Accounting for discounts under IFRS

Last update: July 2023

Discounts are probably the most popular selling tool in business. Without a doubt, many companies discount the price for their products or services in various forms, for example:

- Buy 1, get 1 free (and modifications),

- Get 10% off for purchases over CU 100 (and modifications),

- Gift vouchers,

- Settlement discounts (bonus for early payment or for cash payment),

and many others.

What do discounts really mean for us, accountants?

In most cases, troubles.

The reason is that discounts directly affect measurement of various items in the financial statements and potentially the accounting treatment (timing and journal entries).

In this article, I explain how you should treat the discounts from the point of view of both seller and buyer.

My good friend, Prof. Robin Joyce added a bonus to this article.

We try to explain why discounting is not always that great and how you should decide on the amount of your discount based on your own margins and sales.

Maybe you’ll be surprised to find out that not every single business can afford discounting. Yes, it’s an expensive selling tool!

Sellers provide discounts

When a seller provides a discount, it directly affect the amount of his revenue.

Therefore logically, we should look to the standard IFRS 15 Revenue from Contract with Customers for guidance.

This standard specifies that you should present the revenue net of discounts. Just refer to IFRS 15.47 and following.

In other words, discounts reduce the amount of your revenue and do not represent cost of sales (or cost of promotion etc.).

For example, when you sell a machine for CU 100 and you decide to provide a discount of 3%, then you present a revenue of CU 97, and NOT the revenue of CU 100 and cost (of sales, marketing, whatever) of 3.

This rule seems very basic and very simple, yet its practical application can be challenging at some circumstances.

Let me give you 2 examples.

Example 1: Discount coupons

Imagine you run an e-shop with books. To support your sales, you send a discount coupon for CU 5 that your customers can use with every purchase over CU 100.

How should you account for the discount coupon?

In this particular example, you don’t recognize a provision in your financial statements for a discount at the time of distributing a coupon.

Why?

Because there’s no past event.

Remember, a customer would have to make a purchase over 100 and only then you have a liability to provide a discount of CU 5.

Instead, you simply recognize revenue net of CU 5 discount when a coupon is redeemed.

Example 2: Buy 1, get 1 free (or any free items)

You normally sell Thai cuisine for CU 10, its cost in your inventory is CU 6 and the cost of Thailand travel guide is CU 35.

What do to now?

Under IFRS 15, the accounting treatment is the same if both books are delivered at the same time.

However, if you deliver Thailand travel guide in September and Thai cuisine in October due to low stock, then you would need to split the transaction price of CU 50 based on the relative stand-alone selling prices and recognize revenue accordingly.

More specifically:

- Total stand-alone selling prices: CU 50+CU 10 = CU 60

- Revenue allocated to Thailand travel guide: CU 50/CU 60*CU 50= CU 42 to be recognized in September.

- Revenue allocated to Thai cuisine: CU 10/CU 60*CU 50 = CU 8 to be recognized in October.

Costs of sales are recognized accordingly.

Buyers get discounts

When buyers get discounts, it’s a totally different story.

We need to look at IAS 2 Inventories, IAS 16 Property, plant and equipment or other similar standards for guidance.

Both IAS 2 and IAS 16 prescribe that we should initially measure an item of PPE or inventories at its cost including purchase price. And, it’s net of discounts.

However, let me stop here.

You should examine the reason for getting a discount.

If you receive a discount as a reduction in the purchase price of inventories, then you should deduct it from their costs.

When discounts refund some selling expenses, then these discounts are not deducted from the costs of inventories, but treated as income.

Another consideration might relate to settlement discounts, i.e. discounts received from quick payment. They should not be treated as finance income, but again, they reduce the cost of inventories.

Example 3 Rebates on inventories

- Sales price per unit: CU 5

- Volume discount per 1000 units: 10%

- Settlement discount: 2% when paid within 30 days

- Contribution for leaflet printing costs: 1%

If the supermarket intends to pay within 30 days, then it should reduce costs of inventories by settlement discount, too.

Contribution for leaflet printing costs is clearly refunding some selling expenses and therefore it should be treated as income, not as cost of inventories.

The costs of inventories is: CU 5*1 000 – CU 5*1 000*(10%+2%) = CU 4 400.

What about inventories received for free?

Well, it depends.

If a government (including governmental agencies) donated you some inventories, then you should apply the standard IAS 20 Accounting for Government grants and Disclosure of government assistance.

