How to account for free assets received under IFRS

The best things in life are free…

… at least that’s what Janet Jackson sang in one of her top hits.

However, when your company receives some free assets, then the question is:

Are they really received at no cost and no strings attached?

Is there something else behind?

Many years ago I attended the counting of fixed assets in one big manufacturing company.

It was a freezing December morning, huge piles of snow made it quite difficult to get around and we were sneaking in and counting various types of machines in the client’s storage.

One of my colleagues spotted some cooling units, new – still unpacked, and he could not find them in the document with the register of fixed assets, so he asked:

“ Why are these cooling units not recorded in the register?”

The boss of the warehouse, a bored grey-haired guy, murmured with the tobacco pipe between his teeth something like:

“Oh gosh. We did not buy them. We got them free when we purchased the machines.”

Sorry, I don’t remember now what machines they purchased, but I remember the discussion with the accounting manager that followed.

So what should you do in a similar situation, when you receive some free assets?

In this article I try to tackle this quite frequent issue and give you some hints.

Please note that this article is not about giving assets for free – for this purpose, please see here and here.

Before you start: Is it material?

You need to apply your judgment to assess whether your free asset received is material enough to bother.

For example – when you receive pens, lighters or other promotional materials, they might not make any difference in your books, so just don’t worry about their accounting.

The same applies in a multibillion dollar company that pays monthly telecom plans for their 100 executives and receives 100 mobile phones at no cost from the network provider.

Is their aggregate amount material?

If not, just don’t bother.

If yes, continue reading.

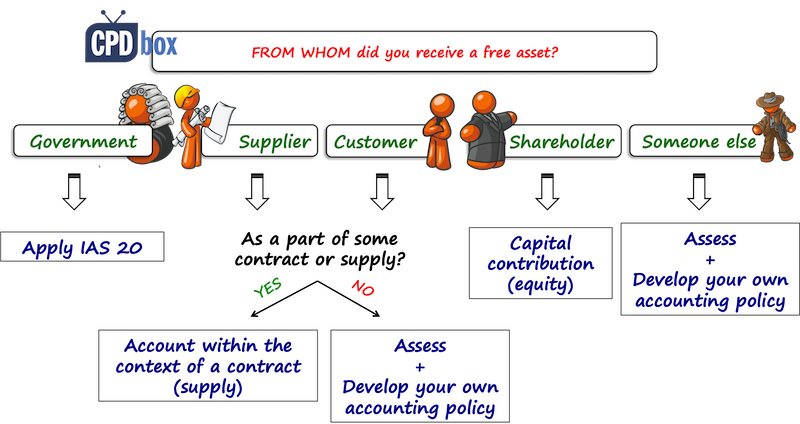

The starting point: Why did you receive your free asset?

Let’s say you received a significant asset.

For example, some piece of equipment, free land or something like that.

The first thing you need to examine is why and who the donor was.

What is the substance of this transaction?

Even more important: Whom did you receive the free asset from?

The accounting treatment will then depend on your answer.

Let me analyze a bit here.

#1: Free asset from government

What counts as “a government”?

Besides government, also government agencies and similar local, national or international bodies count as “government” for the purpose of IAS 20.

So, even if you received your grant from IMF, EU, WHO or similar organizations, you need to follow IAS 20.

#2: Free asset from your supplier

The question is: Did you receive a free asset as a part of some contract, together with the purchase of something else?

If yes, then you might need to allocate a part of total purchase price to the “free asset”.

Example: Free asset from a supplier

Let’s say you enter into a contract with a supplier to acquire 3 big pieces of machinery and the contract says that the total price is CU 3 000 for those 3 pieces (CU 1 000 each).

And, the contract says that the supplier will deliver also a cooling unit (=separate asset) at no additional cost.

A big mistake that many companies make is that they do not recognize a free asset at all.

However, the Conceptual Framework for Financial Reporting asks you to report any asset that you control.

Thus, it is a misstatement if you ignore your free asset, you use it – but you do not show it in your financial statements.

So what to do in this case?

Well, you should measure the free asset – a cooling unit in this case – at its cost.

