How to account for financial guarantees under IFRS 9?

A financial guarantee is a specific type of a financial liability defined in IFRS 9.

It arises when an entity backs up a loan or debt taken by another entity and it often happens among the companies within one group.

And, as it is intra-group, there is often no premium paid by the debtor to the party issuing the guarantee.

I received a following question related to this topic:

“Hi Silvia, we have a subsidiary in a foreign country and the subsidiary needed to take a loan.

The bank provided a loan, but we, the parent company, had to guarantee that we would pay the debt in case if our subsidiary fails to pay.

Our auditors say that we have a financial guarantee under IFRS 9 and we should account for it. But how?

Also, we issued a general guarantee to support our subsidiary in case of the negative equity – should we also account for this guarantee?”

IFRS Answer: What is a financial guarantee?

IFRS 9 Financial Instruments defines the financial guarantee as a contract that requires the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payments when due in accordance with the terms of a debt instrument.

Therefore yes, you have an issued financial guarantee contract here because you as a parent agreed to reimburse lending bank just in case your subsidiary cannot pay.

And yes, your auditors are right – you have to account for this guarantee somehow.

Before I explain how, let’s take a look at the general guarantee to support your subsidiary in case of negative equity.

This is NOT a financial guarantee under IFRS 9, because it is NOT specific, you have no specific payments to make and this type of guarantee can cover pretty much anything on top of the debts.

Financial guarantees: Initial recognition and measurement

Initially, you need to recognize an issued financial guarantee at fair value.

That’s the basic measurement rule in IFRS 9.

What’s the fair value of such a guarantee?

It depends so let me give you a few hints.

Normally, when you issue a financial guarantee to the third party, not intragroup, then you would charge some premium for the guarantee, some fee for issuing that guarantee – and in this case, that would be the fair value of it.

Often, the guarantee is issued intragroup at no fee, like in today’s question.

In this case, we have to apply some alternative methods in line with IFRS 13 Fair value measurement.

For example, you can measure the benefit for the debtor as a result of that guarantee.

What interest rate does the debtor pay with the guarantee?

And, what interest rate would the debtor pay without the guarantee?

If the debtor pays 5% with the guarantee and the market interest rate on unguaranteed loans is 6%, then the fair value of the guarantee is the present value of the difference in interests charged on guaranteed and unguaranteed loans.

What are the journal entries?

Just as a short illustration, let’s say that you received a premium of CU 1 000 for issuing a financial guarantee for 5-year loan. The journal entry is:

- Debit Cash: CU 1 000;

- Credit Liabilities from financial guarantees: CU 1 000.

If you haven’t received any premium, then you:

- Debit Profit or loss: The fair value of your guarantee;

- Credit Liabilities from financial guarantees: The fair value of your guarantee

.

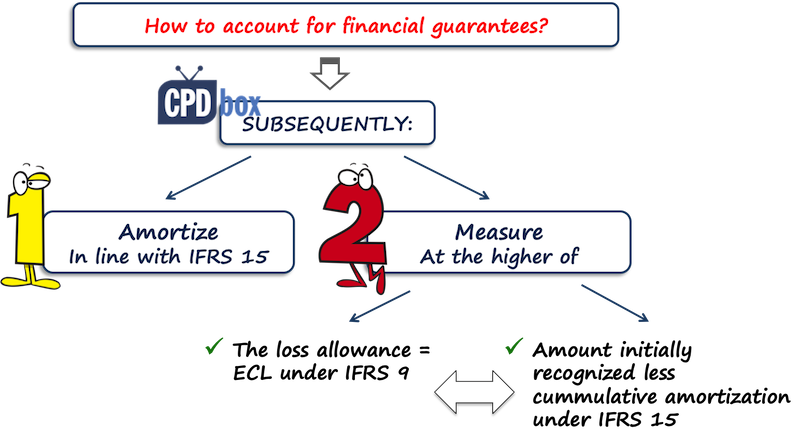

Financial guarantees: Subsequent measurement

First of all, you need to amortize the amount of your financial guarantee in line with IFRS 15 Revenue from Contracts with Customers.

