Example: Leases under IFRS 16 during COVID-19

The pandemics of coronavirus, or COVID-19 has been here for a while and after the first shock of its quick spread and effect on people’s health, we are all seeing its economic consequences.

In order to stop the spread, governments in many countries ordered complete lockdown.

Many businesses had to stop their operations and thus their vital force – sales to the customers and resulting cash flow – was interrupted.

This situation can trigger perhaps the biggest depression we have ever seen.

However, my goal is not to rant about macroeconomics here – there are many other better economic forecasters out there than I am.

To smooth the economic hammer of the preventive measures, the governments and other parties promised certain reliefs or concessions.

One of them is providing some relief from payments of rent.

How the lessors provide rent concessions

My three children visit the school that rented its building with all the classes from the local municipality.

However, due to lockdown, all children were forced to stay at home and the school charged much lower fees to the parents for the scholarship.

But, most of the school’s costs are fixed – salaries of teachers and rent of office represent about 90% of all school’s expenses.

We don’t have to be mathematical geniuses to see that the school suffered a loss and desperately needed some relief from its expenses.

The municipality therefore agreed to provide temporary rent concession in two forms:

- To postpone the rental payment for the 2nd and 3rd quarter of 2020 for 6 months; and at the same time –

- To decrease the amount of quarterly rental payment for the next two payments.

I am sure that our school is not an exception and lessors provide similar rent reliefs elsewhere to support their customers during difficult times.

And, frankly speaking, I received a lot of questions from my subscribers:

How to account for rent concessions under IFRS 16?

Looking to IFRS 16, I gave one and the same answer: lease modification (in most cases).

According to IFRS 16, lease modification is a change in either scope or payments for the lease that was not part of the original conditions.

I teach accounting for the lease modifications in the IFRS Kit and believe me, it is not an easy thing, especially if the lessee has many leases.

It requires recalculation and adjustment of the lease liability – not a pleasant thing to do, especially if many lessees have adopted IFRS 16 in the previous year and already invested a lot of time, effort and money in all the recalculations.

So, I thought, they could start all over, especially when they received significant rent reliefs from the lessors.

The good news is – this is not true anymore.

New amendment of IFRS 16 to reflect COVID-19

Apparently, my thought process related to this topic was not so insane and far from reality, because IASB reacted to this situation.

In May 2020, IASB issued amendment of IFRS 16 Leases to tackle exactly the rent concessions provided to lessees as a response to the COVID-19 pandemics.

The title of the new amendment is Covid-19-related rent concession and you can download the full text of that on the official website of IFRS Foundation here.

The main message of this amendment is that you do not have to account for the rent concession as for the lease modification.

It is a practical expedient and it is voluntary.

However, you need to meet three conditions:

- Revised consideration must be either the same or less than the consideration before the change;

- The discount on rentals must not go beyond 30 June 2021. Therefore, if your lease term ends in December 2021 and the lessor gives you a discount on ALL payments until December 2021, then you CANNOT apply this expedient on ALL the lease.

- No other significant change in terms and conditions of the lease.

OK, but what does that practically mean?

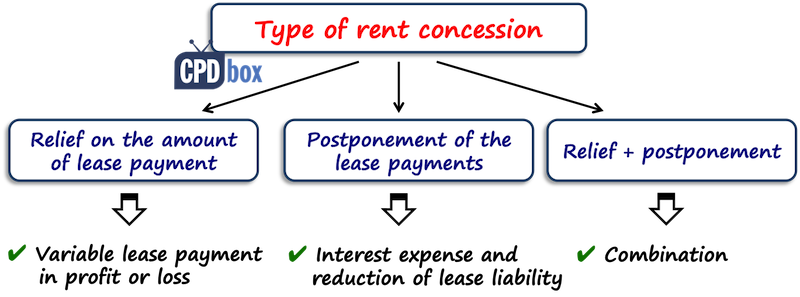

If the lessor decreased or forgave the lease payments, then you simply treat them as a variable lease payments not included in the measurement of the lease liability.

In other words – straight in profit or loss, with the corresponding decrease in the lease liability.

If the lessor decreased the payment in one period, but then proportionally increased it in the subsequent period, then you simply need to continue recognizing the lease liability reduction and the interest as before – at least this is what Basis for conclusion says.

However, I would add that when the timing of the lease payment changes, then there is some remeasurement of the lease liability involved exactly due to different interest accruing over time.