The total cost for 3 machines and 1 cooling unit is CU 3 000, so you should allocate this total purchase price to all assets based on their fair values, or current selling prices if they are new.

Let’s say that the similar cooling unit trades for CU 300.

Then the total of selling prices is CU 3 300 (3 000 for machines and 300 for cooling unit).

Thus you allocate CU 909 to each machine (= CU 1 000/3 300 * 3 000) and CU 273 to the cooling unit (= CU 300/3 300*3 000). Total allocated cost is 909*3+273 = CU 3 000.

Now, many might think that it is not OK since the cost of one machine is CU 1 000.

Well, the standard IAS 16 says that the cost is the purchase price less discount and “free” cooling unit is a sort of a discount, don’t you think?

Another case of free assets received from suppliers is when you receive an asset as a gift for your long-term loyalty or a support of a promotional campaign.

For example, a supplier might sponsor the renovation of your shop and display area.

In this case, it would be very hard and impracticable to allocate a part of purchase price of other products to this free asset.

Therefore, you need to adopt different solution. Just go on reading.

#3: Free asset from your customer

If yes, then you might need to apply IFRS 15 Revenue from Contracts with Customers and assess the situation carefully (IFRIC 18 applied in the past).

In this case, when you receive a free asset from your customer within some contract, is it considered as non-cash consideration.

The article IFRS 15.66 requires including the fair value of non-cash consideration in the transaction price.

Example: Free asset from customer

Let’s say that you enter into a contract with a manufacturing company to process some wood for their one-off project.

You agree that you will use the client’s wood processing machine.

The contract specifies that the price for the wood processing is CU 1 000 and you can keep the machine (since the client will not need it anymore and it is not new).

Let’s say that the fair value of a machine is CU 300.

Thus your transaction price is CU 1 300 and you will recognize the machine at its fair value of CU 300 (it then becomes machine’s cost) at the moment when you gain the full control of a machine.

When that happens?

It depends on the specifics of the contract – sometimes it may happen right in the start of executing the contract (e.g. you take the machine to your premises and work there), sometimes it may happen in a different time (e.g. when you can use the machine only at your client’s premises and take it only after the contract is executed).

If you receive a free asset from a customer outside any contract, then again, you need to find a different solution. Read on!

#4: Free asset received from your shareholder

We can regularly see big transfers of various types of assets, including machinery, lands and sometimes buildings from a parent to its subsidiary.

In this case, if you gain control of an asset, you should recognize it at fair value – which becomes its cost.

As this is a contribution from shareholder, you should NOT recognize it as an income in your profit or loss.

Conceptual Framework strictly excludes contributions from shareholders from the definition of income.

Instead, the shareholder increases its investment in a subsidiary and a subsidiary shows the receipt of a free asset directly in equity as a capital contribution from a shareholder.

#5: Free asset received from other parties

You can receive a free asset from anybody as a gift, with no strings attached.

One example comes to my mind from the past: a hospital receiving USG and other machines from a cancelled hospital at no cost.

In this case, you need to develop your own accounting policy, because IFRS do not contain any guidance on how to do it.

And, I would say that this applies also to free assets received from your suppliers or customers where it is impossible or impracticable to match these free assets with any contracts.

We need to develop the accounting policy based on the similar rules in other standards and the Framework.

What are the closest similar rules?

Yes, you guessed it – the standard IAS 20 that applies for government grants.

Let me give you a few considerations here:

- First of all – you need to show assets that you control. I have already wrote that above.

- Secondly – as you have no cost, the fair value concept applies here.

- You should not show the receipt of your free asset directly in the equity because it does not come from your shareholder.

Analogically, IAS 20 strictly prohibits accounting for grants straight in equity, so we should be consistent with this rules when forming the accounting policy in this case.

Now, this is the hardest part – how should you recognize the free asset that you received?

In other words – what is the credit entry?

Here, I would show the credit entry as income in profit or loss.

Not the revenue, because the revenue comes from ordinary course of business.

The journal entry looks something like that:

- Debit PPE – asset: fair value

- Credit Profit or loss – other income: fair value

Why not deferred income with subsequent amortization of a deferred income in profit or loss?

