Coronavirus and IFRS – What is happening?

Over past few months, coronavirus became the most mentioned word everywhere.

No wonder – not only it takes lives of our dear ones, but it also affects our daily life in many different ways.

In many countries, people cannot go to work, kids cannot go to school, shops are closed, machines are silent, the buzz stopped.

The thing is that the governments in many countries took certain measures to stop the spread of the infection and those measures affect the financial statements in a different way.

In this article, I tried to describe my take on the greatest effects of the pandemic on the financial statements, based on the current IFRS rules.

At the end of the article, you can find a few of my personal thoughts (but feel free to skip this part).

I think that only a very few items in the financial statements are left untouched and free of any effects of the current situation.

However, let me sum up the main considerations for you:

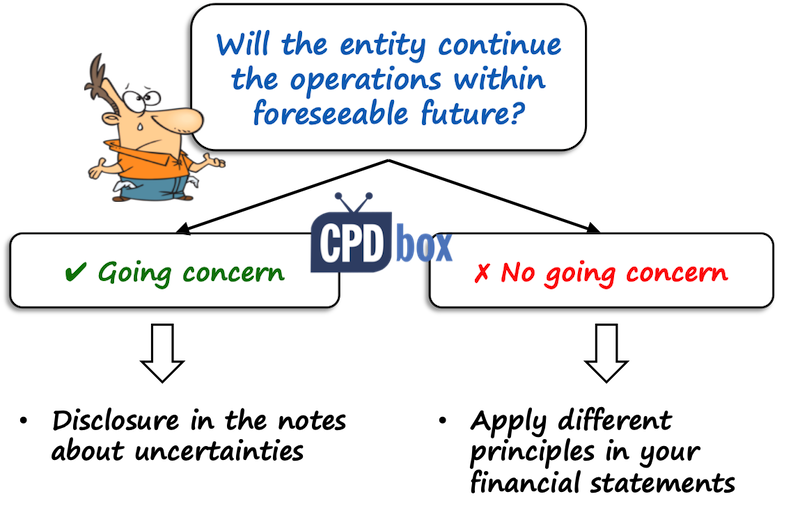

Does going concern principle still apply?

To stop the fast spread of the infection, many governments limited the business operations.

Retail shops are closed. Factories are idle and people stay at home.

That means that many companies stopped generating revenues.

So… can they survive the next 12 months?

Under Conceptual Framework, the entity shall prepare the financial statements under going concern assumption – that is, the entity will continue operations in the foreseeable future (see par. 4.1).

Under IAS 1, the management shall assess the going concern when preparing the financial statements.

It means that the assessment is NOT made on the reporting date (e.g. 31 December 2019).

It is made BEFORE the financial statements are issued.

Now, the pandemic broke out in January 2020 and no one could forecast or assume the financial effects of the pandemic itself and the measures taken to stop it.

However, if you are still preparing the financial statements during the pandemic, you should definitely assess the ability of your entity to survive and go on:

- Are you financially strong?

- Are your assets of high quality?

- Will your company be able to survive the next 12 months or so?

- Will you be able to find alternative sources of financing your business?

After you make this assessment, you have two choices:

- You assess that your company IS a going concern.

In other words, management believes that an entity will survive the pandemic.

However, in this case, you should make at least a disclosure in the notes to the financial statements that although the financial statements have been prepared under going concern assumption, there are many uncertainties surrounding the assessment.

- You assess that your company IS NOT a going concern.

In other words, the management does NOT believe that an entity will survive within 12 months.

In this case, the financial statements must be prepared in a different way. You can read and listen to my Q&A session here for further guidance.