I teach remeasurements and their mechanics in the IFRS Kit, so check that out if interested, but for now, let’s not overcomplicate the things and see the illustration on the example.

Example: Rent concession under IFRS 16

Let’s say that ABC rented an office in January 2019 for 3 years. Quarterly payment is CU 10 000. ABC’s annual incremental borrowing rate is 3% and payments are made at the end of each quarter.

First, we need to see how that lease is initially recognized.

We need to calculate the present value of the lease payments using incremental borrowing rate.

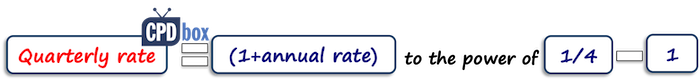

Here’s the trick: we have the annual incremental borrowing rate, but all we need is quarterly rate, because the payments are paid quarterly.

We can use the following formula to derive quarterly rate from the annual rate:

Thus, quarterly rate = 1,03 to the power of ¼ (as the quarter is ¼ of a year) less one = 0,74%.

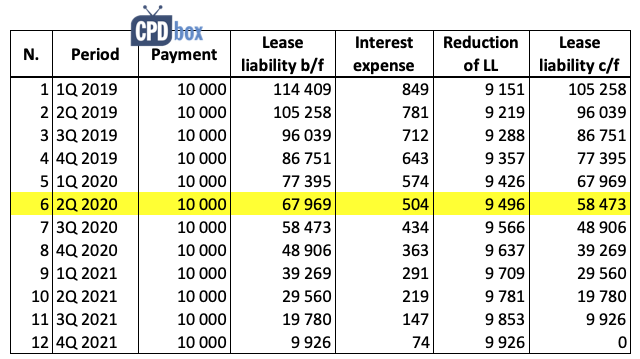

Now, you can use PV function in excel to calculate the present value of series of 12 payments, 10 000 each, payable at the end of each quarter, at the rate of 0,74% per quarter.

It gives us CU 114 409. Hence at the lease commencement, in January 2019, ABC made the following journal entry:

- Debit Right-of-use asset: CU 114 409

- Credit Lease liability: CU 114 409.

Subsequently, ABC recognizes interest expense and the reduction of the lease liability in line with the following table:

OK. Everything went smoothly and then BOOM! Pandemics hit and ABC lost a lot of revenue.

So, ABC’s lessor provided a discount on the next 2 payments, for 2nd and 3rd quarter of 2020, amounting to CU 7 000 per payment.

ABC decided to apply the practical expedient as permitted by the newest IFRS 16 amendment and not account for the discount as for the lease modification, as it apparently met all three conditions to do so.

Therefore, the lease payment amounting to CU 3 000 for the 2nd quarter will be accounted for as:

- Debit Interest expense in profit or loss: CU 504 (as shown in the table above – see the yellow line)

- Debit Reduction of the lease liability: CU 9 496 (as shown in the table above)

- Credit Cash paid: CU 3 000 (Original payment of 10 000 less discount of 7 000)

- Credit Profit or loss – Rent Concession: CU 7 000

The payment for the third quarter will be recognized accordingly.

Final word…

Many accountants indeed appreciate IASB’s quick action and response to the current situation – their amendment indeed eases the life of all people dealing with similar reliefs and concessions.

Please remember that this treatment relates solely to the relief provided as a result of COVID-19 pandemics, not to all concessions.

You can apply this expedient in your financial statements for the period starting on or after 1 June 2020, but even earlier than that if your financial statements have not been authorized for an issue before 28 May 2020.

Also, one more remark – please make sure you perform the impairment test on your right-of-use asset resulting from the leases.

It is quite probable that there might be some impairment, because the declining revenues as a result of pandemics and the related measures adopted by the governments are very strong indicator of this situation.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

69 Comments

Leave a Reply Cancel reply

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

Thank you for this article it really helped. However, could you provide some further assistance please? I do not understand the following statement in its entirety ” Revised consideration must be either the same or less than the consideration before the change”

Thank you. It means that if you rental payments INCREASE as a result of covid-19, then you cannot apply this amendment and you must account the lease modification.

Hi Silvia,

I have a little complicated scenario and would like your thoughts on this.

Background

The lease liability is payable annually in advance. The payment is always paid for the period from April to March. But the accounting period is Jan to Dec. Due to Covid-19, the lessor provided a rent discount (relief) and a rent deferment up to the end of March 21. All the conditions required in the practical expedient are met.

