Current or Non-Current?

Most balance sheets present individual items in distinction to current and non-current (except for banks and similar institutions).

This seems so basic and obvious that most of us do not really think about classifying individual assets and liabilities as current and non-current.

We do it automatically.

But not always correctly.

For example, one of the biggest mistakes I have seen in this area is presenting the long-term loans.

Many companies present them automatically as non-current liabilities – while they are not!

Why?

Just go on reading!

What do the rules say?

The standard IAS 1 Presentation of Financial Statements specifies when to present certain asset or liability as current.

Many people believe that “12 months” is the magic formula or the rule of thumb that precisely determines what is current or non-current.

Not always true.

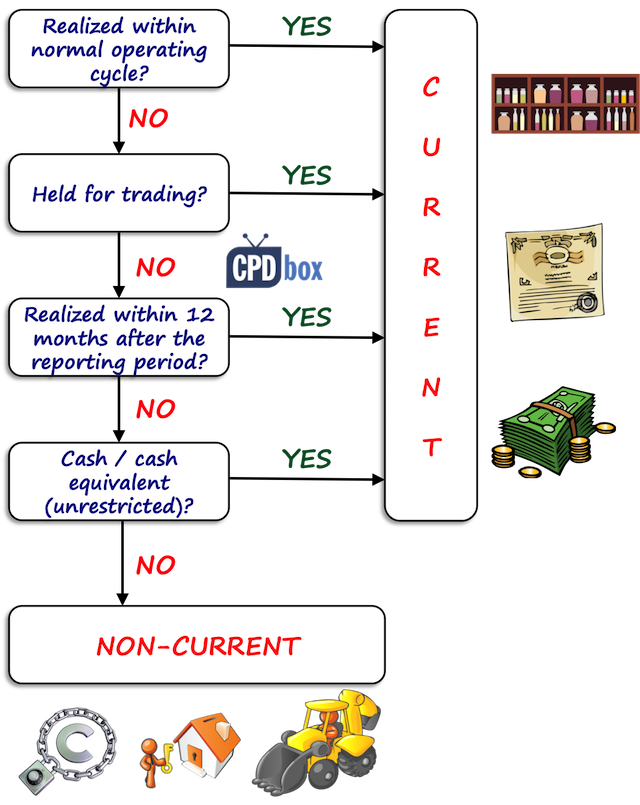

More specifically, an asset is presented as current when:

- It is expected to be realized (sold, consumed) in its normal operating cycle.

Here, the standard does not specify what the normal operating cycle is, as it varies from business to business. Sometimes it’s not so clear – in these cases, it is assumed to be 12 months. - An asset is held for trading.

It does not matter that the company will probably not sell an asset within 12 months; as soon as its purpose is trading, then it’s current. - It is expected to be realized within 12 months after the reporting period, or

- It is a cash or cash equivalent (not restricted in any way).

The same applies for liabilities, too, but the standard IAS 1 adds that when there is no unconditional right to defer settlement of the liability for at least 12 months after the reporting period, then it is current.

Everything else is non-current.

Typical examples of current items are inventories, trade receivables, prepayments, cash, bank accounts, etc.

Typical examples of non-current items are long-term loans or provisions, property, plant and equipment, intangibles, investments in subsidiaries, etc.

These are just examples, but there are a few items that are not that outright and need to be assessed carefully.

Property, plant and equipment

In most cases, property, plant and equipment (PPE) is classified as non-current, because the companies use these assets for a period longer than 12 months, or longer than just one operating cycle.

This also applies for most intangible assets and investment properties.

However, there is a few exceptions or situations, when you should present your PPE as current:

Non-current assets classified as held for sale under IFRS 5

When some non-current assets meets the criteria of IFRS 5 to be classified as held for sale, it shall no longer be presented within non-current assets.

Instead, all assets held for sale or of a disposal group shall be presented separately from other assets in the statement of financial position. The same applies for liabilities, too.

So you would include one separate line item within your current assets, labeled something like “Assets classified as held for sale”.

Non-current assets routinely sold after rental

Some companies hold non-current assets for rentals and then they routinely sell them after some time.

For example, car-rental company routinely rents out its cars to various clients for a short period of time and then these cars are sold after 1 or 2 years. Here, I’m not talking about any finance lease – I mean short-term, or even long-term operating lease.

