How to calculate bad debt provision under IFRS 9

Last update: 2023

If you have a large portfolio of trade receivables, then you face the same issue over and over again:

How to calculate bad debt provision to these receivables?

When I worked as an auditor, I used to discuss this issue with my colleagues very frequently.

Everyone of them agreed that yes, there is always some bad debt hidden among “healthy” receivables and it’s necessary to recognize some provision for that.

However, everyone had a different opinion on how to do it.

The most common approach was, to my surprise and disagreement, to create a provision in a few steps:

- Analyze receivables at the reporting date and sort them according to their aging structure

- Apply certain percentages of provision to the individual aging groups

Sounds easy, right?

In most cases, auditors applied something like 2% to trade receivables within maturity, 10% to trade receivables that were 1-30 days overdue… 100% to receivables more than 360 days overdue.

It always amazed me.

How the hell do you know that this particular company will suffer 10% credit loss on receivables that are 1-30 days overdue???

For me, it always seemed that these numbers were made out of thin air.

It was long time before IFRS 9 was adopted.

Now, luckily, IFRS 9 tells us how to create bad debt provision for trade receivables and how to get these percentages.

In this article, I’d like to explain this methodology and illustrate it on a simple example.

What do the rules in IFRS 9 say?

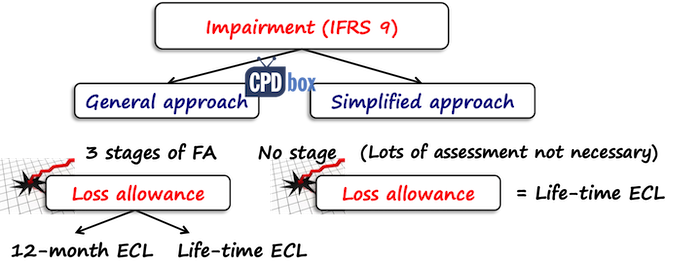

IFRS 9 requires you to recognize the impairment of financial assets in the amount of expected credit loss.

In fact, there are 2 approaches for doing so:

- General approach

In general approach, there are 3 stages of a financial asset and you should recognize the impairment loss depending on the stage of a financial asset in question.Thus, the impairment loss is either in the amount of a 12-month expected credit loss (ECL) or a lifetime expected credit loss (ECL).You can read more about the general approach here.There are a lot of implementation troubles and challenges, for example:

- How do you determine in which stage the financial asset is?

- How do you determine when the credit risk in some financial asset has significantly increased?

- How do you calculate 12-month ECL and lifetime ECL?

- How do you get and update your inputs into the ECL calculations?

Therefore, IFRS 9 permits an alternative for some type of financial assets:

- Simplified approach

In simplified approach, you don’t have to determine the stage of a financial asset because the impairment loss is measured at lifetime ECL for all assets.This is great news because lots of troubles simply disappear.

However, let me warn you that the simplified approach is not for everybody and even if it’s simplified, you still need to make some calculations and effort.

Who can apply simplified approach?

OK, that’s not the best question in the world, because everybody can apply simplified approach.

Type of financial asset is more important here.

You have to apply simplified approach for:

- Trade receivables WITHOUT significant financing component, and

- Contract assets under IFRS 15 WITHOUT significant financing component

For these two types of assets you have no choice – just apply simplified approach.

On top of that, you can make a choice for:

- Trade receivables WITH significant financing component,

- Contract assets under IFRS 15 WITH significant financing component, and

- Lease receivables (IAS 17 or IFRS 16)

For these three types of financial assets, you can apply either simplified approach or general approach.

Can one entity apply both models?

Yes, of course – but not to the same type of financial asset.

Take a bank, for example.

Banks usually provide lots of loans and under IFRS 9, they have to apply general models to calculate impairment loss for loans.

But occasionally, banks can have other financial assets, too.

For example, they may rent redundant offices and have lease receivables.

Or, they can provide advisory services and charge fees for that – thus they can have typical trade receivables.

For these types of assets, the same bank can apply simplified approach.

