Can you capitalize it as PPE or not?

Last update: 2023

Is it an item of property, plant and equipment or a part of its cost?

Or is it a piece of inventories instead?

Or just an expense that goes straight in profit or loss?

Hmmm, what about an intangible asset?

In 90% of all cases, the answer to the above questions is clear – it’s obvious that buildings, machinery or other BIG pieces of tangible assets presumably used for more than 1 period are PPE.

But I’m convinced that you have come across at least 1 or 2 situations in which you were not so sure about the right conclusion.

I can confirm it based on a number of e-mail questions I receive in relation to this topic.

Let me give you my answers to the most common ones.

What does IAS 16 Property, Plant and Equipment prescribe?

Property, plant and equipment are tangible items that:

- Are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and

- Are expected to be used during more than 1 period.

That’s the definition taken right from the standard IAS 16 Property, Plant and Equipment.

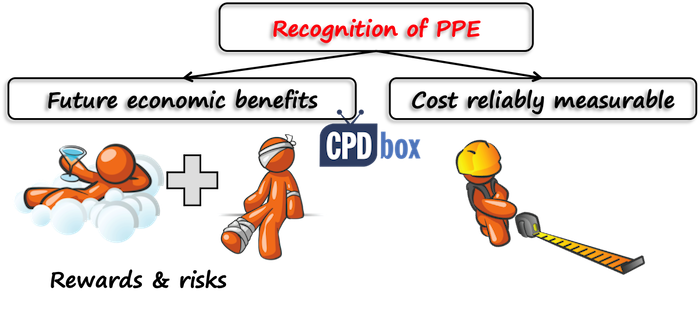

Also, IAS 16 answers our first and basic question: When should we recognize an item of PPE?

The answer in IAS 16 is taken directly from the Conceptual Framework (2018): the cost of an item of property, plant and equipment shall be recognized as an asset if, and only if:

- It is probable that future economic benefits associated with the item will flow to the entity; and

- The cost of the item can be measured reliably.

Therefore, in general, when you’re assessing whether some item shall or shall NOT be treated as an item of PPE, you need to take the following factors into account:

- the purpose for which an item is acquired and / or held

- the useful life of an item (longer than 1 period)

- future economic benefits flowing to the entity and

- cost is reliably measurable.

OK. So we have just set up the fundamentals.

But while it’s easy to assess and categorize some assets, other assets are not so clear and we need to use judgment and often apply the concept of materiality in order to make a conclusion.

Now let’s take a look at several unclear or shady examples.

Should we capitalize spare parts?

There is no uniform opinion about capitalizing spare parts. Instead, spare parts require your own judgment of a specific situation.

In most cases, spare parts and servicing equipment are included in inventories and treated in line with IAS 2 Inventories.

However, major spare parts can qualify for PPE, especially when they can only be used in connection with an item of PPE. For example, some reserves engines for airplanes would rather be included in PPE than in inventories.

Let me give you an example of the opposite situation.

I received a question from my reader about treatment of a big amount of sand (or other construction material). He wrote me that it was a great opportunity to get this sand at a very good price, therefore the company piled up a big stock.

However, a company was not going to use the sand immediately in the construction process. The sand could have stayed in the warehouse for many years.

What to do in this case?

In my opinion, although the sand indeed did have “useful life” longer than 1 period, it’s NOT an item of PPE.

It was a raw material and its purpose was to be consumed in the production process – which perfectly meets the definition of inventories.

Instead of charging depreciation of the sand, I would rather check whether the cost of sand exceeds its net realizable value at the end of each reporting period and if not, then I would leave it in inventories until it’s consumed.

Should we capitalize small items acquired in large amounts?

Imagine you run a library.

There are thousands of books there, each has an acquisition cost of a few dollars (whatever currency) and it will definitely be used for more than 1 period.

Should you treat each book separately and as a result, recognize it in profit or loss when acquired? Or should you treat all books as 1 item of PPE?