These assets shall be presented as non-current during their rental period, but when a company stops renting them out and wants to sell them, they shall be transferred to inventories.

Inventories

Inventories are a typical current asset, as inventory production usually determines the length of company’s operating cycle.

It does not matter whether the asset produced has the economic life shorter than 12 months or not – if you produce machinery or cars, from your point of view it’s still a piece of inventory (unless you’d like to use some items for your own business, for example for test drives, advertising purposes or so).

I’d like to point out that also inventories whose production period is longer than 12 months and are expected to be realized (sold) beyond 12 months after the end of the reporting period, are classified as current assets.

For example, cheese, wine or whiskey that need to mature for a few years, are still classified as current assets.

Deferred tax assets and liabilities

No discussion here.

Deferred tax assets and liabilities are always classified as non-current.

Loans with covenants

This is the trickiest one in my opinion. Here, the companies make big mistakes in presenting their loans.

The standard IAS 1 specifically says that when an entity breaches some provisions of a long-term loan arrangement before the period end and the effect is that the loan become repayable on demand, the loan must be presented as current.

The standard is very strict here – it applies also in the case when the lender (bank) agreed not to demand the payment as the consequence of breach after the end of the reporting period, but before the financial statements are authorized for issue.

Let me illustrate it on a short example:

Question:

ABC took a loan from StrictBank repayable in 5 years. The loan agreement requires ABC to maintain debt service cover ratio at minimum level of 1,2 throughout the life of the loan, otherwise the loan may become repayable on demand.

ABC found out that the debt service cover ratio was 1.05 at the end of November 20X1 and reported the breach to StrickBank. How should ABC present the loan in its financial statements for the year ended 31 December 20X1?

Solution:

The answer depends on the reaction of the StrictBank.

If StrictBank agrees NOT to demand immediate repayment of the loan due to the breach of the covenant at or before the period end (31 December 20X1) and this agreement is valid:

- For more than 12 months after the end of the reporting period => the loan is classified as non-current.

- For less than 12 months after the end of the reporting period => the loan is classified as current.

If StrictBank agrees NOT to demand immediate repayment of the loan due to the breach of the covenant after the period end (31 December 20X1), but before the financial statements are authorized for issue, the loan is classified as current, because ABC does not have an unconditional right to defer the loan settlement for at least 12 months after that date.

The impact of presenting the loan as current instead of non-current can be tremendous, as all liquidity rations worsen immediately.

Therefore, if your company took some loans from the banks, I would strongly encourage you to revise and check keeping the covenants well before the end of the reporting period, so that you have enough time to ask your bank for agreement with non-repayment on demand.

Is there any item you would like me to explain further? Please leave me comment right below article. Do not forget to share this article with your friends. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

What is the treatment to be given to refundable deposits like deposit given to landlord, deposit for 2 year visa, deposit given to telecom/ electricity authorities?

Dear Silvia

I have read many of your articles and they are very helpful, nonetheless, I am faced with some doubts regarding the following. I am confused by article IAS 1.69.(c) which states “the liability is due to be settled within twelve months after the reporting period;”. So for example if I have a liability incurred on 1/July/X, the current part would cover all payments up untill 31/Dec/X+1, however, I see in your responses you describe the current part as payments due within 12 months after the transaction date and not 12 months after the end of the reporting date as mentioned by the standard. Please advise!

Kind regards

Hi Thomas, well I don’t refer to 12 months after the transaction date – at least I cannot find it in my answers. Anyway – yes, it is 12 months with reference to the reporting date and indeed, it is a matter of when you are looking at your financial statements. In your short example – if you are looking at your financial statements on 1 July X, then all due until 30 June X+1 is current, the rest is non-current. If you are preparing the financial statements at 1 July X, then this is the correct answer. When it comes to the actual accounting records – if you want to keep them as correct as possible, then you should indeed keep the amount due from 30 June till 31 December X+1 as non-current (as on 1 July X, it is non-current). Now, let’s shift to 31 December X – here, also current/non-current split shifts. The part due from 30 June till 31 Dec X+1 becomes current and should be reported as such at the financial statements as of 31 Dec X. I hope I made this clear for you 🙂

Wonderful! Simply superb! written in layman’s language. Even a child can understand classification chart presented, still mistake is creeping in and Balance Sheets are signed blindly without cognizance of the facts, Simple english words are mistaken,

Example : Company[construction] has defined “Operating Cycle” as 3 years and based on this classifies Assets and Liabilities as Current and Non-current and are completely ignorant of IFRS and guidance note on revised Schedule VI. Impact – current ratio is going for a toss, Long Term Loans are shown as Short Term Loans!!! This is happening from 2012 till date. Sending this article to the entire audit team.

this is very good, but I want to know how we calculate expected credit loss in financial institution?