If you received some units of inventories for free as a “gift” with your purchase, then you should apply the standard IAS 2 – i.e. measure inventories at cost.

For example, you purchased 1 000 units at CU 2/unit and received 50 units for free, then you record 1 050 units at CU 2 000, i.e. CU 1,90/unit.

I have also seen that some companies record free items at their fair value while a credit entry goes in profit or loss (as an income). However, this approach is not supported by IFRS.

In any case, you should always seek the substance of a transaction and then make appropriate decision. You can read more about accounting for free assets here.

When you should NOT discount your goods or services

Let’s take a different angle of looking at discounts. My friend, Prof. Robin Joyce helped me with that.

Discounts represent a very powerful selling tool, but at the same time, they are like marketing’s nuclear weapon.

Why?

The reason is that discounts can lower price perception permanently or make your product a commodity.

It means that clients will see no difference between your product and other products – they will just buy the cheapest (not necessarily the best).

What do discounts do to your profit? Do you really need to discount your products or services in order to increase your profits?

If you sell some tangible products, then you need to know the exact financial impact of your planned discounts on sales and the net profit.

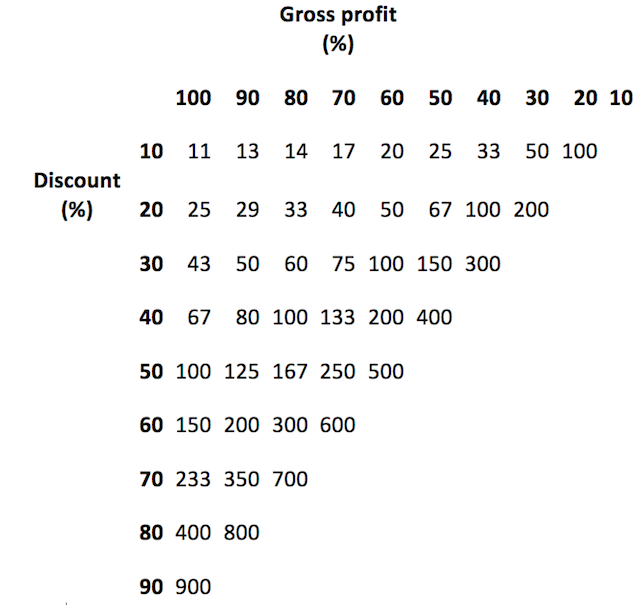

The following table sums it up (read the explanation below the table):

This table shows you how many additional items you should sell at your present profit margins, if you want to keep the same profit.

For example, if you are making 80% margin (top row), and you provide a discount of 20% (side column), you need to sell 33% more units to get the same financial result as without giving a discount.

Putting some numbers to it:

Let’s say you sell a product for CU 100 with 80% margin, therefore its cost of sale is CU 20. You sell normally 100 units, therefore your gross profit is CU 80*100 units = 8 000.

You’d like to give a discount of 20%. Looking at a table above, you need to sell 33% more units than before to have the same effect.

For verification, your new discounted sales price is CU 80, therefore your gross profit with 33% more units sold is CU 60 (80-20) * 133 units = 7 980 (Cu 20 is a rounding difference).

This table assumes that you provide discounts for all your units sold, not just some of them (in this case, you would need to adjust the calculation).

What are the conclusions?

- You need to know your gross margin before considering a discount.

- You need to know how many additional units you need to sell after discount to keep the profit. And, are you able to do so? Will your customers really buy 33% more with 20% discount?

- If you operate with low margins, you cannot afford any discount. For example, if you operate at 10% margin, you cannot give away any discount without hurting your gross profit. You simply cannot sell enough items to pay for it.

It’s your turn now! If you have any questions or concerns with regards to discounts and their accounting, please let me know in the comments below this article. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Recent Comments

- Silvia on Summary of IAS 40 Investment Property

- Anna on Summary of IAS 40 Investment Property

- Ali on Accounting for “buy two + get one free”

- Joe on How to Account for Government Grants (IAS 20)

- Essam Alshammaa on Example: IFRS 10 Disposal of Subsidiary

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (73) 73

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (55) 55

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (26) 26

- Uncategorized (1) 1

Thank you Silvia

Just want to ask weather sales discounts can be recorded directly in the sales account instead of recorded in a contra revenue account?

