How to Measure Fair Value in Agriculture – IAS 41 and IFRS 13

Agriculture is a huge sector, significantly contributing to the world’s GDP.

According to the World Bank, in 2018 the value added in the agricultural sector represented 10.39% on total GDP in average – which is HUGE!

After all, we all need to eat.

Besides its importance as an industry, agriculture is very interesting accounting subject.

Why?

Here, we are dealing with life. Animals, plants, biological transformation, you name it.

We are trying to capture life in the accounts.

While doing so, there are many burning questions and troubles because of life’s specifics. I tried to respond some of them in this article.

Yet still I receive questions related to valuation of agricultural assets – how to measure them? How to set their fair value?

I would sum up the whole valuation process into 2 steps:

- Identify what TYPE of agricultural asset you have;

- Measure it accordingly.

Let’s see.

What type of agricultural asset is that?

From the accounting aspect, you can have a few types of assets involved in agriculture and your primary goal is to identify what type it is.

It is very similar as with financial instruments – classify it first, apply appropriate standard and then measure it accordingly.

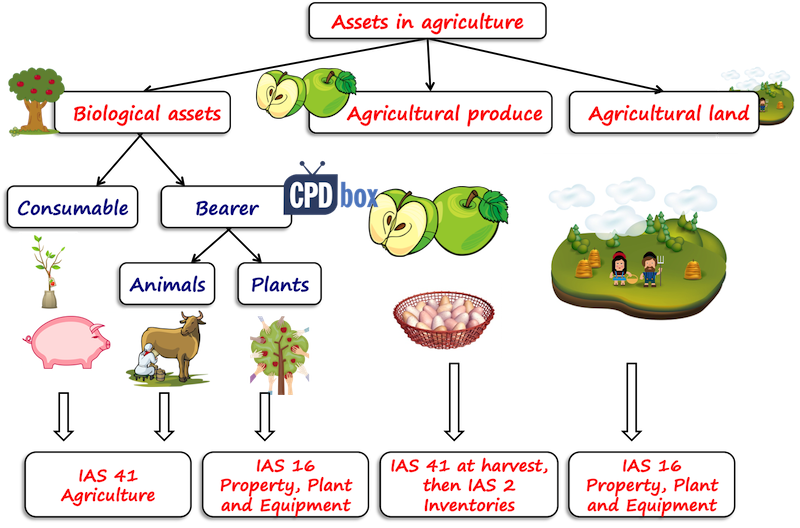

Different types of agricultural assets are shown in the following scheme:

How to measure different types of assets in agriculture?

I. Biological assets

By definition in IAS 41, a biological asset is a living animal or plant.

I find this definition vague, because not all living animals and plants automatically fall within the scope of IAS 41.

First of all, you need to ask yourself a question:

Is the asset used in an agricultural activity?

In other words, are you managing the biological transformation and harvest of biological assets for specified purposes?

- If yes, then OK, the biological asset falls within the scope of IAS 41. For example, fish that you are growing on a farm.

- If not, then the asset is outside of IAS 41 scope. For example, fish that you pick from the sea (you did not manage the biological transformation of wild ocean fish, did you?).

Another example is dog – holding a dog for breeding puppies is agricultural activity (IAS 41 applies), but holding a guard dog for security purposes is not (IAS 41 does not apply).

The second question to ask is:

Is the biological asset bearer or consumable?

Consumable biological assets

Consumable biological assets are those that will be either:

- Harvested as agricultural produce; for example farmed fish, hogs for meat, trees grown for lumber etc.; or

- Sold as biological assets; for example seedlings of apple trees, young puppies, etc.

Consumable assets fall within the scope of IAS 41 and shall be measured at fair value less cost to sell.

Bearer biological assets

Bearer biological assets are other than consumable biological assets, for example apple tree held for harvesting apple, or cattle for milk production.

Here, IFRS makes a distinction between bearer plants and bearer animals:

- Bearer plants fall within the scope of IAS 16; but

- Bearer animals fall within the scope of IAS 41.

In conclusion – basically all animals do fall within the scope of IAS 41, regardless whether they are consumable or bearer.

Therefore, you need to measure them at fair value less cost to sell as well.

With plants, you need to differentiate and correctly assess what they are. And, as this question requires special attention, I will make up a Q&A session soon on this point.

Bearer plants fall within the scope of IAS 16 and therefore they are measured either applying cost model or revaluation model.

II. Agricultural produce

Agricultural produce is the harvested produce of the entity’s biological assets.

Examples are apples, eggs, milk, or meat.

Be careful – products made from agricultural produce are NOT agricultural produce anymore; rather they are inventories, for example apple juice, cheese, salami, etc.

Also, some people get confused about living animals.

Imagine you have a chicken farm and raise young chicks for further sale.

