IAS 12 Income Taxes

Benjamin Franklin once wrote: “In this world nothing can be said to be certain, except death and taxes“. Income tax is something that can hardly be avoided by a profit-making company.

You might find filling-in the tax return a demanding task because everything must be correct – otherwise you are asking for penalties from your tax office.

On top of that, you still need to calculate deferred tax!

Deferred income tax belongs to top 10 reasons of accountants’ headaches because its concept and application is not easy to understand. When it comes to IFRS financial statements, a lot of them contain errors exactly in a deferred taxation.

The standard IAS 12 guides us in the area of income taxes and really, it is not an interesting easy-to-read novel.

In this article, you will learn:

- Objective of IAS 12 Income Taxes

- Understand the differences: current vs deferred, accounting vs tax profit

- Current income tax

- Deferred income tax

- How to present income tax

- Video lecture and further reading

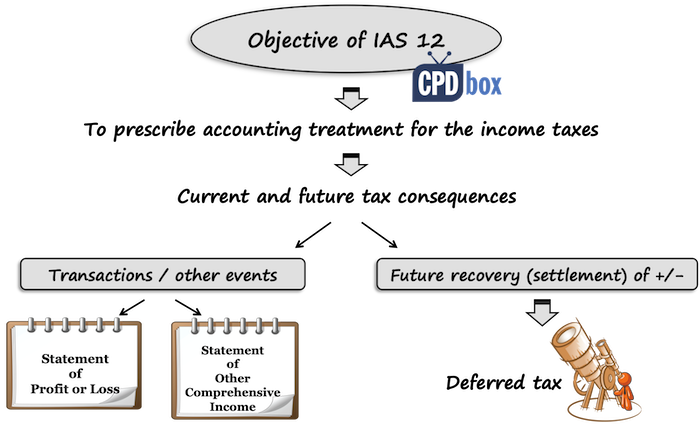

What is the objective of IAS 12?

The objective of IAS 12 is to prescribe the accounting treatment for income taxes.

The main issue here is how to account for the current and future consequences of

- The future recovery (settlement) of the carrying amount of assets (liabilities) recognized in the entity’s financial statements.

Here, if the future recovery or settlement will make future tax payments larger or smaller than they would be if such recovery or settlement were to have no tax consequences, then an entity must recognize deferred tax liability or asset.

- Transactions and other events of the current period recognized in the entity’s financial statements.

IAS 12 requires accounting for current and deferred income tax from certain transaction or event exactly in the same way as the transaction or event itself.

Understand the differences

Almost in every country the accounting rules differ from the tax laws and regulations. Sometimes, these differences are really significant and accountants must make lots of adjustments to their accounting profit in order to arrive to the basis for calculation of income tax.

In order to understand the meaning and the rules of IAS 12 fully, you need to understand the meaning of and differences between

- Accounting profit and taxable profit, and

- Current income tax and deferred income tax.

I. Accounting versus taxable profit

Accounting profit is profit or loss for a period before deducting tax expense. Please note that IAS 12 defines accounting profit as a before-tax figure (not after tax as we normally do) in order to be consistent with the definition of a taxable profit.

Taxable profit (tax loss) is the profit (loss) for a period determined in accordance with the rules established by the taxation authorities upon which income taxes are payable (recoverable).

You can clearly see here that these 2 numbers can differ significantly because accounting and tax rules are not the same. A number of differences can pop out between accounting profit and taxable profit you have to make the following adjustments to your accounting profit:

- Add back the expenses recognized but non-deductible for tax purposes

- Add income not recognized but included under tax regulations

- Deduct expenses not recognized but deductible for tax purposes

- Deduct income recognized but not taxable under tax regulations.

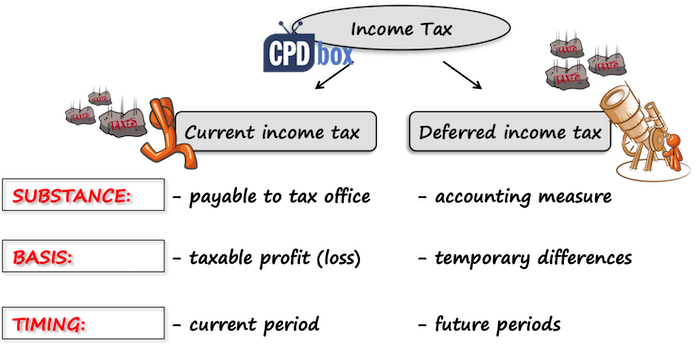

II. Current tax versus deferred tax

Current income tax is the amount of income tax that you actually need to pay to your tax office.

Deferred income tax is an accounting measure used to match the tax effect of transactions with their accounting impact and thereby produce less distorted results.

