How to Prepare Statement of Changes in Equity under IFRS 18 (with excel and video)

As the new IFRS 18 has been adopted, it might bring a bit of turmoil to some accountants who might need to change the structure of their accounts to adjust to the new requirements.

The good news is that the rules for the statement of changes in equity did not change, when compared to the older standard IAS 1 Presentation of Financial Statements.

In this lecture, you will learn:

- IFRS 18 rules for presenting the statement of changes in equity;

- Practical example solved step by step;

- The excel file and the video lecture with the example

Statement of changes in equity in line with IFRS 18

As a minimum, the statement of changes in equity must contain the following items:

- Total comprehensive income for the period, showing separately amounts attributable to owners of the parent and to non-controlling interests.

If you are preparing the individual, or separate statement of changes in equity for a single entity, then the total comprehensive income will be fully attributable to the owners of that entity.

The split info the owners of the parent and non-controlling interests applies only in the consolidated financial statements for the group. Just to make it clear. - The effect of retrospective application or restatement for each component of equity (if applicable).

So, if you corrected some material error in the equity, or applied some accounting policy retrospectively in line with IAS 8, then this effect is reported separately.

This is NOT seen as a change in equity; rather this is seen as the restatement, therefore it is secluded from the other parts. - The reconciliation between the carrying amount at the beginning and the end of the period for each component of equity.

Here, the following changes shall be disclosed separately:- those resulting from profit or loss

- resulting from other comprehensive income

- resulting from transactions with owners (contributions, distributions and changes in ownership).

The best way to do that is in the table format, showing individual components of equity in the columns, and individual transactions in rows.

Also, IFRS 18 prescribes to present amount of dividends recognized as distributions and the related amount per share on the face of the statement of changes in equity or in the notes.

Let’s see the example.

Return to top

Example: Statement of changes in equity

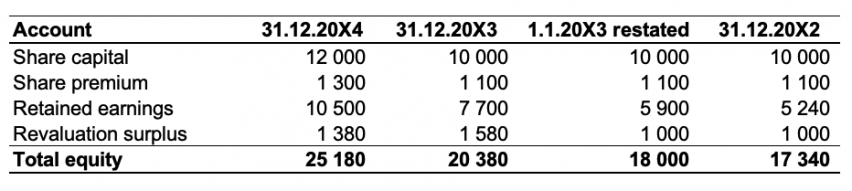

JBC Plc.’s balances on equity accounts were as follows:

During 20X3, the following transactions occurred:

- Change in accounting policy resulting in restatement of retained earnings on 1 January 20X3 by 660 CU upwards;

- Payment of dividends to JBC’s shareholders of 3 000 CU;

- Upward revaluation of PPE of 580 CU (revaluation model under IAS 16 is applied);

- Net profit for the year 20X3 of 4 800 CU.

During 20X4 (that is one year later), the following transactions occurred:

- Issue of 2 000 new 1 CU shares at 1.10 per share;

- Payment of dividends to JBC’s shareholders of 2 500 CU;

- Downward revaluation of PPE of 200 CU (revaluation model under IAS 16 is applied);

- Net profit for the year 20X3 of 5 300 CU.

Prepare the statement of changes in equity for the year ended 31 December 20X4.