In most cases, you would do it straight-line over the term of the loan.

And then, IFRS 9 prescribes to measure the financial guarantees at the higher of:

- The loss allowance determined as expected credit loss under IFRS 9 and

- The amount initially recognized (fair value) less any cumulative amount of income/ amortization recognized in line with IFRS 15.

Here, you have the challenge to determine the expected credit loss on the amount borrowed by your subsidiary.

So you would need to:

- Determine at which stage the loan of your subsidiary is – stage 1, 2, 3; and then

- Calculate the expected loss allowance as either 12-month expected credit loss or lifetime expected credit loss depending on the stage of the loan.

I wrote a few articles about expected credit loss on my website, there are nice explanations of ECL inside my IFRS Kit, so you might want to check that out.

On the other hand, you need to compare the amount of the expected credit loss with the carrying amount of your financial guarantee – which would be the initial fair value less any amortization:

- If the ECL is lower than the carrying amount, then you are all fine.

- If the ECL is higher than the carrying amount, then you need to revalue the financial guarantee and book the remeasurement in profit or loss.

Illustration: Subsequent measurement of financial guarantees

Let’s get back to our financial guarantee of CU 1 000 on 5-year loan.

You would amortize it straight-line over 5 years (just for simplicity) and the entry would be:

- Debit Liabilities from financial guarantees: CU 200 (1 000/5);

- Credit Profit or loss – Income from financial guarantees: CU 200.

Then you would need to determine the expected credit loss on the loan that you back up.

Let’s say the loan is OK, no significant increase in credit risk, so the expected credit loss is CU 500 (just making this up).

Your carrying amount is CU 800, the ECL is 500, so you keep measuring the financial guarantee at 800 as this amount is higher.

If the ECL on the loan is let’s say CU 1 200, then you would need to book the difference of 400 (which is ECL of 1200 less carrying amount of 800) in profit or loss.

Here’s the video summing up the issue:

Any questions or comments? Please let me know below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

79 Comments

Leave a Reply Cancel reply

Recent Comments

- Nayert on Example: How to Adopt IFRS 16 Leases

- Jesslin on How to calculate deferred tax with step-by-step example (IAS 12)

- philip on How to present restricted cash under IFRS?

- Stephan on How to Account for Spare Parts under IFRS

- Bamikole Sikiru on IFRS 10 Consolidated Financial Statements

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia

Thank you, this has been very helpful. The example and illustration used cover the treatment of a financial guarantee from an issuer perspective.

Can I please understand how the same would be accounted by the holder (i.e. the recipient) of the guarantee. Would the holder account for this at FV on their balance sheet, or will the guarantee be off Balance Sheet and only considered for ECL calculation purposes on the underlying debt it is intended to cover. Thanks

The holder of a financial guarantee usually does not recognize it on the balance sheet. It’s treated as an off-balance sheet instrument, but the effect of the guarantee is considered when assessing ECL on the underlying asset under IFRS 9.

Dear Silvia, please explain how to account for Letter of Credit facility given by the Owner of the Company under IFRS 9?

Hi Silvia,

Here’s a situation and my question. A parent company guarantees collection of a receivable owned by the subsidiary. The party who owes the receivable defaults and the parent company pays the subsidiary for the balance of the receivable. The subsidiary still has the right to collect the receivable from the original party who owed it. What does the subsidiary credit when it receives the money from the parent? What does the parent debit when it pays the guarantee?

Hi Beth,

here, we are talking about IFRS 9, and so primary thing you should do is to look at the contractual terms of that arrangement between the parent and the subsidiary. What does it say about rights of each party after the parent pays and subsequently, the debtor pays, too? In other words, how are mutual rights and liabilities settled/extinguished? Does the subsidiary have an obligation to transfer the money back to the parent after the original owner pays? So, I cannot give you the definitive answer here, but in general, usually when the guarantor pays, it is its loss in profit or loss. And as for the subsidiary, the question is if the subsidiary has the right to derecognize the receivable to original debtor and recognize the receivable to the parent – which I don’t know since I cannot see the contracts.

