IFRS 18 Management-Defined Performance Measures (with video and example)

What are management-defined performance measures, the new requirement in IFRS 18?

The guidance in IFRS 18 related to MPMs is quite extensive, however, in my humble opinion, most “outside-financial statements” measures will not meet the definition of MPM in IFRS 18. As a result, no specific disclosure will be needed.

Why?

Because, first, you need to check that the measure or indicator, that you report in your financial statements, meets the definition and criteria for MPM as set in IFRS 18.

And, once you determine that yes, your indicator meets the criteria in IFRS 18, then you need to report those measures in your financial statements, precisely in a single note (for all MPMs).

Let’s break this process down.

Definition of MPMs – what are they?

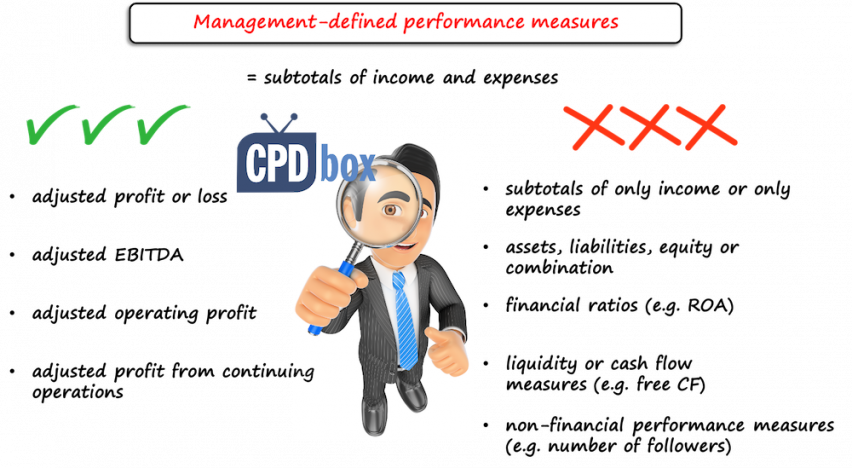

Simply speaking, management-defined performance measures are subtotals or totals of income and expenses that are (see IFRS 18, 117-120):

- …used in public communications outside the financial statements, for example in management commentaries, press releases or investor presentations.

Hint: Social media posts or any oral presentations do not count as public communications in this case. - MPMs communicate management’s view of an aspect of financial performance of the entity as a whole; for example: profitability, etc., and

- They are not a required subtotal or a common subtotal listed in IFRS.

This requirement is logical, because required or common subtotals would be a part of profit or loss statement itself.

The examples of MPMs are:

- Adjusted profit from continuing operations for non-recurring items;

- Adjusted operating profit;

- Adjusted EBITDA – if EBITDA is the same as OPDAI (operating profit before depreciation, amortization and impairments)

- Adjusted profit or loss

The standard IFRS 18 gives examples of indicators that are NOT MPMs (IFRS 18 B116) – and therefore, you do NOT need to provide additional disclosures in the notes:

- Subtotals of only income or only expenses (because, MPM is always a mix);

- Assets, liabilities, equity or their combinations;

- Financial ratios, for example return on assets ROA – because, this measure contains also assets, not purely income and expenses;

- Liquidity or cash flows indicators, for example free cash flows;

- Non-financial performance measures, for example number of followers on social networks.

What to disclose about MPMs?

Once you identified that you indeed have an MPM, here’s what you need to disclose, in a single note for all MPMs (IFRS 18, par. 121-125):

- Statement that:

- MPMs provide management’s view of an aspect (e.g. profitability) of the financial performance of the entity as a whole; and

- MPMs are not necessarily comparable with measures of other entities that report similar labels or descriptions.

- Description of MPM:

- understandable label of MPM (e.g. adjusted profit or loss);

- the aspect of financial performance that is communicated by the MPM, in management’s view (e.g. profitability);

- why that MPM provides useful information about the entity’s performance (e.g. by better understanding of trends);

- how the MPM is calculated

- Reconciliation:

- between MPM and the most directly comparable subtotal listed in IFRS 18 or total or subtotal required by IFRS Accounting Standards;

- include income tax effect and the effect on non-controlling interest for each item in the reconciliation;

- describe how the income tax effect was calculated (e.g. by applying statutory tax rates, pro-rata allocation of tax or other method if gives better information).