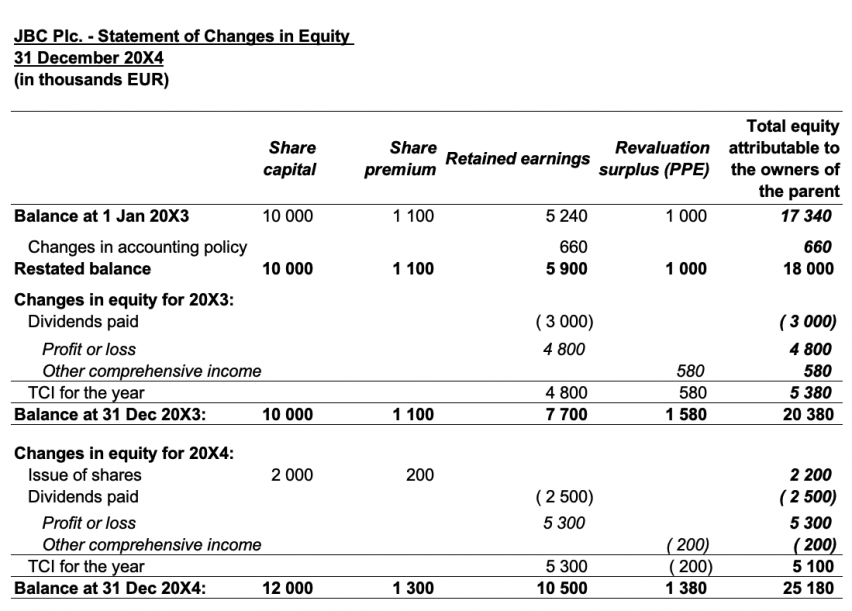

Solution: Statement of changes in equity

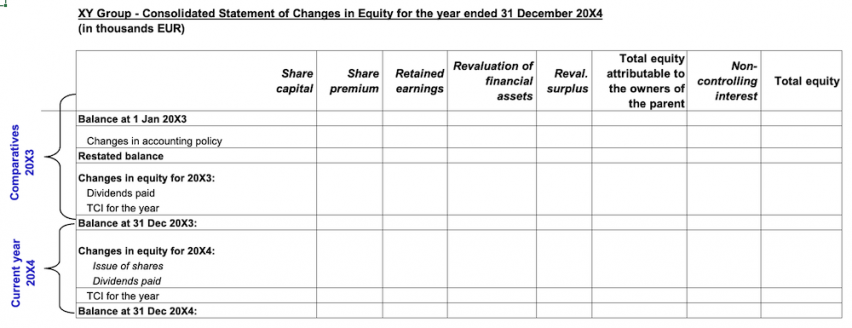

It is always great to prepare the blank statement of changes in equity, and we can follow the format as suggested by implementation examples in IFRS 18.

Here’s just that:

Note – you can download the Excel file at the end of this article. The blank statement is in that Excel, too.

Then, we are going to fill in the gaps, starting with the opening balances and adding the respective transactions. Please watch the video below for the precise method.

A few remarks:

- Please note that the change in accounting policy is reported separately from the changes in equity, since this is a restatement. Also, we present the original balance prior restatement, as well as restated balance.

- Note that the issue of new shares is reported in split between two columns, since this transaction affected two items: share capital (in its nominal amount of 1 CU per share) and share premium (the excess over nominal).

- Other comprehensive income is presented in one line, split into individual movements. In this example, we have just one movement (revaluation surplus), but there could be some other movements, for example cash flow hedge reserve, etc.

- Profit (or loss) for the period is reported in the separate line.

- There is a subtotal for total comprehensive income, being the profit for the period plus other comprehensive income.

- The statement has 2 parts: one for comparatives (20X3) and one for the current reporting period (20X4).

- There is no non-controlling interest, because we are preparing the individual, separate statement of changes in equity.

The statement of changes in equity is as follows:

Video lecture and Excel file for download

CLICK HERE to download the Excel file.

Here’s the video with the step-by-step preparation of the statement of changes in equity:

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

7 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thanks for this for the sharing. Would you share the video regarding presentation statement of comprehensive income after the IFRS 18?

Yes, sure, that’s my plan 🙂

So changes in IFRS 18 is to present restated fig & share premium in seperate line item ?

This video is thought driven, it has opened my eyes to so many things. But Iam asking further, does this IFRS18 apply to NGO/NFPO sector ? if yes why are we not keen at presenting statement of changes in equity in NGO/NFPO financial statements.. Thank you Silvia

It depends if NGO/NFPO applies IFRS or not. If it does, then yes, this must be prepared.

Many thanks for this valuable information

Many thanks for being a blessing to us by your generous sharing. God bless you