I have outlined the other differences between current and deferred income tax in the following scheme:

Current income tax

Current tax is the amount of income tax payable (recoverable) in respect of the taxable profit (loss) for a period.

Measurement of current tax liabilities (assets) is very straightforward. We need to use the tax rates that have been enacted or substantively enacted by the end of the reporting period and apply these rates to the taxable profit (loss).

Current income tax expense shall be recognized directly to profit or loss in most cases. However, If the current tax arises from a transaction or event recognized outside profit or loss, either in other comprehensive income or directly in equity, then current income tax shall be recognized in the same way.

Return to top

Deferred income tax

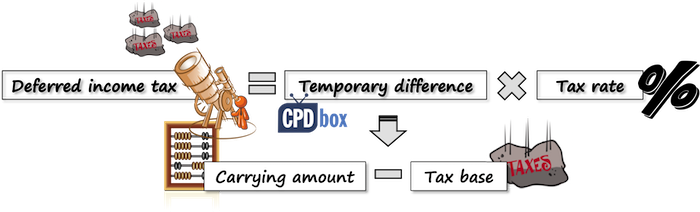

Deferred income tax is the income tax payable (recoverable) in future periods in respect of the temporary differences, unused tax losses and unused tax credits.

Deferred tax liabilities result from taxable temporary differences and deferred tax assets result from deductible temporary differences, unused tax losses and unused tax credits.

We can calculate deferred tax as temporary difference multiplied with the applicable tax rate.

Before you dig deeper in the concept of temporary differences, you need to understand the tax base first.

What is a tax base

Tax base of an asset or liability is the amount attributed to that asset or liability for tax purposes. In my opinion, this definition does not say that much, so let’s explain it in a greater detail:

Tax base of an asset

Tax base of an asset is the amount that will be deductible for tax purposes against any taxable economic benefits that will flow to an entity when it recovers the carrying amount of the asset.

For example, when you have an interest receivable and interest revenue is taxed on a cash basis, then the tax base of interest receivable is 0. Why? Because when you actually receive the cash and remove the interest receivable from your books, you will need to include full amount of cash received into your tax return. At the same time you cannot deduct anything from this amount for tax purposes.

Tax base of a liability

Tax base of a liability is its carrying amount, less any amount that will be deductible for tax purposes in respect of that liability in future periods.

For example, when you accrue some expenses that will be deductible when paid, then the tax base of a liability from accrued expenses is 0.

Careful about items not shown in your balance sheet!

If you review all your assets and liabilities calculating their tax bases, be careful! There could be some items not recognized in your balance sheet that still do have a tax base.

For example, you might have incurred some research costs included in the profit or loss in the past that you could not deduct for tax purposes until later periods. In such a case, the research costs are not shown in your statement of financial position but they do have a tax base.

If you are still unsure about the tax base, then this article will be for you. I described how to determine a tax base of your assets or liabilities in a very simple way.

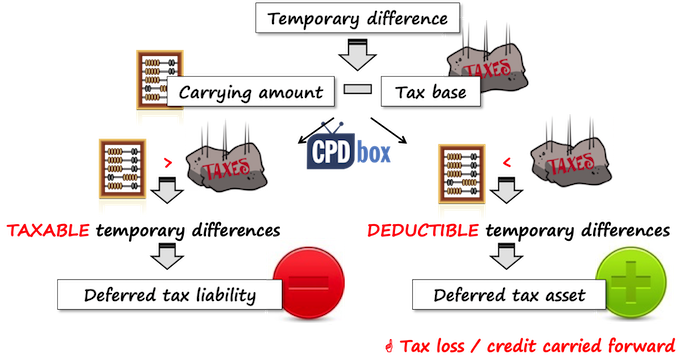

Temporary differences

Temporary differences are differences between the carrying amount of an asset or liability in the statement of financial position and its tax base.

When the carrying amount of an asset or a liability is greater than its tax base, then there is a taxable temporary difference and it gives rise to deferred tax liability.

In the opaque situation, when the carrying amount of an asset or a liability is lower than its tax base, then there is a deductible temporary difference and it gives rise to deferred tax asset.

Important note: This applies to both assets and liabilities, if you view the assets with PLUS and liabilities with MINUS. So for example:

- Example of an asset: Let’s say your asset has a carrying amount of 100, and the tax base of 0 => then, its carrying amount is greater than the tax base, and taxable temporary difference arises.

- Example of a liability: Let’s say you made a provision of 500 that will be tax deductible in the future. Its carrying amount is MINUS 500 (since it is a liability), its tax base is zero, therefore as the carrying amount is smaller than the tax base, deductible temporary difference arises.

Please read more about temporary differences here.

Deferred tax liability

You need to recognize deferred tax liability for all taxable temporary differences you discovered, except for the following situations:

- No deferred tax liability shall be recognized from initial recognition of goodwill

- No deferred tax liability shall be recognized from initial recognition of asset or liability in a transaction that is not a business combination and at the time of the transaction it affects neither accounting nor taxable profit (loss).

