How to account for rentals depending on inflation and future sales?

Variable lease payments are the payments that can change depending on something in the future, for example inflation rate, future sales, asset use etc.

There is some confusion related to the accounting for these payments and incorporating them to the lease accounting schedule, thus in this post and video (in the end), I responded to questions that are frequently popping up. So here it goes:

“We are a large retail chain and we rent the premises for our stores from various property owners, mostly in the high-class shopping malls.

In some cases, the rental payments are calculated as a fixed fee per month plus a percentage of our sales generated in the store during that year.

This is because the shopping malls promote our store and help us to bring in more customers.

Also, the monthly fixed fee is adjusted every two years for the inflation rate.

We are aware that under IFRS 16 we need to determine the right-of-use asset and the lease liability as the present value of all unpaid lease payments.

How to do it when there are lots of uncertainties and contingencies? We don’t know how much we are going to pay based on the future sales and how the fixed fee is going to increase due to inflation adjustment after 2 years.”

IFRS Answer: What do these payments depend on?

Very good question because let’s face it – the new standard IFRS 16 brings the lessees a few complication with so-called operating leases.

The main reason is that under older standard IAS 17, you just accounted for operating leases straight in profit or loss as an expense.

However, this dramatically changed with IFRS 16 and you need to recognize certain right-of-use asset and the lease liability equal to present value of the unpaid lease payments.

That’s simplification, I know, but I wrote a few articles about this topic, like this one and this one, so you can go through it.

Now, let’s focus on these uncertainties related to the future lease payments.

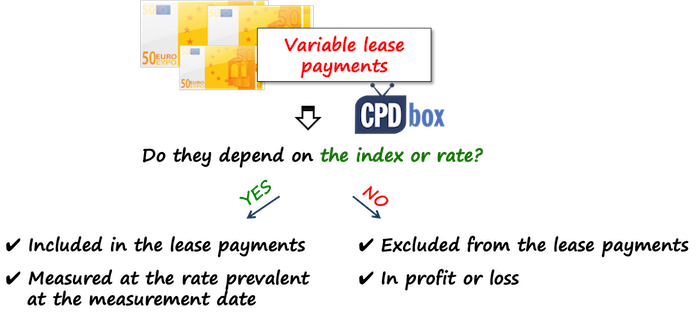

IFRS 16 calls them “variable lease payments” because their amount varies depending on something.

How to treat the variable lease payments?

It depends on what how they are determined.

Basically, the variable lease payment may depend on:

- Index, or a rate – like inflation rate, benchmark interest rate (e.g. LIBOR), consumer price index, etc., or

- Future sales, use of underlying asset or other items unrelated to index/rate.

Before I explain how to treat these kinds of variable payments, let’s explain what the lease payments are.

What are the lease payments under IFRS 16?

Under IFRS 16, the lease payments for the purpose of the lease accounting consist of:

- Fixed lease payments less any lease incentives;

- Variable lease payments depending on an index or a rate;

- Exercise price of a purchase option (if the lessee will exercise it); and

- Penalties for terminating the lease (if the lessee will terminate).

- Residual value guarantees.

Now let’s break the variable payments into easy pieces.

I. Variable lease payment depending on an index or a rate

Variable payments that depend on the index or a rate are a part of the lease payments – you can see it from the definition.

So, the lessee must take the inflation adjustment of the lease payments into account when applying IFRS 16.

OK, but how?

- Initially, you never know how much the inflation adjustment will be after some time.

Are we going to estimate it?

No, not at all.

In fact, it’s easier than that.

Initially, you ignore it.

You will calculate your lease liability and the right-of-use asset based on unadjusted lease payments as known at the commencement date.

- Subsequently, when the lease payments really change as a result of inflation, you will account for the remeasurement of the lease.

You will simply recalculate the new lease liability by discounting adjusted lease payments with the original discount rate.

Then, you will account for the difference as an adjustment of right-of-use asset.

So, yes, it’s a little work, but the good news is that you don’t have to make unnecessary guess work of how the future will look like.

You will take care about it when it happens.

II. Variable lease payments depending on the future sales or use of the asset

Well, under the definitions in IFRS 16, the payments NOT depending on the rate or index DO NOT enter into your lease payments.

In other words they are excluded.

Instead, they are recognized in profit or loss when incurred.

Isn’t that beautiful and easy?

The reason for such simplification is that estimating the future sales and other items would represent very high level of uncertainties and thus the information would not be of any use.