OK, I know that it is the treatment required by IAS 20 for government grants, however:

In this case, there are no strings attached in a sense that you do not have to hold the free asset and use it.

You do not have any conditions attached to the receipt of a free asset, right?

Therefore I believe that the receipt of your free asset indeed represents an increase in your net assets at the moment when you receive the asset and your financial statements should reflect that increase.

If you recognize your free asset in deferred income (liability in the balance sheet), then you are not showing the increase in your net assets.

Also, someone might argue that you are not in line with matching concept because you are not matching the income (receipt of a free asset) with the expenses (its depreciation).

Well, let me explain that IFRS do NOT contain anything like general matching concept – not at all.

But, IFRS tell you to recognize expenses when the relevant service or asset was consumed (thus together with the depreciation).

Also, IFRS tell you that the income “is recognized in the income statement when an increase in future economic benefits related to an increase in an asset or a decrease of a liability has arisen that can be measured reliably” (see Conceptual Framework).

Thus it is perfectly OK and in line with the Conceptual Framework to recognize an income from the receipt of a free asset when it is received and not over its useful life with amortization.

Why is it different from the treatment of government grants under IAS 20?

Well, exactly as I wrote above – government gives you grants (free assets or cash) for some purpose.

In most cases, you need to meet certain conditions to get the grant and afterwards.

Therefore receipt of a free asset from anyone else is different, especially if there are no strings attached.

BUT!!!

If you receive free asset from an entity other than government and there ARE conditions attached to it, then of course, IAS 20 treatment (via deferred income) is more suitable policy choice in this case.

Any questions or comments?

Please let me know below – thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Slyvia, Many thanks your great effort for this article. It covers all the perspective and possibility.

hi, Sylvia

Would you kindly assist with cost of inventory donated to the organization and passed to third parties (Users) such as HIV test kits at nil.

Hi Silvia,

How about if the free asset was a donation to a church. That can be treated as a donation right

Hi Silva, I have a question related to the free contribution in cash by a shareholder. I understand it should be treated as equity (capital contribution). Do you which IFRS applies to this case. Many thanks for your valuable comments, best regards Isabelle

Hi Silvia,

I have a question: What if the shareholder of the company (which is a parent company) is transferring its assets (that has a nil net book value) to its subsidiary. How would you account for that? Do you need to determine its fair value at the time of transfer?

Hi Silvia I have a question: One shareholder gives free to its subsidiary, land for a period of 5 years, during which time the sub-subsidiary will use the land in agricultural activities, at the end of the fifth year, the subsidiary may return the asset or renew the contract for the same period. Monthly the subsidiary will bear the operational expenses and the land taxes will be paid by the shareholder. It seems that this is a capital contribution, what is your criteria? Should the shareholder register the land in accounting records?

Hello Silvia.

Thank you for all the endless knowledge you provide through this program. I really appreciate.

Please I need your assistance with the treatment of this transaction.

LG company gave my company some set of TV in 2019 though it was like barter transactions then because we also gave movie vouchers in return to their customer. But the agreement is that at the end of two years the TV would be ours , so how would i capitalize this TV into our asset at the end of the two years without knowing the value???

Hi. How we should record the equity investment made by the holding company.Further, how we should disclose it in the financial statements of the company who receive the assets?

Hi Silvia. Great article.

Supplier of equipment gives us machine to use for 7 months for free (trial period). If we are satisfied with the machine, there is an option to buy it after the 7m period. How do we account for the machine on acceptance?

Thanks

Hi silvia. thats helpful. But what will be the treatment for assets acquired free of cost and we are not going to spend a single penny on that.

regards

Why not capitalize the fixed asset by crediting Capital a/c

The value is earned not as a result of transactional activity or interest or something

I feel it should be capitalized at its fair value thi

Hello, Silvia. Which IAS regulates contributions from shareholders?

Hello, specifically none, but there is a mention in IAS 1.

Hi Silvia,

Is it allowed for a shareholder (say a Parent) to provide additional capital to its wholly owned subsidiary on credit? Cash outlay will happen in series of payments within one year based on the agreement between the Parent and Subsidiary. Hope you can help me determine which accounting standard I should refer to for this (Purchasing an investment thru a liability instead of an outright cash)

Thank you very much in advance for your help.