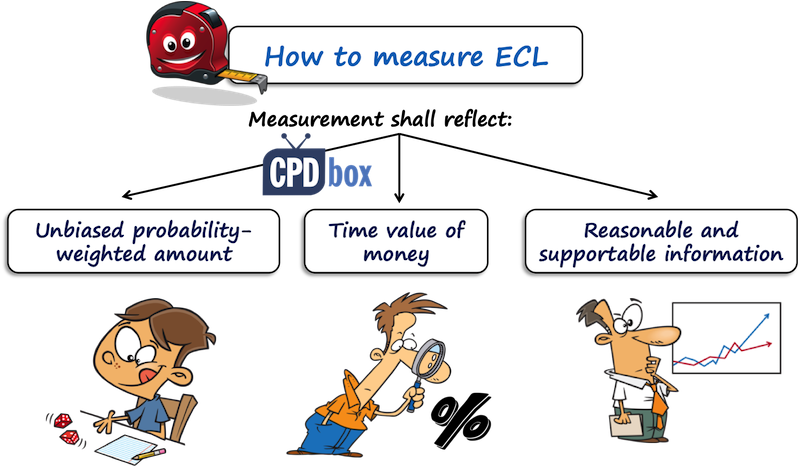

Expected credit loss on financial assets

Even if you are not affected directly by the virus and the related measures, your clients can be affected.

And, they can be badly affected in a way that prevents them to pay you.

As a result, the expected credit loss on your financial assets can be much greater than you estimated based on your historical information and previous forecasts.

You can imagine that all forecasts made prior the outbreak are simply outdated and don’t apply anymore.

IFRS 9 says that expected credit losses shall reflect an unbiased and probability-weighted amount determined by evaluating a range of possible outcomes (see IFRS 9.5.5.17a).

And, you should take reasonable and supportable information about past events, current conditions and forecasts of future economic conditions available at the reporting date (IFRS 9.5.5.17c).

Forced closure of businesses by the governments is very crucial forward-looking information that became available only after the end of 2019 in many countries.

Yes, it is true that the first reports about the virus emerged before the end of 2019, however it is questionable that anyone could have estimated the severity of the impact on the business.

Thus in my opinion, while ECL at the end of 2019 will not probably incorporate the effect of all measures taken in 2020 to stop the virus (as the information was not available at the reporting date), it should incorporate at least some estimate of the effects of the virus on business.

However, if you have trade receivables or loans with debtors whose businesses and cash flows are strongly affected by the virus and the related measures, you should maybe incorporate this forward-looking information into the ECL measurement in the subsequent periods.

How?

Let me give you very short illustration.

Example: ECL and coronavirus pandemic

Let’s say that you have a debtor that owes you 1 000 CU (currency units). The debtor operates a retail store chain with clothes.

Due to the coronavirus pandemic situation, the local government ordered to shut down the shops and the debtor loses the revenues.

Now, the debtor has not gone into the bankruptcy or anything, but it is clear that he will not be able to repay the debt in line with the contract.

Based on the news, the statistical models of pandemic scenarios prepared by the experts and assessing the debtor’s financial statements, you identified three different scenarios:

- The pandemic will be over within one month, the shops will reopen and in this case the client suffers 10% decrease in revenues. This decrease will not affect debtor’s ability to pay on time in full, as his financial situation is stable. However, the statistical models of pandemics estimate the probability of this development at 10%.

- The pandemic will take longer time and the shops will reopen after 6 months. In this case, the client suffers significant decrease in revenues, but he will still be able to recover and you will lose 30% of the receivable. The probability of this scenario is 70%.

- The pandemic will be terrible and the shops will only reopen after 1 year. The debtor will go bankrupt, however, you will be able to recover some receivable from the sale of debtor’s property in the amount of 10% of the receivable (hence your loss is 90%). The probability of this scenario is 20%.

Let’s put this nicely in the table:

| Scenario | LGD | Probability | ECL |

| 1) Shops open in 1 month | 0% | 10% | 0 |

| 2) Shops open in 6 months | 30% | 70% | 210 |

| 3) Shops open in 1 year | 90% | 20% | 180 |

| Total | 390 |

Notes:

- Here, we do NOT take solely the most probable outcome into account. In such a case, ECL would have been just 210. Instead, we weight all scenarios and the loss is 390.

- ECL = CU 1 000 times LGD times probability

This is a very simple illustration of incorporating new forward looking information into the ECL calculation as a result of the coronavirus pandemic measures.

And, as you can see, we are dealing with lots of uncertainties and estimates.

The IFRS Foundation issued a document providing a short guidance on this issue. You can access it here.

Impairment of assets

The standard IAS 36 lists a few external indicators of impairment of assets and I consider the measures of the governments to stop the infection as very significant.

Therefore, yes, in many businesses the external indicator of impairment exists and you should test your assets for the impairment.

Especially in industries such as tourism, restaurants, entertainment and others, the fair value of assets as well as value in use will go down, for one very simple reason:

The estimated future cash flows generated by the asset (or cash generating unit) are much lower. Closed business does not generate any cash flows during the closure.