It does not apply only to the rentals depending on future sales, but also on the future use of an asset.

Just a small example from my own life – my son is farsighted and we visit eye doctor time to time.

The doctor uses the special machine for measuring his diopters – it looks like a gun and the measurement is done with one push of the button.

The doctor explained to me that she must pay the rental fees for every single push of the button, on top of the fixed fee.

So, this is exactly the example of the variable lease payments depending on the use of an asset.

Now, let’s wrap it up and let me illustrate it shortly.

Illustration: Variable lease payments

Imagine you rent a space for the store for 5 years and you agree to pay the fixed monthly fee of 1 000 and annual fee of 1% of your sales.

The fixed fee will be increased by the inflation rate once in 2 years.

At the commencement date, you assume that your sales will be 200 000 per year, the discount rate is 3% and the inflation rate will be 2% per year.

So, initially, you will calculate your lease liability based on the fixed monthly fee of 1 000 paid over 5 years.

How?

Well, just discount the monthly payments of 1 000 for 5 years with the annual discount rate of 3% – careful, because when the payments are monthly, you must calculate the monthly rate out of your annual rate.

I’ve done this for you this time.

Our monthly rate is 0.25% and the present value of all monthly lease payments over 5 years is CU 55 708.

This is your right-of-use assent and the lease liability at the commencement date.

You would recognize it as:

- Debit Right-of-use asset: CU 55 708

- Credit Lease liability: CU 55 708

Then, you should split each monthly payment into 2 parts:

- Interest charged on the remaining lease liability, and

- Repayment of the lease liability.

The short example of how to do it is in this article.

I cover the full recalculations of the rates, variable lease payments, irregular lease payments and many other complications in my IFRS Kit, so please sign up it if interested.

You would ignore the adjustment for the inflation and also ignore the fee of 1% of your sales.

Then when you pay 1% of your sales, you will simply book it in profit or loss.

And, when after 2 years the fixed fee is adjusted by 2% from 1 000 to 1 020, you would recalculate the lease liability by discounting the fees of 1 020 paid over the remaining lease term of 3 years with original rate of 3% and book any difference as an adjustment to the right-of-use asset.

I’ve done that for you again:

- The original lease liability before adjustment of the lease payments after 2 years is CU 34 408;

- The new lease liability after adjustment of the lease payments is CU 35 906

- The difference between these two is CU 1 498 and it is recognized as:

- Debit Right-of-use asset: CU 1 498

- Credit Lease liability: CU 1 498

Again, I have lots of practical examples solved in Excel related exactly to these issues within my IFRS Kit, so make sure you check that out.

Here’s the video that sums it all up:

Any comments? Please let me know below this article. Thank you!

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

41 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Kevin on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Silvia on 3 Biggest Myths in Accounting for PPE

- RASHEED ABOLOMOPE on 3 Biggest Myths in Accounting for PPE

- Silvia on IFRS Reporting in Hyperinflationary Economy (IAS 29)

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (52)

- Foreign Currency (9)

- IFRS Videos (71)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (45)

- Revenue Recognition (26)

- Uncategorized (1)

If I got a property, I lease it to Company A, with the term of the higher of 4 % of the gross operating revenue during the year or $100,000 per annum. The lease is subject to the escalation of 5% of the $100,000 for each year. This lease last for 3 years.

Based on straight-line rental income, each year rental income is $105,083.

However, during the year 2, 4% of the gross operating income is $150,000.

So, for year, shall i recognise which of the following?

1.) the $150,000 rental income; or

2.) $150,083 ($105,083(Rental income based on straight-line) +$45,000 ($150,000 (4 of GOR) – $105,000 (base rental (after escalation))

Hi,

so you are the lessor and the lease appears to be operating in line with IFRS 16 (lessors still CLASSIFY the lease as either finance or operating under IFRS 16), so the rental income is recognized in profit or loss on a straight-line basis, or on some other systematic basis. There is no further guidance in IFRS 16 related to variable lease payments (unlike for lessees), but still, in par. 90 b of IFRS 16, it is stated that the lessors should separately disclose income relating to variable lease payments that do not depend on an index or a rate.

It means that the excess above fixed payments based on performance is recognized when earned. In the year 2, you therefore recognize the fixed income AND variable depending on the performance in profit or loss (to me it seems 150 000, since the rental fee is either 4% of gross operating revenue OR the basis, whatever is higher – but check your contract.

Hello. If you have a period (e.g. first 12 months) where the payments are variable and then move to a fixed fee. When do you start recognising interest costs?