Hi Mariah,

if I understand it correctly – the parent signs up the new shares in subsidiary and will repay them in instalments? If that is legally possible in the local legislation, then of course, it must be possible to treat this correctly in the standards. There is no specific IFRS except for IFRS 9 treating the liability side, so the entry would be just Debit Financial Assets (rec. to shareholder) and Credit Share capital (unpaid). S.

Dear Silvia,

May i know what the proper treatment for free asset give by government to the company without any condition need to fulfill. For example government pay to vendor to buy the train, then goverment giving the building for free to the company. How company need to treat their double entry which is follow IAS 20 or use your method which is by crediting the income?

In other perspective, how the company should treat their asset which is full amount of asset (lump sum) or by stages/percentage like work in progress treatment?

Thank you in advance for your assistance and clarification towards this dilema.

Hi Nukman,

well, in this case, you apply IAS 20 as shown in this article and the video.

Dear Silvia,

Thanks for your thorough explanation. I have a question, A parent company leased a property for a subsidiary, then every year, the parent company exempts the subsidiary from the rent.

what is the best journal entry for this case. In addition, which standard mentions such case?

Thanks

Dear Silvia,

Thanks for your article. My example is as follows. Entity A has a contract to provide monthly services to Entity B. As part of the contract, Entity A also provides a credit fund to Entity B, to use to purchase Office equipment (note the contract specifies this cannot be used to reduce monthly services charge and can only be used to purchase equipment). Can you explain how Entity B would account for the credit fund received and then the entries to record purchases made using the credit fund?

Dear Silvia,

Thank you for your sharing. If assuming the company received free asset (vehicle) from customer, on the debit site (debit site), what is next for the asset value? Is depreciation needed?

I have a lease agreement for 5 years and the Landlord will provide the renovation and participate in the furnishing of the unit Say for $10000. I will normally depreciate the assets over the life of the lease. Does it make sense to account for revenue in year i for 10K bad depreciate the asset over 5 years. Or do the matching concept and accordingly effect on the P&L is Nil and the same with the BS.

When My Organization received grants land .Then Accunts enty , Land Purchase Dr, Fund Accounts Cr.

My Donors say this Accounts enty Fund head not Accept . You are right enty solved

If the condtion of the grant is not satsfeid Dr land cr differed grant income. And amortize the deffred account based on the periods requred to satsfy the condtions.

Hi Silvia

Ethiopian Electric Utility wholly Owned by government ,if the government is donated any amount CU to the company with specific attached condition. How can we account this kind of transaction? is it government grant or not?

Yes, it seems so. IAS 20.

Hi Silvia!

Regarding the #1 case, what happens when the price of the PPE is insignificant (symbolic, say 1$), and very general strings are attached (like taking care of the PPE)? IAS 20 applies, right?

As general rule IFRSs are only applied for material events.

Dear team,

Entity A and B are both government Agencies. Entity A procures equipment worth USD 398,618 for entity B. Note: All costs of procurement are kept in the books of A. How should B account for the equipment in its Books?. which Standard should guide this reporting?

Dear Silvia,

A quick question. Entity A is owned by Matthew and Entity B is also owned by Matthew. Entity A wants to transfer an asset worth $100m to Entity B in exchange of shares in Entity B. So now, first off, can we transfer the asset at Fair value (which is currently $150m)? and transfer the relevant number of shares to Entity A? And also, assuming the investment is less than 5%, will IFRS 9 apply or can we equity account it under IAS 28? Thank you so much in advance

Fantastic and very logical explanation.. Thanks a lot Silvia.. ?

Hello Silvia. Thanks for the wonderful articles you continue to provide on IFRS. They are very helpful to me.

Could you please help address this issue:

My company has a policy in which it allows some employees to own company’s cars after specified period. Our vehicle depreciation policy is three years, so when a car is assigned to an employee, the employee makes monthly payments that amount to 50% of the cost of the vehicle over three years. The cost of maintenance is the employee’s responsibility, but the company underwrites the cost of insurance and annual vehicle registration. At the end of three years, and after the full payment of 50% of the vehicle price, the employee takes ownership of the car. What is the best way to account for all of this?