Hi Silvia,

Can you please reconfirm if Profit and loss needs to be debited rather than directly to equity. As in cash of Intragroup that would be treated as a common control transaction?

If you haven’t received any premium, then you:

Debit Profit or loss: The fair value of your guarantee; or Debit Equity

Credit Liabilities from financial guarantees: The fair value of your guarantee

Hi Silvia,

Please, is it possible to have detailed journal entries for Financial Guarantee.

Third party guarantees plausibly are like

Debit: Profit and Loss 1 0000;

Debit Cash: CU 1 000;

Credit Liabilities from financial guarantees: CU 11 000. Amortize every year & recognize revenue from Premium received.

For subsidiary

Debit Profit or loss: The fair value of your guarantee; 10 000

Credit Liabilities from financial guarantees: The fair value of your guarantee 10 000. If impairment occurs,

Debit Liabilities from financial guarantees: The fair value of your guarantee 10 000

Credit Cash/Bank 10 000. There won’t be anything to amortize.

If Parent company had issued financial guarantee contract on behalf of its subsidiary to a bank and receiving quarterly premiums over the term of loan rather than one of payment. Can you please illustrate how this transaction would be treated in financial statements of Parent Company.

Hi Silvia. Thank you for the very informative article.

I was wondering if you could please assist me with a question. Assuming the same fact pattern as you used above and that the financial guarantee contract was at fair value. However, the parent (guarantor) agreed with the subsidiary to receive a monthly premium instead of a once off premium upfront. Would the journals below be correct?

1- Initial recognition:

Dr Financial Asset CU 1 000 (i.t.o IFRS 9)

Cr Financial Guarantee Liability CU 1 000 (i.t.o IFRS 9)

2- Subsequent measurement – end of month 1:

2.1- Account for the unwinding of interest on the financial asset and the receipt of the monthly premium (assuming a monthly payment of CU 10, and interest income for the first month amounting to CU 3):

Dr Bank CU 10 (IFRS 9)

Cr Interest Income CU 3 (IFRS 9)

Cr Financial Asset CU 7 (IFRS 9)

2.2- Subsequent measurement of the financial gurantee liability:

Dr Financial guarantee liability CU 16.67 {being the straigh line amortisation of 1000 over 60 months} (IFRS 9)

Cr Income from financial guarantee CU 16.67 (IFRS 15)

Hi Silvia,

I work for a unique organization where the deposits of citizens in banks are “insured” by my organisation. In essense, we pledge to repay the depositors a stipulated amount in case the bank fails, much like the FDIC. Although it is called insurance, I feel that it is more of a financial guarantee and should be accounted for under IFRS 9. However, there is debate to apply IFRS 17 as this comes into effect in January 2023, although I feel we fall outside that scope. Can you assist me?

Hi Silvia – great web site. I believe in a parent/sub relationship a guarantee provided with at no charge would not be a charge to P&L in the books of the parent when recognising the financial guarantee liability but would be more appropriately represented asr an increase in the investment in the subsidiary. I believe this is consistent with the conceptual framework as it represents a contribution to sub for which it recognises not liability. Furthermore this treatment would be consistent with the treatment of off market loans between a parent and sub.

Thank you!

Hello Silvia,

It is probably obvious but would like to make sure. When we prepare consolidated financial statements that include the subsiduary to which we gave a financial guarantee, am I ok thinking that the parent’s financial liability for the Financial Guarantee will need to be reversed out. Thank you

Yes, eliminate it.

If a Guarantee Scheme offers Guarantees to SMEs who have no collateral to take out commercial loan. The Guarantor provides the Guarantee on the loan, should the loan be defaults.

The Guarantee scheme charges the Bank a premium fee of 1-2% on the loan.

The question now, is how should the Guarantee Scheme company recongise the receipt of the premium in its books?