These young chicks are NOT an agricultural produce. Instead, they are biological assets, because they are living animals (thus meet the definition of a biological asset).

Agricultural produce shall be measured at fair value less cost to sell at the point of harvest.

After this point, agricultural produce becomes inventories and you need to apply the standard IAS 2.

III. Agricultural land

I mention this asset just to include it here, but it should be crystal clear.

Agricultural land that you use for agricultural activity is definitely within the scope of IAS 16 and measured using cost or revaluation model.

It is NOT an investment property under IAS 41, because you are using it for agriculture (own revenue-generating activity).

The following table sums up the measurement of agricultural assets:

| What? | Example | Measurement |

| Consumable biological asset | Seedlings of apple tree, chicken for sale, etc. | Fair value less cost to sell at the reporting date |

| Bearer plant | Apple tree used to grow and harvest apples | IAS 16 – cost model or revaluation model |

| Bearer animal | Cow held for milking | Fair value less cost to sell at the reporting date |

| Agricultural produce | Apples, eggs, milk… | Fair value less cost to sell at the harvest date |

| Agricultural land | Forestry land | IAS 16 – cost model or revaluation model |

How to measure fair value of agricultural assets

Once we have identified what to measure at fair value less cost to sell and when to measure it, we need to look at the standard IFRS 13 Fair Value Measurement.

Yes, IFRS 13 applies even here with its principles.

IFRS 13 contains fair value hierarchy that classifies inputs to use for setting the fair value and sets priorities of these inputs:

- Level 1 inputs: Quoted prices in active markets for identical assets on the measurement date. This is by far the most preferred and accepted method of measurement.

However, you can apply this only for assets with active market for similar assets with the same condition.No problem for agricultural produce like raw milk, eggs or meat – usually there is a strong active market to derive the fair value of these assets.

Also, no problem for consumable biological assets close to their sale or harvest date.

- Level 2 inputs: Other than quoted market prices within Level 1 that are directly or indirectly observable for the asset.

Basically we are talking about market-determined prices where active market does not exist. Imagine that some asset would be so rarely traded that the last trade happened some time ago. You can use most recent price as the input to fair valuation – that’s basically level 2 input. - Level 3 inputs: Unobservable inputs for the asset.

In agriculture, Level 3 is used when there is no active market for the asset in its present condition (e.g. age, height, weight). In practice, companies use present value of cash flows generated by the asset as Level 3 input to valuation technique.

To sum it up, here’s the order of valuation techniques to use:

- Market price for the identical asset in an active market at the reporting date (or at the harvest date, based on the type of an asset) – that’s Level 1.

- Recent transaction prices for the identical assets when no active market exists – that’s Level 2.

- Market price for similar assets in an active market – that’s Level 2.

- Present value of future cash flows from the assets – that’s Level 3.

- Cost as an approximation of fair value – that’s Level 3, too and it can be used only in some situations as described below.

What does it practically mean?

For harvested agricultural produce and some consumable biological assets, there is an active market with exactly the same assets in the same condition and you can take the market price as level 1 input into your valuation.

For most biological assets that take longer time to produce, to mature and will not be harvested or sold until some distant time in the future, active market does NOT exist and you need to apply discounted cash flow technique.

Let’s illustrate it in the example.

Example – fair value of biological assets by discounted cash flows

ABC is a company that grows eucalyptus trees for harvesting them and using them for production of pulp.

In 20X1, ABC planted 1 000 trees. Eucalyptus trees are mature and ready for harvest after 7 years.

At the end of 20X3, the market price of one mature eucalyptus tree is CU 3 000.

Each year, ABC incurs costs to grow the trees amounting to CU 100 per tree.

ABC uses the discount rate of 5% (being market rate of return).

The fair value of ABC’s trees was CU 1 850 000 at the end of 20X2.

Calculate the fair value of ABC’s trees at the end of 20X3.

For the sake of simplicity, we will ignore inflation and other economic parameters here. I want to show the basic mechanics to you.

ABC’s 1 000 trees will be ready in 20X8, so at the end of 20X3, we need to list all the cash flows in the years 20X4 to 20X8 as I have done here:

| Year | Expenses | Income | Net cash flow | Discount factor | Present value |

| 20X4 | -100 | 0 | -100 | 0,952 | -95,20 |

| 20X5 | -100 | 0 | -100 | 0,907 | -90,70 |

| 20X6 | -100 | 0 | -100 | 0,864 | -86,40 |

| 20X7 | -100 | 0 | -100 | 0,823 | -82,30 |

| 20X8 | -100 | 3 000 | 2 900 | 0,784 | 2 274,60 |

| Total | 1 920,00 |

This is the fair value of one tree; ABC has 1 000 trees, so the fair value of all eucalyptus trees is 1 920 000 CU – pardon for rounding involved here.

