How to present a loan with breached covenants?

“I work for a company that is a subsidiary of a multinational group. Our local company took the large loan from the bank to finance group’s operations repayable after 5 years. As the loan amount was really big, the bank imposed a lot of covenants to keep, like profitability, liquidity ration, etc.

Our financial year-end is on 31 December and based on the financial results we found out that we breached one covenant.

According to our loan contract, we have 6 months to rectify the breach and during this period, the bank will not demand the immediate repayment. If we fail to do so, then the loan will become repayable on demand.

We always classified the loan as non-current, but our auditors insist on the classification as current.

However, we still hope to remedy the situation within 6 months and afterwards the loan will not become repayable on demand.

So, how shall we classify the loan?”

Answer: As a current liability.

Why?

When is the liability current?

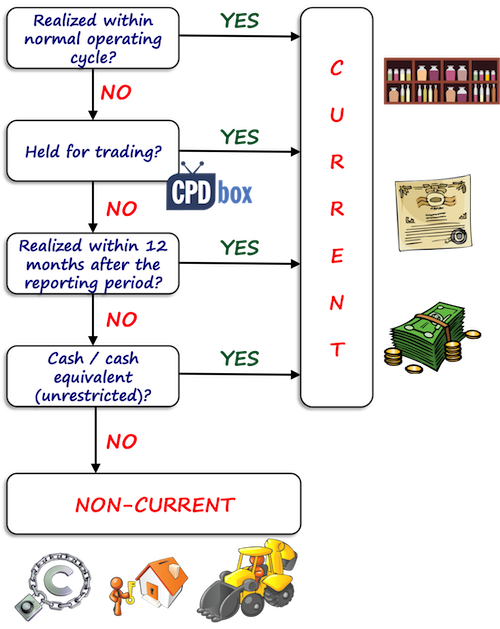

The standard IAS 1 Presentation of financial statements tells you when the liability is current:

- Either it is expected to be settled in its normal operating cycle, which is not our case, because this loan does not have any operating cycle,

- Then when the liability is held primarily for trading – not our case,

- The liability is due to be settled within 12 months after the reporting period – this is very questionable in this case, but the most important is that

- The liability is current when the entity has no unconditional right to defer its settlement for at least 12 months after the reporting period.

So, if you are not sure whether the liability is current or non-current, you need to ask:

Do we have an unconditional right to defer the settlement of the liability for at least 12 months after the reporting period?

If yes, then the liability is non-current.

If not, then the liability is current.

Let’s apply it to this situation.

Is there an unconditional right to defer the settlement?

Does the company from our question have an unconditional right to defer the settlement for at least 12 months at the end of the reporting period?

NO, it does NOT.

The reason is that at the end of the reporting period, the covenants are breached and based on the contract the company has an unconditional right to defer the settlement just for 6 months.

OK, now you might ask:

But, they have 6 months to rectify the situation. They can work on their financials and after 6 months, if there is no breach, the loan will not become repayable on demand.

This is true, but there is a condition: to rectify the situation within 6 months.

So, at the end of the reporting period, the company has a conditional right to defer the settlement for at least 12 months, because the company must rectify the breach – this is the condition to meet.

However, the IAS 1 definition speaks about unconditional right, not conditional.

There is no unconditional right to defer, thus the loan must be shown as current.

This is quite bad, because your liquidity ratios go crazy!

Let me warn you here about few twists of the same situation.

Other examples: current or non-current?

- Covenants breached after the end of the reporting periodWhat if the company meets the covenants at the end of the reporting period, but 1 month later, the covenants are breached and the loan becomes repayable on demand?Well, we need to look at the end of the reporting period and everything was OK then, so there is no reason to change classification of the loan from non-current to current.

The subsequent breach of covenants after the end of the reporting period is non-adjusting event under IAS 10 Events after the Reporting Period, so you would just disclose the fact in the financial statements and no accounting.

- Management intends to repay the loan within 12 monthsWhat if the loan is non-current and the covenants are not breached, but the management intends to repay the loan in the near future?Now, it depends.

If the management entered into agreement with the bank to repay within 12 months, then the loan becomes current.

Or, if the loan has the repayment date beyond 12 months after the reporting period, but the contract says that the company can repay the loan earlier at its own discretion, then the loan can be classified as current.

However, the mere intentions are not enough if the loan has fixed repayment date and no agreement about earlier repayment is in place with the bank.

In this case, the loan would be classified as non-current. - The bank does not demand earlier repayment despite the breach of covenantsWhat if the covenants are breached before the end of the reporting period, the loan became repayable on demand, but the bank agreed not to demand earlier repayment?In this case, if the bank agreed before or at the end of the reporting period, then the loan is classified as non-current, because at the end of the reporting period the company has still unconditional right to defer settlement of the loan beyond 12 months after the reporting period.

But, if the bank agreed only after the end of the reporting period not to demand the repayment, then the loan is current because at the end of the reporting period, there is no unconditional right to defer.

Just to put some dates to illustrate: Let’s say you breach covenants on 30 November.

If your bankers manage to send you their confirmation of not demanding the repayment before 31 December, then you are all safe, because at 31 December you have unconditional right to defer.

If your bankers are lazy or too busy and send you their confirmation of not demanding the repayment sometimes in January, then bad luck – the loan is current, because at 31 December, you did not have the unconditional right to defer.

You can read more about the current/non-current classification in this article.

If you have your own questions or comments to this topic, please share them below. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

5 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Thanks for tackling some of the most confusing issues with simplicity.

Does IFRS 7 have effect on financial reporting quality of banks

Per IFRS how often do you need to change your Audit Firm?

Hi Lisa,

IFRS do not deal with auditing at all.

For listed companies, you need to change your auditor after 7 years but for unlisted companies there is no need to change the auditor.