Thanks and stayed blessed

Hi Soko, well, that’s off topic – however, this is an employee benefit and you should really look to IAS 19 and show all expenses related to the car given to employee as to an employee cost. S.

Great article

Hi. My question:

Shareholder gives interest free loan to the company – 800,000 CU. So we discounted this loan based on market rate and find out that Fair value of this borrowing is 700,000 CU. Finance cost for the year is 10,000 CU.

1. Do we recognise this fair value gain at inception through OCI?

Discounting:

Dr Borrowing 100,000 CU (Balance Sheet)

Cr Remeasurement of payable to shareholders 100,000 CU (OCI)

Unwinding:

Dr Finance cost 10,000 CU

Cr Borrowing 10,000 CU

2. As this interest (100, ooo CU) is “gift” from shareholder, should we consider this as capital contribution and recognise in equity?

3. What about realised Finance cost? Is this cost should be reclassified to Retained earning and recognised in PL. Or this is should decrease our capital contribution?

Thank you very much,

Hi Tofiga,

intercompany loans are covered in this article, I think you will find your answers. S.

Hi Silva, thank you for the insight shared.

I thank you for this great knowledge shared. God bless you abundantly.

Great article Silvia! Thanks for your guidance. May God almighty help you to guide us in more & more complicated accounting system and for the coming generation you will be an asset.

Most of the time you don’t recommend any clear accounting treatment for free assets.always keep rooms to judge the best treatment. This may lead to irregularities in accounting.It violate the consistency of financial informations.In Sri Lanka this is going to be a big issue.because we treat IFRS adjusted profit for income tax calculation.Also free assets adjustments have not been considered even.

Thank you for the comment. Yes I agree with you – my aim was to present my opinion on this matter, give some guidance and try to justify it with the current IFRS rules. All the best!

Nice article. I have always wondered if there was a best Accounting practice to account for free assets. As far as coming up with your own policy goes…….How does this sound?……Dr Asset and Credit a Provision Account; charge no depreciation, and net off the Asset and the provision in the Balance Sheet

Why provision? By definition, a provision is a liability of uncertain timing and amount. In this case – I don’t see any. S.

Great article Silvia! Not many people give guidance and insights like you do.

Thanks Silvia.

This is right on time for me as i have the same issue at hand currently. However, in relation to gift received from shareholder, is this to be accounted for as part of Share Capital or under where in equity?

Hi Abayomi,

that precisely also depends on your legislation, e.g. in some countries the share capital can equal to the amount officially contributed via some commercial court or register. Capital contribution reserve would be OK.

Thank you.

Thanks for your wonderful contribution and explanation of the said point over here.

Really amazing how easy you make things look.

Hello Silvia,

Nice write-up.

Please, how do you consider a shareholder using his/her motor vehicles for personal and official use.

The company keep the vehicles in her assets register, depreciate, does repairs and maintenance?

Thanks

That’s more the tax problem 🙂

This is similar treatment of benefit in kinds (BIK) in taxation. Are the vehicle is being put to personal use. I think full depreciation, costs of repairs and repairs should be charged to P&L of the company. However, for the purpose of taxation, they will be disallowed (thus added back) before arriving at taxable income. But i need to know if Benefit in kinds are taxable under the UK tax system?

Thanks, it was very helpful as all your articles.

hi Silvia

first of all i would like thank u for your valued effort , i have a case in my company that we receive free qty of purchased items 2% as awarranty , meaning that part of it will be used to replace deffective units , what i did is i distribute the total amount of invoice over all units including free cost units , hence cost of units is reduced instead of adding them with zero cost as suggested by one of my colleagus , what will be the right action in this case

I think I covered this case in the article above 🙂

Thanks Silvia, it was really insightful

Vehicle Purchased from ABC Motors for AED 250K/- but in the books of accounts the payment made against the purchase is only AED 50K/- and balance payable is AED 200K/-. The balance was paid by the promoter from his own account. Shall I add AED 200K debit and other income AED 200K?