How to apply simplified approach?

As written above, under simplified approach, you measure impairment loss as lifetime expected credit loss.

IFRS 9 permits using a few practical expedients and one of them is a provision matrix.

What is a provision matrix?

Simply said, it is a calculation of the impairment loss based on the default rate percentage applied to the group of financial assets.

Here, we have 2 important elements:

- Group of financial assets

- Default rates

Let’s break it down.

How to group the financial assets?

When you are using provision matrix for simplification, you still need to be as close to reality as possible.

Therefore, before applying any loss rates, you should group your financial assets first.

Segment them.

The reason is that all trade receivables do not necessarily share the same characteristics and therefore, it would not be reasonable to put them into the same pocket.

How to group them?

It depends on what factors affect the repayment of your receivables.

Maybe you noted that your retail customers (individuals) are less reliable and slower in payments than your business customers (companies).

Therefore, your segments or groups would naturally be retail customers and business customers.

Or, maybe you sell in a few geographical regions and you noted that customers from the capital city pay more reliably than customers in the rural areas (maybe it has something to do with unemployment rate…)

So, your segments would be customers from cities and customers from countryside.

I think you get the point – you should select the grouping of your trade receivables (or other financial assets in questions) depending on your circumstances.

Just a few suggestions for segmenting:

- By product type;

- By geographical region;

- By currency;

- By customer rating;

- By dealer type or sales channel;

etc.

The important point here is that the customers within one group should have the same or similar loss patterns.

How to get the default rates?

Remember – do NOT just trump the default rates up, just like auditors from the intro of this article.

You should really calculate them based on your own data.

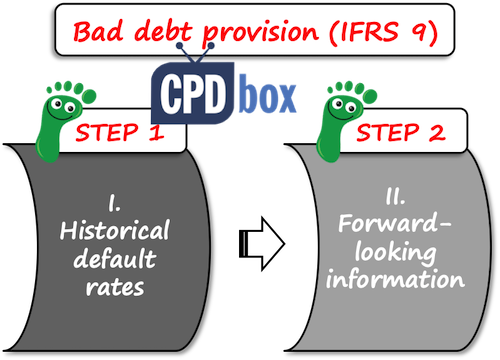

IFRS 9 says that you should:

- Derive the default rates from your own historical credit loss experience; and

- Adjust them for forward-looking information.

Historical default rates

First, you need to analyze the historical credit losses.

How?

You should take the appropriate period of time and analyze which portion of trade receivables created during that period went default.

Just be careful when selecting the appropriate period.

It should not be too short in order to make sense and it also should not be to long because market changes quickly and long period might incorporate market effects that are no longer valid.

I recommend selecting one or two years.

Then you are going to select the time buckets, or periods when the receivables were paid.

Finally, you would calculate the default rate for each bucket.

No worries if this seems too unclear – you can find the illustrative example below.

Forward-looking information

Once you have your historical default rates, you need to adjust them by the forward-looking information.

What is it?

They are all information that could affect the credit losses in the future, for example macroeconomic forecasts of unemployment, housing prices, etc.

You should adjust historical default rates for the information that is relevant for your financial assets.

For example, let’s say the telecom company has 2 segments of receivables:

- Retail customers, or individuals and for this group, unemployment rates are important factor affecting the payment rate.

If unemployment goes up, the credit quality of trade receivables to retail customers worsens. - Business customers: for this group, GDP (gross domestic product) and inflation rate are important factors in this particular country.

How to incorporate the forward-looking information?

When there is a linear relationship between the macroeconomic factor (i.e. unemployment rate) and the input (i.e. increase/decrease in collection of receivables), then the incorporation is quite simple.

In this case, you need to observe what effect has the change in the parameter on your default rates and make simple adjustment (see illustration below).

However, when the relationship is not linear, then the adjustment might require some modeling using either Monte Carlo simulation or other similar methods.

Example: Impairment of trade receivables under IFRS 9

ABC wants to calculate the impairment loss of its trade receivables as of 31 December 20X1. ABC’s policy is to give 30 days for the repayment of receivables.