Dear Silvia,

I have a issue to discuss. My company has taken sanction facility for import of machinery for its new project. As per sanction terms, LC will be in UPAS mode (Usance LC Payment at Sight). The supplier will be paid by the bank at sight but the bank will convert the amount to long term loan of 5 years in maturity in the following manner:

1. 10% of LC amount at 3rd months;

2. 10% of LC amount 6th month;

3. 10% of LC amount 9th month;

4. Remaining 70% at 12th month;

In the UPAS period, interest will be charged at Libor+2.99% per annum and this interest will also be converted to long term loan.

My question is, how can I present the payable in financial statement during the UPAS period.

I have a question which I am struggling with. What if the company in question buys products ( laptops/washing machines/batteries etc) to test for safety and then disposes of them, are these current assets?

If they are not going to be used for more than one year, than yes, current assets.

HI Silvia

In above example for loan with covenants(case of ABC limited and Strict bank) in year 1 the loan become payable on demand and ABC limited does not agree to extend loan period for more than 12 month from end of reporting period Year 1.Hence loan is classified as current for reporting period end

My query is whether ABC limited can reclassify this loan as Non current at end of year 2 if Strict bank agree not to demand of loan repayment for at least 1 year beyond the end of reporting period year 2.(i.e whether reclassification from current liabilities in year 1 to non current liabilities in year 2 is permitted under IAS or not under such situation?

Thank you

Can I say that all account receivable (trade receivable) are always classified ‘current’ as they are assumed to be within the operating cycle by definition?

Can you explain how are liabilities held for trading

Hi Silvia,

It is clear for the bank loans! What about the related parties which finance their Companies?

There are 2 types of such financing of the related parties :

1- for operating activities

1- for only financing activities even in some cases with zero charges

Shall we classify the due from/ to in the current side or non current side.

Best,

Hi Mohamed, I think this article can give an answer. S.

Thank you for the continued guidance

very nice , I love your work

Arising from disposal of fixed assets

Hi silvia

According to our tax rules in our country back in kenya transferring the non current assets to current assets could be a challenge due to disposal gains or losses arising from capital deductions/allowances which is reported in income statement….how can you align the deference

What is accounting treatment of pre-incorporation expenses in IFRS?

Thank you Silvia, really you are amazing professor.

Best regards,

What if the entity classify a receivable as current asset expecting it to be realized in a period of 12 months after reporting period but it wont recovered in the forthcoming year one, two, three and so on? say it stays for three years unrealized should it be continue regarded or categorized as current asset?

Regards!

Hi Raj,

yes, it stays categorized as current because the entity has still unconditional right to payment within 12 months (unless there’s some agreement on repayment schedule signed).S.

So do you mean that the basis upon classifying the receivable whether current or non-current asset is the unconditional right to payment within 12 months? What if the normal operating cycle of the entity is more than 12 months? Would it (Accounts Receivable) still be classified as a current asset?

Raj, it seems you definitely want to play words with me. Yes, if the normal operating cycle is clearly identifiable as longer than 12 months, then assets realized within that cycle are current.

Is this true with Prepaid Expenses in which under IFRS, prepaid expenses are considered as a current asset, yet an entity will incur such expenses covering more than 12 months?

Who said that prepaid expenses are current assets? Can you give the exact reference which IFRS says so? They can also be non-current, too.

Hi Silvia

I have subscribed for IFRS kit and my experience is awesome with it for IFRS.

I have a query like you explained that if entity has unconditional right to not to pay the loan for 12 months after reporting period then it will be classified as non current.

So if Bank has confirmed on the mail that they are not going to demand loan for next 12 months, will it be valid as unconditional right or formal agreement is required for this.