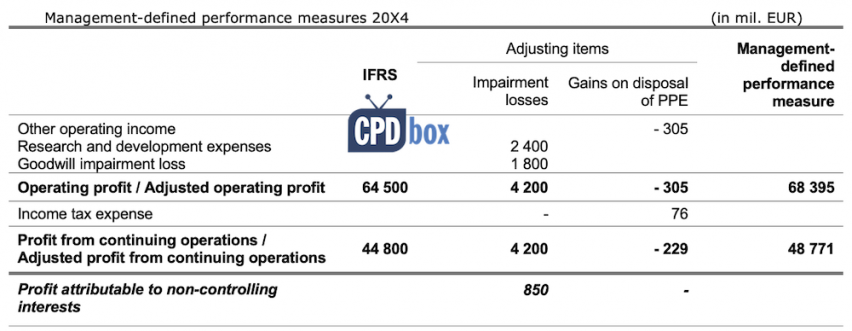

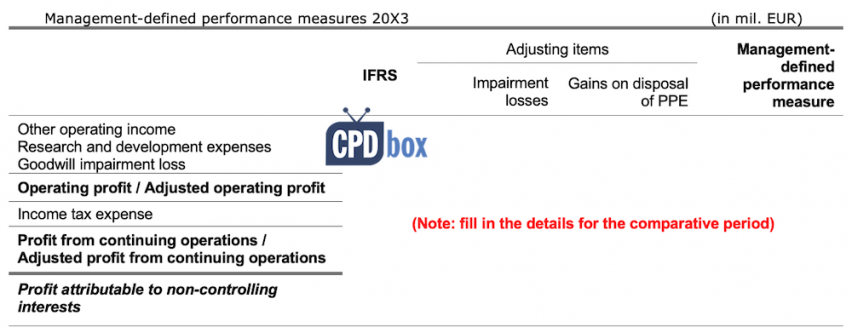

Illustrative example of presenting MPMs in the notes

Here’s the possible way of disclosure in a single note about MPMs. It relates to the fictional Group and all the numbers are made up, the purpose of this example was to show how it can look like.

Of course, this is just an example and other methods are OK if provide better information.

Disclosure on management-defined performance measures

The Group uses the management-defined performance measures (“MPMs”) adjusted operating profit and adjusted profit from continuing operations in its public communications. These measures are not specified by IFRS Accounting Standards and therefore might not be comparable to apparently similar measures used by other entities.

To provide management’s view of the Group’s financial performance, operating profit and profit from continuing operations have been adjusted for items of income or expense that the Group does not expect to arise for several future annual reporting periods. The Group’s management believes these MPMs provide information that is helpful in understanding trends in the Group’s underlying profitability.

The Group generally adjusts for these items of income or expense:

- impairment losses (or reversals thereof) of property, plant and equipment (including right-of-use assets) and intangible assets (for information related to impairments refer to Note 5 Property, plant and equipment, Note 6 Intangible assets and Note 15 Research and development expenses);

- gains or losses on disposal of property, plant and equipment and of intangible assets (for information related to disposal of property, plant and equipment and intangible assets refer to Note 5 Property, plant and equipment, Note 6 Intangible assets and Note 13 Other operating income).

Impairment losses incurred in 20X4 did not yield any tax benefits because they were not eligible for tax deductions in Ireland.

The tax effect of gains on disposal of property, plant and equipment (PPE) is calculated based on the statutory tax rate of 25% applicable in Ireland to non-trading income.

Final word and video

Word of warning: If your financial statements are subject to external audit, then also this disclosure on management-performance measures must be audited, too.

It means more work for an auditor, and that can affect the audit fees.

Therefore, now it is time to reconsider what indicators and measures the management officially communicates outside financial statements.

And, if you identify that those measures meet the definition of MPMs in IFRS 18, well then maybe it would be more effective to change the measures than prepare all those disclosures. Up to the management.

Here’s the video with clear explanations of MPMs:

The full IFRS 18 videos are included in the IFRS Kit. You can also download the Excel files and Word file with illustrative financial statements disclosures.

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

Leave a Reply Cancel reply

Recent Comments

Categories

- Accounting Policies and Estimates (14) 14

- Consolidation and Groups (25) 25

- Current Assets (21) 21

- Financial Instruments (56) 56

- Financial Statements (54) 54

- Foreign Currency (9) 9

- IFRS Videos (73) 73

- Insurance (3) 3

- Most popular (6) 6

- Non-current Assets (55) 55

- Other Topics (15) 15

- Provisions and Other Liabilities (46) 46

- Revenue Recognition (26) 26

- Uncategorized (1) 1