Note: This is an important point – 30 days credit period means that these receivables have NO significant financing component and therefore, you don’t have to worry about the present values.

The aging structure of trade receivables as of 31 December 20X1 is as follows:

| Days after issuing invoice | Amount outstanding |

|---|---|

| Within maturity (0-30 days) | 800 |

| 31-60 days | 350 |

| 61-180 days | 280 |

| 180-360 days | 170 |

| > 360 days | 100 |

| Total | 1 700 |

ABC decided to apply the simplified approach in line with IFRS 9 and calculate impairment loss as lifetime expected credit loss.

As a practical expedient, ABC decided to use the provision matrix.

First, ABC needs to calculate historical default rates.

In order to have sufficient historical data, ABC selected the period of 1 year from 1 January 20X0 to 31 December 20X0.

During this period, ABC generated sales of CU 20 000, all on credit.

Then, we can split the whole analysis process into a few steps.

Step 1: Analyze the collection of receivables by the time buckets

ABC needs to analyze when the receivables were paid and sort them out into table based on number of days from creation of invoice until the collection of the receivable:

| When paid? | Paid amount | Paid amount (cumulative) | Unpaid amount |

|---|---|---|---|

| Within maturity (0-30 days) | 7 500 | 7 500 | 12 500 |

| 31-60 days | 6 800 | 14 300 | 5 700 |

| 61-180 days | 3 000 | 17 300 | 2 700 |

| 180-360 days | 2 200 | 19 500 | 500 |

| > 360 days | 500 = write-off | 19 500 | 500 = write-off |

| Total | 20 000 | n/a | n/a |

Notes:

- The amount of CU 500 in the column “Paid amount” for > 360 days represents in fact defaulted, unpaid amount.

- Paid amount cumulative is calculated as paid amount in certain time bucket plus paid amount in the previous bucket, i.e. cumulative paid amount in 31-60 days is calculated as 6 800+7 500. The exception is > 360 days – here, we can’t include CU 500 because it is not paid.

- Unpaid amount in the last column = total of 20 000 less cumulative paid amount.

Step 2: Calculate the historical loss rates

Then, ABC can calculate the historical default loss rates as the loss amount of CU 500 divided by the amount unpaid (outstanding) at the end of each time bucket:

| When paid? | Unpaid amount | Loss | Default rate |

|---|---|---|---|

| Within maturity (0-30 days) | 20 000 | 500 | 2.5% |

| 31-60 days | 12 500 | 500 | 4.0% |

| 61-180 days | 5 700 | 500 | 8.8% |

| 180-360 days | 2 700 | 500 | 18.5% |

| > 360 days | 500 | 500 | 100.0% |

Note: Default rate = loss divided by the unpaid amount.

Here you might note that data shifted a bit.

Unpaid amount for “within maturity” row amounting to CU 12 500 is now in the “31-60 days” row.

That’s OK because we are calculating amounts that fell into certain time bucket – that is, in the beginning of that bucket, not at its end.

So, in “within maturity” bucket, ABC created CU 20 000 of trade receivables; in “31-60 days” bucket, ABC created CU 12 500, etc.

Also, why did we apply the loss of CU 500 to all buckets?

The reason is that all receivables that were written off (CU 500) were in each stage over their life.

For example, all written off receivables amounting to CU 500 were current (within maturity), or within those CU 20 000 and therefore we can say that the loss generated during 20X0 (tested period) is 500/20 000.

The same applies for any other time bucket.

Now, we are not done yet.

We have only calculated the historical loss or default rates.

We still need to incorporate the forward-looking information.

Step 3: Incorporate forward-looking information

This is more difficult, but let me just outline one very simple approach.

Let’s say that ABC’s credit losses show almost linear relationship with unemployment rates.

Please note that “unemployment rate” is NOT a prescription for you – you should find your own macroeconomic factors that could affect your credit losses.

And, let’s say that the statistical office in ABC’s country assumes that unemployment rate will go up from 5% to 6% in 20X2.