Please advise.

Hi Pradyumn,

thank you for your kind words, I really do appreciate! I published the full podcast episode about it, so it will answer your question – it is here. All the best, S.

A company had a term loan which drawn on 1 Jan 2017 and the repayment period is 31 Dec 2020, for contractual obligation, the loan should be classified as non-current liabilities as at 31 Dec 2017. However, the management intended to settle the loan in May 2018, should the management classify the loan as current liabilities for the year ended 31-Dec-2017.

A company took term loan repayable in installment. as on 30.06.2017 1st installment is due 1,200,000 (Principle 10,00,000+ interest 200,000) how i can present the loan. is total outstanding loan treated as non-current?”

You have to split it into the current and non-current part (all instalments due in 1 year discounted to present value are current, the rest is non-current). S.

What if the entity classify a receivable as current asset expecting it to be realized in a period of 12 months after reporting period but it wont recovered in the forthcoming year one, two, three and so on? say it stays for three years unrealized should it be continue regarded or categorized as current asset?

Regards!

dear silvia,

I’m consufed with the operating cycle rule, is that mean that liability should classify as current even due in more than 12 months, if the operating cycle is beyond that?

thanks

Hi Rayson, yes, you got it right. S.

Dear Silvia,

if a supplier agrees to refinance trade payable (payment in arrears) that was due, should i split the liability to non current and current portion? Thanks!

Let’s say the prepayment will be capitalised as PPE once it’s received within 12 months. In this case, should it be classified as current? That means prepayments have been made for assets purchase that will take delivery few months later.

Classifying it as non-current seems to carry a message that prepayment has been made for purchases which would take delivery beyond 12 months?

Please advise.

Hi should deferred payment for rental on straightline be classified as non current liabilities? Rental agreement does not allow deferred payment. Thanks

If it’s going to be realized in more than 12 months, then it’s non-current.

Hello.

A firm makes television programs. In P/L, closing value of “Released/Unreleased programs and in-production programs” is deducted from cost of sales. In B/S, non-current assets include “Released/Unreleased programs less amortization + in-production programs – current portion” while current assets include “current portion”. If the programs are held for trading (since the firm deals with tele programs then should be deemed as held for trading), then why are they in non-current assets section? Also, television program is an intangible stock for the firm so how can stock be amortised?

Hi Silvia!

Please note the following and advise accordingly:

1. in November 2017 the Company and the Bank get into negotiations for the full and final settlement of a loan. On the 15th of December an installment is due by the company. However the company did not paid the installment due based on an oral agreement between the company and the bank. My question is if the fact the the bank did not impose default interest to the company for not paying the installment could be a conclusive evidence for not classifying the loan as current on 31/Dec/2017. For your info, the company and the bank reached an agreement on 31/Jan/2017 according to which part of the loan was repaid and part of it was written off.

Sorry, I don’t get it fully. Was there just an oral agreement between the bank and a client regarding the full repayment of the loan in November?

And, the client did not repay; the bank did not impose any penalty interest and the question is whether the loan is current or non-current?

Hi Silvia!

Could you advice, how the company should account the anti-virus software with useful life of 1 year : as intangible assets or not?

My auditors didn’t recognize it as intangible asset, but in IAS 38 there is no criteria “more then 1 year”. Please, help. Thank you.

Dear Olena,

you are right, there’s no 1-year criterion, however, in IAS 1, you clearly present intangible assets under non-current assets and by definition, non-current asset is realized after more than 12 months after the end of the reporting period. Anti-virus software is not such a case if you bought the license for less than 1 year. S.

Thank you Silvia for quick response. As I understand, company is not recognize it as intangible asset, because of it is not non-current assets. Should we recognize it as expense immediately after purchase or as prepaid expenses (current assets) and than recognize it in P&L during 12 months (useful period)?

Dear Olena,

it would be OK to recognize it as prepaid expense and recognize in P/L over 12 months, especially when the item is material (=significant for your financial statements). S.