Hi Silvia,

Can you provide ifrs 16 reference for rent based on sales should be recognized in profit or loss.

how can i calculate the amortization expense in operating lease for lessee if the annual payment is changing by rate like in this example? i have searched a lot but did not find the way of solving this.

Illini leases another piece of equipment from Cubs Corporation under a four-year lease agreement on 1/1/20×1. The lease specifies annual payments on each 1/1 and the first payment of $10,000 is made on 1/1/20×1. The lease also specifies a 3% annual increase in the lease payments. The equipment has a fair value of $100,000 on 1/1/20×1. The expected useful life of the equipment is 10 years with no residual value. The equipment will be returned to Cubs at the end of the lease term. The implicit rate is 10%.

Hi. Can you help me to solve this issue?

One of our clients has 399 years long rent. As per the agreement yearly fee is 176k payable on a monthly basis. The agreement is silent for future rent increments. However, the company gets rent increase notifications from the supplier annually. This year’s rent increment notice indicates the increment is a result of recent infrastructure improvements on the property and commercial rent increases. Since this is 399 years agreement, even a minor change to that payment significantly affects the right to use assets and the lease liability.

Can you help me to identify whether this payment change is part of the index or rate change so we need to amend the lease calculations?

Hi Silvia

What will be the treatment if the variable lease payment paid in advance. Then there wont be any OLL, but ROU need to be depreciated over the period of the lease. Then there is a variation between the amount depreciated and the actual rent (as there is an increase in rent every year). How we shall accommodate the same in the FS

Well, maybe you should describe the situation better as it is unclear to me. If the lease payment is paid up front, where is the variation in it?

Hi Silvia

You state that the value of the ROU and the corresponding lease liability is CU 55 708 – which is what I have too, but the further down the article you state that “The original lease liability before adjustment of the lease payments after 2 years is CU 34 408;” Where did you get the second figure from when the original ROU & LL was CU55,708?

Thanks,

That is derived from the lease table not included in this article. You simply take the original LL at the inception of 55 708, increase it by 3%, deduct the lease payment, then increase it again by 3%, then deduct the lease payment and you should arrive at 34 408 after 2 years.

Awesome, thank you. 🙂

Merry Xmas if you celebrate it too

Hi Silvia, you are a life saver! there is nothing like this on the internet

Hi Silvia, thanks for this great article.

If the contract states that the ownership of the leased asset will be transferred to the lessee, but the amounts of lease receivables are based on output produced with no minimum charges. Can the lessor account for this as finance lease or its not a lease contract because even if there is a transfer of ownership at the end of the lease, the lessor retains substantially all the risk and rewards to ownership of the underlying asset through the variability of lease payment.

Thanks in advance

Hi Silvia, this is absolutely golden! Thank you so much for simplifying these conflex concepts so beautifully!!!

Hi Silvia, We are operating in a hyperinflationary country and the rentals are based on a stable currency (USD) and varies monthly depending on the exchange rate at the end of every month (so the USD amount is fixed what, what changes is our monthly rental payment due to change in exchange rate), From the explanation above it means that the variable rental is based on a rate and we should remeasure our lease liability, However it is becoming costly and time consuming to remeasure lease liability on a monthly basis and posting the journals, is there a practical expedient to this since remeasuring lease liability on a monthly basis is impractical since we have several leases in place.

Hi Silvia,

Not sure if you are still responding to queries, if you could please clarify on this.

You mentioned above to Vicky’s question that re-measurement needs to be done every time the rent increases, does this still apply when we definitely know how much to increase each year?

For example, our company knows by the lease agreement that the annual rent increase is 4% (eg. this year $90,000 then next year $93,600 and so on, do I need to remeasure the lease liability every year or can I just take into account the actual increase in the initial calculation?

Hi Allan, if the contract precisely states the lease payments upfront, then there is no reason to account for remeasurement in the future. You simply measure lease liability and ROU based on the payments under the contract.

Thanks Silvia for the prompt reply and clarification.

Hi Silvia, this is again very helpful. I believe this is same as new rent concession for covid-19 as the guidelines suggests to post these as variable payments. My question is that in above example, you showed the accounting entry for CPI – what would be the accounting entry for variable payment i.e. 1% fee on sales each year (Dr Lease Liab and Cr P&L by 200kX1% i.e. 2k?) and will that be posted each month or only when its paid i.e. each year. Thank you in advance.