Good question… you should really read the article and try to decide yourself 🙂 Normally, if you paid something for the asset, it has its cost and you should show it net of discount. Again, you should really assess what’s the substance of the discount and decide.

Dear Silvia,

For the land & buildings received from the company’s shareholders for free, could the credit balance be included in the “Fair value Reserve” rather than the “Capital Contribution” in the statement of equity?

Hi Silvia

Thanks for your nice clarification

Dear Silvia,

What if we have an office in Port Yard where we dont pay any rent. No lease agreement in place since this office was obtained based on the relationship with the port authorities. Our staffs are sitting in the same port office and having other company assets such as computers , laptops etc as all these are capitalised in the books.

Please advise how you will report the office as no rents paid out ? Also based on IFRS or IAS ?

Dear Anoop,

this article is about assets received for free, not the free services. Is the port authority related party? Then you should at least disclose the fact in your financial statements. S.

What about if a donor give you some furniture and fixture along with cash for a specific project e.g. school opening.

If that’s for specific project, you can select the same principles as in IAS 20 and make it your accounting policy.

First of all i would like to thank you. Then i have question. what can we do if the share holder that gives an asset for free is not volunteer to see his free contribution as a capital contribution

Hi Muhammed – sorry, I did not understand the question. Is not volunteer? Can you please reformat the question?

Thank you silvia, I understand his question as the shareholder does not want his free gift to be counted as capital contribution by him.

Oh yes, I see. Well – I don’t think that the application of IFRS, and event the development of your own policies under IFRS, depends on the shareholders’ wishes. All the best! S.

Silvia mam, a Company’s inventory were damaged due to fire and such inventory was collateral against a loan and now one of the sponsors pays the bank in cash and now want to offset inventory loss with his contribution as other income and dont want to increase its equity.. is there any possibility to do that or not? i know your answer is no but is there any way we can do that.

As always great insight. Just, thanks a lot!

Dear Silvia,

What if I receive inventory at no cost? Say I received CU 80k (fair value) inventory at no cost and sold it for CU 100K. Should I recognize 20K operating profit for that in this case? If yes, then what to do with my COGS (does it really mean that my COGS was 80K considering that its actual cost was zero? What`s the logic behind that)?

Thanks in advance.

Hi Sahib, in fact, you will still recognize the operating profit of 100… the first time when you accept inventories for free (80K) and the second time when you sell it (20 K). However with inventories I’ve seen more ways of doing the things. I would do as I described in #5: when you receive inventories then Debit Inventories 80, Credit Profit or loss 80; When you sell them: Debit Cash 100/Credit Revenue 100, Debit COGS 80/Credit Inventories 80.

If the free inventory received was as a result of bulk purchases (leading to free extras). Is it not better to apportion the cost to include the free inventory (similar to the treatment of free assets from suppliers)

Yes sure – please see above, I tackle this point in the article. However I understood that Sahib is talking about completely free inventory when no other transaction occurs.

Yes, Silvia, I was talking about completely free inventory.

Thanks for your time and answer.

Hello Silvia,

I am thinking that since the company will not incur cost on the inventory, there is no need to recognise COGS. But the company should debit inventory 100 and P/L. When it is sold, Dr Bank and Cr Inventory. I stand to be corrected

Hmhm, I am missing the Debit to cash account here 🙂 So how would you like to account for cash received for sale? 🙂

Hi Sylvia,

Thank you, it really helps

Dear Sylvia

what about recording the asset as a non-distributable reserve (instead of other income under #5)?

If it is received from the equity participants, then yes. In other case – no. I would be consistent with IAS 20 in this case and IAS 20 strictly prohibits accounting for grants directly in equity. This is analogical. As I’ve said – this is just a draft of one accounting policy, for me the above seems most logical, but yes, I acknowledge that someone might have a different opinion.

Quite helpful, thanks!

Hello Silvia,

I’m looking for a documentation about solvency 2 and IAS 39

Could you please send me a documentation on my email mansourhabibou@yahoo.fr

Best regard,

Mansour

In non-profit business, computers and some equipment are included in the budget line, and they recorded these as an expense for the project. but some donors donate those computers and equipment to the entity after the project is ended.

How should these free assets from donors be recognized?

Thanks, advance