Question.

The rent relief on the amount originally payable in 2020 (1 April 2020 to 31 March 2021) includes a period of 2021. Therefore when we account for the rent relief in profit and loss, do we pro-rate the rent concession related to the months in 2021 or recognise the full rent concession at the time it is received, which is the year 2020?

Hi Silvia

What if the lease concession was granted by changing the payment pattern, which was originally fixed and then replaced by a variable payment pattern (eg a certain percentage of sales).

Hi Silvia,

What if the lease concession was granted by changing the payment pattern, which was originally fixed and then replaced by a variable payment pattern (eg a certain percentage of sales).

Hi Silvia,

Thanks for explaining the treatment for rent concession in simple manner. I have two scenarios which I wanted to clarify.

If my company is the sub lessor and my sub lessee wants to terminate the contract before the original term. Assuming no early termination fees or cost.

1. How do we account the net investment in sublease?

2. Do we need to remeasure the opening adjustment made in equity when we recognized on 1 Jan 2020?

Hi Silvia

Your stance on delayed payments is to treat it exactly like a lease modification (other than decrease in scope).

Why should we only treat it like a modification and reduce ROU ?

Delay in payments will lead to increased interest charge. After remeasurement (done at original discount rate) the difference in lease liability because of remeasurement should be exactly the increase in interest as result of delay.

We should instead credit this difference to the income statement.

This way in effect the total amount hitting the income statement is same as if no payment is delayed (Excess interest debited minus difference due to remeasurement credited)

However if you adjust the remeasurement with ROU it is incorrect if the lease period is unchanged since for part of the period there is lower depreciation even though there is no change in the right to use asset like in modification.

You seem to be a kind lady. could you kindly respond whether I make sense?

My earlier comments keep getting deleted

Hi Hussain,

I don’t understand where you got this position that “your stance on delayed payments is to treat it exactly like a lease modification…”. I have never said that. I only said that if the contract changes because the lessor changes the payment schedule (and delays payments), then it is a lease modification UNLESS it is a “COVID-19” concession meeting certain conditions. If the lessee delays payments against contract, without actually changing the contract, that’s a different story. If you need more details on lease modifications, I sincerely recommend my IFRS Kit – I solve similar examples step by step, exactly in accordance with IFRS 16. One last remark – your earlier comments were not deleted, in fact I found all 5 of them, and yes, I deleted them afterwards as they were duplicate. Due to high amount of spammers and robots, we manually approve all the comments and no, I don’t do that at the same moment when you post it, sorry. S.

Hi Silvia,

Thank you for the clarification.

However, I have one query in regards to the EMI Sheet/Amortization Schedule.

1. In the above case, don’t we have to prepare modified amortization schedule.

2. I believe, the true rental lease liability won’t be disclosed if we fail to modify the sheet.

Please help me to clear this doubt.

HI Silvia, just a quick one. So if we applying the practical expedient, we don’t find the pv of the lease liability taking into account the rental concessions. We simply take the difference between what was originally due which will reduce the lease liability and what was paid byus to profit/loss?

Hi Silvia

Could you please write an article or just comment on this situation about impairment, if using IAS 16 cost model:

Companies will need to do impairment review based on IAS 36, if CA>RA. But based on IAS 16, what if building was not used for example 4 months – in that case no depreciation should be recognized for 4 months as well, and impairment will be higher, or?

Hi Helena,

well, if you can justify not charging depreciation for 4 months due to no usage (although I cannot imagine the reason for this since n. of units method is questionable in the case of buildings as they do not produce any units), then yes, impairment (if any) would be higher due to higher carrying amount.

Silvia, many thanks – you really are an angel!

Of course I was thinking of production building or maybe if shops were closed being retailer. Now off I go to do my SBR exam today! I really enjoyed your videos during this last 2 months! Keep up the good work.

Oh, I keep my fingers crossed for you – good luck!

Hi Silvia,

How would be the accounting treatment if the rent abatement was granted on 01/07/20 with a retrospective effect for the period you have mentioned (Q2 & Q3 )?Let`s assume year end 30/06/20.

Thank you in advance.

Chris

Hi,

What if rents are adjusted For Quarter ending in Dec 2019, Mar 2020, June 2020 then what would be the effect when reporting date is December 2019.