The most common examples of taxable temporary differences giving rise to deferred tax liabilities are:

- Timing differences

Timing difference arises when the recognition of certain item in the financial statements occurs in a different time than its recognition in tax return, for example, interest received is taxed deductible only when cash is received. - Business combinations

In a business combination identifiable assets and liabilities can be revalued upwards to fair value at the acquisition date, but no adjustment is made for tax purposes. As a result, taxable temporary difference arises. - Assets carried at fair valueWhen a company applies policy of revaluation (for example, revaluation model for property, plant and equipment in line with IAS 16) and some assets are revalued upwards to their fair value, taxable temporary difference arises.

- Initial recognition of an asset / liabilityWhen an asset or liability are initially recognized in the financial statements, part or all of it could be tax-non-deductible or not taxable. In this case, deferred tax liability is recognized based on the specific situation.

Deferred tax asset

While you need to recognize deferred tax liability for all taxable temporary differences, here the situation is different.

A deferred tax asset shall be recognized for all deductible temporary differences to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilized.

No deferred tax asset shall be recognized from initial recognition of asset or liability in a transaction that is not a business combination and at the time of the transaction it affects neither accounting nor taxable profit (loss).

The most common examples of deductible temporary differences giving rise to deferred tax assets are:

- Timing differences

Timing difference arises when the recognition of certain item in the financial statements occurs in a different time than its recognition in tax return, for example, accrued expenses are tax deductible only when paid. - Business combinations

In a business combination identifiable assets and liabilities can be revalued downwards to fair value at the acquisition date, but no adjustment is made for tax purposes. As a result, deductible temporary difference arises. - Assets carried at fair value

When a company applies policy of revaluation (for example, revaluation model for property, plant and equipment in line with IAS 16) and some assets are revalued downwards to their fair value, deductible temporary difference arises. - Initial recognition of an asset / liability

When an asset or liability are initially recognized in the financial statements, part or all of it could be tax-non-deductible or not taxable. In this case, deferred tax asset is recognized based on the specific situation.

Unused tax losses and tax credits

A deferred tax asset shall be recognized for the unused tax losses carried forward and unused tax credits to the extent that it is probable that future taxable profit will be available against which the unused tax losses and unused tax credits can be utilized.

Investments in subsidiaries, branches and associates and interests in joint ventures

Except for various kinds of temporary differences mentioned above, a number of them can arise at business combinations. This issue is even more complicated that it looks because temporary difference may be different in the consolidated financial statements from temporary difference in the individual parent’s financial statements.

Such differences arise in number of circumstances:

- Undistributed profits of subsidiaries, branches, associates and joint arrangements

- Changes in foreign exchange rates when a parent and its subsidiary are based in different countries

- Reduction in the carrying amount of an investment in an associate to its recoverable amount.

Here, 2 essential rules for recognition of deferred tax apply:

- An entity shall recognize a deferred tax liability for all taxable temporary differences associated with investments in subsidiaries, branches and associates, and interests in joint arrangements, except to the extent that both of the following conditions are satisfied:

- the parent, investor, joint venturer or joint operator is able to control the timing of the reversal of the temporary difference; and

- it is probable that the temporary difference will not reverse in the foreseeable future.

- An entity shall recognize a deferred tax asset for all deductible temporary differences arising from investments in subsidiaries, branches and associates, and interests in joint arrangements, to the extent that it is probable that:

- the temporary difference will reverse in the foreseeable future; and

- taxable profit will be available against which the temporary difference can be utilized.

Measurement of deferred tax

In measuring deferred tax assets / liabilities you need to apply the tax rates that are expected to apply to the period when the asset is realized or the liability is settled. However, these expected rates need to be based on tax rates or tax laws that have been enacted or substantively enacted by the end of the reporting period.

So please, don’t use some estimates of the future tax rates, as this is not allowed.

Let me also point out that the measurement of deferred tax should reflect the tax consequences that would follow from the manner of expected recovery or settlement.

So for example, if in your country, sales of property are taxed at 35% and other income at 30%, then for calculation of deferred tax on your property you need to apply the tax rate based on your expected way of property’s recovery – if you plan to sell it, then measure your deferred tax at 35% and if you plan to use it and then remove it, then measure your deferred tax at 30%.