Other similar examples are tool sets, furniture sets, pallets and returnable containers which are used in more than one accounting period, but the cost of 1 piece is low or even negligible.

What to do in this case? How to treat these small items in large amounts?

Again, there’s no uniform answer.

Standard IAS 16 (9) says that the unit of measurement for recognition of PPE is NOT prescribed.

In other words, sometimes it’s appropriate to aggregate individually insignificant items and to apply the criteria to the aggregate value. And sometimes, it’s not.

In our library example, it can be appropriate to treat books as 1 single asset (or a few assets) and depreciate these assets, especially if a running a library belongs to main revenue-producing activities.

Should we capitalize improvements on a leasehold property?

Imagine you rented an office space. The big one.

But, you need to adjust it to fit your needs and therefore, you decide to install glass partitions to divide the space and make it look more elegantly.

Glass partitions are damn expensive. They represent a significant investment.

However, they cannot be used separately without the office space and once your rental contract expires, glass partitions are useless for you. You can’t even take them out and install them in another place.

How to treat your investment in the improvement of leasehold property?

I repeat again: there’s no uniform answer and it depends on your contract and specific circumstances.

First of all – are future economic benefits from these improvements probable? Maybe yes, as glass partitions make the office space usable for you.

Another question – are you going to use these improvements for more than 1 period?

In most cases, you can estimate improvement’s useful life quite reliably and therefore, it’s appropriate to capitalize them as an item of PPE. The useful life will basically depend on the term of your lease, so you need to take that into account.

Should we capitalize pre-operating expenses?

You are establishing a business. Before you can actually start a production process, you need to obtain permits, hire employees and do a lot of things – and all of this costs money.

You need to pay salaries, rent, professional advisers and you might incur many other types of expenses in the pre-operating stage of your business.

Can you capitalize these pre-operating expenses?

In most cases – NO. You cannot capitalize them as a separate intangible asset.

Why?

Because they do not meet the definition of an intangible asset in line with IAS 38 as they are not identifiable, i.e.:

- They cannot be separated and sold/transferred, and

- They do not arise from contractual or other legal rights.

There is one exception when you actually can capitalize pre-operating expenses.

When you construct an item of PPE and your pre-operating expenses were incurred in relation to constructing that PPE, then you can capitalize them if they meet the IAS 16 criteria.

For example, when you build a production hall during the pre-operating stage, you can include salaries of direct production workers to the cost of that production hall.

These are 4 the most discussed and ambiguous examples of capitalizing/not capitalizing an item as PPE. Please help me share this article with your friends or colleagues and if you have some question or remark, just leave me a comment right below this article.

I’ll also welcome your answers and experiences – you’ll help to make Internet a better place!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia, I have a question on capitalizing leasehold improvements. Can renovation works like electricity instalments, new toilet, road works, painting and renovating the canteen also be capitalized if it adapts the office/factory better to the company’s needs?

Hi Silva

Company A agreed to reimburse all EPA cost to Company B for environmental protection assets (EPA) required by law for production. and so does the transaction happened.

But once the equipment installed in Company B, how does Company B treat this Asset in book ?

Zero value assets ? or should be Misc income ?

Thanks

Hi Vinnie, all similar situations must be assessed within the context of the agreement between the parties. Here, I don’t see the broader terms, just one piece of information. Why did A agree to reimburse B? Because they have some other agreement in place? Or was it the act of altruism? Maybe this article will shed some light.

Hi Sylvia,

For a new set up warehouse, new light holes and light fitting s installed eg. 16 light holes at a cost of 8000 dollars, can the light fixtures be capitalised? For example for the same new fire alarm with hosereel setup, do we capitalise this fire alarm system?

Thank you.

Hi Silvia,

Thanks again for publishing these IFRS info.

