How to Adjust Your Local Accounts to IFRS (Part 2)

In the first part of this small series, we have explained preparatory steps for making transformation of local accounts to IFRS. Here, we continue with summing all this up and preparing transformation bridge as the basis for IFRS accounts.

Step 3: Prepare a bridge in excel and enter all adjustments in there

What do I mean by the “bridge”? It is a summary of all adjustments where each adjustment consists of 2 parts: derecognizing all the accounting entries in line with your local GAAP (in step 2.1) and recognizing all the accounting entries in line with IFRS (in step 2.2).

Basis of your bridge can be the trial balance, or general ledger as of the reporting date, put into 1 column. Make sure that total of the account balances gives you 0, all assets and expenses (or debit balances) are stated with plus (+) sign and all liabilities and revenues (credit balances) are stated with minus (-) sign.

Then in the next columns, you will enter all adjustments as you would have been doing regular accounting entries to your general ledger. Of course, you enter debits with plus and credits with minus. Remember to check your totals to be 0. To achieve transparency, I recommend entering each line from above tables to separate column.

When entering your pre-prepared adjustments from the step 2, I would like to warn you about 2 tricky things:

- Entries according to your local GAAP must be DERECOGNIZED. It means that you enter them in the opposite way as they had been accounted for. In our example, you simply Debit Cash at bank and credit IS—Rental expense. Don’t worry about cash balances now—after making full adjustment, they will be correct.

- Remember that you are in the current accounting period. This means that entries made to income statement in the previous periods have already been transferred to equity—profit or loss from previous periods. So you just cannot recognize and derecognize figures related to income statement of previous periods to income statement of current period—that would be fatal error. You simply put all your previous years’ figures related to income statement to equity.

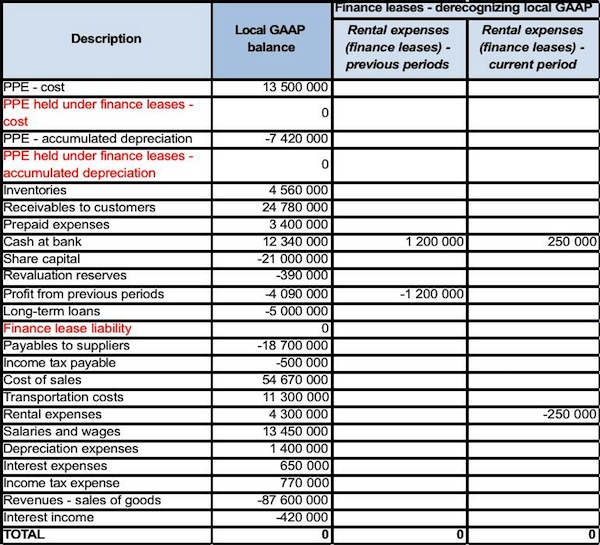

Example: The bridge from our finance lease example would look like the following:

This is just the first part of the whole bridge including only derecognizing local GAAP adjustment. You can download the whole bridge from this example in excel file here.

I used simplified trial balance version and only some figures in it to make it clear. And note that sometimes you must add certain items to your trial balances, like finance lease liabilities in this case—that’s because they are new in IFRS financial statements while they were not present in your local GAAP statements. I highlighted those new items in red.

Step 4: Calculate total impact of IFRS adjustments and IFRS balances

Once you are done with entering all adjustments to the bridge, the last 2 columns will represent horizontal totals:

- in the last but one column, you shall calculate total of all columns starting with column with the 1st adjustment (except for local GAAP balance column). Thus you’ll get total impact of IFRS adjustments on the individual line items of your trial balance.

- in the last column, you shall calculate IFRS balance by adding local GAAP balance and total impact figure together.

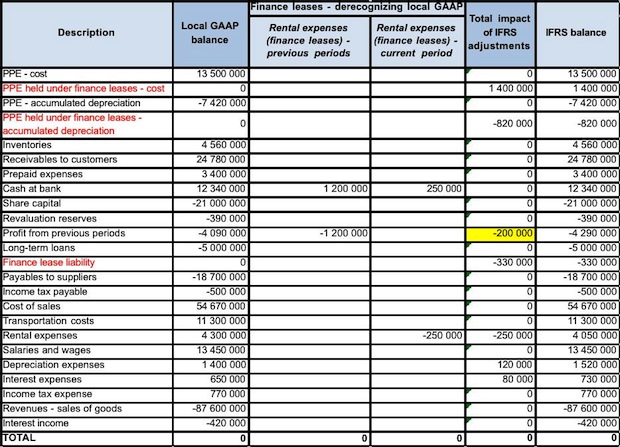

Example: After making these totals, the bridge from our example would look like the following:

Warning! Due to large width of the whole bridge, I have hidden all columns related to recognizing IFRS entries and therefore, total impact of IFRS adjustments does not make sense in this picture. If you would like to review full bridge with formulas, please download it here.