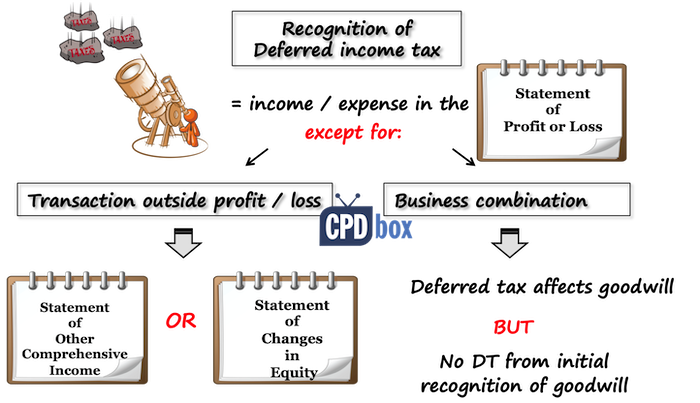

How to recognize deferred taxes

In almost all situations you would recognize deferred tax as an income or an expense in profit or loss for the period. There are just 2 exceptions of this rule:

- if a deferred tax arose from a transaction or even recognized outside profit or loss, then you need to recognize deferred tax in the same way (in other comprehensive income or directly in equity)

- if a deferred tax arose in a business combination, deferred tax affects goodwill or bargain purchase gain.

How to present income taxes

The principal issue in presenting income taxes is offsetting. Can you present current or deferred income tax assets and liabilities as one net amount? Or do you need to show them separately?

Offsetting the current income tax

You can offset current income tax assets and liabilities if 2 conditions are fulfilled:

- You have a legally enforceable right to set off the recognized amounts; and

- You intend either to settle on a net basis or to realize the asset and settle the liability simultaneously.

Offsetting the deferred income tax

You can offset deferred income tax assets and liabilities if 2 conditions are fulfilled:

- You have a legally enforceable right to set off the current income tax assets against current income tax liabilities (see above when it happens); and

- The deferred tax assets and the deferred tax liabilities relate to income taxed levied by the same taxation authority on either

- the same taxable entity; or

- different taxable entities which intend to settle current tax liabilities and assets on a net basis or realize the assets and settle the liabilities simultaneously, in each future period in which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered.

Just be careful when making consolidated financial statements because often you just cannot simply combine deferred tax assets of a parent with deferred tax liabilities of a subsidiary and present them as 1 net amount.

Return to top

Video lecture and further reading

Please, watch the following video with the summary of IAS 12 Income Taxes:

Further reading:

- How to calculate deferred tax (example with video)

- Global Minimum Tax – Who? How? Any IFRS Impact? – learn to calculate global minimum tax step by step and learn what impact it has on the IFRS reporting

- The Unconventional Guide to Tax Bases – very clearly explained how to determine the tax base of assets and liabilities

- Deferred Tax: The Only Way to Learn It – a quick reading for quick understanding of the deferred tax concept.

- Tax Reconciliation under IAS 12 With Example – one of the most difficult numerical disclosures explained clearly step by step

- Tax Incentives – IAS 12 or IAS 20? – when to apply IAS 20 and when to apply IAS 12?

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

70 Comments

Leave a Reply Cancel reply

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

In a year other than for initial adoption of the IAS 12 where is the computed amount (CA is less than TA multiplied by tax rate ) go – is it the balance sheet or is it the charge to the P or L?

Hi Silvia,

There’s a mistake in this article in Taxable temporary difference section.

“When the carrying amount of an asset or a liability is greater than its tax base, then there is a taxable temporary difference and it gives rise to deferred tax liability.

In the opaque situation, when the carrying amount of an asset or a liability is lower than its tax base, then there is a deductible temporary difference and it gives rise to deferred tax asset.”

According to IAS,

When the carrying amount of an asset is greater than its tax base, then there is a taxable temporary difference and it gives rise to deferred tax liability.

When the carrying amount of an asset is lower than its tax base, then there is a deductible temporary difference and it gives rise to deferred tax asset.

When the carrying amount of a liability is greater than its tax base, then there is a deductible temporary difference and it gives rise to deferred tax asset.

When the carrying amount of a liability is lower than its tax base, then there is a taxable temporary difference and it gives rise to deferred tax liability.

For Further Clarification:

Temporary Difference For Asset For Liability

Deductible Temporary Difference CA TB

Taxable Temporary Difference CA > TB CA < TB

Dear Ayyaz,

thank you for your note, but I teach it this way on purpose, because I always view liability as something with MINUS. In this case, my statement is always true, but thank you for the comment, I will update the article.

Hello Sylvia

1. In case of ,PVDBO is CU130 and plan Assets of CU100 ) , Net DBO of CU 100 is presented in SoFP but CU 130 will be deducted in future , what will be the tax base of liability.

Hi Silvia,

I have a question, at the end of the day what will end up in the P/L as an income tax expense

Current tax expense (income) plus deferred tax expense (income).

Hi Silvia,

How the decreases in the value of a pension surplus will affect the deferred tax?

Hello Silvia

if current tax of previous year is amended by tax authority in current year.

how would i account the reassessed tax in F/s.

shall i include in current tax of this current year.