Hi Silvia,

Here is a contract between two companies, and also a Bank Guarantee of 20 million is needed for it, therefore bank separated the amount from our bank account as Bank Guarantee. Now, how should we threat the guarantee amount, should it be under the Current assets or Fixed asset. (contract duration will be 1 year or more than one year)

Thank you in advance,

Hi Silvia!

Have found your note very useful and clear. But I am stuck! I have a financial guarantee on a note program which has no stated maximum term. Given the guarantee is irrevocable, I am thinking that I have to compute lifetime ECL into infinity!! It just does not make sense to me, but I just cannot think of an alternative.

Hi vic, without seeing the terms of the guarantee it is impossible to make a conclusion, but yes, if that guarantee still backs some assets up at the end of the reporting period, then you should measure it.

HI silvia

How do we account for a confirmed letter of credit opened by our firm in favour of a foreign supplier who has not yet supplied .

Thank you so much Silvia, your videos really help I had never come to grips with financial guarantees under IFRS 9, but this has made it really clear !

hi, silvia,

how do we value the performance guarantee ? for example: Co A aqcuire Co B in return for Co B giving a performance guarantee to Co A that 2 yrs later, the financial result will not be lower by more than 10% than the initial or first year?

Hi Silvia,

When the entity choices to designates the financial guarantee issued to fair value to through of profit and loss, does the entity continue amortize the guarantee and after “revaluate” it at end of period?

Thanks. Very good article!

Hi Silvia,

When the board of directors adopted a resolution accepting an investment banker’s offer to guarantee the marketing of $100 million of preferred shares of a company. This event is a non-adjusting event as it was suggested by the bank 2 months after the year-end. so what would be the impact/analysis of this event on the company’s financial statement?

Thank you,

Amir

HI Silvia,

if we received Performance bond/standby LC from a customer which covers the total credit exposure for that customer, shall we exclude it from the Aging while ECL calculation ? if it covers 50% only from the Aging for that particular customer, shall we include only the remaining 50% ? we are following the simplified approach.

Hi. I am working for a Tourism Development Fund. Part of our operations requires providing guarantees to Banks to finance the SMEs mainly for long-term loans. We will be charging a fee from the bank/customer for the same. So I understand that here the treatment would be similar as in the case of financial guarantee you explained above. However, I do not understand the ECL side of the same and recording the higher of ECL or carrying value.

Hi Syed, in general you are right, it seems that your guarantees issued would be financial liabilities. So if you provide a guarantee, you must watch the loan that you are backing up, i.e. the loan of that SME company. Is that SME company paying on time? Does it have any credit risk? You need to try to estimate ECL on that loan, because this is your risk, so yes, you must closely work with the debtor and monitor the loan.

We would like to discuss for our Capital Repayment Financial Guarantee Bond procurement with the consultant of IFRS 15 who probably has better understanding and conversant with the process.

Thank you for your anticipated co-operation and I look forward to your immediate response.

file:///C:/Users/DrZai/Downloads/WISE%20PACIFIC%20AGREEMENT%20SIGNED%20COPY%20DR%20ZAIN.pdf

Hello, I work in a bank and as per IFRS9 it is required to recognize ECL for different debt instruments including the financial guarantees we issued for our customers. My question is The guarantees are not off balance product and pricing is commission based – for example charge the customer 2% quarter commission. How can i calculate the EIR (Effective Interest Rate ) for it ?

Hi Rany,

well, financial guarantees are in fact your liabilities (if you issue them for your clients), not assets. So technically speaking, you are not recognizing ECL on financial guarantee. I assume that what you need to do is to recognize financial guarantee at the amount higher of its carrying amount (which should be its initial amount less accumulated amortization in line with IFRS 15) AND ECL on receivables/loans that you are guaranteeing. So you should be looking at underlying receivables/loans of your customers to calculate ECL on them in order to value your own guarantee (liability). I hope I understood the situation well and if you need more info, I have the full example and explanation in the IFRS Kit. Best, S.

thanks .. Silva

Good Day Silva, thanks for your simplified explanation as always. We have an arrangement where a subsidiary was set up to raise bond on behalf of other subsidiaries and the parent company and the subsidiary will then lend the proceeds to the related entities(including the parent) under terms that seek to mirror the terms of bond raised by the subsidiary with bond investors. The subsidiaries and the parent then provided a financial guarantee to the bond investors. How do you account for that financial guarantee given the scenario.

