How to test hedge effectiveness under IFRS 9?

After changes in IFRS 9 related to hedge accounting a few years ago, many people remained a bit confused.

IFRS 9 introduced prospective test of the hedge effectiveness.

Does that mean that you do not have to recalculate anything to the past, just look to the future when it comes to hedge effectiveness?

Not at all.

Here’s the specific question from one of my readers:

“Under IFRS 9, we are required to test the hedge effectiveness prospectively and we can use the qualitative methods, for example the critical terms matching.

Does it mean that there’s no need for quantitative retrospective testing of the hedge effectiveness?

Here we are talking about cash flow hedge of forecast transaction and all the critical terms of hedged item and hedging instrument match and the hedge is designated at day one.

I believe that if all terms match then the hedge is 100 % effective always and there is no need for quantitative testing. Is it true?”

Answer: Work both prospectively AND retrospectively

It is true that IFRS 9 introduced some changes into the hedge accounting and one of them was prospective evaluation of the hedge effectiveness.

This means that you need to assess whether you expect that the hedge will be effective in the future – this is why it is prospective, because it’s looking to the future.

But it does not mean that you are never going to look back.

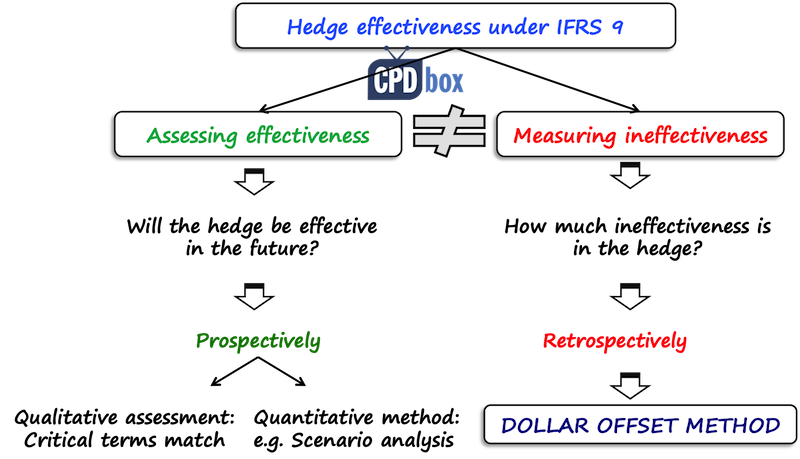

When you enter into the hedging relationship and you want to apply hedge accounting, you need to do 2 things related to the hedge effectiveness:

- Assessing the hedge effectiveness and

- Measuring the hedge ineffectiveness.

OK, so let me explain both of them.

1. Assessing the hedge effectiveness

This is so-called prospective test, because you need to assess whether you expect your hedge to be effective in the future.

So in fact, you are assessing three aspects of the hedge effectiveness:

- There is an economic relationship between the hedged item and the hedging instrument;

- The effect of credit risk does not dominate the value changes rom that economic relationship,

- The appropriate hedge ratio is maintained.

You need to do this:

- At the inception of the hedge,

- At each reporting date, and

- Every time when the circumstances of your hedge change.

How are you going to do that?

There are a few methods, both quantitative and qualitative, for example:

- Critical terms matching – the qualitative method, because you do not perform any calculations.You need to compare the terms of the hedged item with the terms of the hedging instrument, for example maturity dates, the currencies, interest rates, notional amounts, etc.This method is used for simple transactions, like simple forward contracts hedging the forecast transaction.

- Simple scenario analysis method – this is the quantitative method.You simulate various scenarios and analyze how the fair value of your hedged item and hedging instrument change as some other variable changes.

- Linear regression method

- Monte Carlo simulation method

The last 2 methods are quantitative, they require a bit of modelling and simulating and they are used in more complex hedging relationships.

Except for assessing the hedge effectiveness, you need to do the second thing, as I mentioned:

2. Measuring the hedge ineffectiveness

This is done retrospectively, so not at the start or the inception of the hedging relationship.

You apply dollar offset method in most cases.

It means that you need to calculate how the fair value of the hedge item changed over certain period, how the fair value of the hedging instrument moved and based on these movements you can calculate the ineffectiveness.

In the cash flow hedge, you are going to recognize:

- The ineffective part in profit or loss, and

- The effective part in other comprehensive income as a cash flow hedge reserve.

Illustration – assessing the hedge effectiveness vs. measuring hedge ineffectiveness

Imagine you assume to make a sale in 6 months in foreign currency and you want to protect yourself against the foreign currency risk.

Therefore, you enter into the forward contract to sell the foreign currency exactly in the amount of the assumed sale.

This is a typical hedge of the forecast transaction – it is a cash flow hedge.

At the inception, you need to perform the prospective hedge effectiveness assessment.

Are the terms of the forecast transaction – sale and forward contract matching?

Is the maturity date of the forward about the same as the assumed date of the sale?

Is the notional amount of the forward the same as the amount of the assumed sale?

You get the point.

At the beginning, you can’t measure the hedge ineffectiveness yet, because there are no data.

Let’s say that 3 months later, we have the reporting date.

So, you measure that the fair value of the forecast transaction increased by 100 and the fair value of the hedging instrument decreased by 110.

You just measured the hedge ineffectiveness – it is 10 because the fair value change of the forward was by 10 higher than the fair value change of the forecast sale.

And, you book these 10 in profit or loss, and 100 in other comprehensive income.

Plus, on top of that, you still need to assess the hedge effectiveness prospectively – again, compare the critical terms or perform any other method.