The total change in FV of the trees is therefore CU 70 000 (1 920 000 less 1 850 000).

Two remarks to this example:

- Don’t forget to deduct the cost to sell from this fair value. In the table, we included cash outflows related to cost to grow the trees, but not cost to sell, so just bear in mind that once you have your fair values, you need do take cost to sell into account.

- IAS 41 encourages you to disclose the fair value change over the year and to split this change into:

- Change in FV due to physical change (trees grow and thus their FV increases); and

- Change in FV due to change in prices (market prices can change over time).

This disclosure is especially important for biological assets with production cycle longer than one year (e.g. eucalyptus trees in this example).

How to set the cash flows from biological asset?

General rule in IFRS 13 says that you should include all directly attributable cash inflows and outflows to the asset.

Which ones?

This strongly depends on the specific activity you are doing, specific biological assets that you are measuring and yes, it requires some judgment from you.

Examples of cash flow are:

- Cash inflows from sale of an asset or agricultural produce in the future. You might estimate it based on:

- assumed asset’s weight, age, volume, etc.; and

- market prices of a specific biological asset or agricultural produce.

For example, let’s say you take care of forest with trees that will be chopped for wood after some time. You can estimate future cash inflow from the forestry assets (trees) based on assumed volume (cubic meters) of wood harvested from the forest and market price of wood from similar trees.

One big NO: do NOT determine the fair value based on future prices in your contracts.

- Cash outflows to grow the asset.

Examples are numerous here: animal food, vaccination of animals, fertilizers, herbicides, labor cost and other.

Two big NOs: Do not include income tax and financing cash outflows.

Any exceptions from setting fair value of biological assets?

Yes, there are two situations when you don’t have to set the fair value:

- Cost as an approximation of fair value.

You can use cost instead of fair value, but only when either:

- Little biological transformation happened since initial costs were incurred – for example, you plant seedlings of trees very short time before the end of the reporting period.

- The biological transformation does not have a material impact on price, for example the trees with long production cycle right after planting.

- The fair value cannot be reliably measured.

This is extremely rare because you can almost always measure the fair value for biological assets, either based on Level 1, Level 2 or Level 3 inputs.

Any questions or comments? Please let me know below!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

20 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on Accounting for gain or loss on sale of shares classified at FVOCI

- Silvia on Lease term when contract is for indefinite period

- H on Accounting for gain or loss on sale of shares classified at FVOCI

- jibril Tegenu on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Alexei Estrella on Lease term when contract is for indefinite period

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (73) 73

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (55) 55

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (26) 26

- Uncategorized (1) 1

Hi Sylvia,

Thanks for your detail explanation, I appreciate.

Pls I need a guideline format of Financial Position presentation for a typical mixed farming Agribusiness enterprise with at least all key agricultural activities such as cropping, livestock, fishing, forestry etc that would also be helpful. Help me to send to jefolak@yahoo.com

Excellent work Silvia. You are making IAS 41 application very easy and simplified.

Dear Silvia,

I am a poultry farmer in The Gambia, West Africa and I have layers for egg production only.

I am a member of your CPD box and I am in need of your guidance with the following:

1. There is no active market in our country to determine the fair value so I recorded the initial cost of the biological assets (chickens for egg production) at cost plus insurance and freight;

2. I have also capitalized the subsequent costs incurred during the rearing period such as staff salaries, feed costs, vitamins, antibiotics depreciation of poultry building etc). By doing this, the value of the biological asset appreciates;

3. Even though losses due to mortality are recognised in the profit and loss under the cost of sales, the challenge I have is how to account for amortisation/depreciation of the biological assets since they have a life span of 18 months after which they will be sold; Without amortisation, the loss in value as the hens age will not be reflected in the profit and loss.

I need guidance in these areas because there will be a problem at the end of the life cycle as the value of the biological assets will be significant. This is due to the expenses that were capitalised during the rearing period and even if we dispose of them at a competitive price, we would still record a loss on disposal.

Looking forward to hearing from you.

Regards,

Palamin.

Hi all

any one use cost method for agricultural, if yes Cost of Crops is accumulted in Balance sheet until the crop harvested . YES OR NO

so the market value 3000 is actually for the year 2008 right not 2003?

Thank you Silvia for a great topic.

Can I ask you how shall we account for an office flowers? Do they fall into IAS 41 scope, and/or how that shall be accounted ?

Very nice explanation, thanks! How would you think about mariculture raised shellfish? It seems to me they would fall under your big example, a biological asset which must be valued by by discounted cash flows. It is an interesting scenario because there is no market for half-grown shellfish, only for seedlings or fully grown

what type of Assets ” Personal Protective Equipment” OR

When we Purchase Personal Protective Equipment from supplier

how can we treatment this Even

Thank you Silvia for such a good and knowledgeable summary on IAS 41!! Hope to learn other standards’summary as well!!