ABC’s experience is that when unemployment rate increases by 1%, it triggers the increase in default losses by 10% (note – you should be able to prove that).

Therefore, ABC may reasonably assume that the loss of CU 500 can increase by 10% because of the increase in the unemployment rate – that is, to CU 550.

Thus, the calculation of loss (default) rates adjusted by forward-looking information is as follows:

| When paid? | Unpaid amount | Loss | Default rate |

|---|---|---|---|

| Within maturity (0-30 days) | 20 000 | 550 | 2.75% |

| 31-60 days | 12 500 | 550 | 4.40% |

| 61-180 days | 5 700 | 550 | 9.60% |

| 180-360 days | 2 700 | 550 | 20.40% |

Step 4: Apply the loss rates to the current trade receivables portfolio

And finally, coming to the end of this exercise, let’s apply these loss rates to actual portfolio of trade receivables as of 31 December 20X1:

| Days after issuing invoice | Amounts outstanding | Loss rate | Expected credit loss |

|---|---|---|---|

| Within maturity (0-30 days) | 800 | 2.75% | 22.0 |

| 31-60 days | 350 | 4.40% | 15.4 |

| 61-180 days | 280 | 9.60% | 26.9 |

| 180-360 days | 170 | 20.40% | 34.7 |

| > 360 days | 100 | 100.00% | 100 |

| Total | 1 700 | n/a | 199.0 |

Done.

ABC can recognize the impairment loss on trade receivables as

- Debit P/L Impairment loss on trade receivables: CU 199

- Credit Trade receivables – adjustment account: CU 199

Note: this journal entry assumes that the previous balance of the loss allowance was 0. If there was a balance, then ABC recognized just a difference to bring the loss allowance to CU 199.

Further reading

If you wish to dig deeper in the topic, here are a few articles that I recommend reading:

- How new impairment rules in IFRS 9 can affect you

- Measurement of ECL: probability of default vs loss rate approach – learn about two most common methods applied when measuring ECL, their pros and cons and illustrative examples

- How to measure probability of default – this article describes a few methods of measuring probability of default (PD) and contains my personal recommendation for external help if you need (discounts for CPDbox subscribers and readers)

- Expected credit loss on intercompany loans – learn to apply the newest ECL model

- Example: ECL model on interest-free on-demand loan

- How to calculate the impairment loss on intercompany loans?

Also, I would like to point you to our course “ECL for Accountants”, where you will learn how to apply ECL on trade receivables in much greater detail.

Any questions? Please let me know in the comments below this article. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (73) 73

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (55) 55

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (26) 26

- Uncategorized (1) 1

Dear Silvia,

Thank you so much for the detailed explanation. I have a question about recognizing ECL (Expected Credit Loss) over OBS (off- Balance sheet credit risk exposures) such as standby letters of credit.

Should I recognize a “liability” for ECL for OBS, instead of an allowance (contra-asset account) for credit losses?

Looking forward to hear from you, much appreciated.

Regards.

EC

Hi Silvia,

Thank you for the detailed explanation.

May I please ask for the provision matrix, if our accounting software does not enable us to calculate exactly payment received during each stage, how should we calculate the historical loss rate?

Thank you very much.

Hi Lili, you don’t need to know payment received during each stage. You need to know when the payment was received and what was not received. Or I did not understand your question.

Hi Silvia, As per our company policy receivable over 180 days are fully provided and the last couple of years there is no write-off. I have two questions here. 1, Should we consider the amount provided in the previous year as a default loss? Should my provision amount for the current year is over 180 days + amount calculated through ECL or Only ECL calculation?

Hi Silvia,

what if the company does not have a history of bad debts? how will we apply the simplified approach?

Then you may need to look at histories of other similar entities. In practice, this means purchasing the data from credit rating agencies, just as an example, and adjusting them to your company’s specific factors.

Let me ask,

what if you are calculating provision for doubtful debts for the year 2019

can we includes the month of December by using provisional matrix by using IFRS 9?

Thanks!