Hi Silvia ,thank you for all your support which is easily understandable. I have one Question a company in our country is in a tax free period and we are now converting its accounts to IFRS. should we calculate Differed tax asset and or liability on temporary difference ?

Hi Silvia,

How can I present the following issue on current year F/S ?

Previous year tax interest which were not accounted for.

Thank you.

Well, was this interest charged this year only or why was it not accounted for? If it was omitted by mistake, then if it is material, you need to apply IAS 8 and correct it retrospectively (via equity), if not material, then account for it this year.

A company is presenting income taxes in the equity statement based on the agreement between the shareholders. The Company has not recognized deferred tax taking the plea that income taxes are the responsibilities of the shareholders instead of the Company. Is it compliant with IAs 12?

(Since the two shareholders are subject to different tax rates due to their residence/nationality status, so they have the option to either charge it to PL or equity).

Dear Silvia,

Great article!

I am puzzled by the concept that “deferred tax liability should be recognized for all taxable temporary differences” whereas “deferred tax asset are recognized for all deductible temporary differences to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilized”. How is it possible to recognize a liability when taxable profits are not probable? Why should I have a future obligation for tax if there will be no tax to pay?

I ll be more specific with an example.

• I have a CGU that has higher depreciation for tax purposes, hence recognizing a DTL every year. The reversal of this will take place in 10 years, so for these 10 years the company will be recognizing additional DTL

• The CGU is a fairly new company, thought with significant tax losses (due to Debt).

• The tax jurisdiction allows tax losses to be carried forward infidelity.

• The company’s management anticipates that future taxable profits will start in 4 years from today.

So the questions are:

1) Why should the company recognize DTL due to depreciation if it is and will be a loss making company?

2) On the other hand does the recognition of the DTL imply that future taxable profits will be available, hence triggering the recognition of DTA for unused tax losses? At least at the same amount as the DTL

Thank you

New to IFrS and Question may look too basic..

Say Accounting profit as per P/L is 100 whereas tax profit is 80 OCI profit is 40 and say tax rate is 25%.

Whetehr tax to be charged in p/l = 80*25%= 20 and OCI tax shall be calculate at 40*25% = 10

Or

tax shall be calculated as 120*25%=30 and then apportion the tax in accounting profit ratio = I.,e in 100 and 40 which will be tax in p/l = 21.43 tax in OCI =8.57

Hi Silvia,

where one has a revaluation reserve arising from the revaluation of a depreciable assets, in the initial year of revaluation the deferred tax will be computed as CU20,000x 35% (tax rate). =Cu 7000. The double entry for the dtax will be debit reserves and credit dtax leaving a balance on the revaluation reserve of CU 13,000.

Question: In year 2 will dtax be computed as 35% of cu 20,000 or will it be 35% of cu 13,000

Hello, thanks for your continued assistance. Some help here:

I have a carrying value of Inventories of $3million and the Fair value less costs to sale is $2.7million. losses are deductible in the fiscal year the inventory is sold. The tax rate is 30%. I want to come up with deferred tax.

In my opinion, I would think the carrying amount is $2.7million since the inventory is measured at the lower of cost and NRV. I would take the tax base of the inventory to be $3million since the loss is not currently allowed making the tax base to be higher. A deductible difference of $ 0.3million and a deferred tax asset of $0.09million ($0.3million *30%).

Am I right Madam Sylvia? Some help. Thanks

Hi Silvia,

Can you please further explain the first condition to offset deferred tax assets and liabilities i.e. legally enforceable right as to when and in what cases this condition will be satisfied

In means – when it is possible and not contrary to any legislation in force. E.g. you can have DTA on provisions and DTL on your PPE, but your tax office does not care when it came from and asks you to present only one amount – that’s legally enforceable. But imagine you prepare consolidated financial statements and your subsidiary is in a different country. You (parent) have DTL and subsidiary has DTA – in this case it would not be legally enforceable to net it off, because you two operate in two different countries and submit their tax returns to different tax offices. S.

Hi Silvia,

Thank you very much for comprehending IAS 12 in a simple manner. Would you mind putting some light as to why we should not combine the deferred taxes & current taxes of the parent and the subsidiary. If parent and subsidiary both are in the same country and are subject to taxation by the same taxation authorities. In this case too, we won’t combine the deferred taxes & current taxes. Kindly elaborate.

Hi. Please clarify this,

The Company owns a land which was acquired in 2010/2011 at a cost of Rs. 100

Mn. During the financial year 2013/2014 it was identified that the value of this

land is impaired by Rs. 20 Mn. The impairment loss is not allowed for tax

purposes until the land is sold

Want to know what is the tax base for this?

Hi Silvia,

Even after reading second and third time I am unable to figure out (understand) the adjustments you prescribed in business combinations portion.

It’ll be highly helpful if you can provide some practical example covering each situation in it with detailed discussion.