Quick one. – I have a situation where the landlord is reimbursing for some leasehold work that was done by the Tenant . The asset will be control by the landlord and was constructed on the behalf of the lanlord by the tenant. Whats the best way to account for the reimbusement. ( Note this is not considered a lease incentive)

Hi IFRS Newbie, so if the asset is controlled by the landlord, and many other conditions of the lease are met, then basically this asset is in the books of a landlord and the tenant may adjust its ROU asset and the lease receivable. Or, account for the costs incurred as for some receivable to landlord. It is extremely difficult to make a conclusion without revising specific terms of the agreements.

Suppose I’m constructing a PPE which is cuurently is used as of now for producing trial run production. And if satisfied with the outcome , it will be further used and an intermediary good for my final product . and I’m incurring few expenses such as Electricity, Watchman, etc. As this is necessary to bring my machine to present lolcation and condition I can Capitalise it

My question here is uptil what stage i can capitalise this expense til the trail run stage or till the FG stage?

Hi ,

wanted to check is building a football pitch considered as Opex or Capex ?

As soon as you are planning to use it for more than one year in order to provide some services, then it’s capex.

Hi Silvia,

First of all, thanks for all the information you shared. I have a questions around IFRS16, the answer of which I could not find anywhere.

Let’s imagine a company wants to sign a lease agreement for a new plant (including the plot and the building). Nevertheless, the plant is not yet built (it will be a built-to-suit). The design will be done mostly by the lessee. To do so, the lessee hires a Project Manager (internally), who will be focused 100% in the design of the facility and, when the construction works start, he/she will supervise them to ensure the quality of the building.

If the PPE was owned (plot and plant) I understand that the Project Manager costs could be capitalized together with the asset but, in case of a lease, where the lessee will actually not own any asset, could the lessee capitalize the project manager costs? (the work would be exactly the same in both cases).

It is important to highlight that the lessee will own the equipment that will go into this plant.

Thank you very much for all your comments and support.

Kind regards,

Olga

How is this a lease for the plot of land and the building when the building has not been constructed? It appears that the lease is just for the land and the building costs will be capitalized separately?

Dear Silvia,

i am a student of the Madina Institute of Science and Technology in Ghana, specializing in accounting.

I have a question of which i am to give a presentation on and it says:

“Roper Corporation Purchased 100 storage boxes for the office. The boxes cost $15 each and should last at least ten years. Should the cost be capitalized or not? Argue against

Thank you and i would very much grateful for your assistance.

Hi Silvia,

I have a query in regard of capitalization. Actually we are looking for sale of company and there is no production. Our project or engineer department continue to working on installation and other work.

1. in this case can we capitalized the assets?

2. in that situation can we capitalized the cost of operation (e.g. Salary of project department.

Please revert.

Hi Vikram,

in general, if you are creating new assets by the installation/other work then yes, you can capitalize. S.

Thank you for clarifying the capitalization of PPE.

I have a very specific question. I am auditing a company which deals in Serviced offices. They are launching a new location. All costs from during the setup until the property is in operation is carried as pre-opening cost. Once the new property starts operation, they will capitalize the rent expense of the preopening period as leasehold improvement.

I feel they should expense it, but they dont. This has happened at every new location they have launched over the years. It is big group. My firm has not raised an objection in the past audits. Could I get a reference to the IAS where it allows rent expense to be capitalized. And what is the rationale behind capitalizing it? Is it because the Company earns from renting out serviced offices, so it will gain future benefits from the property over the life of the property. And without renting the property they would not be any future benefit.

Thanks. I really appreciate all your efforts.

Hi Mubashir, I think this can help. It is the similar issue. S.

Hi Silvia,

I have a question. I am Company manufacturing Bikes. During initial stage, I capitalise bikes used for Testing purpose and having life of 3yrs ( Company policy). After completion of 1 year Management wants to consider that Bike as a regular vehicle ( Lief 5 years – company policy ). Now question is How do I account the same.