Hi Silvia,

Your explanation is perfect. Could I know that is it required to provide bad debt provision when there is a unconditional bank guarantee against each debtors?

Yes, because the guarantee affects the loss given default, but does not affect the probability of default. So yes, you do account for a provision, although in the lower amount.

Hi Silvia,

Thank you very much for your quick response.

Kindly clarify below concern,

Loss Provision= Debtor amount*LGD*PD

If the LGD is zero, above formula becomes zero. Kindly clarify further?

Thank you in advance…

Yes, if LGD is zero, then provision is zero. Are you sure though? Because, you can experience loss even if the payment arrives later than expected, due to some discounting involved.

Hi Silvia,

Highly appreciate your prompt reply.

Yes. I totally agree with you. Even theoretical provision is zero, in practical concerns provision has to be made because customers may not pay more than one year which need to consider for time value of money.

Thank you again

thank you Silvia.

i have two questions

1. I have a trade receivable with a very reputable customer who has a good track record of paying back and with a large singe amount. my debtors are grouped by ages of receivables. if i included this amount to the grouping it stretches the provision amount knowing that this customer will actual pay me the amount, so how can I minimize the provision amount of this single amount since it is large?

2. a credit sale at Dec 31 2019. when calculating provision can we exclude this amount since it is a single large amount which affects the provision?

Thank you.

My question here is that if u have a trade receivable with a very large amount with a reputable customer who has very low risk of default, can i remove it from grouping and treat separately?

Second q. If a one day long receivable at the reporting date but very big single amount which significantly affects provision expenses how to minimize z effect?

Halil

Thank you for the explanation. Can we record the provision on ECL model in profit and loss after profit before income taxes?

Well I would say that this provision enters into PBT – so my answer would be no.

Hi.

I work in a company that is under a debt arrangement and requesting discounting facilities from banks. The government is writing a guarantee against this facility to help the company. The banks are discussing whether a provision has to be made for the extra facility although a government guarantee is received 100% of the facility.

Thanks.

Hi Silvia,

you are doing a fabulous job.

your articles are really helpful.

I have a small question:

what should be the approach/methodology in calculation of ECL on lease receivables(Consider IFRS 16 applicable)??

Hi Silvia

One of the subsidiaries in our Diversified financial services group is in the business of commercial equipment leasing and we have implemented IFRS 9 and adopted the simplified approach based on Lifetime losses in respect of lease receivables as part of their ECL provision.

Can you please share some insights as to whether we can consider unguaranteed residual value as part of the ECL assessment/calculation for these lease receivables?

Thanks

Maz

Hi Maz, IFRS 16 par. 77 says that the lessor applies impairment requirements of IFRS 9 to the net investment in the lease (excluding unguaranteed residual value). S.

Hello Silvia,

If a company buys insurance or warranty of defaulted debts, which in return recover any un-paid debts.

what happens in this case, do we still provide for default risk or what?

Yes. However, these credit enhancements decrease your loss given default percentage, so the ECL will be lower than without these items.

When is the roll rate approach used?

Hi Pauline, I assume you currently writing your APC based on the question.

A roll-rate model is used for credit cards in Banks.

> The model takes into consideration terms of maturity and supplements the historical loss rate with forward-looking information.

> For trade receivables with typically a short term, a simple provision matrix may be sufficient. However, for longer-term items, the provision matrix will have to be more sophisticated to take into consideration other factors that would also drive credit risk

Hi Silvia,

Great article. I wasn’t sure about the PD for 30 days onwards, but it’s now clear to me.

Thank you

Rama

HI, What is the accounting treatment for recovery of debts written off after providing for as per IFRS 9 provision method?

Hi , thanks for the article.

My question is around the IFRS 9 (para B5.5.41) requirement where it states the ECL should reflect an unbiased and probability-weighted amount that is determined by evaluating a range of possible outcomes. At least two outcomes should be considered.

