How to account for dividends paid to employees?

One of the great methods to motivate employees is to share a part of company’s profit with them. And indeed, many bigger corporations provide bonus to the employees in the form of profit sharing. Some people call this “dividend to employees”.

How shall we account for that?

Tunde from Nigeria asked the following question:

“Our company policy is to pay 2% of the net profit to our employees who worked for us during the full previous year – from 1 January to 31 December.

We booked the dividends for 2016 as a profit distribution in 2017 when it was approved by our shareholders. But our auditors say this is wrong and we should book it as expense in profit or loss in 2016.

Can you please explain why and clarify?”

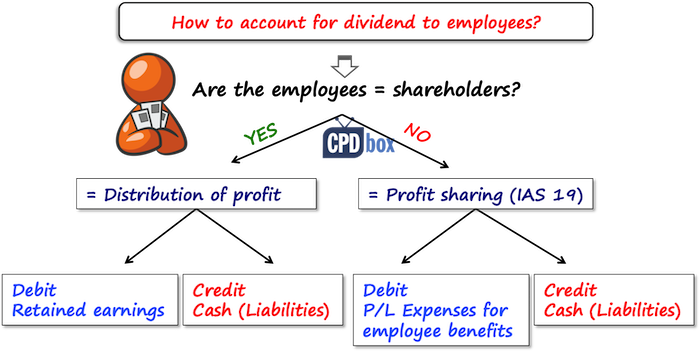

Answer: Are your employees acting in a capacity of a shareholder?

This is a very common question and common belief that anything called dividend is automatically accounted for as a distribution of profit.

However, the true distribution of profit is a transaction with equity holders or with shareholders.

The principal question here is:

Are your employees also the shareholders?

Are the dividends paid out to them in their capacity of shareholders?

Or, are the dividends paid out in return for their service for the company?

If the dividend is paid out to the employees being the shareholders, then yes, you are right.

It normally happens that employees hold also some shares and if they receive the dividend based on the number of shares they hold, then yes, this is recognized as a distribution of profit.

But, if the dividends paid out are a part of some remuneration scheme, then no, this is NOT a distribution of profit reported in the statement of changes in equity.

This is a typical profit sharing plan and it falls under the standard IAS 19 Employee benefits.

So, what does the standard IAS 19 say about the profit sharing?

You should recognize the expected cost of profit sharing only when 2 conditions are met:

- There is a present legal or constructive obligation to make such payments as a result of past events.

- A reliable estimate of the obligation can be made.

Thus if you promised in the employment contract to pay out the so-called dividend to employees, or there’s some trade union treaty, or even employees expect that because that’s your long-term practice – then there’s a present obligation.

Also, the estimate can be made almost always in this case.

Therefore, when you make your closing of the year-end, you have to calculate the amount of profit sharing and recognize it as an expense in that period, not in the subsequent period after it is approved by the shareholders and not as a distribution of profit via statement of changes in equity.

- Debit Profit or loss – Employee benefits

- Credit Liabilities to employees

Here, I’d like to point out one trouble that I see with the profit sharing.

Some employment contracts say that the employee is entitled for profit sharing only if he or she stays with the company for some time after the end of the relevant year.

Let’s say that the financial year-end is on 30 June, but the employees will get the profit share only if they stay for the full calendar year (that is from 1 January to 31 December).

Well, there is no clear guidance on how to treat this issue and there are basically two basic ways of how to deal with that:

- You should recognize the cost of the profit sharing not only in the year in which it is earned, but over longer period until the employee has the right to receive it, because the employee would get nothing if he leaves earlier. Or,

- The second approach, you would recognize the full profit sharing in the year when it is earned, because the amount of benefit does not increase after 30 June or after the year-end.

I like the first approach more than the second one, because this way you don’t overstate your expenses in the first year, but maybe both approaches would be acceptable.

The last point:

In some countries, there are statutory employee benefits schemes where employers are required by the laws or legislation to pay certain percentage of profit after tax to the employees.

This type of bonuses also falls under IAS 19 and should be accounted in the same way I have just described, because in substance it is still provided in return for the employee’s work.

Do not apply IAS 12 Income taxes or IAS 37 Provisions, Contingent Liabilities and Contingent Assets. Instead, follow IAS 19.

Here’s the video summing up this issue:

If you have a comment or an additional question to this topic, please leave a reply below this article. Thank you!

Tags In

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

8 Comments

Leave a Reply Cancel reply

Recent Comments

- mahima on IAS 23 Borrowing Costs Explained (2025) + Free Checklist & Video

- Albert on Accounting for gain or loss on sale of shares classified at FVOCI

- Chris Kechagias on IFRS S1: What, How, Where, How much it costs

- atik on How to calculate deferred tax with step-by-step example (IAS 12)

- Stan on IFRS 9 Hedge accounting example: why and how to do it

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (25)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (54)

- Foreign Currency (9)

- IFRS Videos (74)

- Insurance (3)

- Most popular (7)

- Non-current Assets (56)

- Other Topics (15)

- Provisions and Other Liabilities (46)

- Revenue Recognition (27)

- Uncategorized (1)

Is it legal for an ex-employer to demand repayment of paid (and taxed) stock dividends AFTER terminating an employee?

That is not the question of IFRS, but the laws of the particular jurisdiction, sorry.

Hi Finn,

Let me give it a shot.

Legal obligations are those that arise from contracts or legislation. For example, if an employment contract contains a clause stating that the company will pay a profit sharing bonus to an employee one year after the measurement period. It would also be a legal obligation if a mining company is required by law to rehabilitate the land it used for mining. In this case, the company would have to estimate the costs of rehabilitation and recognise a liability.

A constructive obligation does not have a legal requirement, but has set an expectation that the business can’t reasonably avoid without significant repercussions. Lets say that mining was unregulated and there is no legal obligation for the company to rehabilitate the land. If they announce publicly that they are committed to rehabilitating this land, they have no choice but to follow through or face public backlash, boycotting, losing supply contracts etc. Even though they haven’t broken the law or defaulted on a contract, they still have a constructive obligation to incur these costs.

Another way of phrasing it would be that the company has made a firm (but not legally enforceable) commitment to doing something

Dear Silvia,

I hope you are doing well.

After reading your article dividends paid to employees, I faced a difficulty differentiating Legal and Constructive obligations.

I googled it but couldn’t get it well; therefore, you are requested to explain what are legal and constructive obligations along with examples.

Best Regards

Finn Amani

Thank you!!1

Thank you!!1

From the first article I read on this page, i have been stuck and glued like my life depends on it. Simple, clear and summarized accounting standards. Thank you

Thank you for the clarification.