Now, finally, let me tackle one more point from the question.

Why is there hedge ineffectiveness if the critical terms match? Notional amounts are the same, maturities are the same… why?

The answer lies, in most cases, in a different credit risk.

Forecast transaction or sale – your hedged item – has no credit risk, because there is no counterparty yet.

But, the forward has the credit risk, because you have counterparty – you need to enter into that forward contract with someone else, like some bank.

Due to difference in credit risk, the fair values of your hedged item and hedging instrument will be different and you will have some ineffectiveness inside your hedging relationship.

Here’s the video summing up the issue:

If you have any comments or questions to this topic, please write me below – thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

21 Comments

Leave a Reply Cancel reply

Recent Comments

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

- BSA on Change in the reporting period and comparatives

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Hi Silvia, if I have a pool of assets with a floating rate liability that have different cash flows and I wish to hedge by doing a floating to Fixed IRS how will i be able to manage the cash flow dates – the critical terms matching? is there a way to identify the hedge effectiveness on a pool of assets.

When doing a prospective test when the hedging instrument is an interest rate swap, do you adjust the time to maturity for each data point i.e. only take into consideration the cashflows remaining on the future valuation date ?

Hi Silvia

We are putting in place a cross currency swap to hedge the cashflows on a fx denominated bond. We have been advised to use the hypothetical swap method to test for hedge effectiveness. We will designate the cross currency swap immediately. My question is, if the hypothetical swap will have the exact same terms (maturity, notional , interest rate etc) as the actual cross currency swap wouldnt this relationship ALWAYS be effective? I cannot see the point of the hypoteical swap method unless there is a big time lag between enetring into the cross currency swap and designating the swap?

Hi Silvia,

For fair value hedge, we consider hedging gain or loss arising from hedging instruments in profit or loss statement. If transaction has not been designated as fair value hedge then also it will be considered under profit or loss statement considered as speculative gain or loss. My question is if both treatment are looking similar then why there is a need to follow fair value hedge. Instead we need not designate hedging relationship in such scenario. Please clarify.

We can book Forward even one year in advance, so suppose booked forward in January, 2021, for maturity date of July, 2021. And this forward is to be settled against Future Sale. Then as of reporting date of suppose, March, 2021, you won’t know FV of forecast transaction (Sale) but can only have FV of hedged instrument. In this case, how you measure ineffectiveness of hedge?

Hi Sylivia,

what if we have MTM Gain on hedging instrument of Rs. 100 but when we do ineffectiveness testing it comes loss of Rs. 150. How much amount we need to show in OCI whether it should be gain of Rs. 100 or what. Pls confirm.

Hi Silvia!

In case of government grant that cannot became part of CAPEX but carries some FX risk is there any option to keep to unrealized FX difference in Equity? If yes, how can it be then released once the FY difference gets realized? Although I try to retrieve the relevant guidaince from IAS 20/IFRS 9 I still do not have the big picture.

Many thanks for your guidance.

Hi Sylivia, what would you do if the fair value of the forecast transaction increased by 100 and the fair value of the hedging instrument decreased by 80?

Or, if the forecast transaction decreased by 100 and the fair value of the hedging instrument increased by 80?

Would you book -20 in P/L (first case) and 20 in P/L (second case)?

That’s underhedge in this case and all of it is booked in OCI.

Hi Sylivia, Like to ask one query, what is the new method of testing hedging effectiveness in addition to 80-120% ? Please help me share.

Well, I guess I described it in this Q&A. Please see point 1, 4 methods.

Hi, how the time value should be factored in while computing ineffectiveness ?

Hi Silvia, thank you a lot for the article!

I have a question regarding measuring ineffectiveness for fair value hedge.

1) can a forecast transaction be designated into fair value hedging relationship?

2) how ineffectiveness should be booked in this case?

Hi Silvia,

Can you please assist with credit risk dominance.

1. How does one assess whether credit risk dominates fair value changes?

2. Do we look at the fair value changes of the hedging instrument from day 1 to the reporting date?

Hi,

You have mentioned that “you measure that the fair value of the forecast transaction increased by 100 and the fair value of the hedging instrument decreased by 110. And, you book these 10 in profit or loss, and 100 in other comprehensive income.”

But being a cash flow hedge we only need to account for the hedging instrument and not the hedged item. By accounting for the 100 in OCI as stated above, are we not accounting the hedged item (forecast transaction) ??

No, you are accounting only for the hedging instrument. It’s fair value decreased by 110 and you need to book the full decrease: 100 in OCI and 10 in PL. S.

Hi Silvia,

I red your interesting article, but for me is not clear how you can assessed if credit risk does not dominate the value changes from that economic relationship. IFRS 9 doesn’t explain “dominate” meaning.

Thanks in advance

Hi Silvia, if the fair value of hedged item is not the same as the fair value of the hedging instrument, then how can you set up the fair value of the hedged item? For me, it is unclear. Thanks!

Hi Gopal, excellent question!

IFRS 9 offers the method of a hypothetical derivative – that is, you construct a derivative that does not exist, but it has the same underlying terms as the hedging instrument (e.g. notional, maturity…). Then you will be using risk-free rates to value the hypothetical derivative (these rates are free of credit risk, it is what you need). For hedging instrument, you will use market rates to arrive at fair value. S.

So there is always some ineffectiveness?

Not in 100% cases, but most of the time yes, because it is hard to match the conditions of hedged item and hedging instrument perfectly.