Under the simplified approach we do not appear to be taking a probability weighted amount into account? As such is is permitted or it the practical exception (simplified approach) allow for this requirement to be ignored. This is also important as when we consider IFRS disclosures in the financial statements, there appears to be various references for recommended disclosures to include key details in particular around the probability-weighting applied and range of possible outcomes considered.

Would very much appreciate your view on the above point.

Thank you,learning a lot from these IFRS lessons!

Thanks!!! Very useful for me.

Thanks! Very well written.

Hi Silivia,

Thank you for the article, my question that after having the bad debt allowance calculations and we need to write-off one of specific accounts in receivable aging, does this specific impaired amount will be debited to the allowance or to be separately book under impaired amounts in a separate line to show the written off amounts.

Hi Ashraf, my suggestion is to written-off the specific accounts that you have identified, before doing the calculation described in the article. So, I would use a separate line.

Hi Silvia- Just wanted to ask how simplified approach for trade receivable under ECL is applied where customer are Government entities? In such cases though there are delays in recovery of the amounts but historically management has not witnessed default /impairment of underlying receivable. Could you share your thoughts on how simplified approach (provision matrix) is to be applied?

The term ‘default’ is not defined in IFRS 9 and an entity will have to establish its own policy for what it considers a default, and apply a definition consistent with that used for internal credit risk management purposes for the relevant financial instrument. IFRS 9 includes a rebuttable presumption that a default does not occur later than when a financial asset is 90 days past due unless an entity has reasonable and supportable information to demonstrate that a more lagging default criterion is more appropriate.

Hello,

Just want to find out if ECL impairment of Trade debtor is a further impairment that a Company have to take in ?

Well, what is “further impairment”?

Hello Silvia.

Thank you for clear guidelines on the application of the standard. I have few question though on how an auditee applied the standard, I am of an opinion that thier methodology is incorrect, however i stand to be corrected. They calculated the ECL as: Bad Debts actually written off as a percentage to revenue over five years, no forward – looking adjustment taken into account and no cash sales adjustment also.

The ECL ratio was calculated on YTD revenue and the results, used as a general provision is this correct ?

The specific provision from Previous model we cannot go away with it for tax purposes. Should this now be eliminated from the general provision above or added on to get to the Total Provision for the period.

Please advise, i have an uneasy feeling about this one?

Thank you

Hello,

Thanks for the guidance in the article. From the previous model we would specifically provide for specific debts that we felt would default or delay in payment and after recovery we would then credit that as bad debts collected in the following year. However, with this model we do a general provision which is not specific to specifics debtors. My questions being, after the provisional year end of say $50,000 and then in the next year your provision has reduced to $40,000, how do you treat the $10,000 in terms of double entry.

Dear Silvia,

Thank you very much for this “reader-friendly” article, it is written in very simple and understanduble way and has helped me to understand application of IFRS 9 in non-financial services companies. Best regards

Hi Silvia! should I create provision at reporting date if receivables are collected after reporting date but before the FS is authorized for issue?

Well, I would not as clearly the probability of default is zero.

Auditor is asking under which clause of IFRS 9 it is saying that subsequent collection can be adjusted for ageing of expected loss computation

There is no clause saying this like that. However – once you collect the receivable, then I assume that the expected credit loss is zero, isn’t it?

I would like to know basis for this conclusion. Aren’t we required to look at the information available at the reporting date? How subsequent receipts are an adjusting event for ECL?

Well, I assumed that there is no big time lapse between the end of the reporting period and the collection of receivables, therefore I would indeed take it not as an adjusting event (I did not say that), but as an indicator that PD was close to zero. But in general I agree, you should take the info available at the end of the reporting date.

HI

i want to know the rule in ifrs of calculate interest income from loan and how to calculate loan fee of loan.

Dear Silvia, thank you for the article. 1) If after the reporting date but before the date financial statements are signed by the company, I see that almost all receivables impaired are actually collected (provision was calculated based on default rates, no significant change was considered compared to them due to no change in business environment). Should I create any provision as of reporting date? Can I tell that the management already began working with debtors as of reporting date and believed no provision should be created despite the debtors are overdue and there are some historical default rates? 2) Can the provision be calculated using historical default rates only assuming no change in business environment?