2nd question I can not run the bike on road without registration ( Govt rule ) as a normal bike, But during Testing period it runs within the factory and does not require a registration. The registration charges incurred is capital or revenue in nature ? Asset is put to use or ready to use when i declared it as Test vehicle. But when I change the classification ( Test vehicle to Normal vehicle ) it is ready to use only when registration is completed. Please give your view.

Hi Solvia, Hope you can help me. Our Client (A Ltd Company) purchased a house from the shareholder at market value. The house is intended to be used from the UBO of the Company for his personal use but in the future maybe is going to be rented. Can you assist on the classification?

Hi Silvia,

Thanks for your interesting issues which help us a lot every time. My question is can we treat a future crop costs as an asset in when we incurred costs and reverse up on harvesting time as per I AS 41 Agriculture.

Regards,

Dear Silvia

Does the assets dismantling cost form a part of disposal cost, and should it be considered in calculating the profit/ loss on disposal?

Hi Anoma,

it depends. In some cases, you need to estimate the amount of dismantling costs and capitalize it to the cost of PPE.

How do we treat costs related to the installation of an ATM such as the cost of constructing the ATM house, AC in the ATM house, the door to the ATM house, e.t.c

Security Service before new plant establish will be capitalized or not ? why

Can you capitalize a technical study that costs $5k?

If we are building a warehouse in a rented land (for 99 year) the land rent which we are paying monthly, Can we capitalist this rent until the work completion of building.If it so what is the requirement.

Hi Rajitha, I think this Q&A session gives you the answer. S.

Thanks. Pls what is difference between using PPE for rentals under IAS 16 and Using the same term assets to earn rent under IAS 40. Thank you

Here my question is Park Ltd. is setting up a new refinery outside the city limits. In order to facilitate the construction of the refinery and its operations, Park Ltd. is required to incur expenditure on the construction/development of railway siding, road and bridge. Though Park Ltd. incurs (or contributes to) the expenditure on the construction/development, it will not have ownership rights on these items and they are also available for use to other entities and the public at large. Whether Park Ltd. can capitalise expenditure incurred on these items as property, plant and equipment (PPE)?

Same question. As per IAS 16, the road is necessary for production/supply and will have future benefits for Park Ltd., and cost of works is known. So on face of it should be capitalised. Only issue is lack of control or for e.g. if impairment assessment was to be done, how would you find out value in use specifically for the road? The road/bridge seemingly can’t be capitalised as stand alone asset, and you can’t club it with cost of the manufacturing plant or refinery, because the road/bridge cost by itself may not be deemed as necessary for the refinery to work (or would it be?)

Hello,

I hope you can help me!!

we have purchased new equipments and management has put in a lot of time in making the premises ready to install the equipments. Can we capitalize the management salary?

Hi Silvia.I wanted to ask why do we capitalize motor vehicles.I mean what are the economic benefits that will flow into the entity by acquiring motor vehicles. Why do we capitalize them and include them in PPE?

Hi Silvia,

I’m hoping you can help me.

We are a franchising company. We enter into property leases, construct the fit-out and hand over the site on completion to the franchisee to operate under a licence deed. The title of equipment is handed to the franchisee however the ownership of the leasehold improvement remain with us.

We currently expense the property lease payments and all construction costs. I’d appreciate your thoughts around the possibility of capitalising rental payments along with construction costs pre opening? If this is possible, what would be the accounting treatments pre and post handover.

Thank you,

Laila

Hi Laila, no, I am not in favor of capitalizing any rental expenditures – please see this Q&A session why (it relates to the land, but it can be applied to your situation, too). Also, you can capitalize construction costs if they meet the definition of an asset.

Hello Madam,

I work for hospitality industry, Marriott Hotels. Recently we have purchased a water pump for our swimming pool as the old one completed its life. Should i capitalize it or not?

I think so 🙂

Dear, Silvia, My Name is Deme Gebreyesus. i live in Ethiopia,East Africa. I am accountant at Horizon Plantation PLC. The company running agricultural business. The company using GAAP;but now,the company will have make its report as per IFRS.