As you have explained the whole IAS 12 with a support of the example but I am still confused in respect of the specific part related to the business combinations.

Will it be possible to further explain that with another example, only situations arise in the business combination and all possible adjustments and aspects with the help of a single numerical question?

It will be very helpful.

Thanks

Regards

CA Ankit Garg.

Hmmm, I can’t see in this article what you are talking about. What example is not clear? This article is just a summary, so I am not sure what you are referring to. S.

Dear Silvia

Thank you so much for replying me on my query.

Let me explain my query in specific manner.

I am quite confused regarding the deferred tax implications when business combinations occur.

In IAS12 Lecture 4 you described the practical question of Taxico with subsidiary Taxpall under the situations of business combinations.

My Requirement:- Is it possible to draft 1 or 2 more examples defining the all possible practical situations that can widely incur in the situations of business combinations only, It will be so helpful,

For Example Situation 1:- If Taxpal also existed as a subsidiary in preceding reporting period also.

Situation 2:- If there are some temporary differences directly booked in equity or OCI and brought forward in next reporting period of which we are computing the Deferred Tax.

Situation 3:- Some possible transactions which will be recognized outside of profit & loss i.e. in equity or OCI.

Situation 4:-To explain how the calculations will encounter if above situations (situation 3) occur in the previous reporting period and now we are computing Deferred Tax for the current reporting Period (Under business Combinations) and impacts are carried forward in current reporting period also of which we are actually computing DTL/DTA.

Request:- I know considering this request of giving 1 or 2 examples with detailed coverage of scenarios under business combinations may be very time consuming (Time is precious) or it may be too much demand by my side.

But if you can put some more light in this area this will be highly helpful for me.

Thanks

Regards,

CA Ankit Garg,

Hi Silvia,

What could be the tax rate for deferred tax on assets revaluation in business combination.

“Business combinations

In a business combination identifiable assets and liabilities can be revalued upwards to fair value at the acquisition date, but no adjustment is made for tax purposes. As a result, taxable temporary difference arises.”

Thanks

Hi Silvia,

I love your articles. However, I found not many articles specially talk about Deferred tax assets. After read the materials, I still do not very understand the double entries for usage of recognized Tax loss (DTA) and how it reverse in the DTA when.

For example, a deferred tax asset is recognised for an unused tax loss carryforward with an opening balance 500

It is Taxable profit so rise a current tax 200. How to book this current taxation and how it offset by DTA? The current tax charge supposes offset by tax loss and do not have bank payment.

If Dr Taxation-P/L but actually no taxation expense and cannot reduce DTA balance. I am confused.

Thanks a lot.

Dear Athena,

you should probably take the balance sheet approach. Let’s say your unused tax loss carried forward was 1 000, tax rate= 20%, so you booked DTA of 200, Debit DTA/Credit Profit or loss-deferred tax income.

In the next year, you had taxable profit and you used the tax loss of let’s say 800. So, the remaining tax loss to use is just 200, and the remaining DTA is therefore 200*20% = 40. Opening balance of your DTA was 200, so you need to reduce it to 40, it’s the entry of Debit profit or loss – deferred tax expense/Credit DTA with 160 (200-40). Hope this helps.

This is very enlightening and educating. Well done. Gracias.

Hi silvia,

what will be the accounting treatment for prior period tax whether we should make a entry in statement of comprehensive income or in OCI. it may happen in our case that the prior period tax assessment are done on diferent periods and additional tax are charged for the prior period which we have to recognize in the current period

Hi Silvia

On 1 October 2012, Kappa purchased an equity investment for $200,000. The investment was designated

as fair value through other comprehensive income. On 30 September 2013, the fair value of the investment

was $240,000. In the tax jurisdiction in which Kappa operates, unrealised gains and losses arising on the

revaluation of investments of this nature are not taxable unless the investment is sold. Kappa has no

intention of selling the investment in the foreseeable future

Can you please guide me to calculate with reason what will be the tax base in the above case?

Hi Silvia,

I have a doubt, Suppose there is company for which tax holiday period(the period under which profit from the eligible business is wholly allowed as deduction) is allowed and the period of tax holiday is one year. The company is using its assets for the eligible business and the depreciation allowed as per income tax act is different from depreciation charged to statement of p&L.There exists temporary difference because of that. Year 1 WDV is 54,48 as per accounting books and income tax books and year 2 WDV is 48,38.4 as per accounts and tax books.From year 2 onwards there will be no tax benfits. So for year one tax base liabilty is 38.4(because 38.4 is only allowed as deduction in respect of future taxable profits). Therefore temporary taxable difference is 15.6(54-38.4) for which DTL will be created right? or it will on 6(54-48)?

I love your work. Easy and straight to the point.

