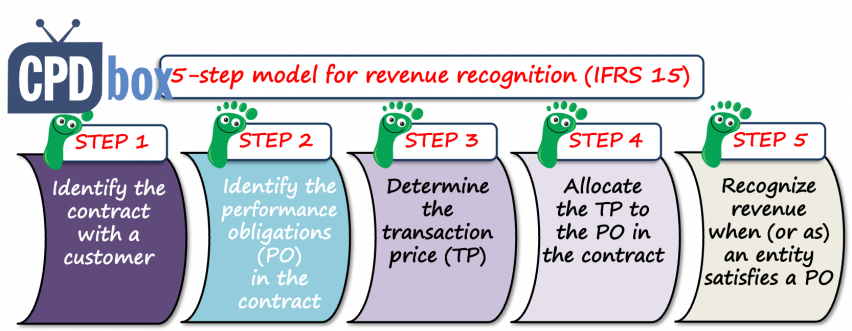

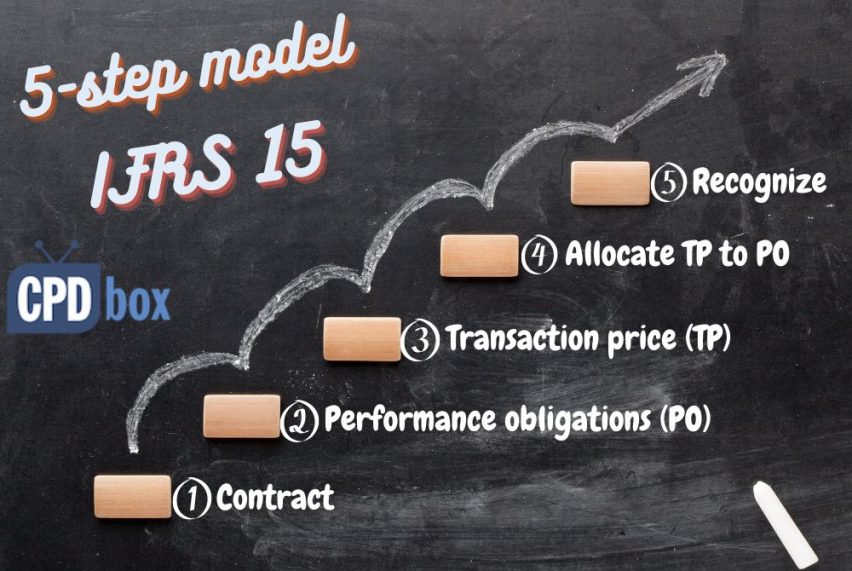

5-Step Model for Revenue Recognition under IFRS 15 + Journal Entries

The standard IFRS 15 has been with us for a while now, yet I still receive the same question:

What precisely is 5-step model and should we really apply it to even the simple shop sales to the customer?

The short answer is YES, you should, because 5-step model represents five steps that you should apply to ALL contracts with customers.

However, if the transaction is very simple, then the 5-step model is easy to apply, without thinking too much about it.

Note: If you don’t want to read and just want the video, then scroll down and watch.

Short simple example: Simple shop purchase

The customer just walks into the shop, buys newspapers for 3 CU and chocolate bar for 1 CU, pays you and walks out.

Strictly applying this model:

- The contract: It is the customer’s acceptance of shop’s terms in line with the applicable laws;

- The performance obligations: The newspapers and chocolate bar.

- The transaction price: 4 CU (3+1)

- The allocation of transaction price to the individual performance obligations: CU 3 to newspapers and CU 1 to chocolate bar.

- Recognition of revenue AT the point of time: At the time of purchase, because the customers takes newspapers and chocolate bar.

That’s it.

Easy, right?

Well, of course, the complications arise when there are some rules or terms attached to the contract.

In such a case, my recommendation is to go through each step carefully.

Let me illustrate on an example.