Hi Sylvia. Thanks you for the great article. I have a few questions on financial and general guarantees:

1. Is the day one fair value and subsequent measurement (higher of FV and ECL) applicable to general guarantees or is the measurement approach different?

2. For intra-group guarantees issued to prevent negative equity and where the guaranteed amount is unknown and where the party receiving any amounts is the subsidiary and not a 3rd party and, how is the guarantee calculated? In this case, there are no known cash flows but just a contract between a parent and subsidiary stating that the parent will support the subsidiary to prevent negative equity.

3. In the case of financial guarantees, to calculate the guarantee, does one need to consider the credit risk of the guarantor and if one needs to how should this be done?

Thanks you.

Joe C

Hello Silvia, Thank you for the amazing article.

Suppose, do you have any guidance for treatment in the books of Subsidiary for financial guarantee given free of cost by holding company to a bank as a part of loan agreement with the bank? Like, subsidiary needs to account the fair value of financial guarantee as “Other equity” and a corresponding notional asset to be created and amortised over the period of the loan. Is it mandatory to record these transactions to create a mirror image?

Well I don’t think that the received financial guarantee creates a financial asset.

Hi Silvia,

Does that mean a subsidiary having a bank loan with guarantee from its holding company is not required to recognise anything in its book?

Definitely it does not mean that. Subsidiary definitely must recognize a bank loan.

Hi Silvia,

although the guarantee received is not a financial asset however the fair valuation of the same is in substance equity and correspondingly the unamortised portion should be reduced from the loan to reflect correct loan facility at amortised cost

Hi Silvia,

Thanks for this incredible platform. I have a scenario where a client has purchased a bond that it tied to claims that may arise from customers in their day to day business. The bond does not attract any interest. After six months they renew the bond. How should this be accounted for in the financial statements?

Samuel, as the bond is tied to claims from customers, it implies that the cash flows from the bond are not solely payments of principal and interest, so in my opinion, the bond does not meet 2 tests for classifying at amortized cost and thus must be carried at fair value through profit or loss. However, the mechanics of the bond are unclear to me, so I cannot really say (but I assume it is an asset). It seems that you would simply recognize modification gain or loss from the bond at the point of its modification and then continue recognizing it at FVTPL.

Thanks Silvia. The client is in the engineering business. The bond was purchased in case their customer makes any claims for work they did. So after every six months when no claims were made the bank just issues a new bond certificate to them with the same amount.

Hi Silvia,

How would we classify a loan guaranteed by parent? Is it secured or unsecured from point of view of separate financials of subsidiary and from point of view of consolidated financials statement?

Thanks

Hari

Hi. Silvia

We asked from Bank to issue Guarantee to our supplier and we keep fixed deposit with bank to cover those bank guarantee . How can we do the accounting in our books.

Hi Selvia,

I am facing a case where foreign currency exchange is involved.

Appreciate if you can advise which exchange rate ( at inception historical exchange rate , or current exchange rate each quarter) shall be used on quarterly base to amortize financial guarantee

Hello Silvia

Which one of the following is a trigger to give a rise for financial guarantee liability: signing a guarantee agreement with the bank or drawing down loan? Sometimes these two events take place in different quarters. Should we recognize the liability right after signing a guarantee agreement with the bank or should we wait for the loan disbursement?

Hi Silver

What if a parent issues a guarantee to a bank for a loan issued to a subsidiary. But in the event of default no cash will flow but the bank will be reimbursed using the shares the parent holds in the subsidiary. I.E if a loss of 100 is incurred by the bank the parent will give shares equivalent to 100 if value of shares is lower no top up is required. Will this meet IFRS 9 requirements especially the “specified payment” requirement ?