Hi Silivia how are u, can you please illustrate how was the 114,409 calculated, i tried to do this on excel but faild, can you please help

Hi Silvia,

I have a scenario in which lessee obtained a rent concession for the three months from April to June. Relating to the practical expedient, shouldn’t we remeasure the lease liability using the same discount rate and any change in the liability be recorded in profit or loss rather than adjusted against right of use asset?

hi Silvia,

will the rent concessions be reflected as ‘other income’ or as ‘negative rent expense’ in the financial statements of the lessee or as credit to interest?

Either way, depending on how your entity presents the profit or loss (there is no one single prescribed format).

Hi Silvia,

Thank you for this article that clearly explains how to treat discounts.

I saw above that there was an example with a deferral, what happens when there is a percentage deferral, say 50% of rent deferred?

hi Silvia,

(early payment with discount)

In case im a lessee

i have lease contract 15 years with annual payment , at first 3years i paid payments on time. at 4th payment date, the leasor offer me to pay the next payments (5th years) as early payment with discount 10% (in addition with the 4th payment). so, i accept his offer.

i would like to ask you about the best and simple solution for this case if:

1. our management assess this early payment as immaterial.

2. if the offer changed to be with 4 early payments instead of one with discount of 10%, which is material.

hi Silvia,

will the rent concessions be reflected as ‘other income’ or as ‘negative rent expense’ in the financial statements of the lessee? indeed thanks in advance for your reply.

Hi Silvia,

Thanks for your valuable sessions.

In case of extension of the lease term ( 2-3 months ), how to go about it?

Hi Silvia

Many thanks for your valuable time for explaining this important topic,

Just wonder how this change can be applicable to hotels which have obtained leasehold from the government to build hotels.In view of Covid-19, those hotels are being assisted by the government with regards to their leasehold obligations.

Dear Silvia

Hope you are well.

Can you please advise on the effect of rent concessions on the Deferred tax balances?

Thank you!

Hi Chantal,

it depends on the tax laws as well. In any case – you always take ending balances of the lease liability and its tax base and compare.

Dear Silvia,

How can the following be accounted for? Say I am a lessor having a finance lease with a client for a period of 12years. The lease is a rent to buy arrangement and rentals (split between a capital repayment potion and just a rental amount) have been structured such that at the end of the lease, the client would have bought the Asset (total of the capital repayment portion). The lease conditions also allows the tenant to terminate the lease by giving 2 months notice and if that happens they are entitled to 70% of the total “capital repayment” made at the time of termination. How can this refund be accounted for vis a vis the Net Investment in Finance lease and finance income??

Its really awesome, its difficult for me to understand from the bare IFRS amendments, you made it very smooth and understandable, Thank you

Hi Silvia! Thank you for your support! It helped a lot. I have one question but it is related to operational lease cars – if the leased cars are used by employees also for personal purposes should these agreements be considered and booked under IFRS 16 or IAS 19 as being employees benefit consideration? Thank you in advance for your answer.

Hi Oana, both standards apply here – you have a lease liability under IFRS 16, and you do provide short-term employee benefit under IAS 19. I would say all ROU asset and interest expense are employee benefit under IAS 19.

Silvia, many thanks for being simple and direct to the point in your article the way you always make IFRS pronouncements much easier to understand.

Thanks a lot!

This is very precise and straight to the point Silvia, Thanks for sharing. Just a little clarification, cant one just divide the 3% annual amount by 4 to the get the quarterly IBR? Just thinking……

Thanks

Hi Stephen, thank you!

No, because if you just divide it by 4, you would find out that your effective interest rate table does not work. The reason is that when you accrue the interest on 1st quarter, then in the 2nd quarter, you accrue interest on both beginning balance in the 1st quarter PLUS interest accrued in the 1st quarter (plus take any payments into account). If you divide your annual rate by four, you would be dismissing this compound interest. S.

Thanks Silvia, this is useful. Perhaps you could put some examples in the IFRSkit for those who subscribe with Excel for the different practical options. E.g. with a monthly lease with a reduction in payments, and also a separate example for a waiver of all payments for e.g. 2 months. And then perhaps for the above as well but where it goes over 30 June so it would be a modification. Thanks.

Hi Ashley, thanks for your idea, I will post something for sure for the IFRS Kit subscribers. Best, S.