Dear Silvia,

I would like to comment on the fact that the word “provision” according to IAS 37 restricts provisions to liabilities of uncertain amount or timing that result from past actions. The phrase “provision for depreciation” has fallen out of use in favour of “accumulated depreciation” because, strictly speaking, depreciation is not a liability to anyone. It is an estimated matching of the cost of an asset over its useful life, not an obligation to anyone. “Provision for doubtful debts”, seems to be suffering from the same predicament beacuse strictly speaking the estimate for doubtful debts is not an obligation to an external party as per IAS 37 definition of a provision. While idea of adjsuting the value of an asset (Trade receivables) downwards is consistent with fair value, the terminology may need to be redressed.

Sure and this is why I personally never use the phrase “provision for depreciation”. Provision for doubtful debts is just commonly used phrase for the impairment of receivables, however I do agree that it is not very good title exactly for the reasons you mentioned.

Dear Silvia,

In what circumstances will I be doing reversal of doubtful debts as the provision was provided in general?

Hi Monz, for example, in the subsequent period, you would calculate your provision in lower amount that already existing in your accounts – so you would reverse a part of it. S.

thank you

its really useful

we are analyzing our provision rates from last year to this year (comparing Q4 2017 sales vs Q4 2016 sales), and resulted to lower rates this year. can you please advise what could be the factor why we have lower rates? thank you

Hi Silvia, Would be it correct to make a specific provision for some debtors within a category and apply the default rate to the rest of the category. It seems to me that what we are doing using the simplified method is making general/portfolio provisions

Yes, that’s acceptable approach. You can make either individual assessment or collective assessment.

Hi. Following from the above comment. In Y2018 a provision for bad debts calculated based on IFRS9 simplified approach for 2017 and 2018 debtors balances. The IFRS9 provision for 2017 debtors’ balances had been recognised as a restatement of opening reserves in 2018 rather than a charge in 2017 P&L. In Y2019 we recognise a specific bad debt provision and we exclude this debtor’s balance from the calculations for the IFRS9 provision Y2019. As a result, a reversal of the previous IFRS9 provision will be made in Y2019 with respect to this debtor’s balance. My question is will the reversal be recognised as a credit in 2019 P&L or does it have to affect the reserves in anyway provided that is was originally recognised as a restatement of the opening reserves? in addition, in P&L do we have to show in a separate line the provision for bad debts based on IFR9 and the specific provisions for bad debts?

What is there are no bad debts history in the company? How will this expected credit loss calculation work.

It cant be 0 provision but something at least.

Hi Silvia,

I have regarding for ECL calculation. The following can be use for calculating ECL?

ECL = PD X LGD X EAD X DF. Is there any rationale behind applying discount factor to ECL?

Hello Silvia

Grateful if you could assist in the following:

I have trade receivable from a related party where there has never been any history of default and no bad debt has ever been recognized in respect of the trade receivable. I expect to receive the full amount after year end. What basis can be used to define the rate to calculate the credit loss?

Hi Silvia,

Thank you for the explanation on IFRS 9!

Just a question – do we still need to recognise expected credit loss on trade receivables that are fully paid after the financial year end?

Hi,

Please be kind enough to brief me about the presentation of IFRS 09 provision based on Simplified approach.

My YE is 31 Dec 2018 and do i need to calculate the day o1 gain or loss (01 Jan 2018) and adjust through Retained profit for simplified approach .

Hi Silvia,

I have a bit of confusion regarding application of simplified approach. As given above under simplified approach you have calculated historical loss rate and applied forward looking information. However IFRS 9 requires to determine expected loss = Probability of default x Loss given default x Exposure at default. However in your example you have not considered Loss given default.

Could you please explain why have you not considered it. (Assume that portfolio is unsecured.)