Hi Silvia,

If our company owner is providing a guarantee from his personal account (Bank just only pledge his account for guarantee amount but not take any cash margin) to get and performance bond for company’s project how we will record this in our financials.

Hi Silvia,

Based on your example above on the parent providing a financial guarantee to its subsidiary for the bank loan, what happens to the capital contribution leg upon derecognition of the financial guarantee when the bank loan has been repaid by the subsidiary? It is measured in accordance with IAS 27 and IAS 37?

The capital contribution amount in the separate financial statements of the parent relating to investment in subsidiary can grow significantly if the subsidiary makes new borrowings, subject to impairment requirements? Would this make sense?

Hello Silvia, what about the case of the subsidiary? they have to account the finance guarantee?

Hello Silvia,

what will be the accounting entry for Claim settlement against Performance Guarantee provided to Customer? the Performance Guarantee was claimed due to contract is canceled on the last stage of the project. Please advise which account I should account the claim settlement amount.

Thanks in advance.

Hello Silvia, let’s say the parent company charges a guarantee fee to its subsidiary, How does the Parent company accounts for the FCG under IFRS?

Thanks in advance,

Alfred

Hi Silva,

Thanks for the information. In case if it is a SME company assisting another SME company. How will it be recognised from the side of the assisting SME company.

Hi SIlvia,

In this case I have doubts about the opposite case.

The financial entity has in its assets a sovereign debt instrument , and enters into a CDS contract with a financial entity for the same nominal and the same maturity of this bond.

At the beginning of 2018 on the basis of IFRS 9, the bond is recorded in the trading portfolio and the CDS aswell,

At the beginning of 2019 we want to apply to the CDS the accounting as financial guarantee under IFRS 4 and change the debt instrument of the trading portfolio to amortized cost.

Could you please confirm if it is possible to make this change at the beginning of 2019? In case the change can be made, how should I account for the derecognition of the CDS balance sheet to include it in off-balance sheet?

I am a parent provides guarantee to my subsidiaries on revolving credit, term loan and bridging loan. For example, I am providing guarantee of 100mil to my subsidiaries but, my subsidiaries might not be utilizing all the guarantee amount when the contract is issue. In this case, how should I measure the FV of the financial guarantee contract? Should it be based on utilization of the guarantee only? Or it should be based on full guarantee amount regardless of whether subsidiaries utilize the guarantee?

if I am charging fees to the subsidiaries based on the utilized portion only, does that means the FV of the liability should be based on the utilized portion only and not the full amount as the liability that I actually have is not the full guarantee amount but only the utilized portion by subsidiaries.

Hi Silvia,

If the financial guarantees provided by the Head Office Parent A to Subs B which lend money to Subs C (Subs B & C is 100% owned by Parent A), from Parent A consolidation financial statements, do we need to accounted the financial guarantees ?

Thanks in advance.

Well, since these are guarantees without involving any party within the group, then as an intragroup transaction the loans will be eliminated, the same as the guarantees themselves.

Hi Silvia

I have a company that obtained a loan from a bank to purchase some shares in a listed company.

The shares form a pledge to the loan facility provided by the financial institution. Does this relate to financial guarantees? If not is there any specific accounting treatment for this pledge?

thank you in advance,

HI Silvia,

The Company has provided a guarantee with 0 premium, but with monthly scheduled payment, which starts from the next month after signing the guarantee contract. Do this mean that at initial recognition the FV of my guarantee is equal to 0 and the ECL should totally recognized in my P&L.

Hi Silvia,

Good day!

How will be the accounting treatment in the books of the debtor, if it is the other way around, that is, the financial guarantee contract was issued to a non-related party? Please see details below:

> Hermes covered

> Bank pays the guarantee premium to Hermes

> The guarantee premium may be used to pay the loans

Hi

When the guarantee in on continuous Over Draft facility would the subsequent measurement be PVTPL.

Dear Sylvia,

I am currently involved in an IFRS 9 implementation project at a bank. Basis of our discussion with our consultants and auditors, I have noted that after applying the IFRS 9 provisioning concepts, our provisions under IFRS 9 has actually decreased compared to the regulatory guidelines specified by central bank/IAS 39, since we were required to comply with very stringent local provisioning policies.