Hi Silvia,

I am Navin Gadidala from Oracle, who is working on multiple IFRS16 solutions for customers. One question raised by customers which appears to interesting, if there is a payment change due to scope change and liability has to be remeasured, should we discount all remaining lease payments with new rate or only ‘Revised’ payments?

My understanding is to adjust liability(remeasure) with only those changed payments. For example if I have 4 lease payments and only one of them is direct rent, if this rent changes because a new floor is added to the lease, then only remaining payments from this revised payments to be taken into consideration for adjustments Liability and ROU upwards. Please let me know what you think.

Hi Navin,

if there is a change in scope, then in accordance with IFRS 16 it is NOT a remeasurement of the lease, but the lease modification. You need to assess if some new right-of-use asset was added or not; and other considerations, too. Then you either account for this as for a separate lease, or as a change in the existing lease or a combination. It is extremely hard to give you general answer to this question as a lot needs to be assessed. S.

Hi Silvia. Would you please check the IFRS Interpretation Committee agenda decision. They estimated the variable lease (percentage of annual revenue) in a sales lease back and recognize a liability, regardless that the sale and lease at market rate.. Is this appropriate? The agenda decision can be found in below link:

https://www.ifrs.org/projects/work-plan/sale-and-leaseback-with-variable-payments/comment-letters-projects/tentative-agenda-decision-and-comment-letters-sale-and-leaseback-with-variable-payments-ifrs-16/#consultation

Yes, because they are in a different situation that that described in this Q&A, plus they are applying different paragraph of IFRS 16 than I applied here.

Hi,

If lease payments are to increase 10% every year. How we calculate lease liability

Initially you take the lease payment prevalent at the commencement date to the calculation (without increase). When they increase, you need to account for the remeasurement of lease liability.

Hello silvia, what if you only have variable rent payments depending on revenue ? How to you account for the lease liability and ROU ?

If they depend on the revenue, then they are not a part of the lease payments and are accounted for in profit or loss.

Hi Silvia,

We are in retail business, and we have a lease which is comprising of 3 component below:

Base rent

Variable rent – % to sales

Minimum guarantee sum

Should I apply minimum guarantee sum for lease calculation?

I am not sure what “minimum guarantee sum” is – is this minimum lease payment you need to pay? If yes, then treat it as fixed lease payment.

Hi Silvia,

I am assuming that he meant the landlord securing minimum lease payment. Let’s suppose if you have agreed to pay 1% of monthly sales unless monthly sales results in the rentals below CU 600 then the lessee has to pay CU 600. The Company made sales of CU 100,000. The tenant will receive CU 1,000. However, The next month, CU 50,000 worth of sales were made. then the rent will be paid CU 600.

Hello Sylvia,

We have leased land for 40 years and the payment was made for all 40 years when the contract was effectively. Could I record for asset and depreciation each year based on payment was paid? Thank you so much.

Well, your right-of-use asset would be equal to that one payment (if you don’t have any other related costs), and then you would depreciate it straight-line.

Hello Sylvia,

We have leased offices for our branches in various parts of the country. The lease payments are made monthly in advance. The lease term is 15 years and it has been agreed with the lessor that the lease charge will increase by 5% every 5 years. We first moved in the premises in June but our year end is December. How should I factor in the increase of lease charges in calculation of the lease liability as the lease charges increased during the year.

Regards

Well then you should account for the lease remeasurement each year.

Hi Mitesh

How did did go about your calculation with the mid year change in lease cost?

Hello Silvia,

Could it be that your revised PV of 35.906 should be 35.096?

Other than that, thanks you for the example.

Regards,

Etienne Langendorff

I also got 35 096. Should be good to get confirmation from Silvia if this is correct. Thank you

Hi Silvia

How do you account for variable maintenance costs that are not fixed and cannot form part of your lease liability schedule?

For example, how would you account for variable after hours airconditioner costs? I would think you would have to expense them in P&L monthly?

Thanks

Hi Silvia,

thank you for this article, it is very useful.

I have one question. What will happen in the situation if we have to pay for office space, but the rent depends only on the future sales, we pay every month rent which is calculated as % of the sales in previous month (there is no fixed lease payment) ? In this case every payment goes directly to P&L, so how to account for this lease at commencement date?

Thank you for replay,

Katarina

How do you account for variable lease payments on a finance lease from a lessor perspective? In the old standard, these were called contingent payments and excluded from finance lease receivables.

Every explanation and calculation as explained in the article remains the same, the lessor will have interest income and lease rental receivables as opposed to interest expense and lease rental payments.