You can account for a discount as you please, but then, in the statement of financial position, you need to present revenues net of discounts. Using different accounts is a matter of convenience and it is OK as soon as you report it correctly in your balance sheet.

Hi Silvia,

I have a similar scenario, except that the supplier is refunding for expenses incurred on their behalf in form of free goods; which we want to sell. The supplier has quoted a lower price than usual since this is a refund in form of free goods ( for clearance purposes)

What should I base my cost price on( note that i want to add a few other landed costs to arrive to the full cost of the free goods)

Hi Silvia

if purchased non current asset using installments (4 year & 4 installment) and recognized it according to IAS 16 then after the second installment the company get discount for settlement his balance by negotiate . how recognized this discount

Dear Silvia

Superb article!!

really i like the way you simplified and give such a insight knowledge about IFRS 15,

i really appreciate your blog. .keep it up..!!

i also enjoyed Q&A also..

How would we account for the below situation? ABC Ltd have issued coupons worth 1 mil to its customers on 31.03.2020. ABC Ltd predict that only 60% of the coupons will be redeemed in next month by end customers. How much shall we accrue in books in Mar’20 books.

Am working as accounting manager in auto leasing company.

On a quarterly basis we are getting discount 3% on total purchases from the vendor.

In the same time we are financing these cars through contracts to our customers for different financing periods 2, 3, 4, 5 Years.

How to recognize these discounts?

Hi M. Mustafa, difficult to say without seeing that contract with the vendor and assessing the probability of getting the discount – is this 100%? Is this volume discount? Or settlement discount? I have no idea. However, if it is a volume discount and the probability is 100%, you should recognize your discount immediately. E.g. you buy a car for 100 000, and you will receive a discount of 3% about 3 months later with 100% probability. Thus the entry would be something like Debit PPE – Car: 97 000; Debit Receivable to vendor: 3 000; Credit Cash/bank/Trade payables/whatever applies: 100 000.

Hie Silvia

can you please help with the following

NM Ltd is a company listed on the ZSE Limited. NM is an online store that sells a large

variety of gifts including books, movies, games and electronics. NM has a February year-end.

During the 2011 christmas season NM sold gift vouchers to the value of $25 600 for cash.

The holders of these gift vouchers may redeem the vouchers for merchandise in the future.

Normally the vouchers expires within 12 months from date of issue. Of these gift vouchers,

$10 200 were sold as part of a promotion where the purchaser will receive a $120 voucher for

$100 paid. These promotional gift vouchers had a 31 January 2019 expiry date and at the

expiry date, 23 vouchers were not redeemed. At 29 February 2019 vouchers to the value of

$5 200 vouchers remained outstanding (not yet exchanged for merchandise).

REQUIRED

Discuss how the sale of gift vouchers of NM Ltd should be measured and recognised in terms of International Financial Reporting Standards (IFRS) for the year ended 29 February 2019.

Hello Silvia,

I have 3 Questions:

1. Assume a car-dealership sells a car for 45.000€ (list price:50.000€) . Can we regard the 5000€ discount as a variable component of consideration? (Assume that nowadays a customer has a valid expectation to get a discount)

2. price of car: 50.000€ -5000€ (discount) ,costs of vehicle(for dealer): 30.000€. Now the dealer recognized 45.000 Revenue and 30.000Cost of Sales on the income statement right? (nothing more in the following years) (The 5.000 discount don’t become apparent on the Inc.Statement right?

3. Which “article” in IFRS 15 states that I am not allowed to recognize variable components? (which “article” prooves my question 2?(that it doesn’t become apparent on the Inc.Statement?))

Thank You!

Silvia,

I need your advice.

We buy 100 unit and get free 3 unit . 3 unit is warranty goods. Instead of having reponsibility of warranty, seller give us 3 unit when diliver 100 unit (total is 103 unit). How should I record the free 3 unit in my book?

Thank you

As 103 units and the unit price of (price for 100 units) divided by 103.

Hi I am currently auditing expenses of a grain handling terminal.

Hi Silvia,

Under IFRS 15, can we recognise the full selling price of the service as revenue if it is offered for free e.g. Sign in now and get 2 months worth of subscriptions for free. e.g. Cr Revenue – $150 (Selling price of Sub) and Dr discount/cost of Service – $150 or should no revenue be recognised as it nets off to 0. Appreciate your assistance.

Thanks

Harshila

Thank you Silvia