Now, in the last column, there is a trial balance of your company in accordance with IFRS and you can easily prepare statement of financial position and statement of comprehensive income in line with IFRS. But before you do so, I highly recommend performing the last step.

Step 5: Verify consistency of IFRS equity

Verifying consistency of IFRS equity means comparing total equity INCLUDING previous year’s profit or loss in line with IFRS as at the end of previous period with total equity in line with IFRS as at the beginning of current reporting period. I will put it into equation to make it crystal clear:

(Profit/loss from previous periods + profit or loss of current period) at the end of previous reporting period (e.g. 31 December 20X0) = profit/loss at the beginning of current reporting period (1 January 20X1).

In practice, I do not compare the whole profit or loss line. I just do it with total impact of IFRS adjustments on profit or loss from previous periods’ line as I assume that local GAAP balances are consistent (yellow figure in the above picture).

This is extremely important step for 2 basic reasons:

- First, if your equity is not consistent, you will not be able to prepare statement of changes in equity under IFRS and I am pretty sure that the other statements will contain errors, too.

- Second, verifying equity serves as a check of your work. Does it add up and equal? Fine, you have included all adjustments (I am not talking about reclassifications not impacting equity) and you made it correctly.

Example: In our example, total impact of IFRS adjustments on profit or loss from previous periods is -200 000 EUR. It is highlighted yellow in the above picture.

To verify consistency of equity, you would have to take the same bridge as of 31 December 20X0 or for previous year and look to the same figure, plus total impacts of IFRS adjustments to all income statement items. Hopefully, it would give you -200 000 EUR too.

That’s it. Just take the trial balance and make IFRS statements out of it.

This process of making IFRS financial statements requires some time for practicing. However if you’d like to speed up the process and learn it quickly, please check out my course How to Make IFRS Financial Statements.

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

8 Comments

Leave a Reply Cancel reply

Recent Comments

- Silvia on How to calculate deferred tax with step-by-step example (IAS 12)

- lino Rosas on How to calculate deferred tax with step-by-step example (IAS 12)

- Silvia on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Kevin on IFRS 18 Presentation and Disclosure in Financial Statements: summary

- Silvia on 3 Biggest Myths in Accounting for PPE

Categories

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (56)

- Financial Statements (52)

- Foreign Currency (9)

- IFRS Videos (71)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (45)

- Revenue Recognition (26)

- Uncategorized (1)

Dear Silvia M.

First of all, I would like to thank you for your valuable and very helpful IFRS resources to understand and easily convert the old principle by the new one. But now I’m really in a critical problem while converting the old financial reports. So I need your help in restating the opening SoFP, Comparative SoFP, and the Financial statements fully prepared by IFRS. How can I get your support? Thank In advance

Hi Tewondros, I think that the best way – if you need our professional help – would be to check out and sign up for “my Helpline” services and our best consultants can help you fast: https://www.cpdbox.com/my-helpline/

Hy Mam,

I have been facing problem for transition to IFRS (NFRS in Nepal) regarding presentation of item on the face of Statement of Profit and Loss for below mentioned problem:

The company was registered some years ago but obtained its operating license just a month before the Financial Year end. The amount received in respect of share capital was placed in fixed deposit hence the company had been earning significant interest income from such deposit before its operation. The company had book such income as write off expenses with negative figure in its Profit and Loss Statement (prepared only for a month i.e. after obtaining license) prepared under previous GAAP. Now where should I present such income in the Statement of Profit and Loss prepared under IFRS?

Thank you in advance.

The Indian Finance Minister in his 2014 Federal Budget has announced that Indian Accounting Standards will converge with IFRSs from fiscal year 2015-16 voluntarily and from 2016-17 mandatorily. Your wonderfully explained Excel templates and accounting entries is a valuable resource for CFOs and accounting staff to ease out the transition to IFRSs in India. Your IFRS expertise is of high quality and commendable. Thank you for sharing!

Thank you very much for your comment, I really appreciate. All the best! S.

Thanks for sharing.

Great piece Cody. I look forward to everything you present. Top notch.

I tink total impact of IFRS adjustments on profit or loss from previous periods is -200 000 EUR. It is highlighted yellow in the above picture.