So,

1. should i capitalize the cost incurred for Up-rooting coffee and infilling costs too,Please??

2. the company planting coffee and accumulating the costs incurred to young coffee till four years. After four years the young coffee begin bearing first coffee fruit. Then, the current practice of the the company will have capitalized the accumulated cost and treat as PPE. My main question is some times,some young coffee are died before four years and before bearing the first coffee fruit. So, How could i recognize the accumulated cost incurred till the coffee uprooted??? The current practice is no action taken rather than infilling. impairment cause is new to entity.

Thank you so much.

Warm greetings

Deme

tell:251937587044

Ethiopia East africa

Hi,

I have a foreign Currency Loan for acquiring Fixed Asset.

Due to the exchange rate fluctuation i have foreign exchange loss.

Please confirm if the foreign exchange loss could be capitalized or not.

Hi Smita,

if you used that loan to purchase the asset, then no, because the asset itself is non-monetary and must be kept at historical cost. If you used that loan to finance the construction of the asset, then if you meet the conditions of IAS 23, you can capitalize the part of that loss within borrowing costs, to the extent it is a foreign exchange related to interest cost – more in this podcast. S.

Hi Silvia, may you please assist we have bought the following items for our bathrooms in our offices

Paper towel dispensers,air freshner dispensers, sanitary bins and toilet paper holders.Should we classify them as capex or opex?

Good day Silvia,

I appreciate all your efforts and I really need your assistance on the classification of sanitary/hygien items bought for the office.We had a meeting with our auditors and i am of the view that dispensers, bins and toilet paper holders in the bathrooms should be expensed as opposed to their advice of capitalising those items.May you please assist.I have read your article on “Should we capitalize small items acquired in large amounts?”, but I am still confused.Each item cost from R500 to R3000 but in total they purchase price was R120 000.

Hi Kefentse,

this is very judgmental. If the aggregate amount of R120 000 is material for your company, then it is necessary and appropriate to capitalize. S.

Much appreciated.Thank you Silvia.

HI Silvia, could you please advise should capitalization of licenses depend on if full ownership is transferred to buyer? can we capitalize as intangible assets licenses that gives us right to use it for several years?

Hi Silva,

if the company had $500 capitalization threshold and was bought by a new company with $ 10,000 capitalization threshold. My questions are:

1. Based on IFRS what will be the accounting treatment for the assets previously booked below the new capitalization threshold?

2. Does change in capitalization threshold fall under the change in accounting policy- IAS 8?

Hope to hear from you soon..

Hi Silvia,

How about software purchase needed to run the PPE. Let say a refrigeration equipment was purchase as the PPE of the Company however the Company also separately purchase a software for the equipment since it is needed to run the refrigeration equipment as this will control and program the temperature of the equipment. Will the software recognize as PPE or intangibles? kindly guide us on the proper recognition of the software.thank you.

hi silvia

i have dillema of treatment of rental inventory( Equipment) as retail inventory i.e Current asset IAS 2 or Fixed asset IAS 16

since by nature client purchase those equipment (Scaffolds) basically for hiring purposes no to sell them completely. but gently speaking i can not ignore the fact that they qualify as fixed asset since they will be used for more that a year, Second they bring future economic

How would you treat ,Fire Protection clothing , which is purchased to comply with risk policy .

Hi Silvia

We have purchased a property and the transfer has not yet taken place. But the process requires that we pay the full purchase amount to the attorneys account.

How should I treat this payment in my books.

Hi Silvia

How do you treat Plates and Spoons for a restuarant?

You can treat them as a set – one PPE, especially if you use them for more than 1 year. S.

Hi Silvia,

Can you advise if 1)cost of land fill and clearing for construction and 2) temporary fences around construction side should be capitalised to cost of land or building? Many thanks

HI Silvia,

Thanks for sharing your knowledge with us.