I’m slightly confused – hope someone can help me. Interest receivable I thought was calculated for companies on an accruals basis – not a receipts basis. i.e. I don’t recall seeing an adjustment in a CT computation for accrued interest bfwd and cfwd i.e. resulting in the interest actually physically received in the bank. The interest is received gross of any tax deduction. Therefore I cannot understand why there is a deferred tax liability on this item. Can someone explain?

Dear Simon,

I think I wrote about the interest receivable in another article and in the comments below that article. Could you please check that out here? Thank you! S.

Dear Silvia,

I have a situation of a finance lease liability, where I get a negative tax base. This is because the company gets a tax deduction through the lease payments, whereas the balance of the lease liability at the year end is less than the sum of MLPs.

Hence, tax base of liability = carrying amount of the liability – any expenses that will be tax deductible during the period that the liability is settled

The above is clearly negative.

Can there be a negative tax base for a liability?

Thanking you in advance!

Hi Elias,

If I understand that right, the full lease payment is deducted for tax purposes, but only an interest part is deducted as an expense in profit or loss. In this case yes, you can get a negative tax base and a deferred tax liability. S.

Hi Silvia

Our country changed its effective tax rate for taxing realized capital gains on investment properties for the new fiscal year.

As such we need to increase our deferred tax liability since we account for investment properties using the fair value basis.

We need to disclose the impact of the change in tax rate in our financial statements, but how would I calculate? Do I reflect the effect of the rate change on the opening deferred tax liability, or on the closing balance?

Thank you in advance

Dear Riaan, it’s calculated on opening balance of DTL. S.

Are you sure teacher that you have written it correctly?

“When the carrying amount of an asset or a liability is greater than its tax base, then there is a taxable temporary difference and it gives rise to deferred tax liability.”

in my opinion its true for assets but for liablity in such case we would get a deductible temporary difference giving rise to deferred tax asset!!

would you make it clear to me kindly!

Thanks in advance.

Ubaid,

please, don’t play words with me. Througout this website I try to explain that the asset is PLUS and a liability is MINUS. Therefore, I say that MINUS 100 is greater than MINUS 200. Is that OK? S.

Hi Silvia,

Your explanations are really easy to understand and helped me a lot. Thank you!

I had a question regarding IAS 12. If for example, I have a lease-hold land with 99 years lease period on which the company claims amortization in books. However, the amortization is not allowed as deduction for the purposes of tax laws. Also, the company will not get any deduction under tax laws at the time when the lease period ends. What shall be the tax base of the lease-hold land in this case and whether a Deferred tax liability needs to be created in this case?

Hello Silvia!

I must express my sincere gratitude for your great work. It’s so difficult for me to understand IFRS but through your free tutorials, life has been much simpler. I am pursuing CPA and now I wonder, why they make textbook so difficult. I wish, they have a course preparer like you. Thank you and keep up the great work.

Regards

Paras

Silvia M

Very informative and well presented, thanks

Question

You state that if one revalues upward an asset at fair value this will give rise to a deferred tax liability. Would this also be the case if the company has carried forward capital tax losses that can only be off set against capital gains, may one off set these tax losses against the fair value revaluation gain to compute a net deferred tax liability?

Thanks

Philip

Hi Silvia,

Thank you for sharing your expertise!

I am trying to interpret a taxation reconciliation given in notes to the consolidated financial statements where taxation at the standard UK corporation tax rate is reconciled with total income tax expense (AS IN THE TAX RECONCILIATION BELOW).

I am stuck on this for ages – how is the deferred tax (8.5) get included in the total tax expense of 179.7 in the RECONCILIATION.

TAX RECONCILIATION:

Profit before tax 702.7

Taxation at the standard UK corporation tax rate 196.8

Dep’n,charges&other amounts non-qualifying fixed assets 1.4

Other income and expenses not taxable or deductible -10.1

Exceptional costs –

Overseas profits taxed at lower rates -6.3

Adjustments to tax charge in respect of prior periods -2.1

Total income tax expense 179.7

TAX CHARGE:

Current tax

UK corporation tax at 28%

– current year 170.3

– prior years -5.2

165.1

Overseas current taxation 6.1

Total current taxation 171.2

Deferred tax

– current year 5.4

– prior years 3.1

Total deferred taxation 8.5

Total income tax expense 179.7

I would be very grateful if you could pull me out of this!

Muhammad, sorry, I can’t pull you out of this. As much as I want to help you, I simply can’t solve these specific requests as I would not do anything else than this. But I hope someone reading this will be able to help you. S.

I hope so but but thanks for responding anyway!

Muhammad

a) Prior year current tax + deferred tax = -5.2+3.1 = -2.1 (which is shown as Adjustments to tax charge in respect of prior periods)

b) The other 5.4 current year deferred tax adjustment get blended in other reconciling items at the top which without looking at the detailed cal itself you won’t be able to reconcile. That 5.4 in theory is the tax effect of the temporary differences of balance sheet items (so that’s the other way of proofing)

Silvia

This is great work you are doing for us guys in finance.Kindly any videos on how we treat prior period events and what causes them? will be highly appreciated.