You can see the example with making cash flow projections for the impairment testing here.

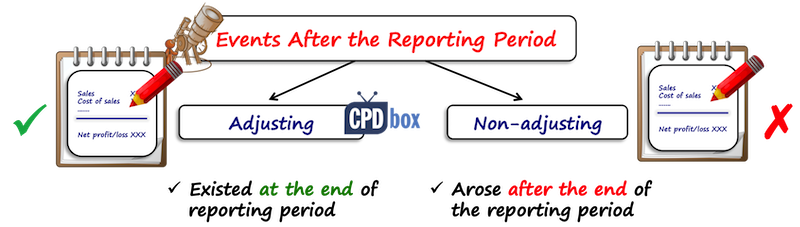

Events after the reporting period

Under the standard IAS 10, you should:

- Identify significant events occurred after the end of the reporting period,

- Determine whether they are adjusting or non-adjusting, and

- Adjust the financial statements for adjusting events or disclose non-adjusting events.

The pandemic and related measures to prevent it are definitely significant event after the reporting period.

However – are they adjusting or non-adjusting?

Here, I would like you to think a bit.

What are the events affecting your business?

- Is it a virus outbreak itself?

- Or measures to prevent the spread imposed by the government?

In most cases, measures of the government are the major event, not the virus itself.

These measures happened only after the end of 2019 and therefore they are non-adjusting, so no accounting entries before the year in this respect.

However I think that most of these events will have a material impact on the financial statements, so the entities should disclose the existence of these events and try to estimate the financial impact.

Other effects

In my opinion, these are the areas affected by the current pandemic situation in the greatest extent.

But, the list is not exhaustive.

Here’s the short list of other potential affected items:

- Provisions under IAS 37 – maybe you will need to think of any restructuring plans, or provisions for onerous contracts;

- Measurement of inventories under IAS 2 – maybe the value of inventories of different kinds will go down, just because some of them might have an expiry period (and you are not able to sell them due to closure of retail businesses), or the customers are willing to spend less as they earn less money;

- Contract with customers under IFRS 15 – well, some customers will not have enough money to meet their contract obligations and that can result in early termination of contracts, modification of contracts, changes in variable considerations, etc.

- Lease contracts under IFRS 16 – in some cases lessors may need to change the lease payment schedules to ease their tenants’ lives, or just because government asked them not to charge rentals for some period. This can result in a lease modification accounting; or accounting for variable lease payments;

… and I can go on – indeed, this situation can affect pretty much everything in the financial statements.

My aim here was to highlight the main things to watch out.

Final word

I want you to know that we are all on the same boat.

And I am also aware that most of us have never faced anything similar so far.

Therefore, I would like to share also my personal thoughts about this situation with you.

I am a mom of three children, currently homeschooling them, because schools have been closed since early March.

At the same time, I see the panic around myself. Everybody is afraid of the virus and of the economic stress it causes – which is understandable.

However, as difficult as this may see, I try to stick with the following:

- No fear and no panic. The stress causes your body goes into “fight or flight or freeze” stress reaction. It means that all the resources are spent to fight the enemy and nothing is left for the regeneration and repair. Simply speaking – the stress weakens your immune system and you will get sick more easily.

Therefore, use all your brain to turn your thinking away from panic and fear events as much as possible.

- Lots of love. Love, gratitude, joy and other pleasant emotions do the exact opposite as stress – they actually strengthen your immune system. Spend your time with loved ones, use it to reconnect, to talk and enjoy each other.

- Don’t stop self-development. This is the time to take that online course you always wanted. Learn. There are so many great things to learn: soft skills, marketing, excel, writing, communication, accounting, IFRS… and many of these courses are free (hint: you can catch up and read all IFRSbox articles)

Please, if you have any questions or something to say, leave me a comment below the video.

Stay strong and healthy!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia,

During the lock down period, tenant granted some rental rebate (example 0.5 month or 1 month) and property tax rebate from landlord or government. Whether this result lease modification or government assistance? If former, what is the accounting treatment for right of use asset (ROU), depreciation & lease liability?

Thank you

Thanks Silvia Very useful material in the current environment

Thanks Silvia. As always your analysis is spot on with the bonus advice.