Hi Sylvia

Great article

I have a question

How is revenue from sale in installments recognized according to IFRS 15

a good one, thank you Silvia

Madame Silvia, thanks for elaboration , you always make IFRS matter easier for us to understand

i am now convinced tat i will join for your online IFRS course probably from April this year.

Thanks Sylvia for the simplifying this topic. I look forward to reading more interesting topics from you.

I would like to appreciate for Silvia’s usual hot issues.

To add some points on issues raised by Endawek, Even if it seems easier to use the Level 3 to determine the fare values of such grapes in such scenarios, it is difficult to determine the future sales value (cash inflow) as there are no companies which sales raw grapes rather they further process to produce wine to be sold. Hence even though we can approximately determine the future cash out flows, it is difficult to determine the future cash inflows in countries like Ethiopia. So is there any simplifications to this.

Dear Silvia, Thanks a lot for a well prepared lesson on how to measure different types of Assets in Agriculture. You have now answered my question that I asked about how can one differentiate between Biological Asset- Bearer Assets Plant under IAS 16 and Biological Asset -Plant under IAS 41. You have introduced us a new terminology Consumable Asset under IAS 41 which cover Biological Assets -Plant and Animal which actually opens up a new discussion on the structure of an Agribusiness Venture Balance Sheet, the venture doing mixed enterprise farming activities i.e cropping and raising livestock, where I suppose the following line items will have to be shown

Assets

Current Assets (Non-Permanent Assets)

-Biological Assets- Consumable Plant e.g. Maize at the field yet to be harvested

(IAS 41) IFRS 13

– Consumable Animal e,g piglets (IAS 41) IFRS 13

-Inventories

– Supplies, Pesticides, Fertilizer etc (IAS 2)

– Agricultural Produce .i.e. gapes, corn (harvested), milk (IAS 41) IFRS 13

PPE/Fixed Assets (Permanent Assets)

-Biological Assets -Animal e.g Breeding Cattle, Pigs etc (IAS 41) IFRS 13

-Bearer Assets- Coffee Tree, Banana tree, Palm Tree etc (IAS 16)

– Property, Plant & Equipment (IAS 16) i,e, Tractors, Harvesters, Planters etc

Help me now:

1. Correct me if I am wrong on the above Financial Position presentation but also

2. In the event there are other Assets such as Dogs used for security at the farm, Help to to show how will the Asset be reported in the Financial Position/Balance Sheet (I believe their valuation will be based on IFRS 13 and all associated expenses will either be expensed in the income statement or capitalized in the BS and their increase/decrease in value will be taken into account in Income statement adjustments at the end of year as gain or loss as appropriate just like the other Biological Assets- Animal under IAS 41

3. If you can provide a guideline format of Financial Position presentation for a typical mixed farming Agribusiness enterprise with at least all key agricultural activities such as cropping, livestock, fishing, forestry etc that would also be helpful

Thanks Sillvia, You have really helped me to grasp the IAS 41 and overall Agriculture IAS reporting requirements I am much more conversant on the subject now than before I started following you on these lessons

This is Albert Mkongwa from Dar es Salaam, Tanzania

Kindly please copy me when responding this to albertmkongwa@gmail.com

Simple and understandable smart note!!! Thanks !!!

Silivia,

Thanks for the Article.

In Ethiopia there are only two Companies engaged in the manufacturing of wine products. This companies use different Vine species to produce the grape which makes the Grapes unique. We have the below restrictions to reliably determine the fair value of agricultural produce:

• There is neither primary nor secondary market for Grapes and similar assets in Ethiopia (Level 1 &2)

• The production of Grape is very volatile and subject to weather condition which affects the quantity and quality of harvest. Hence, it’s very difficult to set yield curve. (Level 2)

• Best information is not available to build fair value from unobservable input as there are only two companies in the industry and no organized data is available. (Level 3)

As the circumstances doesn’t allow us to properly apply the requirements of IFRS 13 and IAS 41, we believe that the fair value of the Grapes cannot be reliably measured.

The requirement of IAS 41 of measuring agricultural produce harvested from an entity’s biological asset at its fair value less costs to sell at the point of harvest is based on the view (presumption) that the fair value of agricultural produce at the point of harvest can always be measured reliably. However, this is not the case in Ethiopia.

Considering the above conditions and circumstances and the requirements of IAS 41 & IFRS 13, Is it possible to rebut the presumption that fair value can be measured reliably for agricultural produce and apply ‘measurement reliability’ exception?

Hi

I understand that the cost method is used is this the case?

Hi Sylvia. Great piece.Ok Another great piece. Appreciating from Kenya.

Great article! Keep your good work going. Thanks