Hi Alega,

thank you. If you browse this website, please look for IAS 8 label – there are some videos on this topic. S.

please help me with this question

On 1 January 20Z1, ABC borrowed CU 100 000 to finance the construction of the production hall. The construction started on 1 January, continued throughout the year and ABC spent CU 20 000. On 1 February, ABC decided to temporarily invest unused borrowing of CU 80 000. On 1 June 20Z1, the temporary investment was terminated and all remaining borrowings were used to finance the production hall.

Interest rate on the loan is 5% and interest rate on the investment is 3%.

What borrowing costs should ABC capitalize into the cost of production hall in 20Z1? Ignore compound discounting.

a. CU 4 200.

b. CU 5 000.

c. CU 3 333.

d. CU 3 000

Dear Jane,

may I recommend you reading article about IAS 23? I’m sure that afterwards, you’ll be able to tackle this question yourself – this is what counts and contributes to your skills. You can find an article here: http://www.cpdbox.com/capitalize-borrowing-costs-ias-23/ S.

Hi,

I think it is CU4200 (100000*5%-80000*4/12*3%)

If a company has acquired a manufacturing machine for USD 1,000, the depreciation of which is not deductible for tax purposes. Should the company recognise deferred tax liability?

No, as this difference is not temporary.

Hi Sylvia

I am reading this today and believe me you, it is a great presentation of Deferred Tax. It has been very helpful for my reporting and instruction.

Thank you very much.

Thank you, Teresa, glad to help! S.

Hi Silvia!

I was wondering, if I see a provision for prior year income taxes in the balance sheet, for example 6 000 GBP, and the tax authorities say it should be, say, 15 000 GBP, should I record deferred taxes in this case? Sounds a bit weird I must say… and if I should, is the tax base would be 15 000 then?

Thank you very much!

Hi Idan, well, for me it seems that when tax authorities say it should be 15 000, then it’s a current tax, not deferred, isn’t it? Remember, deferred tax is an accrual for tax, not something to be paid. Here’s a good article by Professor Joyce on this topic: http://www.cpdbox.com/ias-12-deferred-tax/

Dear Silvia,

Please read my previous comment above Idan’s comment and please correct me. Bit confused in this matter.

Dear Silvia,

I have a query.

Say, there is an outstanding expense of Rs. 25 which is charged to P/L and shown as liability in accounts in current period. But, the same expense is deductible for tax only when cash is paid (cash basis). In this case, carrying amount of the liability is Rs. 25 and the tax base is Nil.

As mentioned in your note, Carrying amount is greater than Tax base of the liability and this should be temporary taxable difference that gives rise to deferred tax liability.

But, I think deferred tax asset should be created as Rs. 25 will be deductible in future for tax purpose when we pay cash for the expense. This would give rise to tax advantage in future which must be a deferred tax asset to the entity today.

So, in my opinion, for items of liability side, if carrying amount exceeds tax base, it should be recognized as deferred tax asset, not deferred tax liability.

Please correct me if I am wrong.

Hi Raj,

sorry, I somehow skipped your comment.

Dear, please use correct signs and everything will be OK. For your liability, carrying amount is MINUS 25, and tax base is nil, so in fact, tax base is GREATER than carrying amount (not the opposite way) => yes, DTA arises.

Sure, you can do it your way and say everything in absolute numbers, but you can generate mess easily, so I prefer to use PLUS for assets and MINUS for equity and liability accounts, and it this case, everything works.

Hope it helps! S.

Thank you so much silvia..was waiting for your reply for a long time..now i am clear..i never thought it was because of using minus sign for liability

I hope I can get the IAS that i learn in college. TQ

Thanks very much.

I real appreciate for the job you are doing.

That is awesome. Thanks a million, your lessons are just amazing.

It really helped me a lot to better understand the concepts.

Thanks again 🙂

Awesome,just awesome

Thanks alot for your free course. It is really helpful. keep sending your free and full of knowledge courses

Hi Silvia

Thank you for your articles on IFRSs which are very helpful. Expecting more.

Hi Silvia,

Really I enjoy reading the article, appreciate your usual support, and many thanks for your free and helpful course in your website. These days it is so difficult to find useful and free courses.

Thanks once again

Mutaz

Hi Silvia,

Thank you for this topic, it has been very helpful in my studies and will surely help me in my ACCA F7 exam in December.

Regards,

Hi Silvia,

This is great for sure and your doing it just for free.I have no words to thank you rather than just say “thank you very much”.Well organized, summarized and simplified.Your the best

I thank you,

Juma R.