We have recently completed our office building. We have used metal emboss logo of the company at the gate and nameplate of the individual department at each floor and ground floor of the building. Could you please advice if we should capitalise or expense the metal logo and the name plates.

Thank you.

Hi Nalini,

yes, of course, you can capitalize these logos, as they are clearly used in your business for admin purposes and their useful life is longer than 1 year.

Thank you. Could you please let me know under what head I can keep them? Building or any other head.

Thank you

A Power Utility company has drilled two water wells to pump water to its Power plants and Admin Bldg.

Can we capitalize these Water Wells? If yes, at what useful life?

Thank you in advance.

Hi, yes, of course, you can capitalize wells. And, it’s up to you to estimate their useful life. S.

HI Silvia,

A new company created a management team to oversee the various construction projects necessary in the operation of a new cement plant. Are all pre-operating expenses incurred by the team such as food, travel, trainings, management fees be capitalized or be expensed outright. Thank you

Hi Silvia,

Company A rent a store for 5 years, in the first year, company A did a leasehold improvement to the store. So company A record Leasehold Improvement as an asset and depreciate it with useful life of 5 years. At the end of year 2, company A stop the rent and sell all the fixed asset to company B. Can the leasehold improvement also be sold to company B according to IFRS? If yes, please tell me in which part that IFRS mention about that. Thanks!

Hi Lisa,

well, IFRS do not speak about what you can/cannot sell. If someone buys the leasehold improvement on something that he/she does not own, then it’s strange, but OK. Normally, when you terminate the lease earlier and there’s still some leasehold property to depreciate, you should think either about accelerated depreciation or impairment loss. S.

Hi Silvia,

Should we capitalised or expense the cost incurred to refurbish large fuel storage tanks used to store fuel( various kind of) used for electricity generation? Basically for ‘sand blasting & painting of inner and outer surfaces’ , ‘welding works’ etc.

Hi Anoma,

it requires judgement as to whether it is significant cost, how often you need to do it, etc. If you plan to do this once in 3-5 years, then you should capitalize it and depreciate over those 3-5 years. S.

Hi Silvia,

can we capitalize penalty & fines as PPE. To be more specific, i recently found a problem. A machinery was imported and due to compliance issue custom authority charged a fine on the disposal of the same.And later the fine was capitalized. Did IFRS anywhere specifically refer capitalized or not to capitalized “”fines & penalties”?

Hi, Can I know if one department of a company selling a machine to another department and the new department capitalise the machine with total amount including the profit margin charged by the first department.

Hi Udayakumar, I guess you are talking about 2 different companies within the same group. Yes, the buyer capitalizes the full cost including the profit margin, but if you consolidate, then you must remove the profit margin from group accounts on consolidation. If this is some transfer within the company, then it’s the same issue. S.

Can You please mention relevant IFRS standard applicable for this.

Hi Silvia can you please assist in deciding whether professional supervision costs (i.e. payments made to an Engineer) incurred during construction of a room for collection of Company’s waste for disposal to a Municipal designated areas can be capitalized. I will appreciate quoting the appropriate IFRS or IAS

How would we treat preoperative expenses that are general in nature e.g. salary of security staff, canteen expenses etc relating to the period when the project has NOT commenced commercial production? In such a situation, the company would not prepare any P&L Account and hence, such expenses cannot be w/o to this account.

These expenses cannot be capitalized as I mentioned a few times in this post and in the comments. May I ask a question – if the company is incorporated, why would it NOT prepare any P/L??? S.

Hi Miss Silvia, I would like to ask if the books at the library is considered as a PPE of the school? Thanks 🙂

Dear Joshua, if you read this article, you should know the answer because I replied there. S.

sorry. but “sometimes it’s appropriate to aggregate individually insignificant items and to apply the criteria to the aggregate value. And sometimes, it’s not.” is not a useful answer. Might as well write “maybe, then again maybe not”.