More complex example: Telecom contracts

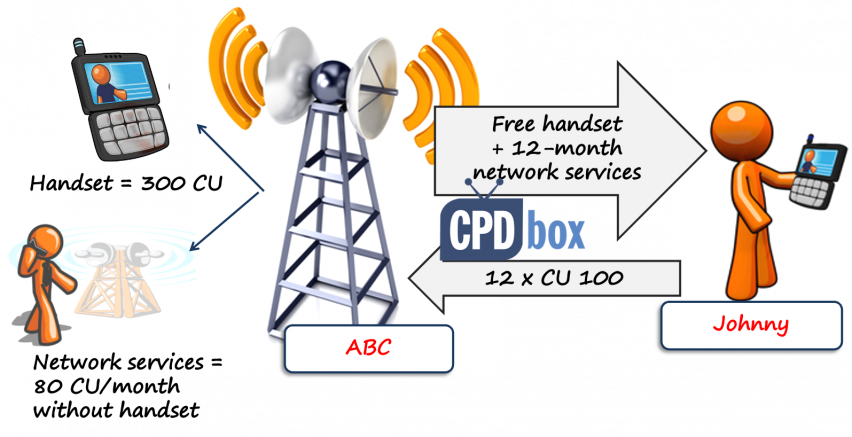

ABC, a telecom company, entered into a contract with Johnny:

- Johnny subscribes for ABC’s monthly plan for 12 months, and

- as a bonus he receives free handset from ABC Corp. immediately after contract signature,

- Johnny will pay a monthly fee of CU 100.

ABC sells the same handsets for CU 300 and the same monthly plans for CU 80/month without handset.

How should this telecom company account for that contract?

Warning before we start applying the 5-step model:

You just cannot treat the mobile phone as a marketing cost. That’s wrong and that’s what changed by IFRS 15.

Now, let’s start with 5-step model.

Step #1: Identify the contract with the customer

Here, it is very straightforward, because ABC has a written contract with Johnny.

Step #2: Identify the performance obligations in that contract

Performance obligations are simply the promises that the telecom company gave to Johnny in that contract. Here, we have two in fact:

- Network services or connection for 12 months

- Phone that the company gives to Johnny right away after signing the contract.

Step #3: Determine the transaction price

It means to determine how much in total will Johnny pay to ABC.

He should pay 100 CU per month over 12 months, so that’s 1 200 CU in total.

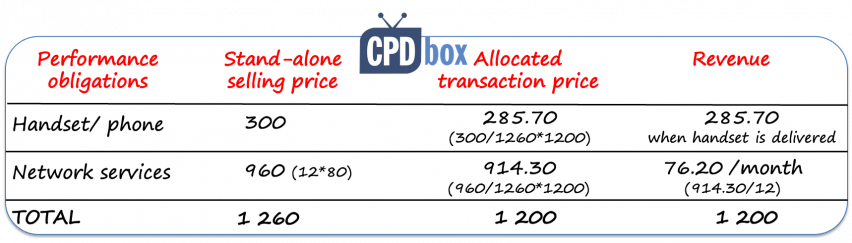

Step #4: Allocate the transaction price to the individual performance

This is where it becomes interesting.

We know that total transaction price is 1 200 CU (see step #3) and we need to allocate it based on the relative stand-alone selling prices.

The stand-alone selling price is simply the price at which ABC would sell the handset and network services separately.

From the information in the example, we know that:

- ABC sells similar phones at CU 300, and

- ABC offers similar monthly plans for CU 80 per month if purchased without handset.

Therefore, the total of stand-alone selling prices is CU 1 260 (being CU 300 + CU 80*12).

Now, we can do the allocation in the table:

So, you can see, that we allocated CU 285.70 to “free” mobile phone and CU 914,30 to the network services (CU 76.20 per month).