Hi, Silvia

Please help me to clarify whether the prepayments for delivery of the goods within next 36 months should be splitted into current and non-current. Prepayments are not financials assets/liabilities and therefor IAS 1 is to applicable since its requirements refer to financial instruments, not non-financial. Thus, I see that those prepayments are to be accounted for as current since the underlaying assets (finished goods) are part of current assets. In similar to the treatment of CAPEX advances where they are recognised as non-current assets regardless the fact that they are payabe within less than 12 months.

Please advise, whether my understanding is correct.

Kind regards

Olga

Dear Olga,

unfortunately, prepayments are not specifically addressed by IFRS, and you need to assess each item individually.

IAS 1 says that if the item is expected to be realized (or intended for sale or consumption) in the normal operating cycle, then it’s current. And I need to stress that current assets include also assets that are sold, consumed or realized as a part of normal operating cycle even when they are not expected to be realized within 12 months after the reporting period. So, based on what your operating cycle is, I would classify the prepayments for inventories as current. S.

HI Silvia

Is there any agewise disclosure requirements for trade receivable. ?? Please explain with reference to IFRS

Rgds

Sandeep Diwan

Dear Sylvia,

if my company has signed an agreement to reschedule the payments of interest payable until 2018 should these liabilities be classified as current or non current?

Moreover, how to account for unused credit facilities? Just disclosure?

Thank you!

Dear Jenny,

if they are agreed to be rescheduled, then yes, a part of it is current (repayable within 12 months) and the rest is non-current.

You do not account for unused credit facilities – disclosure is OK. S.

In case of loan liability, can we calculate current liability by comparing Closing balance of this year and next year???

There is qn no 2 in Dip IFRS in Dec 10 where they calculate current liab as 17717 but as per me it should be 15820.

if possible pls advice

Hello!! I love your articles! It helps me so much in class. I was wondering if you have a separate summary on IFRS 5?

Kind regards

Dear Sylvia,

should a trade payable that was sold by the supplier to the bank and the bank requested the repayment of the liability within 5 years be classified as current or non current?

Thank You very much for your insights! IFRS KIT rocks 🙂

Kind regards

Hi Jane,

thank you!

For me it seems that once it was sold to the bank and the bank requested the repayment within 5 years, its original maturity date ceased to be valid. Also, if it’s not repayable on demand, then I would classify it as non-current. S.

Dear Sylvia, your advice is great! Thank you! Keep up the good work!

Hi Silvia,

In regard to inventories, I am working for an abbattoir whereby we buy cattle and feed them for about 3 months before slaughter. Our business is selling meat and my question is should the cattle be accounted under IAS 41 – Biological Assets or under ISA 2- Inventories

Regards,

Hello Silvia

Regarding IAS 11 construction contracts, the accounts “Due to.. and Due from” must be classified as current or do i have to split the amount.? If i have to present a non current asset/liability do i have to present it in amortized cost according IAS 39?

Thanks in advance

Dear Silvia,

Hope this finds you well

Regarding the loan example, I want to ask what do you mean by saying ” the loan is classified as current, because ABC does not have an unconditional right to defer the loan settlement for at least 12 months after that date” and how we are classifying the loan as current even if the bank agrees NOT to demand immediate repayment of the loan due to the breach of the covenant after year end but before issuing the financials. Isn’t that supposed to be a subsequent event that should be reflected in the financials

Thanks

Hi Silvia, you’re such a life saver. I love your work.

Hi Silvia,

I wanted some clarification on cash and cash equivalent. It is mentioned in IAS 1 that current assets include cash and cash equivalent unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period. What will be the classification if this cash is restricted such that it cannot be used for at least twelve months after the reporting period. Will this cash be classified as non current asset ?

Kindly enlighten

Thanks

Yes, exactly.

Dear Sivia,

Thank you for your vaulable article.

Regards,

Hi Silvia

Regarding IAS 17 operating leases in the the lessee’s perspective, how does one classify prepaid rental expenses as non-current and current from year to year?

all prepaid rents relating to more than 1 year will be called non-current and that rent which is to be paid with 12 months will be classified as current assets

Dear Silvia M.

Thank you very much for insight on IFRS. I don’t miss any of your news letter including comments/reply from users.

Regards,

Sudhakar Amin

My dear Silvia,

How are you today? thank you for the wonderful work you are doing. I look forward to doing this as well as touching people’s lives in my continent (Africa) particulary my country Nigeria which is faced with poor economic policy direction.

