP at year-end date?

Would also like to ask the same, do we revalue WIP?

Hi Silvia,

Can I ask how to account for expected scrap $ at the end of decomm, should the expected scrap be included in our decom provision ( lower our decomm provision ) or should it be treated as an income statement gain when arises and not accounted for in decomm provision?

Hi Emma, normally you should consider residual value in your depreciable amount of the asset, i.e. depreciate cost less residual value over its useful life. Do not lower your provision.

Hi SIlvia,

Thank you for the great article.

A question regarding revaluation method. The standard does not give specific guidance on how often should we revalue fixed assets. Suppose, one chooses to revalue an asset every year (at the end of the accounting year), will he be required to continue depreciating the same asset as well every year?

Hi Silvia

Our company has a fleet of wet fish trawlers (hake) and our current accounting policy used is at Cost.

At the end of the 2020 financial year when the vessel valuations were completed on our fleet we noticed that the vessels book values were significantly lower in our Annual Financial Statements than indicated in the respective valuation reports.

All our vessels has a yearly compulsory drydock where repair and maintenance jobs are performed on the vessels as well as replacing equipment which are identified as being replaceable in order for the vessels to uphold their operational efficiencies and remain in a safe working condition for the next 12 months.

Historical data indicated that with the significant yearly drydock costs the Valuation & Useful lives were constant the past 10 years, but this was not updated accordingly when applying the cost model.

My queries are as follow:

1. Will we be able to do an accounting policy change to the Revaluation Model without triggering prior year errors/misstatements?

2. Valuations on the Vessels are done as a whole for Insurance & selling purposes, which will actually simplify the accounting process. Will we be able to justify capitalizing the total drydock (made up of capex of nature items such as replacing steel plates of the hull if the steel thickness is below a certain thickness, will only be done in 10 years’ time again as well as R&M Components) but the drydock costs split is a worldwide dilemma. The justification will be that if a portion is over capitalized then it will eventually be expensed via P&L once the yearly valuation is taken into account?

Hi Champion, well, this is a classic situation and I tried to cover it in this article with the video. You will get most of your answer here and if you have further questions, please let me know. That article covers slightly different situation, but it is applicable in your circumstances as well. S.

Hi Silvia,

The Company is into renewable energy business and currently have wind farms on which there are wind turbines. The WTGs are already COD and commercially producing and selling electricity. The Company under local laws and regulations to renew license related to land leases require to do certain expenditure for cleaning the lands for hardstands works etc and for this the Company paid significant amount.

1) Can the company capitalise this cost of hardstand work?

2) Does it need to be recognised as an expense?

3) If can be capitalised, does it need to identify new asset?

Hi Silvia,

How are you??

I have a query. Can you please explain:

Company A incurred $ 500 for repair and maintenance of the plant and machinery in the year 2020. It was also covered by insurance policy. Company A was unsure about the time and amount of claim it would receive from insurance company. Insurance company made the reimbursement of the claim in the year 2022.

Query

Is A required to recognized contingent assets ?

What accounting entries would A make in the year 2020 and 2022 ?

What will be the accounting entry if company A receives the claim in the year 2020?

Hi Silvia,

We bought an asset with original cost of $500,000. But because we received the asset with some damage we got a credit from our supplier $100,000.

Question: What is the accounting treatment?

Well, the cost of an asset is its purchase price less any discounts

Hi Silivia,

I have a question:

Company A (Lessor) leased land to Company B (Lessee) under an operating lease and in the agreement it was written that company A will provide electricity to Company B however the cost of power sub-station will be borne by Company B.

After 3 years, B agreed to construct the Power Sub-Station and A willing to buy the cables and borne the cabling cost.

A is responsible about the cost of cables which is a material cost but ownership of cables will eventually once the power sub-station is constructed will reside with Company B due to the agreement.

My question is that are cables an expense or Asset for Company A.

Hey Silvia,

I have a question:

For a self constructed building, if subsequently, it is found that a capitalized payment was not made in terms of the agreement and needs to be provided for. How to account for it? The building was also subsequently upwards revalued.

hey silvia can you provide the reference pls ?