Dislcosure :that it has applied the practical expedient to all rent concessions that

meet the conditions in paragraph 46B or, if not applied to all such rent

concessions, information about the nature of the contracts to which it

has applied the practical expedient (see paragraph 2); and

I didnt get what is paragraph 2. If i apply practical expedient it will be applicable to all leases or can the Conmpany pick and choose

Par. 2 of IFRS 16 requires you to apply this expedient to ALL leases with similar characteristics in similar circumstances. So if you have some leases with different characteristics, then you can opt if you apply expedient or not.

C20A- A lessee shall apply Covid-19-Related Rent Concessions (see paragraph C1A)

retrospectively, recognising the cumulative effect of initially applying that

amendment as an adjustment to the opening balance of retained earnings (or

other component of equity, as appropriate) at the beginning of the annual

reporting period in which the lessee first applies the amendment.

What will be transferred to retained earnings then

There could be a situation when the rent concession was provided in March or April 2020 (as an example), so before the amendment was issued and the end of the reporting period of the lessee fell into that period. So let’s say your end of the reporting period is 31 March and you got the rent concession for March or so and you accounted for it as for lease modification in line with then applicable standard. And, if you are going to receive more rent concession, you can avoid accounting for further concessions as for lease modifications – instead, you can apply this practical expedient according to the new amendment. However, in this particular case, you need to apply this expedient retrospectively – hence also to rent concession received before the end of your reporting period, so you need to restate.

Also careful about interim financial statements that have different end of the reporting period.

Anyway – if the end of the annual reporting period is 31 December 2019, I don’t think that applying this practical expedient will affect your opening retained earnings. S.

Thanks a lot for your prompt response

Hi Silvia,

Thanks for sharing this. I want to know how to deal with situation where rent has increased due to COVID-19. Will that account for modification and how to treat the same

Hi Sourav,

interesting situation. This amendment does NOT apply to rent increases at all, thus you need to apply regular IFRS 16 paragraphs and yes, in most cases it is a lease modification, but it can be something else depending on the contract.

Thanks for the info. What if the lessor give you discount on the annual escalations or waives it for a certain period of time?

Again, if this discount or waiver relates to the Covid-9, you need to apply these rules as shown above.

Great and lovely article! You actually did justice to this topic.

Thanks

Hi Silvia, i really enjoy your articles they open my horizon to lots of things in the accounting profession.

This was well thought out Silvia, I enjoy your articles…

Hi Silvia,

In case of the lessor, If i’m giving a discount of to my tenant, Should i present the discount provided in P&L separately (Gross rent amount) or should i present the net rent amount. Thanks in advance.

Hi RJ,

this amendment says nothing about lessors, so you just continue to apply other requirements of IFRS 16. S.

Hello Silvia,

Thanks for simple clarification of new amendment.

I have one question, are we able to use new amendment for March and April 2020 periods and adjust the previous transactions, or this scenario will come into force only from May 2020?

Hi Dodoli,

yes, absolutely, provided that your financial statements have not been authorized for an issue before 28 May 2020. If they were approved, then well, you cannot use this expedient and you need to account for that as for lease modification. After all – this is voluntary, to ease your life, not mandatory. S.

Hi Silvia, thank you for useful explanation. I love that you always explain with examples – makes it clearer and helps a lot. My questions are:

1. The scenario you covered is for waived rent. What would be the accounting entry if payment is deferred?

2. I don’t have one liability account but two i.e. ‘short term liab.’ and ‘long term liab’. Should I post this to short term liab?

Thank you

Hi Sal,

thank you!

1. As I wrote above in the scheme – there is some remeasurement involved. So, although the amendment to IFRS 16 asks you to continue charging interest in profit or loss and the rest to reduction of the lease liability, I believe that what it does NOT mention is the fact that there IS some remeasurement because of the effect of discounting (later payments trigger larger discount to present value, thus lower lease liability than you are showing in your books). As I wrote above, I teach remeasurements in the IFRS Kit. However, if you have a few leases and the payment is slightly postponed, then you can perhaps reasonably assume that the effect of remeasurement would not be material and just do nothing. If that is material, then you need to discount the future lease payments to the present value and any difference in lease liability is adjusted with ROU asset.

2. If you are referring to the above example – short-term, because the adjustment related to the payment just to be made. S.

Thank you Silvia.