Please advise me on how i can get the IFRS Kit, the cost and means of payment. With the kit, i believe i will get all accounting treatment a lot more clearer and better especially with hyperflationary economies (IFRS 29) which we seems to be heading in my country (Nigeria).

Warmest regards.

JULIUS OREYE

Dear Julius,

thank you very much for your nice comment and the interest in my IFRS Kit. You can get it here: http://www.cpdbox.com/ifrs-kit (payments by credit card, PayPal or if not possible, write me an e-mail and I’ll send you bank transfer details). However, please revise carefully what’s included inside as not all topics have been covered yet (e.g. IAS 29).

Anyway, enjoy the website and if you need my help, let me know! S.

Thank you Silvia, I just bought your IFRS Kit, and am enjoying it 🙂

Thank you Francois, for me – absolutely pleasure to read it 🙂 S.

Hi Silvia,

Need your inputs on sale of PPE assets which are getting sold after the life is over or once it gets damaged. Normally, these idendified assets are sold to vendor and decapitalised from PPE subsequetly. As per the Non-current and current classification, whether these identified assets are removed from PPE and showed as separately as current assets uner IFRS 5? please clarify the same.

Hi, well, IFRS 5 sets exact conditions when you need to classify your assets as held for sale (thus show them in the current assets). Basically, as I wrote above, if you do it routinely, then this would be the appropriate accounting policy to reclassify them as held for sale at the end of their useful life. S.

Hello Silvia,

The issue is on inventory.

If you have a stock of oil and gas asset such as pipelines, tubings etc. that you have not used in your operations but are kept in your ware house. How do you classify them when you are still holding them in stock and when you eventually used them for production?

Hi Abiola,

well, for me, it seems that these assets are rather property, plant and equipment (spare parts) and not inventory. So I would say to classify them under non-current assets. IAS 16 guides us on spare parts, too. S.

What is the implication if the entity is in a bank

Thank you very much Silvia for clarification ,before it I recognized items between current & non current according to 12 month rule.

Hello Silvia,

Thanks for this insightful article. I am currently having an issue with one of my clients on this issues. Traditionally, we know that prepayment are current asset. But how do we classify prepaid rent on a property for five years from now. How we going to have current and non current portion of the prepaid rent in the financials? I urgently need your comment on this.

Thanks

Hi Olusesan,

in this case, a part of this prepayment is indeed non-current and you should show it within non-current assets, as some long-term receivable or so. So, the part related to the enxt 12 months is current and the rest of it is non-current. Hope it helps, S.

Hi Silvia,

I really appreciate your articles and your kind sharing of knowledge. My concern with your response is to know how the rent prepayments shall be treated in accordance with IFRS 16 Leases. Can you say stng abt this?

i think Olusesan, needs to consider whether the arrangement is or contains a lease in which case IFRS 16 will become relevant.

Hello Silvia,

If the prepaid rent for five years from now, under IFRS16 ” Leese ” shall we continue classify the payment as current and non-current and not apply IFRS16 ?

Thank you

Dear Sylvia,

Some items of equipment were bought previously but were expensed. Now we want to bring them into the books in line with IFRS but IAS 16 is silent about that. What should one do?

Zukky, you say you want to try to change the past, isn’t it? Why were these items expensed in the past and what is the reason for change? For me it seems that you simply did not apply IAS 16 correctly in the past (as you should have revised the useful lives of your assets periodically and adjust depreciation – it also relates to immediate expensing). This is more to do with the correction of errors under IAS 8. I have covered it in this article. S.

Or a change of accounting policy if they previously have a policy of expensing items below a certain amount

I want to understand about one point in your Loan Example. You said that, If StrictBank agrees NOT to demand immediate repayment of the loan due to the breach of the covenant at or before the period end (31 December 20X1) and this agreement is valid: Whether this means that Strict Bank would not ask for Payment for next 12 months?.. can u please clarify. The second point is pretty clear.

Hi Punit,

it tried to say that when StrictBank gets the report on breach of covenants, then it has right to demand immediate repayment. But despite this right, StrictBank confirms that it does NOT want the immediate repayment (or the repayment within 12 months) and ABC can continue repaying the loan under the current schedule. Hope it’s clearer.

S.

Thanks for the getting back to me.