Step #5: Recognize revenue when or as the entity satisfies a performance obligations

There are two basic ways of satisfying the performance obligations:

- Over time: this would apply to the network services; and

- At the point of time: this applies to the mobile phone delivered at the time of contract start.

This step is important to determine WHEN to recognize revenue in your journal entries.

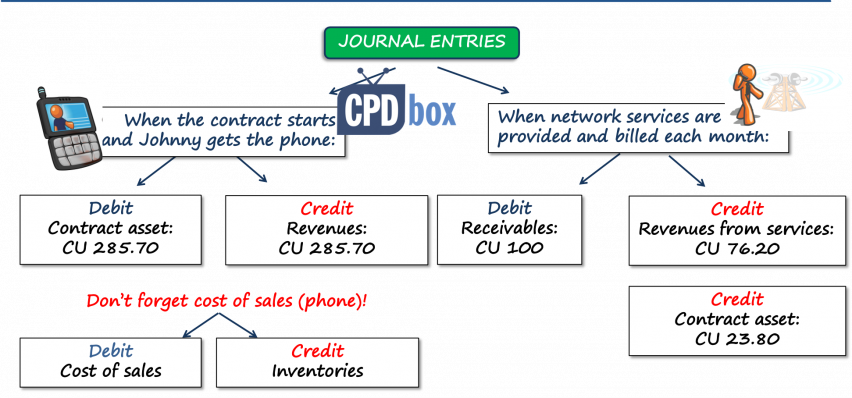

Journal entries

Let’s wrap it up and draft the journal entries which ABC passes in connection with the Johnny’s contract.

At the start of the contract when the phone is delivered:

- Debit Contract asset: CU 285.70;

- Credit Revenues from sale of a phone: CU 285.70;

As you might notice, the amount of CU 285.70 comes from our table in the Step #4. It is the amount allocated to the phone.

Also, why contract asset and not receivable?

Well, in short, because ABC does not have any right to issue invoice to Johnny in the amount of CU 285.70, as the phone is given for “free”.

If you would like to more about the difference between contract asset and receivable, please see here (with video).

At the end of each month when ABC issues monthly invoice for the network services:

- Debit Receivables: CU 100;

- Credit Revenues from network services: CU 76.20;

- Credit Contract asset: CU 23.80;

The amount of CU 76.20 for the revenue from network services comes from the allocation table in step #4. Again.

And, the amount of CU 23.80 is just the balancing amount between the receivable of CU 100 (invoicing to Johnny) and revenues recognized (CU 76.20).

Over 12 months of services, the contract asset gradually decreases to zero.

CU 23.80 * 12 = CU 285.60

OK, OK. The initial contract asset was CU 285.70, so sorry for my rounding here.

Finally…

That’s the whole point of IFRS 15.

Instead of recognizing zero revenues for phone and CU 100 per network services, you should recognize some revenue for mobile, too, based on relative stand-alone selling prices.

The mobile phone is NOT a marketing cost.

Here’s the video with this example, if you prefer watching it:

Any questions?

Please let me know in the comments. Thanks!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

6 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on How to calculate deferred tax with step-by-step example (IAS 12)

- lino Rosas on How to calculate deferred tax with step-by-step example (IAS 12)

- Silvia on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Kevin on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Silvia on 3 Biggest Myths in Accounting for PPE

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (52)

- Foreign Currency (9)

- IFRS Videos (71)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (45)

- Revenue Recognition (26)

- Uncategorized (1)

Wish to be able to make such wonderful content myself. Thanks for sharing this Silvia

It was really helpful

Thanks

Hi Silvia,

Thank you for sharing your knowledge on IFRS 15, your content is amazing, and easy to understand. Can you please also provide your knowledge on how to account warranty as per IFRS 15

Explained very well through the telecom company example……..now deferring the revenue recognition is not possible.

Hi Silvia,

Super efforts by you !

Hi Silvia,

Thanks for sharing . Both your blogs and videos have amazing and useful content which are easy to understand and comprehend.