1. So, in your example above, if the entire amount in 2Q of 2020 (highlighted in yellow) is deferred to 2Q in 2021 then the accounting entries should be:

Second quarter of 2020:

• Debit Interest expense in profit or loss: CU 504 (as shown in the table above – see the yellow line)

• Debit Reduction of the lease liability: CU 9 496 (as shown in the table above)

• Credit Cash paid: nil (Original payment of 10 000 is deferred to 2Q of 2021)

• Credit Profit or loss – Rent Concession: CU 10 000

Second quarter of 2021:

• Credit Cash paid: CU 10 000 (Original payment of 10 000 deferrred from 2Q of 2020)

• Debit Profit or loss – Rent Concession: CU 10 000 (this cancells the profit recorded in 2Q of 2020)

Do you agree? Thank you again.

No, I do not agree. If the payment is just postponed – AND PROVIDED IT IS ABSOLUTELY IMMATERIAL – the entries would be something like:

– Debit Interest expense 504

– Credit Lease liability 504 and that’s it. No reduction of the lease liability is booked, because you did not pay anything. Then this reduction is recognized when the payment is made.

HOWEVER – as I warned you – this is NOT 100% correct, because the effective interest method does not work here. It is acceptable ONLY when the effect of remeasurement would be immaterial – which you would need to recalculate.

Hi Silvia,

Thank you.

In case of re-measurement, discount rate will also change right ?

And in general case, how do we assess the materiality ? is it on the discretion of management ?

Thanks again

Hi Anurag,

frankly speaking – IFRS 16 is quite silent about remeasurement when payments are postponed. And, the amendment does not tell you But yes, I would revise the discount rate since this is the situation similar to the modification of the financial liability under IFRS 9.

As for materiality – there is a guidance on materiality in IAS 1, also in Practice statement and other sources. I would say that yes, managers assess the materiality, but it is NOT within their discretion – instead, they must follow the rules of IFRS to assess materiality. I know, this is very judgemental (as many things in IFRS), but management should do its best. Basic question to ask is: can omitting lease remeasurement have such a great impact on the financial statements that it would mislead the users of the financial statements? Simply speaking, if you omit the remeasurement, will this be completely false and misleading for your investors/tax office/…?

Thank you Silvia, as always, well summarised and easy to understand. Much appreciated

Hi Silvia,

Correct me if I am mistaken, what I understand in this example is there will be no change in schedule (table). The rent Concession is recognized in profit and loss.

YES. BUT – only if this concession meets the three conditions as mentioned in the article.

In the above example, I think the CR to the P&L is in the current period. When you read the IFRS article on 28 May, the transition paragraph makes me query whether we need to apply the benefit to opening reserves as opposed to in the period. Can you advise please?

Yes, of course, it is in the current period…. I see no reason to touch your opening equity provided that the end of your reporting period is 31 December 2019. S.

Hi Silvia,

If our year end is 31 Dec 2019 and we receive the rent concession due to COVID in say April and May, do we not need to adjust our opening reserves as opposed to showing the impact through the current year P&L? I refer to the IFRS leaflet “lessee shall apply Covid-19-Related Rent Concessions (see paragraph C1A)

retrospectively, recognising the cumulative effect of initially applying that amendment as an adjustment to the opening balance of retained earnings (or other component of equity, as appropriate) at the beginning of the annual reporting period in which the lessee first applies the amendment”, Thank you

Hi Aly,

well, why would you adjust the opening retained earnings if this concession relates only to the current year of 2020 – in your case (thus the end of reporting period is 31 December 2019)? As I explained above, such a concession is treated as a variable lease payment not depending on the index or a rate, and it treated in profit or loss when occurs, so no adjustment to the table. The point of IASB was to make it easier for you, not more difficult. S.

Dear Silva,

Thank you for simplifying this subject matter. My concern is the 3rd entry in the ABC illustration, How are we supposed to credit cash paid with CU 3,000 when there was no outflow of cash? Your response will be greatly appreciated.

Well, actually in this example, the cash was paid. The discount was CU 7 000, the original payment was 10 000, so the difference was indeed paid.

Hi Silvia, thanks for the clarification using this example, however, we can summarise the entry as the following:

Debit Cash received: CU 7000 (Original payment of 10 000 less discount of 7 000)Credit Profit or loss – Rent Concession: CU 7 000 because after the pandemic we could do this entry while initially entry supposed already posted in the accounting books.

I see where you are going, but please do NOT confuse other readers with this. This entry is valid ONLY if you posted original entry from the table – and in many cases it will not work that way because many softwares are connected to the bank statements and you simply cannot credit cash and debit cash without actual movements. Another point – the brackets behind “Debit Cash received” do not apply – instead, 7 000 IS a discount.