I would appreciate your advice on how we can account for the ‘gain’ upon transition as currently all literature direct us to decrease in the retained earning, upon adoption of IFRS 9

1. Should we credit ‘all gains to our retained earnings only?

2. Can we credit to retained earnings subject to a limit (based on regulatory guidance) and allocate rest to non-distributable equity reserves?

3. What will be the deferred tax impact?

4. Any other adjustments required.

I would appreciate any guidance from you on the above issues.

Thanks.

Dear Cheshma,

this is off topic, please write me a message via my Contact form. S.

Provision based on IFRS 9 or provision based on local law, whichever is higher is to be considered for FS. Disclosures and calculations have to be substantiated.

In any case, all the other points would not arise.

Hope this clarifies.

Hello Hari KV,

I am also working on bank IFRS 9 and will need little bit advise.

Hi Zahir, sorry, we do not share personal numbers here to protect your privacy. We have our online advisory service https://www.cpdbox.com/my-helpline/ where we can give the professional advice to you and also, within a short time, all IFRS Kit subscribers will have the option to discuss inside the IFRS Kit with other users. S.

Dear Sylvia,

my company has a financial liability (loan) for which the assignment agreement has been signed, in which is specified that our customer will repay the bank loan in the name of the name of our company: The bank accepted our receivables for the repayment of the loan, so we assumed we are legally released from this obligation and recognized the original debt. We took over the However, if our customer does not pay when due the bank may seek payment from us. We got the bank confirmation, on which it stands that we are still the debtors, and not the customer on which are debt was assigned to (the bank accepted the assignment). so we are very confused what to do now.

We did not recognize any financial guarantee.

Kind regards,

As per my view, the continuing involvement provisions will be applicable in such case.

Hi Silvia,

Do you have worked examples how a financial services company would account for disposal of a portfolio for performing and non performing loans in the financial statements?

I agree that that would be very beneficial example, with alternatives if the purchase price of nonperforming loan’s portfolio is above/below carrying amount of the portfolio itself

Hi Silvia

Thanks for clarifying on the accounting of financial guarantees. If there is no fee charged to the subsidiary company and also if the subsidiary company has not received any benefits in interest rates I.e. there is difference between market interest rate and interest rate on loan issued financial guarantee. So in that will the fair value of the guarantee considered to be Nil?

What will be the accounting treatment in this case?

Then you must propose some alternative way of setting the fair value of a guarantee. That’s another topic though. S.

Dear Silvia, In the above example, after writing off 400 in profit or loss, does it follow that the “Liabilities from financial guarantee” will then come to 1200, and if so, shall we amortize 1200 over three years, assuming that the write-off of 400 occurred at the end of the second year, and that there are three more years for the loan to go before its full repayment?

Hi Edmund, no, you need to compare original amount of 1 000 amortized to date and ECL at the reporting date.

I think the journal entry for the excess $400 is as follows:

DR P&L-Impairment loss on loan $400

Cr Financial guarantee liabilities $400

To record the liability at the amount of the loan loss allowance ($1,200 ECL – $800 Financial guarantee CA)

Hi Silvia,

How do we account for the gaurantee if the bank in the subsequent Financial year has withdrawn the requirement of the guarantee?

That depends on the contract related to the guarantee and what it says about its withdrawal/settlement.

Hi Silvia,

Thankyou for making this podcast on Financial Guarantee.

However, I have one question.

Should we account for a performance bank guarantee that a bank has provided on our behalf to another company. Or should it be only recorded by the bank as financial guarantee and we shall only make disclosure of the same?

Hi Suman,

well, performance bank guarantees, in other words – performance bonds are contracts that meet the definition of the insurance contract under IFRS 4, so they should be accounted for under IFRS 4.

Hi Silvia,

Pleases explain further on accounting entries that need to be made/ or journal to be passed when a bank provides on our behalf to another company a performance bank guarantee.