Hi Qaiser,

in fact, using the default rates is exactly simplified application of this formula PDxLGDxED. The reason is that historical rates of default were derived from actual losses, that occurred with certain probability and you already know what was loss at default and exposure of default (that was the total portfolio in this case). IFRS 9 brings exactly this provisioning matrix example as one good method of application of simplified model. S.

this is very explained and i truly get the concept. but what if part of the amount impaired was eventually recovered, do we write back.

what if the company just have provision in previous years and there was not actual bad debt was booked. than what should be the driver for default rate calculation

Dear Silvia,

I didn’t get the 7,500 in the second table! Is it represet the amount collected Within maturity (0-30 days) based on date after issuing the invoice or amount collected in Jan. In following month after year end

Hi. Thank you for putting it simply. I have a better understanding of IFRS 9 after reading your article. Just would like to ask if the provision matrix is also applicable to trade receivables with credit term of 60 days. Thank you,

Hi Gladys, thanks. Yes, it is. You simply evaluate the days after maturity date after credit term expires (after 60 days). S.

Hi Silvia, thank you for that clarification. Consider a bank loan whose term is, for example, 24 months but repayment is made by monthly instalments. If this loan goes into arrears, say 180 days before the expiry of the term, where in the matrix age bracket would you include this loan?

Hello Silvia,

Thanks for the wonderfully article. My question is – under simplified approach, when we compute the historical default rates, how should the sales returns and credit notes be considered? I mean should we include credit notes and sales returns also as part of unpaid balance >360 days? Thanks!

Interesting question. I would say yes, because they decrease your credit exposure to the same client.

Ok. just to be sure about my understanding .. Your “Yes” means – In the example you have given, CU 500 would include not just the value am still expecting the customer to pay, but also those values which I know they will not pay because I have issued a credit note to the customer or there was a sales return. If this is the way “default” is to be taken, then it will increase my provision %. Please confirm my understanding. Thanks

Teby, I would say that 500 is the net trade receivable towards your client.

Hi Silvia,

Thanks for the IFRS information, about the only place where IFRS are explained in understandable terms. We provision our trade debtors on specifically based on a review on a balance by balance basis which I am guessing is still acceptable under the simplified approach without using the provision matrix. Or do we have to use the provision matrix.

Hi Tomas,

thank you for your kind words! What do you mean by “balance by balance basis”? Is it that you revise each debtor individually and create a provision based on the individual assessment? Yes, that would be acceptable, provided that you are incorporating historical experience with that debtor + forward looking information to your assessment.

Hello Silvia,

Am asking to you to present IFRS9 based on business modle with the suitable method either general or simplified.

For example

Trade receivable.

Lease receivables

Credit cards

Long term investenents

….. etc.

Thanks

Hello Silvia

I want to ask that the result of ABC you mentioned above is that ABC recognizes the impairment loss on trade receivables as:

Debit P/L Impairment loss on trade receivables: CU 199

Credit Trade receivables – adjustment account: CU 199

But in my opinion, it should be as under;

Debit P/L Impairment loss on trade receivables: CU 100

Credit Trade receivables – Provision account: CU 100

Now, because the provision of CU 100 is already booked in P/L over the time, the outstanding receivables of CU 100 will be written off in the books simply as follow after 360 days,

Debit Trade receivables – Provision account: CU 100

Credit Trade receivables account: CU 100

In this way, the loss of CU 100 will be charged in P/L as an expense and also written off from the books as receivables.

What do you think?

Hi Silvia

Thanks for the article. I was wondering how you should adapt the above approach if you have zero historic losses e.g. a few large contracts where there have never been any bad debts? Historic loss rates are zero but obviously there is non-zero probability of credit loss in the future.

Thanks

Good question. Well, you have to look at any available information, e.g. buy some industry statistics and use the experience of similar companies in similar industry as a benchmark. Just as an example.

Any Suggestions on the modelling approach under IFRS 9.

Is it mandatory to build statistical models for portfolio having zero or few numbers of defaults in history.

– Loss Rate approach ? is it acceptable in such scenario ?

Hi Silvia ,

To calculate historical default rate we need to specify the payment period (same ageing but for payment )

but i think it need special system to manage ,how to calculate if system not support this method