Yes, it is useful answer. It wants to say that you should apply your judgement and there is no one single correct answer, because every situation is different. And I do not agree that “sometimes” can be replaced with “maybe”. “Sometimes” says “assess according to circumstances”, while “maybe” says “I don’t know”. I am sending you all the love and peace that is in my heart! 🙂 S.

Hi Silvia Please i would like to know if road construction and land scapping can be capitalized? If yes can they be treated as land or as building? Thank you

Hi Chika, in general, both items can be capitalized. Road is a separate asset, but landscaping depends. In most cases, adjustments on the land are added to the cost of land, but they are depreciated separately (as land is not depreciated at all). S.

Hi..i want to ask about this question, should be classified as PPE or not?

Expenditure paid for a major overhaul on a truck.

Can I ask at which point should you stop capitalising development expenditure under IAS 38? Is it the same as under construction of an asset under IAS 16 – ie, when the asset is available for use regardless of whether it is brought into use at a later date, or is it when the asset actually comes into use? I can’t seem to find any answer to this.

Hi Joseph,

Research and development are revenue expenditure, this is as they will enable you (or not) to develop an asset at a later stage.

On the other point you capitalise when the asset is “ready for use”, whether you use it or not is a different thing.

Hope that helps,

Hi Gabriel, thanks for responding, but I do not fully agree. You never capitalize research and expense it, that’s true, but the development is sometimes capitalized after meeting certain criteria, so it’s not always “revenue expenditure” as you named it. S.

Dear Joseph, when you start capitalizing the development expenditure, then you always must check whether 6 criteria for capitalization are met (please revise IAS 38). And, these 6 criteria are hard to be met and really, subsequent “not meeting” is very rare. Then, when the asset comes into use or is available for use, it is assumed that the development has been completed, isn’t it? If further development is going on, then the capitalization criteria are the same as before – check 6 criteria in IAS 38. S.

Hello Silvia,

I have an issue where my mangaer wants to capitalise warehousing costs of network PPE yet to be installed on telecoms base station. His view is that, he is incurring the cost as a result of building several base stations i.e if the company is not buidling base stations, no warehouse cost will be incurred. I have argued that these costs should be expensed as they are not directly attributable to bringing the assets to the location and condition intended for management. They are in effect storage costs. Could you please shed further light on this. I have searched all over the internet and cannot find anywhere warehousing costs are capitalised. Even IAS 2 prohibits capitalising storage costs except it’s required for a further production process.

Dear Temilade,

you are right and there’s not much more I can say about it. Your manager can equally argue that without building several base stations, a few of admin expenses would not have been incurred – but you can’t capitalize them either because they are not attributable to “bringing the asset to its location and condition”. The same applies for warehouse – storage: they might have been incremental (i.e. incurred only as a result of building the asset), but you can’t capitalize them because they are not directly attributable to bringing the asset to its condition and location (note: directly attributable cost do not necessarily need to be directly attributable to the asset itself). Hope this helps, S.

Maximize OPEX

given our current position we try to maximize OPEX and minimize CAPEX for a new industrial project.

Therefore we’re investigating if it’s possible to put following in OPEX:

– external construction management (not the builders, but the external party coordinating the different third party builders/equipment suppliers)

– scaffolding needed for the building process

what’s your view on this as IAS 16 is not fully clear for me?

Thx Mathijs!

How do you handle airport ground storage costs for imported ppe. can they be capitalised.

Hi Silvia,

My company bought a Crane machine and use it fully to construct building. Can we capitalize depreciation of the the Crane machine to Building?

Yes, you can 🙂

hai madam.

the company provides airport terminal services. if the company decides to expand its business operation to include warehousing for bulk items and the company wishes to acquire a loan specifically to construct the warehouse. warehouse is new asset, so it is PPE right? And why the company wishes to construct its own assets instead of acquiring them through an outright purchase or acquiring loans as a means to obtain the warehouse.